Peptide Synthesis Market By Product (Equipment, Reagents and Consumables, Others), By Technology (Solid-Phase Peptide Synthesis, Solution-Phase Synthesis, Liquid-Phase Peptide Synthesis, Hybrid and Recombinant), By End-User (Pharmaceutical and Biotechnology Companies, Contract Manufacturing Organization (CMO), Academic and Research Institutes), By Application (Therapeutics, Diagnosis, Research), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

-

45295

-

April 2024

-

301

-

-

This report was compiled by Trishita Deb Trishita Deb is an experienced market research and consulting professional with over 7 years of expertise across healthcare, consumer goods, and materials, contributing to over 400 healthcare-related reports. Correspondence Team Lead- Healthcare Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

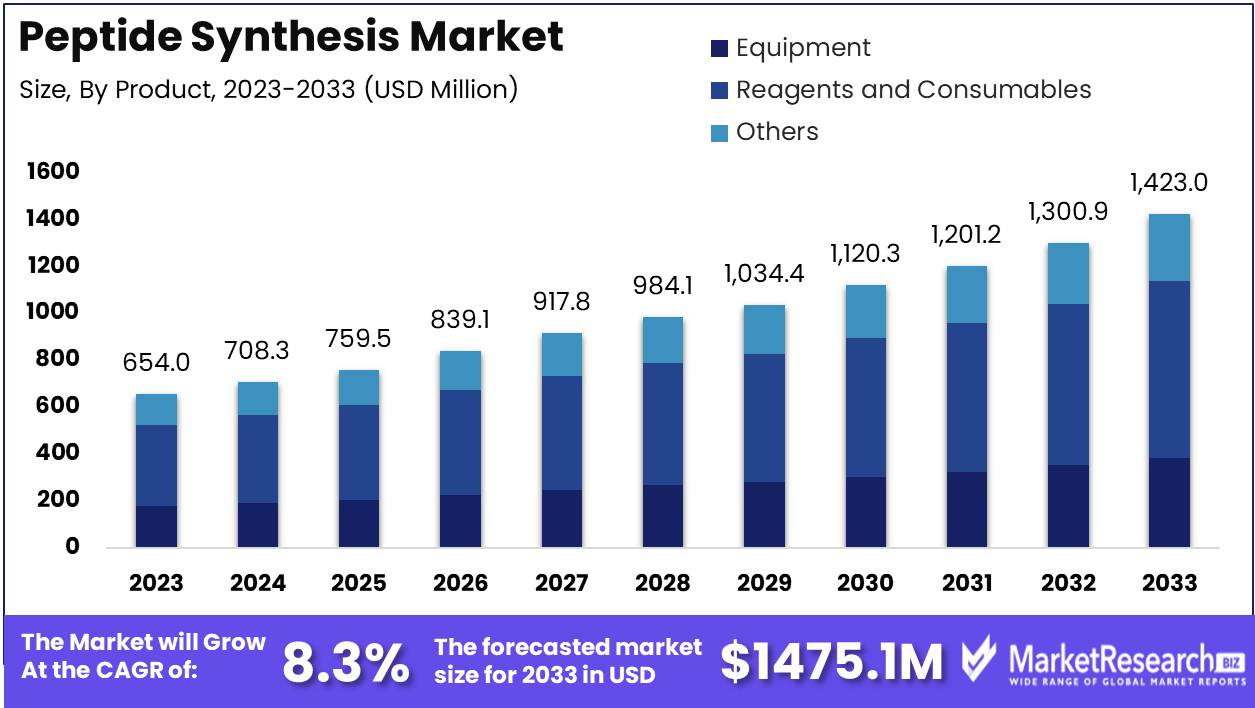

The Global Peptide Synthesis Market was valued at USD 654 Mn in 2023. It is expected to reach USD 1475.1 Mn by 2033, with a CAGR of 8.3% during the forecast period from 2024 to 2033.

