Liquefied Petroleum Gas [LPG] Market Report By Source (Non-Associated Gas, Associated Gas, Refinery), By Application (Residential, Commercialt, Industrial, Transportation, Others), By Distribution Channel (Direct Sales, Distributor Sales, Online Sales)By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

-

9408

-

March 2024

-

154

-

-

This report was compiled by Correspondence Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Report Overview

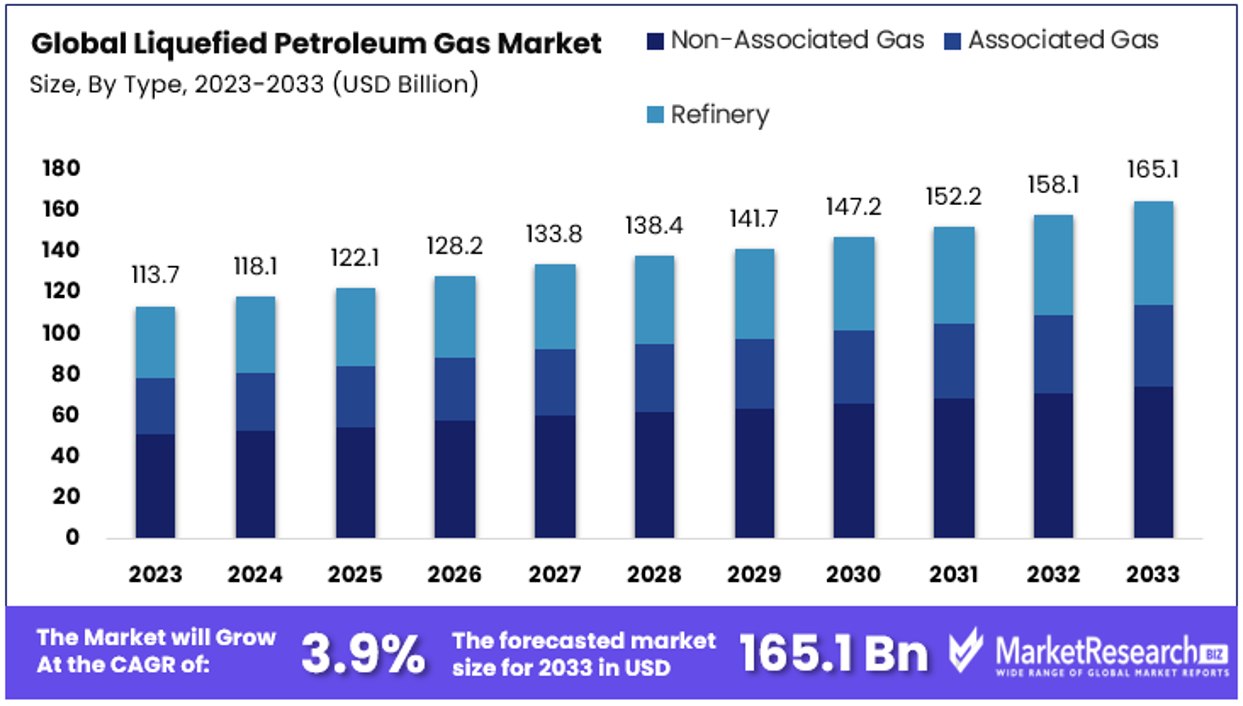

The Global Liquefied Petroleum Gas [LPG] Market size is expected to be worth around USD 165.1 Billion by 2033, from USD 113.7 Billion in 2023, growing at a CAGR of 3.90% during the forecast period from 2024 to 2033.

The surge in demand for the cleaner energy resources, rise in residential and commercial sectors and government initiatives are some of the main key driving factors for the LPG market. Liquefied petroleum gas which is commonly known as LPG is defined as a versatile and broadly used flammable hydrocarbon gas mixture.

It mainly consists of propane and butane; LPG is extracted from natural gas processing and petroleum refining. It is the main characteristics which has the potentiality to change from a gaseous state to a liquid form under moderate pressure, transportation, usage and facilitating storage.

