Medical Tubing market By Material(Plastics, Rubbers, Specialty polymers, Others), By Application(Bulk disposable tubing, Catheters & cannulas, Drug delivery systems, Special applications), By Structure(Braided tubing, Single-lumen, Co-extruded, Multi-lumen, Tapered or bump tubing) By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2023-2032

-

25847

-

March 2023

-

181

-

-

This report was compiled by Correspondence Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

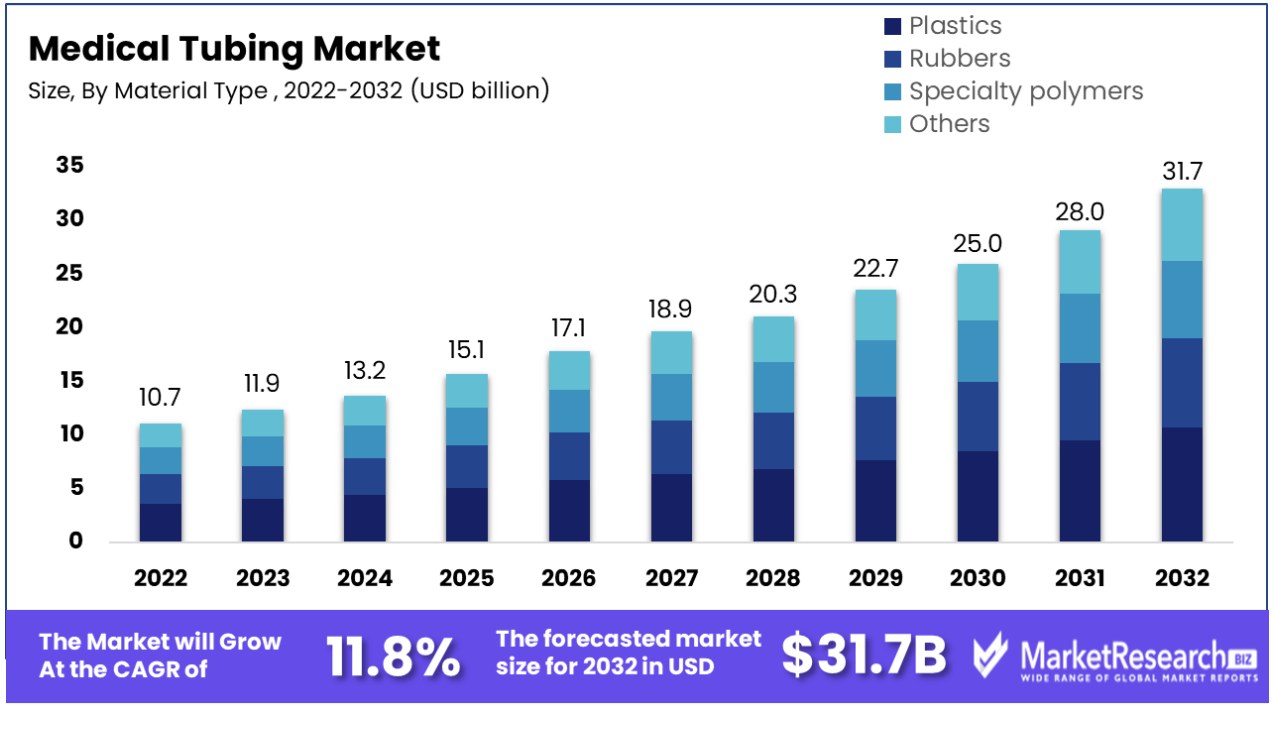

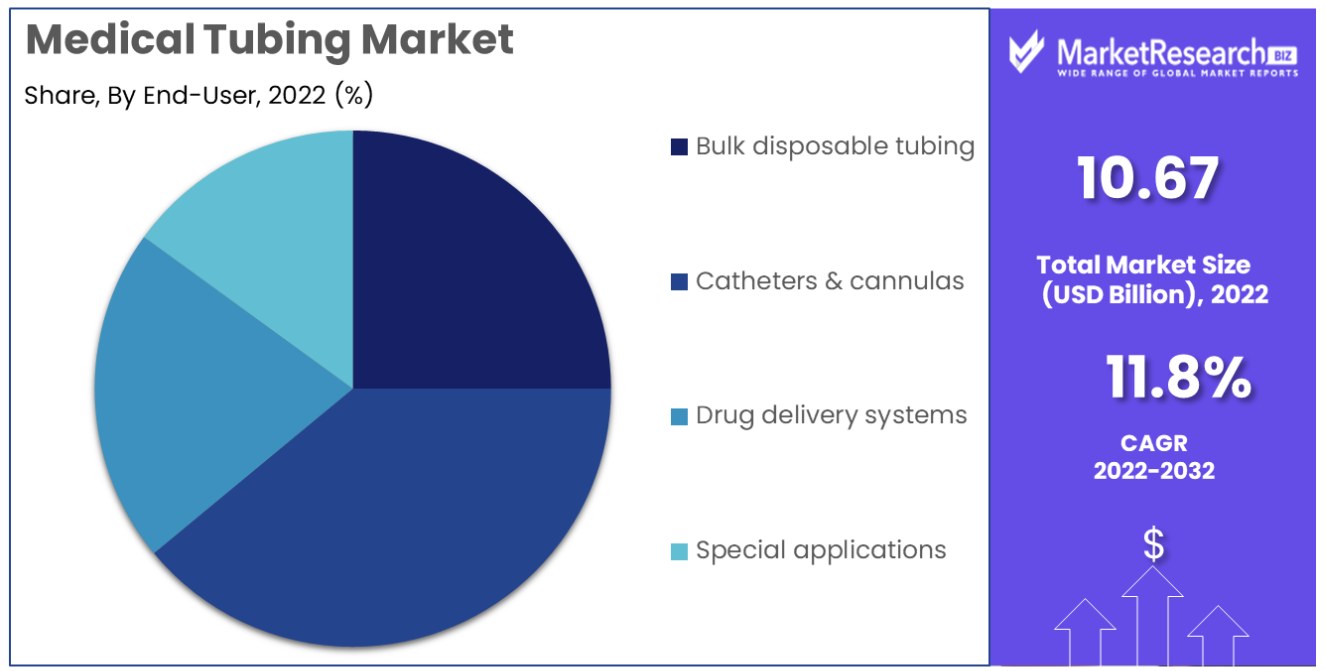

The medical tubing market was valued at USD 10.67 billion by 2022. It is expected to reach USD 31.7 billion by 2032, with a CAGR of 11.8% during the forecast period from 2023 to 2032.

The surge in demand for minimally invasive medical techniques and modern technological advancement are some of the main driving factors for the medical tubing market. Tubes that are used in medicine help physicians manage fluids as well as the medical gases to flow for any kind of treatment. Medical tubing comprises medical ventilators and IVs, but it is also used to help in providing access to the devices and as a delivery procedure for other medical devices.

According to WHO, there are around 17.9 million individuals who die due to cardiovascular diseases globally but more than that every 4 out of 5 individuals are reported to die due to heart attacks and strokes, and 1/3 of these deaths appear mostly in people whose age is under 70 years.

Tubing is used to drive catheters in cardiovascular catheterizations to test heart diseases and find the narrow blood vessels, check heart pressure and oxygen levels in different parts of the human body as well as diagnose congenital heart disorders, and detect heart valve problems by using the catheterization methods.

The medical tubing market is widely driven by the healthcare sector due to a surge in demand for products and solutions at a highly competitive price point. The introduction of peelable heat shrink tubing medical products makes sure that the catheter manufacturers can progress efficiency by expanding the workflow or operations.

Peelable heat-shrink tubing (PHST) focuses on the healthcare needs that are unmet like ultra-small PHST that helps in advanced smaller catheter-based procedures. The PHST is an advanced technology that decreases the total expenses of ownership as manufacturers do not have to truant heat-shrink products from the catheters.

As medical technology is advancing, manufacturers are aiming to produce new advanced medical tubes that can assist medical experts with the capability to reach inaccessible anatomical areas.

The minimally invasive treatment options for past untreatable patients have developed new devices that are used in PHST. Due high demand for medical tubing for various treatments will contribute to the market growth during this forecast period.

Driving Factors

Chronic Diseases and Aging Population Fuel Medical Tubing Market

The increasing prevalence of chronic diseases and a growing geriatric population are key drivers for the medical tubing market. These demographic and health trends lead to a heightened need for medical interventions, where medical tubing plays a crucial role in applications like fluid management and drug delivery.

The aging population, more prone to chronic conditions, necessitates ongoing medical care, often requiring tubing for various treatments. This trend points to a sustained market demand, anchored in the ongoing healthcare needs of an aging and increasingly health-conscious population.

