On Board Diagnostics (Obd) After Market By Components(Empennage, Wings, Fuselage, Nacelle & Pylon, Nose, Others), By Application(Fleet Management, Consumer Telematics, Car Sharing, Used-based Insurance), By Platform(Fixed-Wing Aircraft(Military, Commercial, General Aviation Aircraft, Business Jet), Rotary-Wing Aircraft(Military Helicopters, Commercial Helicopters, UAVs)), By End-User(OEM, Aftermarket), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

44280

-

April 2024

-

300

-

-

This report was compiled by Correspondence Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Report Overview

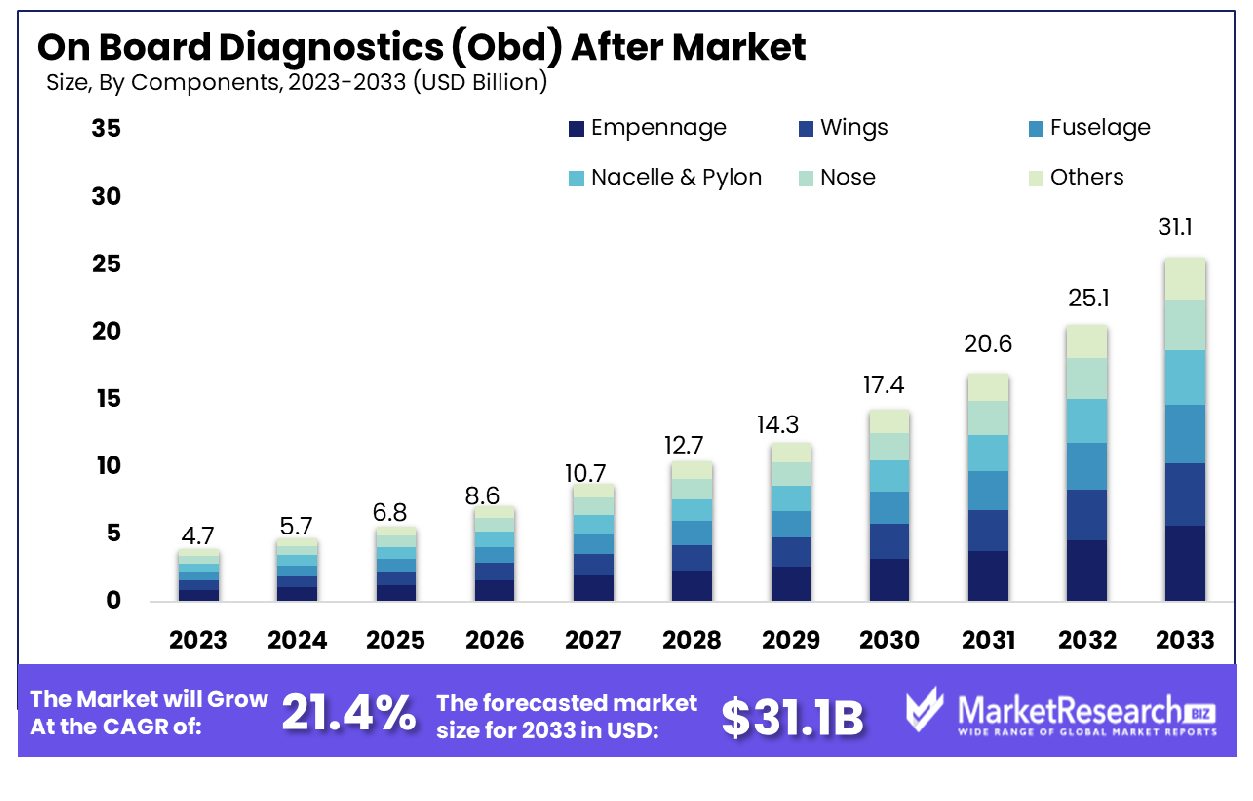

The On Board Diagnostics (Obd) After Market was valued at USD 4.7 billion in 2023. It is expected to reach USD 31.1 billion by 2033, with a CAGR of 21.4% during the forecast period from 2024 to 2033.

