Optical Coating Market By Type (Anti-Reflective (AR) Coatings, High Reflective Coatings, Transparent Conductive Coatings, Filter Coatings, Others), By End-Use Industry (Healthcare, Electronics, Solar, Military & Defense, Telecommunication/Optical Communication, Transportation), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2023-2032

-

4713

-

May 2023

-

169

-

-

This report was compiled by Research Team Research team of over 50 passionate professionals leverages advanced research methodologies and analytical expertise to deliver insightful, data-driven market intelligence that empowers businesses across diverse industries to make strategic, well-informed Correspondence Research Team Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

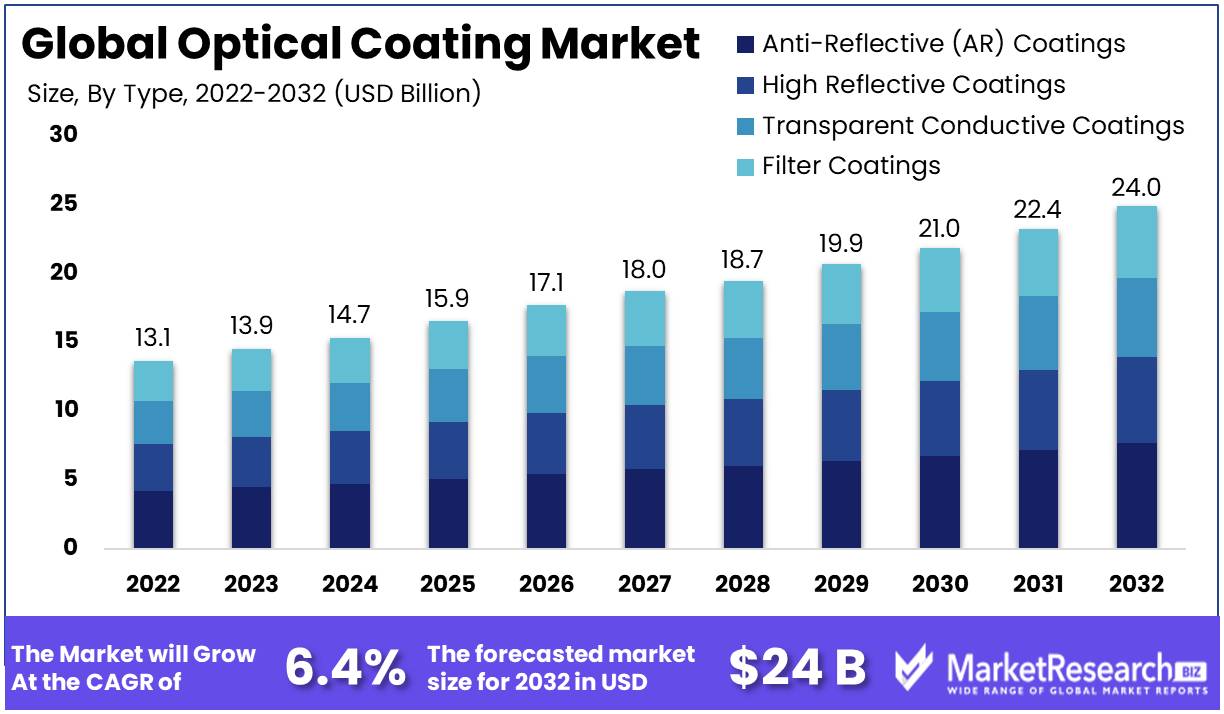

Optical Coating Market size is expected to be worth around USD 24 Bn by 2032 from USD 13.1 Bn in 2022, growing at a CAGR of 6.4% during the forecast period from 2023 to 2032.

An intricate and labyrinthine industry, the Optical Coating Market encompasses a vast array of optical coatings that confer upon substrates, be they glass, plastic, or metal, the ability to manifest an enhanced reflectivity or a modified reflectivity specific to particular wavelengths of light. A remarkable increase in the demand for cutting-edge technologies, including but not limited to smartphones, automotive devices, semiconductors, and medical equipment, has led to a constant increase in the trajectory of the industry.

