Perfume Market By Product Type(Eau de Parfum, Eau de Toilette, Eau de cologne, Eau Fraiche), By Product(Mass, Premium), By End-Use(Women, Men, Unisex), By Sales Channel(Online Retailers, Offline Retailers, Others), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

43469

-

Feb 2024

-

179

-

-

This report was compiled by Research Team Research team of over 50 passionate professionals leverages advanced research methodologies and analytical expertise to deliver insightful, data-driven market intelligence that empowers businesses across diverse industries to make strategic, well-informed Correspondence Research Team Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

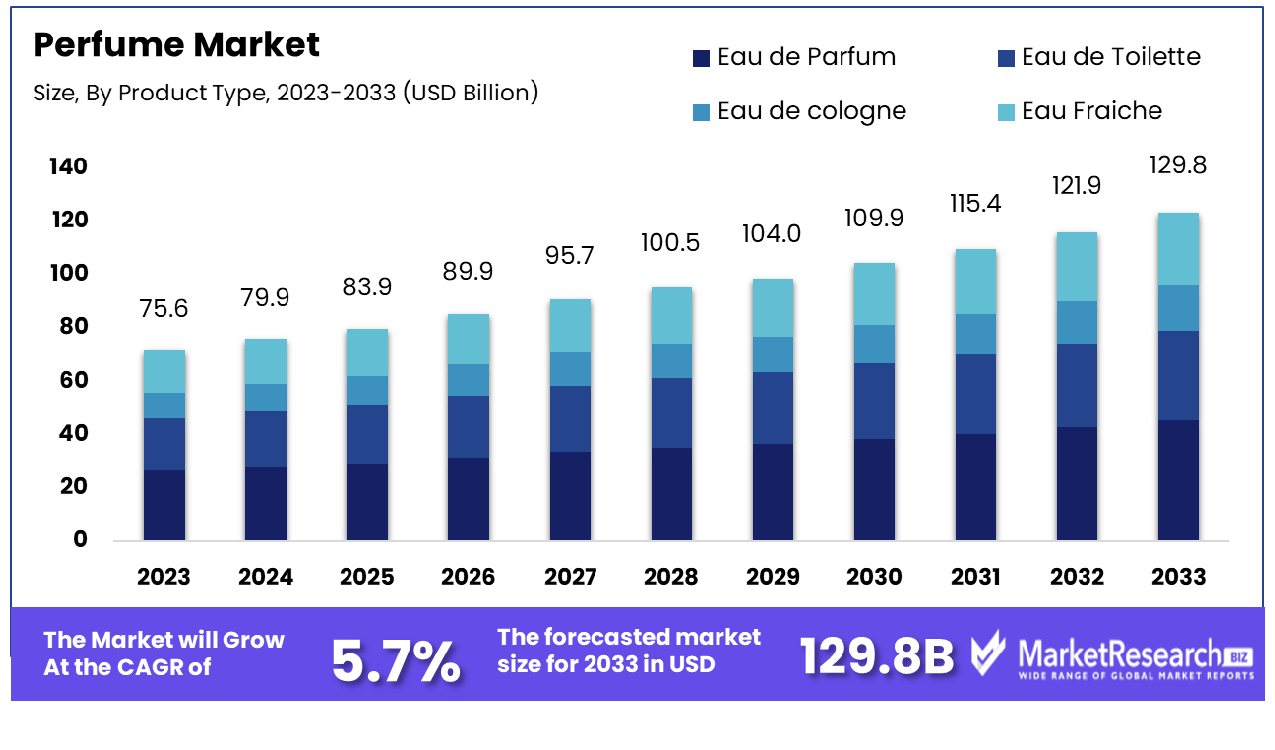

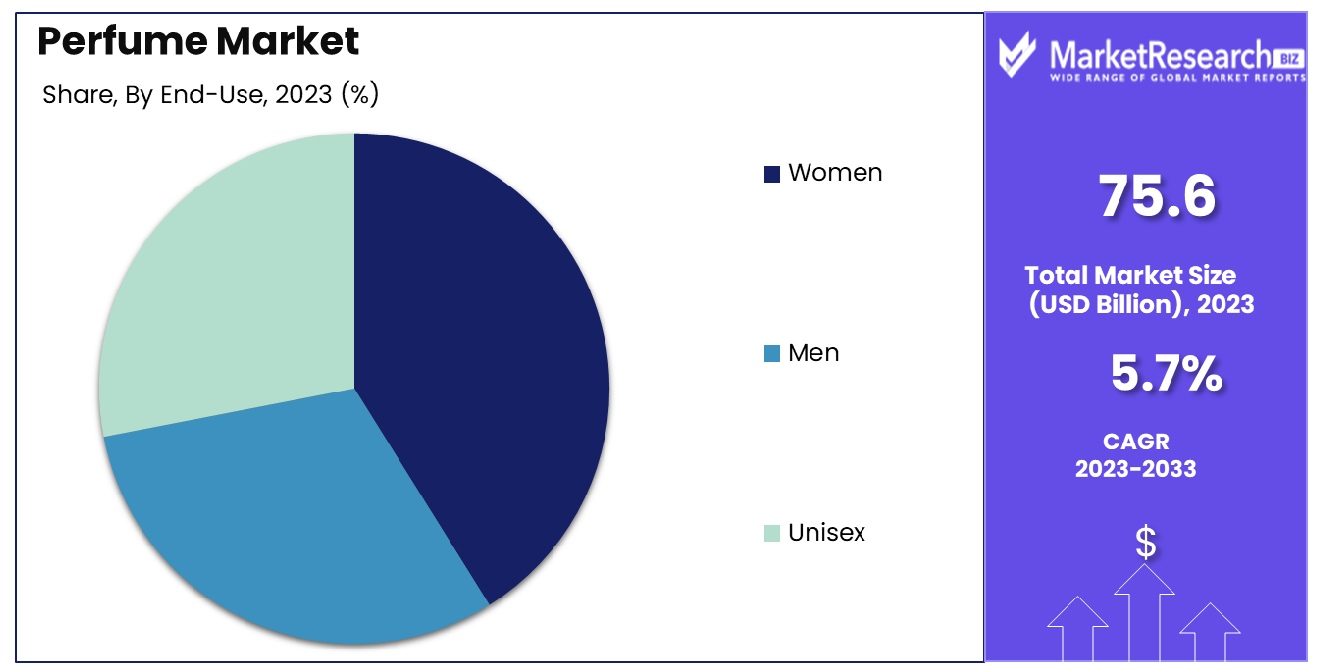

The perfume market was valued at USD 75.6 billion in 2023. It is expected to reach USD 129.8 billion by 2033, with a CAGR of 5.7% during the forecast period from 2024 to 2033. The surge in changing lifestyles, growing population, and rapid expansion of online and e-commerce platforms are some of the main key driving factors for the perfume market.

Perfume is defined as a liquid that is made up of essential oils, solvents, and aroma compounds, designed to offer a pleasant and attractive scent. The word perfume is derived from the Latin word “per fumum”, known as through smoke. For many centuries, perfumes have been used for religious, cultural, and personal reasons. Its main element comprises a base, top notes, and middle, each contributing to the whole fragrance profile.