The surge in demand for modern vehicles and its diagnostics are key driving factors for the on-board diagnostic after market expansion. The on-board diagnostics are a special type of system that is executed in every vehicle engine component. It is an electronic system that helps keep the emission levels of engines in check by supervising the quality of the performance index of several engine elements. It also helps monitor the big fault in a component which can cause failure or damage the whole engine. It can also take data from different current sensors and regulate the fuel injectors to give better performances.

OBD which is also known as on-board diagnostics has several elements like sensors, actuators, and electronic control units. All these parts work in perfect synchronization to sense any type of failure in the system and supervise the emission levels on different components of the engine. The electronic control unit is the main part of the system. It gathers the information from different current sensors, for example, oxygen sensors, and examines the information. According to that examination, it regulates the actuators like the fuel injectors to provide better quality of performance.

The on-board diagnostics after-market has witnessed substantial growth in the last few decades. It comprises developing and distributing solutions that focus on enhancing and increasing the functionality of onboard diagnostic systems found in modern vehicles. Previously, such types of systems were executed by regulatory needs to control emissions and secure safety. But, they have now turned into refined on-board computer systems within contemporary vehicles. They have key responsibilities that comprise continuous supervision and recording of important information regarding automobile performance. It also comprises examining factors like engine health, fuel efficacy, emission standard levels, and other different parameters to secure better functioning.

Moreover, customers are now getting more attracted to personalized automobiles providing a major catalyst for the OBD aftermarket expansion. Many car owners are continuously searching for techniques to enhance their vehicle performance and whole driving encounters The OBD aftermarket solutions provide better revenue to get these aspirations by permitting customers to enhance their engine setting, supervise real-time information, and undertake advanced changes while ensuring compliance with regulatory measures. The demand for the OBD aftermarket will gradually increase due to its high requirement in the automobile industry which will help in market expansion during the forecasted period.

Key Takeaways

- Market Growth: The On Board Diagnostics (Obd) After Market was valued at USD 4.7 billion in 2023. It is expected to reach USD 31.1 billion by 2033, with a CAGR of 21.4% during the forecast period from 2024 to 2033.

- By Components: Empennage components are crucial for aircraft stability and control efficiency.

- By Application: Fleet management application enhances operational safety and reduces maintenance costs.

- By Platform: Fixed-wing aircraft platform dominates due to versatility and range capabilities.

- By End-User: OEM end-users significantly influence innovation in aircraft component manufacturing.

- Regional Dominance: North America holds a 46.4% share in the OBD aftermarket.

- Growth Opportunity: In 2023, the OBD aftermarket is set to grow, driven by stricter emission regulations and AI/ML advancements, enhancing emissions monitoring, predictive maintenance, and real-time diagnostics for regulatory compliance and customer value.

Driving factors

Expansion of the Automotive Sector

The burgeoning growth of the automotive industry is a pivotal driver for the expansion of the On-Board Diagnostics (OBD) aftermarket. As the global vehicle population escalates, with millions of new vehicles hitting the roads annually, the demand for aftermarket OBD products and services experiences a corresponding upsurge. This growth is propelled not just by the sheer volume of vehicles but also by the diversification of vehicle types, including electric and hybrid models, which require specialized diagnostic tools.

The OBD aftermarket thrives on this proliferation, offering a wide array of diagnostic, monitoring, and optimization tools tailored for an increasingly varied automotive landscape. Consequently, the aftermarket for OBD devices is witnessing significant growth, capitalizing on the expanding base of vehicles that necessitate regular diagnostics and maintenance.

Imperative for Emissions Control

Emissions control stands as a critical factor bolstering the OBD aftermarket. Initially conceived to monitor and report on a vehicle's emission output, OBD systems have become indispensable in the global drive toward environmental sustainability. By enabling early detection of malfunctions that could lead to increased emissions, OBD technologies play a crucial role in ensuring vehicles adhere to stringent emission standards.

