Global Biological Buffers Market By Type (Phosphate Type, Acetate Type, Other), By End-User (Research Institution, Pharmaceutical Industry, Other), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2023-2032

-

38028

-

June 2023

-

152

-

-

This report was compiled by Correspondence Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Report Overview

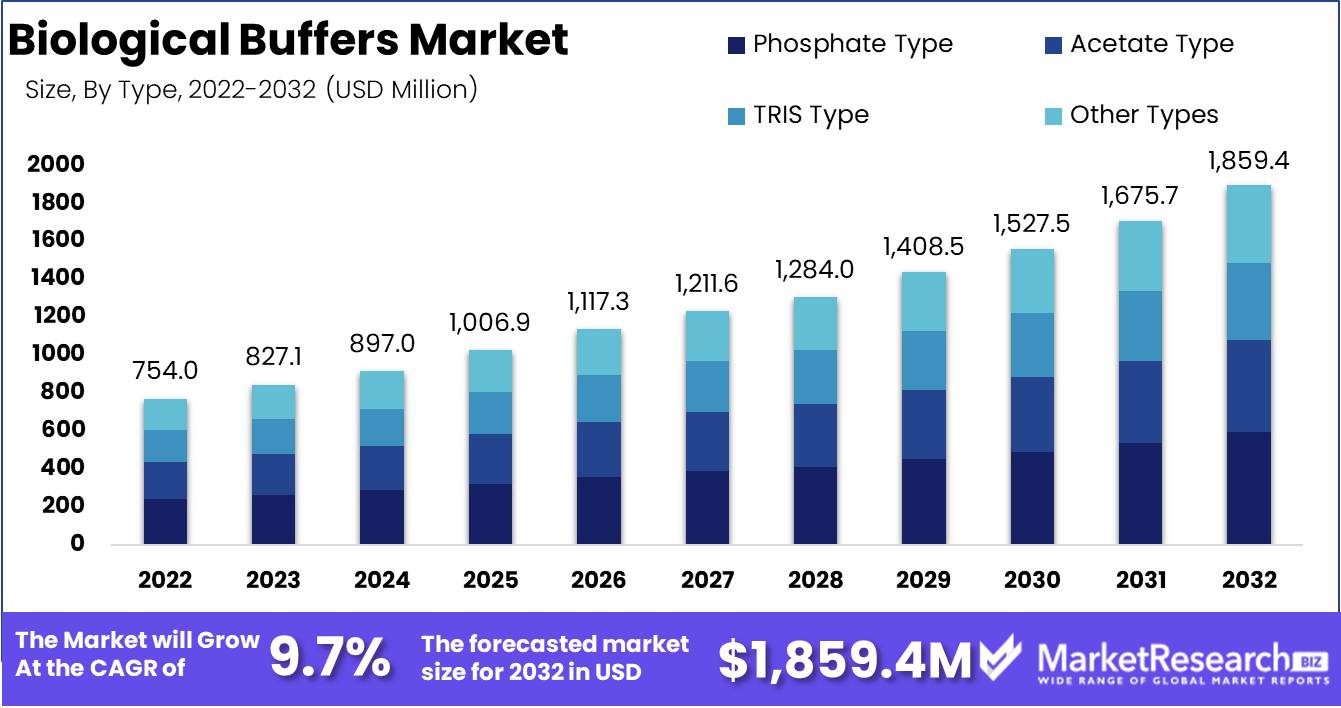

Global Biological Buffers Market size is expected to be worth around USD 1,859.4 Mn by 2032 from USD 754.0 Mn in 2022, growing at a CAGR of 9.7% during the forecast period from 2023 to 2032.

Biological buffers, which stabilize pH in biological systems, have a complex global market. Even with strong acids or bases, these buffers resist pH swings. These buffers play a crucial role in biological research, diagnostics, and analytical chemistry, ensuring precise and reliable experimental results. This vast market has a variety of products, including biological and pharmaceutical buffers, biochemical-grade buffers, and diagnostic-grade buffers, all of which contribute to its growth and vitality.

The global biological buffers market has seen many major discoveries and game-changing technologies recently. Concentrated solutions make biological buffers more dispensable and efficient. High-purity diagnostic buffers have revolutionized medical diagnostics by increasing precision and efficacy.