Minimally Invasive Procedures Spur Tubing Demand

The growing demand for minimally invasive procedures is significantly boosting the medical tubing market. These procedures, favored for their reduced recovery times and lower risks, often require specialized medical tubing for precision and efficacy.

The shift towards less invasive medical interventions suggests a long-term increase in demand for medical tubing, tailored to support these advanced surgical techniques. Moreover, the demand for specialized medical tubing goes beyond the surgical suite. Many minimally invasive procedures rely on continuous monitoring, precise drug delivery, or drainage systems that necessitate the use of advanced tubing technologies. As a result, medical tubing manufacturers are constantly innovating to meet these evolving needs.

Technological Advancements Propel Market Innovation

Technological advancements and product innovations are crucial in shaping the medical tubing market. Continuous innovation leads to more sophisticated tubing solutions, meeting the evolving requirements of the medical field.

These advancements not only address current market needs but also set the stage for future growth, as new applications and technologies emerge. The trend toward technological sophistication in medical tubing suggests a market trajectory characterized by innovation, quality improvement, and adaptation to new medical practices.

Restraining Factors

High Production Costs Restrict the Growth of Medical Tubing Market

High production costs significantly limit the growth of the medical tubing market. The production of medical tubing requires specialized materials that meet stringent health and safety standards, such as biocompatibility and sterilization resistance. These high-quality materials, along with the advanced manufacturing processes needed to ensure precision and reliability, contribute to elevated production costs.

Additionally, the need for ongoing research and development to keep pace with evolving medical standards and technologies further adds to the expenses. These factors collectively result in higher prices for the end products, potentially restricting their adoption in cost-sensitive healthcare markets or regions with limited medical funding.

Limited Shelf Life of Products Restrains the Medical Tubing Market Growth

The limited shelf life of medical tubing products also poses a significant challenge to market growth. Medical tubing, often made from materials like silicone or thermoplastics, can degrade over time, especially under certain storage conditions. This degradation can affect the tubing's structural integrity and performance, necessitating stringent inventory management and frequent replacement cycles.

The need to regularly replace medical tubing can lead to increased operational costs for healthcare providers and can be a particular constraint in settings with limited resources. Managing these inventory and replacement challenges, while ensuring the continuous availability of high-quality tubing, is a key factor restraining the market's expansion.

Medical Tubing Market Segmentation Analysis

By Material

Plastics are the predominant material in the medical tubing market due to their versatility, durability, and cost-effectiveness. This segment includes a range of polymers such as PVC, polyethylene, and thermoplastic elastomers, each chosen for specific properties like flexibility, strength, and chemical resistance.

The growth of this segment is driven by the increasing demand for disposable medical devices and the need for tubing that can withstand various sterilization methods. Advances in polymer science are continually expanding the capabilities and applications of plastic medical tubing.

Rubber materials, known for their flexibility and resilience, are used in applications requiring more robust tubing. Specialty polymers, such as silicone and fluoropolymers, cater to niche applications where unique properties like biocompatibility and high-temperature resistance are required. The 'Others' category includes emerging materials designed for specific medical needs, contributing to the market's innovation and diversification.

By Application

Bulk disposable tubing is a key application area in the medical tubing market. This segment's growth is propelled by the rising demand for single-use medical devices to prevent cross-contamination and infection. Disposable tubing is widely used in a variety of settings, including hospitals, clinics, and laboratories, for applications such as fluid management and drainage.

Catheters and cannulas are essential for diagnostic and therapeutic procedures. Drug delivery systems, including infusion and peristaltic pump tubing, are critical in patient treatment regimens. Special applications encompass tubing used in unique or emerging medical technologies. Each of these applications plays a vital role in the healthcare sector, driving demand for specialized medical tubing.

By Structure

Braided tubing, characterized by its reinforced structure, is the leading segment in medical tubing structure. This tubing is reinforced with a braided pattern of material, often metal or another polymer, to enhance strength and durability while maintaining flexibility. The segment's dominance is due to its critical role in applications where tubing needs to withstand pressure without collapsing or kinking, such as in catheter and endoscope applications.

Single-lumen tubing is used for basic fluid transfer applications. Co-extruded tubing offers layered structures for more complex applications. Multi-lumen tubing, with multiple channels within a single tube, is essential for simultaneous, separate fluid paths. Tapered or bump tubing is designed for specialized applications requiring variable diameters. Each of these structural types meets specific requirements, contributing to the medical tubing market's versatility and growth.

Medical Tubing Industry Segments

By Material

- Plastics

- Rubbers

- Specialty polymers

- Others

By Application

- Bulk disposable tubing

- Catheters & cannulas

- Drug delivery systems

- Special applications

By Structure

- Braided tubing

- Single-lumen

- Co-extruded

- Multi-lumen

- Tapered or bump tubing

Growth Opportunities

Expansion Of Distribution Networks And Online Sales Channels Offers Growth Opportunities in Medical Tubing Market

The expansion of distribution networks and the increasing adoption of online sales channels are pivotal for growth in the medical tubing market. The healthcare industry's shift towards digital platforms has broadened the market reach, making medical supplies, including tubing, more accessible. Online channels offer a wider selection, competitive pricing, and convenience, appealing to a diverse range of healthcare providers.

Additionally, expanded distribution networks ensure efficient delivery and availability of medical tubing across various regions. This integration of online and physical distribution channels reflects a significant market growth opportunity, catering to the evolving procurement habits in the healthcare sector.

Strategic Initiatives Drive Growth in Medical Tubing Market

Strategic initiatives such as mergers, acquisitions, and partnerships are significant contributors to the growth of the medical tubing market. These collaborations enable companies to pool resources, share technologies, and access new markets, leading to enhanced product offerings and increased market presence.

Mergers and acquisitions can streamline operations and reduce costs, while partnerships may lead to innovative product development and expanded customer bases. These strategic moves are especially pertinent in a market that is continually evolving with technological advancements and regulatory changes. The trend toward consolidation and collaboration in the industry suggests a robust path for market expansion and competitiveness in the medical tubing sector.

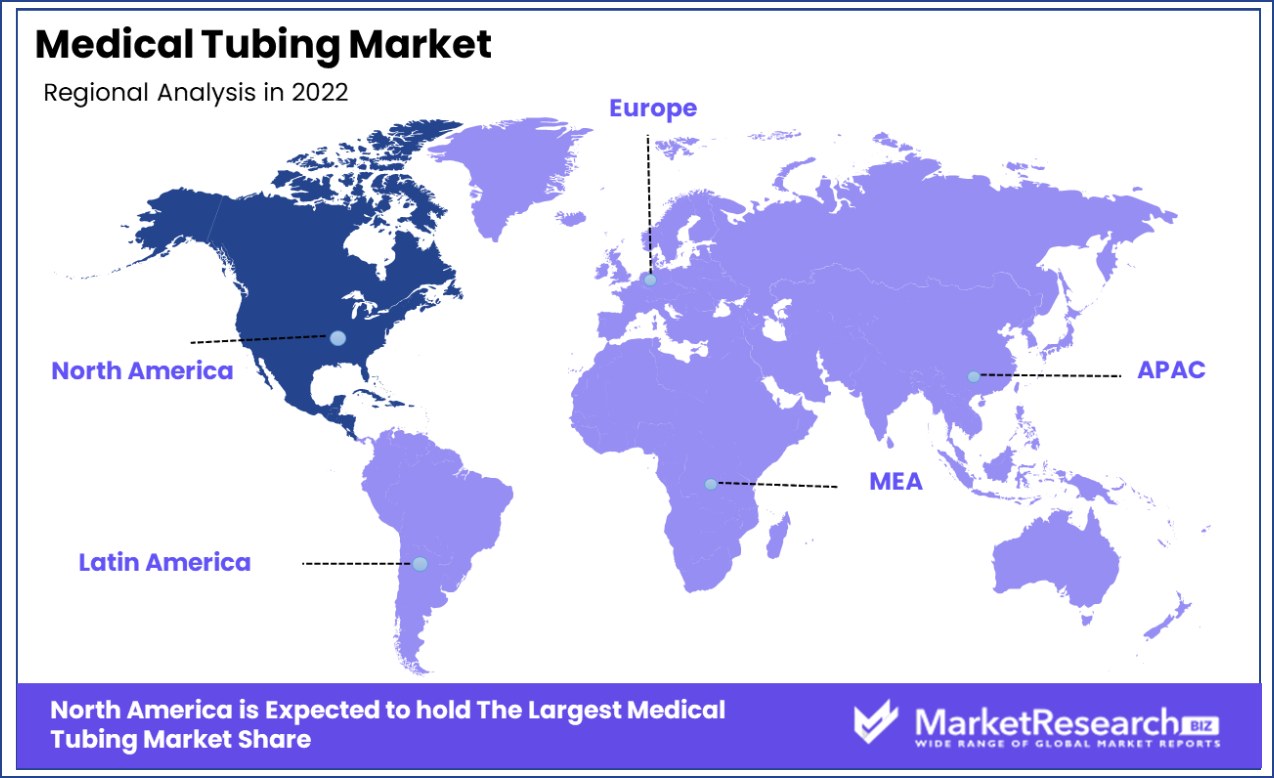

Regional Analysis

North America Dominates with a 37% Market Share

North America’s significant 37% share of the global medical tubing market is primarily driven by its advanced healthcare system and increasing demand for minimally invasive surgical procedures. The region's strong emphasis on healthcare innovation and quality standards has led to the adoption of high-performance medical tubing in various medical applications.

