Mobile Device Management Market Organization Analysis (Small and Medium-sized Enterprises, Large enterprises), Vertical Analysis (BFSI, Healthcare, IT & Telecom, Retail, Others), Deployment Model Analysis (Cloud, On-premise), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2023-2032

-

25930

-

March 2023

-

184

-

-

This report was compiled by Vishwa Gaul Vishwa is an experienced market research and consulting professional with over 8 years of expertise in the ICT industry, contributing to over 700 reports across telecommunications, software, hardware, and digital solutions. Correspondence Team Lead- ICT Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

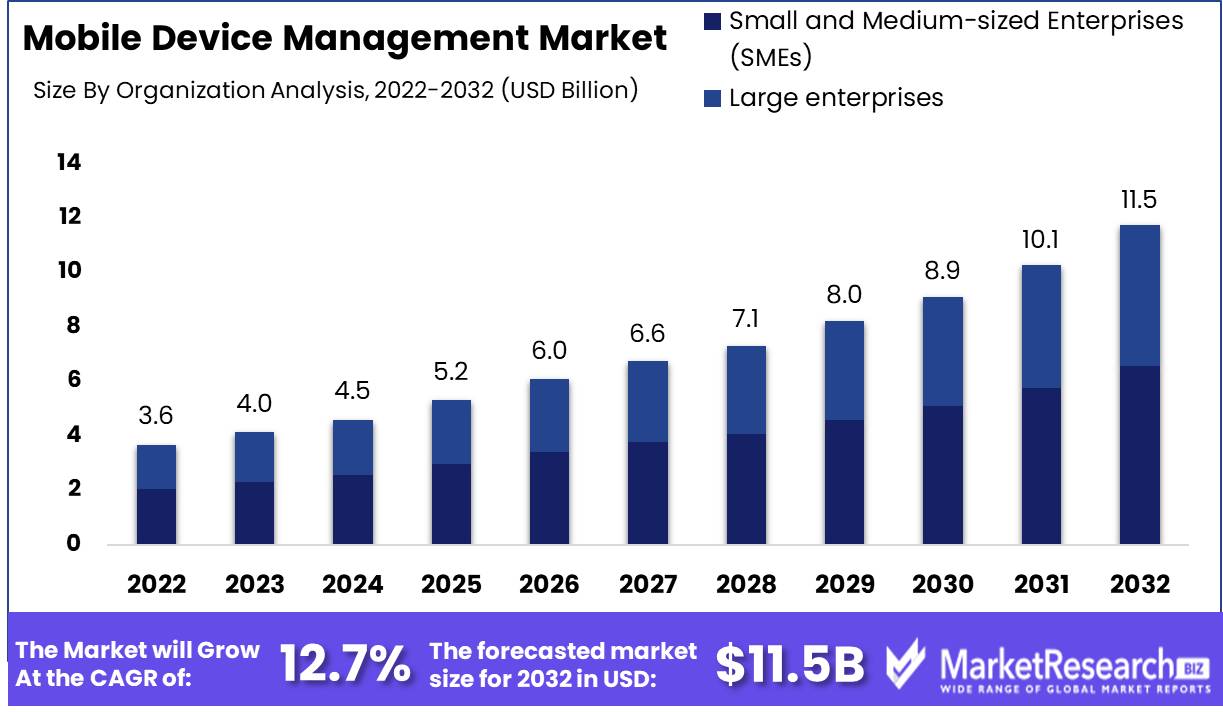

The Mobile Device Management Market size is expected to be worth around USD 11.5 Bn by 2032 from USD 3.6 Bn in 2022, growing at a CAGR of 12.7% during the forecast period from 2023 to 2032.

The mobile device management market (MDM), a multifaceted and dynamic software solution, plays a crucial role in enabling organizations to effectively manage and secure their diverse array of mobile devices, including smartphones, tablets, and laptops. MDM's primary objective is to secure corporate data and applications while simultaneously allowing employees to use their mobile devices for professional purposes without jeopardizing the integrity of corporate security.

The ever-evolving mobile device management market is perennially flooded with new innovations, with novel solutions and capabilities being introduced on an annual basis. The integration of artificial intelligence (AI) and machine learning (ML) paradigms is a significant development within the MDM domain, as it enables MDM systems to proactively examine mobile devices and quickly identify real-time security hazards.

