Online Travel Booking Market By Service Type (Transportation Booking, Accommodation Booking, Vacation Packages, Others), By Booking Method (Online Booking, Direct Travel Agency), By Device (Desktop, Mobile), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

-

48746

-

July 2024

-

136

-

-

This report was compiled by Vishwa Gaul Vishwa is an experienced market research and consulting professional with over 8 years of expertise in the ICT industry, contributing to over 700 reports across telecommunications, software, hardware, and digital solutions. Correspondence Team Lead- ICT Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

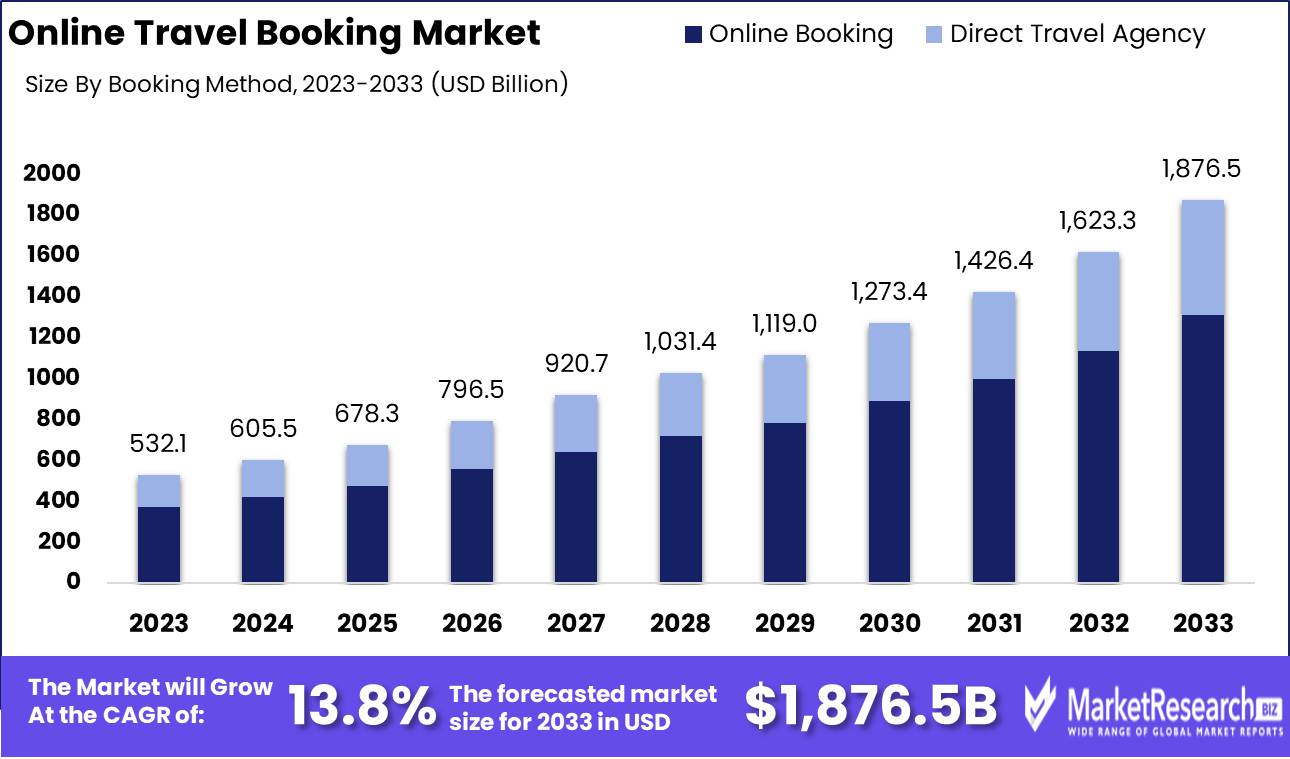

The Global Online Travel Booking Market was valued at USD 532.1 Bn in 2023. It is expected to reach USD 1876.5 Bn by 2033, with a CAGR of 13.8% during the forecast period from 2024 to 2033.

The Online Travel Booking Market encompasses digital platforms and services that facilitate the reservation of travel-related activities, including flights, hotels, car rentals, and vacation packages. This market is driven by the growing preference for convenience, price comparison, and customization offered by online booking tools. Key players include travel agencies, meta-search engines, and direct service providers. Technological advancements, such as AI-driven recommendations and mobile applications, are enhancing user experience and accessibility. As global travel demand rebounds and digital adoption increases, the Online Travel Booking Market is poised for significant growth, transforming how consumers plan and book their travel experiences.

