Elderly Monitor Market By Product (Personal Emergency Response Systems (PERS), Smart Home Systems, and Other), By Application (Fall Prevention and Detection, Health Monitoring, and other), By End-User (Home-based Care, Assisted Living Facilities, and other), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2023-2032

-

37916

-

June 2023

-

150

-

-

This report was compiled by Correspondence Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Report Overview

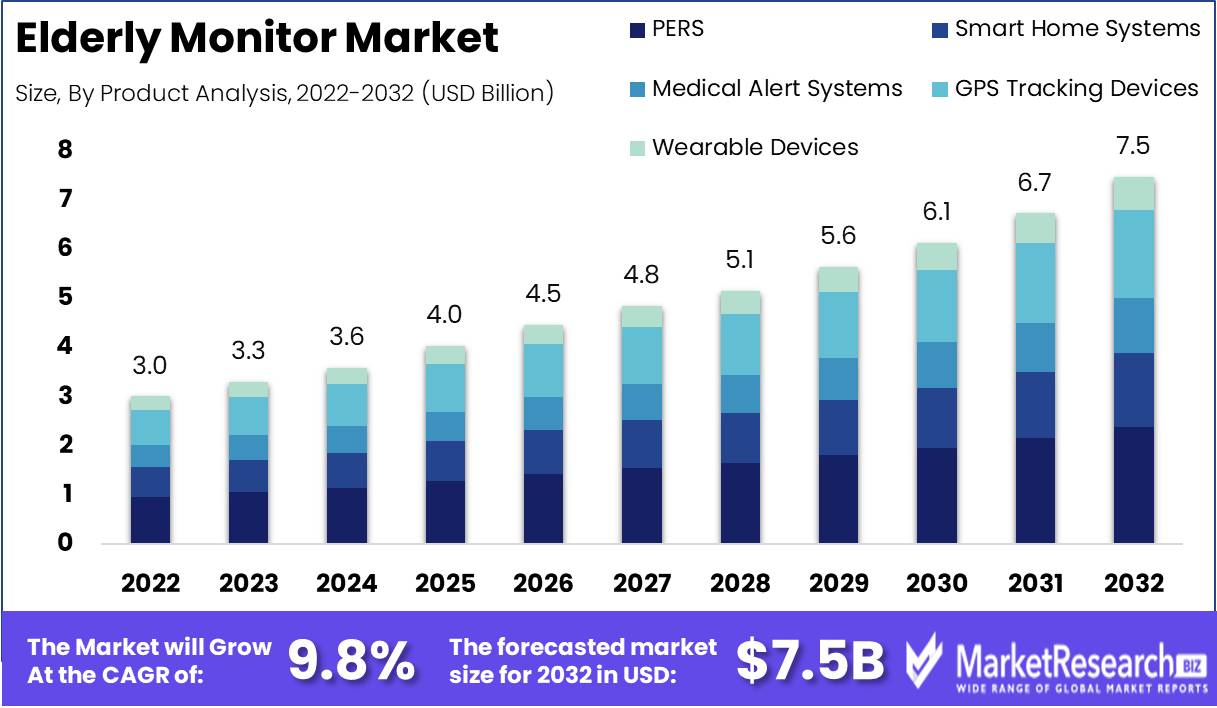

Elderly Monitor Market size is expected to be worth around USD 7.5 Bn by 2032 from USD 3.0 Bn in 2022, growing at a CAGR of 9.8% during the forecast period from 2023 to 2032.

The Global Elderly Monitor Market is witnessing a surge in demand driven by the expanding elderly population and advancements in technology. As the elderly population grows, there is an increasing need for personal care and health monitoring. This market is also benefiting from the progress made in IoT and AI technologies. In this comprehensive report, we will delve into various aspects of the Global Elderly Monitor Market, including its definition, significance, innovations, investments, applications, and ethical concerns.

