Luxury Perfumes Market By Distribution Channel Analysis (Department Stores, Supermarkets/Hypermarkets, Specialty Stores, Other), By Gender Analysis (Male, Female, Unisex), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

12389

-

May 2024

-

300

-

-

This report was compiled by Research Team Research team of over 50 passionate professionals leverages advanced research methodologies and analytical expertise to deliver insightful, data-driven market intelligence that empowers businesses across diverse industries to make strategic, well-informed Correspondence Research Team Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

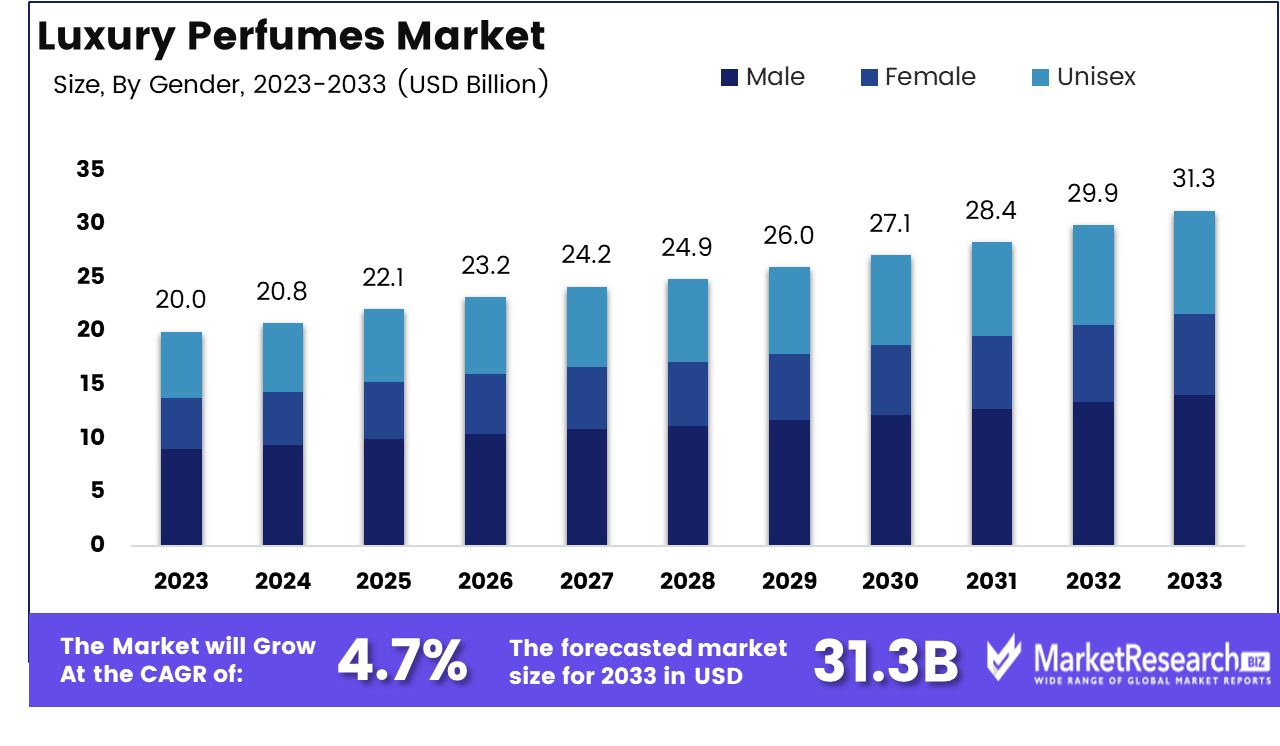

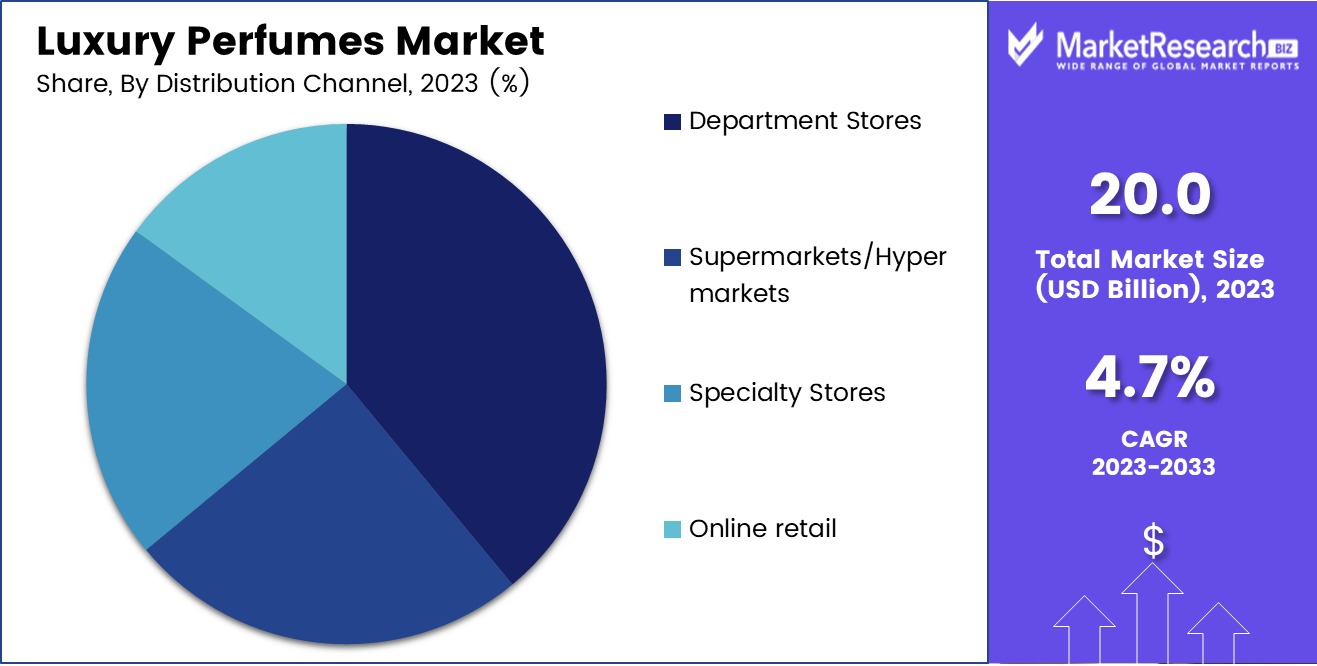

The Luxury Perfumes Market size is expected to be worth around USD 31.3 Bn by 2033 from USD 20 Bn in 2023, growing at a CAGR of 4.7% during the forecast period from 2024 to 2033.

The surge in demand for premium perfumes in the fashion industry and organic perfumes are some of the main driving factors for the luxury perfume market expansion. Premium perfumes have become an important part of the fashion industry. Many designers are introducing premium perfume lines that have been created to match specific fashion pools. The perfume and fashion continue to grow, with the two sectors becoming rapidly interconnected. For example, Gucci and its luxurious Gucci Bloom perfume is a new addition to the world of luxury perfumes. Its unique fragrance makes it a preferred choice for modern women who want to create a statement with their fragrance.

Sustainability is one of the global concerns for the customers as well as to the perfume manufacturing industry with the fashion industry. Several brands are aiming to develop sustainable or organic products that have less impact on the environment. For example, some perfumes are extracted from natural and organic ingredients that are naturally sourced and cruelty-free. Fashion designers are using such types of recycled products and implementing natural manufacturing methods to decrease waste and carbon footprints. Another example is Bon Parfumeur, our eaux de parfum are made with 82% natural ingredients.

