Kraft Paper Market By Grade Analysis (Bleached, Unbleached), By End-Use Industry Analysis (Foods & Beverages, Pharmaceuticals, Cosmetics & Personal Care, Other), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2023-2032

-

22068

-

April 2023

-

150

-

-

This report was compiled by Kalyani Khudsange Kalyani Khudsange is a Research Analyst at Prudour Pvt. Ltd. with 2.5 years of experience in market research and a strong technical background in Chemical Engineering and manufacturing. Correspondence Sr. Research Analyst Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

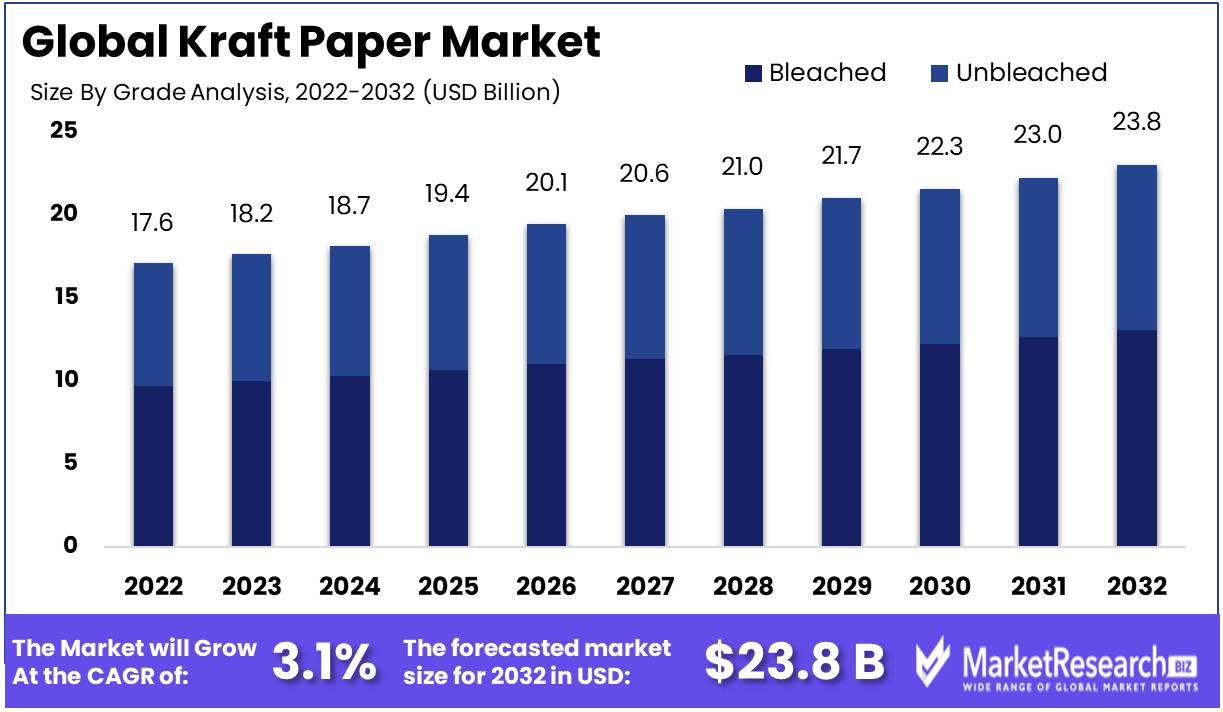

Kraft Paper Market size is expected to be worth around USD 23.8 Bn by 2032 from USD 17.6 Bn in 2022, growing at a CAGR of 3.1% during the forecast period from 2023 to 2032.

In recent years, the kraft paper market, a thriving industry characterized by rapid growth and constant innovation, has witnessed remarkable innovations and widespread adoption. With an emphasis on sustainability and environmental tolerance, kraft paper has become an increasingly popular option for businesses in a variety of industries.

