Paper Packaging Material Market Report By Type of Paper Material (Corrugated Board, Kraft Paper, Folding Boxboard, Solid Bleached Sulphate, White Top Linerboard, Others), By Packaging Format (Cartons, Boxes, Bags, Wraps, Pouches, Trays, Others), By End User Industry (Food and Beverage, Pharmaceuticals, Personal Care and Cosmetics, Household Products, Electronics, E-commerce, Retail, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

-

46778

-

May 2024

-

325

-

-

This report was compiled by Kalyani Khudsange Kalyani Khudsange is a Research Analyst at Prudour Pvt. Ltd. with 2.5 years of experience in market research and a strong technical background in Chemical Engineering and manufacturing. Correspondence Sr. Research Analyst Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

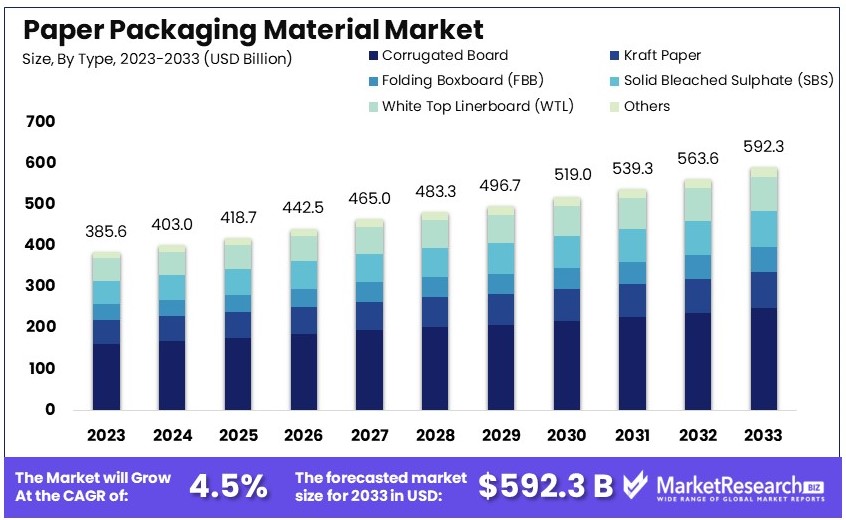

The Global Paper Packaging Material Market size is expected to be worth around USD 592.3 Billion by 2033, from USD 385.6 Billion in 2023, growing at a CAGR of 4.5% during the forecast period from 2024 to 2033.

The Paper Packaging Material Market includes materials used for packaging products in paper-based formats. This market covers items like corrugated boxes, cartons, and paper bags. Demand is driven by the need for sustainable and eco-friendly packaging solutions, as well as growth in e-commerce and retail sectors. Innovations in material strength and recyclability are key market trends.

Leading companies focus on enhancing durability and reducing environmental impact. The paper packaging material market is essential for providing versatile, sustainable packaging options that meet consumer and regulatory demands for eco-friendly products.

The Paper Packaging Material Market is positioned for significant growth, driven by increasing environmental concerns and a shift towards sustainable packaging solutions. Companies with high ratings for ESG (Environmental, Social, and Governance) performance enjoy average operating margins that are 3.7 times higher than those with lower ESG ratings. This underscores the financial benefits of adopting sustainable practices, including the use of paper packaging.

Consumer preferences are also influencing market dynamics. In fast-growing markets such as China, India, and Indonesia, 79% of consumers express concern about environmental sustainability. This consumer demand for eco-friendly products is prompting companies to shift from plastic to paper packaging.

In the UK, plastic packaging constitutes a significant environmental issue, with 2.3 million tonnes of plastic packaging placed on the market annually. Plastic packaging accounts for nearly 70% of the country's plastic waste, highlighting the urgent need for alternative solutions. The focus on reducing plastic waste is driving the adoption of paper packaging, which is biodegradable and recyclable.