The Online Travel Booking Market is witnessing substantial growth, driven by the increasing preference for digital platforms that offer convenience, price transparency, and customization. As of December 2022, Booking.com led the market with a capitalization of $78.17 billion, significantly outpacing its closest competitor, Airbnb, which had a market capitalization of $54.137 billion. This dominance reflects the competitive landscape and the significant investments made in enhancing user experience through technology.

The Online Travel Booking Market is witnessing substantial growth, driven by the increasing preference for digital platforms that offer convenience, price transparency, and customization. As of December 2022, Booking.com led the market with a capitalization of $78.17 billion, significantly outpacing its closest competitor, Airbnb, which had a market capitalization of $54.137 billion. This dominance reflects the competitive landscape and the significant investments made in enhancing user experience through technology.The shift towards online booking is underscored by recent data from 2023, indicating that 72% of global travelers preferred to book their trips online, compared to just 12% who opted for traditional travel agencies. This trend highlights the critical role of digital transformation in the travel industry, as consumers increasingly value the ease and efficiency of online booking tools. The proliferation of smartphones and the expansion of internet accessibility have further catalyzed this shift, making travel planning more accessible to a broader audience.

Technological advancements, such as AI-driven personalized recommendations and mobile application enhancements, are continually improving the booking process, providing travelers with tailored options and seamless experiences. Additionally, the integration of customer reviews, virtual tours, and dynamic pricing models is enriching the decision-making process, enabling informed and flexible travel arrangements.

Key Takeaways

- Market Value: The Global Online Travel Booking Market was valued at USD 532.1 Bn in 2023. It is expected to reach USD 1876.5 Bn by 2033, with a CAGR of 13.8% during the forecast period from 2024 to 2033.

- By Service Type: By Service Type, accommodation booking comprises 40% of the Online Travel Booking Market.

- By Booking Method: By Booking Method, online booking commands a substantial 70% share of the Online Travel Booking Market.

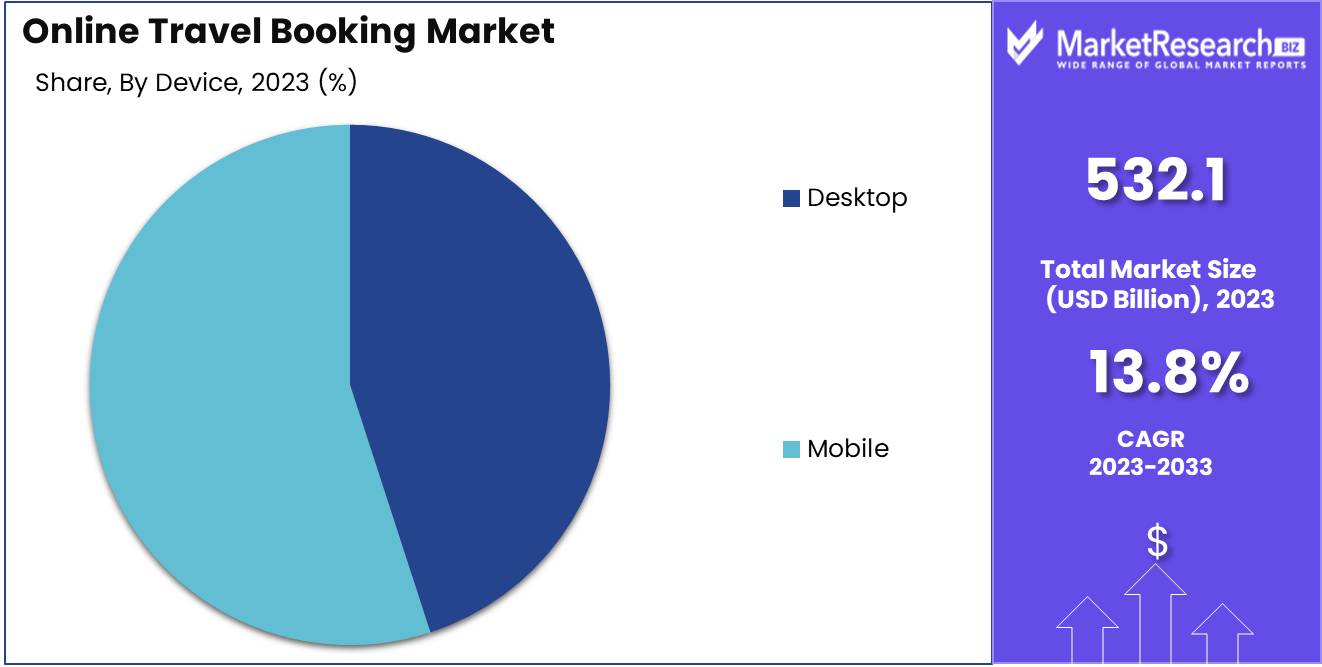

- By Device: By Device, mobile devices account for 55% of the Online Travel Booking Market.

