Tablet Coating Market By Polymer Type(Cellulosic Polymers, Vinyl Derivatives, Other), By Functionality(Non-functional non-modifying coatings, Functional modifying coatings), By Type(Film-coated tablets, Sugar-coated tablets, Other), By End User(Pharmaceutical Industry, Nutraceutical Industry), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

42696

-

Jan 2024

-

179

-

-

This report was compiled by Correspondence Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Tablet Coating Market Size, Share, Trends Analysis

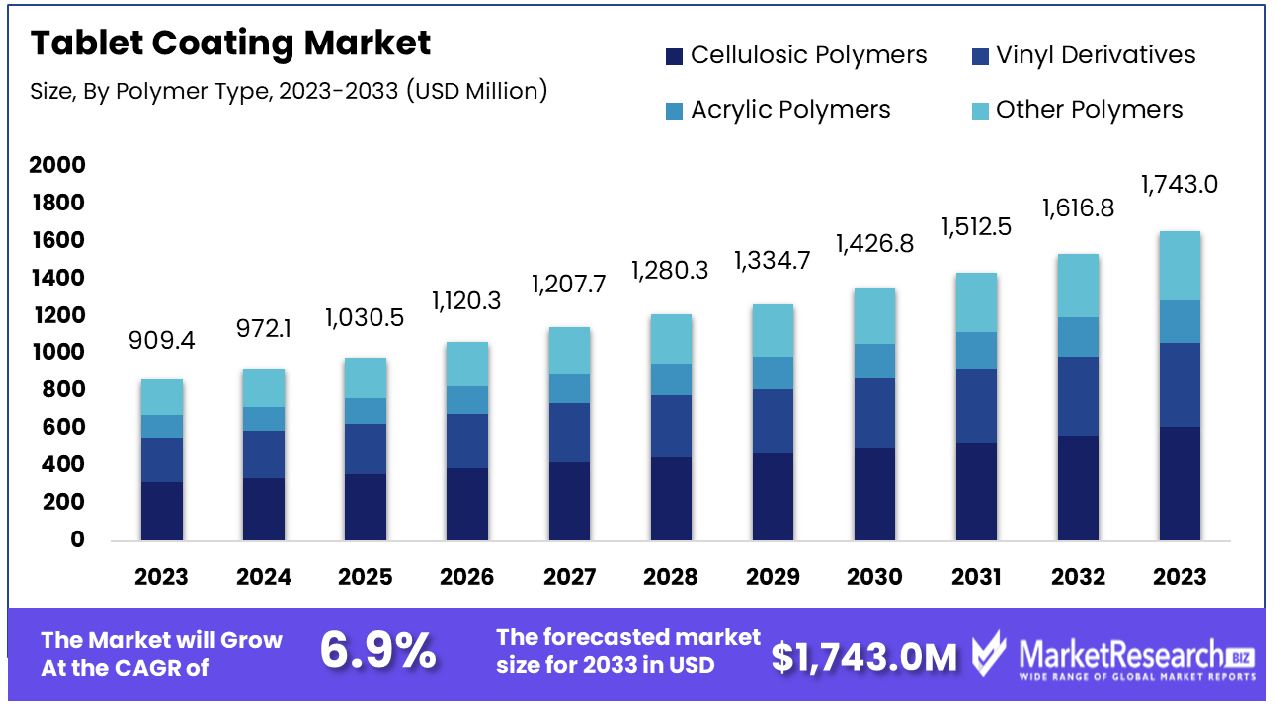

The tablet coating market was valued at USD 909.4 million in 2023. It is expected to reach USD 1,743.0 million by 2033, with a CAGR of 6.9% during the forecast period from 2024 to 2033.

The surge in demand for technological advancements and pharmaceuticals are some of the main driving factors for the tablet coating market expansion. Tablet coating is one of the oldest pharmaceutical techniques that comprise sugar or polymeric coating over the tablet. The benefit of coating tablets is enhancing the taste covering, odor covering, chemical and physical protection mask, protecting the drug inside the stomach for dissolving it properly and regulating its release profile.

Tablet coating also focuses upon to provide longer shelf life for the drugs, loss of volatile elements that can be decreased, improvement of mechanical strength of solid form of drugs as well as the drug release rate can also be altered through this technique specifically deferral release tablet or enteric-coated table and sustained release drugs.