Paper packaging materials offer a sustainable alternative, addressing environmental concerns while meeting regulatory requirements. The market is seeing increased investment in innovative paper packaging solutions, enhancing their durability and functionality. Companies are leveraging advanced technologies to produce paper packaging that can replace plastic in various applications.

Overall, the Paper Packaging Material Market presents substantial growth opportunities. The shift towards sustainability, driven by consumer preferences and regulatory pressures, is expected to accelerate the adoption of paper packaging. As companies continue to enhance their ESG performance and respond to market demands, the paper packaging sector is set to expand, contributing to a more sustainable future.

Key Takeaways

- Market Value: The Global Paper Packaging Material Market is expected to reach USD 592.3 billion by 2033, from USD 385.6 billion in 2023, growing at a CAGR of 4.5%.

- Type of Paper Material Analysis: Corrugated board dominates with 42%; strength and versatility.

- Packaging Format Analysis: Cartons dominate with 35%; versatility and convenience.

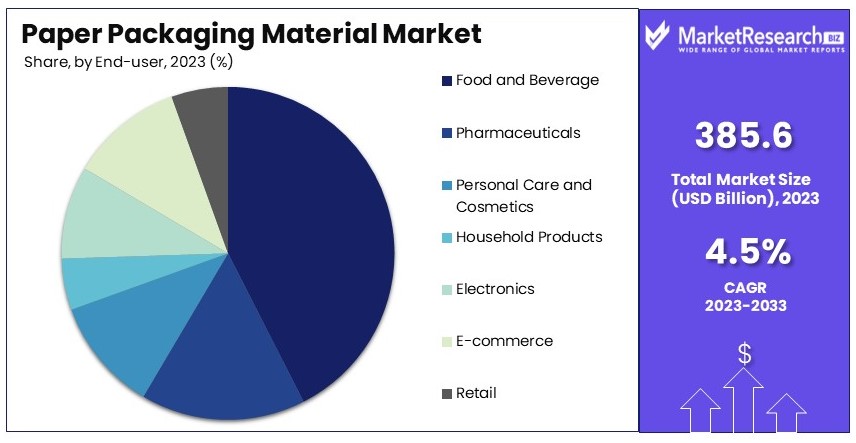

- End User Industry Analysis: Food and beverage dominate with 40%; high consumption and diverse applications.

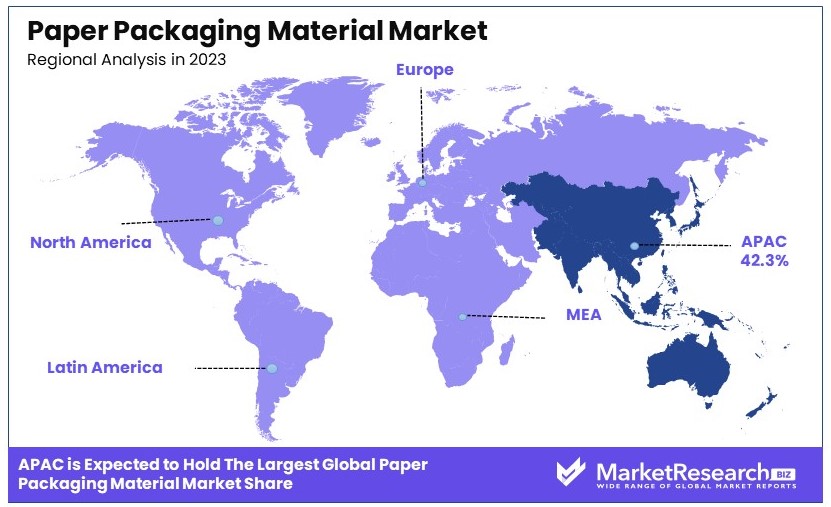

- Dominant Region: APAC with 42.3%; driven by high demand in e-commerce and food industries.

- High Growth Region: North America with 23.5%; growth driven by sustainability trends.