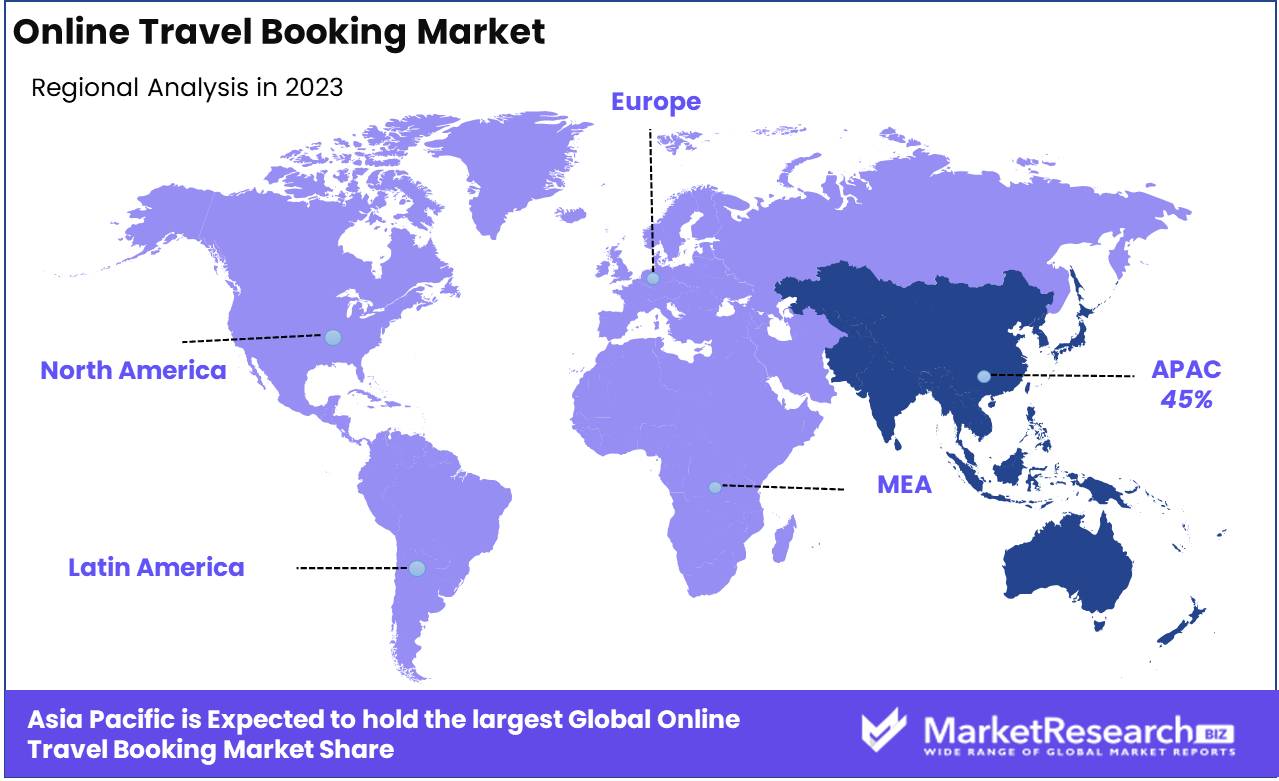

- Regional Dominance: Asia Pacific dominates the Online Travel Booking Market with about 45% of the global share.

- Growth Opportunity: The rising adoption of mobile devices and the increasing popularity of personalized travel experiences drive growth opportunities in the Online Travel Booking Market.

Driving factors

Internet Penetration and Smartphone Usage Catalyze Market Growth

The rapid increase in internet penetration and smartphone's usage is a primary driver for the growth of the online travel booking market. As more people gain access to the internet, especially through mobile devices, the ability to book travel services online has become more convenient and accessible.