In essence, the kraft paper market, an extraordinary variety of paper, attributes its existence to the complexities of the kraft process, a chemical marvel involving the transformation of wood chips into endless fibrous strands. This complex procedure produces a paper that is resistant to shredding and bursting forces. Consequently, kraft paper has a wide range of applications, including but not limited to packaging, printing, and industrial utilization.

The realm of the kraft paper market has witnessed a succession of remarkable breakthroughs, with cutting-edge innovations transforming the landscape of the market. The introduction of water-resistant kraft paper, with the capacity to protect moisture-sensitive products with immaculate packaging, represents a significant advancement. The emergence of tear-resistant kraft paper, ideally adapted for accommodating heavy-duty packaging requirements, represents a further breakthrough.

As the global awareness of the critical need for sustainable alternatives increases, businesses are investing heavily in kraft paper to replace conventional paper products. As a number of e-commerce businesses switch to using kraft paper envelopes and packaging materials in an effort to reduce their carbon footprint, this transformation can be seen as an excellent example in the realm of online retail. Similarly, in the food and beverage industry, a massive shift is occurring as numerous companies opt for kraft paper bags and receptacles in an effort to promote environmental friendliness and sustainability throughout the product's lifecycle.

Diverse industries have recognized the unmatched potential of kraft paper, resulting in substantial investments to satisfy the escalating demand for sustainable products. The food and beverage industry relies significantly on kraft paper for packaging and container purposes, making it a prominent beneficiary. Similarly, the e-commerce industry has adopted kraft paper extensively, replacing conventional packaging materials with sustainable alternatives and thereby reducing their environmental impact.

Obviously, as in any industry, ethical considerations cast a shadow over the production and utilization of kraft paper. The issue of deforestation, wherein the procurement of wood for paper production threatens the integrity of natural forests, is the most pressing of these concerns.

Driving factors

Growing Demand Propels the Kraft Paper Market

Increasing demand from the packaging industry is one of the primary drivers of this growth. The kraft paper market has emerged as a viable alternative to conventional materials as an increasing number of businesses prioritize sustainable and eco-friendly packaging solutions.

With the Rise of E-Commerce, the Demand for Kraft Paper Surges

As more products are shipped and delivered in cardboard boxes and other paper-based packaging materials, the increase in online purchasing and e-commerce has also contributed to the growth of the kraft paper market. In addition, the food and beverage industry has expanded recently, leading to a surge in demand for kraft paper products packaging for food.

Kraft Paper is Prevalent in Food Packaging

In the construction industry, Kraft paper is in high demand for packaging and protecting building materials during transport and storage. Increasing demand for biodegradable packaging materials, coupled with a greater emphasis on recycling and waste reduction, has fueled the growth of the kraft paper market.

The Construction Industry Increases Kraft Paper Demand

In recent years, flexible packaging solutions have also acquired popularity, driving up demand for kraft paper. With high demand for products such as medical containers and packaging for medical devices, the healthcare industry has also emerged as a key market for the kraft paper market.

Eco-Friendly Trend Fuels Kraft Paper Growth

In the future years, potential regulatory changes could have an impact on the kraft paper market. For instance, governments may impose stringent restrictions on the use of plastic packaging, leading to a surge in demand for eco-friendly alternatives such as kraft paper.

Healthcare Drives the Kraft Paper Market

Emerging technologies such as digital printing and intelligent packaging may also impact the kraft paper market. These technologies could enable businesses to provide customers with more customized and individualized packaging solutions.

Regulations and Engineering Reshape the Kraft Paper Market

Potential market disruptors may include new entrants offering alternative packaging materials or innovative solutions that could supplant the conventional kraft paper market. Changes in consumer behavior may also have an impact on the market, with a growing emphasis on convenience and simplicity of use possibly leading to an increase in demand for flexible and lightweight packaging solutions.

Restraining Factors

Limiting Factors Influencing the Kraft Paper Market

In recent years, a number of restraining factors have been affecting the growth of the kraft paper market factor. These factors include fluctuations in the price of raw materials, increasing competition from alternative packaging materials, stringent regulations on paper manufacturing and packaging, global economic volatility, and environmental concerns associated with paper manufacturing.