Base notes deliver complexity and longevity, middle notes make the heart of the perfume scent and the top notes provide the first initial impression. Perfumes are developed through a scrupulous mixing method, integrating natural or synthetic elements to create different olfactory experiences. The creativity of perfumery comprises trained perfumers making original, unique, and harmonious mixes that appeal to individual tastes by creating an idiosyncratic and personal accessory in the world of sensory experience.

January 2024, highlights that distributors of fragrance inter parfums post record-high net sales of USD 1.32 billion in 2023. Moreover, the fragrance distribution in Europe grew by 2% in the 2023 fourth quarter, mainly propelled by a 17% increase in Coach brand sales, as per Inter Parfums. Similarly, the net sales for Jimmy Choo and Montblanc in the fourth quarter of 2023 somewhat decreased after experiencing growth of 78% and 50% respectively in the last quarter of 2022. For the whole year of 2023, European sales have risen by 16% with Coach, Jimmy Choo, and Montblanc brands witnessing growth rates of 25%, 19%, and 15% respectively.

Perfume is one of the essential accessories that every person uses in their day-to-day life. It holds a strong position in personal grooming and helps in interacting among the society. It encourages self-expression by permitting individuals to convey their distinct personalities and improves their overall style. An ideal and perfect choice of fragrance and perfume can augment confidence, heighten the mood, and develop ever-lasting positive associations with personal experience. Perfume also provides aromatherapy advantages contributing to whole well-being by promoting relaxation. The demand for the perfume will increase due to its high requirement by the customers for their daily grooming purposes, which will help in market expansion during the forecast period.