Recent developments in the Optical Coating market have sparked awe and intrigue. A shining example of innovation is the use of superlative materials, such as the illustrious diamond-like carbon, which imparts increased durability and abrasion resistance to coatings. In addition, there has been a remarkable evolution in the field of smart coatings, which are coatings that swiftly adapt to external stimuli such as temperature, humidity, and the unrelenting focus of luminous exposure. Moreover, a seismic shift has occurred at the core of the industry, as it has undertaken a fervent crusade to embrace coatings that are inherently sustainable, thereby reducing the ecological burden placed on our beleaguered planet.

The Optical Coating Market, a magnetic force that attracts substantial investments through funding rounds and the consolidation of corporations, has successfully harnessed these resources to spur the birth of cutting-edge technologies, novel products, and customized services that invariably provide the industry with an unrivaled competitive advantage. A further feather in its cap is the successful incorporation of optical coatings into a vast array of products and services, from the lofty realm of mobile phone displays to the intricate world of camera lenses to the intricately woven fabric of medical diagnostic devices.

The Optical Coating Market, resembling a slumbering titan, anticipates its reawakening and ascent to new heights, driven by the incessant demand for high-tech marvels that resonate with the zeitgeist of our time. The market is expected to experience unquenchable demand from a variety of industries, including soaring aerospace dominance, the impregnable defense landscape, the unwaveringly steadfast automotive domain, and the ever-evolving realm of medical advancements. Within the verdant womb of the Asia-Pacific region, the crescendo of growth reverberates the loudest, a sonic spectacle spawned by the inundation of investments pouring into research and development.

The Optical Coating Market is propelled by a complex web of forces, including the relentless march of technological advancements, the burgeoning demand for coatings endowed with unrivaled durability and longevity, and the soaring demand for the accouterments of the digital age: smartphones, laptops, and cameras. The proliferation of optical coatings in the automotive and aerospace industries has also contributed to the unstoppable expansion of this industry. Moreover, the throbbing pulse of the global consciousness, pulsing with an ardent desire to reduce carbon emissions and reduce our collective carbon footprint, has spawned a burgeoning demand for coatings imbued with sustainability, a demand rooted in the unwavering desire to adhere to environmental regulations and foster a harmonious coexistence with Mother Earth.

Driving Factors

The Growing Adoption of Smartphones and Electronic Devices

In the semiconductor and electronics industries, the growing popularity of smartphones and other electronic devices with touchscreens and displays has increased the demand for high-quality and long-lasting optical coatings. This demand is driven by the need to improve the performance and durability of these devices through the application of effective optical coatings. Consequently, prominent market participants are investing in research and development, resulting in technological advancements and the emergence of new coating materials and processes. In the Optical Coating Market, tablet coating techniques have emerged as a promising solution for enhancing light transmission properties.

Demand for Anti Reflective Coatings in Eyewear and Camera Lenses is Growing

Due to the rising demand for anti-reflective coatings in the eyewear and camera lens industries, the optical coating market is expanding. Consumers are pursuing coatings that minimize reflections, improve clarity, and enhance visual experiences. This trend is driven by the pursuit of superior optical performance in a variety of applications, such as spectacles, sunglasses, and professional camera lenses.

The Growth in Optical Coatings for Aerospace, Defense, and Automotive Industries

Demand for optical coatings is primarily driven by the demand for energy-efficient illumination solutions and improved aesthetics in the aerospace, defense, and automotive industries. To increase the durability and aesthetic appeal of vehicles, the automotive industry is experiencing a significant increase in demand for high-quality and long-lasting optical coatings. In addition, the aerospace and defense industries rely more and more on optical coatings to optimize light transmission and reduce reflections in a variety of applications.

The Impact of Emerging Technologies on the Optical Coating Market

Emerging technologies such as nanotechnology and microelectromechanical systems (MEMS) could have a substantial impact on the optical coating market. These technologies provide coating applications with novel material options and advanced methods. They facilitate the development of innovative coatings with enhanced performance characteristics, thereby creating new opportunities for industry growth and development.