Generally, LPG employs for different applications that comprises of heating, vehicle fuels, industrial processes and cooking. It is the clean burning feature that makes it an environmentally favorable energy sources by emitting less pollutants than many old fuels.

LPG is stored in pressurized containers and can be transported hassle-free by offering energy accessibility in both urban and remote areas. As an easy and effective energy solution, LPG plays an important role in multiple industries by providing a cleaner substitute to old fossil fuels and by contributing to sustainable energy practices.

According to an article published by Zawya in February 2024, highlights that emirates gas, a subsidiary of ENOC group has announced of 2 kg and 11 kg marine LPG composite cylinders that is the very first in the UAE will uplift the sailing and marine lifestyle experience. These cylinders have 75 mbar pressure relief valve which is designed with high quality of rubber diaphragm whereas, it also has premium LPG hose designed from robust mesh-rain forced rubber with 8 mm thickness that makes customer’s safety at sea.

Moreover, according to an article published by MSN in March 2024, highlights that PM Narendra Modi has introduced the 109 km long Muzzaffarpur- Motihari LPG pipeline of Indian Oil as he reveals developmental projects which values Rs. 12,800 crores at Bettiah in west Champaran in Bihar.

LPG holds a strong position in the market due to its versatility, environmental friendly that fulfils multiple requirements. Its role has widened to consisting of clean cooking, automotive fuel and heating. LPG is hassle-free, efficient and minimizes environmental hazard by contributing to sustainable energy practices that brings into line with global efforts towards a cleaner and greener future. The demand for the LPG will increase due to its high requirement in various diversified applications that will help in market expansion in the coming years.

Key Takeaways

- Market Value Projection: The Global LPG Market is forecasted to reach USD 165.1 Billion by 2033, witnessing growth from USD 113.7 Billion in 2023, with a CAGR of 3.90% during the forecast period from 2024 to 2033.

- Major Segments:

- Source: Non-Associated Gas dominates the LPG market, driven by increasing exploration and extraction activities in regions abundant with non-associated gas reserves.

- Application: Residential applications emerge as the dominant sector, fueled by the widespread use of LPG for cooking, heating, and other household purposes.

- Distribution Channel: Direct Sales is a prominent distribution channel, offering flexibility and personalized services. Distributor Sales play a crucial role in expanding market reach, especially in remote regions.