- Analyst Viewpoint: The market is steadily growing with increasing demand for sustainable packaging solutions. Innovations in material technology will drive future growth.

- Growth Opportunities: Expanding into biodegradable and recyclable materials can provide significant market opportunities.

Driving Factors

Rising Demand for Sustainable and Eco-friendly Packaging Drives Market Growth

The global shift towards environmental sustainability is significantly boosting the demand for eco-friendly packaging solutions. This trend is particularly evident in the increased use of paper-based materials. Paper packaging is favored for its biodegradability, renewability, and recyclability, making it a highly attractive alternative to plastic. Major companies, such as PepsiCo and Nestlé, have committed to incorporating more sustainable packaging materials into their product lines, including paper-based solutions. The demand for sustainable packaging solutions has driven growth in the paper products segment, particularly in the packaging industry.

In addition to corporate commitments, consumer behavior is a significant driver. Consumers are becoming more environmentally conscious, preferring products with sustainable packaging. This shift is evident in various sectors, including food and beverage, where eco-friendly packaging is becoming a standard.

The combined impact of corporate sustainability initiatives and consumer demand for eco-friendly products is creating a robust market for paper packaging materials. As more companies adopt sustainable practices and regulatory bodies enforce environmental standards, the paper packaging material market is poised for substantial growth.

Increasing Emphasis on Product Branding and Aesthetics Drives Market Growth

The emphasis on product branding and aesthetics is significantly influencing the growth of the paper packaging material market. Paper packaging offers a natural and premium look, which is appealing to consumers and enhances the brand image. This type of packaging provides a versatile canvas for creative designs, embossing, and printing, allowing brands to differentiate their products on retail shelves effectively.

Luxury cosmetics and high-end consumer goods brands often use paper-based packaging to convey a sense of quality and elegance. The ability to customize and create visually appealing packaging is a crucial factor for these brands.

The interaction between aesthetic appeal and functionality in paper packaging is driving market growth. Brands are investing in innovative packaging designs to attract and retain customers, leveraging the tactile and visual benefits of paper. This trend is further supported by advancements in printing technology and materials, enabling more intricate and high-quality packaging solutions. As a result, the paper packaging material market is experiencing significant expansion driven by the need for effective branding and aesthetic appeal.

Regulatory Push Against Plastic Packaging Drives Market Growth

Regulatory measures aimed at reducing plastic waste are playing a crucial role in driving the shift towards paper-based packaging solutions. Many countries and regions are implementing strict regulations to limit the use of single-use plastics, encouraging the adoption of more sustainable packaging alternatives. The European Union, for instance, has introduced directives to reduce plastic waste, which has significantly boosted the demand for paper packaging materials. Rising awareness about plastic pollution has led to a surge in the use of paper cups and plates as sustainable alternatives.

These regulatory actions are creating a favorable environment for the growth of the paper packaging material market. Companies are increasingly seeking compliant packaging solutions to avoid penalties and meet environmental standards. This shift is evident in the rising adoption of paper packaging across various industries, including retail, food and beverage, and e-commerce.

Restraining Factors

Competition from Other Sustainable Packaging Materials Restrains Market Growth

Paper packaging faces stiff competition from other sustainable materials like bioplastics and compostable options. These alternatives can offer additional benefits or better environmental credentials. For example, bioplastic packaging, made from plant-based materials such as corn starch or sugarcane, is increasingly popular in the food and beverage industry due to its compostable nature. This popularity limits the growth of paper packaging in certain applications where these alternatives are more advantageous.

Additionally, consumer preferences for materials perceived as more advanced or innovative can reduce the demand for paper packaging. According to a recent study, the global bioplastics market is expected to grow at a CAGR of 20.9% from 2020 to 2027. This rapid growth signifies a competitive threat to the paper packaging market, as businesses and consumers might opt for these alternative materials over paper-based solutions.