In the pharmaceutical and nutraceutical sector, tablets have substantial importance as a dosage form. Earlier, tablet coating focused upon to provide better taste and odor of drug formulation but eventually, it is playing a vital role in enhancing the overall physical appearance, functionality, and shelf life of the tablet.

As the older population is increasing rapidly and the surge in chronic disorders like diabetes, cancer, and other cardiovascular diseases has contributed a lot to the demand for drug production and therapy. Generic drug production has a high demand, according to an article which was published by the world’s top tech in July 2023, the worldwide exports of drugs and medications will reach USD 458.4 billion in 2022.

The export of drugs and medicines supply via the international market has increased by 22.9% for the exporting nations since 2018 when the drugs and medications trading value was USD 373 billion. In comparison to USD 450.5 billion, there was a surge of 6.5% year-over-year upturn during 2021. Europe has exported the highest amount of drugs and medicines during 2022 with the supply from Europe falling to USD 358.2 billion or 79.9% of the worldwide total.

Asia is the second largest pharmaceutical exporter at 9.9% while North America has 8.9% of exporting drugs and medicines. Moreover, according to the FDA in January 2023, generic drugs and medicines accounting for 9 out of 10 medical prescriptions filled with over 32K generic drugs have been approved.

Manufacturers are investing huge amounts of money in R&D for new coating experiments with the launch of new drug formulations. The demand for tablet coating will increase as per its requirements due to which it will contribute to the market expansion in the forecast period.

Tablet Coating Market Dynamics

Neurological Needs Boost Tablet Coatings

The rising prevalence of neurological disorders and mental health conditions globally is significantly driving the tablet coating market. As the number of individuals requiring medication for these conditions increases, so does the demand for coated tablets, which offer improved drug delivery, patient compliance, and dosage accuracy.

Coatings can also mask unpleasant tastes and protect drug stability, enhancing the effectiveness and patient experience of neurological and psychiatric medications. The ongoing rise in mental health and neurological disorders is likely to continue fueling the demand for advanced coating technologies.

Generic Production Expands Coating Demand

Tablet coatings have become an indispensable component of cost-effective generic drug manufacturing, thanks to rising consumer demand. Tablet coatings play a vital role in both increasing appeal and improving performance - these components make up part of generic manufacturers' goal to produce quality drugs at lower costs while still meeting quality standards.

Coatings play an integral part in distinguishing products, prolonging shelf life, and improving patient compliance. As pharmaceutical firms shift towards less costly medications, demand for efficient tablet coatings designed specifically for generic drug production will likely grow significantly.

Regulatory Support Shapes Coating Standards

Government support and stringent regulations are driving tablet coating growth. Regulator bodies ensure coatings meet quality and safety standards, encouraging companies to invest in top-quality coating materials and techniques. Furthermore, their regulatory environment promotes creativity while helping ensure compliance with current standards - encouraging more innovative coating options to develop over time.

Government initiatives designed to expand the pharmaceutical sector further fuel the market growth rate. As regulations change and become stricter, tablet coatings markets should adapt their business models to focus on conformity, innovation, and quality requirements imposed upon them.

Customization and Industrial Scale Production Challenges Restrain Tablet Coating Market Growth

Tablet coating markets face growth restrictions due to issues associated with customization and industrial-scale production. Tablet coating processes must adapt to various pharmaceutical formulations, necessitating modifications in terms of coating material thickness and technology - as well as being tailored specifically for commercial-scale production if applicable. Fulfilling such requirements while guaranteeing quality and efficiency at scale is often challenging and expensive.

Manufacturers must invest in flexible technology and equipment that can adapt to various coating requirements, including those for custom solutions as well as large-scale, cost-effective production. Failure to do so hinders market expansion.

Limited Penetration Capability Impedes Tablet Coating Market Expansion

Limitations in coating penetration capabilities are another barrier to expanding tablet coating markets. An effective coating ensures the proper release of drugs into the body while protecting active pharmaceutical ingredients as well as increasing tablet durability and shelf life.

Securing an effective and uniform coating that penetrates effectively to fulfill these functions can be challenging when working with irregularly shaped or complex tablets, where insufficient penetration or inconsistent coating could compromise the efficacy or quality of the final product. Overcoming technological limitations is vital to ensure quality and reliability for coated tablets - this ultimately contributes to market expansion as well as consumer trust.

