Ocean Technology Market By Type(Wave, Tidal, Ocean Thermal), By Application(Generate Electricity, Energy Storage, Grain Mills, Fuels, Others), By Location(Onshore, Offshore), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2023-2032

-

42493

-

Dec 2023

-

179

-

-

This report was compiled by Correspondence Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Ocean Technology Market Size, Share, Trends Analysis

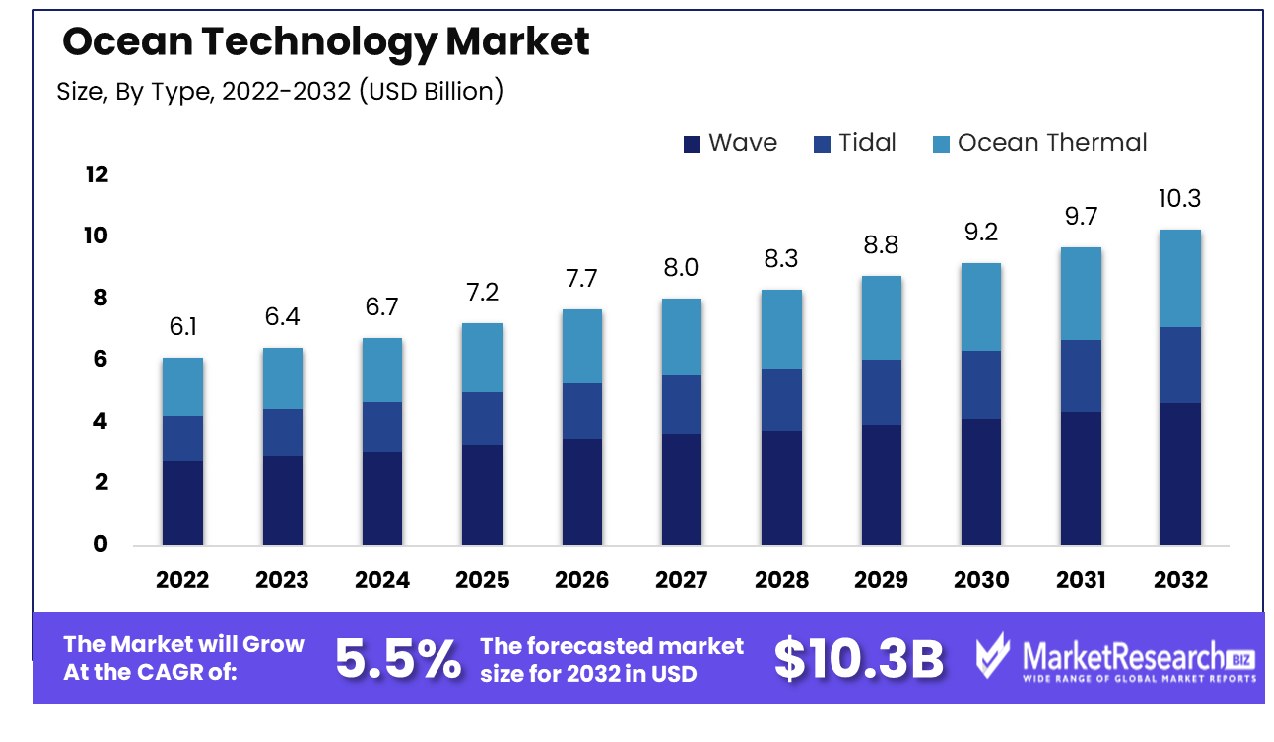

Ocean Technology Market size is estimated to reach USD 10.3 Bn by 2032, an increase from its USD 6.1 Bn estimate by 2022. Growth projections estimate an annual compound compound annual growth rate of (CAGR) 5.5% during 2023-2032.

Ocean Technology refers to advanced tools and methodologies developed for exploring, monitoring, and harnessing ocean resources. This field includes subsectors like marine biotechnology, underwater robotics, and renewable marine energy. Technologies like sonar for seabed mapping, autonomous underwater vehicles for research, and tidal turbines for energy generation are key. This sector is crucial for understanding marine ecosystems, addressing climate change, and tapping into the vast potential of ocean-based resources.

Marine protected areas (MPAs) currently cover more than 8% of the sea with over 18,000 MPAs spanning more than 29,500,000 km2 as of 2022. This statistic demonstrates a significant global effort in marine conservation.