Sustainability is one of the global concerns for the customers as well as to the perfume manufacturing industry with the fashion industry. Several brands are aiming to develop sustainable or organic products that have less impact on the environment. For example, some perfumes are extracted from natural and organic ingredients that are naturally sourced and cruelty-free. Fashion designers are using such types of recycled products and implementing natural manufacturing methods to decrease waste and carbon footprints. Another example is Bon Parfumeur, our eaux de parfum are made with 82% natural ingredients.Manufacturers have given more focus to the packaging of the luxury perfumes. As consumers want organic natural perfume, the packaging is also sustainable. The bottles are made of 100% recyclable glass and the external packaging is made from virgin and recycled pulp which is certified by the Forest Stewardship Council. As organic perfumes are made up of natural essential oils, it has to receive Cosmetic organic and natural standard certification to be recognized as a purely organic and natural perfume.

These luxury perfumes are available in different store outlets. Consumers are more inclined towards online shopping as it provides a wide range of options to choice. Many of the products are also not available in the physical stores but the distributors have expanded their market reach to the online platforms. Online platforms generate the highest market revenue as compared to other physical stores. As the demand for luxury perfume will increase due to customer demand, it will also contribute to the market expansion in the forecast period.

Key Takeaways

- Market Value: The Luxury Perfumes Market size is expected to be worth around USD 31.3 Bn by 2033 from USD 20 Bn in 2023, growing at a CAGR of 4.7% during the forecast period from 2024 to 2033.

- Based on Distribution Channel: Department Stores lead as prime channel in Luxury Perfumes Market

- Based on Gender: Luxury perfumes for men show robust growth in market demand.