The market dynamics in North America are influenced by the region's aging population and increasing prevalence of chronic diseases, which necessitate advanced medical care and devices, including medical tubing. The growing adoption of home healthcare services and the rise in medical procedures like dialysis and catheterization further boost the demand for medical tubing. The region's stringent regulatory environment ensures high-quality standards in medical device manufacturing, maintaining consumer trust and market stability.

Looking ahead, the medical tubing market in North America is expected to continue its growth trajectory. Technological advancements in materials and manufacturing processes are likely to produce more efficient and safer medical tubing solutions. The increasing focus on patient safety and demand for cost-effective medical devices will continue to drive innovations in the market, sustaining North America’s dominance.

Europe Has High Standards and Technological Advancements

Europe's medical tubing market is driven by its high standards in healthcare and a strong focus on technological advancements. The region's stringent regulatory guidelines ensure the production of high-quality medical tubing. Europe's ongoing research in polymer science and material engineering contributes to the development of innovative tubing solutions, meeting the diverse needs of its healthcare sector.

Asia-Pacific's Rapid Growth and Increasing Healthcare Expenditure

The medical tubing market in Asia-Pacific is experiencing rapid growth, fueled by the region's increasing healthcare expenditure and expanding medical device sector. Countries like China and India are witnessing a surge in healthcare infrastructure development and a growing demand for medical devices, including medical tubing. The region's burgeoning population and rising health consciousness are additional factors contributing to the market growth, positioning Asia-Pacific as a key emerging market in the global medical tubing industry.

Medical Tubing Industry by Region

North America

- The US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of Asia Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of the Middle East & Africa

Key Player Analysis

In the specialized field of medical tubing, the companies listed are instrumental in shaping the market through innovative products and strategic positioning. Vention Medical Inc., with its focus on custom medical device manufacturing, highlights the market's need for specialized, application-specific tubing solutions. This approach underscores the importance of versatility and customization in medical applications.

Lubrizol Corporation, known for its advanced polymer solutions, plays a crucial role in enhancing the durability and functionality of medical tubing. Their products demonstrate the industry's shift towards materials that can withstand challenging medical environments while ensuring patient safety.

Polyone Corp. and DOW Corning Corporation, both leaders in material science, contribute significantly to the market through their innovative polymer formulations. Their focus on developing materials that meet stringent medical standards showcases the ongoing evolution of tubing materials to meet diverse healthcare needs.

W.L. Gore & Associates Inc., renowned for their high-performance materials, emphasizes the importance of cutting-edge technology in creating tubing that offers reliability and precision, particularly in demanding medical applications.

Lastly, Saint-Gobain Performance Plastics, with its broad range of high-purity tubing, reflects the industry's commitment to quality and regulatory compliance. Their products cater to a wide array of medical applications, demonstrating the market's diversity and the need for tubing solutions that can meet various medical standards and requirements.

Collectively, these companies drive the medical tubing market's growth and innovation, each emphasizing aspects such as material innovation, custom solutions, and adherence to medical standards, crucial for meeting the complex demands of the healthcare industry.

Key Players

- Vention Medical Inc.

- Lubrizol Corporation

- PolyOne Corp.

- DOW Coning Corporation

- W.L. Gore & Associates Inc.

- Saint-Gobain Performance Plastics

- Bluestar Silicones International

- Freudenberg Medical LLC

- Tecknor Apex Co

- Vention Medical Inc.

- Raumedic AG

- Lubrizol Corporation.

- Nordson

- Putnam Plastics

- Helix Medical

Recent Development

- In November 2023, TekniPlex Healthcare gave a presentation at AMI's Medical Tubing & Catheters Conference, which took place on November 1-2 in Tampa, FL. The presentation explored materials science progress that aids the administration of critical liquids and other medical fluids.

- In August 2023, AGIC Capital, a European-Asian private equity firm with $2.2 billion in assets under management, completed an undisclosed investment into AP Technologies (AP Tech), an emerging medical device contract

- In June 2023, Luminoah, a company aiming to reinvent tube feeding for medical purposes, raised $6 million in funding to develop a more portable, discreet, and user-friendly tube-feeding device.

- In May 2023, DuPont announced the acquisition of Spectrum Plastics Group for a purchase price of $1.75 billion. This acquisition expands DuPont's presence in the medical device and packaging market. Spectrum Plastics is known for manufacturing medical tubing, complex catheter delivery systems, injection molded components, and flexible packaging.

Report Scope

Report Features Description Market Value (2022) USD 10.67 Billion Forecast Revenue (2032) USD 31.7 Billion CAGR (2023-2032) 11.8% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Material(Plastics, Rubbers, Specialty polymers, Others), By Application(Bulk disposable tubing, Catheters & cannulas, Drug delivery systems, Special applications), By Structure(Braided tubing, Single-lumen, Co-extruded, Multi-lumen, Tapered or bump tubing) Regional Analysis North America - The US, Canada, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Vention Medical Inc., Lubrizol Corporation, PolyOne Corp., DOW Corning Corporation, W.L. Gore & Associates Inc., Saint-Gobain Performance Plastics, Bluestar Silicones International, Freudenberg Medical LLC, Tecknor Apex Co, Vention Medical Inc., Raumedic AG, Lubrizol Corporation., Nordson, Putnam Plastics, Helix Medical Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

- 1. Executive Summary

- 1.1. Definition

- 1.2. Taxonomy

- 1.3. Research Scope

- 1.4. Key Analysis

- 1.5. Key Findings by Major Segments

- 1.6. Top strategies by Major Players

- 2. Global Medical Tubing Market Overview

- 2.1. Medical Tubing Market Dynamics

- 2.1.1. Drivers

- 2.1.2. Opportunities

- 2.1.3. Restraints

- 2.1.4. Challenges

- 2.2. Macro-economic Factors

- 2.3. Regulatory Framework

- 2.4. Market Investment Feasibility Index

- 2.5. PEST Analysis

- 2.6. PORTER’S Five Force Analysis

- 2.7. Drivers & Restraints Impact Analysis

- 2.8. Industry Chain Analysis

- 2.9. Cost Structure Analysis

- 2.10. Marketing Strategy

- 2.11. Russia-Ukraine War Impact Analysis

- 2.12. Opportunity Map Analysis

- 2.13. Market Competition Scenario Analysis

- 2.14. Product Life Cycle Analysis

- 2.15. Opportunity Orbits

- 2.16. Manufacturer Intensity Map

- 2.17. Major Companies sales by Value & Volume

- 2.1. Medical Tubing Market Dynamics

- 3. Global Medical Tubing Market Analysis, Opportunity and Forecast, 2016-2032

- 3.1. Global Medical Tubing Market Analysis, 2016-2021

- 3.2. Global Medical Tubing Market Opportunity and Forecast, 2023-2032

- 3.3. Global Medical Tubing Market Analysis, Opportunity and Forecast, By By Material, 2016-2032

- 3.3.1. Global Medical Tubing Market Analysis by By Material: Introduction

- 3.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Material, 2016-2032

- 3.3.3. polyvinyl chloride

- 3.3.4. polyolefin

- 3.3.5. thermoplastic elastomer

- 3.3.6. thermoplastic polyurethane

- 3.3.7. silicone

- 3.3.8. various specialty polymers such as fluoropolymers

- 3.3.9. polycarbonate.

- 3.4. Global Medical Tubing Market Analysis, Opportunity and Forecast, By By Application, 2016-2032

- 3.4.1. Global Medical Tubing Market Analysis by By Application: Introduction

- 3.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Application, 2016-2032

- 3.4.3. catheters

- 3.4.4. disposable tubing

- 3.4.5. cannulas

- 3.4.6. drug delivery system

- 3.4.7. gas supply tubing

- 3.4.8. majorly for urinary catheters.