Tablet Coating Market Segmentation Analysis

By Polymer Type Analysis

The cellulosic polymer segment has emerged as the dominant segment in the tablet coating market. Cellulosic segment polymers like HPMC (hydroxypropylmethylcellulose), are frequently utilized as pharmaceutical film coatings due to their flexibility, safety, and ease of application in film-coating processes. HPMC's non-toxic nature and lubricity provide aesthetic appeal; while aesthetic enhancement is another benefit.

Polymers have become popular due to their ability to enhance the look, feel, and lifespan of tablets while simultaneously eliminating unpleasant aromas or tastes. Research continues to find ways to modify polymers to increase efficiency and patient satisfaction; other polymers such as vinyl Derivatives, Acrylic Polymers, and other innovative formulations also contribute significantly to this market by offering unique properties tailored specifically for specific coating requirements and needs.

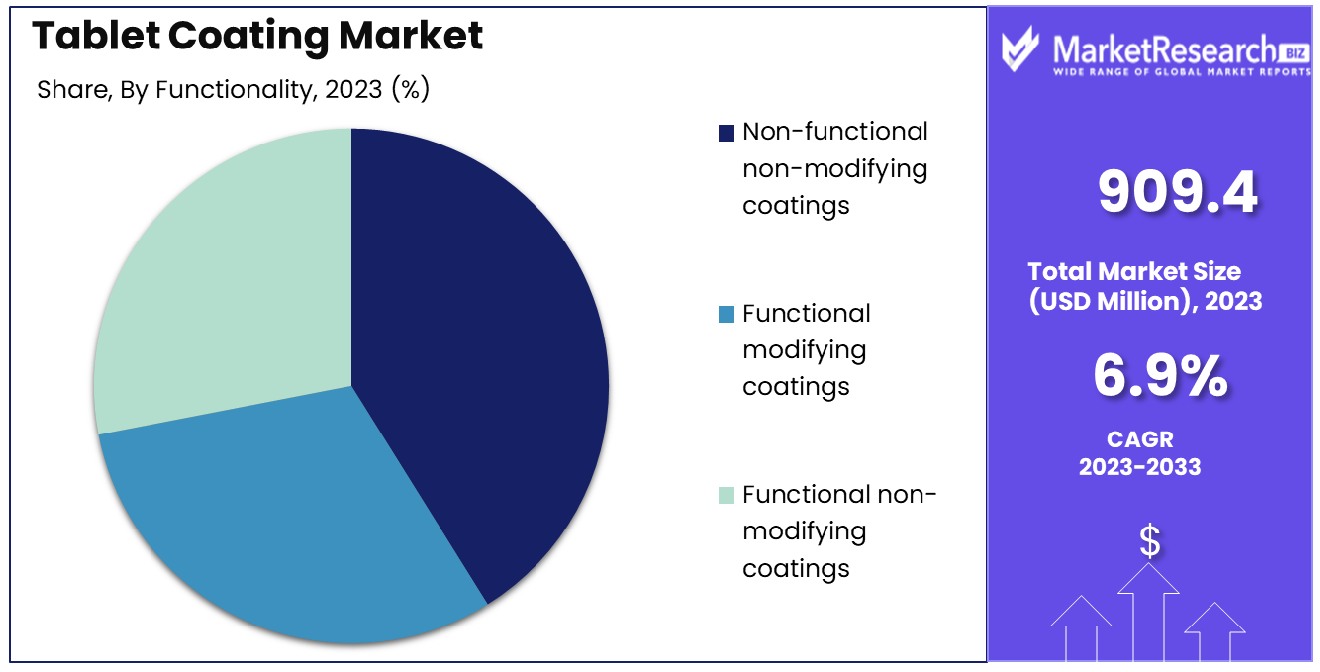

By Functionality Analysis

Non-functional non-modifying coatings are the leading functionality type in the tablet coating market. Pill coatings are frequently employed to improve the physical and visual characteristics of tablets, including color clarity, glossiness, and smoothness without altering release properties that relate to active ingredients (API). Coatings may make swallowing more comfortable or mask any unpleasant flavors while protecting from air and moisture elements.

Pharmaceutical companies' desire to enhance patient compliance and the visual appeal of tablets has propelled this category's rise, and both functionally modifying coatings, as well as non-modifying ones, play an integral part in providing customized release profiles and additional API protection, aiding controlled drug distribution.