The global biological buffers market has attracted several companies due to rising demand across many sectors. These visionary enterprises, aware of the indispensable role performed by biological buffers, have launched on ambitious journeys, spending large resources on tireless research and development activities, all aimed at creating superior and more efficient varieties of these indispensable buffers.

Biological buffers are also being used in many products and services. The pharmaceutical industry has intentionally used biological buffers in every stage of drug development and manufacture to improve therapeutic interventions' quality and efficacy. The diagnostics industry uses premium-grade buffers to identify diseases with unmatched accuracy, improving diagnostic capabilities and patient outcomes.

As one explores this lively ecosystem, pharmaceutical, and biotechnology giants play a major role as investors. These industry titans use biological buffers for medication development, production, and quality control. To maximize illness detection and experimental analysis, diagnostic and analytical sectors require top-tier biological buffers.

The global biological buffers market is indispensable. As these buffers are used more across disciplines, transparency, explication, and accountability must be prioritized throughout their production, distribution, and use. Industry stakeholders must preserve ethical standards and adopt responsible procedures, ensuring the safety and efficacy of biological buffers in various applications.

The global biological buffers market has many business applications. The pharmaceutical and biotechnology industries, where the indispensable role played by biological buffers in the development and production of life-changing medications, are the most prominent examples of these applications. These buffers are indispensable in the diagnostic industry, enabling reliable illness detection and diagnosis. Research labs and top universities use biological buffers to maintain precise and reproducible experimental settings, advancing science and knowledge.

Driving factors

Growing Interest in Biological Buffers in Life Sciences

In recent years, the global market for biological buffers has expanded significantly due to rising demand in life sciences research and biopharmaceutical manufacturing. Biological buffers aid in maintaining a stable pH range in a solution, making them indispensable for cell culture advancements and other laboratory techniques. The need for pH regulation in numerous industries, including healthcare and pharmaceuticals, is fueling the expansion of biological buffers.

Regulatory Impact on the Market for Biological Buffers

In addition, there are regulations governing the use of biological buffers in various applications. Any changes to these regulations may have an effect on the market, so market participants must remain current to ensure compliance.

Emerging Technologies Shape the Market for Biological Buffers

Several emerging technologies could affect the market for biological buffers as a result of the accelerated development of technology. These include the development of bioreactors for the production of biopharmaceuticals and the rise of green chemistry principles for the production of sustainable biological buffers.

Disruptive Potential of Substitutes in the Market for Biological Buffers

The availability of substitutes and alternatives is a potential factor that could impact the competitive landscape of the market for biological buffers. The use of buffer solutions derived from natural sources, for instance, could disrupt the market for synthetic buffers.

Consumer Tendencies Promoting Resilient Biological Buffers

Additionally, emerging trends and variations in consumer behavior may impact the market for biological buffers. For instance, the increasing demand for personalized medicine and the expanding trend of green chemistry in the healthcare and pharmaceutical industries may motivate the use of sustainable biological buffers.

Restraining Factors

Factors Restricting the Market for Biological Buffers

Several restraining factors have a significant impact on the biological buffers market, including raw material price volatility, regulatory requirements, and alternative methods. In recent years, the global market for biological buffers has experienced a significant increase in demand, which has led to stricter regulations regarding product quality control, safety, and efficacy.

The Impact of Raw Material Price Volatility on Market Buffers

The price volatility of raw materials is one of the main restraints on the market for biological buffers. The cost of raw materials is a significant portion of the manufacturing cost of biological buffers, and fluctuations in their prices can result in substantial price changes for the final product. The limited availability of certain raw materials utilized in the production of biological buffers exacerbates the problem.

Regulatory Obstacles for the Market for Biological Buffers

Regulatory requirements are another major factor affecting the market for biological buffers. The production and distribution of biological buffers are subject to stringent regulations designed to ensure the product's safety and efficacy. These regulations vary by region and have become more stringent in recent years as product safety concerns have increased.

Compliance Expenses Impact Buffers Market

Compliance with regulatory requirements necessitates substantial investments of time and resources, which can be a significant barrier to entry for new market participants. Existing market participants' profitability may also be affected by the high cost of compliance.

Impact of Alternative Methods on the Market for Buffers

The market for biological buffers is also affected by the availability of alternative methods. Biological buffers can be replaced by a variety of alternative methods. In some instances, these alternatives may not be as effective as biological buffers, but they can be more cost-effective.