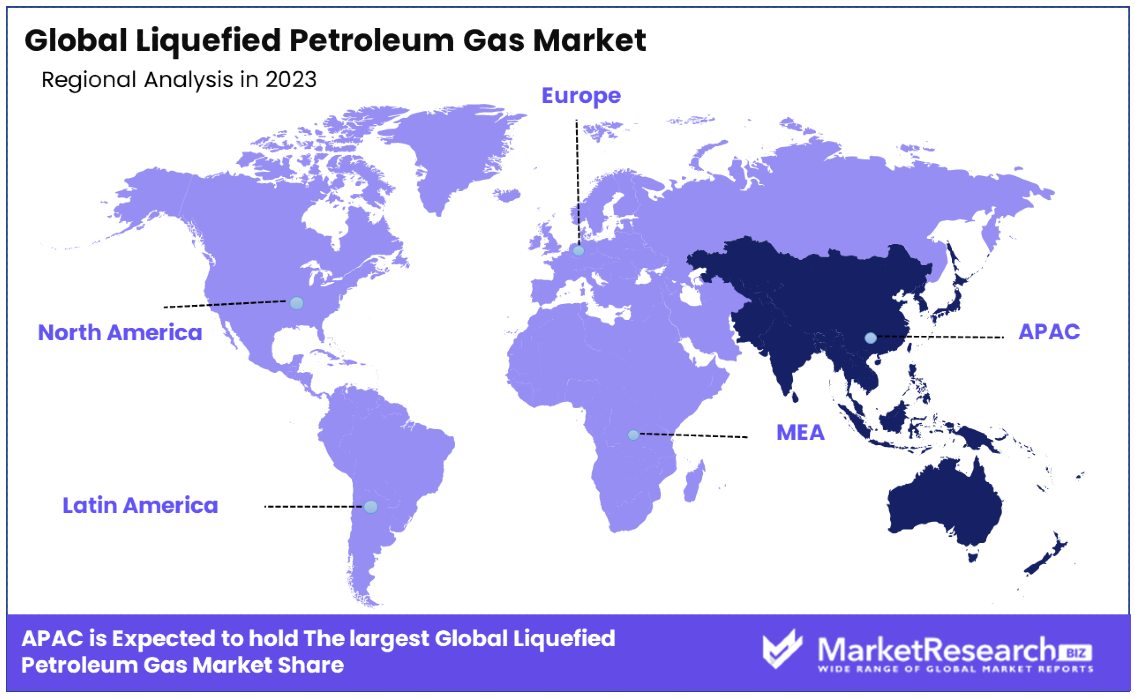

- Regional Dynamics: Asia Pacific dominates the market with a 42.7% market share in the LPG Market. The region's significant share is attributed to factors such as rapid urbanization, industrialization, and growing demand for energy.

- Analyst Viewpoint: Analysts anticipate steady growth opportunities in the LPG Market, driven by increasing energy demand, urbanization, and industrialization, particularly in emerging economies. Investments in infrastructure, technology, and distribution networks are expected to fuel market expansion further.

- Growth Opportunities: Opportunities lie in expanding LPG applications beyond traditional sectors, such as residential and commercial, into industrial, transportation, and emerging niche segments like off-grid energy solutions.

Driving Factors

Increasing Demand for Clean Energy Sources Drives LPG Market Growth

The global push towards clean energy, with investments set to reach USD 1.7 trillion in 2023, positions Liquefied Petroleum Gas (LPG) as a key player in the transition away from more pollutive fossil fuels. As a cleaner-burning option, LPG offers significant environmental benefits for residential, commercial, and industrial use, contributing to its growing demand.

Initiatives like India's Pradhan Mantri Ujjwala Yojana further amplify this trend by promoting LPG to improve indoor air quality and enhance public health. This shift towards cleaner energy sources is not only a response to environmental concerns but also aligns with policy-driven efforts worldwide to reduce carbon emissions, making LPG an increasingly preferred energy solution.

Growing Urbanization and Population Growth Fuel LPG Demand

Rapid urbanization and population surges, especially in emerging economies, are escalating the need for accessible and efficient energy sources such as LPG. With urban populations expanding, the demand for LPG for cooking, heating, and industrial applications has risen correspondingly.

As of 2021, the global electricity access rate has reached 91%, highlighting the pivotal role of fossil fuels, which account for 60% of worldwide electricity generation. China's urban growth exemplifies this dynamic, where increasing residential and commercial energy needs have significantly boosted LPG consumption, showcasing the direct correlation between urbanization, population growth, and the escalating demand for LPG.

Expanding Petrochemical Industry Propels LPG Usage

The expansion of the petrochemical industry, driven by the soaring demand for plastics, synthetic rubbers, and other derivatives, underscores the growing importance of LPG as a critical feedstock. This sector's robust growth, particularly in regions like the Middle East, has led to heightened LPG consumption to produce essential petrochemical products.

As the industry continues to evolve, the demand for LPG is expected to rise, reflecting its integral role in meeting the global demand for various petrochemicals. This trend not only highlights LPG's versatility and economic value but also its contribution to the broader petrochemical sector's expansion and innovation.

Restraining Factors

Price Volatility Restrains LPG Market Growth

The fluctuating prices of Liquefied Petroleum Gas (LPG), closely linked to the volatile crude oil market, present a significant challenge to its broader adoption. Factors such as geopolitical unrest, supply chain disruptions, and shifts in global economic conditions can lead to sharp price changes.

