Microcontroller Socket Market Report By Product (DIP , SOIC , SOP , BGA , QFP), By Application (Industrial , Consumer Electronics , Medical Devices , Automotive , Military & Defense), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

-

21453

-

April 2024

-

280

-

-

This report was compiled by Vishwa Gaul Vishwa is an experienced market research and consulting professional with over 8 years of expertise in the ICT industry, contributing to over 700 reports across telecommunications, software, hardware, and digital solutions. Correspondence Team Lead- ICT Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

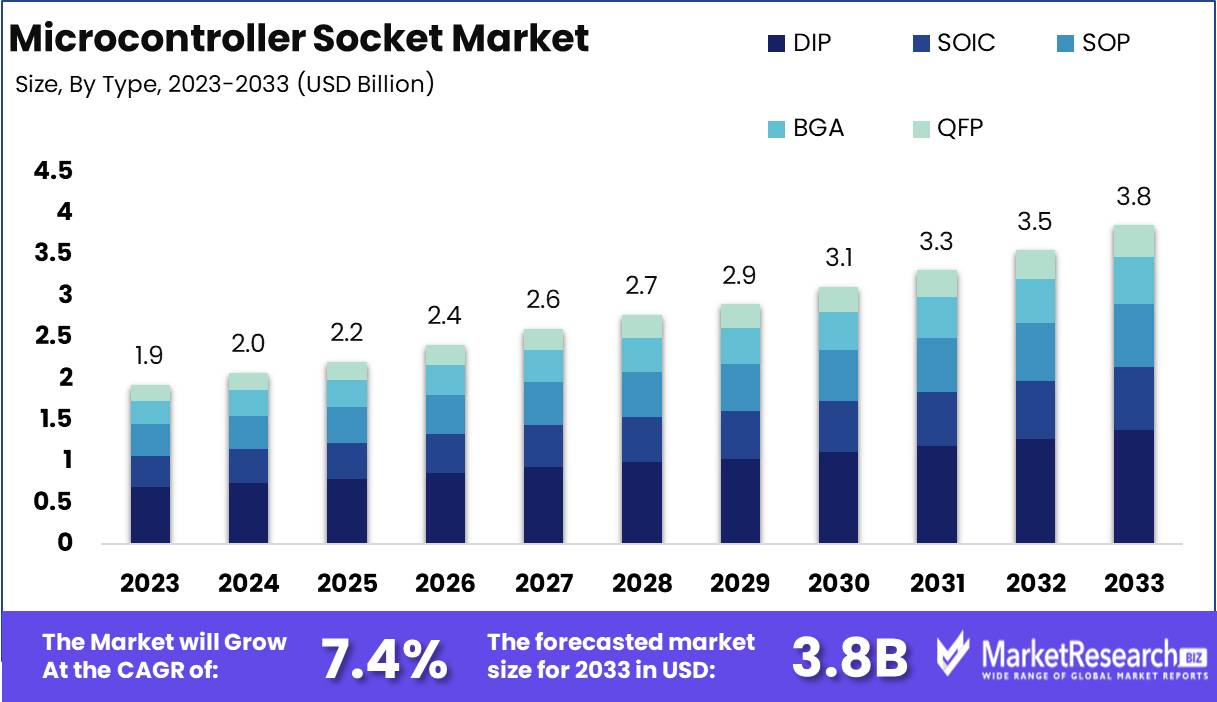

The Global Microcontroller Socket Market size is expected to be worth around USD 3.8 Billion by 2033, from USD 1.9 Billion in 2023, growing at a CAGR of 7.40% during the forecast period from 2024 to 2033.

The surge in demand for microcontroller usage in communication, automation, automobile, and industrial market segments are some of the main driving factors for the microcontroller socket market.

Microcontroller sockets are integrated circuit sockets that are fixed connectors designed for low-voltage power equipment. It has been classified into five main categories: dual in-line package, ball grid array, small outline package, quad flat package, and small outline integrated circuit package. These are some of the standard product types.

Among these, ball grid array has been acknowledged as a fast-growing product segment with significant revenue generation in the last few years. These microcontrollers are embedded in the electronic devices and regulate various types of operations that are executed by the devices. The advanced technology has helped in the easy, hassle-free management of the electronic equipment.