The Peptide Synthesis Market refers to the dynamic ecosystem encompassing the production, distribution, and utilization of peptides synthesized through various methods, predominantly solid-phase peptide synthesis. Peptides, composed of amino acids, play pivotal roles in pharmaceuticals, biotechnology, and research sectors, driving the market's growth. This market is characterized by advanced technologies such as automated synthesizers and innovative methodologies to overcome challenges in synthesizing longer peptides. With escalating demand for peptide-based therapeutics and expanding applications across industries, the Peptide Synthesis Market presents lucrative opportunities for players to capitalize on evolving trends and meet the demands of diverse stakeholders.

The Peptide Synthesis Market continues to witness robust growth driven by a confluence of factors such as increasing demand from pharmaceutical and biotechnology industries, advancements in peptide synthesis technologies, and expanding applications in drug discovery and development. Solid-phase peptide synthesis stands out as the cornerstone method in contemporary peptide production, offering automation capabilities and facilitating high-throughput synthesis. This method, wherein the C-terminus of the initial amino acid is linked to an activated solid support, has become the preferred choice for its efficiency and scalability.

The Peptide Synthesis Market continues to witness robust growth driven by a confluence of factors such as increasing demand from pharmaceutical and biotechnology industries, advancements in peptide synthesis technologies, and expanding applications in drug discovery and development. Solid-phase peptide synthesis stands out as the cornerstone method in contemporary peptide production, offering automation capabilities and facilitating high-throughput synthesis. This method, wherein the C-terminus of the initial amino acid is linked to an activated solid support, has become the preferred choice for its efficiency and scalability.The market's trajectory is further propelled by the surging demand for longer peptides, particularly those exceeding 50 amino acids. However, synthesizing such peptides presents formidable challenges, prompting the adoption of cutting-edge synthesizers like CEM Liberty PRIME and CSBio II. These modern synthesizers epitomize the industry's commitment to innovation, enabling laboratory-scale peptide synthesis with enhanced efficiency and precision.

As pharmaceutical companies intensify their efforts in developing peptide-based therapeutics for a spectrum of ailments, including cancer biomarkers, metabolic disorders, and infectious diseases, the demand for advanced peptide synthesis technologies is poised to escalate further. Furthermore, the expanding applications of peptides in areas such as targeted drug delivery, diagnostics, and personalized medicine underscore the immense growth potential of the peptide synthesis market.

Key Takeaways

- Market Growth: The Global Peptide Synthesis Market was valued at USD 654 Mn in 2023. It is expected to reach USD 1475.1 Mn by 2033, with a CAGR of 8.3% during the forecast period from 2024 to 2033.

- By Product: Reagents and consumables dominate the segment, accounting for approximately 53%.

- By Technology: Solid-phase peptide synthesis dominates the segment, commanding approximately 44% of the market share.

- By End-User: Pharmaceutical and biotechnology companies lead the sector, capturing roughly 48% of the market share.