The Volatility of Raw Material Costs Hinders Kraft Paper Market

The price fluctuations of raw materials used in the production of kraft paper have been one of the most significant factors restraining the market for kraft paper. Over the years, the prices of basic materials such as wood pulp, chemicals, and energy have fluctuated, making it difficult for manufacturers to maintain stable production costs.

Alternatives Offer Competition to Kraft Paper

In addition, the rising demand for kraft paper has led to an increase in the demand for basic materials, resulting in a rise in their prices. This factor has led to a decline in the profitability of kraft paper manufacturers, which has impacted the market growth of kraft paper. Alternative packaging materials, such as plastic, metal, and glass, have created intense competition in the kraft paper market. These alternative packaging materials offer a number of benefits, including being lightweight, simple to manufacture, and inexpensive in terms of production, making them a preferred choice for packaging goods.

Environmental Issues Influence Demand for Kraft Paper

In addition, the environmental concerns associated with the use of kraft paper have led to the adoption of alternative packaging materials as a more sustainable packaging option. The growth of the kraft paper market has been impacted by this factor, which has led to a decline in demand for kraft paper. Stringent regulations on paper manufacturing and packaging have been affecting the kraft paper market, which has hampered its growth.

The Kraft Paper Market Is Influenced by Strict Regulations

These regulations have led to increased production costs for manufacturers of kraft paper, which has impacted their profitability. In addition, the regulations have led to a decline in demand for kraft paper as consumers seek more sustainable packaging options. This factor has substantially impacted the growth of the kraft paper market. The volatility of the global economy has impacted the kraft paper market.

Influence of the Global Economy on Kraft Paper Demand

The growth of diverse industries, such as e-commerce, retail, and logistics, which have been impacted by the volatility of the global economy, is a major factor in the demand for kraft paper. This factor has led to a decline in demand for kraft paper, which has impacted its growth. Due to its production method, the kraft paper market has been associated with environmental concerns.

Grade Analysis

The bleached segment dominates the kraft paper market. This trend reflects the changing preferences of consumers in the packaging industry, which is consistent with global emerging trends. The adoption of bleached kraft paper is influenced by the economic growth of emerging economies. Due to this trend, it is anticipated that the bleached segment will experience the highest growth rate in the future years, making it an attractive investment opportunity.

The adoption of bleached kraft paper is significantly influenced by consumer trends and preferences for premium products. In numerous emerging economies, consumer preferences are transitioning toward environmentally friendly products, and this trend benefits the bleached segment. In these regions, consumers seek secure, hygienic, and eco-friendly packaging materials, and bleached kraft paper meets all three criteria.

In addition, bleached kraft paper is favored for its aesthetic qualities. This type of kraft paper allows graphic design and printing companies to simply advertise their products, which is anticipated to have a positive effect on the future adoption of bleached kraft paper. As aesthetic allure becomes an essential factor that influences consumer purchasing behavior, this market segment has enormous growth potential.