Microcontroller sockets are generally used to carefully insert and remove integrated circuit chips that may get damaged from welding. These sockets also provide various advantages, like low power usage, minimal data bandwidth, lightness, vulnerability, and high-end user interface support.

Due to product assumptions in the automotive sector, the microcontroller socket has been boosted. The rise in demand for smart metering and power line communications with great precision is helping to enhance the performance of the meters, which also helps in the market expansion of microcontroller sockets.

Manufacturers are focusing more on designing and producing powertrain applications, which can positively impact the package market sector. These producers are also aiming to create new designs for interconnecting solutions for good pitch, high I/O, minimal profile applications, and achieving severe control over dependability and performance.

The surge in IC packaging developments that provide a fin application at an optimal low price, low profile, and low design has led to the expansion of ICs. OEMs, system developers, packaging and test sub-contractors, and chip producers are retaining high-end risk and high-stakes bets on the upcoming generation of packaging solutions that enable faster, better, and more economical results than the progression in wafer processing.

The demand for the microcontroller socket will increase due to its high-end demand in the automobile and other industrial sectors, which will help in market expansion in the coming years.

Key Takeaways

- Market Value: The Global Microcontroller Socket Market is projected to reach approximately USD 3.8 Billion by 2033, showing substantial growth from USD 1.9 Billion in 2023, with a CAGR of 7.40% during the forecast period from 2024 to 2033.

- Dominant Segments:

- Product Segment Analysis: DIP (Dual In-line Package) emerges as the dominant sub-segment, holding a 36% market share. However, as technology advances towards miniaturization, the demand for more compact and high-performance sockets like SOIC, SOP, BGA, and QFP is increasing.

- Application Segment Analysis: The Industrial segment dominates with a 30% market share, driven by rapid adoption of automation technologies and IoT integration. Other significant segments include Consumer Electronics, Medical Devices, Automotive, and Military & Defense.

- Regional Insights:

- APAC: Dominates the market with a 36% share, driven by robust industrial growth and technological advancements.

- North America: Holds approximately 25% market share, fueled by advancements in automotive and consumer electronics sectors, alongside significant investments in IoT technologies.

- Analyst Viewpoint: Analysts anticipate continued growth in the microcontroller socket market, driven by advancements in technology, increasing demand for miniaturized and high-performance electronic devices, and the widespread adoption of automation and IoT technologies across various industries.

- Growth Opportunities:

- Miniaturization and High-Performance: Developing compact and high-performance socket solutions to meet the increasing demand for miniaturized electronic devices.

- IoT Integration: Capitalizing on the growing adoption of IoT technologies by offering sockets optimized for IoT devices, sensors, and smart systems.

- Industrial Automation: Expanding product offerings tailored for industrial automation applications, including robotics, control systems, and monitoring devices.

Driving Factors

Increasing Demand for IoT and Connected Devices Drives Market Growth

The surge in the Internet of Things (IoT) and connected devices has significantly contributed to the expansion of the Microcontroller Socket Market. This trend is evident across several industries, such as consumer electronics, automotive, healthcare, and industrial automation, which are increasingly incorporating IoT solutions to enhance operational efficiency, safety, and consumer experience. As these sectors strive for innovation, the demand for microcontroller sockets has escalated, given their crucial role in enabling the integration of microcontrollers.

These sockets are instrumental in facilitating efficient data processing, communication, and control within IoT devices, thereby underpinning the functionality of smart home systems, wearable technology, and industrial automation equipment. According to recent market analysis, the IoT devices market is expected to grow at a CAGR of over 25% through the next five years, directly influencing the microcontroller socket market by increasing the demand for these components. This growth is supported by advancements in connectivity technologies and the increasing adoption of smart devices among consumers and industries alike.

Advancements in Embedded Systems and Edge Computing Elevate Market Prospects

The microcontroller socket market is witnessing substantial growth, driven by the advancements in embedded systems and the burgeoning field of edge computing. These technologies require robust and efficient microcontroller integration, facilitated by advanced sockets that support high-performance and low-power consumption. In sectors like automotive, where real-time data processing is vital for functions such as advanced driver assistance systems (ADAS) and engine control units (ECUs), microcontroller sockets are indispensable.