Type Analysis

Among the various varieties of biological buffers, the phosphate type segment dominates the market, accounting for the largest share of the market. This segment is expected to witness the most rapid growth over the next few years, driven by factors such as economic growth in emergent economies, consumer trends and behavior, and the growing demand for biochemical research.

Emerging nations have a substantial impact on the adoption of biological buffers of the phosphate type. As more countries in regions such as Asia-Pacific and Latin America endeavor to develop their healthcare and research infrastructure, the demand for high-quality biological buffers is expected to rise. In recent years, countries like India, China, and Brazil have witnessed significant economic growth, resulting in increased investments in the life sciences and research sectors. This has driven a rise in research institutions and pharmaceutical companies, which fuels the demand for biological buffers.

The demand for advanced biological buffers is driven by the trend toward personalized medicine and the increased emphasis on drug discovery research. This has resulted in a transition towards the use of phosphate-type buffers in numerous research environments. Phosphate-type buffers are preferable because they are exceptionally effective at maintaining a pH within the optimal range for enzyme activity. The growing demand for better biological buffers is driving manufacturers to concentrate on creating innovative buffer formulations that provide greater precision and consistency.

Because of the high demand from the research and pharmaceutical industries, the phosphate-type segment is anticipated to register the highest growth rate in the coming years. The demand for advanced biological buffers is also growing as a result of the increasing prevalence of chronic diseases and the increasing pressure to develop effective treatments. Phosphate-type buffers are crucial for a variety of research applications, including cell culture and protein purification, because they can sustain an optimal pH for enzyme activity. The rising demand for high-quality biological buffers is expected to drive the adoption of phosphate-type biological buffers in the global biological buffer market.

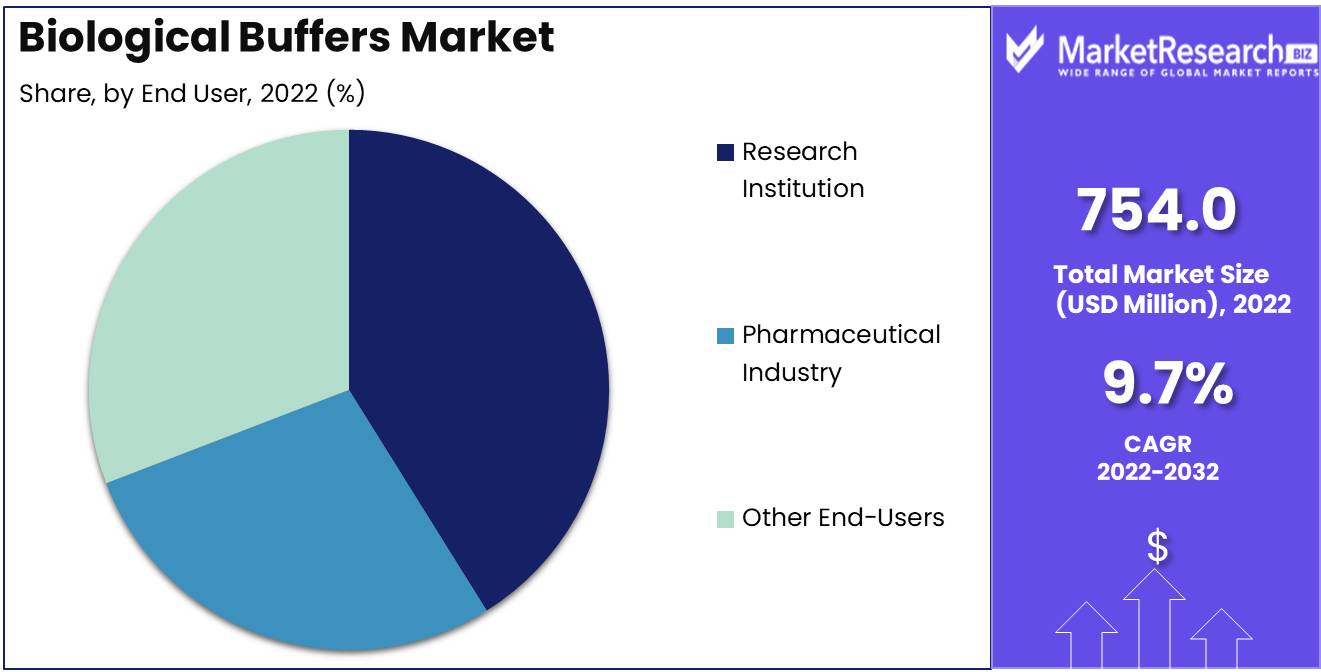

End-User Analysis

The research institution market segment dominates the global biological buffers market, accounting for the greatest market share. In the coming years, the segment is expected to witness the highest growth rate, driven by factors such as economic development in emerging economies, consumer trends and behavior, and the growing need for biochemical research.

