Medical Tubing market By Material(Plastics, Rubbers, Specialty polymers, Others), By Application(Bulk disposable tubing, Catheters & cannulas, Drug delivery systems, Special applications), By Structure(Braided tubing, Single-lumen, Co-extruded, Multi-lumen, Tapered or bump tubing) By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2023-2032

-

25847

-

March 2023

-

181

-

-

This report was compiled by Correspondence Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

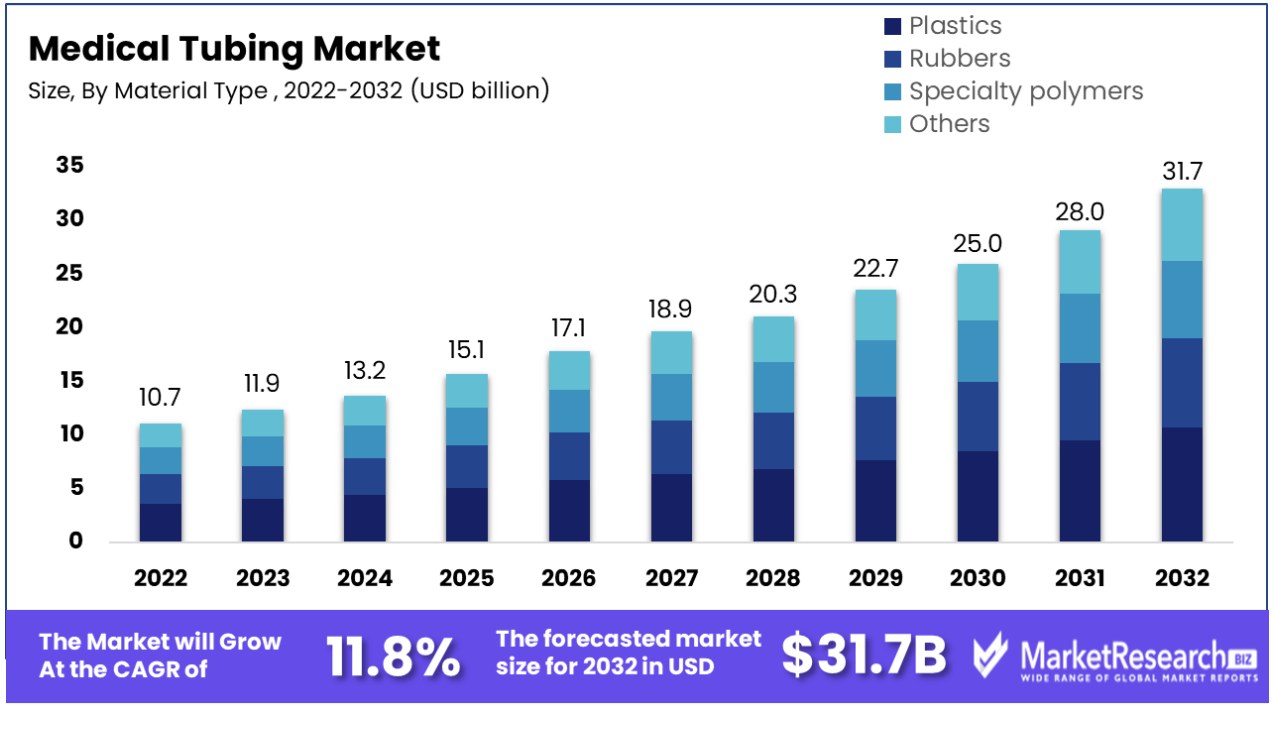

The medical tubing market was valued at USD 10.67 billion by 2022. It is expected to reach USD 31.7 billion by 2032, with a CAGR of 11.8% during the forecast period from 2023 to 2032.

The surge in demand for minimally invasive medical techniques and modern technological advancement are some of the main driving factors for the medical tubing market. Tubes that are used in medicine help physicians manage fluids as well as the medical gases to flow for any kind of treatment. Medical tubing comprises medical ventilators and IVs, but it is also used to help in providing access to the devices and as a delivery procedure for other medical devices.

