Nephrology Drugs Market By Drug Class (ACE inhibitors, Angiotensin receptor blockers (ARBs), Others), Phosphate binders, Others), By Route of Administration (Oral, Parenteral drugs), By Distribution Channel, By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends And Forecast 2023-2032

-

41714

-

Oct 2023

-

167

-

-

This report was compiled by Correspondence Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Report Overview

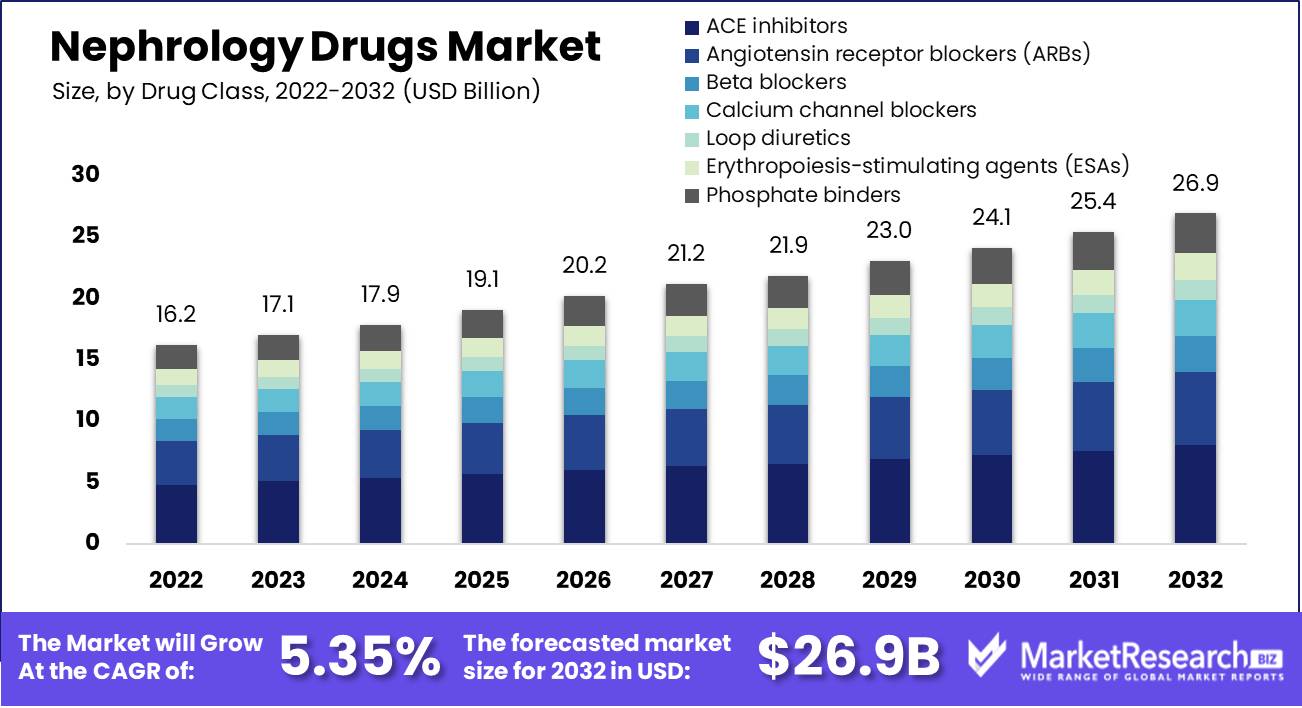

Nephrology Drugs Market size is expected to be worth around USD 26.9 Bn by 2032 from USD 16.2 Bn in 2022, growing at a compound annual growth rate of 5.35% during the forecast period from 2023 to 2032.

Nephrology drugs are prescribed to treat various kidney-related conditions such as chronic kidney disease, diabetic nephropathy, kidney infections, and acute kidney injury. Their increasing prevalence coupled with an aging population is driving this market's expansion. Furthermore, ESRD patients play a pivotal role in its success story and further fuel its expansion.

