Naphtha Market By Type (Light Naphtha, and Heavy Naphtha), End-User Industry (Petrochemical, Agriculture, Paints and Coatings, Aerospace, and Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032

-

40254

-

July 2023

-

137

-

-

This report was compiled by Shreyas Rokade Shreyas Rokade is a seasoned Research Analyst with CMFE, bringing extensive expertise in market research and consulting, with a strong background in Chemical Engineering. Correspondence Team Lead-CMFE Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

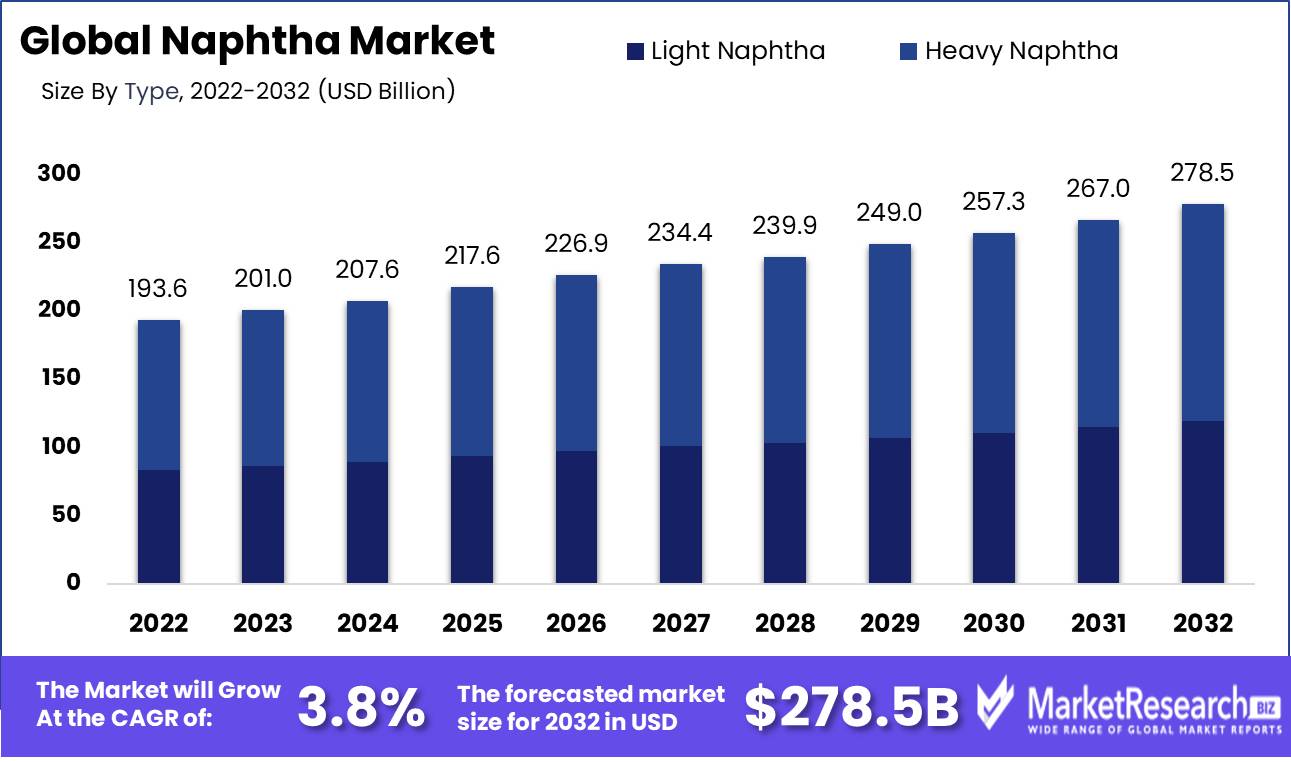

Naphtha Market size is expected to be worth around USD 278.5 Bn by 2032 from USD 193.6 Bn in 2022, growing at a CAGR of 3.8% during the forecast period from 2023 to 2032.

The increasing demand for naphtha in many industries, including transportation, construction, and plastic, is driving the global market. Naphtha is gaining popularity due to its high olefin content, which is widely used in the production of gasoline. The global naphtha market is also being driven by the increasing demand for petrochemicals like propylene and ethylene for plastic manufacturing. Hydro-pyrolysis, which is a more efficient and cost-effective method of producing the product, is another positive development. The global naphtha market is seeing positive signs due to the development of advanced furnace materials and distillation columns.

Driving factors

Rising Demand For Olefin-Rich Naphtha To Drive the Market Growth.

The olefin-rich naphtha, a naphtha derivative, is used primarily as a feedstock for the production of low-cost high-octane diesel. Naphtha use has increased in industrialized as well as developing countries due to an increase in population and rapid urbanization. Petroleum naphtha can also be used as a solvent. Petroleum naphtha can be found in many cleaning products. It can also be used to thin paint, varnish, and asphalt. Naphtha is also used in dry cleaning.