This widespread connectivity enables consumers to search for, compare, and book travel options at any time and from anywhere, significantly enhancing the user experience. The convenience offered by mobile device management has led to a substantial rise in online travel bookings, driving market growth.

Increasing Disposable Income Fuels Demand

The rise in disposable income across various regions has significantly contributed to the growth of the online travel booking market. As individuals' purchasing power increases, they are more likely to spend on travel and leisure activities. This trend is particularly evident in emerging economies where the middle class is expanding.

The World Bank reports a steady increase in global GDP per capita, reflecting higher disposable incomes. This financial capability allows more people to explore travel options, book vacations, and engage in tourism activities, thereby boosting the demand for online travel booking services. Higher disposable income also means consumers can afford premium travel options, enhancing the market's revenue potential.

Ease of Comparing Travel Options Online Enhances Market Appeal

The ease of comparing travel options online is another significant factor driving the growth of the online travel booking market. Online travel platforms provide users with comprehensive tools to compare prices, read reviews, and evaluate different travel packages and services. This transparency and accessibility empower consumers to make informed decisions, ensuring they get the best value for their money.

According to a survey by Expedia, 74% of travelers use online platforms to compare travel options before making a booking. This capability to easily compare and choose the best options increases consumer trust and satisfaction, encouraging more people to utilize online travel booking services.

Restraining Factors

Data Privacy and Payment Security Concerns Challenge

Data privacy and payment security concerns pose significant challenges to the growth of the online travel booking market. As consumers become increasingly aware of the risks associated with online transactions, their concerns about the safety of their personal and financial information can deter them from using online travel booking platforms. Incidents of data breaches and cyber-attacks have heightened these fears, leading to a demand for more robust security measures.

The Online Travel Booking Survey by Norton indicated that 41% of users hesitate to complete online travel transactions due to security concerns. To address these challenges, online travel companies must invest in advanced encryption technologies and secure payment gateways to build consumer trust and ensure the protection of sensitive information.

Manipulation of User Reviews Undermines Trust

The manipulation of user reviews is another critical issue impacting the online travel booking market. Consumers heavily rely on reviews and ratings to make informed decisions about travel services. However, the prevalence of fake or manipulated reviews can lead to mistrust and dissatisfaction.

A study by BrightLocal found that 79% of consumers have read a fake review in the past year, which can significantly influence their purchasing decisions. It is essential for online travel booking platforms to implement stringent measures to verify the authenticity of reviews, such as using AI algorithms to detect fraudulent activity and encouraging verified reviews from actual travelers.

By Service Type Analysis

By Service Type Accommodation booking held a dominant market position, capturing more than a 40% share.

In 2023, accommodation booking held a dominant market position in the by service type segment of the online travel booking market, capturing more than a 40% share. The substantial market share of accommodation booking can be attributed to the growing preference for online platforms to book hotels, vacation rentals, and other lodging options. The convenience of comparing prices, reading reviews, and accessing a wide range of accommodation choices has driven consumers to increasingly use online channels for their booking needs.

Transportation booking, which includes flights, trains, and car rentals, represents another significant segment of the online travel booking market. The increasing number of travelers opting for online platforms to book by transportation management system due to ease of access, real-time updates, and competitive pricing has contributed to the growth of this segment.

Vacation packages, which offer bundled deals combining flights, accommodations, and sometimes additional services such as tours and activities, also constitute an important segment. The appeal of convenience and cost savings drives the demand for vacation packages, especially among families and group travelers.

The "others" category, which includes services such as travel insurance, destination-specific activities, and travel concierge services, makes up the remaining portion of the market. This segment, while smaller, is growing as consumers look for comprehensive travel solutions that cover all aspects of their trips.

By Booking Method Analysis

By Booking Method Online booking held a dominant market position, capturing more than a 70% share.

In 2023, online booking held a dominant market position in the by booking method segment of the online travel booking market, capturing more than a 70% share. The substantial market share of online booking can be attributed to the increasing penetration of internet services, the widespread use of smartphones, and the growing preference for the convenience and flexibility offered by online platforms. Consumers are increasingly turning to online booking methods to access a wide range of travel options, compare prices, read reviews, and make reservations at their convenience, all of which contribute to the significant growth of this segment.

Direct travel agency bookings, while representing a smaller portion of the market, still play an essential role, particularly among travelers who prefer personalized service and expert advice. Traditional travel agencies cater to specific customer needs, such as complex itineraries, luxury travel, and special travel packages.