They enable the deployment of complex embedded systems that can process data locally, reducing latency, and enhancing the responsiveness of edge computing applications. The global edge computing market, projected to expand at a CAGR of approximately 37% from 2023 to 2033, underscores the pivotal role of microcontroller sockets in supporting the growth of edge computing and embedded systems. This trend is reflective of the market's shift towards more decentralized computing models, where processing occurs closer to the data source, thereby necessitating the need for efficient microcontroller sockets.

Miniaturization and Portability Requirements Shape Market Dynamics

The demand for compact and portable electronic devices has significantly influenced the microcontroller socket market. As consumer preferences evolve towards sleeker, more portable devices, the need for microcontroller sockets that can accommodate these design constraints has intensified. This is particularly relevant in the medical devices sector, where portability can enhance patient mobility and comfort, and in consumer electronics, where space-saving designs are increasingly favored.

The trend towards miniaturization challenges manufacturers to develop microcontroller sockets that are not only small in size but also offer high performance and reliability. This requirement has catalyzed innovations in socket design and materials, leading to the development of products that meet the industry's stringent size and functionality criteria. The proliferation of wearable technology, expected to witness a CAGR of over 15% in the coming years, exemplifies the industry's shift towards smaller, more efficient devices and underscores the critical role of microcontroller sockets in facilitating this trend.

Restraining Factors

Compatibility Issues and Design Constraints Restrains Market Growth

Microcontroller sockets are designed to fit specific microcontroller packages and must align with the printed circuit board (PCB) designs they are used with. This specificity can lead to compatibility challenges and design constraints, creating hurdles in the seamless integration of these sockets across diverse applications. The requirement for precise compatibility restricts the universal applicability of microcontroller sockets, making it harder for manufacturers to produce universally adaptable sockets.

This limitation not only complicates the design process but also restricts the market's ability to cater to a broad range of industries and technological needs. As a result, the growth potential of the Microcontroller Socket Market can be significantly hampered, especially in sectors rapidly evolving towards customized and advanced technological solutions. The absence of a one-size-fits-all solution necessitates additional research and development efforts, increasing costs and time to market for new products.

Technical Complexity and Skill Requirements Restrains Market Growth

The design and manufacturing of microcontroller sockets encompass a high level of technical complexity, requiring specialized skills and expertise. This factor becomes a significant restraint in regions where there is a scarcity of skilled labor or inadequate educational resources focusing on electronics and microcontroller technologies. The necessity for a highly skilled workforce implies additional challenges in terms of training and development, potentially leading to higher labor costs and longer development cycles.

Moreover, the rapid pace of technological advancements in the field adds another layer of complexity, as professionals must continuously update their skills to remain relevant. This situation could limit the capacity of manufacturers to scale up production or innovate, thereby restraining the market growth. The skill gap also represents a barrier to entry for new firms, further limiting the expansion of the Microcontroller Socket Market in less developed markets where access to skilled personnel is more constrained.

Product Segment Analysis

DIP Leads Microcontroller Socket Market with 36% Share, While Advanced Sockets Gain Traction in High-Performance Applications

The Microcontroller Socket Market is segmented by product into several categories, including DIP (Dual In-line Package), SOIC (Small Outline Integrated Circuit), SOP (Small Outline Package), BGA (Ball Grid Array), and QFP (Quad Flat Package). Each of these segments caters to different requirements based on the electronic device's complexity, space availability, and performance needs.

DIP, holding a 36% share, emerges as the dominant sub-segment within the product category. This predominance can be attributed to the DIP's ease of use, including the simplicity of soldering and desoldering, which makes it highly favored for prototyping and small-scale production environments. DIP sockets are commonly used in consumer electronics, educational kits, and initial design stages of product development due to their cost-effectiveness and straightforward integration with standard breadboards.

However, as technology advances towards miniaturization, the demand for more compact and high-performance sockets like SOIC, SOP, BGA, and QFP increases. These sub-segments cater to applications requiring higher pin densities and reduced form factors, such as mobile devices, advanced automotive electronics, and sophisticated industrial machinery.

While DIP maintains its stronghold in specific sectors, the growing need for smaller, more efficient devices drives the demand for other socket types. SOIC and SOP offer solutions for applications demanding compactness without significantly compromising performance, making them suitable for medium-density devices. Meanwhile, BGA and QFP are preferred for high-density, high-performance applications, underscoring their importance in advanced consumer electronics, automotive systems, and industrial automation.

