Global Palm Sugar Market By Form (Block, Granule, Liquid), By Packaging (Bottles & Jars, Pouches, Others), By Distribution Channel (Supermarkets, Specialty Stores, Online Retail, Convenience Stores, Others), By Application (Food & Beverage Industry, Food Service, Household), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

-

45068

-

April 2024

-

219

-

-

This report was compiled by Shreyas Rokade Shreyas Rokade is a seasoned Research Analyst with CMFE, bringing extensive expertise in market research and consulting, with a strong background in Chemical Engineering. Correspondence Team Lead-CMFE Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

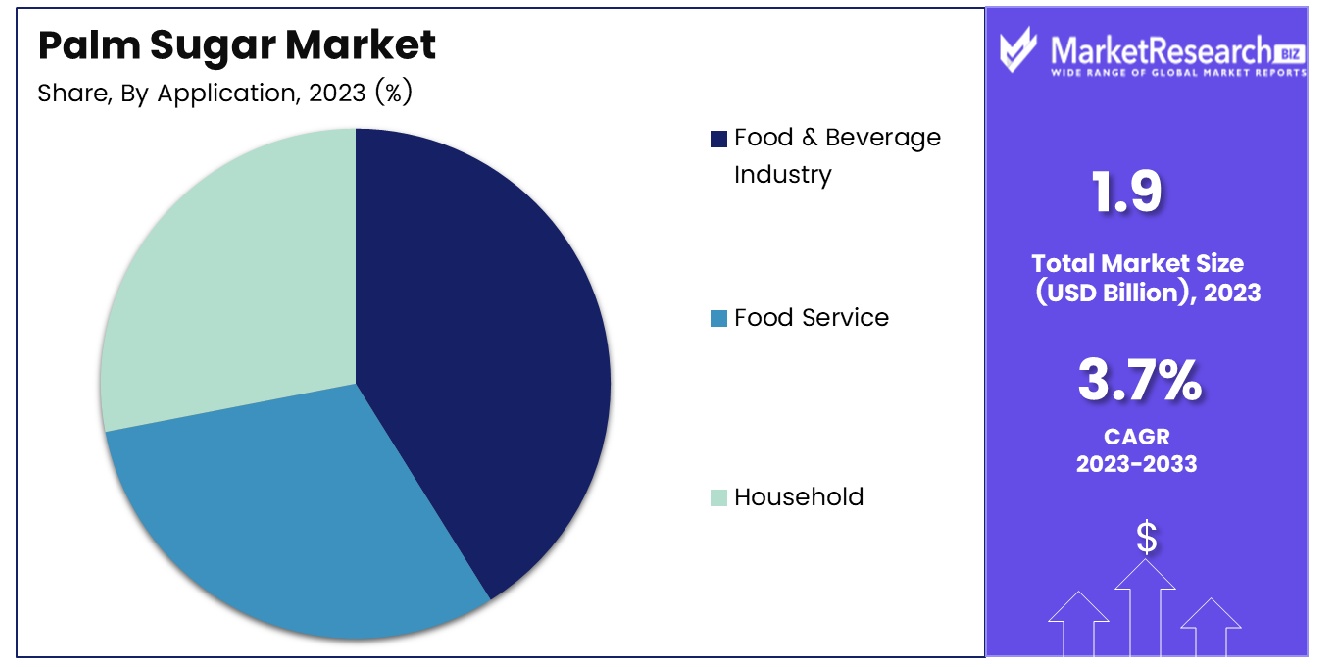

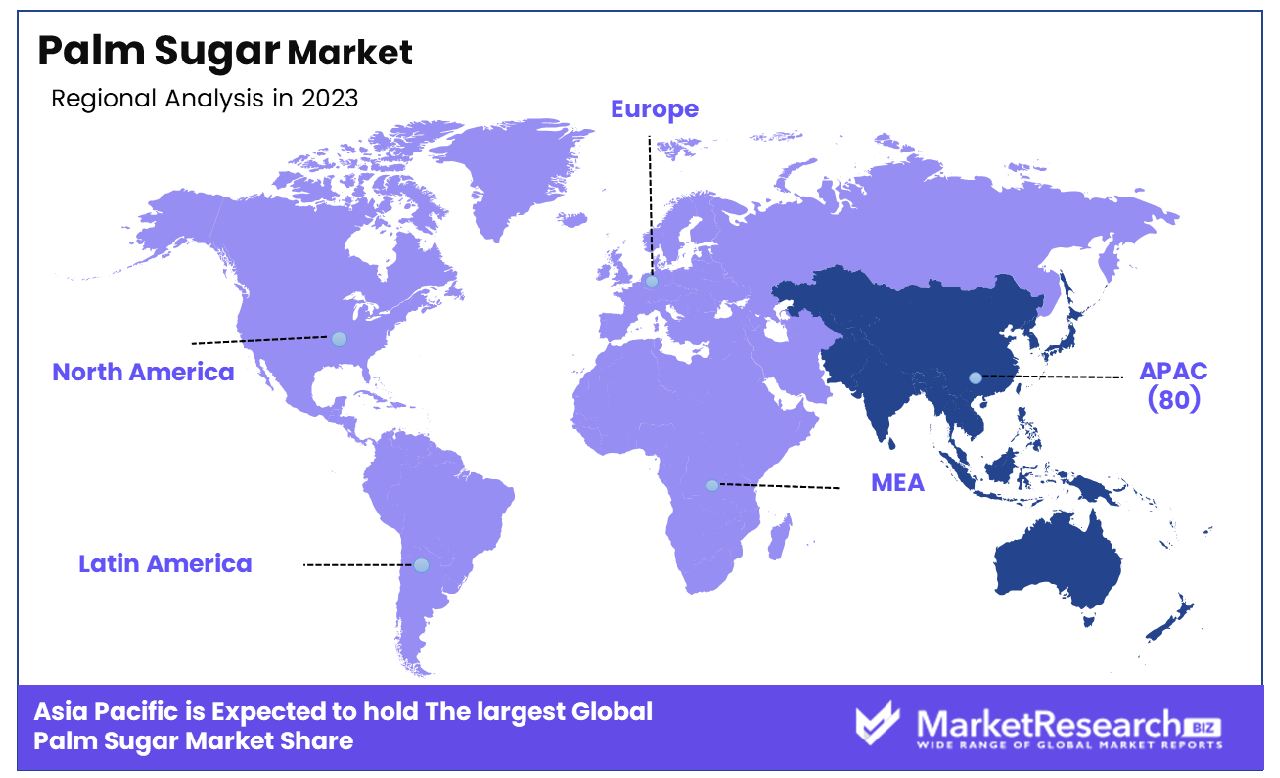

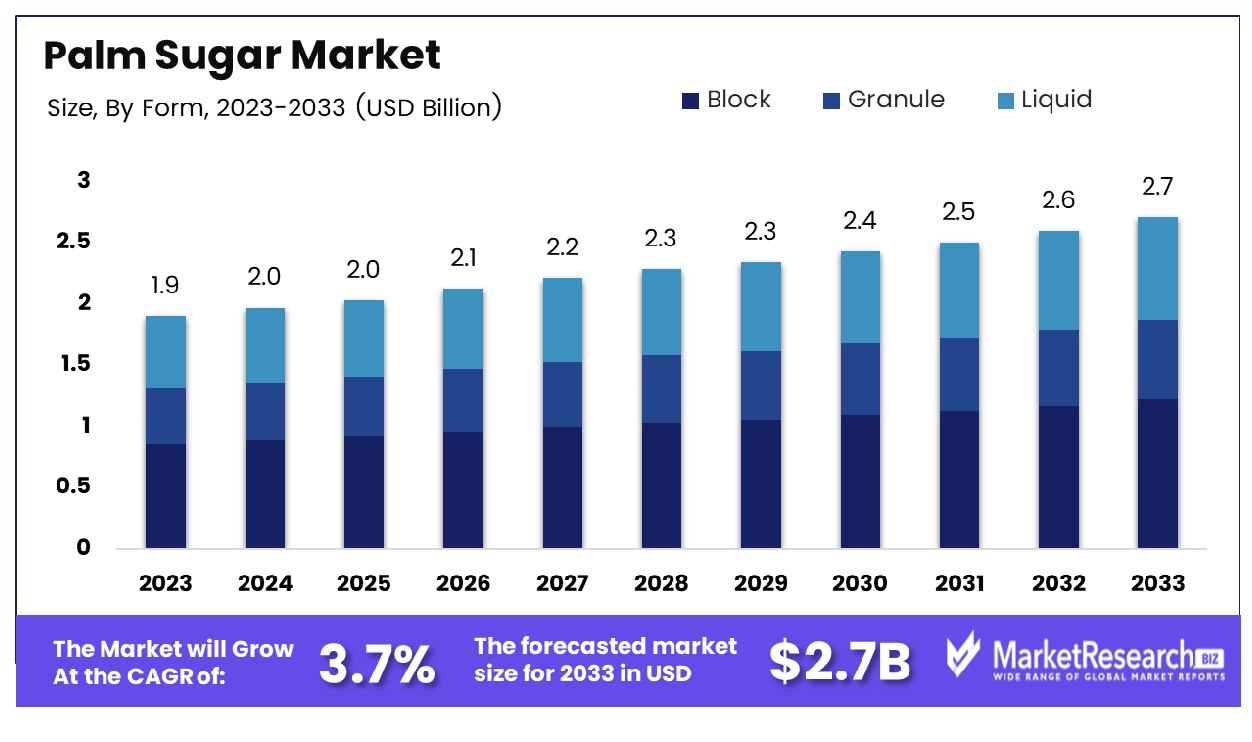

The Global Palm Sugar Market was valued at USD 1.9 Bn in 2023. It is expected to reach USD 2.7 Bn by 2033, with a CAGR of 3.7% during the forecast period from 2024 to 2033.

The Palm Sugar Market encompasses the trade and consumption of a natural sweetener derived from the sap of various palm trees. As consumers increasingly seek healthier alternatives to refined sugars, this market presents opportunities for companies across sectors like food and beverage, cosmetics, and pharmaceuticals. Palm sugar's low glycemic index and nutrient-rich profile position it as a desirable option for health-conscious consumers.

With growing awareness of sustainability and ethical sourcing, companies engaging in the Palm Sugar Market must prioritize transparency in their supply chains, ensuring responsible harvesting practices and fair treatment of local communities. Embracing innovation and consumer education are key strategies for capitalizing on this dynamic market landscape.

-

-

- Navitas Organics LLC

- Windmill Organics Ltd.

- Big Tree Farms Inc.

- Betterbody Foods and Nutrition LLC

- Phalada Agro Research Foundation

- Palm Nectar Organics

- American Key Food Products Inc.

- Royal Pepper Company

- Asana Inc.

- Wholesome Sweeteners Inc.