Potential Disruptors in the Optical Coating Market

Several factors pose a potential threat to the optical coating market. One such factor is the entry of new actors, which intensifies competition and stimulates innovation in the industry. In addition, alternative coating technologies, such as electroplating and vacuum deposition, present competitive challenges because they provide alternative coating application solutions. To maintain a competitive advantage, market participants must remain vigilant and adapt to shifting market dynamics.

Restraining Factors

High Capital Expenditure Required for the Production of Optical Coatings

The production of optical coatings necessitates substantial capital expenditures on specialized apparatus and facilities. Coatings are applied using complex vacuum deposition processes that require sophisticated equipment, cleanroom conditions, and skilled operators. As a result, companies operating in this industry incur high capital and operational expenses, which hinder their capacity to scale and meet rising demand. This frequently prevents new competitors from entering the market, thereby inhibiting innovation and competition.

Availability of Alternative Technologies for Some Applications

In spite of the fact that optical coatings offer unrivaled performance enhancements for a variety of applications, alternative technologies exist for certain applications. Anti-reflective coatings are commonly used on eyeglasses and camera lenses, but some consumers prefer polarized or photochromic lenses. These materials have their advantages, but they may not offer the same level of efficacy as optical coatings. However, the presence of alternative technologies restricts the market potential for optical coatings, resulting in decreased adoption and slowed growth.

Complex manufacturing processes lead to high production costs

As previously stated, the production of optical coatings involves a complex and delicate procedure, which contributes substantially to the production cost. Coating fabrication is a multi-step procedure that requires precision and attention to detail in order to minimize defects and ensure quality. This means that manufacturers invest a great deal of time and effort into the production of each coating, driving up production costs and, consequently, prices. Consequently, end-users may contemplate more cost-effective alternatives, resulting in a decline in demand for optical coatings.

Environmental Regulations and Concerns over the Use of Certain Coating Materials

As is the case with all industries, the optical coating market is increasingly scrutinized by government agencies and environmental groups. As an example, the use of certain coatings containing hexavalent chromium poses environmental and health concerns. This has resulted in stricter regulations, including material restrictions and compliance requirements, thereby reducing the number of coating materials available for use. As a result, manufacturers confront difficulties in sourcing and developing compliant materials, and consumers may consider alternatives to optical coatings that are more durable and safer.

Covid-19 Impact on Optical Coating Market

The pandemic of COVID-19 has affected nearly every aspect of human life, including the optical coating industry, which has been severely impacted. The procedure of applying thin coatings to optical components, such as lenses and mirrors, to enhance their performance is known as optical coating. As the pandemic continues to impact the global economy, both positive and negative effects have been felt in the optical coating market.

Supply chain disruption is one of the primary negative effects of COVID-19 on the optical coating market. Countries that are significant producers and consumers of optical coatings have imposed lockdowns and travel restrictions, making it difficult for businesses to acquire raw materials. As a consequence, a significant number of optical coating companies have been compelled to suspend or reduce operations, resulting in lost revenues and profits.

COVID-19 has had both positive and negative effects on the optical coating market. The pandemic has increased the demand for medical apparatus, such as diagnostic imaging devices and surgical instruments, which require optical components of superior quality. This has created new opportunities for companies that specialize in supplying the medical industry with optical coatings.

The increased demand for optical components used in remote communication technologies is another positive effect of COVID-19 on the optical coating market. As an increasing number of businesses and institutions adopt remote work and remote learning, the demand for webcams and other optical components has increased substantially. This has resulted in an increase in demand for optical coating companies that provide these components.

In spite of the challenges and opportunities presented by COVID-19, it is anticipated that the optical coating market will continue to expand in the future years. The market is driven by a number of factors, such as the rising demand for high-performance optical components in a variety of industries and the rising adoption of cutting-edge technologies such as 5G, artificial intelligence, and autonomous vehicles.

Type Analysis

The anti-reflective coatings segment, which currently dominates the optical coating market, is anticipated to continue driving market expansion over the following few years. By reducing reflection and increasing light transmission, anti-reflective coatings play a crucial role in enhancing the performance of optical systems. In industries such as electronics, healthcare, and automotive, where sophisticated optical systems are essential, this segment is in high demand.