Higher Costs and Supply Chain Challenges Restrain Market Growth

The cost of paper packaging materials can be higher than traditional plastic packaging, particularly for certain applications and product types. This cost disparity can deter businesses from switching to paper packaging. Furthermore, the supply chain for paper packaging materials faces challenges related to availability, logistics, and transportation costs. The recent surge in demand for paper-based packaging has led to supply shortages and price increases for certain paper grades, impacting the cost-effectiveness of paper packaging solutions.

For example, in 2021, the price of corrugated paperboard increased by approximately 20% due to high demand and limited supply. This increase in costs can make paper packaging less attractive to companies looking to manage expenses tightly. These supply chain issues and higher costs create significant barriers to the widespread adoption of paper packaging, limiting its market growth.

Type of Paper Material Analysis

Corrugated Board Dominates with 42% Due to Strength and Versatility

Corrugated board is the dominant sub-segment within the paper packaging material market, accounting for approximately 42% of the market share. This dominance is attributed to its strength, durability, and versatility, which make it ideal for a wide range of applications, particularly in the e-commerce and food and beverage industries. The corrugated board is made up of a fluted corrugated sheet and one or two flat linerboards, providing excellent protection for goods during transit. This material's ability to withstand heavy weights and its cushioning properties make it a preferred choice for shipping and packaging.

The e-commerce boom has significantly driven the demand for corrugated board, as more consumers shop online and require robust packaging for safe delivery. Additionally, the food and beverage industry relies heavily on corrugated board for packaging fresh produce, beverages, and other perishable items, ensuring they reach consumers in optimal condition. The growing trend towards sustainable packaging further bolsters the market for corrugated board, as it is recyclable and made from renewable resources.

Other sub-segments in this category, such as Kraft Paper, Folding Boxboard (FBB), Solid Bleached Sulphate (SBS), and White Top Linerboard (WTL), play significant roles in the market. Kraft paper, known for its strength and durability, is used extensively in packaging heavy-duty products. Folding Boxboard (FBB) and Solid Bleached Sulphate (SBS) are favored in high-end packaging applications due to their superior printability and smooth surface. White Top Linerboard (WTL) is used in applications where visual appeal is crucial, such as consumer electronics packaging.

Despite the dominance of corrugated board, these other materials contribute to market growth by catering to specific needs across different industries. Kraft paper's robustness makes it suitable for industrial packaging, while FBB and SBS are popular in personal care and cosmetics packaging due to their premium appearance. The combined growth of these segments supports the overall expansion of the paper packaging material market, driven by increasing demand for diverse and sustainable packaging solutions.

Packaging Format Analysis

Cartons Dominate with 35% Due to Versatility and Convenience

Cartons are the leading packaging format within the paper packaging material market, holding approximately 35% of the market share. This dominance is due to their versatility and convenience, making them suitable for a wide range of applications, from food and beverage packaging to pharmaceuticals and personal care products. Cartons are easy to stack, store, and transport, offering excellent protection for products and enhancing their shelf life.

The food and beverage industry is a major driver of the carton market, with milk, juice, and other liquid products commonly packaged in cartons. The growing consumer preference for convenient and lightweight packaging further boosts the demand for cartons. Additionally, the shift towards sustainable packaging solutions favors carton use, as they are recyclable and often made from renewable resources.

Boxes, bags, wraps, pouches, and trays are other significant sub-segments in this category. Boxes are widely used in e-commerce and retail for packaging and shipping a variety of products. Bags are popular in the food industry for packaging items like snacks, cereals, and baked goods. Wraps are used for protecting products during transit, while pouches offer a convenient packaging solution for products like sauces, condiments, and personal care items. Trays are commonly used in the food industry for packaging fresh produce, meats, and ready-to-eat meals.

Each of these sub-segments plays a crucial role in market growth by meeting specific packaging needs across different industries. The versatility and convenience of these packaging formats contribute to their widespread adoption, supporting the overall expansion of the paper packaging material market. As consumers and businesses increasingly prioritize sustainability, the demand for recyclable and eco-friendly packaging solutions like cartons and other paper-based formats is expected to continue growing.