Application Segment Analysis

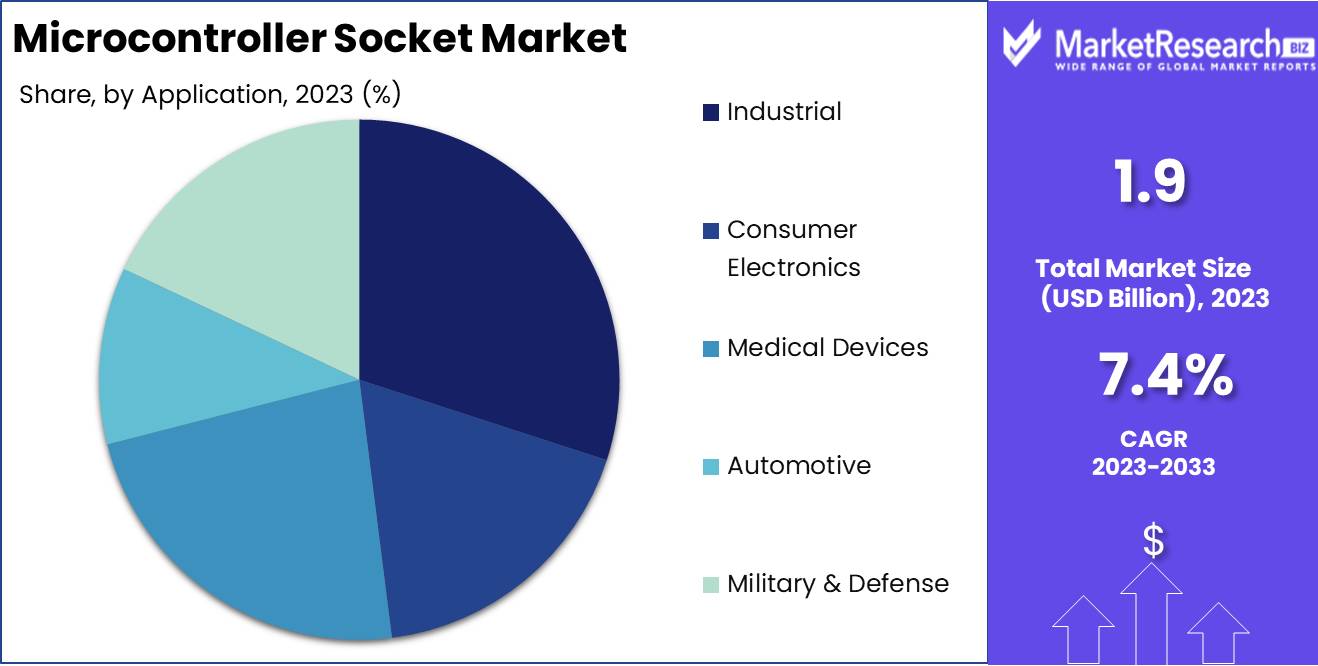

Industrial Applications Dominate Microcontroller Socket Market with 30% Share, Driven by Automation and IoT Integration

In the application segment analysis of the Microcontroller Socket Market, the categories include Industrial, Consumer Electronics, Medical Devices, Automotive, and Military & Defense. Each segment demonstrates unique growth drivers, technological advancements, and application-specific demands that shape the market dynamics.

The Industrial segment, with a 30% market share, stands out as the dominant sub-segment. This dominance is largely due to the industrial sector's rapid adoption of automation technologies, IoT integration, and the need for robust, reliable control systems in manufacturing environments. Microcontroller sockets play a critical role in facilitating the development and maintenance of industrial machinery, control systems, and monitoring devices, where durability and precision are paramount. The versatility of microcontroller sockets enables their application across a wide range of industrial equipment, contributing to increased efficiency, predictive maintenance capabilities, and higher productivity levels.

While the Industrial segment captures the largest share, other application areas like Consumer Electronics, Medical Devices, Automotive, and Military & Defense also contribute significantly to the market's growth. Consumer electronics demand compact, high-performance sockets for devices such as smartphones, tablets, and wearables, driving advancements in socket technologies like SOIC, SOP, BGA, and QFP. The Medical Devices segment relies on microcontroller sockets for a variety of applications, including portable monitoring equipment and diagnostic devices, where reliability and precision are critical.