The economic growth of emerging economies is driving the adoption of biological buffers in research institutions. The rise in disposable income is driving market growth, along with increased investments in the research and pharmaceutical sectors. Numerous emerging economies, including China, India, and Brazil, are attempting to become significant players in the pharmaceutical industry, which has resulted in the growth of research institutions and other life sciences industries. This has resulted in the exponential growth of the market for biological buffers.

Driving the growth of the biological buffers market are consumer behavior trends, which are crucial. The growing need for advanced research institution instruments to study biological systems and the increasing emphasis on drug development and personalized medicine are propelling the demand for advanced biological buffers, thereby fostering the segment's growth. In addition, the adoption of automation in research institutions is accelerating the demand for high-quality biological buffers and other reagents.

The research institution segment is anticipated to experience the quickest growth rate over the coming years, driven by the rising adoption of in-vitro models for research purposes. Advanced biological buffers are crucial for maintaining the stability and accuracy of these models, driving the demand for high-quality buffers among research institutions. In addition, the growing demand for cutting-edge research tools to study intricate biological processes is driving the demand for biological buffers, which is expected to propel the growth of the research institution segment in the global biological buffers market.

Key Market Segments

By Type

- Phosphate Type

- Acetate Type

- TRIS Type

- Other Types

By End-User

- Research Institution

- Pharmaceutical Industry

- Other End-Users

Growth Opportunity

Demand for Advanced Biological Buffers Is Growing

The production of biologics, diagnostics, and vaccines relies heavily on biological buffers. As these industries continue to expand, the demand for formulations of high-quality buffers increases. Manufacturers are investing significantly in R&D to create novel buffer formulations with improved performance, stability, and compatibility with a wide range of applications.

The Market for Customized Buffer Formulations Growing

With the increasing demand for advanced biologics, the need for precise and dependable buffers that optimize product quality and yield is growing. Innovative formulations assure the stability of biological products during storage, transport, and use.

Emerging Markets Drive the Growth of Biological Buffers

The market for biological buffers is expanding significantly as manufacturers seek out new opportunities. Emerging markets, such as Asia-Pacific and Latin America, are gaining importance for the production of buffers. These regions have a rising demand for biologics, lower production costs, and favorable regulatory environments. Consequently, major manufacturers are expanding their operations in these regions, thereby establishing partnership opportunities and fostering market expansion.

Precision and Dependability in Biopharmaceutical Buffers

The demand for customized buffers is increasing, with manufacturers seeking formulations that meet their specific requirements. pH, ionic strength, and compatibility are just a few of the factors that can be customized. As biologics become more complex and diverse, the need for customized buffers to ensure optimum yield and product quality increases.

Buffer Production is Revolutionized by Automation

The industry is being transformed by the incorporation of automation technology into buffer production. Automation increases productivity and accuracy while decreasing the likelihood of human error. Utilizing automation, manufacturers are optimizing production processes, increasing yields, and decreasing costs. By automating crucial buffer preparation stages, manufacturers can ensure product quality consistency and increase output.

Latest Trends

Demand for Biological Buffers is Growing

Pharmaceutical and biotechnology companies are increasing their demand for biological buffers in the market. Biological buffers are essential for maintaining the pH of a solution, stabilizing proteins and enzymes, and enhancing the precision and sensitivity of analytical techniques. They are extensively utilized in research and development activities as well as the manufacturing of numerous pharmaceutical and biotech products, making them a crucial component of the life sciences sector.

Animal-Free Buffers Revolutionize the Market

In the manufacturing of biological buffers, animal-derived products are frequently used. Nevertheless, animal-derived products have limitations in terms of stability, reproducibility, and contamination risks. To overcome the limitations of animal-derived products, a number of manufacturers offer animal-free buffers that eradicate contamination risks and guarantee high efficacy. These buffers are easy to use, have a long shelf life, and are extremely stable, making them an ideal solution for companies that place a premium on quality and efficiency in their products.