This environmental imperative has not only mandated the integration of OBD systems in vehicles but has also fueled innovation and demand in the aftermarket. Manufacturers and service providers are continuously enhancing their offerings with advanced diagnostics and emissions monitoring tools, thereby ensuring compliance and contributing to environmental conservation efforts.

Advancements in Technology and Vehicle Performance

Technological advancements and the pursuit of enhanced vehicle performance are key contributors to the growth of the OBD aftermarket. Innovations in diagnostics technologies have transformed OBD systems into comprehensive vehicle management tools that extend beyond traditional diagnostics. Today’s OBD devices offer advanced features such as real-time data logging, predictive maintenance insights, and performance tuning, catering to the evolving needs of consumers who demand greater control over their vehicle’s performance and health.

This shift towards intelligent diagnostics and performance optimization tools reflects a broader trend in automotive technology, where connectivity, data analytics, and user-centric solutions drive market evolution. As vehicles become more sophisticated, the OBD aftermarket is poised for further growth, propelled by the continuous demand for innovative solutions that enhance vehicle efficiency, safety, and performance.

Restraining Factors

Economic Barriers Imposed by High Costs

The high cost of On-Board Diagnostics (OBD) devices constitutes a significant economic barrier, constraining the expansion of the OBD aftermarket. Advanced OBD devices, which offer comprehensive diagnostic features and connectivity options, often come with a premium price tag. This pricing strategy can deter a considerable segment of potential consumers, particularly those from middle to low-income brackets or small-scale automotive service providers, from adopting OBD technology.

As a result, the market's growth potential is curtailed, with cost-sensitive consumers either postponing purchases or opting for basic diagnostic tools with limited functionalities. This price sensitivity underscores the need for cost-effective solutions that can democratize access to advanced vehicle diagnostics, thereby fostering broader market penetration and growth.

The Challenge of Consumer Awareness and Knowledge

The proliferation of the OBD aftermarket is further challenged by a pervasive lack of awareness and understanding among consumers. Despite the critical role OBD systems play in vehicle maintenance, emissions control, and performance optimization, a significant proportion of vehicle owners remain unaware of these benefits. This gap in knowledge limits consumer engagement with OBD technologies and inhibits the market's expansion.

The situation is compounded by the technical complexity of OBD systems, which can intimidate non-technical consumers, discouraging them from exploring and investing in OBD solutions. Elevating consumer awareness through education and straightforward marketing strategies could mitigate this restraint, unlocking new growth avenues for the OBD aftermarket by empowering consumers with the knowledge to leverage OBD technologies for enhanced vehicle management and performance.

By Components Analysis

Empennage components are essential for aircraft stability, influencing design, performance, and aerodynamic efficiency significantly.

In 2023, Empennage held a dominant market position in the "By Components" segment of the On-Board Diagnostics (OBD) Aftermarket, indicating a pivotal shift in market dynamics. This segment, encompassing crucial components such as Empennage, Wings, Fuselage, Nacelle & Pylon, Nose, and Others, has been instrumental in defining the contours of the market's competitive landscape. The prominence of Empennage within this array signifies a targeted consumer preference and technological advancement tailored to enhance aerodynamic efficiency and maintenance diagnostics.

The strategic positioning of Empennage, characterized by its integral role in stability and control, underscores its criticality in OBD applications. This preference is not only indicative of the segment's evolution but also highlights the advancements in material science and current sensor technology, facilitating superior diagnostics and performance analytics. The aftermarket's inclination towards Empennage, alongside other components, mirrors the overarching industry trends focused on sustainability, operational efficiency, and enhanced safety protocols.

Moreover, the integration of sophisticated OBD systems within these components has propelled market growth, driven by regulatory mandates for emission controls and consumer demand for optimized fuel efficiency and vehicle longevity. The data analytics and predictive maintenance capabilities embedded in these systems underscore the shift towards data-driven decision-making and proactive maintenance strategies.

By Application Analysis

Fleet management applications optimize operational efficiency, reduce costs, and enhance safety in aviation operations.