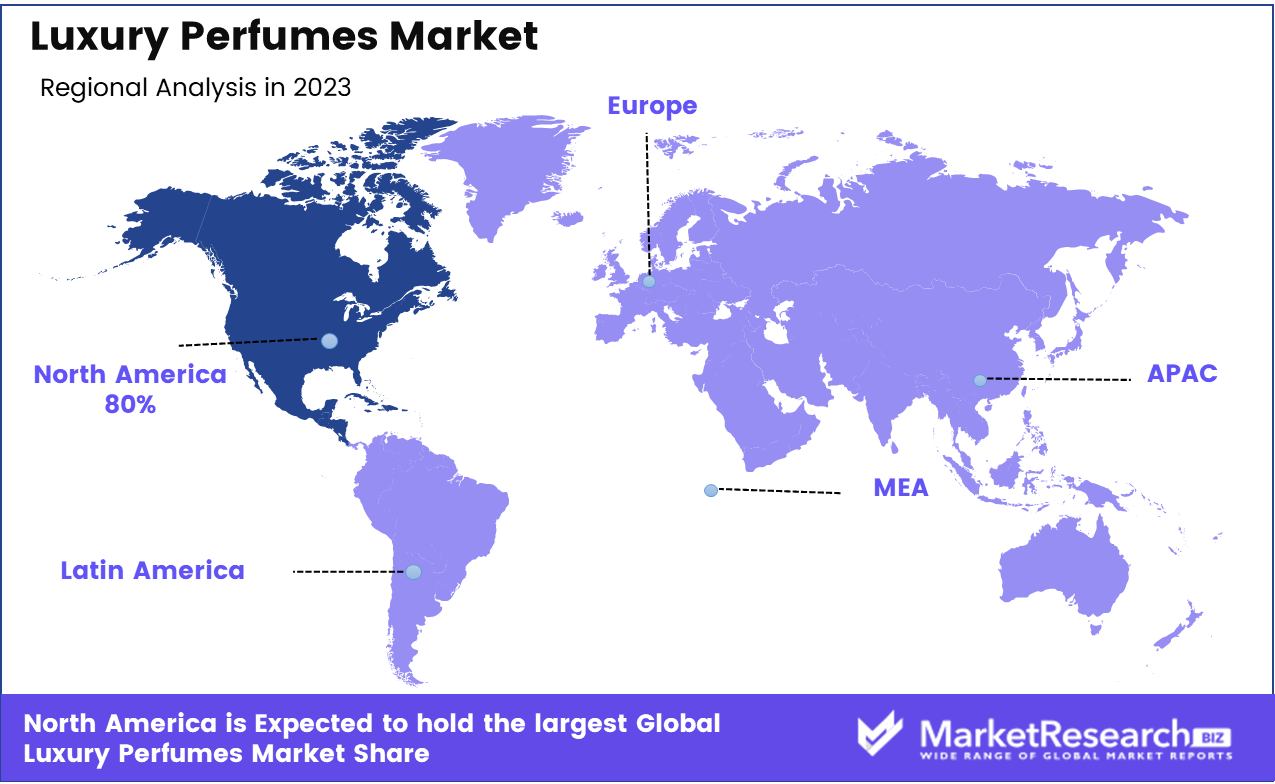

- Regional Analysis: North America dominates 80% of the global luxury perfume market.

- Growth Opportunity: In 2023, the luxury perfume market is set to grow significantly, driven by an expanding affluent consumer base in emerging markets and increased e-commerce adoption post-pandemic, enhancing access and customer engagement.

Driving factors

Exclusivity and Brand Prestige: Elevating Consumer Aspirations

The luxury perfume market thrives on the exclusivity and prestige associated with top-tier brands, often tied to renowned fashion houses and celebrated public figures. This exclusivity cultivates a distinct brand identity and a sense of aspiration among consumers. The involvement of celebrities not only magnifies the brand's visibility but also adds a layer of personal aspiration, as consumers are drawn to the glamour and status symbolized by their favorite icons. High-end brands leverage this by crafting narratives around exclusivity and luxury, which effectively aligns with the consumers’ desire for distinguished lifestyles. This strategy not only solidifies consumer loyalty but also allows brands to command premium pricing, thereby driving up the market value.

Gifting Culture: Sustaining Demand Across Seasons

Luxury perfumes hold a significant place in the gifting culture, with heightened sales during holidays and special occasions such as Valentine’s Day, Mother’s Day, and Christmas. This consistent demand across various gifting seasons underpins stable revenue streams for luxury perfume brands. The practice of giving luxury perfumes as gifts is propelled by their perceived value and the emotional weight they carry, making them a favored choice for consumers seeking to make a memorable and sophisticated impression. This aspect of luxury perfumes ensures a continuous market presence and helps in maintaining cyclic sales peaks, thus contributing robustly to the overall market growth.

Customization and Personalization: Enhancing Consumer Engagement

In response to growing consumer demand for unique and individualized products, luxury perfume brands have increasingly embraced customization and personalization. This trend allows consumers to create or influence the creation of their signature scents, thereby enhancing the personal connection with the product. Such personalized experiences not only deepen customer engagement but also increase the perceived value of the product. Brands that offer these bespoke services are seen as more customer-centric, which significantly boosts customer loyalty and satisfaction. This strategic move not only differentiates brands within a competitive market but also fosters a deeper emotional attachment to the product, leading to increased sales and market penetration.

Restraining Factors

High Price Points: Creating Barriers to Broader Market Penetration

The luxury perfumes market, characterized by its premium price tags, faces inherent limitations in its consumer reach. These high costs inherently restrict access primarily to upper-income brackets, consequently narrowing the potential customer base. While the exclusivity and prestige associated with high pricing can enhance brand value and appeal, they simultaneously serve as a barrier to entry for budget-conscious consumers. This dichotomy can restrain market growth as it limits the volume of potential sales, particularly in economically diverse or less affluent regions.

Moreover, the sensitivity to economic fluctuations means that during downturns, even the wealthier segments may curtail discretionary spending, including on luxury items like perfumes. Thus, while high price points maintain the luxurious aura of these products, they also significantly curtail the expansion of the customer base, affecting overall market growth.