Significant interest has been shown by venture capitalists and technology titans in the expanding mobile device management market. This is exemplified by Google's recent acquisition of CloudSimple, an enterprise-focused company that specializes in delivering secure MDM solutions for cloud-based workloads. Likewise, Blackberry has emerged as a formidable competitor in the MDM landscape, offering comprehensive security solutions that cover the entire spectrum of smartphones and other mobile devices.

The meteoric growth trajectory of the mobile device management market is primarily attributable to the increasing adoption of mobile devices in a variety of workplace settings. Numerous industries, including healthcare, financial services, and retail, have acknowledged unequivocally the inherent benefits of utilizing mobile devices for professional duties, resulting in significant investments in MDM solutions.

The healthcare industry is surprisingly one of the most avid investors in mobile device management solutions. Hospitals and healthcare providers have seamlessly integrated mobile devices into their operational frameworks, utilizing them to effectively monitor patient data, manage appointments, and facilitate patient communication. Furthermore, a broad spectrum of industries, including finance, government, and manufacturing, have invested heavily in MDM solutions, demonstrating the far-reaching impact and applicability of this innovative technology.

However, amidst the ever-increasing prevalence of mobile devices in professional domains, ethical concerns regarding employee privacy and data collection have risen to the forefront. It is of the utmost importance for organizations to vigorously emphasize transparency, explainability, and accountability in their MDM practices, nurturing an environment in which employees can confidently use their mobile devices while their privacy is meticulously protected.

The mobile device management applications within the business landscape are multifaceted and extensive. MDM solutions serve as formidable defenders of confidential financial data in the finance industry, constituting a crucial pillar for regulatory compliance. Similarly, MDM solutions are an indispensable component of patient data management in the healthcare industry, ensuring compliance with stringent regulations such as HIPAA that protect patient privacy and data security.

Driving factors

Adoption Spurs Mobile Device Management Market Demand

Bring-your-own-device (BYOD) policies are becoming more widely adopted by organizations, which is a significant factor. As more employees use their personal devices for work, companies are seeking solutions that can manage and secure these devices while also complying with data security regulations such as the GDPR and HIPAA.

Mobile Technology Accelerates Mobile Device Management

Mobile technology's rapid evolution also contributes to the growth of the mobile device management market. Companies need solutions that can keep up with these developments as 5G, periphery computing, and AI becomes more prevalent. In addition, the COVID-19 pandemic has increased the demand for remote work solutions, thereby accelerating the need for mobile device management solutions.

Mobile Apps Boost Mobile Device Management Market

Another factor contributing to the growth of the mobile device management market is the increasing prominence of mobile-based applications and services in various industries. Businesses are utilizing mobile devices and applications to streamline their operations, improve consumer experience by offering in-app services, and boost employee productivity.

5G Transforms Device Administration

Regarding emerging technologies, the introduction of 5G will radically alter the mobile device landscape. 5G may allow for more advanced mobile devices and accelerate the shift toward mobile-only workplaces. In terms of regulation, there is an ongoing discussion regarding the potential regulation of mobile devices, which could have a future impact on the mobile device management market.

New Competitors Disrupt the Mobile Device Management Market

In terms of potential disruptors, we may observe new market entrants offering innovative solutions or MDM vendors forming strategic alliances with other technology providers to expand their capabilities. In addition, the growing awareness of the benefits of mobile device management solutions may increase market competition.

Restraining Factors

Cost Constraints Hinder Mobile Device Management Market Growth

In recent years, the mobile device management (MDM) market has expanded significantly due to the increased adoption of smartphones and tablets by businesses. Nonetheless, there are a number of factors inhibiting the growth of this market, particularly for small and medium-sized enterprises (SMEs).

Closing the Knowledge Gap for Mobile Device Management

The high cost of MDM solutions, particularly for SMBs, is one of the major factors impeding the growth of the MDM market. The majority of MDM solutions on the market are designed for large enterprises with larger budgets that can afford to invest in costly MDM solutions. SMEs, however, cannot afford to spend large amounts on MDM solutions due to financial constraints.

Resistance of Employees to Mobile Device Management

Regarding mobile device management policies and solutions, many organizations lack knowledge and technical expertise. They are unaware of the various MDM solutions available on the market, their features, and their business benefits. In addition, they lack the necessary technical expertise to implement and administer MDM policies and solutions.

Complexity Management in MDM Solutions

Employee resistance to employing MDM policies and solutions is possible. They feel that these policies and solutions can be intrusive and restrict their ability to use personal devices for work-related purposes. In addition, they may feel that MDM policies and solutions compromise their privacy and security.