The Global Elderly Monitor Market encompasses a wide range of tools and devices designed to monitor the health and well-being of the elderly. These tools include wearable medical devices, home monitoring systems, and medical alert systems. The main objective of these monitoring systems is to enhance the quality of life for the elderly by enabling them to maintain their independence while receiving the necessary care and attention.

The elderly population is growing at an unprecedented rate worldwide, necessitating specific attention and care. Elderly monitoring systems offer a crucial solution to ensure their safety and meet their health needs. These systems provide several advantages, such as early detection of health issues, improved communication between healthcare professionals and the elderly, reduced healthcare costs, and increased independence for older adults.

In recent years, the Global Elderly Monitor Market has witnessed significant innovations that have greatly improved the lives of older adults. These innovations include AI-powered monitoring systems, wearable devices that track medication intake and physical activity, and home monitoring systems that monitor vital signs and detect falls. Notably, these innovations enable the early detection of specific health conditions like dementia and cardiovascular disease, thereby reducing the risk of hospitalization and other complications.

Driving factors

Advancements in Remote Monitoring Technologies

With the continuous development of wearable health technology, smart home devices, and remote monitoring systems, the elderly monitor market has witnessed significant advancements in remote monitoring technologies. These technological innovations have brought about a positive impact, enabling elderly patients to remotely monitor their health and well-being in ways that were previously unimaginable.

Demand for Independent Living Solutions

The increasing desire among the elderly population to maintain their independence and live in their own homes for as long as possible has fueled the demand for independent living solutions. This demand has created a need for technologies that facilitate independent living while providing peace of mind for caregivers and family members. As a result, the elderly monitor market is experiencing substantial growth.

Focus on Proactive Elderly Care Spurs Market Growth

A shift in focus from reactive to proactive elderly care is contributing to the growth of the elderly monitor market. Healthcare providers and caregivers are now seeking ways to prevent health issues before they arise, rather than merely reacting to them. This shift in approach has led to an increased demand for monitoring technologies and services that can identify potential health risks and prevent complications.

Restraining Factors

Privacy and Data Security Concerns

Concerns about privacy and data security are one of the most significant restraining factors for the global elderly monitor market. There have been concerns regarding the vulnerability of personal data since the adoption of various monitoring technologies in healthcare services. Patients, particularly the elderly, are frequently wary of who has access to their information and how it may be utilized. Given the ethical and legal complexities, it may be difficult to address such concerns.

Age-Related Adoption Barriers Among Elderly Individuals

A further significant challenge for the global elderly monitor market is the low adoption rate among the elderly. Despite the fact that monitoring technologies offer numerous advantages, older individuals frequently struggle to implement them. For instance, older individuals may find digital devices difficult to use, unfamiliar, and intimidating, resulting in a reluctance to employ them. In addition, elderly individuals, especially those who reside alone, may require more hands-on care, which may not be feasible with remote monitoring technologies. In the Elderly Monitor Market, dementia care products enable real-time tracking and enhanced safety measures for individuals living with dementia.

Product Analysis

Segment PERS (Personal Emergency Response Systems) Dominates the Global Elderly Monitor Market. As the world's geriatric population continues to grow, the need for elderly care systems has become a matter of grave concern. Personal Emergency Response Systems (PERS) represent one of the most important segments of the geriatric monitor market. PERS systems provide the elderly with immediate assistance in the event of an accident, medical emergency, or other unanticipated event.

The PERS system consists of a wearable device connected to a central monitoring system capable of detecting emergencies and alerting caregivers or emergency personnel. The PERS market is dominated by industry leaders who offer a variety of features to meet the requirements of different users.

The economic development in emerging societies has fueled the adoption of PERS systems. The availability of technology and income has facilitated the adoption of these systems in these regions, where the elderly population is growing significantly.

Application Analysis

The Fall Prevention and Detection Segment dominates the global market for elderly monitors. Important aspects of geriatric care, fall prevention and detection are addressed by the Fall Prevention and Detection Segment of the elderly monitor market. Falls are prevalent among the elderly and frequently result in severe injuries. As a result, the Fall Prevention and Detection Segment provides a proactive approach to senior care by preventing falls before they occur.