Limited Availability of Niche Perfumes: Specialized Appeal Restricting Volume Growth

Niche perfumes, which are often crafted to appeal to specific tastes and preferences, possess a unique position in the luxury perfume market. However, their appeal to a relatively smaller demographic limits their availability and presence in broader retail channels compared to mass-produced counterparts. This exclusivity supports a brand’s luxury status and can command loyal followings among aficionados, yet it simultaneously restricts the total marketable audience.

Limited distribution channels and the specialized nature of niche perfumes mean that while they can achieve high margins, their overall contribution to market volume remains constrained. This factor plays a critical role in shaping the market dynamics by maintaining high value per customer while limiting the potential for widespread market penetration.

Distribution Channel Analysis

Department stores lead the Luxury Perfumes Market distribution, offering personalized service and a premium selection.

In 2023, Department Stores held a dominant market position in the "By Distribution Channel" segment of the Luxury Perfumes Market. This channel's strength lies in its ability to offer an upscale shopping experience, personalized service, and the advantage of physical interaction with products before purchase. Department stores, often located in premium shopping districts or well-trafficked malls, attract a significant footfall of affluent customers who prefer the tactile experience of sampling perfumes before committing to a purchase. The ambiance and customer service provided in these stores enhance the luxury buying experience, aligning well with consumer expectations for high-end products.

Supermarkets/Hypermarkets, though less associated with luxury, play a crucial role in accessibility and convenience. Their extensive network and high-volume sales capability enable them to stock a variety of luxury perfumes, making them accessible to a broader audience. This distribution channel benefits from high consumer traffic and the impulse-buying behavior often seen in such settings.

Specialty Stores are another pivotal channel, specializing in niche fragrances and exclusive brands that are not typically available in more generalized retail environments. These stores attract discerning customers looking for expert advice, personalized service, and unique products that differentiate them from mainstream offerings.

Online retail has seen exponential growth, driven by the digital transformation of the shopping experience. Consumers value the convenience of browsing and purchasing luxury perfumes from the comfort of their homes. Ecommerce platforms also offer the opportunity for brands to reach a global audience, complemented by detailed product descriptions, reviews, and competitive pricing strategies. This channel's growth is enhanced by improved logistics, including faster delivery options and robust return policies, making it increasingly popular among luxury perfume buyers.

Gender Analysis

Luxury perfumes marketed towards males are gaining traction due to their distinct and bold scents.

In 2023, Male fragrances held a dominant market position in the "By Gender" segment of the Luxury Perfumes Market. This segment's prominence is reinforced by the growing cultural shift towards grooming and personal care among men globally. As societal norms evolve, there is an increased acceptance and even expectation for men to invest in luxury personal care products, including perfumes. The male demographic is increasingly viewed as a lucrative market by perfume brands, which are now crafting scents that cater specifically to men's preferences and lifestyles, involving woodsy, aromatic, and spicy notes that traditionally appeal to this group.

Meanwhile, the Female segment continues to be a stronghold in the luxury perfume market, characterized by a vast array of scent profiles and longstanding consumer loyalty. Brands within this segment frequently innovate by introducing new home fragrances and limited-edition scents to maintain interest and excitement among their female consumer base. The marketing strategies often focus on emotional connection, tapping into personal memories and experiences.

The Unisex segment has seen remarkable growth and is rapidly expanding as gender norms in fashion and beauty continue to blur. This segment appeals to consumers who prefer versatile and unique fragrances that do not conform to traditional gender-specific categorizations. Unisex perfumes often emphasize neutral, earthy, and fresh notes, making them appealing across the board.