According to WHO, there are around 17.9 million individuals who die due to cardiovascular diseases globally but more than that every 4 out of 5 individuals are reported to die due to heart attacks and strokes, and 1/3 of these deaths appear mostly in people whose age is under 70 years.

Tubing is used to drive catheters in cardiovascular catheterizations to test heart diseases and find the narrow blood vessels, check heart pressure and oxygen levels in different parts of the human body as well as diagnose congenital heart disorders, and detect heart valve problems by using the catheterization methods.

The medical tubing market is widely driven by the healthcare sector due to a surge in demand for products and solutions at a highly competitive price point. The introduction of peelable heat shrink tubing medical products makes sure that the catheter manufacturers can progress efficiency by expanding the workflow or operations.

Peelable heat-shrink tubing (PHST) focuses on the healthcare needs that are unmet like ultra-small PHST that helps in advanced smaller catheter-based procedures. The PHST is an advanced technology that decreases the total expenses of ownership as manufacturers do not have to truant heat-shrink products from the catheters.

As medical technology is advancing, manufacturers are aiming to produce new advanced medical tubes that can assist medical experts with the capability to reach inaccessible anatomical areas.

The minimally invasive treatment options for past untreatable patients have developed new devices that are used in PHST. Due high demand for medical tubing for various treatments will contribute to the market growth during this forecast period.

Driving Factors

Chronic Diseases and Aging Population Fuel Medical Tubing Market

The increasing prevalence of chronic diseases and a growing geriatric population are key drivers for the medical tubing market. These demographic and health trends lead to a heightened need for medical interventions, where medical tubing plays a crucial role in applications like fluid management and drug delivery.

The aging population, more prone to chronic conditions, necessitates ongoing medical care, often requiring tubing for various treatments. This trend points to a sustained market demand, anchored in the ongoing healthcare needs of an aging and increasingly health-conscious population.

Minimally Invasive Procedures Spur Tubing Demand

The growing demand for minimally invasive procedures is significantly boosting the medical tubing market. These procedures, favored for their reduced recovery times and lower risks, often require specialized medical tubing for precision and efficacy.

The shift towards less invasive medical interventions suggests a long-term increase in demand for medical tubing, tailored to support these advanced surgical techniques. Moreover, the demand for specialized medical tubing goes beyond the surgical suite. Many minimally invasive procedures rely on continuous monitoring, precise drug delivery, or drainage systems that necessitate the use of advanced tubing technologies. As a result, medical tubing manufacturers are constantly innovating to meet these evolving needs.

Technological Advancements Propel Market Innovation

Technological advancements and product innovations are crucial in shaping the medical tubing market. Continuous innovation leads to more sophisticated tubing solutions, meeting the evolving requirements of the medical field.

These advancements not only address current market needs but also set the stage for future growth, as new applications and technologies emerge. The trend toward technological sophistication in medical tubing suggests a market trajectory characterized by innovation, quality improvement, and adaptation to new medical practices.

Restraining Factors

High Production Costs Restrict the Growth of Medical Tubing Market

High production costs significantly limit the growth of the medical tubing market. The production of medical tubing requires specialized materials that meet stringent health and safety standards, such as biocompatibility and sterilization resistance. These high-quality materials, along with the advanced manufacturing processes needed to ensure precision and reliability, contribute to elevated production costs.

Additionally, the need for ongoing research and development to keep pace with evolving medical standards and technologies further adds to the expenses. These factors collectively result in higher prices for the end products, potentially restricting their adoption in cost-sensitive healthcare markets or regions with limited medical funding.

Limited Shelf Life of Products Restrains the Medical Tubing Market Growth

The limited shelf life of medical tubing products also poses a significant challenge to market growth. Medical tubing, often made from materials like silicone or thermoplastics, can degrade over time, especially under certain storage conditions. This degradation can affect the tubing's structural integrity and performance, necessitating stringent inventory management and frequent replacement cycles.