For instance, the 2022 surge in crude oil prices, exacerbated by the Russia-Ukraine conflict, directly impacted LPG affordability, making it less attractive compared to other more stable energy sources. This volatility can deter both residential and commercial consumers, as budgeting and financial planning become more complex, potentially limiting LPG's market growth and its appeal as a reliable energy solution.

Infrastructure Constraints Limit LPG Market Expansion

The expansion of the LPG market is significantly hampered by infrastructure challenges. Developing a comprehensive network for LPG storage, transportation, and distribution demands substantial investment, which can be particularly daunting for remote and underdeveloped regions.

These logistical and capital hurdles restrict LPG's accessibility and adoption, especially in areas that stand to benefit the most from its use. In several developing nations, the absence of efficient distribution systems and adequate storage facilities has impeded LPG's market penetration, especially in rural locales where it could serve as a vital clean energy source. This lack of infrastructure not only constrains the market's growth but also limits the potential environmental and health benefits LPG offers.

Source Analysis

In examining the Liquefied Petroleum Gas (LPG) market, it becomes apparent that the source of production plays a crucial role in shaping market dynamics. Among the primary sources, Non-Associated Gas stands out as the dominant contributor to the LPG supply chain. This dominance can be attributed to the increasing exploration and extraction activities in regions abundant with non-associated gas reserves.

The efficient extraction processes and favorable economics associated with non-associated gas extraction bolster its position in the market. Additionally, advancements in technology have facilitated the extraction of LPG from non-associated gas, further enhancing its dominance.

Meanwhile, Associated Gas and Refinery sources constitute the remaining sub-segments in the LPG market. Associated Gas, sourced as a byproduct of crude oil extraction, holds a significant but comparatively lesser share due to fluctuating crude oil prices and extraction complexities. Refinery-sourced LPG, extracted during the refining process of crude oil, maintains a steady but smaller share owing to limitations in production capacity and refining margins.