By Device Analysis

By Device Mobile devices held a dominant market position, capturing more than a 55% share.

In 2023, mobile held a dominant market position in the by device segment of the online travel booking market, capturing more than a 55% share. The significant market share of mobile devices can be attributed to the widespread use of smartphones, the convenience of booking travel on-the-go, and the increasing availability of user-friendly travel apps. The enhanced functionalities of mobile apps, including real-time updates, seamless payment options, and personalized recommendations, have contributed to the growing preference for mobile bookings among consumers.

Desktop bookings, while holding a smaller market share compared to mobile, continue to be an important segment of the online travel booking market. Desktops are often preferred for more complex travel arrangements, where users may require larger screens to compare multiple options and access detailed information.

Key Market Segments

By Service Type

- Transportation Booking

- Accommodation Booking

- Vacation Packages

- Others

By Booking Method

- Online Booking

- Direct Travel Agency

By Device

- Desktop

- Mobile

Growth Opportunity

Untapped Markets with Tourism Potential

The global online travel booking market is poised for substantial growth in 2024, driven by the expansion into untapped markets with significant tourism potential. Regions such as Southeast Asia, Africa, and parts of Latin America are emerging as attractive travel destinations, boasting rich cultural heritage, natural beauty, and increasing infrastructural development. As these regions gain popularity among international tourists, there is a significant opportunity for online travel booking platforms to capture new customer bases.

By focusing on these untapped markets, travel booking services can cater to a growing demand for convenient and accessible travel options. The United Nations World Tourism Organization (UNWTO) projects that Africa and Asia-Pacific will see above-average growth in international tourist arrivals, underscoring the market potential in these regions.

AI and Machine Learning for Personalized Recommendations

The integration of AI and machine learning technologies offers a pivotal growth opportunity for the online travel booking market in 2024. These technologies can analyze vast amounts of user data to provide personalized travel recommendations, enhancing the user experience and increasing customer satisfaction. By leveraging AI, online travel platforms can offer tailored travel itineraries, accommodation suggestions, and activity options based on individual preferences and past behaviors.

This personalized approach not only improves the booking process but also drives customer loyalty and repeat business. According to a report by McKinsey, personalization can boost sales by 10-15%, highlighting the significant revenue potential for platforms that effectively implement AI-driven recommendations.

Latest Trends

Mobile-First Booking Platforms

A significant trend in the online travel booking market for 2024 is the shift towards mobile-first booking platforms. With the increasing penetration of smartphones and the convenience they offer, more consumers are turning to mobile devices for their travel planning and booking needs. Mobile-first platforms are designed to provide a seamless, user-friendly experience optimized for smaller screens, ensuring that travelers can easily search for flights, accommodations, and activities on the go.

This trend emphasizes the importance for travel booking platforms to invest in mobile app development and responsive web designs to capture the growing segment of mobile users.

Use of VR for Virtual Tours

The use of Virtual Reality (VR) for virtual tours is another emerging trend that is set to transform the online travel booking market in 2024. VR technology allows potential travelers to explore destinations, hotels, and attractions virtually before making a booking decision. This immersive experience provides a more realistic preview of what to expect, helping travelers make informed choices and increasing their confidence in their travel plans.

A survey by Travelzoo found that 81% of respondents would be more likely to book a vacation if they could experience it virtually first. The integration of VR in online travel booking platforms not only enhances the user experience but also serves as a powerful marketing tool to showcase destinations and services.

Regional Analysis

The Asia Pacific region dominates the Online Travel Booking Market, capturing 45% of the global market share. This dominance is attributed to rapid growth in internet penetration and the increasing adoption of smartphones across countries like China, India, and Japan. The rising middle-class population with growing disposable incomes drives the demand for online travel services. The booming tourism industry, coupled with advancements in digital payment systems and aggressive marketing by major online travel agencies (OTAs), further fuels market growth.

North America holds a substantial share in the Online Travel Booking Market, driven by high internet penetration and widespread use of digital platforms. The United States and Canada are key contributors, with established travel industries and a strong presence of major OTAs. The market benefits from the convenience and variety of online booking options, high consumer expectations for personalized travel experiences, and the growing trend of bleisure (business and leisure) travel.

Europe represents a significant portion of the Online Travel Booking Market, supported by advanced digital infrastructure and high adoption of online services. Leading markets like the UK, Germany, and France benefit from robust tourism sectors and high internet penetration rates. The demand for customized travel packages and the surge in mobile travel bookings drive market growth, along with the expansion of low-cost airlines and budget travel options.