Ensuring MDM Interoperability

MDM solutions can be complicated, particularly for large organizations. They must manage a large number of devices, which can be challenging. In addition, MDM solutions must be compatible with a diverse array of devices, operating systems, and applications. This can make ensuring seamless integration and interoperability challenging.

Mobile Device Management is Difficult with Legacy Systems

MDM solutions must be compatible with legacy applications and systems. This can be challenging, as legacy systems and applications may not be designed to function well with modern MDM solutions. This may result in compatibility and integration problems.

Organization Analysis

small and medium-sized enterprises (SMEs) segment, dominate the mobile device management (MDM) market. SMEs drive global employment and GDP growth. The demand for MDM solutions has increased due to the increasing adoption of mobile devices in the workplace. The SMEs segment is expected to dominate the MDM market in the future years.

Emerging economies' economic growth has played a key impact in driving MDM market segment adoption. The need for solutions that effectively manage and secure employee mobile devices is growing due to the increasing number of small and medium-sized businesses in these economies. MDM solutions adoption has improved production, cost, and security for these businesses.

Consumer behavior toward the small and medium-sized enterprises (SMEs) segment, a segment of the MDM market has also contributed to its dominance. With the increasing trend of remote work and Bring Your Own Device (BYOD), firms are outsourcing IT services, including mobile device management. The SMEs segment offers cost-effective solutions to manage employee devices regardless of location.

Vertical Analysis

The healthcare segment dominates the market, accounting for a large part. The healthcare business has transformed with the increasing usage of mobile devices like smartphones and tablets. Mobile devices are used for patient care, data collection, and communication, increasing demand for MDM solutions in healthcare.

Emerging economies' economic growth has played a key influence in driving MDM market adoption. The requirement for secure mobile device management solutions has increased as the healthcare industry continues to grow in these economies. The adoption of MDM solutions has helped healthcare providers improve patient care and data security.

Consumer habits and behavior toward the healthcare segment of the MDM market have also contributed to its dominance. MDM solutions are widely used by healthcare professionals to manage and secure mobile devices used for patient care and data collecting.