Due to the economic growth of emerging economies, the use of anti-reflective coatings is increasing. High economic development in nations such as China, India, and Brazil is fueling the expansion of industries such as electronics, healthcare, and automotive. These industries utilize sophisticated optical systems that necessitate anti-reflective coatings for optimal performance.

The advantages of using anti-reflective coatings in everyday life are becoming more apparent to consumers. They prefer smartphones, laptops, and televisions with anti-reflective coatings, which alleviate eye strain and enhance the viewing experience. In addition, patients in the healthcare industry are increasingly choosing eyeglasses with anti-reflective coatings because they improve clarity and reduce glare from bright lighting.

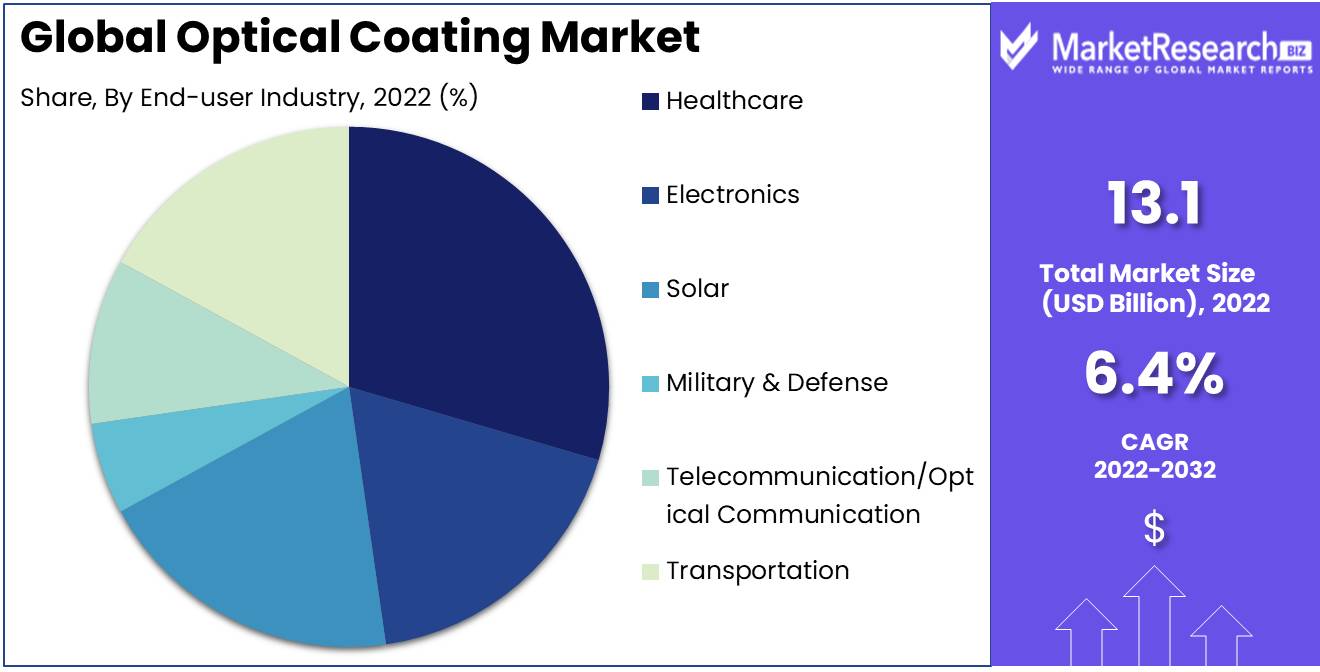

End-Use Industry Analysis

The healthcare segment dominates the optical coating market, which includes anti-reflective coatings. For diagnostic and surgical procedures, the healthcare industry utilizes advanced optical systems, which require high-quality, dependable, and long-lasting optical components.

The expansion of emerging economies has resulted in an increase in the demand for healthcare services, which has in turn increased the utilization of advanced optical systems. China and India have experienced an increase in the number of hospitals, clinics, and healthcare facilities, which has increased the demand for advanced optical systems.

The demand for high-quality eyeglasses with anti-reflective coatings, which enhances clarity and reduces reflection, is rising in the healthcare industry. In addition, optical systems utilized in diagnostic and surgical procedures must be dependable, long-lasting, and high-performing, which has led to an increase in the use of anti-reflective coatings in the healthcare industry.