Novo Nordisk recently made headlines when it entered the nephrology drugs market by purchasing late-stage hypertension and chronic kidney disease (CKD) medications from KBP Biosciences that have advanced through Phase 3 trials and show promise as potential therapies to treat uncontrolled hypertension or advanced CKD. Their strategic acquisition highlights nephrology's growing significance within healthcare as an industry; specifically their dedication towards meeting unfulfilled patient needs related to kidney issues.

Roxadustat from AstraZeneca received European Commission approval in June 2022 as a treatment option to address anemia among chronic kidney disease (CKD) patients, an often debilitating complication. This development marked a crucial step toward expanding treatment options available to those living with the chronic disease while offering new approaches for managing one of its more challenging symptoms.

In August 2023, the U.S. House of Representatives witnessed a critical development in further research and treatment for chronic kidney disease (CKD), with the introduction of the Chronic Kidney Disease Improvement in Research and Treatment Act (CKD-IRTA). This legislation showed recognition for advances required for nephrology care while increasing research options available to those affected by chronic kidney disease - strengthening pharmaceutical products available for kidney patients as well as overall care given.

As global kidney diseases increase with an aging population and lifestyle-related conditions such as diabetes and hypertension, so does the patient base. Furthermore, ongoing advances in research and development are providing new therapies and pharmaceuticals that give nephrology patients more treatment options available to them.

Awareness and proactive healthcare initiatives designed to identify kidney diseases at earlier stages are driving early intervention and ultimately market expansion. Further, strategic acquisitions and legislation such as Novo Nordisk's Chronic Kidney Disease Improvement in Research and Treatment Act show the industry's dedication to optimizing patient care while driving the growth of its market for nephrology pharmaceuticals.

Driving factors

Rising Incidence of Chronic Kidney Disease

One major driver for the growth of the nephrology drugs market is due to increasing prevalence of chronic kidney disease, due to its increasing incidence.

Product Innovation

One key trend gaining ground in the nephrology drugs market is product innovation. Companies are focused on developing new medications or improving existing ones to meet rising demands for effective therapies. AstraZeneca recently gained FDA approval for its anemia drug roxadustat for treating anemia among those living with chronic kidney disease.

Increased Geriatric Population

Aging is also one of the major drivers behind the expansion of the nephrology drug market, as as people age their risk for kidney disease increases significantly.

Technological Advancements

Technological advancements within the healthcare industry are also contributing to the expansion of the nephrology drugs market. New diagnostic tools and imaging techniques allow physicians to detect kidney diseases at an earlier stage, leading to improved treatment outcomes, thus creating greater demand for nephrology drugs.

Restraining Factors

High Cost of Nephrology Drugs

One of the main factors inhibiting growth in the market for nephrology drugs is their high cost, particularly in developing countries where healthcare access may be limited. This makes their adoption much less likely.

Stringent Regulatory Requirements

One factor holding back the growth of the nephrology drugs market is the stringent regulatory requirements that must be fulfilled for their approval for use. Approving new medications can be a long and expensive process as a result, many major companies hesitate to invest in developing new medicines in light of this uncertain regulatory environment.

Increased Incidence of Chronic Kidney Disease

One of the key challenges facing the market today is an increasing prevalence of chronic kidney disease (CKD) and end-stage renal disease (ESRD) globally, due to several factors like an aging population, rising rates of diabetes and hypertension as well as lifestyle changes.

High cost of treatment

One challenge facing the nephrology drugs market is its high treatment costs. Patients suffering from chronic kidney disease and end-stage renal disease need ongoing medical care, including dialysis or transplants which can be costly; thus prompting demand for more affordable and accessible therapies that can manage these conditions more effectively.

Drug Class Analysis

The market for nephrology drugs can be divided by drug class and application. Major drug categories in this market include ACE inhibitors, ARBs, beta-blockers, calcium channel blockers, loop diuretics, ESAs (erythropoiesis-stimulating agents), and phosphate binders.