End User Industry Analysis

Food and Beverage Dominates with 40% Due to High Consumption and Diverse Applications

The food and beverage industry is the dominant end-user industry for paper packaging materials, accounting for approximately 40% of the market share. This dominance is driven by the high consumption of packaged food and beverages and the diverse applications of paper packaging within the industry. Paper packaging is used extensively for packaging fresh produce, processed foods, beverages, and ready-to-eat meals, providing protection and extending shelf life.

The increasing demand for convenient and sustainable packaging solutions is a major driver of the paper packaging market in the food and beverage industry. Consumers are increasingly seeking eco-friendly packaging options, prompting manufacturers to adopt paper-based materials. Additionally, the rise of e-commerce and online food delivery services has further boosted the demand for paper packaging, as these services require reliable and protective packaging solutions.

Other significant end-user industries include pharmaceuticals, personal care and cosmetics, household products, electronics, e-commerce, and retail. The pharmaceutical industry relies on paper packaging for its versatility and ability to provide a barrier against contamination. Personal care and cosmetics products are often packaged in high-quality paper materials that enhance their visual appeal. Household products, including cleaning supplies and detergents, use paper packaging for its durability and recyclability.

The electronics industry uses paper packaging to protect delicate components during transit, while the e-commerce sector drives significant demand for robust and reliable packaging solutions. Retailers also use paper packaging to enhance the shopping experience and promote brand sustainability.

Each of these industries contributes to the growth of the paper packaging material market by leveraging the unique benefits of paper-based solutions. The continued emphasis on sustainability and eco-friendly packaging across these industries is expected to drive further market expansion, with the food and beverage industry leading the way.

Key Market Segments

By Type of Paper Material

- Corrugated Board

- Kraft Paper

- Folding Boxboard

- Solid Bleached Sulphate

- White Top Linerboard

- Others

By Packaging Format

- Cartons

- Boxes

- Bags

- Wraps

- Pouches

- Trays

- Others

By End User Industry

- Food and Beverage

- Pharmaceuticals

- Personal Care and Cosmetics

- Household Products

- Electronics

- E-commerce

- Retail

- Others

Growth Opportunities

Expanding into New Product Categories and Applications Offers Growth Opportunity

Expanding paper packaging into new product categories and applications presents significant growth opportunities. Currently, paper packaging is predominantly used in the food and beverage sector. However, there is substantial potential for growth in other industries such as personal care, pharmaceuticals, and consumer electronics. Companies like Fikka are pioneering the use of paper-based packaging solutions for consumer electronics, replacing traditional plastic clamshells and blister packs.

This expansion is driven by the increasing demand for sustainable packaging solutions across various industries. As more companies seek eco-friendly alternatives, the adoption of paper-based packaging is expected to rise. The personal care and pharmaceutical sectors, in particular, can benefit from the shift towards paper packaging due to its recyclability and lower environmental impact. The consumer electronics market also offers a lucrative opportunity, as consumers and manufacturers alike prioritize sustainability. By exploring and developing new applications for paper packaging, the market can experience substantial growth.

Developing Advanced Functional Paper Packaging Offers Growth Opportunity

The development of advanced functional paper packaging presents a promising growth opportunity within the market. Innovations in coatings, laminations, and material composition can enhance the barrier properties, strength, and durability of paper packaging materials. Companies like Billerudkorsnäs and Mondi are investing in the development of paper-based packaging solutions with superior barrier properties for demanding applications, such as food packaging.

Advanced functional paper packaging can address specific product requirements, making it suitable for a broader range of applications. For example, improved barrier properties can prevent moisture and oxygen from affecting the packaged products, thereby extending their shelf life. This innovation is particularly beneficial for the food industry, where maintaining product freshness is crucial. Additionally, enhancing the strength and durability of paper packaging can make it a viable alternative to plastic in various sectors, further driving market growth. As these advanced materials gain traction, they will likely spur increased adoption across multiple industries.