Key Takeaways

- Market Growth: The perfume market was valued at USD 75.6 billion in 2023, It is expected to reach USD 129.8 billion by 2033, with a CAGR of 5.7% during the forecast period from 2024 to 2033.

- By Product Type: Eau de Parfum remains dominant, offering long-lasting fragrance with higher concentration levels.

- By Product: Mass-produced perfumes lead the market, catering to a wider consumer base's affordability.

- By End-Use: Women's fragrances dominate, reflecting their enduring preference for diverse scent options.

- By Sales Channel: Online retailers drive sales, leveraging convenience and variety to capture the majority of market share.

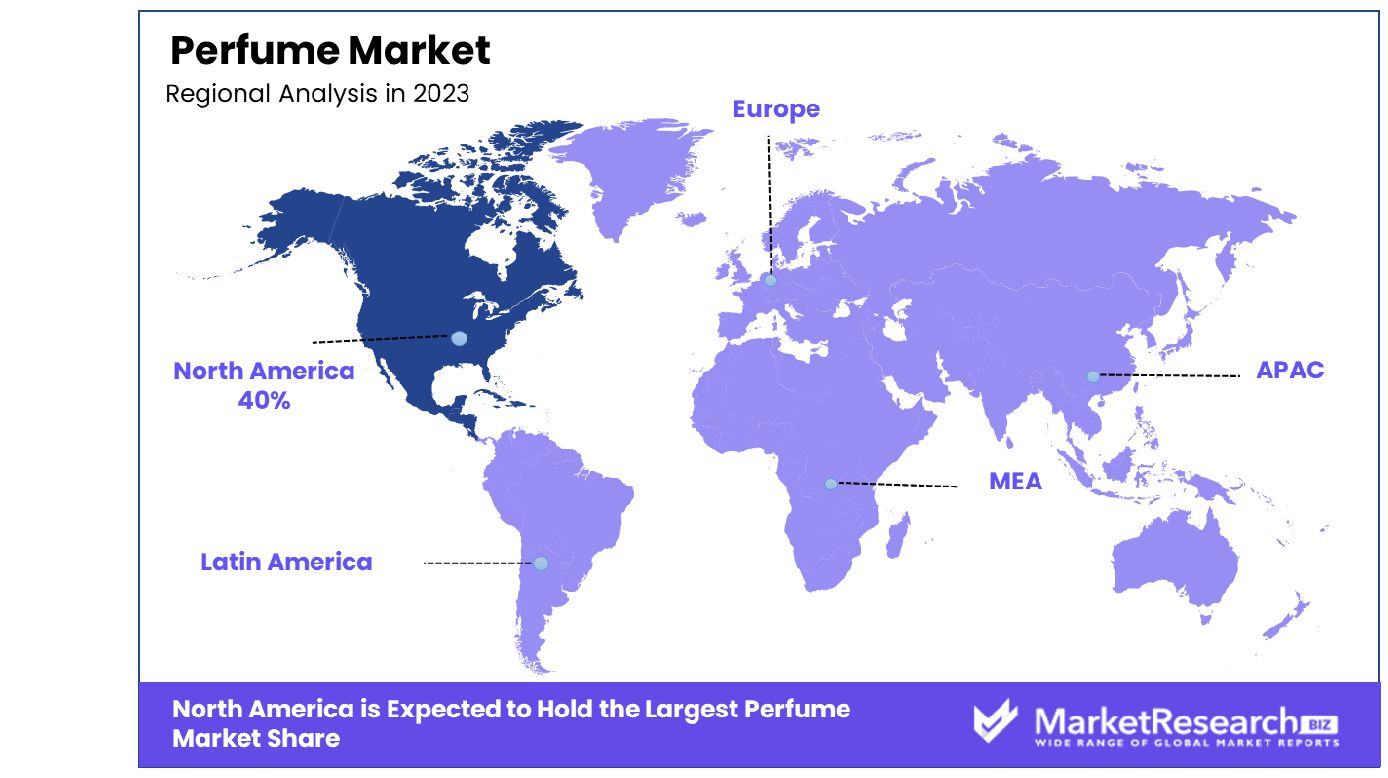

- Regional Dominance: North America leads the perfume industry with a commanding 40% market share, showcasing its significant dominance.

- Growth Opportunity: Novel delivery formats like rollerballs and solid perfumes enhance convenience, while the trend towards natural ingredients elevates scent profiles, appealing to consumers.