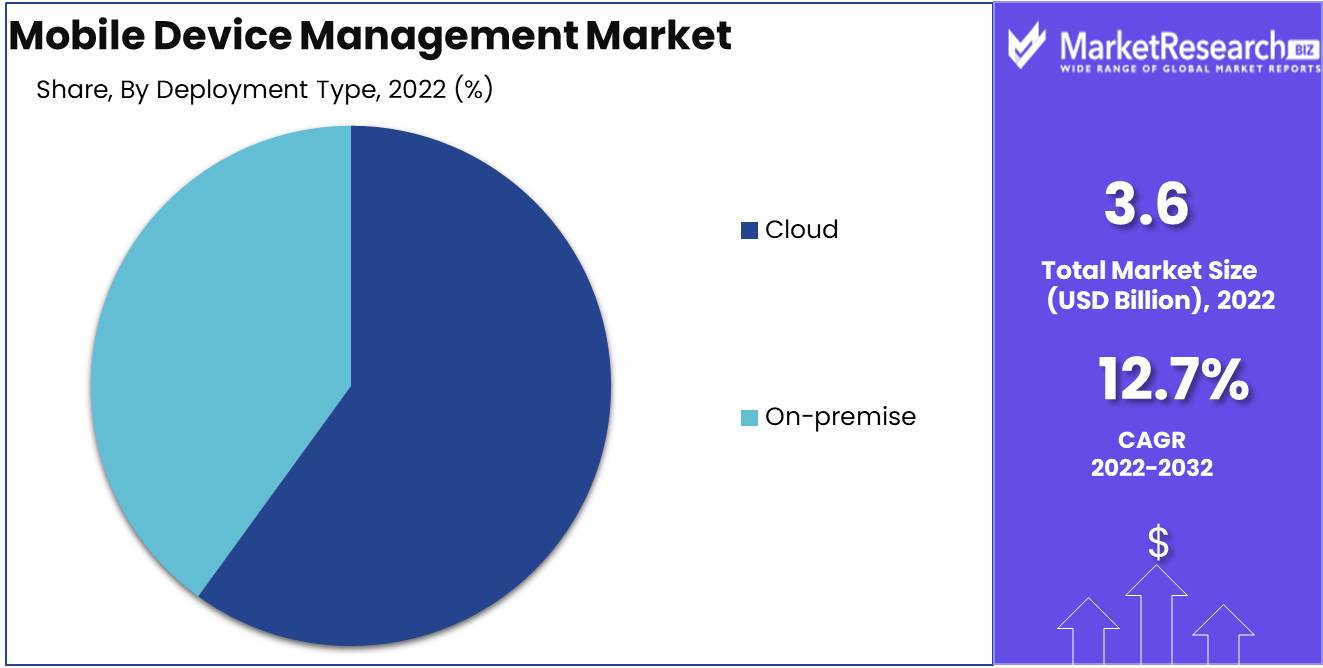

Deployment Model Analysis

MDM is mostly cloud-based. Due to the advantages, it offers, including flexibility, scalability, and cost-effectiveness, the adoption of cloud-based MDM solutions has increased in recent years. Cloud-based solutions are suitable for geographically distributed businesses since they can be accessed anytime, anywhere.

Emerging economies' economic growth has played a key influence in driving MDM cloud market adoption. As businesses in these economies grow, the requirement for mobile device management solutions has increased. Cloud-based solutions manage staff mobile devices cost-effectively and scalablely.

Consumer behaviors and behavior toward the cloud segment of the MDM market have contributed to its domination. Businesses are increasingly using cloud-based solutions to manage their mobile devices due to the growing trend of remote work and the requirement for mobile device management.

Key Market Segments

Organization Analysis

- Small and Medium-sized Enterprises (SMEs)

- Large enterprises

Vertical Analysis

- BFSI

- Healthcare

- IT & Telecom

- Retail

- Education

- Transportation & Logistics

- Manufacturing

- Government

- Others

Deployment Model Analysis

- Cloud

- On-premise

Growth Opportunity

Cloud and IoT Drive Mobile Device Management Market

Opportunity drives mobile device management market growth. Rising need for cloud-based mobile device management solutions, As IoT devices become more popular and require management, Mobile device management solutions for new industries, New mobile technologies, such as wearables and AR, and Emerging markets require mobile device management solutions.

Industries Grow Mobile Device Management Market

Smartphones and other mobile devices are increasingly used in personal and professional settings, driving growth in the mobile device management (MDM) market. The increased demand for cloud-based MDM solutions, the growing usage of Internet of Things (IoT) devices, and the requirement for effective management of these devices, which is becoming more difficult as they become more numerous and varied, have contributed to this growth.

Mobile Technologies Fuel MDM Market

Cloud-based mobile device management solutions are driving growth in the MDM market. These solutions have benefits over traditional, on-premise solutions, such as increased flexibility and scalability, lower costs, and improved security. Demand for cloud-based MDM is expected to rise as more enterprises shift away from on-premise solutions.

Cloud-based MDM Solutions Grow Market

Another MDM market growth factor is IoT device usage. There is a growing need for effective device management due to the proliferation of connected devices, from smart home gadgets to industrial sensors. MDM solutions can help firms protect, update, and operate IoT devices.

IoT Drives Mobile Device Management Market

As the MDM market expands, so do the industries that use these solutions. Retail, transportation, and industrial industries are adopting MDM alongside finance and healthcare. These industries recognize MDM solutions' benefits in productivity, security, and device management.

Emerging Markets Mobile Device Management

Wearables and AR are also growing the MDM market. There is a growing need for effective management solutions as these technologies become more popular in businesses. MDM can help enterprises protect, update, and operate these devices.

Latest Trends

Mobile Device Management Evolves

As technology advances at unprecedented rates, businesses worldwide have responded to the growing requirement for mobile devices to perform important activities. Mobile device management (MDM) is essential for managing and safeguarding enterprise mobile devices in the digital age. To be competitive, businesses must keep up with market trends like unified endpoint management (UEM) solutions, mobile application management (MAM), and mobile content management (MCM).

UEMT Revolution

UEM solutions are a major trend in mobile device management. UEM is a single console for managing all devices—phones, tablets, laptops, and desktops. Enterprise mobility management (EMM) and client management tools have converged to create UEM. UEM solutions feature a single source of truth for device data, policies, and analytics, which can boost operational efficiency and productivity while lowering the cost of managing and securing mobile devices in the enterprise.

MAM/MCM Security

MDM's biggest trends are mobile application management (MAM) and mobile content management (MCM). MAM focuses on managing and securing BYOD application data, while MCM focuses on securing critical business data and files on mobile devices. MAM and MCM allow employees to securely access business-critical data on their mobile devices while adhering to corporate data security regulations.