Formulations of Specialized Buffers for Diverse Applications

Different applications necessitate buffer formulations that cater to specific requirements, such as pH, ionic strength, and temperature stability. To satisfy the growing demand for specialized buffer formulations, a number of manufacturers offer application-specific formulations that cater to specific needs, such as enzymatic assays, protein crystallization, cell culture, and DNA sequencing. Companies can achieve reproducibility and consistency with these specialized formulations, which are crucial to the efficiency of their products and research.

Buffer Solutions That are Ready to Use are Becoming More and More Common

Preparing buffer solutions requires trained personnel and precise calculations of ingredients and pH levels. Several manufacturers offer ready-to-use formats that require minimal or no preparation in order to simplify the buffer preparation procedure. These formats are easy to use, save time, and reduce the likelihood of making mistakes. The adoption of these formats by biotech companies and laboratories is influenced by their convenience and efficiency.

Enhanced Stability through the Use of Concentrated Buffers

To maintain their effectiveness and extend their expiration life, buffers must be stored and transported under the proper conditions. Traditional storage methods have limitations in terms of buffer stability and contamination risks, as powdered or liquid buffers must be reconstituted or diluted prior to buffer preparation. Several manufacturers offer lyophilized or concentrated buffers that offer improved stability and storage convenience to overcome these obstacles.

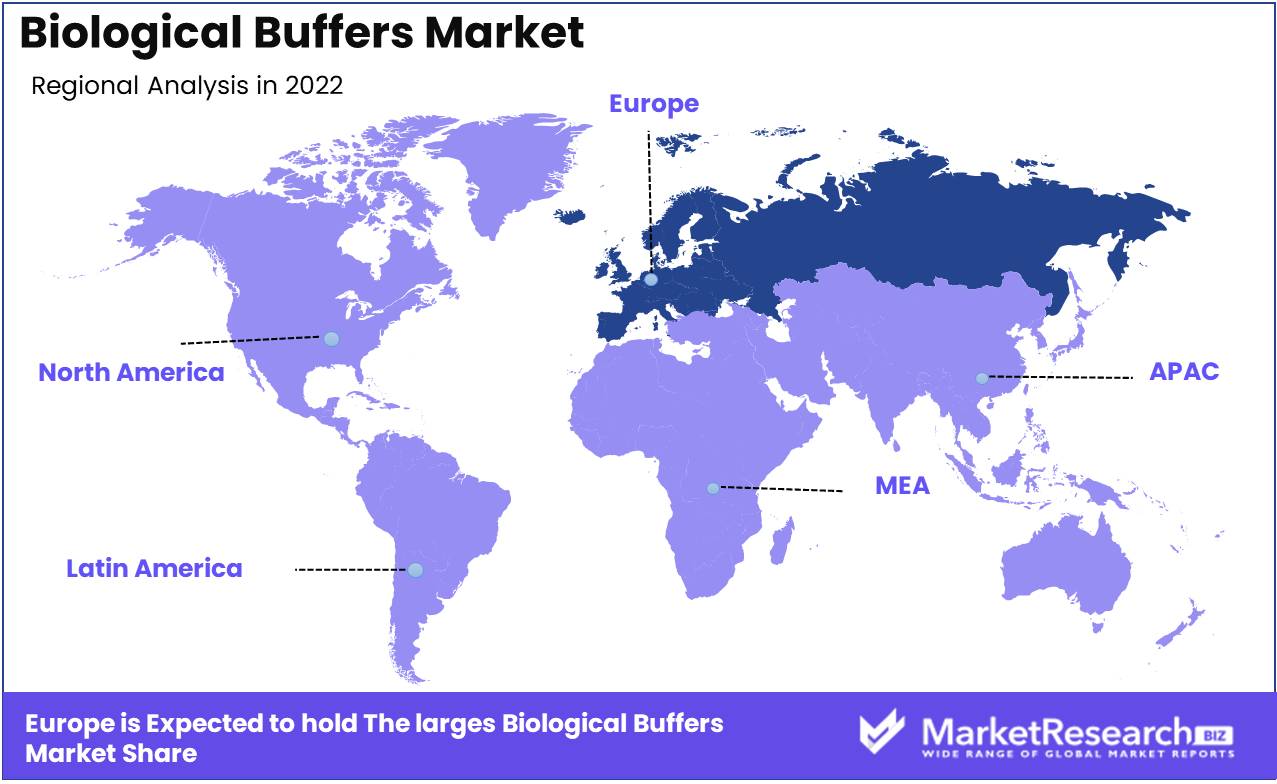

Regional Analysis

Europe dominates the biological buffers market. Biological buffers exist in many scientific labs. Protein expression, electrophoresis, and immunoassays require these chemicals to stabilize biomolecules and regulate pH. Biological buffers are therefore in high demand in the scientific community. The production and demand for these chemicals vary by region.