Driving factors

Online Sales Channel Revolutionizes Perfume Market Dynamics

The burgeoning online retail landscape is a key driver of the perfume market's growth. E-commerce platforms have democratized access to an extensive array of fragrances, transcending geographical limitations. This shift has particularly benefitted smaller and niche perfume brands, enabling them to reach a broader customer base beyond traditional brick-and-mortar confines.

The online model offers consumers the convenience of exploring and purchasing diverse scents from the comfort of their homes. This expansion of online sales channels has significantly contributed to the market's dynamism, fostering competition and innovation while catering to a wide range of consumer preferences.

Rising Disposable Incomes Propel Fragrance Consumption

Globally, increasing disposable incomes, particularly in emerging economies, are pivotal in escalating perfume sales. Higher spending power allows consumers to indulge in luxury goods, including perfumes.

Countries like India, witnessing a surge in their middle-class population, are becoming fertile grounds for the fragrance industry's growth. This economic upliftment translates into heightened consumer spending on discretionary items, with perfumes emerging as a symbol of personal indulgence and status.

Premiumization Trend Elevates Market Value

The perfume industry is experiencing a pronounced shift towards premiumization. Today's consumers exhibit a willingness to invest in unique, high-quality fragrances, especially those offered by esteemed brands. The rising popularity of niche and artisanal perfumes underscores this trend. These premium scents, often characterized by distinct, bespoke qualities, are rapidly gaining market share, driven by consumers seeking exclusivity and luxury perfumes in their fragrance choices.

Celebrity Fragrances Resonate with Younger Audiences

Celebrity-endorsed fragrances significantly influence the perfume market, especially among younger demographics. Celebrities serve as powerful brand ambassadors, their endorsements bridging the gap between fans and fragrance brands. For instance, Ariana Grande's fragrance line has achieved remarkable success, exemplifying the impact of celebrity associations in driving sales and brand recognition. This trend harnesses the star power of celebrities to create a personal connection with consumers, thereby amplifying market reach and appeal.

Restraining Factors

Market Saturation in Developed Economies Dampens Perfume Market Expansion

The perfume industry faces a significant growth challenge in developed regions like North America and Western Europe due to market saturation. These markets have already achieved high penetration rates for fragrance products, leading to a stagnation in demand.

For instance, in the United States, there was a noticeable decline in fragrance sales in 2022, reflecting a softened demand in a market already flush with options. This saturation means fewer opportunities for new entrants and limited growth prospects for existing brands, as most potential customers already possess or are familiar with the available fragrance products.

Counterfeiting Undermines Perfume Industry Growth

Counterfeit products pose a substantial threat to the perfume industry, particularly impacting prestige brands. The production and sale of fake replicas not only siphoned off sales from genuine products but also damaged the brand equity of established perfume labels.

Annually, authorities confiscate millions of dollars worth of counterfeit perfumes, highlighting the scale of this problem. This illicit trade undermines consumer trust in the authenticity of products, leading to potential revenue losses for legitimate brands and creating a hurdle for market growth. The presence of these counterfeit goods in the market dilutes brand value and can deter consumers from investing in the high-end fragrances industry.

By Product Type Analysis

Eau De Parfum Leads In Product Type, Followed By Mass.

Eau de Parfum holds dominance in the perfume market, primarily due to its optimal balance of fragrance concentration and longevity. Eau de Parfum contains a higher percentage of fragrance oils (typically 15-20%), offering a richer aroma that lasts longer than other types. This makes it highly sought after by consumers seeking a lasting scent without the intensity of pure perfume.

Other segments like Eau de Toilette, Eau de Cologne, and Eau Fraiche offer varying concentrations of the fragrance oil market. Eau de Toilette, with a lower concentration, is preferred for lighter, day wear. Eau de Cologne offers a fresher, subtler scent, suitable for all genders, while Eau Fraiche has the lowest concentration, ideal for a light, refreshing aroma. Despite their appeal, the lasting fragrance of Eau de Parfum underpins its market dominance.

By Product Analysis

Women's Preferences Dominate End-Use, Particularly In Online Retail.

The Mass perfume segment dominates the market, driven by its wide accessibility and affordability. Mass perfumes cater to a broad consumer base, offering a diverse range of scents at lower price points than premium perfumes. This segment benefits from extensive distribution networks and marketing strategies that target a larger audience.