The Middle East & Africa region is gradually expanding its footprint in the Online Travel Booking Market, driven by the growing tourism industry and increasing internet accessibility. Key markets include the UAE, Saudi Arabia, and South Africa, where rising demand for online travel services is supported by efforts to develop tourism infrastructure and promote the region as a travel destination.

Latin America is experiencing steady growth in the Online Travel Booking Market, fueled by increasing internet penetration and a rising number of tech-savvy travelers. Major markets such as Brazil, Mexico, and Argentina benefit from growing tourism industries and improving digital infrastructure.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The global Online Travel Booking Market in 2024 is set for dynamic growth, driven by increasing digitalization, rising disposable incomes, and the growing preference for online travel services. Key players in this market are expected to capitalize on these trends through technological innovation, strategic partnerships, and expansive service offerings.

Yatra and MakeMyTrip are anticipated to maintain strong positions in the market, particularly in India and other emerging economies. Their comprehensive platforms offering flight, hotel, and holiday bookings, coupled with aggressive marketing strategies, will continue to attract a large customer base. MakeMyTrip's mergers and acquisitions strategy will further strengthen its market dominance.

Priceline Group Inc. and Booking Holdings are expected to leverage their extensive global reach and advanced technological platforms to capture significant market share. Their focus on offering a wide range of travel services and enhancing customer experience through AI and machine learning will drive growth. Booking Holdings' extensive portfolio, including brands like Booking.com and Agoda, provides a competitive edge.

Ctrip.Com International Ltd. (now known as Trip.com Group) will continue to dominate the Asian market, particularly China, through its comprehensive travel services and strong local partnerships. Its investment in technology and focus on expanding international offerings will support its global expansion efforts.

Webjet and Trivago are likely to benefit from their specialized offerings in online travel booking and price comparison services. Trivago’s strong brand presence and user-friendly interface will continue to attract budget-conscious travelers seeking the best deals.

Thomas Cook Group Plc., despite facing financial challenges in recent years, is expected to leverage its legacy and brand recognition to regain market share through strategic partnerships and digital transformation.

Amadeus and Edreams Odigeo are poised for growth due to their robust technological platforms and wide-ranging travel services. Amadeus’s focus on providing innovative solutions for travel agencies and airlines will enhance its market position.

Trip.com and MakeMyTrip Limited will continue to expand their footprints through strategic partnerships and acquisitions, offering diversified travel services to a global audience.

Hotel Urbano Travel and Tourism SA and Despegar are expected to strengthen their positions in the Latin American market, benefiting from the growing middle class and increasing internet penetration in the region.

Market Key Players

- Yatra

- MakeMyTrip

- Priceline Group Inc.

- Webjet

- Booking Holdings

- Ctrip.Com International Ltd.

- Thomas Cook Group Plc.

- Amadius

- Trip.com

- MakeMyTrip Limited

- Edreams Odigeo

- Hotel Urbano Travel and Tourism SA

- Despegar

- Trivago

Recent Development

- April 2024: Booking.com enhanced its platform by integrating AI-driven personalized travel recommendations, aiming to streamline user experiences and boost satisfaction.

- March 2024: Expedia Group announced a partnership with Airbnb to expand lodging options and increase competitive offerings in the online travel booking market.

Report Scope

Report Features Description Market Value (2023) USD 532.1 Bn Forecast Revenue (2033) USD 1876.5 Bn CAGR (2024-2033) 13.8% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Service Type (Transportation Booking, Accommodation Booking, Vacation Packages, Others), By Booking Method (Online Booking, Direct Travel Agency), By Device (Desktop, Mobile) Regional Analysis North America - The US, Canada, & Mexico; Western Europe - Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe - Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC - China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America - Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa - Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Yatra, MakeMyTrip, Priceline Group Inc., Webjet, Booking Holdings, Ctrip.Com International Ltd., Thomas Cook Group Plc., Amadius, Trip.com, MakeMyTrip Limited, Edreams Odigeo, Hotel Urbano Travel and Tourism SA, Despegar, Trivago Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Yatra

- MakeMyTrip

- Priceline Group Inc.

- Webjet

- Booking Holdings

- Ctrip.Com International Ltd.

- Thomas Cook Group Plc.

- Amadius

- Trip.com

- MakeMyTrip Limited

- Edreams Odigeo

- Hotel Urbano Travel and Tourism SA

- Despegar

- Trivago