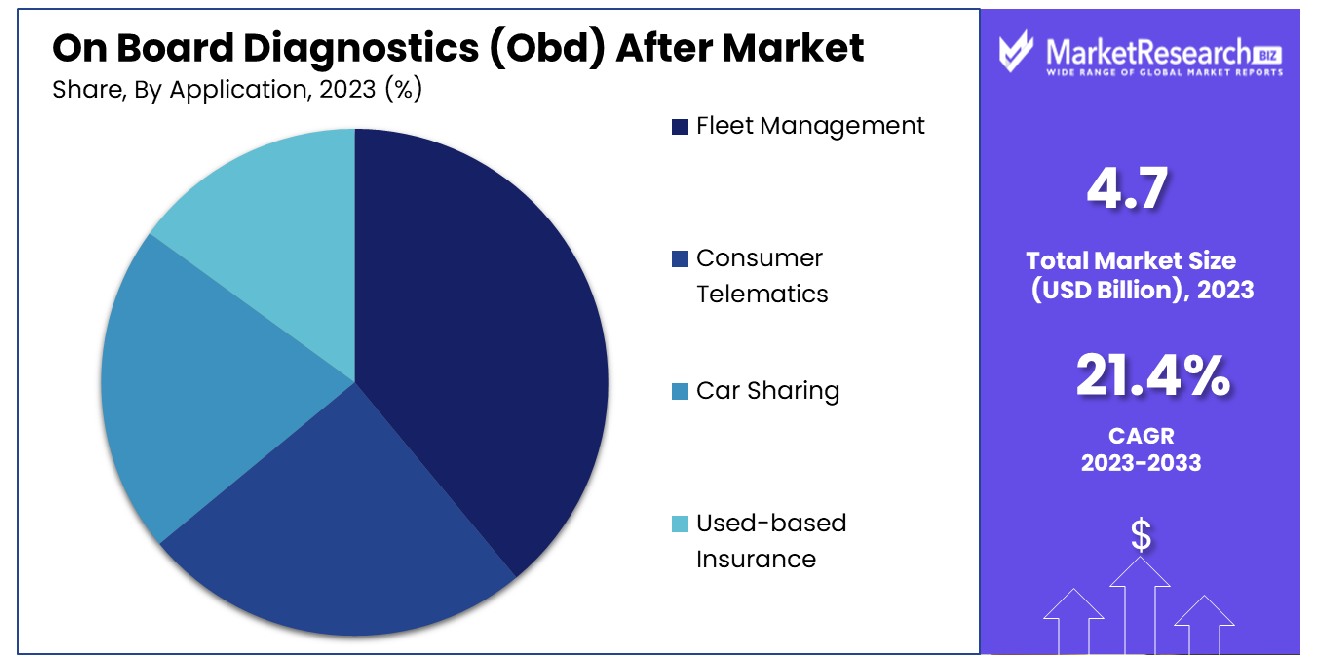

In 2023, Fleet Management segment held a dominant market position in the "By Application" segment of the On-Board Diagnostics (OBD) Aftermarket, showcasing a robust trajectory in the integration of advanced diagnostics solutions across commercial operations. This segment, comprising Fleet Management, Consumer Telematics, Car Sharing, and Usage-based Insurance, underscores the diverse application of OBD systems beyond traditional vehicle diagnostics, extending into strategic business operations and consumer services.

The ascendancy of the Fleet Management segment within this context is attributed to the increasing demand for operational efficiencies, cost reduction, and enhanced regulatory compliance among commercial fleet operators. The adoption of OBD systems in fleet management not only facilitates real-time remote vehicle diagnostics and preventive maintenance but also enables optimized route planning, fuel management, and driver behavior monitoring, thereby contributing to significant operational savings and sustainability goals.

The strategic leverage of OBD data in Fleet Management exemplifies the segment's capacity to transform vehicle diagnostics into actionable insights, fostering a data-driven approach to fleet operations. This evolution reflects a broader market trend towards the integration of IoT and analytics technologies in automotive applications, driving improvements in vehicle safety, efficiency, and connectivity.