Sensors and algorithms are utilized by fall detection systems to detect falls and immediately alert caregivers or emergency personnel. Contrarily, fall prevention systems employ strategies such as adjusting lighting, installing grab bars and handrails, and implementing flooring with slip-resistant properties, among others.

Emerging economies' economic growth has facilitated the implementation of Fall Prevention and Detection systems. The availability of technology and income has facilitated the adoption of these systems in these regions, where the elderly population is growing significantly.

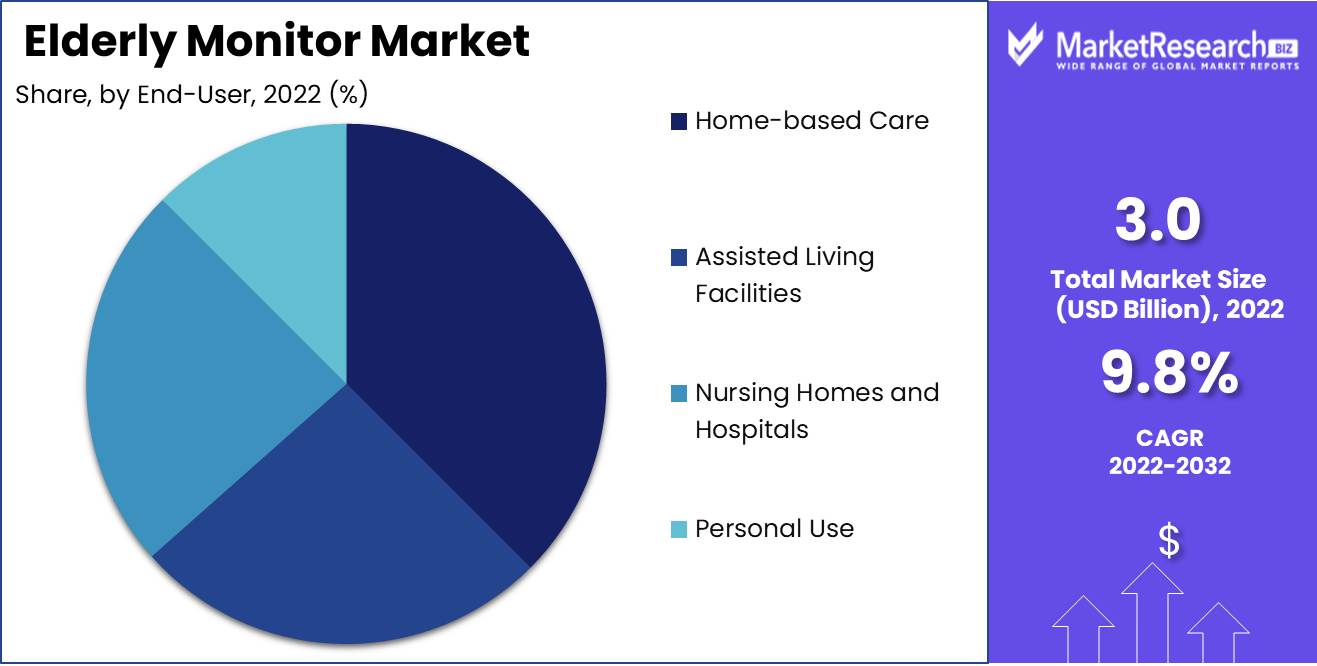

End User Analysis

Home-based care segment dominates the global elderly monitor market. The Home based Care Segment of the geriatric Monitor Market provides solutions for geriatric care in the home. As the number of elderly people continues to rise, many families now prefer home-based care. The facility provides the elderly with a familiar and comfortable environment, allowing them to age in place.

Home-based care solutions include peripheral devices and smart home sensors for monitoring the daily activities and health of the elderly. The devices offer a variety of features, such as medication reminders, fall detection, and emergency notifications, that enable caregivers to provide individualized care.