Application Analysis

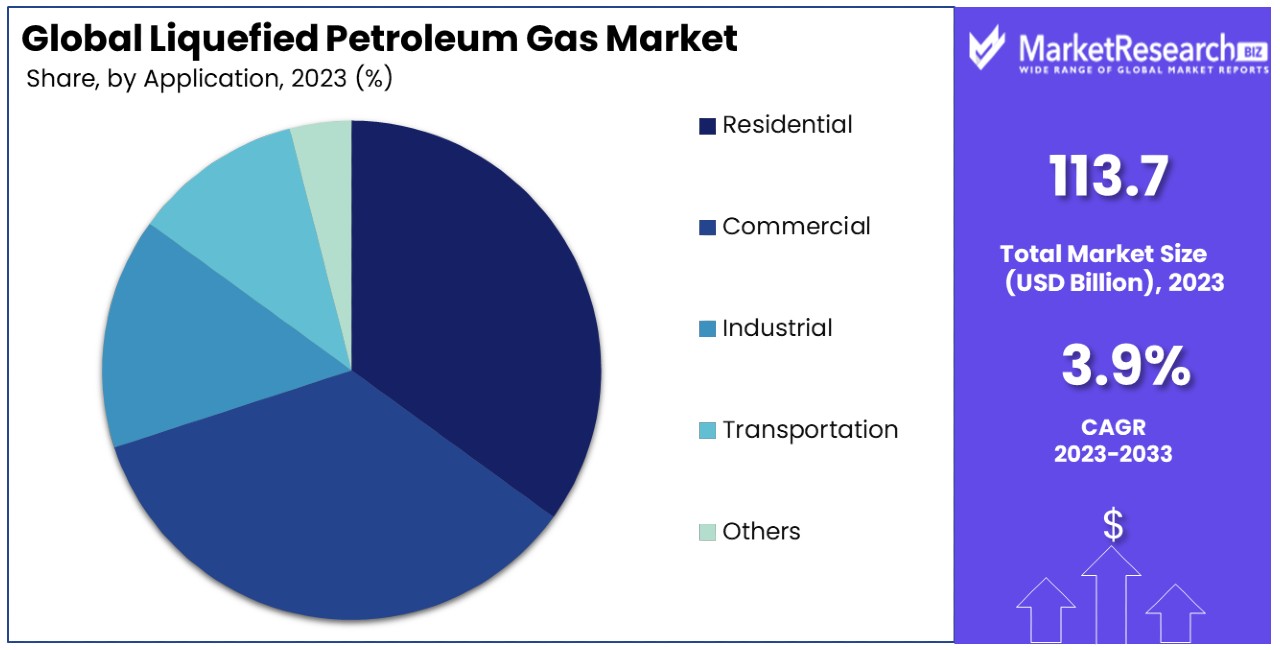

The analysis shifts towards the application segments within the LPG market. Among these segments, Residential emerges as the dominant sector, exerting a substantial influence on market dynamics. The dominance of residential applications can be attributed to the widespread use of LPG for cooking, heating, and other household purposes.

Factors such as convenience, affordability, and ease of access contribute to the steady growth of residential LPG consumption globally. Simultaneously, the Commercial segment also commands a significant market share, driven by the adoption of LPG in commercial establishments such as restaurants, hotels, and hospitals. The versatility of LPG applications in these settings, coupled with its cost-effectiveness and environmental advantages, fuels the growth of the commercial segment.

Meanwhile, Industrial, Transportation, and Other applications represent niche segments within the LPG market, each contributing to market expansion in specific contexts. Industrial applications leverage LPG for various processes such as manufacturing, power generation, and chemical production, albeit with a smaller market share compared to residential and commercial sectors.

Similarly, the Transportation segment utilizes LPG predominantly in fleet vehicles and niche transport modes, while Other applications encompass diverse sectors like agriculture, recreation, and off-grid energy solutions, each contributing marginally to overall market growth.

Distribution Channel Analysis

An examination of distribution channels sheds light on the mechanisms through which LPG reaches end consumers. Direct Sales emerges as a prominent distribution channel, facilitating direct transactions between LPG suppliers and end-users. This channel offers flexibility, personalized services, and direct communication, catering effectively to the diverse needs of consumers.

Meanwhile, Distributor Sales play a crucial role in expanding market reach, especially in remote and underserved regions where direct access may be limited. Distributors serve as intermediaries, aggregating LPG supply from various sources and distributing it to retailers and consumers efficiently.

Additionally, the advent of Online Sales channels introduces a new dimension to LPG distribution, offering convenience, accessibility, and real-time transactions to consumers. While still in its nascent stage, online sales are poised for significant growth, driven by technological advancements, changing consumer preferences, and the shift towards digital commerce platforms.

Key Market Segments

By Source

- Non-Associated Gas

- Associated Gas

- Refinery

By Application

- Residential

- Commercial

- Industrial

- Transportation

- Others

By Distribution Channel

- Direct Sales

- Distributor Sales

- Online Sales

Growth Opportunities

Adoption in Industrial and Commercial Sectors Offers Growth Opportunity

The industrial and commercial sectors present substantial growth opportunities for the LPG market, driven by the sectors' diverse energy needs. LPG's clean-burning nature, efficiency, and versatility make it an attractive choice for heating, cooking, and powering equipment across manufacturing, hospitality, and agriculture.

For instance, the food processing industry has increasingly turned to LPG-powered equipment for its cost-effectiveness and minimal environmental impact. As businesses seek to mitigate rising energy costs and address environmental concerns, LPG stands out as a reliable energy source. This trend towards LPG adoption in industrial and commercial settings highlights its potential for market expansion, catering to a broad range of consumer pain points.

Development of LPG-powered Vehicles Offers Growth Opportunity

The shift towards alternative fuels in the transportation sector, motivated by the urgent need to reduce greenhouse gas emissions, positions LPG as a promising automotive fuel. The rise in fuel costs and growing environmental awareness among consumers have spurred interest in more economical and cleaner transportation options.