By Platform Analysis

Fixed-wing aircraft platforms, known for their efficiency and range, dominate commercial and military aviation.

In 2023, Fixed-Wing Aircraft held a dominant market position in the "By Platform" segment of the On-Board Diagnostics (OBD) Aftermarket, highlighting the sector's pivotal role in advancing diagnostics and maintenance technologies. This segment, which includes Fixed-Wing Aircraft across Military, Commercial, General Aviation, and Business Jet categories, alongside Rotary-Wing Aircraft such as Military Helicopters, Commercial Helicopters, and UAVs, showcases the diverse applicability and critical importance of OBD systems in aviation.

The preeminence of Fixed-Wing Aircraft in this landscape is primarily driven by the extensive use of these platforms across various sectors. The military sector, for example, leverages advanced OBD systems for enhanced mission readiness and operational safety, whereas the commercial aviation industry utilizes these systems to improve fleet reliability and reduce downtime, directly impacting profitability and passenger satisfaction. Similarly, General Aviation and Business Jets benefit from OBD technologies through personalized maintenance schedules and operational efficiency, optimizing performance and extending aircraft lifespans.

The integration of sophisticated OBD systems in Fixed-Wing Aircraft facilitates real-time data analytics, predictive maintenance, and streamlined regulatory compliance, reflecting the sector's adaptation to evolving technological landscapes. This has not only enhanced safety and efficiency but also contributed to environmental sustainability by optimizing fuel consumption and reducing emissions.

By End-User Analysis

Original Equipment Manufacturers (OEMs) rely on advanced technologies to meet evolving aerospace industry standards.

In 2023, Original Equipment Manufacturers (OEM) held a dominant market position in the "By End-User" segment of the On-Board Diagnostics (OBD) Aftermarket, underscoring the strategic significance of OEMs in the proliferation and integration of advanced diagnostic systems. This segment, bifurcated into OEM and Aftermarket, highlights the evolving dynamics between manufacturer-installed systems and aftermarket solutions, with OEMs leading the charge in innovation and market penetration.

The leadership of OEMs in this arena can be attributed to their intrinsic capacity to integrate OBD systems during the manufacturing process, ensuring seamless compatibility and operational efficiency from the outset. This advantage not only enhances vehicle performance and safety but also aligns with regulatory standards, offering consumers a level of reliability and sophistication that aftermarket solutions strive to match.

Furthermore, the dominance of OEMs is bolstered by consumer preference for brand consistency and the warranty benefits associated with OEM-installed diagnostic systems. The trust in OEM-provided technologies extends beyond mere functionality, encompassing the assurance of quality, longevity, and compliance with stringent emissions and safety regulations.

Key Market Segments

By Components

- Empennage

- Wings

- Fuselage

- Nacelle & Pylon

- Nose

- Others

By Application

- Fleet Management

- Consumer Telematics

- Car Sharing

- Used-based Insurance

By Platform

Fixed-Wing Aircraft

- Military

- Commercial

- General Aviation Aircraft

- Business Jet

Rotary-Wing Aircraft

- Military Helicopters

- Commercial Helicopters

- UAVs

By End-User

- OEM

- Aftermarket

Growth Opportunity

Growing Emphasis on Emission Regulations

In 2023, the global On-Board Diagnostics (OBD) aftermarket is poised for expansion, largely driven by the tightening of emission regulations across the globe. The emphasis on reducing vehicular emissions and adhering to stringent regulatory mandates has catalyzed the demand for advanced OBD systems. These systems, designed to monitor the performance of the engine and other vital components, play a crucial role in ensuring vehicles comply with emission standards.

The aftermarket sector, thus, finds substantial growth opportunities in developing solutions for real-time emissions monitoring and reporting. By equipping vehicles with the capability to not only detect but also report emissions data, aftermarket players are instrumental in enabling compliance with environmental regulations. This focus on sustainability and regulatory compliance is expected to continue driving the market forward, as manufacturers and consumers alike seek efficient and reliable means to monitor and reduce the environmental impact of vehicular emissions.