The need to regularly replace medical tubing can lead to increased operational costs for healthcare providers and can be a particular constraint in settings with limited resources. Managing these inventory and replacement challenges, while ensuring the continuous availability of high-quality tubing, is a key factor restraining the market's expansion.

Medical Tubing Market Segmentation Analysis

By Material

Plastics are the predominant material in the medical tubing market due to their versatility, durability, and cost-effectiveness. This segment includes a range of polymers such as PVC, polyethylene, and thermoplastic elastomers, each chosen for specific properties like flexibility, strength, and chemical resistance.

The growth of this segment is driven by the increasing demand for disposable medical devices and the need for tubing that can withstand various sterilization methods. Advances in polymer science are continually expanding the capabilities and applications of plastic medical tubing.

Rubber materials, known for their flexibility and resilience, are used in applications requiring more robust tubing. Specialty polymers, such as silicone and fluoropolymers, cater to niche applications where unique properties like biocompatibility and high-temperature resistance are required. The 'Others' category includes emerging materials designed for specific medical needs, contributing to the market's innovation and diversification.

By Application

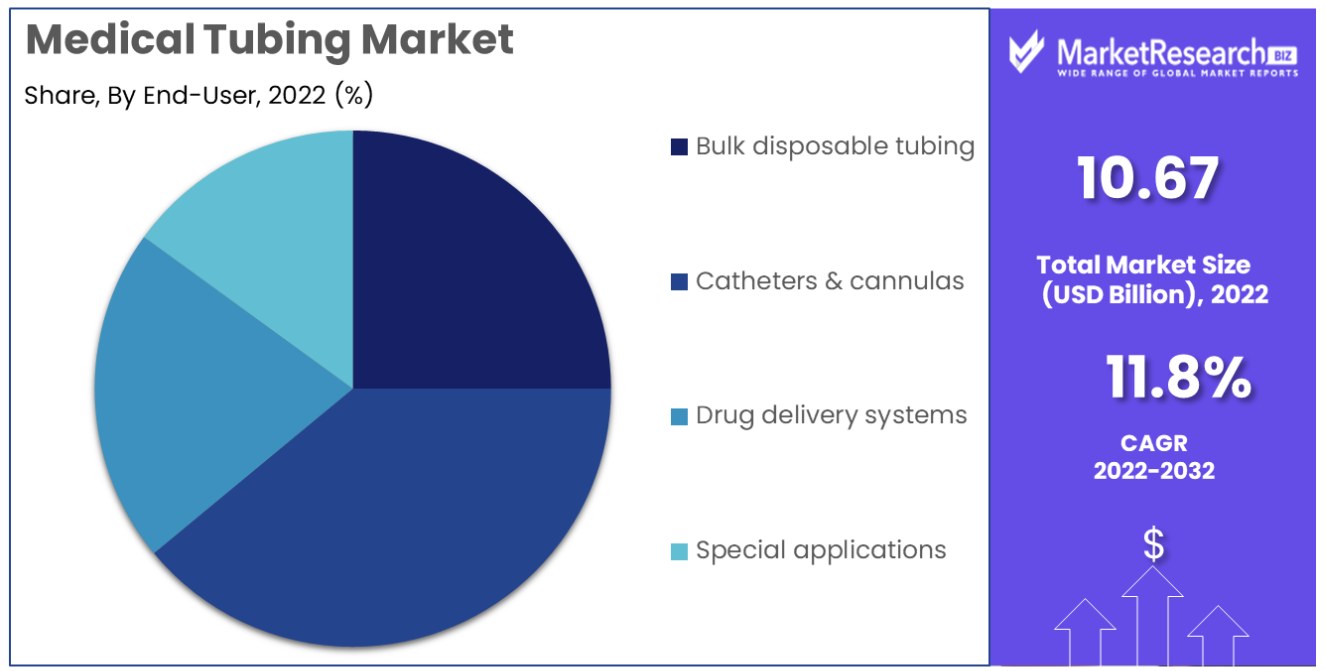

Bulk disposable tubing is a key application area in the medical tubing market. This segment's growth is propelled by the rising demand for single-use medical devices to prevent cross-contamination and infection. Disposable tubing is widely used in a variety of settings, including hospitals, clinics, and laboratories, for applications such as fluid management and drainage.