In the Automotive sector, the increasing incorporation of electronic systems for safety, entertainment, and vehicle management spurs demand for microcontroller sockets, especially in electric and autonomous vehicles. Lastly, the Military & Defense segment requires rugged, reliable sockets for equipment operating in extreme conditions, emphasizing durability and performance.

Key Market Segments

By Product

- DIP

- SOIC

- SOP

- BGA

- QFP

By Application

- Industrial

- Consumer Electronics

- Medical Devices

- Automotive

- Military & Defense

Growth Opportunities

Expansion in Smart Home Applications Offers Growth Opportunity

The smart home market is rapidly expanding, with consumers increasingly embracing connected devices for enhanced convenience, safety, and energy efficiency in their homes. This shift towards intelligent living environments has elevated the demand for microcontroller sockets, which are pivotal in enabling seamless communication and control among various smart devices. Microcontroller sockets facilitate the integration of advanced functionalities in devices like thermostats, security cameras, and automated lighting systems, making them smarter and more responsive to user needs.

The growth of the smart home market, projected to reach $701.7 billion by 2033, signifies a substantial opportunity for microcontroller socket manufacturers. By focusing on the development of sockets that support the complex requirements of smart home applications, manufacturers can tap into this burgeoning market, catering to the increasing consumer demand for interconnected and automated home ecosystems.

Growing Automotive Electronics Offers Growth Opportunity

The automotive sector's evolution towards more electronic and connected vehicles presents a significant growth opportunity for the Microcontroller Socket Market. The rise of electric vehicles (EVs), autonomous driving technologies, and sophisticated in-car infotainment systems necessitates the use of microcontroller sockets to facilitate the integration and control of various electronic modules. These sockets are crucial for the functionality of engine control units (ECUs), advanced driver-assistance systems (ADAS), and multimedia interfaces, ensuring reliable operation and connectivity.

With the automotive electronics market expected to exceed $392 billion by 2026, the demand for microcontroller sockets in this domain is set to increase markedly. This trend offers microcontroller socket manufacturers the chance to expand their product offerings and innovation capabilities, specifically targeting the automotive industry's needs. As vehicle electrification and digitalization continue to advance, the role of microcontroller sockets as enablers of automotive innovation and connectivity becomes increasingly pivotal, highlighting a clear path for market growth and expansion.

Trending Factors

Miniaturization and Integration Are Trending Factors

The microcontroller socket market is experiencing a significant trend towards the miniaturization and integration of electronic components. This movement is primarily driven by the consumer demand for devices that are not only smaller and lighter but also packed with advanced features. As electronic devices such as smartphones, IoT gadgets, and wearables become more compact, the need for microcontroller sockets that can accommodate this shift towards miniaturization grows.

Manufacturers are responding by developing sockets that are not only smaller in size but also offer high levels of integration. For instance, the use of flip-chip technology allows for a higher density of connections within a smaller footprint, catering to the space and performance requirements of modern electronics. This trend highlights the market's adaptation to evolving consumer preferences and technological advancements, positioning miniaturization and integration as key drivers of innovation and market growth.

Adoption of High-Speed Interfaces Are Trending Factors

As electronic devices increasingly require high-speed data transmission, the microcontroller socket market is seeing a growing demand for sockets that support advanced data interfaces such as USB, HDMI, and PCIe. This demand is fueled by consumer expectations for devices that offer seamless connectivity and rapid data transfer, essential for applications ranging from gaming to high-performance computing.

The market is trending towards the adoption of microcontroller sockets that can provide enhanced signal integrity and bandwidth to support these high-speed interfaces. For example, in gaming consoles and computing systems, there is a noticeable trend towards microcontroller sockets equipped with PCIe Gen4 or Gen5 interfaces, addressing the needs of bandwidth-intensive applications. This shift underscores the industry's response to the increasing demand for faster and more efficient data communication, making the adoption of high-speed interfaces a prominent trend in the microcontroller socket market.