Advancements in Artificial Intelligence (AI) and Machine Learning (ML)

The integration of Artificial Intelligence (AI) and Machine Learning (ML) technologies into OBD systems represents another significant growth frontier for the aftermarket sector in 2023. By harnessing AI and ML, aftermarket solutions are evolving from mere diagnostic tools to sophisticated systems capable of predictive maintenance and real-time fault detection. This technological advancement not only enhances the functionality of OBD systems but also adds remarkable value for customers.

Predictive maintenance, powered by AI, allows for the early detection of potential issues, reducing downtime and maintenance costs. Furthermore, real-time fault detection and automated diagnostics streamline the troubleshooting process, enabling quicker and more accurate repairs. The infusion of AI and ML into OBD systems marks a transformation in vehicle maintenance and repair, offering a more proactive and predictive approach. As these technologies continue to advance, their integration into OBD aftermarket solutions is expected to drive significant market growth, presenting lucrative opportunities for innovation and development in the sector.

Latest Trends

Wireless Connectivity Advancements

The global On-Board Diagnostics (OBD) aftermarket is experiencing a significant transformation in 2023, largely attributed to advancements in wireless connectivity. The integration of technologies such as Bluetooth and Wi-Fi into aftermarket OBD devices has marked a pivotal shift in how vehicle data is accessed and managed. This enhancement in connectivity facilitates seamless interaction between OBD devices and smartphones, tablets, or other smart devices, thus significantly elevating user convenience.

Users can now effortlessly monitor their vehicle's health and performance in real-time, without the need for physical cables or specialized equipment. This trend not only simplifies the diagnostic process but also opens up new avenues for application developers to create innovative, user-friendly applications that interact with OBD systems, further driving the market's growth.

Cloud-Based Diagnostics Solutions

Another trend shaping the OBD aftermarket landscape in 2023 is the adoption of cloud-based diagnostic solutions. These platforms revolutionize vehicle diagnostics by enabling remote access to a wealth of vehicle data, facilitating real-time monitoring, and sophisticated analysis capabilities. For businesses involved in fleet management, this trend offers the ability to oversee and optimize the performance of multiple vehicles from a central location, enhancing operational efficiency.

Furthermore, cloud-based solutions support predictive maintenance strategies, allowing for the identification and resolution of potential vehicle issues before they escalate into more serious problems. This proactive approach not only reduces downtime but also extends the lifespan of vehicles, presenting a significant value proposition for vehicle owners and fleet managers alike. The move towards cloud-based diagnostics underscores the aftermarket's shift towards more connected, efficient, and intelligent vehicle management solutions.