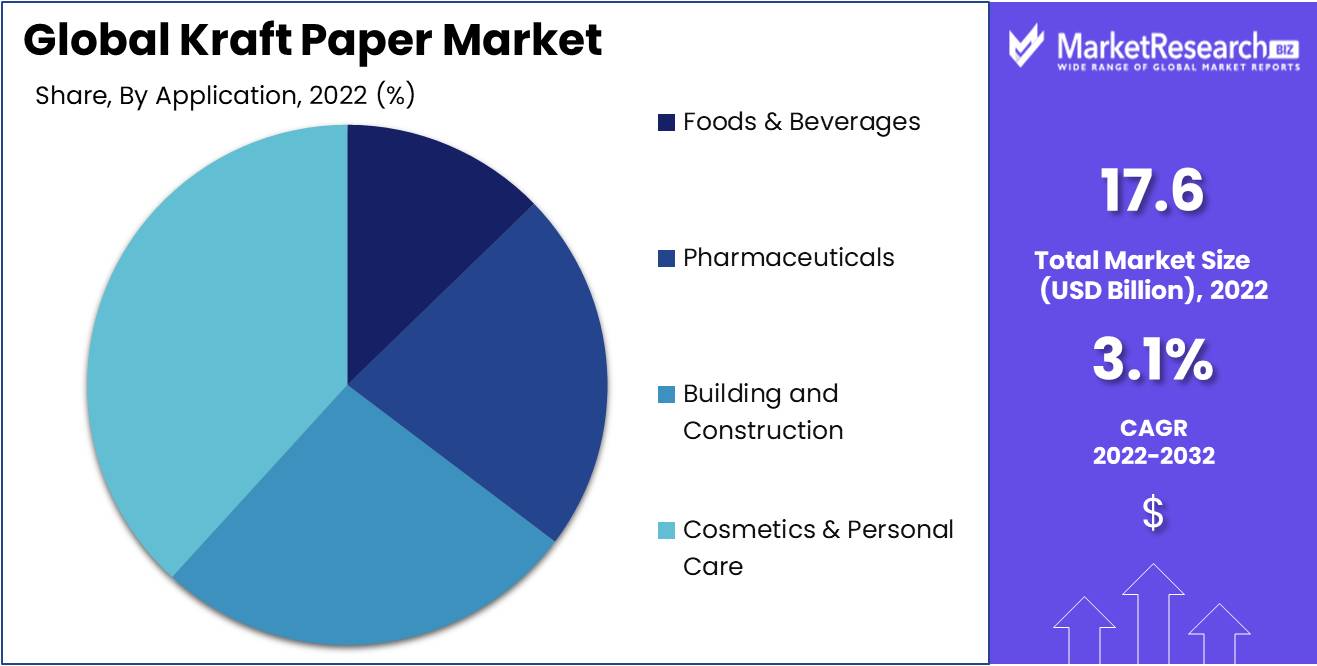

End-Use Industry Analysis

Due to the expanding demand for aesthetically pleasing packaging, the cosmetics and personal care segment dominates the kraft paper market. The growth of emergent economies drives the adoption of cosmetics and personal care kraft paper, especially as consumers place a greater emphasis on eco-friendly products. Importantly, the use of eco-friendly products in the cosmetics and personal care industry mitigates the environmental impact of packaging and enables companies to market their products as eco-friendly.

In recent years, consumer trends and attitudes toward the cosmetics and personal care market have been particularly favorable. The increasing demand for eco-friendly packaging is a result of consumers' desire for products that are both safe and environmentally beneficial. The cosmetics and personal care segment is anticipated to develop at the highest rate over the next few years, making it an attractive investment opportunity for entrepreneurs interested in the kraft paper market.

The sub-60 GSM segment dominates the kraft paper market. As consumers look to reduce waste, economic growth in emerging economies is driving the adoption of this segment in the food and beverage industry. Less waste is produced with finer kraft paper, making the less than 60 GSM segment a preferred product among consumers. Consequently, companies have shifted towards eco-friendly packaging materials, and this trend also favors narrow kraft paper.

In recent years, consumer trends and behavior toward the segment of less than 60 GSM have been favorable due to the expanding awareness of sustainable packaging. Consumers are making increasingly conscientious decisions about the products they purchase; consequently, eco-friendly packaging is a primary concern for the majority of consumers. The less than 60 GSM segment is projected to experience the highest growth rate over the future years, making it an attractive investment opportunity for entrepreneurs seeking to enter the kraft paper market.

Key Market Segments

By Grade Analysis

- Bleached

- Unbleached

By End-Use Industry Analysis

- Foods & Beverages

- Pharmaceuticals

- Building and Construction

- Cosmetics & Personal Care

- Other End-Use Industries

Growth Opportunity

Kraft Paper Market Growth Is Boosted by Demand for Sustainable Packaging

Potential for Growth in the Kraft Paper Market Fueled by Opportunity Increasing Demand for Sustainable Packaging Solutions, Increasing Adoption of Kraft Paper in the Food and Beverage Industry, Increasing Demand for E-commerce Packaging Solutions, Expansion of the Construction Industry, Increasing Popularity of Customized Packaging Solutions.