Thus, providing services like coastal mapping, seafloor imaging, and habitat modeling plays a crucial role in supporting marine conservation efforts. As environmental concerns grow, there's an increasing demand for accurate data to inform conservation strategies. Major companies specializing in these services can capitalize on this need, contributing to sustainable management.

Moreover, the development of advanced sensors, drones, robots, and monitoring systems for the marine environment opens significant market opportunities. For Instance, the collaboration in December 2023, between L3Harris, Voyis, and Wavefront, enhancing NATO Navy's AUV capabilities, exemplifies the growing demand for sophisticated underwater technology, especially in critical areas like mine countermeasure operations. Companies investing in these technologies can tap into a growing market focused on maritime security, environmental monitoring, and oceanographic research.

Building offshore structures and equipment suitable for ocean exploration, shipping, and renewable energy harvesting presents vast market opportunities. For Instance, Oceaneering's sea Perception software, with its successful field trial in August 2023 for marine mammal mitigation, showcases the potential for innovative technologies in enhancing offshore operational efficiencies, particularly in wind and renewable energy construction. This market segment is expanding as industries seek more efficient, environmentally sensitive methods for offshore development, creating opportunities for companies that provide such solutions.

Automation technologies in the marine economy are creating new job opportunities outside the traditional workforce. As these innovations advance, demand increases for skilled professionals who can design, manage, and maintain these systems - not only diversifying job markets in marine sectors but also creating avenues of economic expansion that appeal to tech-savvy workforces while driving innovation in maritime operations. Companies in this space industry can leverage this trend to expand their workforce and explore new business opportunity models aligned with the evolving landscape of the ocean economy.

Ocean Technology Market Dynamics

Autonomous Shipping Trends Propel Ocean Technology Demand

The increasing demand for autonomous ships is significantly surging the need for advanced marine sensors and other ocean technologies. As the maritime industry moves towards automation for enhanced efficiency and safety, the development and deployment of sophisticated ocean technologies become crucial.

These technologies include navigation systems, communication tools, and sensors for environmental monitoring and ship operations. The trend towards the autonomous shipping industry is indicative of a broader shift in the industry towards technology-driven solutions, suggesting sustained growth in the ocean technology market as the maritime sector continues to innovate and evolve.

Competitive Innovation Drives Ocean Technology Development

Businesses focusing on cutting-edge technology are driving innovations in ocean technology forward as they look for competitive advantages. Seatech innovations are driven not only by increased efficiency in operations but also by the desire to sustainably exploit sea resources.

Innovations in marine technology span a diverse array of applications, from deep-sea exploration and data collection to renewable energy production. New ideas in marine research reflect its dynamic market environment and fast-changing nature; companies constantly look for novel solutions that address specific marine ecosystem challenges or opportunities.

Marine Biotechnology Growth Fuels Ocean Technology Market

Marine biotechnology encompasses the use of marine organisms and resources for applications in pharmaceuticals, cosmetics, and food security, among others. The extraction, processing, and analysis of these marine resources require specialized ocean technologies.

As demand for marine-derived products grows, driven by their unique properties and potential benefits, the need for advanced ocean technologies to support this sector also increases. This trend signifies a market expansion in response to the growing intersection of marine biotechnology and technological advancements, highlighting the symbiotic relationship between these industries.

Security Issues in Ocean Technology Restrain Market Expansion

Security concerns, particularly those involving sensitive information related to port operations, cargo, and crew, significantly impede the expansion of the ocean technology market. The protection of critical data against cyber threats and unauthorized access is paramount in maritime operations.

Breaches can lead to significant financial losses, safety risks, and operational disruptions. The challenge of ensuring robust cybersecurity measures in an increasingly digital maritime world adds complexity and cost to deploying new ocean technologies. These security issues can deter investment and adoption of advanced technologies, limiting market rapid growth as stakeholders prioritize safeguarding their operations against emerging security threats.

Stringent Environmental Regulations and Lack of Uniform Standards Slow Down Maritime Safety Market Growth

The growth of the maritime safety market is slowed by stringent environmental regulations and the lack of uniform standards to implement security solutions across the marine industry. Navigating and complying with these environmental regulations, which vary across regions and aim to protect marine ecosystems, can be challenging and resource-intensive for technology developers and maritime operators.