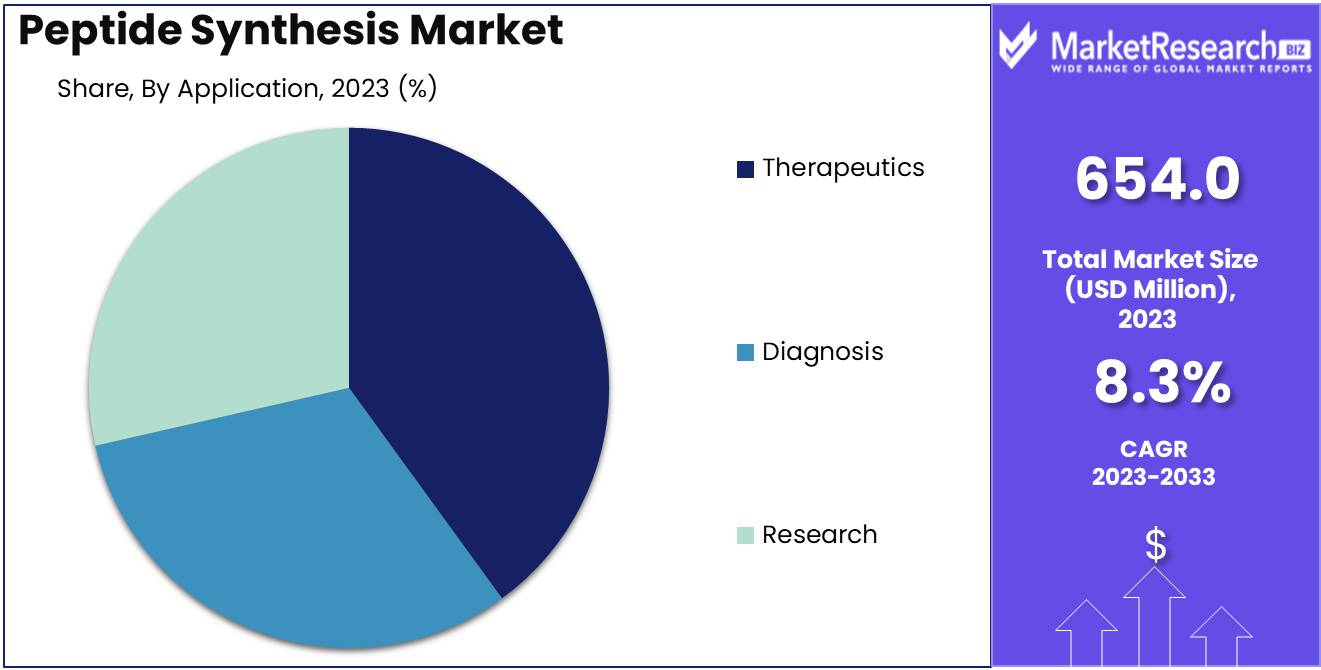

- By Application: Therapeutics take the lead, commanding about 42% of the market share.