The Food and Beverage Sector Adopts Kraft Paper Packaging

Due to growing environmental concerns, there has been an increasing demand for sustainable packaging solutions. Because it is biodegradable and recyclable, Kraft paper is a sustainable option. In addition to becoming more aware of the environmental impact of packaging materials, consumers are opting for eco-friendly packaging alternatives. This has led to a surge in demand for Kraft paper, which is anticipated to continue into the foreseeable future.

E-commerce Drives Demand for Kraft Paper Packaging

The food and beverage industry is among the greatest Kraft paper consumers. Kraft paper is the preferred packaging material for food items such as chocolates, dried fruits, and bakery goods. The rising consumer preference for sustainable paper packaging solutions and the increasing demand for processed food items are driving the adoption of Kraft paper in the food and beverage industry.

The Expansion of the Kraft Paper Market is Driven by the Construction Industry

The rise of the e-commerce industry has led to a surge in demand for Kraft paper packaging solutions. Due to its strength, durability, and sustainability, Kraft paper is a common choice for e-commerce packaging. Additionally, e-commerce companies are transitioning to sustainable packaging solutions, which is driving the demand for Kraft paper.

The Popularity of Kraft Paper Propels the Expansion of Customized Packaging

Another important market for Kraft paper is the construction industry. In the construction industry, Kraft paper is utilized as subflooring. The increasing construction activities and infrastructure development initiatives are driving Kraft's paper demand.

Latest Trends

Eco-Friendly Kraft Packaging on the Rise

The paper industry has witnessed a significant shift in market trends, including the growing popularity of biodegradable and compostable kraft paper packaging, the adoption of automation and digitization in the paper manufacturing process, an increased emphasis on product innovation and development, and the expansion of the paper recycling industry. These trends have had a significant impact on the kraft paper market and have shaped its future direction.

Automation Revolutionizes the Paper Industry

With increasing environmental consciousness, biodegradable and compostable kraft paper packaging has gained popularity. Both businesses and consumers demand eco-friendly packaging options that reduce their carbon footprint. This demand is met by biodegradable and compostable kraft paper packaging, a sustainable alternative to conventional packaging materials.

Innovation Drives Kraft Paper Market

This trend has been recognized by manufacturers, who have begun to produce biodegradable and compostable kraft paper packaging alternatives. Consequently, the market for these environmentally favorable alternatives has expanded significantly. As consumers continue to prioritize environmental sustainability in their purchasing decisions, the trend shows no symptoms of abating.

Moisture-Resistant Kraft Paper Market Takes Over

Historically, manual labor has been utilized in the paper manufacturing process, with employees performing tasks such as quality control and machine management. With the advent of automation and digitization technologies, however, the manufacturing processes of the industry have undergone a significant transformation. Automated processes have been increasingly incorporated into paper mills, resulting in quicker production times, increased efficiency, and decreased labor costs.

With Kraft Paper, Luxury Packaging Soars

The paper industry has placed a substantial emphasis on innovation and development. Companies seek to introduce new products and solutions to the market as a result of increased competition and shifting consumer demands. This emphasis on innovation has led to the development of new varieties of kraft paper with enhanced functionality and aesthetics.

Diverse Designs Transform Kraft Paper

Specifically in the food packaging industry, kraft paper with moisture-resistant properties has become increasingly popular. Additionally, manufacturers have introduced kraft paper with a glossy finish, which enhances its visual allure for luxury and premium packaging applications. The demand for premium and luxury packaging solutions has increased, and consumers have demonstrated a propensity to pay more for such packaging. Kraft paper has become a preferred material for premium packaging due to its natural, rustic appearance and feel, which appeals to eco-conscious consumers.