LPG-powered vehicles, offering lower emissions and cost savings, align with these consumer priorities. In Turkey, for example, government policies and incentives supporting LPG use in vehicles have led to a significant uptake, demonstrating LPG's potential in transforming transportation. This development signals a considerable growth opportunity for the LPG market, tapping into the demand for sustainable and efficient fuel alternatives.

Trending Factors

Technological Advancements in LPG Infrastructure Are Trending Factors

Technological innovations in the infrastructure of Liquefied Petroleum Gas (LPG) are setting new trends within the market. These advancements address key consumer concerns regarding safety, distribution efficiency, and operational costs.

For example, the introduction of composite LPG cylinders, which are safer and have a longer lifespan than traditional steel cylinders, has made LPG more accessible and appealing to both residential and commercial users. Improved technologies in storage, transportation, and distribution have enhanced the overall efficiency and safety of LPG, making it a more competitive energy source. These trends are vital in driving the adoption of LPG, as they significantly mitigate previous barriers related to safety and cost.

Integration of LPG with Renewable Energy Systems Are Trending Factors

The integration of Liquefied Petroleum Gas (LPG) with renewable energy systems like solar and wind power marks a significant trend in the energy sector. This synergy aims to overcome the intermittency challenges of renewable sources and provide a reliable energy supply, especially in regions with limited grid connectivity.

Hybrid systems that combine renewable energy installations with LPG-powered generators exemplify this trend, offering a consistent and dependable energy solution for remote residential and commercial applications. The move towards such integrated systems addresses consumer pain points related to the reliability and storage of renewable energy, showcasing LPG's role as a versatile and adaptable energy solution in a progressively renewable-focused market landscape.

Regional Analysis

Asia Pacific Dominates with 42.7% Market Share

The Asia Pacific region's significant market share in the LPG industry can be attributed to its vast population, rapid urbanization, and escalating energy needs. High demand from residential sectors for cooking and heating, coupled with industrial applications in manufacturing and agriculture, drives LPG consumption. Additionally, government initiatives to promote clean energy use over traditional biomass and coal have spurred LPG adoption.

Asia Pacific's diverse economic landscape features both developed and emerging economies, contributing to varied LPG demand across the region. Investments in infrastructure, such as storage facilities and distribution networks, further facilitate LPG access and use. The region's commitment to reducing carbon emissions and improving air quality also supports the shift towards LPG.

Given the ongoing trends, the Asia Pacific's dominance in the LPG market is expected to continue. The region's focus on sustainable development and energy security, along with infrastructural improvements, will likely enhance LPG's role as a primary energy source. As more countries within this region invest in LPG infrastructure and technology, its market share could expand further, influencing global LPG dynamics.

Regional Market Shares:

- North America: The market share or growth rate in North America reflects the region's mature LPG market, driven by steady demand in residential heating and as a petrochemical feedstock.

- Europe: Europe's LPG market share is influenced by environmental policies and the adoption of LPG in automotive fuels, besides its traditional uses.

- Asia Pacific: As discussed, this region's large population and energy transition efforts significantly contribute to its dominant market share.

- Middle East & Africa: The LPG market here benefits from the region's abundant natural gas resources, supporting both domestic consumption and exports.

- Latin America: Growth in Latin America's LPG market is propelled by expanding urbanization and government initiatives to replace traditional fuel sources with LPG for household use.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

In the Liquefied Petroleum Gas (LPG) Market, several key players exert significant influence and strategic positioning, shaping the competitive landscape and driving market dynamics. These players, through their extensive operations and market presence, play pivotal roles in meeting energy demand, especially in residential applications and industrial sectors, while also contributing to the transition towards clean fuel and green energy sources.