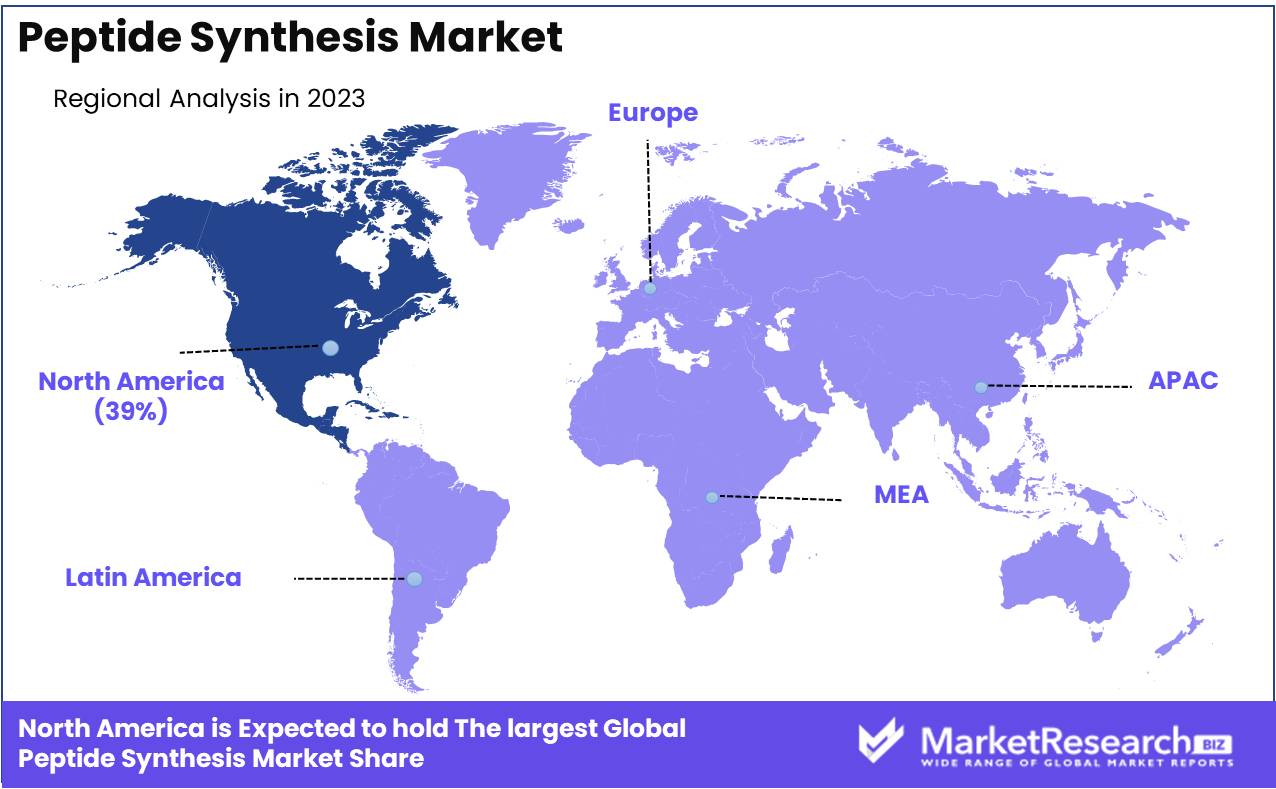

- Regional Dominance: The peptide synthesis market exhibits regional dominance with North America leading at approximately 39%.

- Growth Opportunity: The peptide synthesis market is poised for substantial growth, fueled by increasing demand for personalized medicine and the expanding adoption of peptide-based therapeutics, driven by oncology applications.

Driving factors

Rising Peptide Use in Pharmaceuticals

The increasing utilization of peptides in pharmaceuticals is a pivotal factor propelling the growth of the Peptide Synthesis Market. Peptides offer a myriad of advantages, including high specificity, low toxicity, and favorable pharmacokinetic properties, making them an attractive choice for drug development. Pharmaceutical companies are increasingly incorporating peptides into their drug pipelines due to their efficacy in targeting specific biological buffers pathways.

As the pharmaceutical industry continues to focus on developing innovative peptide-based therapies, the demand for peptide synthesis services is expected to soar. Contract Research Organizations (CROs) specializing in peptide synthesis are witnessing heightened demand for their expertise in custom peptide synthesis, purification, and characterization. Consequently, this surge in demand is driving investments in peptide synthesis technologies and infrastructure to meet the evolving needs of the pharmaceutical sector.

Demand Surge for Personalized Medicines

The burgeoning demand for personalized medicines is a significant catalyst for the expansion of the Peptide Synthesis Market. Personalized medicine, also known as precision medicine, emphasizes tailoring medical treatment to individual patients based on their genetic makeup, lifestyle factors, and disease characteristics. Peptides play a pivotal role in personalized medicine as they enable the development of targeted therapies designed to address specific patient needs and disease profiles.

With advancements in genomics and molecular diagnostics, there is a paradigm shift towards precision medicine approaches across various therapeutic areas, including oncology, neurology, and autoimmune disorders. Peptide-based drugs offer unparalleled precision in targeting disease pathways, minimizing off-target effects, and enhancing therapeutic outcomes for patients. The growing adoption of personalized medicine strategies by healthcare providers and pharmaceutical companies is fueling the demand for custom peptide synthesis services. These services enable the rapid development and production of peptide-based therapeutics tailored to individual patient populations.

Expanding Therapeutic Applications

The expanding therapeutic applications of peptides are driving the diversification and growth of the Peptide Synthesis Market. Peptides exhibit remarkable versatility in targeting a wide range of molecular targets implicated in various diseases, thereby offering immense potential for therapeutic innovation.

Peptides have gained traction as promising candidates for the treatment of diverse medical conditions, including cardiovascular disorders, metabolic diseases, and infectious diseases. The growing recognition of peptides as viable drug candidates across multiple therapeutic areas is fostering collaborations between academic research institutions, pharmaceutical companies, and biotechnology firms. These collaborations are aimed at advancing preclinical and clinical development programs focused on novel peptide-based therapeutics.