By Type Analysis

Film-coated tablets represent the most prominent segment in the tablet coating market. Film coatings have numerous advantages that make them an appealing solution, including improved patient compliance and protection of tablet ingredients as well as their ability to regulate rates of drug release. Film coatings also tend to produce thinner coating layers which offer more polished looks while using less substance than alternative techniques.

Film coating's versatility enables pharmaceutical firms to customize textures, colors, and release profiles for each tablet they manufacture, making film coating a preferred solution for many pharmaceutical firms. Film-coated tablets dominate the market; various types such as sugar-coated tablets gelatin-coated tablets enteric-coated tablets play key roles in various applications and all provide aesthetic and therapeutic advantages for certain uses.

By End User Analysis

The Pharmaceutical Industry is the dominant end-user in the tablet coating market. Coating technology's widespread application in this industry is driven by the need for efficient drug delivery, increased patient compliance, and product differentiation. Tablet coatings play an invaluable role in increasing the visual stability, physical strength, and palatability of medicines; playing an essential part in the manufacturing process.

Nutraceuticals make up a large segment of the market, using coatings to increase both the value and effectiveness of supplements for daily dietary consumption. With more people becoming health conscious, demand for nutraceuticals coated with coatings continues to increase leading to further innovation and development within this industry.

Tablet Coating Industry Segments

By Polymer Type

- Cellulosic Polymers

- Vinyl Derivatives

- Acrylic Polymers

- Other Polymers

By Functionality

- Non-functional non-modifying coatings

- Functional modifying coatings

- Functional non-modifying coatings

By Type

- Film-coated tablets

- Sugar-coated tablets

- Enteric-coated tablets

- Gelatin-coated tablets

- Other tablet coatings

By End User

- Pharmaceutical Industry

- Nutraceutical Industry

Tablet Coating Market Growth Opportunity

Increasing Demand for Customized Coatings Spurs Growth in Tablet Coating Market

Custom tablet coatings represent substantial growth opportunities in the tablet coating market. Pharmaceutical and nutraceutical companies seeking to differentiate their products are creating increased demand for specific coatings with distinctive properties like controlled release, enhanced taste masking, and enhanced appearance - such as coatings with controlled release, enhanced taste masking, or controlled release properties.

Customized coatings allow manufacturers to meet specific therapeutic and consumer preferences more easily and generate greater market demand for new coating solutions. This trend toward personalized and more functional tablet coatings indicates rapid market expansion as companies adapt quickly enough to meet these shifting demands.

Increasing Adoption in Nutraceutical and Pharmaceutical Industries Fuels Tablet Coating Market

Pharmaceutical and nutraceutical industries have seen increased adoption of tablet coatings in recent years, which has contributed to market expansion for tablet coatings. Pharmaceutical coatings play a crucial role in protecting active ingredients while controlling drug release rates and improving patient compliance through taste enhancement and improved visuals.

Like its sister industry, nutraceuticals, coatings are increasingly being utilized to improve both the quality and appearance of nutritional supplements. With demand for nutraceuticals and pharmaceuticals skyrocketing comes an increase in cutting-edge coating technologies being utilized; presenting tablet coating companies with an enormous opportunity for growth due to this need for high-quality functional coatings for these sectors.