Key Market Segments

By Type

- Anti-Reflective (AR) Coatings

- High Reflective Coatings

- Transparent Conductive Coatings

- Filter Coatings

- Others (Beam Splitter Coatings And Electrodeposition (EC) Coatings)

By Technology

- Vacuum Deposition Technology

- Ion-Assisted Deposition (IAD) Technology

- E-Beam Evaporation Technology

- Sputtering Process

By End-Use Industry

- Healthcare

- Electronics

- Solar

- Military & Defense

- Telecommunication/Optical Communication

- Transportation

Growth Opportunity

Increasing demand for high-quality optical coatings in emerging economies

In emerging economies such as China, India, and Indonesia, the demand for high-quality optical coatings has increased significantly. This growth is a result of the accelerated expansion of the consumer electronics and automobile industries in these economies. The demand for optical coatings used in the displays and lenses of consumer electronics like smartphones, tablets, and laptops has increased as a result of the rise in demand for these devices. In the coming years, this demand is anticipated to skyrocket, creating tremendous development potential for the optical coating market in emerging economies.

Increasing demand for consumer electronics and the trend toward larger displays

The optical coating market is still heavily driven by consumer electronics. The trend toward larger displays in smartphones, televisions, and computer monitors has increased the demand for optical coatings of superior performance and durability. These coatings enhance the display's clarity, color, and contrast, thereby enhancing the end-users viewing experience. The increasing prominence of these larger displays across the globe will result in a rise in demand for optical coatings, creating significant market growth potential.

Expansion of the Solar Energy Sector

In recent years, the solar energy industry has expanded significantly, with an increasing emphasis on renewable energy sources. Solar panels require high-performance optical coatings in order to maximize their efficiency, safeguard them from external factors, and preserve their longevity. The expansion of the solar energy industry, especially in emerging economies such as China and India, has increased the demand for optical coatings for solar panels.

Increasing focus on sustainable and energy-efficient lighting solutions

As demand for eco-friendly products continues to rise, there is a growing emphasis on sustainable and energy-efficient lighting solutions. Optical coatings are utilized to increase the efficacy and performance of lighting solutions, such as LED lights, by enhancing their optical properties. The demand for coatings with high reflectivity, light transmission, and thermal management is propelling the expansion of the optical coating market.

Latest Trends

The Increasing Adoption of Smart Glasses and Augmented Reality Technology

The increasing adoption of smart glasses and augmented reality technology has been a significant factor in the expansion of the Optical Coating Market. Smart glasses and other augmented reality technologies necessitate sophisticated coatings to provide a clear and high-quality image and to safeguard the delicate electronics within the devices. As a result, businesses have made substantial investments in the development of new coatings that can satisfy the stringent requirements of these cutting-edge technologies.

The Development of Nanocoatings and Other Advanced Coating Materials

In addition to nanocoatings and other advanced coating materials, the development of nanocoatings has been a significant growth catalyst for the Optical Coating Market. Nanocoatings are thin coatings applied to surfaces to provide protection and other advantageous properties. These coatings are ideal for use in optical applications because they reduce reflection and increase transmission to an exceptional degree. In addition, nanocoatings can be engineered to have a variety of properties, such as abrasion resistance, self-cleaning, and anti-fogging.

A Growing Trend Towards Customized Optical Coatings for Specific Applications

Another significant trend driving the growth of the Optical Coating Market is the increasing demand for optical coatings that are tailored to specific applications. As businesses seek to develop new products with specific performance characteristics, they are increasingly turning to optical coatings that can be customized to satisfy their particular requirements. This has led to the development of a vast array of specialized coatings, each of which is designed to provide unique properties based on the intended application.

Rising Demand for Flexible and Stretchable Coatings for Wearable Electronics

The increasing demand for flexible and stretchable coatings for wearable electronics has also been a significant factor in the expansion of the Optical Coating Market. As wearable devices grow in popularity, the demand for coatings that can withstand the rigors of daily wear and tear increases. This has led to the creation of new, flexible coatings that can be applied to a variety of substrates, including fabrics and other flexible materials.