Restraining Factors

Specificity and Environmental Impact Concerns

The demand for specificity in drug development has intensified due to advancements in personalized medicine and precision therapeutics. Peptides offer an attractive solution due to their high specificity in targeting molecular pathways associated with various diseases. Pharmaceutical companies are increasingly turning to peptides to develop tailored therapies that address specific patient populations or disease phenotypes. This trend is reflected in the growing number of peptide-based drugs in clinical trials and on the market.

However, alongside the pursuit of specificity, there's a growing awareness of environmental impact concerns associated with traditional peptide synthesis methods. Conventional peptide synthesis processes often involve the use of solvents and reagents that are harmful to the environment and pose safety risks to workers. Peptide synthesis typically generates significant waste, including chemical by-products and excess reagents, contributing to environmental pollution.

Hurdles in Enzymatic Production Efficiency

Enzymatic synthesis of peptides holds immense potential for enhancing production efficiency and reducing environmental impact. Enzymes offer exquisite selectivity and mild reaction conditions, enabling the synthesis of complex peptides with high purity and yield. However, despite the promise of enzymatic synthesis, several hurdles impede its widespread adoption in the industry.

One of the primary challenges is the limited substrate scope and scalability of enzymatic reactions for peptide synthesis. Enzymes often exhibit substrate specificity, limiting the range of peptide sequences that can be synthesized efficiently. Furthermore, enzymatic reactions may suffer from low reaction rates and product yields, particularly for long or structurally complex peptides.

By Product Analysis

Reagents and consumables hold the lion's share at 53% in the product segment.

In 2023, Reagents and Consumables held a dominant market position in the By Product segment of the Peptide Synthesis Market, capturing more than a 53% share. This segment's substantial share can be attributed to the indispensability of reagents and consumables in peptide synthesis processes. Reagents and consumables are essential components required for various stages of peptide synthesis, including peptide coupling, deprotection, and purification. The increasing demand for peptide-based therapeutics across diverse medical applications, such as oncology Drugs, metabolic disorders, and infectious diseases, has significantly propelled the consumption of reagents and consumables in peptide synthesis.

Moving on to the Equipment segment, it emerged as another significant contributor to the Peptide Synthesis Market. While not as dominant as reagents and consumables, equipment plays a crucial role in facilitating peptide synthesis procedures. High-quality equipment, such as peptide synthesizers, liquid handling systems, and chromatography instruments, are essential for ensuring precise and reproducible peptide synthesis outcomes. The growing adoption of automated peptide synthesizers and other advanced equipment by research laboratories and pharmaceutical companies has bolstered the demand for this segment.

By Technology Analysis

Solid-phase peptide synthesis reigns supreme with a commanding 44% in technology.

In 2023, Solid-Phase Peptide Synthesis (SPPS) held a dominant market position in the By Technology segment of the Peptide Synthesis Market, capturing more than a 44% share. This significant share underscores the widespread adoption and effectiveness of SPPS as a preferred method for peptide synthesis among researchers and pharmaceutical manufacturers. Solid-phase peptide synthesis involves the stepwise assembly of peptide chains on a solid support matrix, enabling efficient purification and synthesis of high-quality peptides. The method offers several advantages, including ease of automation, rapid synthesis times, and compatibility with a wide range of peptide sequences and modifications.

In contrast, Solution-Phase Synthesis, Liquid-Phase Peptide Synthesis, and Hybrid and Recombinant methods collectively constitute the remaining share of the By Technology segment. Solution-Phase Synthesis involves the synthesis of peptides in solution phase, often utilizing traditional coupling chemistries and protecting group strategies. While this method offers versatility in peptide synthesis, it may face challenges in scalability and purification compared to solid-phase approaches.

Liquid-Phase Peptide Synthesis, involves the direct synthesis of peptides in a liquid phase without the need for solid support matrices. Although less commonly utilized than solid-phase methods, liquid-phase synthesis can be advantageous for certain peptide sequences and applications.

Hybrid and Recombinant methods combine aspects of solid-phase and solution-phase synthesis techniques, often leveraging recombinant DNA technology to produce peptides. These methods offer unique capabilities for synthesizing complex and structurally diverse peptides, making them valuable tools for peptide engineering and drug discovery efforts.