Tablet Coating Market Regional Analysis

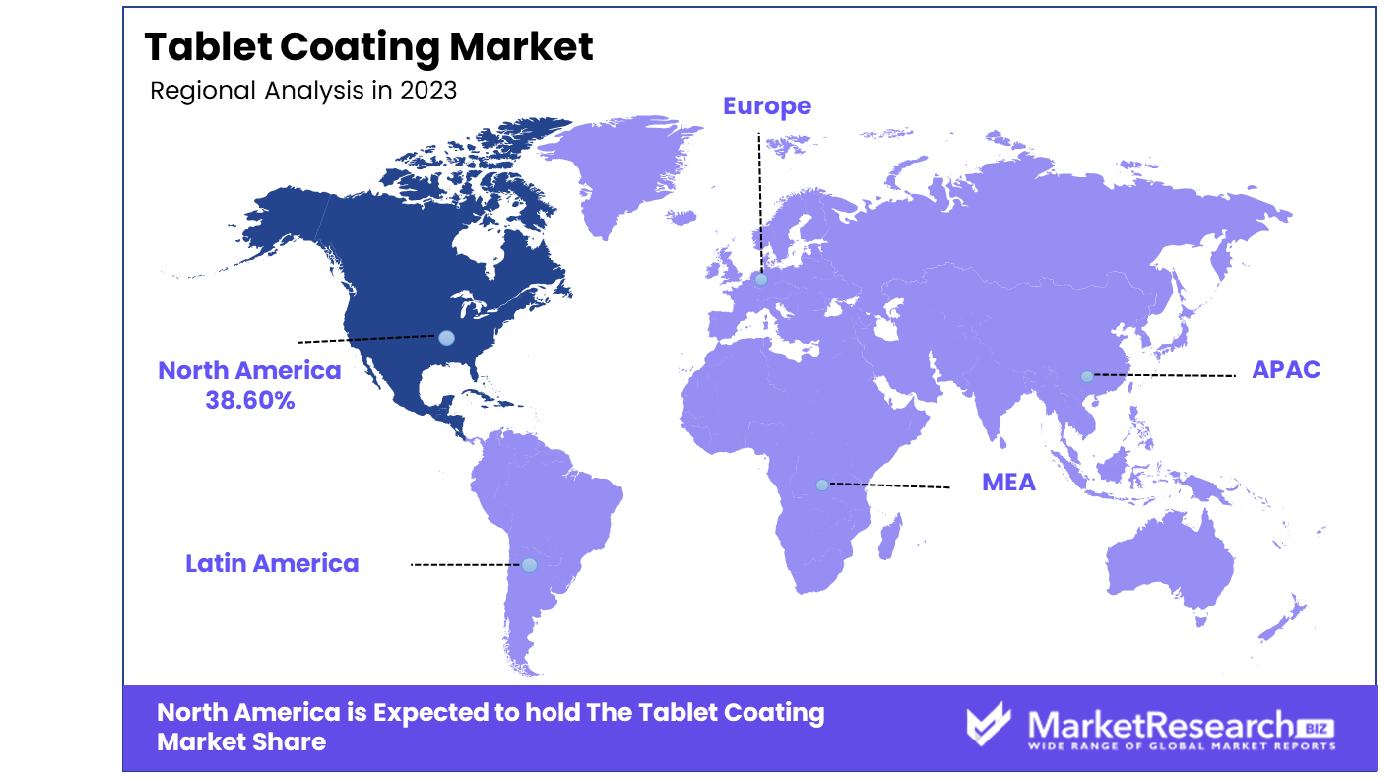

North America Dominates with 38.60% Market Share in Tablet Coating Market

North America holds an estimated 38.60% market share for tablet coatings, propelled primarily by its robust pharmaceutical industry and high demand for medicine. The United States stands out as a world leader when it comes to pharmaceutical innovation and investments; particularly those related to tablet coating technology. FDA regulations ensure the highest standards are upheld within pharmaceutical coating technology, necessitating constant technological innovations in tablet coating. Furthermore, chronic illnesses and an aging population help drive increased demand for coated tablets resulting in market expansion.

North American market conditions today are marked by an increasing need for visually appealing and user-friendly dosage forms, functional coatings that control release time, mask flavoring, and enhanced stability are in high demand. R&D activities have produced new coatings, materials, and techniques while the presence of large pharmaceutical companies as well as rising spending on healthcare are also contributing factors to North America's current dominance.

Europe: High-Quality Standards and Technological Advancements

Europe's tablet coating market is driven by high standards and technological advancements, including top pharmaceutical companies as well as EU regulations that guarantee top-quality coating production on tablets. Furthermore, research and development efforts as well as rising demands for innovative coating solutions contribute to this region's rapid expansion.

Asia-Pacific: Rapid Growth and Increasing Pharmaceutical Production

Asia-Pacific region tablet coating market is growing quickly due to the expanding pharmaceutical industry and increasing healthcare needs. China and India have emerged as global centers of pharmaceutical production, driving tablet coating technologies forward. Cost-effective production capabilities combined with investments in healthcare infrastructure present ample opportunity for market expansion in this region.