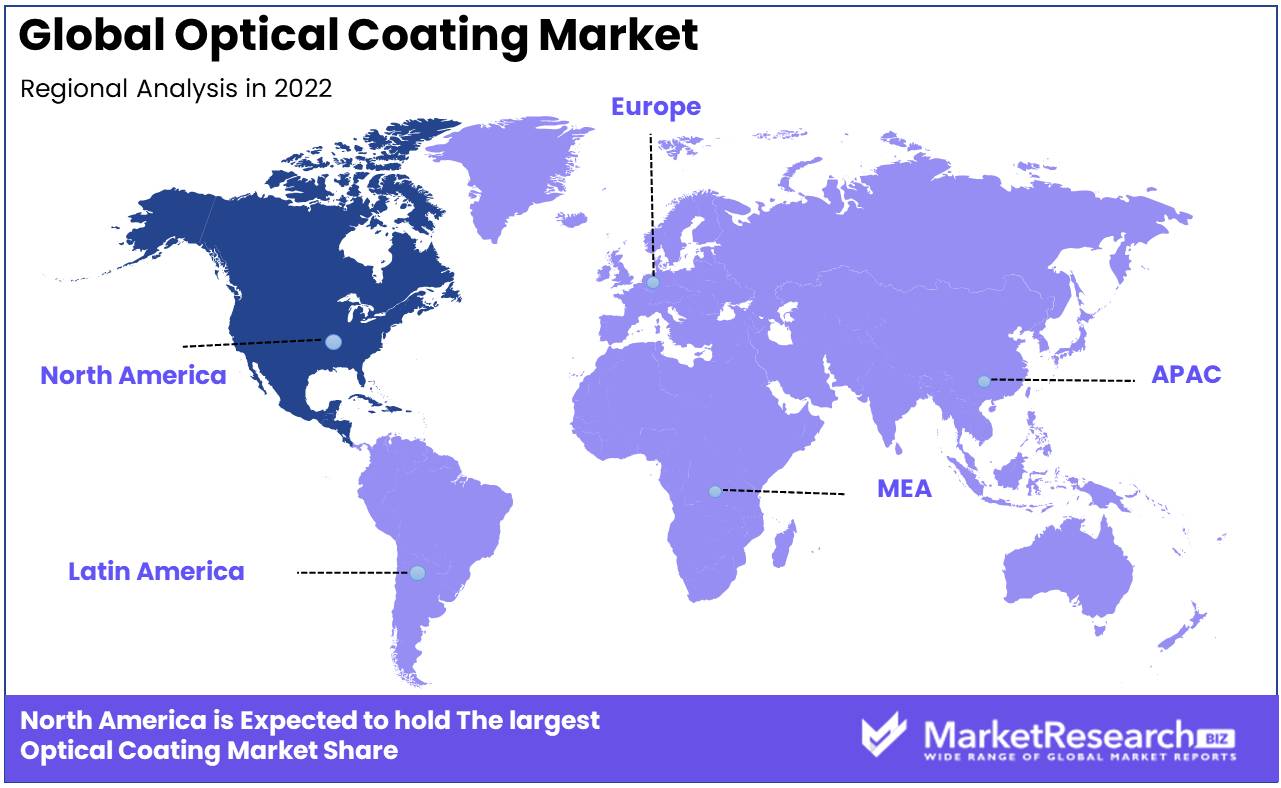

Regional Analysis

Market Dominance of North America in Innovation and Technology, North America has become the epicenter of innovation and technology, primarily as a result of the United States market dominance. Through the presence of key actors and a strong emphasis on innovation and technology development, the United States has maintained its position as the industry's leader. This article intends to delve deeply into the reasons for North America's innovation and technology market dominance.

In addition to the obvious main players, the United States also has a thriving startup culture that has successfully generated new ideas that redefine the market. Numerous of these startups have disrupted conventional business models and contributed significantly to the global technology landscape. The combination of these key actors, ranging from multinational corporations to scrappy startups, makes North America the innovation hub of the world.