Regional Analysis

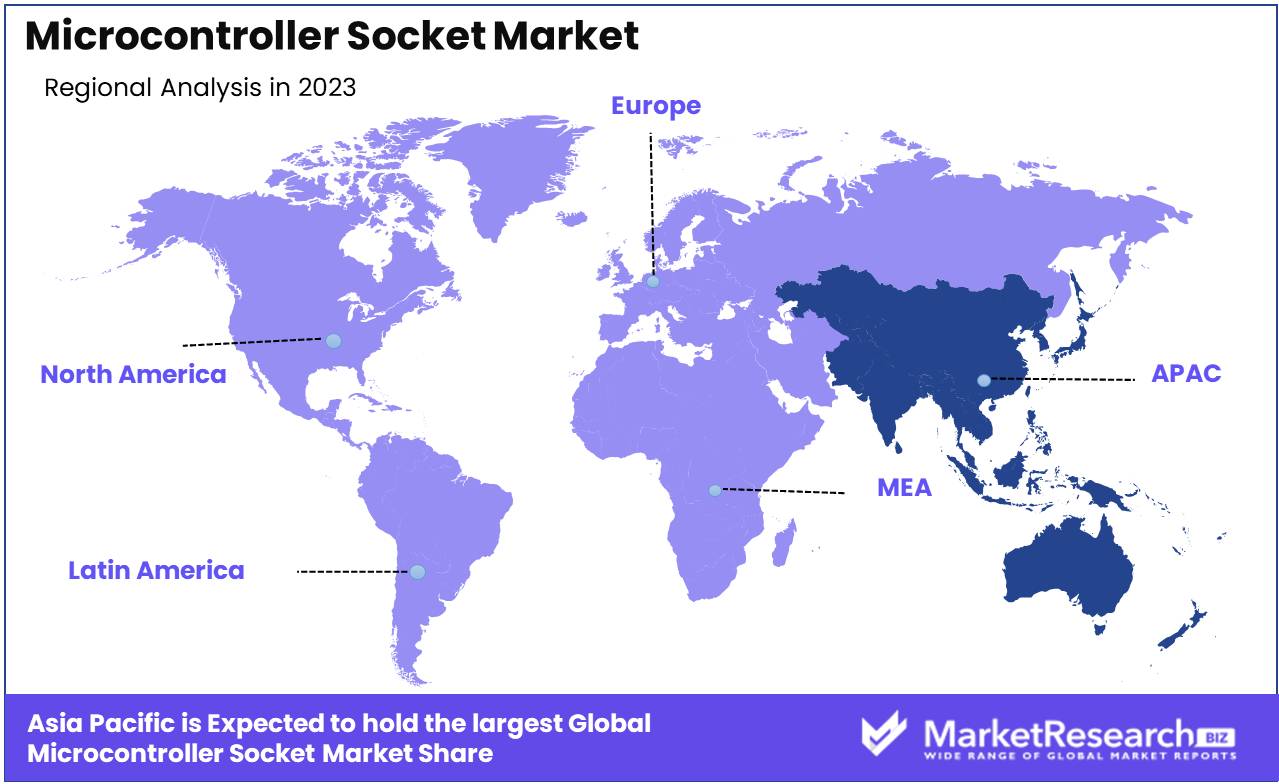

APAC Dominates with 36% Market Share

The Asia Pacific (APAC) region holds a commanding 36% share of the Microcontroller Socket Market, standing as the dominant force due to several compelling factors. This prominence is primarily attributed to the region's extensive manufacturing base, particularly in countries like China, South Korea, and Taiwan, which are pivotal in the electronics industry. The APAC region benefits from the combination of high technological adoption rates, significant investments in IoT and automation across industries, and a robust presence of leading electronics manufacturers. These elements contribute to a high demand for microcontroller sockets, essential for a myriad of applications from consumer electronics to automotive and industrial automation.

Regional characteristics such as a vast consumer market, rapid urbanization, and governmental support for technology advancements further bolster the APAC market's dynamics. This environment fosters innovation and drives the development of advanced microcontroller socket technologies to meet the region's growing demands.

APAC region's influence on the Microcontroller Socket Market is expected to continue growing. Factors like increasing digitization, the expansion of smart cities, and the push towards electric vehicles are poised to further drive demand for microcontroller sockets, suggesting a future where APAC not only maintains but potentially increases its market share dominance.

Regional Market Shares and Dynamics:

- North America: Holding approximately 25% market share, North America's robust growth is fueled by advancements in automotive and consumer electronics sectors, alongside significant investments in IoT technologies.

- Europe: Europe accounts for about 20% of the market share, driven by strong automotive manufacturing, increased adoption of smart home technologies, and substantial investments in industrial automation.

- Middle East & Africa: The region captures around 10% of the market, with growth attributed to increasing infrastructure development, growing consumer electronics market, and initiatives in smart city projects.