Furthermore, the absence of standardized protocols for implementing and integrating new security solutions adds to the complexity. This lack of uniformity can lead to inefficiencies and inconsistencies in safety measures, hindering widespread adoption. Balancing environmental compliance with the advancement of safety technologies is a key challenge in driving market growth in this sector.

Ocean Technology Market Segmentation Analysis

By Type Analysis

Wave energy technology, leading the ocean technology market with a 61.5% share, is the most advanced and widely implemented form of ocean-based renewable energy. Its dominance is attributed to the significant potential of wave energy to provide a consistent and abundant power source. Wave energy converters - devices that convert ocean waves' energy into electrical energy - have undergone dramatic advancements thanks to innovations. Their success can be attributed to three factors: global demand for sustainable energy sources; government policies supporting this field of technology; and innovations focused on harnessing waves' power more effectively and sustainably.

Tidal energy, harnessing the predictable nature of tidal movements, is significant but limited by geographical constraints. Ocean Thermal Energy Conversion (OTEC) is an emerging technology that uses the temperature difference between surface and deep ocean waters for power generation, suitable for tropical regions.

By Application Analysis

Generating electricity is the primary application of ocean technology, accounting for 41.9% of the market. This segment's dominance is driven by the increasing global demand for sustainable and clean energy sources. Ocean technologies, particularly wave and tidal, offer reliable and scalable solutions for electricity generation. Their integration into power grids is crucial for reducing carbon emissions, diversifying energy sources, and enhancing energy security.

Energy storage solutions are being developed to complement ocean technologies, addressing the intermittency of wave and tidal energy. Ocean sector technology applications in grain mills and fuel production are niche but growing areas. Other applications include desalination and cooling systems.

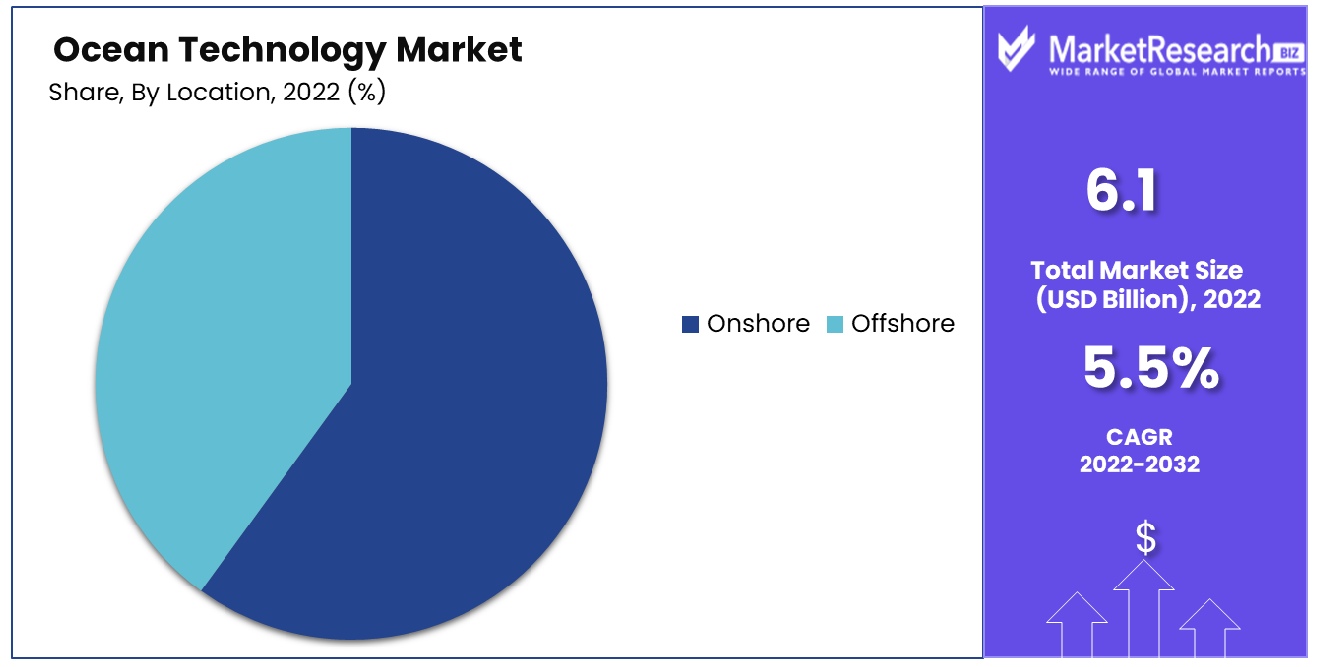

By Location Analysis

Onshore ocean technologies, which include near-shore wave and tidal energy systems, dominate the market with a 64.4% share. The onshore segment benefits from easier accessibility for installation and maintenance, lower costs compared to offshore setups, and fewer environmental impacts. These factors make onshore technologies appealing, especially for countries with extensive coastlines.