Catheters and cannulas are essential for diagnostic and therapeutic procedures. Drug delivery systems, including infusion and peristaltic pump tubing, are critical in patient treatment regimens. Special applications encompass tubing used in unique or emerging medical technologies. Each of these applications plays a vital role in the healthcare sector, driving demand for specialized medical tubing.

By Structure

Braided tubing, characterized by its reinforced structure, is the leading segment in medical tubing structure. This tubing is reinforced with a braided pattern of material, often metal or another polymer, to enhance strength and durability while maintaining flexibility. The segment's dominance is due to its critical role in applications where tubing needs to withstand pressure without collapsing or kinking, such as in catheter and endoscope applications.

Single-lumen tubing is used for basic fluid transfer applications. Co-extruded tubing offers layered structures for more complex applications. Multi-lumen tubing, with multiple channels within a single tube, is essential for simultaneous, separate fluid paths. Tapered or bump tubing is designed for specialized applications requiring variable diameters. Each of these structural types meets specific requirements, contributing to the medical tubing market's versatility and growth.

Medical Tubing Industry Segments

By Material

- Plastics

- Rubbers

- Specialty polymers

- Others

By Application

- Bulk disposable tubing

- Catheters & cannulas

- Drug delivery systems

- Special applications

By Structure

- Braided tubing

- Single-lumen

- Co-extruded

- Multi-lumen

- Tapered or bump tubing

Growth Opportunities

Expansion Of Distribution Networks And Online Sales Channels Offers Growth Opportunities in Medical Tubing Market

The expansion of distribution networks and the increasing adoption of online sales channels are pivotal for growth in the medical tubing market. The healthcare industry's shift towards digital platforms has broadened the market reach, making medical supplies, including tubing, more accessible. Online channels offer a wider selection, competitive pricing, and convenience, appealing to a diverse range of healthcare providers.

Additionally, expanded distribution networks ensure efficient delivery and availability of medical tubing across various regions. This integration of online and physical distribution channels reflects a significant market growth opportunity, catering to the evolving procurement habits in the healthcare sector.

Strategic Initiatives Drive Growth in Medical Tubing Market

Strategic initiatives such as mergers, acquisitions, and partnerships are significant contributors to the growth of the medical tubing market. These collaborations enable companies to pool resources, share technologies, and access new markets, leading to enhanced product offerings and increased market presence.

Mergers and acquisitions can streamline operations and reduce costs, while partnerships may lead to innovative product development and expanded customer bases. These strategic moves are especially pertinent in a market that is continually evolving with technological advancements and regulatory changes. The trend toward consolidation and collaboration in the industry suggests a robust path for market expansion and competitiveness in the medical tubing sector.