The Premium segment, while significant, caters to a niche market. Premium perfumes are characterized by exclusive scents, higher-quality ingredients, and luxury branding. Despite their allure and loyal customer base, the higher price points and select distribution channels limit their market share compared to mass perfumes.

By End-Use Analysis

Online Retailers Emerge As The Primary Sales Channel For Fragrances.

Women's perfumes constitute the dominant end-use segment in the perfume market. This dominance is driven by a longstanding cultural association of perfume usage with femininity and the wide range of products specifically targeted at women. The diversity in scents, from floral to musky tones, caters to varying preferences among women consumers.

Men's perfumes, offering scents from fresh citrus to deep woody aromas, have a significant market presence. Unisex perfumes, appealing to those seeking gender-neutral scents, are growing in popularity but still hold a smaller portion of the market compared to women's perfumes.

By Sales Channel Analysis

Mass-Produced Eau De Parfum Prevails Among Women Via Online Platforms.

Online Retailers represent the dominant sales channel in the perfume market. The rise of e-commerce platforms has significantly shifted consumer shopping habits. Online retailers offer a vast selection of perfumes, competitive pricing, and the convenience of home delivery.

Offline Retailers, including department stores and specialty boutiques, provide sensory experiences and personalized services, which are critical for luxury and premium perfume sales. However, the growing trend of online shopping, coupled with the increased digital engagement strategies by perfume brands, reinforces the dominance of online retailers in the market.

Key Market Segments

By Product Type

- Eau de Parfum

- Eau de Toilette

- Eau de cologne

- Eau Fraiche

By Product

- Mass

- Premium

By End-Use

- Women

- Men

- Unisex

By Sales Channel

- Online Retailers

- Offline Retailers

- Others

Growth Opportunity

Novel Delivery Formats: Enhancing Consumer Experience in the Perfume Market

The introduction of innovative delivery formats like rollerballs, solid perfumes, and body mists represents a significant growth avenue in the perfume industry. These formats offer consumers increased convenience and portability, making it easier to apply and reapply fragrances on the go. Rollerballs, for instance, provide a more controlled and personal application, while solid perfumes offer a travel-friendly, non-spill solution. The accessibility and ease of use associated with these novel formats cater to a modern, on-the-move lifestyle, appealing to a broader consumer base, including those who may seek more practical and discreet fragrance options.

Innovative Natural Ingredients: Elevating Scent Profiles in Perfumes

The evolving consumer preference towards natural and sustainable ingredients in perfumes opens up new avenues for market growth. Incorporating unique natural elements like damask rose extract or oud oil enables brands to offer distinct and exotic scent profiles. These natural ingredients not only cater to the growing demand for eco-friendly and ethically sourced products but also allow for the creation of a unique and complex fragrance industry. This trend towards naturality in perfumery not only aligns with environmental concerns but also adds a layer of luxury and exclusivity to products, appealing to consumers seeking authenticity and differentiation in their fragrance choices.

Latest Trends

Sustainable Scent Solutions

With growing environmental awareness, consumers are seeking eco-friendly options in perfumery. This trend sees a surge in demand for sustainable ingredients, recyclable packaging, and cruelty-free production processes. Brands are innovating with biodegradable materials, natural extracts, and responsible sourcing practices to meet this demand, appealing to environmentally conscious consumers.

Personalized Fragrance Experiences

The perfume market is witnessing a shift towards personalized scent solutions. From bespoke fragrances tailored to individual preferences to customizable packaging and application methods, brands are offering unique experiences to consumers. Utilizing advanced technology such as AI and data analytics, companies are enhancing their understanding of consumer preferences, allowing for more targeted product offerings and enhancing customer satisfaction.

Regional Analysis

North America Dominates with 40% Market Share in the Perfume Industry

North America's commanding 40% share in the global perfume market is anchored in its strong consumer spending power, a diverse range of fragrance preferences, and the presence of major industry players. The U.S., being a central hub, significantly contributes with its expansive retail networks and robust e-commerce platforms. Additionally, the region's inclination towards premium and niche fragrances, coupled with a growing trend of personalized scents, further propels the market growth. The cultural emphasis on personal grooming and the rise in consumer awareness regarding the ingredients used in perfumes also play pivotal roles.