This increases the demand for naphtha, which is expected to drive the market's growth. Modern technology has led to novel furnace materials and improved distillation processes. Naphtha is being used more because of the growth in the chemical industry. Market drivers will include the development of new markets and strategic alliances, which will increase the chances that the naphtha market grows at an acceptable rate.

Restraining Factors

The Shift From the Low-Cost Alternative From Naphtha Due to the Fluctuation in the Crude Oil Prices Restraint the Market Growth.

Crude Oil is an important component of the global naphtha industry. The volatility and fluctuation in crude oil prices are significant limitations to the global naphtha industry's growth. The shift from naphtha use to low-cost alternatives such as liquefied petroleum gas (LPG) and natural gas liquid is expected to limit the market's growth over the forecast period.

Type Analysis

The Heavy Naphtha Segment Dominates the Market Globally.

Based on type, the market is segmented into Heavy Naphtha and Light Naphtha. In 2022, the largest share of the naphtha market data was held by the heavy naphtha segment. Light naphtha is often used in petrochemical steam crackers, in contrast to heavy naphtha which improves fuel efficiency in catalytic converters in refineries. In most cases, the impurities are removed by heavy naphtha hydrotreating before the hydrotreated naphtha is introduced to the catalytic reformer. The reformer's expensive platinum-based catalyst is susceptible to poisoning from such impurities.

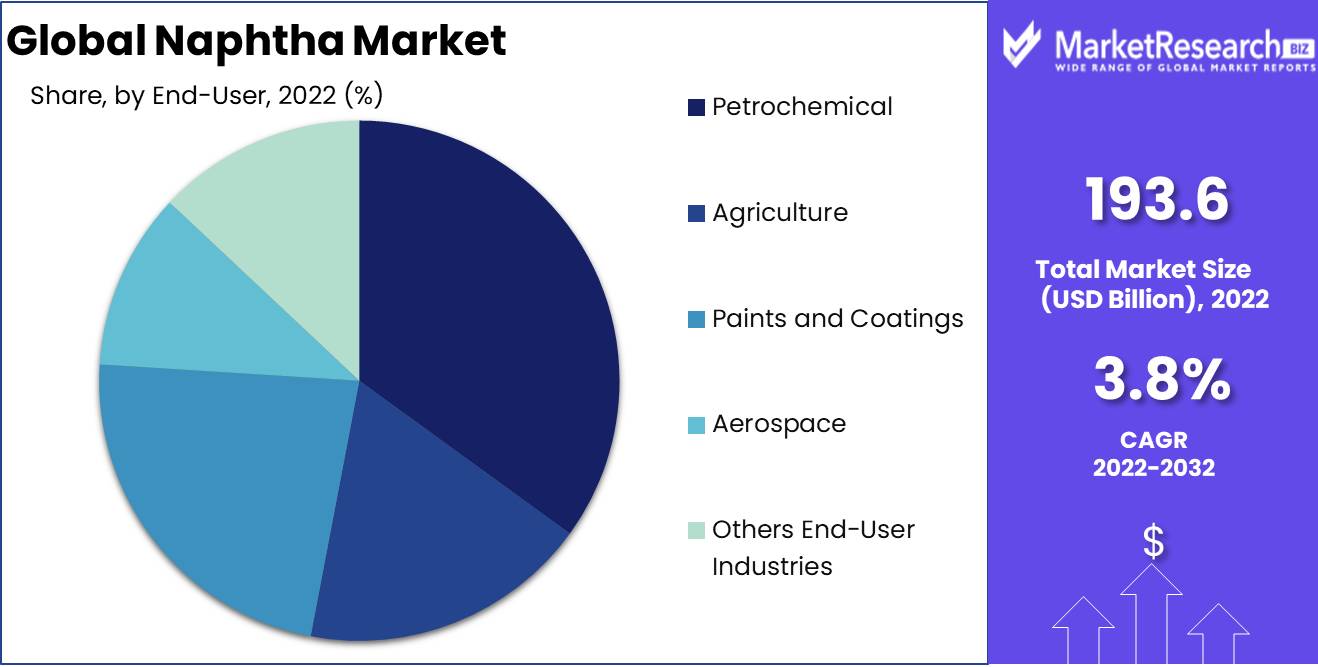

End-User Analysis

Petrochemical Industry Segment Dominates the Market Share Globally.

Based on End-User, the naphtha market is segmented into Petrochemical, Agriculture, Paints & Coatings, Aerospace, and Other End-Users. Over the course of the forecasted period, the market is anticipated to be bolstered by rising naphtha demand from the primary end-user petrochemical industry. The market is expected to expand further in the not-too-distant future as a result of the rapid urbanization and industrialization that are taking place in both large and emerging economies.