- 3.5. Global Medical Tubing Market Analysis, Opportunity and Forecast, By By Structure, 2016-2032

- 3.5.1. Global Medical Tubing Market Analysis by By Structure: Introduction

- 3.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Structure, 2016-2032

- 3.5.3. braided tubing

- 3.5.4. single-lumen

- 3.5.5. multi-lumen tubing co-extruded tubing

- 3.5.6. tapered tubing

- 4. North America Medical Tubing Market Analysis, Opportunity and Forecast, 2016-2032

- 4.1. North America Medical Tubing Market Analysis, 2016-2021

- 4.2. North America Medical Tubing Market Opportunity and Forecast, 2023-2032

- 4.3. North America Medical Tubing Market Analysis, Opportunity and Forecast, By By Material, 2016-2032

- 4.3.1. North America Medical Tubing Market Analysis by By Material: Introduction

- 4.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Material, 2016-2032

- 4.3.3. polyvinyl chloride

- 4.3.4. polyolefin

- 4.3.5. thermoplastic elastomer

- 4.3.6. thermoplastic polyurethane

- 4.3.7. silicone

- 4.3.8. various specialty polymers such as fluoropolymers

- 4.3.9. polycarbonate.

- 4.4. North America Medical Tubing Market Analysis, Opportunity and Forecast, By By Application, 2016-2032

- 4.4.1. North America Medical Tubing Market Analysis by By Application: Introduction

- 4.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Application, 2016-2032

- 4.4.3. catheters

- 4.4.4. disposable tubing

- 4.4.5. cannulas

- 4.4.6. drug delivery system

- 4.4.7. gas supply tubing

- 4.4.8. majorly for urinary catheters.

- 4.5. North America Medical Tubing Market Analysis, Opportunity and Forecast, By By Structure, 2016-2032

- 4.5.1. North America Medical Tubing Market Analysis by By Structure: Introduction

- 4.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Structure, 2016-2032

- 4.5.3. braided tubing

- 4.5.4. single-lumen

- 4.5.5. multi-lumen tubing co-extruded tubing

- 4.5.6. tapered tubing

- 4.6. North America Medical Tubing Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 4.6.1. North America Medical Tubing Market Analysis by Country : Introduction

- 4.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 4.6.2.1. The US

- 4.6.2.2. Canada

- 4.6.2.3. Mexico

- 5. Western Europe Medical Tubing Market Analysis, Opportunity and Forecast, 2016-2032

- 5.1. Western Europe Medical Tubing Market Analysis, 2016-2021

- 5.2. Western Europe Medical Tubing Market Opportunity and Forecast, 2023-2032

- 5.3. Western Europe Medical Tubing Market Analysis, Opportunity and Forecast, By By Material, 2016-2032

- 5.3.1. Western Europe Medical Tubing Market Analysis by By Material: Introduction

- 5.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Material, 2016-2032

- 5.3.3. polyvinyl chloride

- 5.3.4. polyolefin

- 5.3.5. thermoplastic elastomer

- 5.3.6. thermoplastic polyurethane

- 5.3.7. silicone

- 5.3.8. various specialty polymers such as fluoropolymers

- 5.3.9. polycarbonate.

- 5.4. Western Europe Medical Tubing Market Analysis, Opportunity and Forecast, By By Application, 2016-2032

- 5.4.1. Western Europe Medical Tubing Market Analysis by By Application: Introduction

- 5.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Application, 2016-2032

- 5.4.3. catheters

- 5.4.4. disposable tubing

- 5.4.5. cannulas

- 5.4.6. drug delivery system

- 5.4.7. gas supply tubing

- 5.4.8. majorly for urinary catheters.

- 5.5. Western Europe Medical Tubing Market Analysis, Opportunity and Forecast, By By Structure, 2016-2032

- 5.5.1. Western Europe Medical Tubing Market Analysis by By Structure: Introduction

- 5.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Structure, 2016-2032

- 5.5.3. braided tubing

- 5.5.4. single-lumen

- 5.5.5. multi-lumen tubing co-extruded tubing

- 5.5.6. tapered tubing

- 5.6. Western Europe Medical Tubing Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 5.6.1. Western Europe Medical Tubing Market Analysis by Country : Introduction

- 5.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 5.6.2.1. Germany

- 5.6.2.2. France

- 5.6.2.3. The UK

- 5.6.2.4. Spain

- 5.6.2.5. Italy

- 5.6.2.6. Portugal

- 5.6.2.7. Ireland

- 5.6.2.8. Austria

- 5.6.2.9. Switzerland

- 5.6.2.10. Benelux

- 5.6.2.11. Nordic

- 5.6.2.12. Rest of Western Europe

- 6. Eastern Europe Medical Tubing Market Analysis, Opportunity and Forecast, 2016-2032

- 6.1. Eastern Europe Medical Tubing Market Analysis, 2016-2021

- 6.2. Eastern Europe Medical Tubing Market Opportunity and Forecast, 2023-2032

- 6.3. Eastern Europe Medical Tubing Market Analysis, Opportunity and Forecast, By By Material, 2016-2032

- 6.3.1. Eastern Europe Medical Tubing Market Analysis by By Material: Introduction

- 6.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Material, 2016-2032

- 6.3.3. polyvinyl chloride

- 6.3.4. polyolefin

- 6.3.5. thermoplastic elastomer

- 6.3.6. thermoplastic polyurethane

- 6.3.7. silicone

- 6.3.8. various specialty polymers such as fluoropolymers

- 6.3.9. polycarbonate.

- 6.4. Eastern Europe Medical Tubing Market Analysis, Opportunity and Forecast, By By Application, 2016-2032

- 6.4.1. Eastern Europe Medical Tubing Market Analysis by By Application: Introduction

- 6.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Application, 2016-2032

- 6.4.3. catheters

- 6.4.4. disposable tubing

- 6.4.5. cannulas

- 6.4.6. drug delivery system

- 6.4.7. gas supply tubing

- 6.4.8. majorly for urinary catheters.

- 6.5. Eastern Europe Medical Tubing Market Analysis, Opportunity and Forecast, By By Structure, 2016-2032

- 6.5.1. Eastern Europe Medical Tubing Market Analysis by By Structure: Introduction

- 6.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Structure, 2016-2032

- 6.5.3. braided tubing

- 6.5.4. single-lumen

- 6.5.5. multi-lumen tubing co-extruded tubing

- 6.5.6. tapered tubing

- 6.6. Eastern Europe Medical Tubing Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 6.6.1. Eastern Europe Medical Tubing Market Analysis by Country : Introduction

- 6.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 6.6.2.1. Russia

- 6.6.2.2. Poland

- 6.6.2.3. The Czech Republic

- 6.6.2.4. Greece

- 6.6.2.5. Rest of Eastern Europe

- 7. APAC Medical Tubing Market Analysis, Opportunity and Forecast, 2016-2032

- 7.1. APAC Medical Tubing Market Analysis, 2016-2021

- 7.2. APAC Medical Tubing Market Opportunity and Forecast, 2023-2032

- 7.3. APAC Medical Tubing Market Analysis, Opportunity and Forecast, By By Material, 2016-2032

- 7.3.1. APAC Medical Tubing Market Analysis by By Material: Introduction

- 7.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Material, 2016-2032

- 7.3.3. polyvinyl chloride

- 7.3.4. polyolefin

- 7.3.5. thermoplastic elastomer

- 7.3.6. thermoplastic polyurethane

- 7.3.7. silicone

- 7.3.8. various specialty polymers such as fluoropolymers

- 7.3.9. polycarbonate.

- 7.4. APAC Medical Tubing Market Analysis, Opportunity and Forecast, By By Application, 2016-2032

- 7.4.1. APAC Medical Tubing Market Analysis by By Application: Introduction

- 7.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Application, 2016-2032

- 7.4.3. catheters

- 7.4.4. disposable tubing

- 7.4.5. cannulas

- 7.4.6. drug delivery system

- 7.4.7. gas supply tubing

- 7.4.8. majorly for urinary catheters.