Offshore wind ocean technologies, while currently less prevalent, are significant for their potential to harness stronger and more consistent energy resources. The shift towards wave energy and the focus on electricity generation reflects the broader trend of transitioning to a sustainable, low-carbon global energy mix.

Ocean Technology Industry Segments

By Type

- Wave

- Tidal

- Ocean Thermal

By Application

- Generate Electricity

- Energy Storage

- Grain Mills

- Fuels

- Others

By Location

- Onshore

- Offshore

Ocean Technology Market Regional Analysis

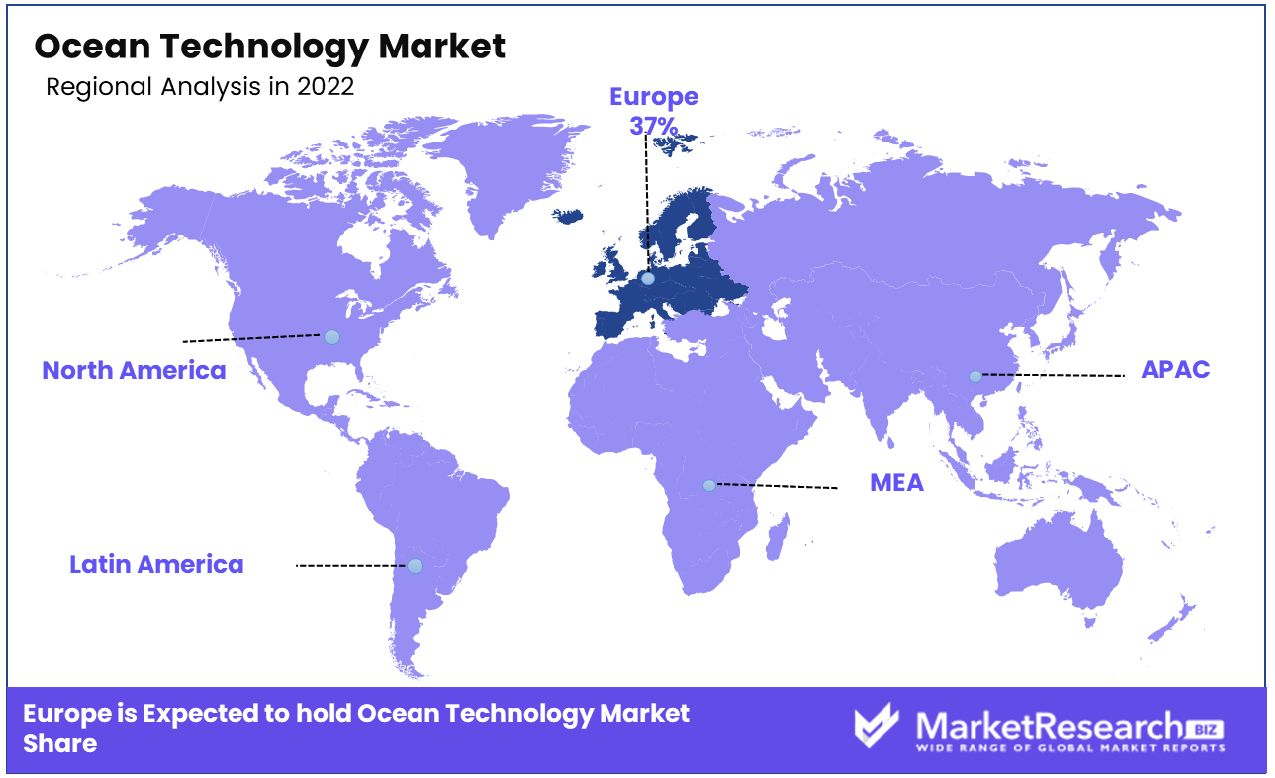

Europe Dominates with 37% Market Share in Ocean Technology

Europe holds 37% of the ocean technology market, valued at $3 billion, thanks to its long maritime heritage and advanced technological capabilities. European nations boast an abundance of innovation and exploration within the maritime realm, leading to oceanographic research as well as sustainable management of marine resources and the creation of marine industries. Furthermore, Europe hosts several top research and development companies as well as institutions specializing in maritime or oceanographic technology.