Market Size & Strategic Positioning:

Among the key players, Exxon Mobil Corporation, Saudi Arabian Oil Co. (Saudi Aramco), and Petroliam Nasional Berhad (PETRONAS) stand out due to their extensive global presence and substantial investments in LPG production and distribution infrastructure. With their vast resources and operational expertise, these companies hold considerable market share and wield significant influence over market trends and dynamics.Joint Ventures & Market Expansion:

Several players, including Chevron Corporation, bp p.l.c., and China Petroleum & Chemical Corporation (Sinopec), have engaged in strategic joint ventures and partnerships to expand their foothold in the LPG market. These collaborations enable access to new markets, technology sharing, and synergies in distribution networks, thereby strengthening their competitive positioning and market reach.Competitive Landscape & Market Influence:

Bharat Petroleum Corporation Limited, Reliance Industries Limited, and China Gas Holdings Ltd. are prominent players within their respective regions, contributing to the competitive landscape and influencing market dynamics. Through their strong distribution networks and customer-centric strategies, these companies play vital roles in catering to the growing demand for LPG, particularly in residential applications and clean cooking initiatives.Clean Fuel Transition & Sustainability:

As the world increasingly emphasizes the transition towards clean energy sources, companies like Origin Energy Limited and Qatargas Operating Company Limited play significant roles in promoting LPG as a cleaner alternative to traditional fuels. Their efforts in promoting LPG for water heating, cooking, and industrial applications align with sustainability goals, driving the adoption of LPG as a viable green energy solution.Overall, these key players collectively shape the LPG market landscape, driving innovation, market expansion, and sustainability initiatives. With their combined efforts, they contribute to meeting the rising energy demand while advancing the transition towards cleaner, more sustainable fuel sources.

Market Key Players

- Exxon Mobil Corporation

- Bharat Petroleum Corporation Limited

- Chevron Corporation

- China Gas Holdings Ltd.

- FLAGA Gmbh

- JGC HOLDINGS CORPORATION

- Saudi Arabian Oil Co.

- Phillips 66 Company

- Petroliam Nasional Berhad

- Reliance Industries Limited

- China Petroleum & Chemical Corporation

- Abu Dhabi National Oil Company

- bp p.l.c.

- KBR Inc.

- Origin Energy Limited

- Qatargas Operating Company Limited

- PetroChina Company Limited

- Petredec Pte Limited

Recent Developments

- On March 2024, NYK and Astomos Energy held a naming ceremony at the Sakaide Works of Kawasaki Heavy Industries to christen their new jointly-owned dual-fuel LPG carrier, named Gas Garnet.

- On February 2024, Snapper Creek Energy announced the launch of its Physical Liquified Petroleum Gas (LPG) brokerage desk, marking a significant step in the company's expansion into the LPG market.

- On December 2023, Perenco Oil & Gas Gabon (POGG) officially opened its Batanga Liquefied Petroleum Gas (LPG) plant in Gabon as part of a $50 million major gas development project.

Report Scope

Report Features Description Market Value (2023) USD 113.7 Billion Forecast Revenue (2033) USD 165.1 Billion CAGR (2024-2033) 3.90% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Source (Non-Associated Gas, Associated Gas, Refinery), By Application (Residential, Commercialt, Industrial, Transportation, Others), By Distribution Channel (Direct Sales, Distributor Sales, Online Sales) Regional Analysis North America - The US, Canada, & Mexico; Western Europe - Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe - Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC - China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America - Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa - Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Exxon Mobil Corporation, Bharat Petroleum Corporation Limited, Chevron Corporation, China Gas Holdings Ltd., FLAGA Gmbh, JGC HOLDINGS CORPORATION, Saudi Arabian Oil Co., Phillips 66 Company, Petroliam Nasional Berhad, Reliance Industries Limited, China Petroleum & Chemical Corporation, Abu Dhabi National Oil Company, bp p.l.c., KBR Inc., Origin Energy Limited, Qatargas Operating Company Limited, PetroChina Company Limited, Petredec Pte Limited Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Chevron Corporation

- British Petroleum Plc

- Petroleum National BHD

- China Petroleum & Chemical Corporation

- Royal Dutch Shell plc

- Exxon Mobil Corporation

- China National Petroleum Corporation

- Phillips 66 Company

- Valero Energy Corporation

- Origin Energy Limited