- 7.5. APAC Medical Tubing Market Analysis, Opportunity and Forecast, By By Structure, 2016-2032

- 7.5.1. APAC Medical Tubing Market Analysis by By Structure: Introduction

- 7.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Structure, 2016-2032

- 7.5.3. braided tubing

- 7.5.4. single-lumen

- 7.5.5. multi-lumen tubing co-extruded tubing

- 7.5.6. tapered tubing

- 7.6. APAC Medical Tubing Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 7.6.1. APAC Medical Tubing Market Analysis by Country : Introduction

- 7.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 7.6.2.1. China

- 7.6.2.2. Japan

- 7.6.2.3. South Korea

- 7.6.2.4. India

- 7.6.2.5. Australia & New Zeland

- 7.6.2.6. Indonesia

- 7.6.2.7. Malaysia

- 7.6.2.8. Philippines

- 7.6.2.9. Singapore

- 7.6.2.10. Thailand

- 7.6.2.11. Vietnam

- 7.6.2.12. Rest of APAC

- 8. Latin America Medical Tubing Market Analysis, Opportunity and Forecast, 2016-2032

- 8.1. Latin America Medical Tubing Market Analysis, 2016-2021

- 8.2. Latin America Medical Tubing Market Opportunity and Forecast, 2023-2032

- 8.3. Latin America Medical Tubing Market Analysis, Opportunity and Forecast, By By Material, 2016-2032

- 8.3.1. Latin America Medical Tubing Market Analysis by By Material: Introduction

- 8.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Material, 2016-2032

- 8.3.3. polyvinyl chloride

- 8.3.4. polyolefin

- 8.3.5. thermoplastic elastomer

- 8.3.6. thermoplastic polyurethane

- 8.3.7. silicone

- 8.3.8. various specialty polymers such as fluoropolymers

- 8.3.9. polycarbonate.

- 8.4. Latin America Medical Tubing Market Analysis, Opportunity and Forecast, By By Application, 2016-2032

- 8.4.1. Latin America Medical Tubing Market Analysis by By Application: Introduction

- 8.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Application, 2016-2032

- 8.4.3. catheters

- 8.4.4. disposable tubing

- 8.4.5. cannulas

- 8.4.6. drug delivery system

- 8.4.7. gas supply tubing

- 8.4.8. majorly for urinary catheters.

- 8.5. Latin America Medical Tubing Market Analysis, Opportunity and Forecast, By By Structure, 2016-2032

- 8.5.1. Latin America Medical Tubing Market Analysis by By Structure: Introduction

- 8.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Structure, 2016-2032

- 8.5.3. braided tubing

- 8.5.4. single-lumen

- 8.5.5. multi-lumen tubing co-extruded tubing

- 8.5.6. tapered tubing

- 8.6. Latin America Medical Tubing Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 8.6.1. Latin America Medical Tubing Market Analysis by Country : Introduction

- 8.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 8.6.2.1. Brazil

- 8.6.2.2. Colombia

- 8.6.2.3. Chile

- 8.6.2.4. Argentina

- 8.6.2.5. Costa Rica

- 8.6.2.6. Rest of Latin America

- 9. Middle East & Africa Medical Tubing Market Analysis, Opportunity and Forecast, 2016-2032

- 9.1. Middle East & Africa Medical Tubing Market Analysis, 2016-2021

- 9.2. Middle East & Africa Medical Tubing Market Opportunity and Forecast, 2023-2032

- 9.3. Middle East & Africa Medical Tubing Market Analysis, Opportunity and Forecast, By By Material, 2016-2032

- 9.3.1. Middle East & Africa Medical Tubing Market Analysis by By Material: Introduction

- 9.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Material, 2016-2032

- 9.3.3. polyvinyl chloride

- 9.3.4. polyolefin

- 9.3.5. thermoplastic elastomer

- 9.3.6. thermoplastic polyurethane

- 9.3.7. silicone

- 9.3.8. various specialty polymers such as fluoropolymers

- 9.3.9. polycarbonate.

- 9.4. Middle East & Africa Medical Tubing Market Analysis, Opportunity and Forecast, By By Application, 2016-2032

- 9.4.1. Middle East & Africa Medical Tubing Market Analysis by By Application: Introduction

- 9.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Application, 2016-2032

- 9.4.3. catheters

- 9.4.4. disposable tubing

- 9.4.5. cannulas

- 9.4.6. drug delivery system

- 9.4.7. gas supply tubing

- 9.4.8. majorly for urinary catheters.

- 9.5. Middle East & Africa Medical Tubing Market Analysis, Opportunity and Forecast, By By Structure, 2016-2032

- 9.5.1. Middle East & Africa Medical Tubing Market Analysis by By Structure: Introduction

- 9.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Structure, 2016-2032

- 9.5.3. braided tubing

- 9.5.4. single-lumen

- 9.5.5. multi-lumen tubing co-extruded tubing

- 9.5.6. tapered tubing

- 9.6. Middle East & Africa Medical Tubing Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 9.6.1. Middle East & Africa Medical Tubing Market Analysis by Country : Introduction

- 9.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 9.6.2.1. Algeria

- 9.6.2.2. Egypt

- 9.6.2.3. Israel

- 9.6.2.4. Kuwait

- 9.6.2.5. Nigeria

- 9.6.2.6. Saudi Arabia

- 9.6.2.7. South Africa

- 9.6.2.8. Turkey

- 9.6.2.9. The UAE

- 9.6.2.10. Rest of MEA

- 10. Global Medical Tubing Market Analysis, Opportunity and Forecast, By Region , 2016-2032

- 10.1. Global Medical Tubing Market Analysis by Region : Introduction

- 10.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Region , 2016-2032

- 10.2.1. North America

- 10.2.2. Western Europe

- 10.2.3. Eastern Europe

- 10.2.4. APAC

- 10.2.5. Latin America

- 10.2.6. Middle East & Africa

- 11. Global Medical Tubing Market Competitive Landscape, Market Share Analysis, and Company Profiles

- 11.1. Market Share Analysis

- 11.2. Company Profiles

- 11.3. Vention Medical Inc.

- 11.3.1. Company Overview

- 11.3.2. Financial Highlights

- 11.3.3. Product Portfolio

- 11.3.4. SWOT Analysis

- 11.3.5. Key Strategies and Developments

- 11.4. Lubrizol Corporation

- 11.4.1. Company Overview

- 11.4.2. Financial Highlights

- 11.4.3. Product Portfolio

- 11.4.4. SWOT Analysis

- 11.4.5. Key Strategies and Developments

- 11.5. Polyone Corp.

- 11.5.1. Company Overview

- 11.5.2. Financial Highlights

- 11.5.3. Product Portfolio

- 11.5.4. SWOT Analysis

- 11.5.5. Key Strategies and Developments

- 11.6. DOW Corning Corporation

- 11.6.1. Company Overview

- 11.6.2. Financial Highlights

- 11.6.3. Product Portfolio

- 11.6.4. SWOT Analysis

- 11.6.5. Key Strategies and Developments

- 11.7. W.L. Gore & Associates Inc.

- 11.7.1. Company Overview

- 11.7.2. Financial Highlights

- 11.7.3. Product Portfolio

- 11.7.4. SWOT Analysis

- 11.7.5. Key Strategies and Developments

- 11.8. Saint-Gobain Performance Plastics

- 11.8.1. Company Overview

- 11.8.2. Financial Highlights

- 11.8.3. Product Portfolio

- 11.8.4. SWOT Analysis

- 11.8.5. Key Strategies and Developments

- 11.9. Bluestar Silicones International

- 11.9.1. Company Overview

- 11.9.2. Financial Highlights

- 11.9.3. Product Portfolio

- 11.9.4. SWOT Analysis

- 11.9.5. Key Strategies and Developments

- 11.10. Freudenberg Medical LLC

- 11.10.1. Company Overview

- 11.10.2. Financial Highlights

- 11.10.3. Product Portfolio

- 11.10.4. SWOT Analysis

- 11.10.5. Key Strategies and Developments

- 11.11. Tecknor Apex Co

- 11.11.1. Company Overview

- 11.11.2. Financial Highlights

- 11.11.3. Product Portfolio

- 11.11.4. SWOT Analysis

- 11.11.5. Key Strategies and Developments

- 11.12. Vention Medical Inc.

- 11.12.1. Company Overview

- 11.12.2. Financial Highlights

- 11.12.3. Product Portfolio

- 11.12.4. SWOT Analysis

- 11.12.5. Key Strategies and Developments

- 11.13. Raumedic AG

- 11.13.1. Company Overview

- 11.13.2. Financial Highlights

- 11.13.3. Product Portfolio

- 11.13.4. SWOT Analysis

- 11.13.5. Key Strategies and Developments

- 11.14. Lubrizol Corporation.