Key Market Segments

By Distribution Channel Analysis

- Department Stores

- Supermarkets/Hypermarkets

- Specialty Stores

- Online retail

By Gender Analysis

- Male

- Female

- Unisex

Growth Opportunity

Expanding Consumer Base in Emerging Markets

The luxury perfume market is poised for significant growth in 2023, primarily driven by the expanding affluent consumer base globally. As wealth increases, particularly in emerging markets like Asia-Pacific and the Middle East, more consumers are willing to invest in luxury goods, including high-quality scents. This trend offers a substantial opportunity for luxury perfume brands to tap into new demographic segments that are developing a taste for luxury and exclusivity. By strategically entering these markets or expanding their presence, brands can capitalize on the growing pool of consumers who view luxury perfumes as a symbol of status and personal style.

Leveraging E-commerce for Market Penetration

Another pivotal growth opportunity in 2023 lies in the expansion of last mile delivery. The online sales of luxury perfumes have seen rapid growth, a trend accelerated by the global shift towards digital following the pandemic. This shift presents a dual opportunity: first, to reach a broader audience that includes tech-savvy and younger consumers who prefer online shopping; and second, to enhance the brand experience through exclusive online content and personalized digital interactions. By creating immersive online experiences, luxury perfume brands can engage customers more deeply, offering them the convenience of shopping from home while still enjoying a premium brand experience. This approach not only broadens the market reach but also strengthens customer loyalty by merging accessibility with luxury.

Latest Trends

Rising Demand for Niche Fragrances

In 2023, the luxury perfumes market is set to be strongly influenced by the growing appeal of niche fragrances. These unique and often unconventional scents crafted by indie brands are rapidly gaining popularity among discerning consumers who seek distinctiveness beyond mainstream offerings. Niche fragrances distinguish themselves by using rare ingredients and complex scent profiles, catering to a clientele that values individuality and craftsmanship. This trend is not only reshaping consumer preferences but also encouraging major brands to innovate and diversify their own product lines to include niche-like elements. As a result, the market is experiencing a surge in demand for these bespoke fragrances, signaling a shift towards more personalized and artisanal scents in the luxury sector.

The Allure of Limited Editions and Exclusivity

Another significant trend shaping the luxury perfume market in 2023 is the strategic release of limited edition perfumes and exclusive collaborations. These initiatives create a sense of urgency and exclusivity, driving up consumer interest and engagement. Limited editions often feature unique packaging or rare ingredients, making them highly desirable among collectors and enthusiasts. Furthermore, exclusive collaborations, such as those between luxury brands and renowned artists or designers, add an additional layer of prestige and novelty, appealing to a broader audience. This approach not only boosts sales during the release period but also enhances brand perception as innovative and elite. The dual strategy of offering niche fragrances and exclusive products is effectively expanding the market’s reach while reinforcing the luxury status of the brands involved.

Regional Analysis

North America dominates the luxury perfume market, holding an impressive 80% of the global share.

The global luxury perfumes market exhibits dynamic growth characteristics, heavily influenced by regional consumer preferences and economic conditions. Notably, North America emerges as the dominating region, accounting for an impressive 80% of the market share. This dominance is primarily driven by the high purchasing power of consumers in the United States and Canada, combined with a strong presence of leading luxury brands that innovate consistently to cater to sophisticated consumer tastes.

In Europe, the market thrives on a rich heritage of perfumery, particularly in countries like France and Italy, known globally for their luxury fragrance houses. European consumers display a high affinity for niche and artisanal perfumes, supporting a vibrant market for luxury scents characterized by exclusivity and craftsmanship.

The Asia Pacific region is witnessing rapid growth in the luxury perfume sector, fueled by increasing disposable incomes and a growing middle-class population. Markets such as China and India are becoming key players, as they show a growing inclination towards luxury goods as symbols of social status and personal success.

In the Middle East & Africa, the luxury perfumes market benefits from a traditional affinity for rich, opulent fragrances. The cultural significance of perfume in the region supports a steady demand for luxury, high-quality scents, making it a significant market for high-end perfume brands.