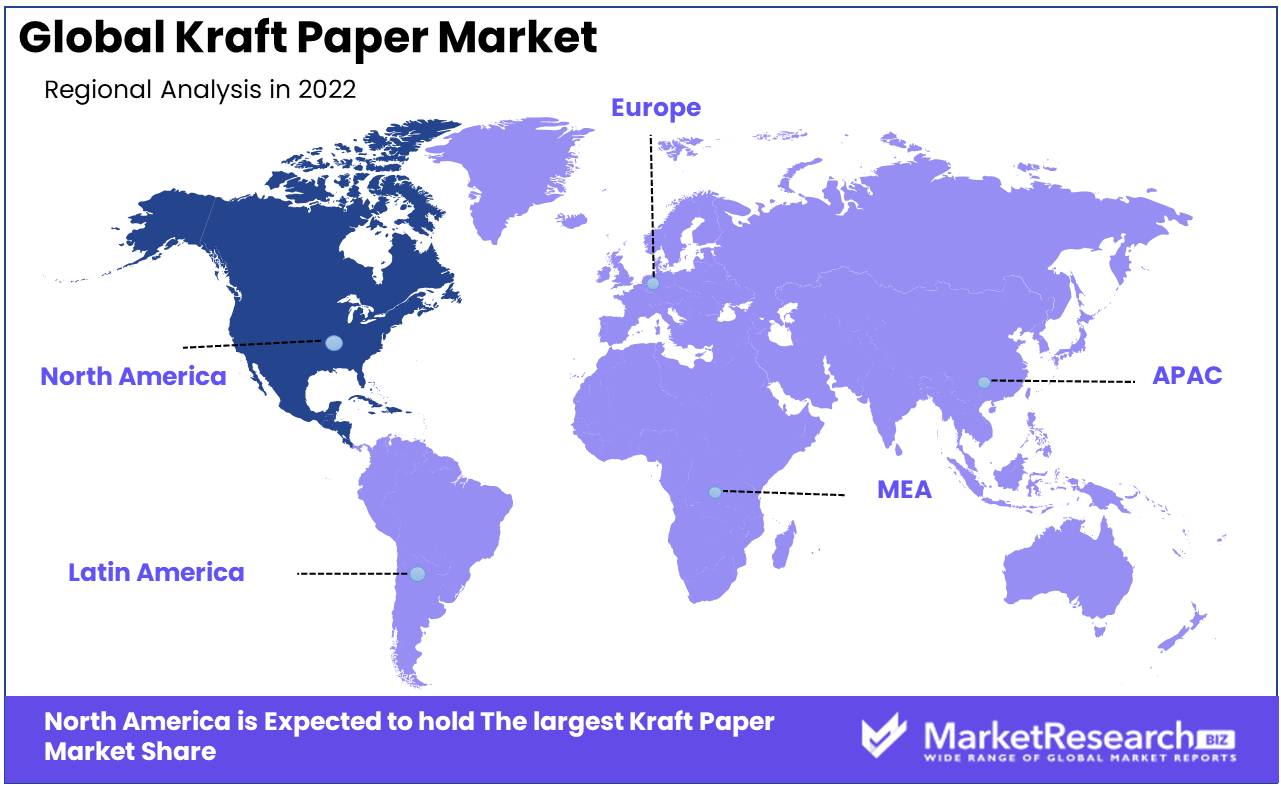

Regional Analysis

North America is experiencing an increase in demand for sustainable packaging solutions as well as the expansion of the e-commerce industry, which is driving market expansion. In recent years, consumers have become more aware of their impact on the environment, and businesses have responded by offering more eco-friendly packaging options. In addition, the rise of e-commerce has led to a rise in shipping and handling, thereby increasing the demand for more durable and effective packaging solutions.

Utilizing recycled materials is one of the most prevalent sustainable packaging solutions in North America. This method not only reduces production waste but also reduces energy consumption. To meet consumer demand, many packaging companies prioritize the use of recycled products. The use of biodegradable materials that decompose naturally in the environment is an emerging trend. In the food and beverage industry, where products frequently have a reduced shelf life, these materials are becoming increasingly popular.