- 11.14.1. Company Overview

- 11.14.2. Financial Highlights

- 11.14.3. Product Portfolio

- 11.14.4. SWOT Analysis

- 11.14.5. Key Strategies and Developments

- 12. Assumptions and Acronyms

- 13. Research Methodology

- 14. Contact

- List of Figures

- Figure 1: Global Medical Tubing Market Revenue (US$ Mn) Market Share by By Material in 2022

- Figure 2: Global Medical Tubing Market Attractiveness Analysis by By Material, 2016-2032

- Figure 3: Global Medical Tubing Market Revenue (US$ Mn) Market Share by By Applicationin 2022

- Figure 4: Global Medical Tubing Market Attractiveness Analysis by By Application, 2016-2032

- Figure 5: Global Medical Tubing Market Revenue (US$ Mn) Market Share by By Structurein 2022

- Figure 6: Global Medical Tubing Market Attractiveness Analysis by By Structure, 2016-2032

- Figure 7: Global Medical Tubing Market Revenue (US$ Mn) Market Share by Region in 2022

- Figure 8: Global Medical Tubing Market Attractiveness Analysis by Region, 2016-2032

- Figure 9: Global Medical Tubing Market Revenue (US$ Mn) (2016-2032)

- Figure 10: Global Medical Tubing Market Revenue (US$ Mn) Comparison by Region (2016-2032)

- Figure 11: Global Medical Tubing Market Revenue (US$ Mn) Comparison by By Material (2016-2032)

- Figure 12: Global Medical Tubing Market Revenue (US$ Mn) Comparison by By Application (2016-2032)

- Figure 13: Global Medical Tubing Market Revenue (US$ Mn) Comparison by By Structure (2016-2032)

- Figure 14: Global Medical Tubing Market Y-o-Y Growth Rate Comparison by Region (2016-2032)

- Figure 15: Global Medical Tubing Market Y-o-Y Growth Rate Comparison by By Material (2016-2032)

- Figure 16: Global Medical Tubing Market Y-o-Y Growth Rate Comparison by By Application (2016-2032)

- Figure 17: Global Medical Tubing Market Y-o-Y Growth Rate Comparison by By Structure (2016-2032)

- Figure 18: Global Medical Tubing Market Share Comparison by Region (2016-2032)

- Figure 19: Global Medical Tubing Market Share Comparison by By Material (2016-2032)

- Figure 20: Global Medical Tubing Market Share Comparison by By Application (2016-2032)

- Figure 21: Global Medical Tubing Market Share Comparison by By Structure (2016-2032)

- Figure 22: North America Medical Tubing Market Revenue (US$ Mn) Market Share by By Materialin 2022

- Figure 23: North America Medical Tubing Market Attractiveness Analysis by By Material, 2016-2032

- Figure 24: North America Medical Tubing Market Revenue (US$ Mn) Market Share by By Applicationin 2022

- Figure 25: North America Medical Tubing Market Attractiveness Analysis by By Application, 2016-2032

- Figure 26: North America Medical Tubing Market Revenue (US$ Mn) Market Share by By Structurein 2022

- Figure 27: North America Medical Tubing Market Attractiveness Analysis by By Structure, 2016-2032

- Figure 28: North America Medical Tubing Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 29: North America Medical Tubing Market Attractiveness Analysis by Country, 2016-2032

- Figure 30: North America Medical Tubing Market Revenue (US$ Mn) (2016-2032)

- Figure 31: North America Medical Tubing Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 32: North America Medical Tubing Market Revenue (US$ Mn) Comparison by By Material (2016-2032)

- Figure 33: North America Medical Tubing Market Revenue (US$ Mn) Comparison by By Application (2016-2032)

- Figure 34: North America Medical Tubing Market Revenue (US$ Mn) Comparison by By Structure (2016-2032)

- Figure 35: North America Medical Tubing Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 36: North America Medical Tubing Market Y-o-Y Growth Rate Comparison by By Material (2016-2032)

- Figure 37: North America Medical Tubing Market Y-o-Y Growth Rate Comparison by By Application (2016-2032)

- Figure 38: North America Medical Tubing Market Y-o-Y Growth Rate Comparison by By Structure (2016-2032)

- Figure 39: North America Medical Tubing Market Share Comparison by Country (2016-2032)

- Figure 40: North America Medical Tubing Market Share Comparison by By Material (2016-2032)

- Figure 41: North America Medical Tubing Market Share Comparison by By Application (2016-2032)

- Figure 42: North America Medical Tubing Market Share Comparison by By Structure (2016-2032)

- Figure 43: Western Europe Medical Tubing Market Revenue (US$ Mn) Market Share by By Materialin 2022

- Figure 44: Western Europe Medical Tubing Market Attractiveness Analysis by By Material, 2016-2032

- Figure 45: Western Europe Medical Tubing Market Revenue (US$ Mn) Market Share by By Applicationin 2022

- Figure 46: Western Europe Medical Tubing Market Attractiveness Analysis by By Application, 2016-2032

- Figure 47: Western Europe Medical Tubing Market Revenue (US$ Mn) Market Share by By Structurein 2022

- Figure 48: Western Europe Medical Tubing Market Attractiveness Analysis by By Structure, 2016-2032

- Figure 49: Western Europe Medical Tubing Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 50: Western Europe Medical Tubing Market Attractiveness Analysis by Country, 2016-2032

- Figure 51: Western Europe Medical Tubing Market Revenue (US$ Mn) (2016-2032)

- Figure 52: Western Europe Medical Tubing Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 53: Western Europe Medical Tubing Market Revenue (US$ Mn) Comparison by By Material (2016-2032)

- Figure 54: Western Europe Medical Tubing Market Revenue (US$ Mn) Comparison by By Application (2016-2032)

- Figure 55: Western Europe Medical Tubing Market Revenue (US$ Mn) Comparison by By Structure (2016-2032)

- Figure 56: Western Europe Medical Tubing Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 57: Western Europe Medical Tubing Market Y-o-Y Growth Rate Comparison by By Material (2016-2032)

- Figure 58: Western Europe Medical Tubing Market Y-o-Y Growth Rate Comparison by By Application (2016-2032)

- Figure 59: Western Europe Medical Tubing Market Y-o-Y Growth Rate Comparison by By Structure (2016-2032)

- Figure 60: Western Europe Medical Tubing Market Share Comparison by Country (2016-2032)

- Figure 61: Western Europe Medical Tubing Market Share Comparison by By Material (2016-2032)

- Figure 62: Western Europe Medical Tubing Market Share Comparison by By Application (2016-2032)

- Figure 63: Western Europe Medical Tubing Market Share Comparison by By Structure (2016-2032)

- Figure 64: Eastern Europe Medical Tubing Market Revenue (US$ Mn) Market Share by By Materialin 2022

- Figure 65: Eastern Europe Medical Tubing Market Attractiveness Analysis by By Material, 2016-2032

- Figure 66: Eastern Europe Medical Tubing Market Revenue (US$ Mn) Market Share by By Applicationin 2022

- Figure 67: Eastern Europe Medical Tubing Market Attractiveness Analysis by By Application, 2016-2032

- Figure 68: Eastern Europe Medical Tubing Market Revenue (US$ Mn) Market Share by By Structurein 2022

- Figure 69: Eastern Europe Medical Tubing Market Attractiveness Analysis by By Structure, 2016-2032

- Figure 70: Eastern Europe Medical Tubing Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 71: Eastern Europe Medical Tubing Market Attractiveness Analysis by Country, 2016-2032

- Figure 72: Eastern Europe Medical Tubing Market Revenue (US$ Mn) (2016-2032)

- Figure 73: Eastern Europe Medical Tubing Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 74: Eastern Europe Medical Tubing Market Revenue (US$ Mn) Comparison by By Material (2016-2032)

- Figure 75: Eastern Europe Medical Tubing Market Revenue (US$ Mn) Comparison by By Application (2016-2032)

- Figure 76: Eastern Europe Medical Tubing Market Revenue (US$ Mn) Comparison by By Structure (2016-2032)

- Figure 77: Eastern Europe Medical Tubing Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 78: Eastern Europe Medical Tubing Market Y-o-Y Growth Rate Comparison by By Material (2016-2032)

- Figure 79: Eastern Europe Medical Tubing Market Y-o-Y Growth Rate Comparison by By Application (2016-2032)

- Figure 80: Eastern Europe Medical Tubing Market Y-o-Y Growth Rate Comparison by By Structure (2016-2032)

- Figure 81: Eastern Europe Medical Tubing Market Share Comparison by Country (2016-2032)

- Figure 82: Eastern Europe Medical Tubing Market Share Comparison by By Material (2016-2032)

- Figure 83: Eastern Europe Medical Tubing Market Share Comparison by By Application (2016-2032)

- Figure 84: Eastern Europe Medical Tubing Market Share Comparison by By Structure (2016-2032)

- Figure 85: APAC Medical Tubing Market Revenue (US$ Mn) Market Share by By Materialin 2022

- Figure 86: APAC Medical Tubing Market Attractiveness Analysis by By Material, 2016-2032

- Figure 87: APAC Medical Tubing Market Revenue (US$ Mn) Market Share by By Applicationin 2022

- Figure 88: APAC Medical Tubing Market Attractiveness Analysis by By Application, 2016-2032

- Figure 89: APAC Medical Tubing Market Revenue (US$ Mn) Market Share by By Structurein 2022

- Figure 90: APAC Medical Tubing Market Attractiveness Analysis by By Structure, 2016-2032