By End-User Analysis

Pharmaceutical and biotech firms lead with 48% in end-user market share.

In 2023, Pharmaceutical and Biotechnology Companies held a dominant market position in the By End-User segment of the Peptide Synthesis Market, capturing more than a 48% share. This commanding share underscores the pivotal role played by pharmaceutical and biotechnology companies in driving the demand for peptide synthesis services and products. These companies are actively engaged in the development of peptide-based therapeutics for a wide range of medical indications, including oncology, metabolic disorders, and autoimmune diseases. The robust pipeline of peptide drugs in various stages of development, coupled with the growing emphasis on biologics and personalized medicine, has propelled the demand for peptide synthesis among pharmaceutical and biotechnology firms.

Contract Manufacturing Organizations (CMOs) or Contract Research Organizations (CROs) and Academic and Research Institutes collectively constitute the remaining share of the By End-User segment. CMOs and CROs provide peptide synthesis services to pharmaceutical companies and research institutions, offering expertise in custom peptide synthesis, process optimization, and scale-up production. These organizations play a crucial role in supporting the peptide synthesis ecosystem by providing specialized services to meet the diverse needs of clients in drug discovery and development.

Academic and Research Institutes encompass universities, research laboratories, and academic centers engaged in basic and translational research in the field of peptide science. While these institutions may not command as significant a share of the market as pharmaceutical and biotechnology companies, they contribute to the advancement of peptide synthesis through fundamental research, technology development, and education. Academic and research institutes serve as hubs of innovation, driving advancements in peptide synthesis methodologies, and fostering collaborations with industry partners for translating research findings into clinical applications.

By Application Analysis

Therapeutics lead the application segment with 42% market dominance.

In 2023, Therapeutics held a dominant market position in the By Application segment of the Peptide Synthesis Market, capturing more than a 42% share. This substantial share highlights the widespread utilization of peptides as therapeutic agents in various medical treatments and underscores the significance of peptide synthesis in drug discovery and development efforts. Peptide therapeutics have gained immense popularity due to their high specificity, low toxicity, and diverse biological activities, making them promising candidates for addressing a wide range of diseases, including cancer, diabetes, and cardiovascular disorders.

Diagnosis and Research collectively constitute the remaining share of the By Application segment. Diagnosis encompasses the use of peptides in diagnostic assays and imaging techniques for detecting diseases, monitoring treatment response, and assessing patient prognosis. Peptide-based diagnostic tools, such as peptide biomarkers and peptide ligands for targeting specific molecular pathways, play a crucial role in personalized medicine and precision diagnostics.

Research represents the application of peptides in basic and translational research endeavors aimed at unraveling the molecular mechanisms underlying disease pathogenesis, exploring new therapeutic targets, and developing innovative drug delivery systems. Peptides serve as valuable tools for studying protein-protein interactions, cell signaling pathways, and biological processes, facilitating the discovery of novel therapeutic interventions and diagnostic strategies.

Key Market Segments

By Product

- Equipment

- Reagents and Consumables

- Others

By Technology

- Solid-Phase Peptide Synthesis

- Solution-Phase Synthesis

- Liquid-Phase Peptide Synthesis

- Hybrid and Recombinant

By End-User

- Pharmaceutical and Biotechnology Companies

- Contract Manufacturing Organization (CMO)

or Contract Research Organization (CRO) - Academic and Research Institutes

By Application

- Therapeutics

- Diagnosis

- Research

Growth Opportunity

Advancing Personalized Medicine

The convergence of technological innovations and the surging demand for personalized medicine is poised to redefine the landscape of the global Peptide Synthesis Market in 2024. With breakthroughs in genomics and proteomics, the market is witnessing a paradigm shift towards tailored therapeutic solutions. Peptides, owing to their specificity and efficacy, stand as key components in personalized medicine formulations. As the healthcare industry increasingly embraces precision therapies, the demand for customized peptides is expected to soar, presenting lucrative opportunities for market players.