The North American perfume market thrives on innovation and marketing strategies. Limited edition launches, celebrity endorsements, and immersive in-store experiences are key tactics. There's also a rising trend of eco-friendly and organic perfumes, reflecting the growing consumer awareness towards sustainability. The market is highly competitive, with major players continuously exploring new scent combinations and packaging designs to attract a broad customer base. Seasonal key trends and festive sales also significantly influence market dynamics, driving spikes in purchases.

Europe’s Influence in the Perfume Market

Europe, particularly France and Italy, holds a significant portion of the global perfume market. This dominance is attributed to the region's rich perfume-making heritage, strong brand presence, and high-quality standards in fragrance production.

Asia-Pacific’s Role in the Perfume Market

Asia-Pacific is witnessing rapid growth in the perfume industry, driven by increasing disposable incomes, western influence on lifestyle choices, and the rising young consumer base, especially in countries like China, India, and Japan.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of Middle East & Africa

Key Players Analysis

The perfume market is dominated by key players whose influence spans global fragrance production and sensory experiences. Firmenich & Cie and Givaudan, both hailing from Switzerland, stand at the forefront, renowned for their pioneering work in crafting bespoke fragrances and their commitment to sustainability within the luxury perfume segment growth. These major companies, alongside International Flavors & Fragrances Inc. from the USA, lead in market share and innovation, setting fashion trends that shape consumer preferences worldwide.

Germany's Symrise brings to the table a unique blend of creativity and biotechnological prowess, specializing in developing natural fragrances that resonate with contemporary desires for authenticity and naturalness. Robertet of France distinguishes itself with a focus on natural ingredients, appealing to the growing market segment that values organic ingredients and eco-friendly products.

The USA's Sensient Flavors & Fragrances Group and Takasago International Corporation from Japan are instrumental in integrating novel scent technologies and materials, enhancing the sensory appeal of the perfume market while adhering to stringent quality standards. IFF, with its global footprint, excels in creating fragrances that capture the essence of diverse cultures and preferences, facilitating a personalized fragrance experience.

Market Key Players

- Firmenich & Cie (Switzerland)

- International Flavors & Fragrances Inc. (USA)

- Givaudan (Switzerland)

- Symrise (Germany)

- Robertet (France)

- Sensient Flavors & Fragrances Group (USA)

- Takasago International Corporation (Japan)

- IFF (USA)

- Kerry Group (Ireland)

- Huabao International (China)

- Ogawa (Japan)

- KAO Corporation (Japan)

- BASF SE (Germany)

- Rhodia (France)

- Citrus & Allied Products (USA)

Recent Development

- In January 2023, Ajmal & Sons, a family-owned and operated perfume business with its headquarters within the U.A.E., launched a new line of perfumes in Shoppers Stop located in India. The two major companies teamed up to introduce the well-known scent brand's new offerings. Prestige is the brand name for the luxurious and unique collection. It features Aristocrat Eau De Parfum for Him & Her Aristocrat Eau De Parfum for Him & Her, the world's top-selling fragrance.

- In October 2023, Marc Jacobs International and Marc Jacobs Fragrances which is an affiliate of Coty Inc., launched Perfect Marc Jacobs, Marc Jacobs' latest fragrance for women.

Report Scope

Report Features Description Market Value (2023) USD 75.6 Billion Forecast Revenue (2033) USD 129.8 Billion CAGR (2024-2032) 5.7% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type(Eau de Parfum, Eau de Toilette, Eau de cologne, Eau Fraiche), By Product(Mass, Premium), By End-Use(Women, Men, Unisex), By Sales Channel(Online Retailers, Offline Retailers, Others) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Firmenich & Cie (Switzerland), International Flavors & Fragrances Inc. (USA), Givaudan (Switzerland), Symrise (Germany), Robertet (France), Sensient Flavors & Fragrances Group (USA), Takasago International Corporation (Japan), IFF (USA), Kerry Group (Ireland), Huabao International (China), Ogawa (Japan), KAO Corporation (Japan), BASF SE (Germany), Rhodia (France), Citrus & Allied Products (USA) Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Firmenich & Cie (Switzerland)

- International Flavors & Fragrances Inc. (USA)

- Givaudan (Switzerland)

- Symrise (Germany)

- Robertet (France)

- Sensient Flavors & Fragrances Group (USA)

- Takasago International Corporation (Japan)

- IFF (USA)

- Kerry Group (Ireland)

- Huabao International (China)

- Ogawa (Japan)

- KAO Corporation (Japan)

- BASF SE (Germany)

- Rhodia (France)

- Citrus & Allied Products (USA)