- Figure 91: APAC Medical Tubing Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 92: APAC Medical Tubing Market Attractiveness Analysis by Country, 2016-2032

- Figure 93: APAC Medical Tubing Market Revenue (US$ Mn) (2016-2032)

- Figure 94: APAC Medical Tubing Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 95: APAC Medical Tubing Market Revenue (US$ Mn) Comparison by By Material (2016-2032)

- Figure 96: APAC Medical Tubing Market Revenue (US$ Mn) Comparison by By Application (2016-2032)

- Figure 97: APAC Medical Tubing Market Revenue (US$ Mn) Comparison by By Structure (2016-2032)

- Figure 98: APAC Medical Tubing Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 99: APAC Medical Tubing Market Y-o-Y Growth Rate Comparison by By Material (2016-2032)

- Figure 100: APAC Medical Tubing Market Y-o-Y Growth Rate Comparison by By Application (2016-2032)

- Figure 101: APAC Medical Tubing Market Y-o-Y Growth Rate Comparison by By Structure (2016-2032)

- Figure 102: APAC Medical Tubing Market Share Comparison by Country (2016-2032)

- Figure 103: APAC Medical Tubing Market Share Comparison by By Material (2016-2032)

- Figure 104: APAC Medical Tubing Market Share Comparison by By Application (2016-2032)

- Figure 105: APAC Medical Tubing Market Share Comparison by By Structure (2016-2032)

- Figure 106: Latin America Medical Tubing Market Revenue (US$ Mn) Market Share by By Materialin 2022

- Figure 107: Latin America Medical Tubing Market Attractiveness Analysis by By Material, 2016-2032

- Figure 108: Latin America Medical Tubing Market Revenue (US$ Mn) Market Share by By Applicationin 2022

- Figure 109: Latin America Medical Tubing Market Attractiveness Analysis by By Application, 2016-2032

- Figure 110: Latin America Medical Tubing Market Revenue (US$ Mn) Market Share by By Structurein 2022

- Figure 111: Latin America Medical Tubing Market Attractiveness Analysis by By Structure, 2016-2032

- Figure 112: Latin America Medical Tubing Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 113: Latin America Medical Tubing Market Attractiveness Analysis by Country, 2016-2032

- Figure 114: Latin America Medical Tubing Market Revenue (US$ Mn) (2016-2032)

- Figure 115: Latin America Medical Tubing Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 116: Latin America Medical Tubing Market Revenue (US$ Mn) Comparison by By Material (2016-2032)

- Figure 117: Latin America Medical Tubing Market Revenue (US$ Mn) Comparison by By Application (2016-2032)

- Figure 118: Latin America Medical Tubing Market Revenue (US$ Mn) Comparison by By Structure (2016-2032)

- Figure 119: Latin America Medical Tubing Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 120: Latin America Medical Tubing Market Y-o-Y Growth Rate Comparison by By Material (2016-2032)

- Figure 121: Latin America Medical Tubing Market Y-o-Y Growth Rate Comparison by By Application (2016-2032)

- Figure 122: Latin America Medical Tubing Market Y-o-Y Growth Rate Comparison by By Structure (2016-2032)

- Figure 123: Latin America Medical Tubing Market Share Comparison by Country (2016-2032)

- Figure 124: Latin America Medical Tubing Market Share Comparison by By Material (2016-2032)

- Figure 125: Latin America Medical Tubing Market Share Comparison by By Application (2016-2032)

- Figure 126: Latin America Medical Tubing Market Share Comparison by By Structure (2016-2032)

- Figure 127: Middle East & Africa Medical Tubing Market Revenue (US$ Mn) Market Share by By Materialin 2022

- Figure 128: Middle East & Africa Medical Tubing Market Attractiveness Analysis by By Material, 2016-2032

- Figure 129: Middle East & Africa Medical Tubing Market Revenue (US$ Mn) Market Share by By Applicationin 2022

- Figure 130: Middle East & Africa Medical Tubing Market Attractiveness Analysis by By Application, 2016-2032

- Figure 131: Middle East & Africa Medical Tubing Market Revenue (US$ Mn) Market Share by By Structurein 2022

- Figure 132: Middle East & Africa Medical Tubing Market Attractiveness Analysis by By Structure, 2016-2032

- Figure 133: Middle East & Africa Medical Tubing Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 134: Middle East & Africa Medical Tubing Market Attractiveness Analysis by Country, 2016-2032

- Figure 135: Middle East & Africa Medical Tubing Market Revenue (US$ Mn) (2016-2032)

- Figure 136: Middle East & Africa Medical Tubing Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 137: Middle East & Africa Medical Tubing Market Revenue (US$ Mn) Comparison by By Material (2016-2032)

- Figure 138: Middle East & Africa Medical Tubing Market Revenue (US$ Mn) Comparison by By Application (2016-2032)

- Figure 139: Middle East & Africa Medical Tubing Market Revenue (US$ Mn) Comparison by By Structure (2016-2032)

- Figure 140: Middle East & Africa Medical Tubing Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 141: Middle East & Africa Medical Tubing Market Y-o-Y Growth Rate Comparison by By Material (2016-2032)

- Figure 142: Middle East & Africa Medical Tubing Market Y-o-Y Growth Rate Comparison by By Application (2016-2032)

- Figure 143: Middle East & Africa Medical Tubing Market Y-o-Y Growth Rate Comparison by By Structure (2016-2032)

- Figure 144: Middle East & Africa Medical Tubing Market Share Comparison by Country (2016-2032)

- Figure 145: Middle East & Africa Medical Tubing Market Share Comparison by By Material (2016-2032)

- Figure 146: Middle East & Africa Medical Tubing Market Share Comparison by By Application (2016-2032)

- Figure 147: Middle East & Africa Medical Tubing Market Share Comparison by By Structure (2016-2032)

- List of Tables

- Table 1: Global Medical Tubing Market Comparison by By Material (2016-2032)

- Table 2: Global Medical Tubing Market Comparison by By Application (2016-2032)

- Table 3: Global Medical Tubing Market Comparison by By Structure (2016-2032)

- Table 4: Global Medical Tubing Market Revenue (US$ Mn) Comparison by Region (2016-2032)

- Table 5: Global Medical Tubing Market Revenue (US$ Mn) (2016-2032)

- Table 6: Global Medical Tubing Market Revenue (US$ Mn) Comparison by Region (2016-2032)

- Table 7: Global Medical Tubing Market Revenue (US$ Mn) Comparison by By Material (2016-2032)

- Table 8: Global Medical Tubing Market Revenue (US$ Mn) Comparison by By Application (2016-2032)

- Table 9: Global Medical Tubing Market Revenue (US$ Mn) Comparison by By Structure (2016-2032)

- Table 10: Global Medical Tubing Market Y-o-Y Growth Rate Comparison by Region (2016-2032)

- Table 11: Global Medical Tubing Market Y-o-Y Growth Rate Comparison by By Material (2016-2032)

- Table 12: Global Medical Tubing Market Y-o-Y Growth Rate Comparison by By Application (2016-2032)

- Table 13: Global Medical Tubing Market Y-o-Y Growth Rate Comparison by By Structure (2016-2032)

- Table 14: Global Medical Tubing Market Share Comparison by Region (2016-2032)

- Table 15: Global Medical Tubing Market Share Comparison by By Material (2016-2032)

- Table 16: Global Medical Tubing Market Share Comparison by By Application (2016-2032)

- Table 17: Global Medical Tubing Market Share Comparison by By Structure (2016-2032)

- Table 18: North America Medical Tubing Market Comparison by By Application (2016-2032)

- Table 19: North America Medical Tubing Market Comparison by By Structure (2016-2032)

- Table 20: North America Medical Tubing Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 21: North America Medical Tubing Market Revenue (US$ Mn) (2016-2032)

- Table 22: North America Medical Tubing Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 23: North America Medical Tubing Market Revenue (US$ Mn) Comparison by By Material (2016-2032)

- Table 24: North America Medical Tubing Market Revenue (US$ Mn) Comparison by By Application (2016-2032)

- Table 25: North America Medical Tubing Market Revenue (US$ Mn) Comparison by By Structure (2016-2032)

- Table 26: North America Medical Tubing Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 27: North America Medical Tubing Market Y-o-Y Growth Rate Comparison by By Material (2016-2032)

- Table 28: North America Medical Tubing Market Y-o-Y Growth Rate Comparison by By Application (2016-2032)

- Table 29: North America Medical Tubing Market Y-o-Y Growth Rate Comparison by By Structure (2016-2032)

- Table 30: North America Medical Tubing Market Share Comparison by Country (2016-2032)

- Table 31: North America Medical Tubing Market Share Comparison by By Material (2016-2032)