The market dynamics in Europe are influenced by the region’s emphasis on research and development in areas such as marine renewable energy, deep-sea exploration, and ocean monitoring. Governmental support and funding for ocean advanced technology industry projects, coupled with collaborative initiatives across European Union member states, play a crucial role. Additionally, Europe's stringent regulations on marine environmental protection drive the need for advanced ocean technology solutions, including monitoring and conservation tools.

Asia-Pacific's Rapid Expansion in Maritime Activities

Asia-Pacific’s ocean technology market is experiencing rapid economic growth, fueled by the region’s extensive maritime activities and burgeoning maritime industries. Countries such as China and Japan are investing heavily in maritime technology for fishing, the shipping industry, and offshore energy exploration. China's Ministry of Natural Resources reported an impressive increase in gross marine product development, underscoring how technology like 5G, Artificial Intelligence, and big data have transformed this sector of industry.

North America's Advanced Technology and Environmental Focus

North American markets for ocean technology benefit from cutting-edge technological knowledge and an increased emphasis on environmental responsibility in managing marine resources. U.S. Department of Energy's Water Power Technologies Office is involved with collecting and analyzing information regarding hydrokinetic and marine science systems performance as well as technological advancements to assist with solving development, research, or demonstration issues. North America has taken an innovative approach towards ocean technology thanks to both public and private investments that have strengthened its standing internationally.

Ocean Technology Industry By Region

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of Asia Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of Middle East & Africa

Ocean Technology Market Share Analysis

Eco Wave Power and Wave Swell, with their innovative wave energy conversion technologies, are at the forefront, demonstrating the market's focus on developing efficient and sustainable solutions for capturing oceanic power.

Carnegie Clean Energy and CorPower Ocean, known for their advanced wave energy devices, play pivotal roles in pushing the boundaries of ocean technology with systems that offer high energy yield and durability, reflecting the industry's shift towards maximizing efficiency and reliability in harsh marine environments.

Sinn Power and Nemos, with their unique approaches to wave energy harvesting, contribute significantly to the diversity of technologies in the market, showcasing the potential for innovative designs to meet various geographical and environmental conditions.

For new players entering the market, the scenario is both challenging and opportunistic. They face the task of carving out a niche amidst established players, yet the rapidly advancing technology and growing interest in marine energy present significant opportunities for innovation and market disruption. Existing players, with their established networks and proven technologies, have the advantage of experience but must continuously innovate to maintain their market positions amid emerging competition and evolving technology.

Ocean Technology Industry Key Players

- Eco Wave Power

- Carnegie Clean Energy

- Sign Power

- Nemos

- Wave Swell

- AWS Ocean Energy

- CorPower Ocean

- Ocean Power Technology

- Aquanet Power and AMOG Consulting.

Ocean Technology Market Recent Development

- In 2023, This cutting-edge AI platform combines artificial intelligence with underwater cameras to monitor coral reef health. Launched in October 2023 by IBM and MBARI, Deepsea AI helps track environmental threats and supports conservation efforts by providing valuable data on coral bleaching, pollution, and other disturbances.

- In October 2023, Maersk confirmed significant reductions, proving the system's potential for cleaner and more efficient shipping.

- In September 2023, Ocean Infinity, a company specializing in seabed surveys, employed their advanced autonomous underwater vehicle (AUV) to make a remarkable discovery.

Report Scope

Report Features Description Market Value (2022) USD 6.1 Billion Forecast Revenue (2032) USD 10.3 Billion CAGR (2023-2032) 5.5% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type(Wave, Tidal, Ocean Thermal), By Application(Generate Electricity, Energy Storage, Grain Mills, Fuels, Others), By Location(Onshore, Offshore) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Eco Wave Power, Carnegie Clean Energy, Sinn Power, Nemos, Wave Swell, AWS Ocean Energy, CorPower Ocean, Ocean Power Technology, Aquanet Power and AMOG Consulting.; Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Eco Wave Power

- Carnegie Clean Energy

- Sign Power

- Nemos

- Wave Swell

- AWS Ocean Energy

- CorPower Ocean

- Ocean Power Technology

- Aquanet Power and AMOG Consulting.