ACE inhibitors segment held the largest market share in 2022 due to their widespread application in treating high blood pressure and heart failure by relaxing blood vessels, and they are projected to continue their dominance through 2032. ARBs were the second-most-popular class, commonly used to treat these ailments by blocking angiotensin II production; beta-blockers could potentially offer applications across high blood pressure, heart failure, and angina while growing at an estimated compound annual compound growth rate of 4.0% until 2032.

Calcium channel blockers for high blood pressure and arrhythmia, loop diuretics for edema and hypertension, ESAs to treat anemia associated with chronic kidney disease patients, and phosphate binders for treating hyperphosphatemia are other key drug classes.

Segmenting by application would analyze how nephrology drugs are prescribed for various diagnoses such as chronic kidney disease, diabetes, hypertension, and other renal conditions. Examining market share and growth trends by drug class and application provides further insight into the structure and future growth areas for the market for these products.

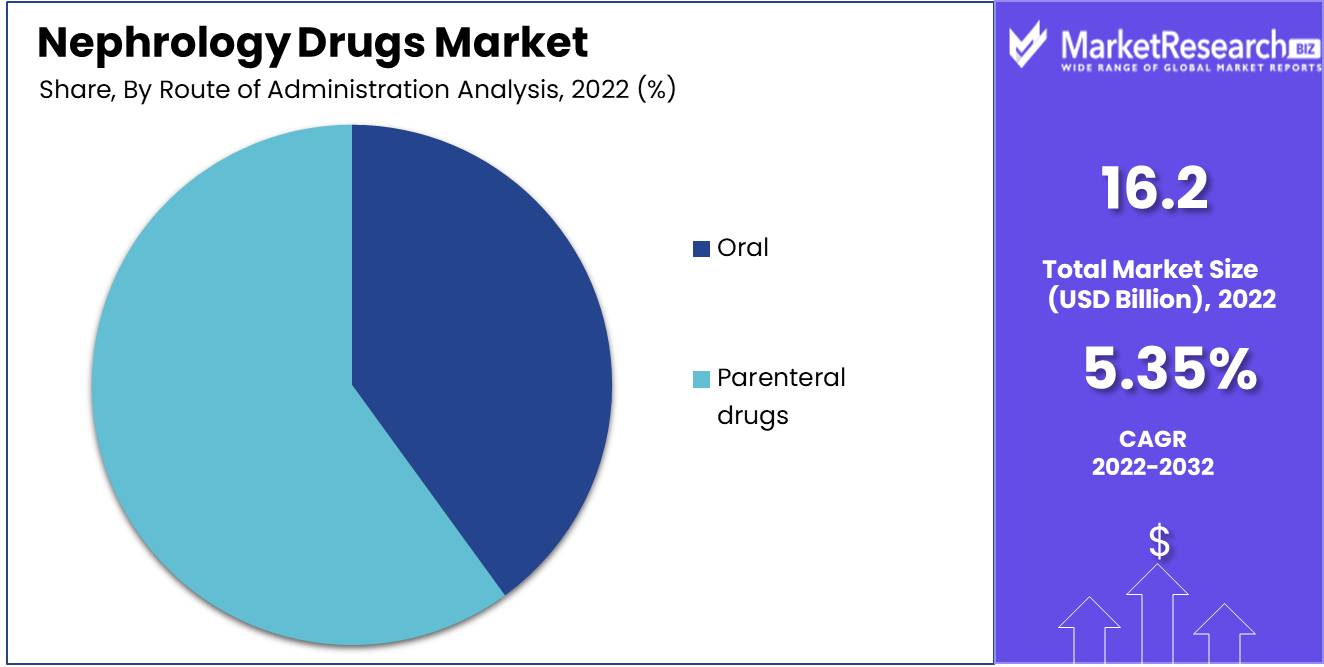

Route of Administration Analysis

The global nephrology drugs market can be divided by route of administration into oral and parenteral drugs, with oral drugs leading the pack by taking place directly by mouth while parenteral ones being administered through non-oral routes such as injection.

According to our research team, oral medications are expected to generate maximum revenue and experience the fastest growth through 2032. This is attributable to their convenience for self-administration by patients.