Trending Factors

Personalization and Customization Are Trending Factors

The trend towards personalized and customized packaging is gaining momentum, driven by consumer demand for unique and tailored experiences. Paper packaging materials offer excellent printability and design flexibility, enabling brands to create personalized packaging solutions that resonate with consumers. Companies like Jones Packaging and Smurfit Kappa are leading the way by offering customized paper-based packaging solutions with digital printing and embossing capabilities.

This trend is fueled by the desire to enhance consumer engagement and build brand loyalty. Personalized packaging can create a memorable unboxing experience, making products more appealing and increasing customer satisfaction. As brands continue to seek ways to differentiate themselves in a competitive market, the demand for customized paper packaging is expected to grow. The versatility of paper materials in accommodating various design elements makes them an ideal choice for personalized packaging solutions, contributing to their growing popularity.

Smart and Interactive Packaging Are Trending Factors

The integration of smart technologies into packaging is a significant trending factor in the paper packaging material market. Technologies like QR codes, Near-Field Communication (NFC), and augmented reality (AR) are being incorporated into packaging to enhance consumer engagement and brand experiences. Paper packaging materials provide a suitable canvas for incorporating these interactive elements, offering brands a way to connect with consumers in innovative ways.

Brands like 19 Crimes and Lego have successfully implemented AR experiences on their paper-based packaging, allowing consumers to unlock additional content and information through their smartphones. This trend is driven by the growing use of smartphones and the increasing demand for interactive and immersive experiences. Smart packaging can provide valuable product information, offer interactive marketing campaigns, and enhance the overall consumer experience. As technology continues to advance, the integration of smart features into paper packaging will likely become more widespread, driving further market growth.

Regional Analysis

APAC Dominates with 42.3% Market Share

The Asia-Pacific (APAC) region leads the paper packaging material market with a 42.3% share. Key factors driving this dominance include rapid industrialization, urbanization, and a booming e-commerce sector. Countries like China and India are significant contributors due to their large populations and growing consumer markets. Additionally, the rising demand for sustainable packaging solutions and government initiatives promoting eco-friendly practices further boost market growth in this region.

APAC's market dynamics are influenced by its diverse economies and robust manufacturing base. The region's extensive supply chain network and cost-effective labor force make it a hub for paper packaging production. High consumption of packaged goods and increasing disposable income levels also support market expansion. Moreover, the shift towards online shopping has accelerated the demand for durable and sustainable packaging solutions, driving further growth in the paper packaging sector.

North America: 23.5% Market Share

North America holds a 23.5% market share in the paper packaging material market. The region's growth is driven by strong consumer demand for sustainable packaging and advancements in packaging technology. The presence of major packaging companies and a well-established e-commerce sector also contribute to the market's expansion.

Europe: 21.1% Market Share

Europe accounts for 21.1% of the paper packaging material market. The region's stringent environmental regulations and high consumer awareness of sustainability drive the demand for paper-based packaging. The adoption of eco-friendly packaging solutions by leading brands and retailers further supports market growth.

Middle East & Africa: 7.6% Market Share

The Middle East and Africa region has a 7.6% market share. Market growth is driven by increasing urbanization, rising disposable incomes, and the expansion of the food and beverage sector. The region's focus on sustainable development and packaging innovations also contributes to the market's expansion.

Latin America: 5.5% Market Share

Latin America holds a 5.5% share in the paper packaging material market. The region's growth is influenced by the rising demand for packaged goods, increased e-commerce activities, and growing awareness of environmental sustainability. Government initiatives promoting the use of eco-friendly packaging materials further bolster market development.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The Paper Packaging Material market is shaped by several influential companies that lead in innovation and sustainability. International Paper Company, WestRock Company, and Smurfit Kappa Group are major players with extensive global operations. They are known for their wide range of products and commitment to environmentally friendly practices, setting industry standards in sustainable packaging solutions.