Europe is a leader in the production and supply of biological buffers. Europe's dominant market position, strong pharmaceutical industry, and a large number of research centers and colleges in the region all contribute to the biological buffers industry's growth, according to the present report.

European countries produce biological buffers. Germany, the UK, France, and Italy are examples. Germany produces 30% of all biological buffers in Europe. UK and France follow with 15% and 12%.

Europe's pharmaceutical industry dominates the biological buffers market. The demand for biological buffers and medication production go hand in hand. High-quality biological buffers are in demand due to chronic disease incidence and pharmaceutical industry developments. Europe also has various research centers and academic institutions for biological buffers research and development.

Several factors explain Europe's biological buffers market dominance. The region has invested heavily in the pharmaceutical industry. This investment has led to the development of modern biological buffer facilities and technology that enable the production of high-quality biological buffers.

Second, the European Union supports regional scientific research and development through various organizations and agencies. These groups fund local and international biological buffers research.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europel

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

Increased life sciences research funding, biopharmaceutical manufacturing adoption of buffer solutions, and disease diagnosis demand have driven the global biological buffers market. Key competitors in this market are creating breakthrough biological buffer solutions and expanding globally through strategic collaborations and partnerships.

Merck KGaA, a global biological buffers market leader, offers a wide range of buffer solutions for life science applications. The company sells TRIS, HEPES, MOPS, MES, and TAPS buffers. Merck KGaA launches innovative products and forms strategic collaborations to grow its market share.

Pierce buffer solutions from Thermo Fisher Scientific Inc. are another key competitor in the global biological buffers market. The global corporation acquires and partners to grow its product line. Thermo Fisher Scientific Inc. bought Patheon, a renowned pharmaceutical and biotechnology contract manufacturer.

Avantor Performance Materials, LLC, Bio-Rad Laboratories Inc., Lonza Group AG, and Biological Industries Israel Beit-Haemek Ltd. also dominate the global biological buffers market. These companies develop unique biological buffer solutions and expand globally through strategic partnerships and collaborations. These leading players are projected to continue to drive considerable growth in the global biological buffers market due to increased demand for buffer solutions in life science applications.

Top Key Players in the Biological Buffers Market

- Merck KGaA

- Thermo Fisher Scientific Inc

- Avantor

- GE Healthcare

- Santa Cruz Biotechnology, Inc.

- Lonza Group Ltd.

- Bio-Rad Laboratories, Inc

- F. Hoffmann-La Roche Ltd.

- Hamilton Company

- BASF SE

Recent Development

- In 2019, A new class of pH-responsive biodegradable buffers was introduced.

- In 2020, Scientists improved biological buffers' stability and selectivity.

- In 2021, Researchers worked on finding buffer solutions with low environmental impact as sustainable practices became more popular.

- In 2022, Nanotechnology will advance buffer development.

- In 2023, Multiplexed assays and high-throughput analysis have led to the development of new buffer systems.

Report Scope:

Report Features Description Market Value (2022) USD 754.0 Mn Forecast Revenue (2032) USD 1,859.4 Mn CAGR (2023-2032) 9.7% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Phosphate Type, Acetate Type, TRIS Type, Other Types), By End-User (Research Institution, Pharmaceutical Industry, Other End-Users) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Merck KGaA, Thermo Fisher Scientific Inc., Avantor, GE Healthcare, Santa Cruz Biotechnology, Inc., Lonza Group Ltd., Bio-Rad Laboratories, Inc., F. Hoffmann-La Roche Ltd., Hamilton Company, BASF SE Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Merck KGaA

- Thermo Fisher Scientific Inc

- Avantor

- GE Healthcare

- Santa Cruz Biotechnology, Inc.

- Lonza Group Ltd.

- Bio-Rad Laboratories, Inc

- F. Hoffmann-La Roche Ltd.

- Hamilton Company

- BASF SE