North America's innovation and technology market dominance can also be attributed to a strong emphasis on innovation and technology advancement. The United States government invests extensively in research and development initiatives across multiple industries, including the technology sector. In addition, the United States has a talent pool of highly trained professionals, which is a necessary ingredient for revolutionary innovation.

Additionally, innovation and technological advancement are highly valued in American culture. Innovation and technology startups frequently receive substantial venture capital funding, which propels their expansion and growth. Investors are eager to support audacious and novel concepts with the potential to disrupt existing markets.

Additionally, the United States has a high-quality education system that produces experienced professionals who are equipped to innovate and create new technologies. In the realm of technology, MIT, Stanford, and Harvard are renowned for producing top-tier talent. Collaboration and interdisciplinary thought, which are essential for innovation, are also fostered by this educational system.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Zeiss is a well-known German corporation with a significant presence in the precision optics and coatings market. They provide an extensive selection of optical coatings for a variety of industries, including optics, optoelectronics, and the medical technology sector. Zeiss is renowned for its expertise in manufacturing optical components and coatings of superior quality.

United States-based Newport Corporation is a prominent provider of photonics technologies. They provide optical coatings, optics of high precision, and laser systems. Newport's optical coatings are designed for a variety of applications and industries, allowing clients to improve the performance and efficiency of their optical components and systems.

PPG Industries, a global champion in the coatings industry, offers optical coatings for a variety of applications. They serve the automotive, aerospace, and architectural glass industries. In these applications, optical coatings from PPG contribute to enhanced optical properties, durability, and aesthetic appeal.

Abrisa Technologies, based in the United States, specializes in thin film optical coatings. They provide coatings for display systems, imaging systems, and optoelectronic devices. Coatings developed by Abrisa Technologies optimize light transmission, reduce reflection, and enhance the overall efficacy of optical systems.

The California-based Reynard Corporation provides optical coatings for both commercial and military applications. In addition to anti-reflective, reflective, and conductive coatings, they also offer conductive coatings. Coatings by Reynard Corporation improve the optical performance, durability, and efficacy of various optical systems.

Top Key Players in Optical Coating Market

- I. du Pont de Nemours and Company

- PPG Industries Inc.

- Nippon Sheet Glass Co. Ltd

- Zeiss Group

- Optical Coatings Japan

- Newport Corporation

- Artemis Optical Ltd.

- Abrisa Technologies

- Reynard Corporation

- Schott AG

Recent Development

In 2020, 3M Company introduced a new line of enduring and high-performance optical films designed for display and touchscreen applications. This innovation from 3M is a significant step toward enhancing the durability and visibility of these essential components.

In 2018, Applied Materials introduced a new line of optical coatings for use in semiconductor fabrication. The purpose of these coatings is to enhance the efficacy and durability of optical components in semiconductor devices.

In 2017, Evaporated Coatings Inc. announced the development of a new coating process for the production of optical coatings that are highly uniform and durable. This innovation in coating technology has the potential to revolutionize the industry by enhancing the overall quality and performance of optical components.

Report Scope:

Report Features Description Market Value (2022) USD 13.1 Bn Forecast Revenue (2032) USD 24 Bn CAGR (2023-2032) 6.4% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Anti-Reflective (AR) Coatings, High Reflective Coatings, Transparent Conductive Coatings, Filter Coatings, Others (Beam Splitter Coatings And Electrodeposition (EC) Coatings))

By Technology (Vacuum Deposition Technology, Ion-Assisted Deposition (IAD) Technology, E-Beam Evaporation Technology, Sputtering Process)

By End-Use Industry (Healthcare, Electronics, Solar, Military & Defense, Telecommunication/Optical Communication, Transportation)Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape I. du Pont de Nemours and Company, PPG Industries, Inc., Nippon Sheet Glass Co., Ltd, Zeiss Group, Optical Coatings Japan, Newport Corporation, Artemis Optical Ltd., Abrisa Technologies, Reynard Corporation, Schott AG Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- I. du Pont de Nemours and Company

- PPG Industries Inc.

- Nippon Sheet Glass Co. Ltd

- Zeiss Group

- Optical Coatings Japan

- Newport Corporation

- Artemis Optical Ltd.

- Abrisa Technologies

- Reynard Corporation

- Schott AG