Regional Analysis

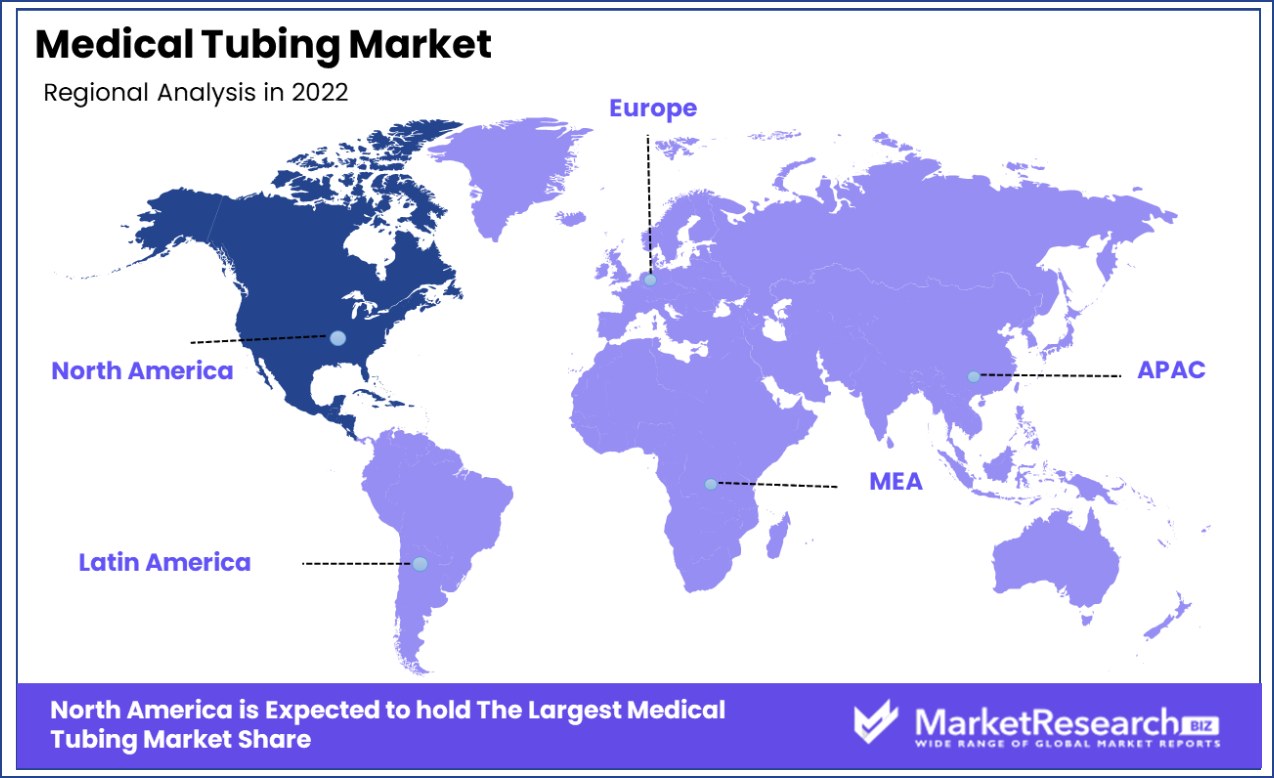

North America Dominates with a 37% Market Share

North America’s significant 37% share of the global medical tubing market is primarily driven by its advanced healthcare system and increasing demand for minimally invasive surgical procedures. The region's strong emphasis on healthcare innovation and quality standards has led to the adoption of high-performance medical tubing in various medical applications.

The market dynamics in North America are influenced by the region's aging population and increasing prevalence of chronic diseases, which necessitate advanced medical care and devices, including medical tubing. The growing adoption of home healthcare services and the rise in medical procedures like dialysis and catheterization further boost the demand for medical tubing. The region's stringent regulatory environment ensures high-quality standards in medical device manufacturing, maintaining consumer trust and market stability.

Looking ahead, the medical tubing market in North America is expected to continue its growth trajectory. Technological advancements in materials and manufacturing processes are likely to produce more efficient and safer medical tubing solutions. The increasing focus on patient safety and demand for cost-effective medical devices will continue to drive innovations in the market, sustaining North America’s dominance.

Europe Has High Standards and Technological Advancements

Europe's medical tubing market is driven by its high standards in healthcare and a strong focus on technological advancements. The region's stringent regulatory guidelines ensure the production of high-quality medical tubing. Europe's ongoing research in polymer science and material engineering contributes to the development of innovative tubing solutions, meeting the diverse needs of its healthcare sector.

Asia-Pacific's Rapid Growth and Increasing Healthcare Expenditure

The medical tubing market in Asia-Pacific is experiencing rapid growth, fueled by the region's increasing healthcare expenditure and expanding medical device sector. Countries like China and India are witnessing a surge in healthcare infrastructure development and a growing demand for medical devices, including medical tubing. The region's burgeoning population and rising health consciousness are additional factors contributing to the market growth, positioning Asia-Pacific as a key emerging market in the global medical tubing industry.

Medical Tubing Industry by Region

North America

- The US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of Asia Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of the Middle East & Africa

Key Player Analysis

In the specialized field of medical tubing, the companies listed are instrumental in shaping the market through innovative products and strategic positioning. Vention Medical Inc., with its focus on custom medical device manufacturing, highlights the market's need for specialized, application-specific tubing solutions. This approach underscores the importance of versatility and customization in medical applications.