MDM/IAM Integration Improves Security

Another major MDM market trend is the integration of mobile device management with identity and access management (IAM) solutions. MDM and IAM integration improves mobile device management by allowing security teams to centrally authenticate people, devices, and remote access policies.

Zero-Trust Next-Level MDM Security

Zero-trust security frameworks are the next MDM trend in today's hyper-connected society. Zero trust security doesn't trust user identification or location. Instead, it believes every user, device, and entity must be authenticated and authorized before accessing resources. This security paradigm is crucial for businesses that handle sensitive data and need tight security, like financial institutions, healthcare providers, and government agencies.

AI/ML Change MDM

AI and ML are trends in mobile device management. AI and ML evaluate mobile device data to discover security issues. These technologies let MDM solutions predict user behavior, automate policy enforcement, and personalize user experiences while improving security and efficiency.

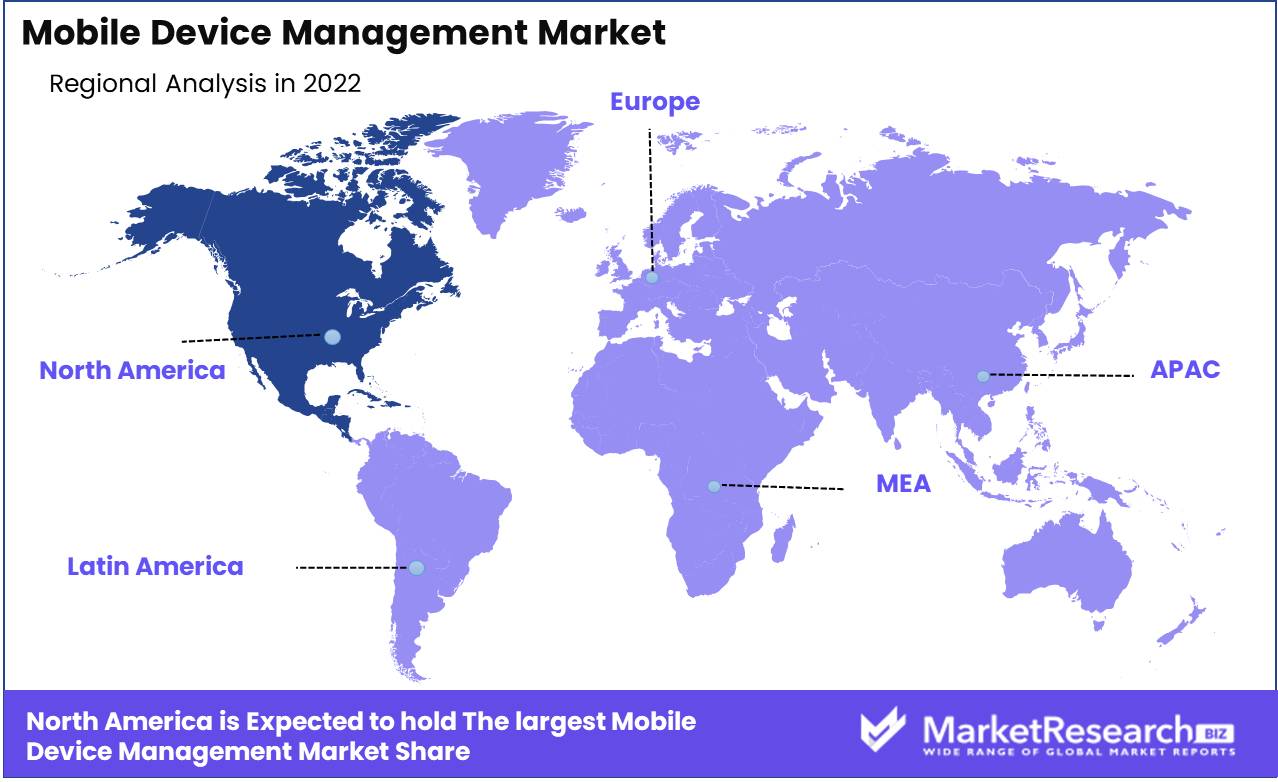

Regional Analysis

Mobile device management (MDM) is an indispensable element of contemporary corporate operations. As more employees use personal devices for work, companies must manage and secure these devices to safeguard sensitive data and maintain employee productivity. The North American MDM market is one of the world's largest and most developed, with a variety of software solutions available to suit the needs of businesses ranging from small startups to multinational corporations.