Fostering Collaborations for Research

In 2024, collaborations across academia, industry, and research institutions are emerging as pivotal drivers in the Peptide Synthesis Market. These partnerships foster knowledge exchange, resource pooling, and innovation acceleration. By leveraging complementary expertise and resources, stakeholders are expediting the development and commercialization of novel peptide-based therapies. Such collaborative endeavors not only enhance the efficiency of research and development processes but also facilitate market penetration, thereby amplifying growth prospects.

Rising Demand for GLP-1 Peptide Manufacturing

The escalating prevalence of metabolic disorders, coupled with the burgeoning demand for effective diabetes management, is fueling the need for GLP-1 peptide manufacturing. GLP-1 peptides, renowned for their glucose-lowering properties and minimal side effects, are gaining prominence as promising therapeutics for type 2 diabetes. With the global diabetes burden reaching unprecedented levels, pharmaceutical companies are ramping up their production capacities to meet the escalating demand for GLP-1 peptides, presenting a substantial growth avenue for the Peptide Synthesis Market in 2024.

Latest Trends

Liquid Phase Synthesis on the Rise

In 2024, the global Peptide Synthesis Market is witnessing a notable uptick in the adoption of liquid phase synthesis methodologies. Liquid phase synthesis offers distinct advantages such as higher purity, scalability, and flexibility in synthesizing complex peptide structures. As advancements in automation and chemistry drive down costs and improve efficiency, liquid phase synthesis emerges as a preferred choice for peptide manufacturing across diverse therapeutic areas. This trend is poised to reshape the market landscape, with stakeholders capitalizing on the versatility and productivity offered by liquid phase synthesis platforms.

Solid-Phase Synthesis Gaining GMP Traction

Solid-phase synthesis is experiencing a resurgence in 2024, particularly in the context of gaining Good Manufacturing Practice (GMP) compliance. With stringent regulatory requirements governing pharmaceutical manufacturing, solid-phase synthesis offers inherent advantages in terms of process control, reproducibility, and quality assurance. Pharmaceutical companies are increasingly leveraging solid-phase synthesis platforms to ensure the production of high-quality, regulatory-compliant peptides for therapeutic applications. This trend underscores the industry's commitment to upholding stringent quality standards while driving innovation in peptide synthesis technologies.

Combinatorial Approach for Enhanced Efficiency

In 2024, the adoption of combinatorial approaches is emerging as a key trend in the Peptide Synthesis Market, aimed at enhancing efficiency and accelerating drug discovery and development processes. By combining high-throughput screening techniques with parallel synthesis methodologies, researchers can rapidly explore vast chemical space, identify lead compounds, and optimize peptide sequences for desired pharmacological properties. This trend reflects a strategic shift towards more streamlined and cost-effective drug discovery pipelines, as stakeholders seek to expedite the translation of novel peptide therapeutics from bench to bedside.

Regional Analysis

North America commands a significant share of the peptide synthesis market at around 39% globally.

The North American region holds a dominant position in the peptide synthesis market, accounting for approximately 39% of the global market share. This can be attributed to factors such as well-established pharmaceutical and biotechnology industries, robust research and development activities, and significant investments in healthcare infrastructure. Moreover, increasing prevalence of chronic diseases such as cancer and cardiovascular disorders in the region further drives the demand for peptide-based therapeutics. For instance, according to the American Cancer Society, an estimated 1.9 million new cancer cases were diagnosed in the United States in 2020.

Europe represents a significant market share in the global peptide synthesis market, driven by factors such as increasing healthcare expenditure, growing demand for personalized medicine, and advancements in peptide synthesis technologies. Countries such as Germany, France, and the United Kingdom are witnessing a rise in research activities focused on developing novel peptide-based drugs for various therapeutic applications. For example, according to the European Federation of Pharmaceutical Industries and Associations (EFPIA), the pharmaceutical R&D expenditure in Europe amounted to approximately €37.5 billion in 2020.

The Asia Pacific region is experiencing rapid growth in the peptide synthesis market, fueled by factors such as increasing investments in healthcare infrastructure, rising adoption of advanced technologies, and growing awareness about peptide-based therapeutics. Countries like China, India, and Japan are witnessing a surge in research and development activities, supported by government initiatives aimed at promoting biotechnology and pharmaceutical industries.