Latin America, though smaller in comparison, is showing promising growth, driven by an expanding consumer base increasingly inclined towards luxury products, and the gradual economic stabilization in countries like Brazil and Mexico, which enhances consumer spending power on luxury items.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

In 2023, the global luxury perfume market is shaped significantly by the strategic movements of its key players, each contributing unique strengths to this dynamic industry. Parfums Christian Dior and Chanel, Inc. stand out with their iconic heritage and mastery in creating timeless fragrances that continue to appeal to both traditional and new generations of perfume lovers. Their ongoing commitment to maintaining high standards of craftsmanship and exclusivity reinforces their leadership position in the market.

LVMH Moët Hennessy and Kering SA, owning multiple luxury brands, leverage their extensive portfolios to innovate and capture diverse consumer segments, enhancing their global reach. Similarly, The Estée Lauder Companies Inc. has successfully expanded its footprint by consistently investing in brand acquisitions and digital marketing strategies, thus broadening its consumer base and adapting to changing market trends.

Calvin Klein and Ralph Lauren Corporation have capitalized on their strong brand recognition and broad distribution networks, making significant inroads into both developed and emerging markets. Their ability to blend classic scents with modern elements resonates well with a global audience seeking both familiarity and innovation in luxury perfumes.

Versace and Guccio Gucci S.p.A. enhance their market positions through bold branding and the allure of Italian luxury, attracting a clientele that values both style and olfactory uniqueness. Meanwhile, niche players like Annick Goutal SAS and Prada S.p.A. focus on artisanal and bespoke fragrances, catering to a market segment that appreciates personalized and distinctive scent experiences.

Top Key Players in Luxury Perfumes Market

- Parfums Christian Dior

- Calvin Klein

- LVMH Moët Hennessy

- Dior

- Versace

- Annick Goutal SAS

- Prada S.p.A.

- Chanel, Inc.

- Ralph Lauren Corporation

- The Estée Lauder Companies Inc.

- Gianni Versace S.p.A.

- Kering SA

- Guccio Gucci S.p.A.

Recent Development

- In March 2024, FRAGRANCE DU BOIS introduces "Voyage À Paris," a luxurious Paris-inspired perfume with top notes of rum, orange blossom, and marigold, capturing French sophistication and elegance in collaboration with Master Perfumers, and is available at selected stores and BEYONDSKIN boutiques, as reported by the PR announcement.

- In April 2024, L’Oreal is in discussions to acquire a minority stake in the Omani luxury perfume brand Amouage, valued at €3 billion, to leverage the sultanate's rich history.

- In April 2024, ROJA Luxury Parfums and Eau de Parfums, renowned for their British craftsmanship and elegance, are now available at SCENTONIQ across multiple locations in Malta, offering an unparalleled luxury perfumery experience.

- In November 2023, Scented Technology and Collaborations In recent years, luxury perfume brands have considered partnering with technology companies to incorporate fragrance into a variety of tech products.

Report Scope:

Report Features Description Market Value (2023) USD 20 Bn Forecast Revenue (2033) USD 31.3 Bn CAGR (2024-2033) 4.7% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Distribution Channel Analysis (Department Stores, Supermarkets/Hypermarkets, Specialty Stores, Online retail), By Gender Analysis (Male, Female, Unisex) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Parfums Christian Dior, Calvin Klein, LVMH Moët Hennessy, Dior , Versace, Annick Goutal SAS, Prada S.p.A., Chanel, Inc., Ralph Lauren Corporation, The Estée Lauder Companies Inc., Gianni Versace S.p.A., Kering SA, Guccio Gucci S.p.A. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Parfums Christian Dior

- Calvin Klein

- LVMH Moët Hennessy

- Dior

- Versace

- Annick Goutal SAS

- Prada S.p.A.

- Chanel, Inc.

- Ralph Lauren Corporation

- The Estée Lauder Companies Inc.

- Gianni Versace S.p.A.

- Kering SA

- Guccio Gucci S.p.A.