Parenteral drugs - injections, intravenous infusions, and other non-oral routes - are frequently utilized during acute situations requiring immediate action, so their sub-segment is expected to experience exponential growth during this forecast period despite being less convenient for patients.

Oral medication's ease of use is one-factor driving growth in this subsegment, while parenteral treatments will still hold onto an impressive share of the market due to their effectiveness and emergency use. Looking at the nephrology drugs market by route of administration provides further insight into key trends impacting its future growth and product development.

Distribution Channel Analysis

The global nephrology drugs market can be divided into three distribution channels, retail pharmacies, hospital pharmacies, and online pharmacies. Hospital pharmacies dominate due to hospitals being the primary points of care for people living with kidney diseases who require prescriptions of nephrology drugs in hospital settings.

Retail pharmacies remain an important segment in the global nephrology drugs market, accounting for approximately two-fifths of its overall share. Patients benefit from easily accessible retail pharmacies that provide an extensive range of nephrology drugs - making this option increasingly attractive for many patients.

Online pharmacies are becoming an increasingly popular distribution channel for nephrology drugs, offering patients the convenience of ordering their medications from home and having them sent directly. This segment of pharmacy sales is expected to experience explosive growth over the coming years.

Key Market Segmentation

By Drug Class

- ACE inhibitors

- Angiotensin receptor blockers (ARBs)

- Beta blockers

- Calcium channel blockers

- Loop diuretics

- Erythropoiesis-stimulating agents (ESAs)

- Phosphate binders

- Others

By Route of Administration

- Oral

- Parenteral drugs

By Distribution Channel

- Retail pharmacies

- Hospital pharmacies

- Online pharmacies

Growth Opportunity

- New medications to address specific pathways related to chronic kidney diseases (CKD) or end-stage kidney disease (ESRD) have become increasingly crucial. Such therapies may stop or slow disease progression while improving transplant results.

- Personalized treatments tailored specifically to an individual patient depend on factors like their medical history and genetic profile, such as biomarkers or diagnostic tools that identify those at risk of kidney disease and track their response to treatment.

- This report indicates that demand for erythropoietin-stimulating agents (ESAs) will likely surge over the coming years due to increasing rates of chronic kidney disease and anemia treatment. ESAs are used as treatments for anemia caused by this condition and will likely experience rapid expansion as more individuals seek solutions with them.

Latest Trends

Emergence of Chronic Nephrology Conditions and Aging

The rising incidence of chronic kidney ailments coupled with an aging population are major drivers behind an increase in demand for nephrology medications. Furthermore, poor lifestyle choices such as smoking cigarettes and poor eating habits contribute to an increase in chronic kidney cases.

Asia-Pacific as an Emerging Hotspot

The Asia-Pacific region is expected to experience rapid expansion over the coming years, due to an increasing number of individuals suffering from chronic kidney issues across China and India.

Global Intensity of Chronic Kidney Disease

Chronic kidney disease (CKD) is on the rise globally. CKD is one of the risk factors leading to end-stage renal disease (ESRD), which requires dialysis or transplantation in severe cases. With population aging and increased incidences of hypertension and diabetes globally, risks for CKD will only grow.

Biologic Therapies Gain Popularity

Demand for biologics has steadily been on the rise. Biologics are molecules made from living organisms and used to treat illnesses such as autoimmune disorders and cancer care among others. Within nephrology drug markets specifically, these agents such as erythropoietin-stimulating agents (ESAs) and monoclonal antibodies (mAbs) can treat anemia while decreasing inflammation respectively.