Regional Analysis

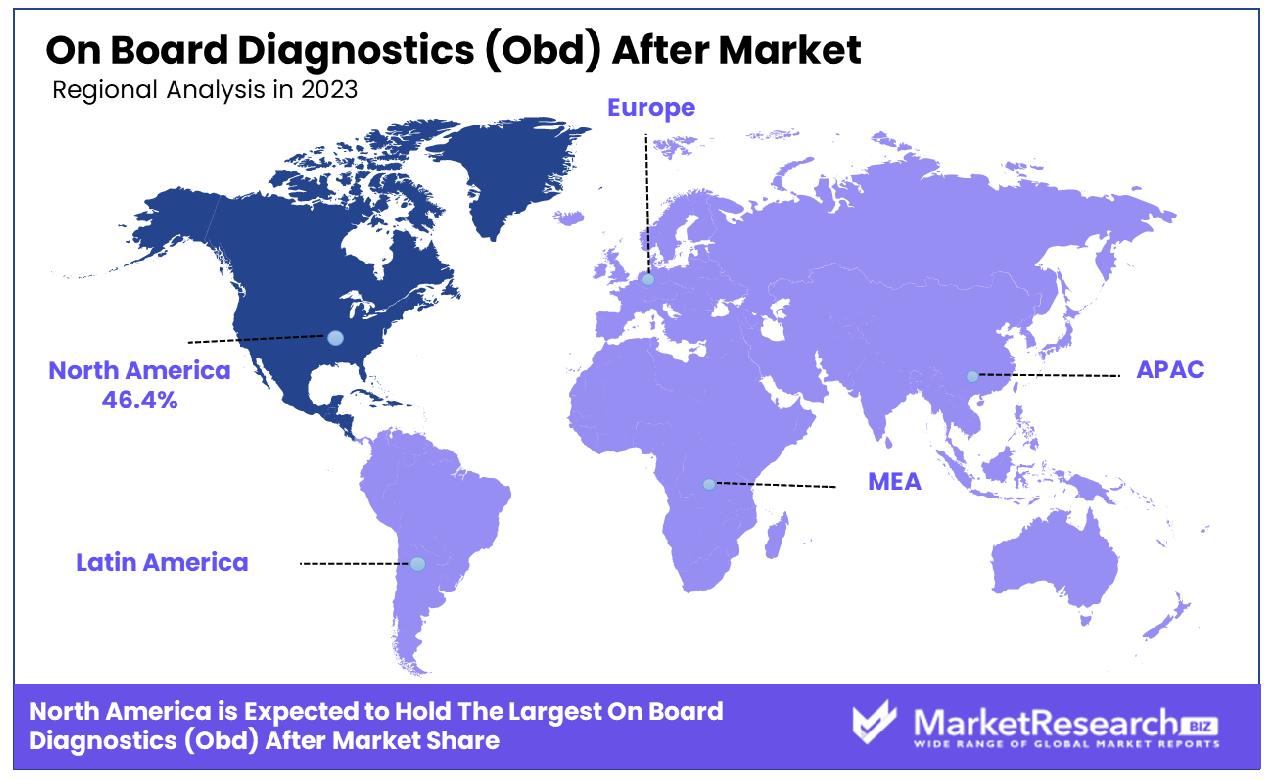

The OBD aftermarket in North America commands a substantial 46.4% market share in 2023.

The On-Board Diagnostics (OBD) aftermarket is witnessing significant regional disparities in terms of growth, technological adoption, and market dynamics. In North America, the region's dominance is pronounced, holding a substantial 46.4% share of the global market. This can be attributed to stringent emission control norms, a high level of consumer awareness regarding vehicle health, and the presence of key industry players. Furthermore, the adoption of advanced telematics and connected vehicle technologies in the U.S. and Canada significantly propels the demand for OBD aftermarket services and products.

Moving to Europe, the market is characterized by strict environmental regulations and a strong inclination towards sustainable transportation solutions. The European Union's rigorous policies on vehicle emissions and diagnostics have fostered a conducive environment for the growth of the OBD aftermarket. Moreover, the region's advanced automotive infrastructure and high penetration of electric vehicles (EVs) are pivotal in driving the adoption of next-generation OBD systems.

The Asia Pacific region is emerging as a lucrative market, driven by rapid urbanization, increasing vehicle penetration, and evolving emission standards, especially in countries like China and India. The escalating demand for passenger vehicles, coupled with the burgeoning automotive manufacturing sector, underscores the region's potential for substantial OBD aftermarket expansion.

Conversely, the Middle East & Africa and Latin America regions are gradually catching up, with growth fueled by improving automotive standards, economic development, and increasing awareness about vehicle maintenance. Although these regions currently hold smaller market shares, the rising demand for automotive diagnostics and consumer propensity towards vehicle longevity are likely to enhance their market stance over the forecast period.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of the Middle East & Africa

Key Players Analysis

In the rapidly evolving landscape of the global On-Board Diagnostics (OBD) aftermarket in 2023, several key players have significantly contributed to the sector's expansion and technological advancements. Magneti Marelli S.p.A., with its rich heritage in automotive innovation, has continued to influence the market through the development of advanced OBD systems that enhance vehicle diagnostics and maintenance efficiency. Intel Corporation, a titan in the technology industry, has leveraged its expertise in computing and connectivity to introduce cutting-edge solutions that bolster the OBD aftermarket's capabilities, particularly in telematics and vehicle data analytics.