These regions represent emerging markets for peptide synthesis, characterized by increasing healthcare expenditure, rising prevalence of chronic diseases, and growing awareness about personalized medicine. Although the market penetration is relatively low compared to other regions, initiatives aimed at improving healthcare infrastructure and expanding access to advanced therapeutics are expected to drive market growth in these regions.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

In 2024, the global Peptide Synthesis Market is poised for significant growth, with several key players driving innovation and shaping the industry landscape. Among these key companies, Bachem Holding AG stands out as a frontrunner, commanding a substantial market share and demonstrating a strong commitment to advancing peptide synthesis technologies.

Bachem Holding AG has established itself as a leader in the field, leveraging its extensive experience and expertise to deliver high-quality peptides for research, diagnostic, and therapeutic applications. The company's comprehensive portfolio of peptide synthesis products and services caters to diverse customer needs, ranging from custom peptide synthesis to large-scale production.

Merck KGaA (EMD Millipore) is another key player contributing to the expansion of the global peptide synthesis market. With a focus on innovation and collaboration, Merck KGaA continues to develop cutting-edge solutions for peptide synthesis, including novel reagents, resins, and instrumentation. By offering integrated platforms and tailored solutions, the company enables researchers to streamline the peptide synthesis process and accelerate their discovery efforts.

CEM Corporation has emerged as a prominent player in the peptide synthesis market, renowned for its innovative microwave-assisted peptide synthesis technology. By harnessing the power of microwave energy, CEM Corporation enables rapid and efficient peptide assembly, significantly reducing synthesis times and enhancing overall productivity. This technology has garnered widespread adoption among researchers seeking to expedite the synthesis of complex peptides.

Market Key Players

- Bachem Holding AG

- Merck KGaA (EMD Millipore)

- CEM Corporation

- AAPPTec, LLC

- Biotage AB

- Gyros Protein Technologies AB

- GenScript Biotech Corporation

- Thermo Fisher Scientific Inc.

- New England Peptide, Inc.

- AnaSpec, Inc.

- Bio-Synthesis, Inc.

- Peptides International Inc.

- Advanced ChemTech

- CSBio

Recent Development

- In March 2024, Almac Group expands commercial manufacturing and peptide production capacity at its Craigavon headquarters. New facilities boost Almac Pharma Services' sachet drug product packaging and Almac Sciences' peptide API manufacturing.

- In March 2024, MIT's Picower Institute reveals that 40 Hz light and sound therapy activates neurons to release peptides, facilitating the removal of Alzheimer's-related proteins via the brain's glymphatic system.

- In September 2024, CordenPharma expands its Boulder, Colorado peptide plant, investing over $215 million to increase capacity to over 2 metric tons annually. Upgrades include automation, larger reactor volume, and new jobs.

Report Scope

Report Features Description Market Value (2023) USD 654 Mn Forecast Revenue (2033) USD 1475.1 Mn CAGR (2024-2033) 8.3% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Equipment, Reagents and Consumables, Others), By Technology (Solid-Phase Peptide Synthesis, Solution-Phase Synthesis, Liquid-Phase Peptide Synthesis, Hybrid and Recombinant), By End-User (Pharmaceutical and Biotechnology Companies, Contract Manufacturing Organization (CMO), or Contract Research Organization (CRO), Academic and Research Institutes), By Application (Therapeutics, Diagnosis, Research) Regional Analysis North America - The US, Canada, & Mexico; Western Europe - Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe - Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC - China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America - Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa - Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Bachem Holding AG, Merck KGaA (EMD Millipore), CEM Corporation, AAPPTec, LLC, Biotage AB, Gyros Protein Technologies AB, GenScript Biotech Corporation, Thermo Fisher Scientific Inc., New England Peptide, Inc., AnaSpec, Inc., Bio-Synthesis, Inc., Peptides International Inc., Advanced ChemTech, CSBio Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-