Mondi Group, DS Smith plc, and Packaging Corporation of America also hold strong market positions. These companies excel in delivering high-quality paper packaging that meets the diverse needs of various industries, including food, beverage, and consumer goods. Their focus on recyclable and renewable materials aligns with global trends towards sustainability.

Oji Holdings Corporation, Nippon Paper Industries Co., Ltd., and Stora Enso Oyj are key players in the Asia-Pacific and European regions. They are pioneers in integrating advanced technology with paper packaging production, enhancing both efficiency and environmental compliance.

Sealed Air Corporation and Huhtamäki Oyj are noted for their innovative approaches to packaging design and material science. These firms offer unique solutions that improve packaging performance and consumer convenience, further driving market growth.

Smaller, yet significant, players like Cascades Inc., Sappi Limited, and Nine Dragons Paper (Holdings) Limited contribute by focusing on specific market segments, such as recycled paper and specialty packaging products. Their targeted strategies help meet specific customer demands and enhance their competitive positioning.

Overall, the key players in the Paper Packaging Material market drive the industry forward through technological advancements, strategic sustainability initiatives, and a strong focus on customer needs. Their efforts are crucial in addressing the growing demand for eco-friendly and high-performance packaging solutions.

Market Key Players

- International Paper Company

- WestRock Company

- Smurfit Kappa Group

- Mondi Group

- Georgia-Pacific LLC

- DS Smith plc

- Oji Holdings Corporation

- Nippon Paper Industries Co., Ltd.

- Stora Enso Oyj

- Sealed Air Corporation

- Packaging Corporation of America

- Cascades Inc.

- Sappi Limited

- Nine Dragons Paper (Holdings) Limited

- Huhtamäki Oyj

Recent Developments

- May 2024: Diageo has partnered with PA Consulting and PulPac to trial paper-based packaging for Baileys Irish Cream Liqueur, marking a significant step toward sustainable packaging innovation.

- May 2024: Colpac expands its range with a new recyclable multi-food pot, the natural kraft 950ml pot. This addition aims to provide a sustainable packaging solution for higher value lunches and meal offerings, supporting menu development and customer choice in the foodservice sector.

- April 2024: PulPac joins Two Sides to advance sustainable fiber molded packaging. The partnership aims to promote Dry Molded Fiber as a circular and environmentally friendly alternative in the packaging industry.

Report Scope

Report Features Description Market Value (2023) USD 385.6 Billion Forecast Revenue (2033) USD 592.3 Billion CAGR (2024-2033) 4.5% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type of Paper Material (Corrugated Board, Kraft Paper, Folding Boxboard, Solid Bleached Sulphate, White Top Linerboard, Others), By Packaging Format (Cartons, Boxes, Bags, Wraps, Pouches, Trays, Others), By End User Industry (Food and Beverage, Pharmaceuticals, Personal Care and Cosmetics, Household Products, Electronics, E-commerce, Retail, Others) Regional Analysis North America - The US, Canada, & Mexico; Western Europe - Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe - Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC - China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America - Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa - Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape International Paper Company, WestRock Company, Smurfit Kappa Group, Mondi Group, Georgia-Pacific LLC, DS Smith plc, Oji Holdings Corporation, Nippon Paper Industries Co., Ltd., Stora Enso Oyj, Sealed Air Corporation, Packaging Corporation of America, Cascades Inc., Sappi Limited, Nine Dragons Paper (Holdings) Limited, Huhtamäki Oyj Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- International Paper Company

- WestRock Company

- Smurfit Kappa Group

- Mondi Group

- Georgia-Pacific LLC

- DS Smith plc

- Oji Holdings Corporation

- Nippon Paper Industries Co., Ltd.

- Stora Enso Oyj

- Sealed Air Corporation

- Packaging Corporation of America

- Cascades Inc.

- Sappi Limited

- Nine Dragons Paper (Holdings) Limited

- Huhtamäki Oyj