- Latin America: Holding close to 9% market share, Latin America's market is expanding due to rising consumer demand for electronic devices and growing investments in automotive and industrial sectors.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The Microcontroller Socket Market is propelled by the robust presence and strategic positioning of key players such as Aries Electronics Inc., Loranger International Corporation, and Foxconn Technology Group. These industry giants wield significant influence due to their extensive product portfolios and global reach.

Chupond Precision Co. Ltd., Enplas Corporation, and Mill-Max Mfg. Corp. also play pivotal roles, offering specialized solutions that cater to diverse market segments. Their innovative approaches contribute to market expansion and technological advancement.

WELLS-CTI Inc., Molex Inc., and Plastronics Socket Company Inc. exhibit strong market presence, leveraging their expertise to address evolving customer needs and maintain competitive edge.

Yamaichi Electronics Co. Ltd., Tyco Electronics Ltd., and Johnstech International Corporation are recognized for their reliability and quality standards, positioning them as preferred partners for microcontroller socket solutions.

Additionally, the contributions of 3M Company, CNC Tech LLC, and Socionext America Inc. cannot be overlooked, as they continuously drive innovation and efficiency in the microcontroller socket market.

Texas Instruments Inc. and Sensata Technologies B.V. round out the key players, capitalizing on their technological prowess and market insight to shape industry trends and standards. Their strategic initiatives and market influence propel the growth trajectory of the microcontroller socket market.

Market Key Players

- Aries Electronics Inc.

- Loranger International Corporation

- Foxconn Technology Group

- Chupond Precision Co. Ltd.

- Enplas Corporation

- Mill-Max Mfg. Corp.

- WELLS-CTI Inc.

- Molex Inc.

- Plastronics Socket Company Inc.

- Yamaichi Electronics Co. Ltd.

- Tyco Electronics Ltd.

- Johnstech International Corporation

- 3M Company

- CNC Tech LLC

- Socionext America Inc.

- Texas Instruments Inc.

- Sensata Technologies B.V.

Recent Developments

- On April 2, 2024, Signaloid introduced its Tiny FPGA Development Board, the Signaloid C0-microSD, which is the size of a microSD card. This innovative board contains an iCE40 FPGA and runs custom designs or a Signaloid C0 RISC V-based core for processing data uncertainty.

- On April 11, 2024, MIKROE announced that 500 development boards incorporating the mikroBUS socket are now available from top semiconductor makers. This development allows any of MIKROE's 1600+ compact Click peripheral boards to be used on the development board, significantly reducing embedded development time and prototyping.

- On March 25, 2024, Ryan Murphy's line-power smart thermostats expand off-the-shelf sockets for home assistant heating. These smart thermostats are available in rotary encoder or six-button variants, using ESPHome to integrate with Home Assistant.

Report Scope

Report Features Description Market Value (2023) USD 1.9 Billion Forecast Revenue (2033) USD 3.8 Billion CAGR (2024-2033) 7.40% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (DIP , SOIC , SOP , BGA , QFP), By Application (Industrial , Consumer Electronics , Medical Devices , Automotive , Military & Defense) Regional Analysis North America - The US, Canada, & Mexico; Western Europe - Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe - Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC - China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America - Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa - Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Aries Electronics Inc., Loranger International Corporation, Foxconn Technology Group, Chupond Precision Co. Ltd., Enplas Corporation, Mill-Max Mfg. Corp., WELLS-CTI Inc., Molex Inc., Plastronics Socket Company Inc., Yamaichi Electronics Co. Ltd., Tyco Electronics Ltd., Johnstech International Corporation, 3M Company, CNC Tech LLC, Socionext America Inc., Texas Instruments Inc., Sensata Technologies B.V. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Aries Electronics Inc.

- Loranger International Corporation

- Foxconn Technology Group

- Chupond Precision Co. Ltd.

- Enplas Corporation

- Mill-Max Mfg. Corp.

- WELLS-CTI Inc.

- Molex Inc.

- Plastronics Socket Company Inc.

- Yamaichi Electronics Co. Ltd.

- Tyco Electronics Ltd.

- Johnstech International Corporation

- 3M Company

- CNC Tech LLC

- Socionext America Inc.

- Texas Instruments Inc.

- Sensata Technologies B.V.