This is driving the demand for inexpensive fuel, which is expected to drive the enormous demand for naphtha. The well-intentioned plan to set up a number of chemical plants in the APAC region is expected to produce a variety of plastics and other petrochemical products, that are used in a variety of end-use industries, most likely the electronics automotive, paint, and electric vehicle battery industries, which are all expected to grow the naphtha market during the forecast period.

Key Market Segments

Based on Type

- Light Naphtha

- Heavy Naphtha

Based on End-User

- Petrochemical

- Agriculture

- Paints and Coatings

- Aerospace

- Others End-User Industries

Growth Opportunity

Increase Trade Activity to Rise the Demand of the Naphtha Market.

Naphtha demand is expected to rise due to increased trade activity by consumers in many regions. Technology advancements have led to improved distillation processes and the development of advanced furnace materials. Naphtha consumption is increasing due to the expansion of the chemical industry. Market drivers include the development of new markets and strategic partnerships that will increase market opportunities and increase naphtha market growth.

Latest Trends

Growing Of Petrochemical Industry Demand To Fuel The Market Growth.

Both light and heavy naphtha are used in many industries. Naphtha is the primary feedstock used in the petrochemical sector. About half of the naphtha produced is used by the petrochemical sector. The petrochemical sector uses about 50% of the produced naphtha for its production of aromatics and other olefins, including benzene, butadiene, and ethylene.

Because of its constant expansion, the industry is aggressive in ensuring that the naphtha market grows. Naphthalene rich in olefin is used primarily as a feedstock for low-cost, high-octane fuel diesel. Its consumption has increased in both developed and emerging economies due to a growing population and accelerated urbanization. Its production and demand are increasing in fast-growing countries like India, China.

Regional Analysis

North America Holds The Largest Market Share Globally.

The global naphtha market can be divided into North America and Europe, Asia Pacific, Latin America, Middle East & Africa, and Europe. The North America region is one of the largest producers of natural gas and oil. It is expected that the region will hold the largest share of the global oil well count. To meet the increasing demand for petrochemicals and other allied products, the region's petrochemical sector is expanding. In the next few years, the growth of the petrochemical sector is expected to increase the demand for naphtha.

Europe is a major producer of chemicals and allied products. In the next few years, the European chemical industry will continue to grow. The region of Latin America has a growing fertilizer industry. This has led to a rise in demand for naphtha feedstock. The growth of the Latin American fertilizer industry is expected to increase the growth rate of the naphtha marketplace over the forecast period.

The Asia Pacific region has a high potential for growth in the naphtha industry. Due to the high demand and low labor costs, countries such as India and China have seen steady growth in their agrochemical, paints & coatings, and petrochemical industries. These industries will increase the demand for naphtha in the Asia Pacific region, which is expected to lead to a rise in sales of raw materials. The Middle East and Africa have a moderately expanding chemical industry. This is why the forecast period will see steady growth in the demand for naphtha to be a feedstock.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

To increase the number of their product lines, naphtha market leaders are investing a lot in R&D. This will allow them to grow even further. Market players are also taking key market initiatives to expand their global footprint. These include new product launches, contract agreements, increased investments, and mergers and acquisitions. To survive and expand in a highly competitive market, naphtha industry competitors must provide cost-effective products.

Top Key Players in Naphtha Market

- Chevron Corporation

- Reliance Industries Limited

- Shell Chemicals

- SABIC

- BP PLC

- Exxon Mobil Corporation

- China Petrochemical Corporation

- Indian Oil Corporation Ltd

- Novatek

- Other Key Players

Recent Development

- PDV LLC, an oil and gas company based in Venezuela, announced plans to build smaller pipes to address the shortage of imported naphtha. This has led to delays in heavy crude exports and production.

- Naphtha, which was imported via ships from Russia to Venezuela in July 2019, was shipped to the Venezuelan company PDV LLC. To meet the country's gasoline demand, the export quantity of naphtha was approximately 330,000t

- The Indian Government reduced the customs duties on naphtha to 4% from 5% in July 2019. This is expected to increase India's demand for naphtha.

Report Scope:

Report Features Description Market Value (2022) USD 193.6 Bn Forecast Revenue (2032) USD 278.5 Bn CAGR (2023-2032) 3.8% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type: Light Naphtha, and Heavy Naphtha; End-User Industry: Petrochemical, Agriculture, Paints and Coatings, Aerospace, and Others End-User Industries. Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Chevron Corporation, Reliance Industries Limited, Shell Chemicals, SABIC, BP PLC, Exxon Mobil Corporation, China Petrochemical Corporation, Indian Oil Corporation Ltd, Novatek, and Other Key Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Chevron Corporation

- Reliance Industries Limited

- Shell Chemicals

- SABIC

- BP PLC

- Exxon Mobil Corporation

- China Petrochemical Corporation

- Indian Oil Corporation Ltd

- Novatek

- Other Key Players