Innova Electronics Corporation has carved a niche for itself by focusing on user-friendly OBD diagnostic tools that cater to both professional technicians and automotive enthusiasts. This approach has facilitated a deeper understanding of vehicle health among a broader audience. Hella GmbH & Co. KGaA has also made notable contributions, especially in integrating lighting systems with diagnostic functionalities, thereby enriching the diagnostics ecosystem.

Geotab Inc. stands out for its emphasis on GPS fleet tracking and management solutions integrated with OBD technology, offering invaluable insights into vehicle performance and operational efficiency. Similarly, CalAmp Corporation has excelled in providing telematics solutions that leverage OBD data to enhance fleet management and vehicle security.

Continental AG, with its comprehensive suite of automotive components and systems, has played a pivotal role in advancing OBD technologies, particularly through innovations in-vehicle communication systems. Bosch Diagnostic (Robert Bosch GmbH), a name synonymous with automotive excellence, has continued to lead in the development of diagnostic tools and software, significantly impacting the aftermarket landscape.

Companies like Danlaw Inc., Azuga Inc., AVL DiTEST GmbH, and Autel Intelligent Technology Corp., Ltd., have also made significant strides in the OBD aftermarket, each contributing specialized expertise in diagnostics, telematics, and vehicle data analytics. Their collective efforts have not only enhanced vehicle diagnostics and maintenance but also propelled the OBD aftermarket toward greater connectivity and intelligence.

Market Key Players

- Magneti Marelli S.p.A.

- Intel Corporation

- Innova Electronics Corporation

- Hella GmbH & Co. KGaA

- Geotab Inc.

- Electronic System LTD

- ERM

- Continental AG

- CalAmp Corporation

- Danlaw Inc.

- Bosch Diagnostic (Robert Bosch GmbH)

- Azuga Inc.

- AVL DiTEST GmbH

- Autel Intelligent Technology Corp., Ltd.

Recent Development

- In January 2024, Mankaran integrates Redmi Note 9 Pro with Maruti Alto, enabling autonomous driving via the FlowDrive algorithm. Despite government caution, the innovation signals the potential for responsible advancement in automotive technology.

- In November 2023, Reliance Jio launched JioMotive, an OBD device, that turns cars into smart vehicles. It offers real-time tracking, geofencing, and vehicle health monitoring. Subscription-based services with first-year complimentary.

- In June 2023, NHTSA backed vehicle telematics secrecy, opposing Massachusetts' right-to-repair law. Ignoring telematics security flaws favors automakers' control. Advocates call for robust cybersecurity oversight.

Report Scope

Report Features Description Market Value (2023) USD 4.7 Billion Forecast Revenue (2033) USD 31.1 Billion CAGR (2024-2032) 21.4% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Components(Empennage, Wings, Fuselage, Nacelle & Pylon, Nose, Others), By Application(Fleet Management, Consumer Telematics, Car Sharing, Used-based Insurance), By Platform(Fixed-Wing Aircraft(Military, Commercial, General Aviation Aircraft, Business Jet), Rotary-Wing Aircraft(Military Helicopters, Commercial Helicopters, UAVs)), By End-User(OEM, Aftermarket) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Magneti Marelli S.p.A., Intel Corporation, Innova Electronics Corporation, Hella GmbH & Co. KGaA, Geotab Inc., Electronic System LTD, ERM, Continental AG, CalAmp Corporation, Danlaw Inc., Bosch Diagnostic (Robert Bosch GmbH), Azuga Inc., AVL DiTEST GmbH, Autel Intelligent Technology Corp., Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Magneti Marelli S.p.A.

- Intel Corporation

- Innova Electronics Corporation

- Hella GmbH & Co. KGaA

- Geotab Inc.

- Electronic System LTD

- ERM

- Continental AG

- CalAmp Corporation

- Danlaw Inc.

- Bosch Diagnostic (Robert Bosch GmbH)

- Azuga Inc.

- AVL DiTEST GmbH

- Autel Intelligent Technology Corp., Ltd.