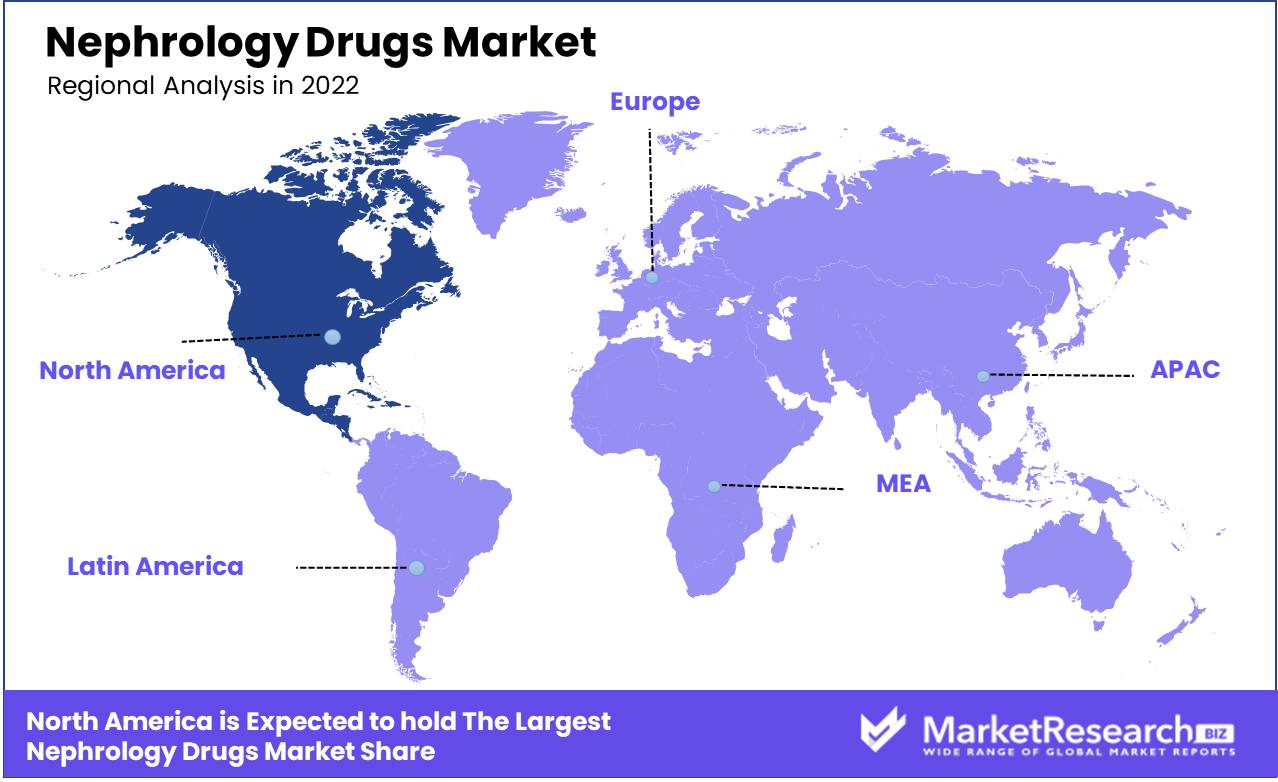

Regional Analysis

The global nephrology market can be divided into three regions - North America, Europe, and Asia Pacific. Of these regions, North America held the largest market share for nephrology drugs in 2022 - accounting for 44% of global market revenue due to high kidney-related disease prevalence as well as modern healthcare infrastructure availability being major drivers of growth here.

Europe is the second-largest market for nephrology medications globally, driven by increasing incidences of kidney disease among an aging population and access to new healthcare services.

Asia Pacific is projected to experience the fastest market expansion for nephrology medications over the forecast period. Rising kidney disease incidence, combined with a growing geriatric population and modern healthcare infrastructure and services will drive expansion here.

Nephrology drugs are poised for rapid expansion due to a rising burden of chronic diseases among aging populations and improved healthcare infrastructure in various regions; North America, Europe, and Asia Pacific will become key markets.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of Asia Pacific

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of Middle East

Key Players Analysis

- AstraZeneca PLC: is an international pharmaceutical company, producing medications designed to treat various kidney conditions such as type 2 diabetes. Their Farxiga treatment can treat this as well as chronic kidney issues.