Lubrizol Corporation, known for its advanced polymer solutions, plays a crucial role in enhancing the durability and functionality of medical tubing. Their products demonstrate the industry's shift towards materials that can withstand challenging medical environments while ensuring patient safety.

Polyone Corp. and DOW Corning Corporation, both leaders in material science, contribute significantly to the market through their innovative polymer formulations. Their focus on developing materials that meet stringent medical standards showcases the ongoing evolution of tubing materials to meet diverse healthcare needs.

W.L. Gore & Associates Inc., renowned for their high-performance materials, emphasizes the importance of cutting-edge technology in creating tubing that offers reliability and precision, particularly in demanding medical applications.

Lastly, Saint-Gobain Performance Plastics, with its broad range of high-purity tubing, reflects the industry's commitment to quality and regulatory compliance. Their products cater to a wide array of medical applications, demonstrating the market's diversity and the need for tubing solutions that can meet various medical standards and requirements.

Collectively, these companies drive the medical tubing market's growth and innovation, each emphasizing aspects such as material innovation, custom solutions, and adherence to medical standards, crucial for meeting the complex demands of the healthcare industry.

Key Players

- Vention Medical Inc.

- Lubrizol Corporation

- PolyOne Corp.

- DOW Coning Corporation

- W.L. Gore & Associates Inc.

- Saint-Gobain Performance Plastics

- Bluestar Silicones International

- Freudenberg Medical LLC

- Tecknor Apex Co

- Vention Medical Inc.

- Raumedic AG

- Lubrizol Corporation.

- Nordson

- Putnam Plastics

- Helix Medical

Recent Development

- In November 2023, TekniPlex Healthcare gave a presentation at AMI's Medical Tubing & Catheters Conference, which took place on November 1-2 in Tampa, FL. The presentation explored materials science progress that aids the administration of critical liquids and other medical fluids.

- In August 2023, AGIC Capital, a European-Asian private equity firm with $2.2 billion in assets under management, completed an undisclosed investment into AP Technologies (AP Tech), an emerging medical device contract

- In June 2023, Luminoah, a company aiming to reinvent tube feeding for medical purposes, raised $6 million in funding to develop a more portable, discreet, and user-friendly tube-feeding device.

- In May 2023, DuPont announced the acquisition of Spectrum Plastics Group for a purchase price of $1.75 billion. This acquisition expands DuPont's presence in the medical device and packaging market. Spectrum Plastics is known for manufacturing medical tubing, complex catheter delivery systems, injection molded components, and flexible packaging.

Report Scope

Report Features Description Market Value (2022) USD 10.67 Billion Forecast Revenue (2032) USD 31.7 Billion CAGR (2023-2032) 11.8% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Material(Plastics, Rubbers, Specialty polymers, Others), By Application(Bulk disposable tubing, Catheters & cannulas, Drug delivery systems, Special applications), By Structure(Braided tubing, Single-lumen, Co-extruded, Multi-lumen, Tapered or bump tubing) Regional Analysis North America - The US, Canada, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Vention Medical Inc., Lubrizol Corporation, PolyOne Corp., DOW Corning Corporation, W.L. Gore & Associates Inc., Saint-Gobain Performance Plastics, Bluestar Silicones International, Freudenberg Medical LLC, Tecknor Apex Co, Vention Medical Inc., Raumedic AG, Lubrizol Corporation., Nordson, Putnam Plastics, Helix Medical Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Vention Medical Inc.

- Lubrizol Corporation

- PolyOne Corp.

- DOW Coning Corporation

- W.L. Gore & Associates Inc.

- Saint-Gobain Performance Plastics

- Bluestar Silicones International

- Freudenberg Medical LLC

- Tecknor Apex Co

- Vention Medical Inc.

- Raumedic AG

- Lubrizol Corporation.

- Nordson

- Putnam Plastics

- Helix Medica