Companies must remain ahead of the curve to succeed in the intensely competitive North American business environment. Mobile device management is one area in which businesses can acquire a competitive edge. With so many employees using smartphones, tablets, and other devices for work, there has never been a greater need for effective MDM solutions.

MDM software enables companies to remotely administer and secure mobile devices through a centralized dashboard. This may include device monitoring, data encryption, app control, and other features. By implementing MDM software, companies can reduce the risk of data intrusions and provide employees with the tools they require to remain productive and efficient.

As the North American MDM market continues to evolve, software providers strive to remain ahead of the curve by developing innovative new features and enhancing existing ones. Among the most recent trends in MDM software development are:

AI-powered MDM solutions can automate routine duties like device enrollment and app deployment, allowing IT teams to focus on more strategic endeavors.

Edge computing, which refers to the processing of data on devices as opposed to in the cloud, can enhance data security and decrease latency.

Models of security with zero trust presume that all devices and users may be compromised, necessitating continuous verification and monitoring to ensure data security.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The market for mobile device management (MDM) is a growing industry with an increasing demand for effective and dependable solutions to manage mobile devices. Microsoft Corporation, IBM Corporation, VMware Inc., Cisco Systems Inc., BlackBerry Limited, Citrix Systems Inc., MobileIron Inc., and AirWatch LLC are among the key participants in this market.

Microsoft Corporation offers an MDM solution called Microsoft Intune that enables organizations to manage and secure mobile devices, data, and applications. IBM Corporation offers an MDM solution called MaaS360, which provides security and management features for mobile devices on all main platforms.

VMware Inc. offers a mobile device management solution called VMware Workspace ONE that enables organizations to manage and secure devices, applications, and content across all major platforms. Cisco Systems Inc. offers a mobile device management solution called Cisco Meraki that enables organizations to manage mobile devices and secure networks.

BlackBerry Limited offers an MDM solution called BlackBerry Enterprise Mobility Suite, which provides security, management, and productivity applications for mobile devices. Citrix Systems Inc. offers an MDM solution called Citrix Endpoint Management that enables organizations to manage mobile devices and secure mobile apps and data.

MobileIron Inc. offers a mobile device management solution called MobileIron Access that provides secure access to cloud services and mobile applications. AirWatch LLC is a leading provider of MDM solutions and offers a platform called Workspace ONE that offers unified endpoint management, identity management, and access control.

Top Key Players in Mobile Device Management Market

- IBM Corporation

- Citrix systems

- VMware

- AirWatch

- MobileIron

- NetPlus Amtel

- SAP

- Symantec Corporation

- BlackBerry Ltd.

- SOTI Inc.

- Sophos

- Microsoft Corporation

Recent Development

- In 2023, Privacy-focused Compliance Measures will be implemented. In 2023, MDM solutions have prioritized implementing stricter compliance measures in response to growing privacy concerns.

- In 2022, Integration of Unified Endpoint Management (UEM) MDM solutions started integrating with Unified Endpoint Management (UEM) platforms 2022 as the distinction between mobile and traditional endpoints grew.

- In 2021, MDM platforms will introduce remote work-specific features, such as secure VPN connectivity, virtual desktop integration, and seamless collaboration tools, allowing employees to work remotely while maintaining data security.

- In 2020, The concept of zero trust security MDM acquired prominence in the MDM landscape. Zero-trust security focuses on perpetually verifying the identity of users and devices, irrespective of their network location.

- In 2019, MDM solutions started incorporating AI and machine learning capabilities to improve device management.

Report Scope:

Report Features Description Market Value (2022) USD 3.6 Bn Forecast Revenue (2032) USD 11.5 Bn CAGR (2023-2032) 12.7% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered Organization Analysis (Small and Medium-sized Enterprises, Large enterprises), Vertical Analysis (BFSI, Healthcare, IT & Telecom, Retail, Education, Transportation & Logistics, Manufacturing, Government, Others), Deployment Model Analysis (Cloud, On-premise) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape IBM Corporation, Citrix systems, VMware, AirWatch, MobileIron, NetPlus Amtel, SAP, Symantec Corporation, BlackBerry Ltd., SOTI Inc., Sophos, Microsoft Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- IBM Corporation

- Citrix systems

- VMware

- AirWatch

- MobileIron

- NetPlus Amtel

- SAP

- Symantec Corporation

- BlackBerry Ltd.

- SOTI Inc.

- Sophos

- Microsoft Corporation