- AbbVie Inc: As a research-driven pharmaceutical company that develops products to address various therapeutic areas such as Nephrology, AbbVie Inc is best known for producing Humira emulsion to treat autoimmune conditions like rheumatoid arthritis and psoriasis.

- Amgen Inc: Amgen Inc. is a biotechnology business that produces medicines to treat kidney diseases in various therapeutic areas, such as secondary hyperparathyroidism in adults living with chronic kidney diseases. Amgen products in this arena include Parsabiv for treating secondary hyperparathyroidism.

- F. Hoffmann-La Roche AG: FHLA is an internationally acclaimed pharmaceutical company known for offering innovative therapeutic solutions across various fields - such as CellCept (r), part of their nephrology offering that assists transplant recipients experiencing kidney rejection issues.

- Johnson &Johnson Inc: Johnson &Johnson is an international medical device, pharmaceutical, and consumer goods producer that is widely known for developing innovative therapies to treat kidney conditions such as Procrit for treating anemia as well as treating other symptoms of renal impairment.

Key Market Players

- Amgen Inc.

- AstraZeneca

- Pfizer Inc.

- Johnson & Johnson Inc

- F. Hoffmann-La Roche Ltd.

- Sanofi

- GlaxoSmithKline

- Otsuka Pharmaceutical Co., Ltd.

- Kyowa Hakko Kirin Co., Ltd.

- OPKO Health, Inc.

- FibroGen Inc

- Novartis AG

- Akebia Therapeutics Inc

Recent Development

- In August 2023, the U.S. House of Representatives saw a significant development in nephrology drugs and the treatment of chronic kidney disease (CKD) with the reintroduction of The Chronic Kidney Disease Improvement in Research and Treatment Act.

- Novo Nordisk has acquired late-stage hypertension and kidney disease drug from KBP Biosciences. The drug has reached Phase 3 testing as a potential treatment for uncontrolled hypertension and advanced chronic kidney disease. The deal is the latest in a series of acquisitions by Novo Nordisk aimed at expanding its presence in the nephrology drugs market.

- In June 2022, AstraZeneca announced that it had received approval from the European Commission for its drug roxadustat, used to treat anemia in chronic kidney disease patients.

- In May 2022, the US Food and Drug Administration (FDA) approved a new drug called Korsuva for the treatment of pruritus, or severe itching, in patients with chronic kidney disease undergoing hemodialysis.

- In September 2022, Boehringer Ingelheim announced that it had received approval from the European Medicines Agency for its drug Jardiance to be used in the treatment of chronic kidney disease.

Report Scope

Report Features Description Market Value (2022) USD 16.2Bn Forecast Revenue (2032) USD 26.9Bn CAGR (2023-2032) 5.35% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Drug Class (ACE inhibitors, Angiotensin receptor blockers (ARBs), Beta-blockers, Calcium channel blockers, Loop diuretics, Erythropoiesis-stimulating agents (ESAs), Phosphate binders, Others), By Route of Administration (Oral, Parenteral drugs), By Distribution Channel (Retail Pharmacies, Hospital Pharmacies, Online pharmacies) Regional Analysis North America – The US, Canada, Mexico, Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America, Eastern Europe – Russia, Poland, The Czech Republic, Greece, Rest of Eastern Europe, Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, Rest of Western Europe, APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, Rest of APAC, Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, Rest of MEA Competitive Landscape Amgen Inc., AstraZeneca, Pfizer Inc., Johnson & Johnson, F. Hoffmann-La Roche Ltd., Sanofi, GlaxoSmithKline, Otsuka Pharmaceutical Co., Ltd., Kyowa Hakko Kirin Co., Ltd., OPKO Health, Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Amgen Inc.

- AstraZeneca

- Pfizer Inc.

- Johnson & Johnson Inc

- F. Hoffmann-La Roche Ltd.

- Sanofi

- GlaxoSmithKline

- Otsuka Pharmaceutical Co., Ltd.

- Kyowa Hakko Kirin Co., Ltd.

- OPKO Health, Inc.

- FibroGen Inc

- Novartis AG

- Akebia Therapeutics Inc