The expansion of the e-commerce industry has also presented businesses with new challenges. When it comes to online purchasing, customers seek ease and convenience, but they also expect products to arrive intact and undamaged. This has caused businesses to prioritize durable and lightweight packaging solutions. Companies are also investing in automation technology to increase packaging and transportation practices' efficiency and reduce their environmental impact.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

Kraft paper, which is produced from natural wood fibers, has become an indispensable packaging material due to its superior strength and durability. The global kraft paper market is expanding significantly due to the increasing demand for eco-friendly packaging solutions. The market's dominant players are continually innovating their products to enhance their strength, durability, and printability.

Mondi Group, Smurfit Kappa Group, Georgia-Pacific, International Paper Company, WestRock Company, DS Smith Plc, Kapstone Paper and Packaging Corporation, Stora Enso Oyj, Klabin S.A., and BillerudKorsnas AB are among the leading players in the global kraft paper market. These companies hold a substantial market share and are investing in a variety of product development strategies.

Mondi Group, one of the major players in this market, focuses on product innovation and development to provide consumers with sustainable solutions. Ideal for packaging applications, the company's Advantage kraft paper range includes high-strength and high-performance paper grades. Similarly, Smurfit Kappa Group provides customers with innovative kraft paper products that suit their evolving needs.

Top Key Players in Kraft Paper Market

- International Paper Inc.

- Stora Enso Oyj

- Smurfit Kappa Group plc

- Nippon Paper Group

- Mondi Group Plc.

- ITC Limited

- Sappi Limited

- Ahlstrom-Munksjö Oyj

- BillerudKorsnäs AB

- Sukraft Papers Private Limited

- DS Smith Plc.

- Canadian Kraft Paper Industries Ltd.

- French Paper Company

- WestRock Company

- Other Key Industry Players

Recent Development

- In March 2023, BillerudKorsnas, a leading provider of sustainable packaging solutions, announced the launch of a new line of kraft paper papers specifically suited for flexible packaging applications such as pouches and sachets.

- In January 2023, Mondi, a global leader in packaging and paper, announced the expansion of its kraft paper production facility in Russia, increasing the facility's annual production capacity by 100,000 tonnes.

- In November 2022, WestRock, one of the largest producers of kraft paper in North America, announced the acquisition of a corrugated packaging company thereby expanding its product offerings and market reach.

- In September 2022, Smurfit Kappa, a leading provider of paper-based packaging solutions, introduced a new compostable, biodegradable, and recyclable kraft paper product.

- In July 2022, A new kraft paper mill was opened in Italy by DS Smith, a leading provider of sustainable packaging solutions, increasing its annual production capacity by 100,000 tonnes.

Report Scope:

Report Features Description Market Value (2022) USD 17.6 Bn Forecast Revenue (2032) USD 23.8 Bn CAGR (2023-2032) 3.1% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Grade Analysis (Bleached, Unbleached), By End-Use Industry Analysis (Foods & Beverages, Pharmaceuticals, Building and Construction, Cosmetics & Personal Care, Other End-Use Industries) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape International Paper Inc., Stora Enso Oyj, Smurfit Kappa Group plc, Nippon Paper Group, Mondi Group Plc., ITC Limited, Sappi Limited, Ahlstrom-Munksjö Oyj, BillerudKorsnäs AB, Sukraft Papers Private Limited, DS Smith Plc., Canadian Kraft Paper Industries Ltd., French Paper Company, WestRock Company, Other Key Industry Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- International Paper Inc.

- Stora Enso Oyj

- Smurfit Kappa Group plc

- Nippon Paper Group

- Mondi Group Plc.

- ITC Limited

- Sappi Limited

- Ahlstrom-Munksjö Oyj

- BillerudKorsnäs AB

- Sukraft Papers Private Limited

- DS Smith Plc.

- Canadian Kraft Paper Industries Ltd.

- French Paper Company

- WestRock Company

- Other Key Industry Players