Tablet Coating Industry By Region

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of Asia Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of Middle East & Africa

Tablet Coating Market Share Analysis

In the Tablet Coating Market, a crucial sector for pharmaceutical manufacturing, the companies listed are instrumental in driving technological advancements and market growth. Eastman and DuPont de Nemours, Inc. are industry leaders known for their high-quality coating materials, setting standards in functionality and safety, crucial for pharmaceutical product applications.

Ashland Global Holdings, Inc. and Evonik Industries AG are significant for their innovative coating solutions that enhance tablet efficacy and patient compliance, reflecting the industry's focus on improving drug delivery and performance. Colorcon, Inc. is a key player in providing a wide range of coating products, known for its commitment to quality and innovation, influencing market key trends towards more versatile and efficient coating solutions.

Aquadry Pharma Pvt. Ltd., Coatings Place, Inc., and Ideal Cures Pvt. Ltd., though smaller in scale, provide specialized coating services and products, demonstrating the market's adaptability to cater to diverse pharmaceutical needs. L'Air Liquide S.A. and Biogrund GmbH contribute to the market with their niche technologies and services, enhancing the sector's focus on precision and customization.

Tablet Coating Industry Key Players

- Eastman Chemical Company

- Ashland Global Holdings, Inc.

- Aquadry Pharma Pvt. Ltd.

- Coatings Place, Inc.

- Evonik industries ag

- ideal cures pvt. ltd.

- L'Air Liquide S.A.

- biogrund gmbh

- DuPont de NemoursInc.

- Colorcon, Inc.

- Aries Exim Pvt. Ltd.

- Kerry Group Plc

- Croda International PLC

- Sensient Technologies Corporation

Tablet Coating Market Recent Development

- In November 2023, ACG Engineering, a division of ACG, launched the SMARTCOATER X•ONE series, which is the company's fastest tablet coater to date. This coater is designed for high-speed tablet coating with an emphasis on process speed, efficiency, and operator ease. It features an advanced baffle design for quick processing times, an optimized drying airflow pattern, a fully perforated coating drum, closed dust-free charging, integrated discharge baffles, an active purging temperature sensor, a high-performing spray-arm, and a 2.0 spray nozzle with an anti-bearding cap.

- In September 2023, Colorcon, a company specializing in film coating systems, specialty excipients, and functional packaging for the healthcare industry, announced the launch of a new Opadry film coating system. This new system is designed to address the moisture management needs for pharmaceutical tablets without the use of titanium dioxide (TiO2).

- In 2023, Romaco introduced its Tecpharm TPR 25 tablet coater at PACK EXPO Las Vegas. This system features a sonar system and a patented spray arm for automatic adjustments. It is available in pilot scale through 600kg, making it suitable for a wide range of applications in the pharmaceutical and nutraceutical industries.

- In February 2022, JRS PHARMA introduced VIVACOAT-free, an easy-to-use titanium dioxide-free coating solution, suitable for nutraceuticals and pharmaceutical formulations.

Report Scope

Report Features Description Market Value (2023) USD 909.4 Million Forecast Revenue (2033) USD 1,743.0 Million CAGR (2024-2032) 6.9% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Polymer Type(Cellulosic Polymers, Vinyl Derivatives, Acrylic Polymers, Other Polymers), By Functionality(Non-functional non-modifying coatings, Functional modifying coatings, Functional non-modifying coatings), By Type(Film-coated tablets, Sugar-coated tablets, Enteric-coated tablets, Gelatin-coated tablets, Other tablet coatings), By End User(Pharmaceutical Industry, Nutraceutical Industry) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Eastman Chemical Company, Ashland Global Holdings, Inc., Aquadry Pharma Pvt. Ltd., Coatings Place, Inc., Evonik industries ag , Ideal Cures Pvt. ltd., L'Air Liquide S.A., biogrund gmbh , DuPont de Nemours Inc., Colorcon, Inc., Aries Exim Pvt. Ltd., Kerry Group Plc, Croda International PLC, Sensient Technologies Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Eastman Chemical Company

- Ashland Global Holdings, Inc.

- Aquadry Pharma Pvt. Ltd.

- Coatings Place, Inc.

- Evonik industries ag

- ideal cures pvt. ltd.

- L'Air Liquide S.A.

- biogrund gmbh

- DuPont de NemoursInc.

- Colorcon, Inc.

- Aries Exim Pvt. Ltd.

- Kerry Group Plc

- Croda International PLC

- Sensient Technologies Corporation