- Table 32: North America Medical Tubing Market Share Comparison by By Application (2016-2032)

- Table 33: North America Medical Tubing Market Share Comparison by By Structure (2016-2032)

- Table 34: Western Europe Medical Tubing Market Comparison by By Material (2016-2032)

- Table 35: Western Europe Medical Tubing Market Comparison by By Application (2016-2032)

- Table 36: Western Europe Medical Tubing Market Comparison by By Structure (2016-2032)

- Table 37: Western Europe Medical Tubing Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 38: Western Europe Medical Tubing Market Revenue (US$ Mn) (2016-2032)

- Table 39: Western Europe Medical Tubing Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 40: Western Europe Medical Tubing Market Revenue (US$ Mn) Comparison by By Material (2016-2032)

- Table 41: Western Europe Medical Tubing Market Revenue (US$ Mn) Comparison by By Application (2016-2032)

- Table 42: Western Europe Medical Tubing Market Revenue (US$ Mn) Comparison by By Structure (2016-2032)

- Table 43: Western Europe Medical Tubing Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 44: Western Europe Medical Tubing Market Y-o-Y Growth Rate Comparison by By Material (2016-2032)

- Table 45: Western Europe Medical Tubing Market Y-o-Y Growth Rate Comparison by By Application (2016-2032)

- Table 46: Western Europe Medical Tubing Market Y-o-Y Growth Rate Comparison by By Structure (2016-2032)

- Table 47: Western Europe Medical Tubing Market Share Comparison by Country (2016-2032)

- Table 48: Western Europe Medical Tubing Market Share Comparison by By Material (2016-2032)

- Table 49: Western Europe Medical Tubing Market Share Comparison by By Application (2016-2032)

- Table 50: Western Europe Medical Tubing Market Share Comparison by By Structure (2016-2032)

- Table 51: Eastern Europe Medical Tubing Market Comparison by By Material (2016-2032)

- Table 52: Eastern Europe Medical Tubing Market Comparison by By Application (2016-2032)

- Table 53: Eastern Europe Medical Tubing Market Comparison by By Structure (2016-2032)

- Table 54: Eastern Europe Medical Tubing Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 55: Eastern Europe Medical Tubing Market Revenue (US$ Mn) (2016-2032)

- Table 56: Eastern Europe Medical Tubing Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 57: Eastern Europe Medical Tubing Market Revenue (US$ Mn) Comparison by By Material (2016-2032)

- Table 58: Eastern Europe Medical Tubing Market Revenue (US$ Mn) Comparison by By Application (2016-2032)

- Table 59: Eastern Europe Medical Tubing Market Revenue (US$ Mn) Comparison by By Structure (2016-2032)

- Table 60: Eastern Europe Medical Tubing Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 61: Eastern Europe Medical Tubing Market Y-o-Y Growth Rate Comparison by By Material (2016-2032)

- Table 62: Eastern Europe Medical Tubing Market Y-o-Y Growth Rate Comparison by By Application (2016-2032)

- Table 63: Eastern Europe Medical Tubing Market Y-o-Y Growth Rate Comparison by By Structure (2016-2032)

- Table 64: Eastern Europe Medical Tubing Market Share Comparison by Country (2016-2032)

- Table 65: Eastern Europe Medical Tubing Market Share Comparison by By Material (2016-2032)

- Table 66: Eastern Europe Medical Tubing Market Share Comparison by By Application (2016-2032)

- Table 67: Eastern Europe Medical Tubing Market Share Comparison by By Structure (2016-2032)

- Table 68: APAC Medical Tubing Market Comparison by By Material (2016-2032)

- Table 69: APAC Medical Tubing Market Comparison by By Application (2016-2032)

- Table 70: APAC Medical Tubing Market Comparison by By Structure (2016-2032)

- Table 71: APAC Medical Tubing Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 72: APAC Medical Tubing Market Revenue (US$ Mn) (2016-2032)

- Table 73: APAC Medical Tubing Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 74: APAC Medical Tubing Market Revenue (US$ Mn) Comparison by By Material (2016-2032)

- Table 75: APAC Medical Tubing Market Revenue (US$ Mn) Comparison by By Application (2016-2032)

- Table 76: APAC Medical Tubing Market Revenue (US$ Mn) Comparison by By Structure (2016-2032)

- Table 77: APAC Medical Tubing Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 78: APAC Medical Tubing Market Y-o-Y Growth Rate Comparison by By Material (2016-2032)

- Table 79: APAC Medical Tubing Market Y-o-Y Growth Rate Comparison by By Application (2016-2032)

- Table 80: APAC Medical Tubing Market Y-o-Y Growth Rate Comparison by By Structure (2016-2032)

- Table 81: APAC Medical Tubing Market Share Comparison by Country (2016-2032)

- Table 82: APAC Medical Tubing Market Share Comparison by By Material (2016-2032)

- Table 83: APAC Medical Tubing Market Share Comparison by By Application (2016-2032)

- Table 84: APAC Medical Tubing Market Share Comparison by By Structure (2016-2032)

- Table 85: Latin America Medical Tubing Market Comparison by By Material (2016-2032)

- Table 86: Latin America Medical Tubing Market Comparison by By Application (2016-2032)

- Table 87: Latin America Medical Tubing Market Comparison by By Structure (2016-2032)

- Table 88: Latin America Medical Tubing Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 89: Latin America Medical Tubing Market Revenue (US$ Mn) (2016-2032)

- Table 90: Latin America Medical Tubing Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 91: Latin America Medical Tubing Market Revenue (US$ Mn) Comparison by By Material (2016-2032)

- Table 92: Latin America Medical Tubing Market Revenue (US$ Mn) Comparison by By Application (2016-2032)

- Table 93: Latin America Medical Tubing Market Revenue (US$ Mn) Comparison by By Structure (2016-2032)

- Table 94: Latin America Medical Tubing Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 95: Latin America Medical Tubing Market Y-o-Y Growth Rate Comparison by By Material (2016-2032)

- Table 96: Latin America Medical Tubing Market Y-o-Y Growth Rate Comparison by By Application (2016-2032)

- Table 97: Latin America Medical Tubing Market Y-o-Y Growth Rate Comparison by By Structure (2016-2032)

- Table 98: Latin America Medical Tubing Market Share Comparison by Country (2016-2032)

- Table 99: Latin America Medical Tubing Market Share Comparison by By Material (2016-2032)

- Table 100: Latin America Medical Tubing Market Share Comparison by By Application (2016-2032)

- Table 101: Latin America Medical Tubing Market Share Comparison by By Structure (2016-2032)

- Table 102: Middle East & Africa Medical Tubing Market Comparison by By Material (2016-2032)

- Table 103: Middle East & Africa Medical Tubing Market Comparison by By Application (2016-2032)

- Table 104: Middle East & Africa Medical Tubing Market Comparison by By Structure (2016-2032)

- Table 105: Middle East & Africa Medical Tubing Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 106: Middle East & Africa Medical Tubing Market Revenue (US$ Mn) (2016-2032)

- Table 107: Middle East & Africa Medical Tubing Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 108: Middle East & Africa Medical Tubing Market Revenue (US$ Mn) Comparison by By Material (2016-2032)

- Table 109: Middle East & Africa Medical Tubing Market Revenue (US$ Mn) Comparison by By Application (2016-2032)

- Table 110: Middle East & Africa Medical Tubing Market Revenue (US$ Mn) Comparison by By Structure (2016-2032)

- Table 111: Middle East & Africa Medical Tubing Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 112: Middle East & Africa Medical Tubing Market Y-o-Y Growth Rate Comparison by By Material (2016-2032)

- Table 113: Middle East & Africa Medical Tubing Market Y-o-Y Growth Rate Comparison by By Application (2016-2032)

- Table 114: Middle East & Africa Medical Tubing Market Y-o-Y Growth Rate Comparison by By Structure (2016-2032)

- Table 115: Middle East & Africa Medical Tubing Market Share Comparison by Country (2016-2032)

- Table 116: Middle East & Africa Medical Tubing Market Share Comparison by By Material (2016-2032)

- Table 117: Middle East & Africa Medical Tubing Market Share Comparison by By Application (2016-2032)

- Table 118: Middle East & Africa Medical Tubing Market Share Comparison by By Structure (2016-2032)

- 1. Executive Summary

-

- Vention Medical Inc.

- Lubrizol Corporation

- PolyOne Corp.

- DOW Coning Corporation

- W.L. Gore & Associates Inc.

- Saint-Gobain Performance Plastics

- Bluestar Silicones International

- Freudenberg Medical LLC

- Tecknor Apex Co

- Vention Medical Inc.

- Raumedic AG

- Lubrizol Corporation.

- Nordson

- Putnam Plastics

- Helix Medica