Economic development in emerging economies has fueled the adoption of home-based care solutions. As the elderly population in these regions continues to grow significantly and access to healthcare facilities remains limited, the importance of home-based care solutions has grown.

Key Market Segments

By Product

- Personal Emergency Response Systems (PERS)

- Smart Home Systems

- Medical Alert Systems

- GPS Tracking Devices

- Wearable Devices

By Application

- Fall Prevention and Detection

- Health Monitoring

- Memory Aid

- Movement and Mobility Monitoring

- Safety and Security Monitoring

By End-User

- Home-based Care

- Assisted Living Facilities

- Nursing Homes and Hospitals

- Personal Use

Growth Opportunity

Development of User-Friendly Monitoring Devices

The development of user-friendly monitoring devices has been a major factor in the growth of the elderly monitor market. The development of easy-to-use and elderly-friendly devices has been made feasible by technological advancements. These devices, which track the elderly's health status and notify caregivers in the event of emergencies, include wearables, sensors, and home monitoring systems.

Wearable devices, such as smartwatches and fitness trackers, have gained popularity among the elderly because they are easy to use and comfortable to wear. They monitor a variety of health parameters, including blood pressure, pulse rate, and walking speed, and provide valuable insight into the health status of the elderly. Home monitoring systems that utilize sensors to detect accidents, temperature fluctuations, or sound can also detect any health issues and alert caregivers.

Integration of Artificial Intelligence and Machine Learning for Data Analysis

Another growth driver for the elderly monitor market is the integration of artificial intelligence and machine learning for data analysis. AI and ML algorithms can analyze vast quantities of data from a variety of sources and provide useful insights into the health status of the elderly. This includes detecting any anomalies in vital signs, recognizing patterns in activity levels, and predicting potential health issues.

AI and ML can also aid in decision-making for caregivers. They can provide alerts for emergencies or suggest appropriate actions based on the elderly's health status. This technology can also automate mundane duties, freeing up time for caregivers to concentrate on providing superior care.

Expansion of Remote Monitoring Services

The elderly monitor market for remote monitoring services has expanded significantly. In response to the growing demand for home care services, remote monitoring services have become an appealing option for elderly patients and their caregivers. Remote monitoring services, such as telemedicine and telemonitoring, provide elderly patients with valuable support while reducing hospital visits.

Telemedicine enables physicians to remotely diagnose and treat patients via telecommunication technologies like video conferencing. Telemonitoring, on the other hand, enables caregivers to monitor the health status of elderly patients from a remote location using wearable devices or residential monitoring systems.

Latest Trends

Elderly Wearable Health Monitoring Devices

In recent years, wearable health monitoring devices have gained popularity, and this trend is likely to continue in the future. These devices are designed to monitor various aspects of an individual's health, including pulse rate, blood pressure, and activity levels. Wearable health monitoring devices are especially useful for detecting and monitoring chronic conditions such as diabetes, hypertension, and heart disease in older adults. They can also be used to monitor medication adherence and provide timely medication reminders for seniors.

Home Monitoring Systems for Fall Detection and Safety

In recent years, home monitoring systems have also grown in popularity, particularly among older adults who wish to live independently in their own homes. These systems are designed to detect and prevent falls, monitor vital signs, and notify caregivers or emergency personnel in the event of an emergency. With the aid of sensors and other sophisticated technologies, home monitoring systems can provide healthcare providers and family members with real-time data on a senior's health.

Integrating Vital Sign Monitoring into Intelligent Home Technologies

The integration of vital sign monitoring in smart home systems is a result of recent advancements in smart home technologies. Smart home technologies can be used to monitor the health of a senior while they are at home by providing a continuous stream of data on vital indicators such as heart rate, blood pressure, and oxygen saturation levels. This data can be analyzed by healthcare providers in order to detect trends, identify prospective health problems, and develop individualized care plans.

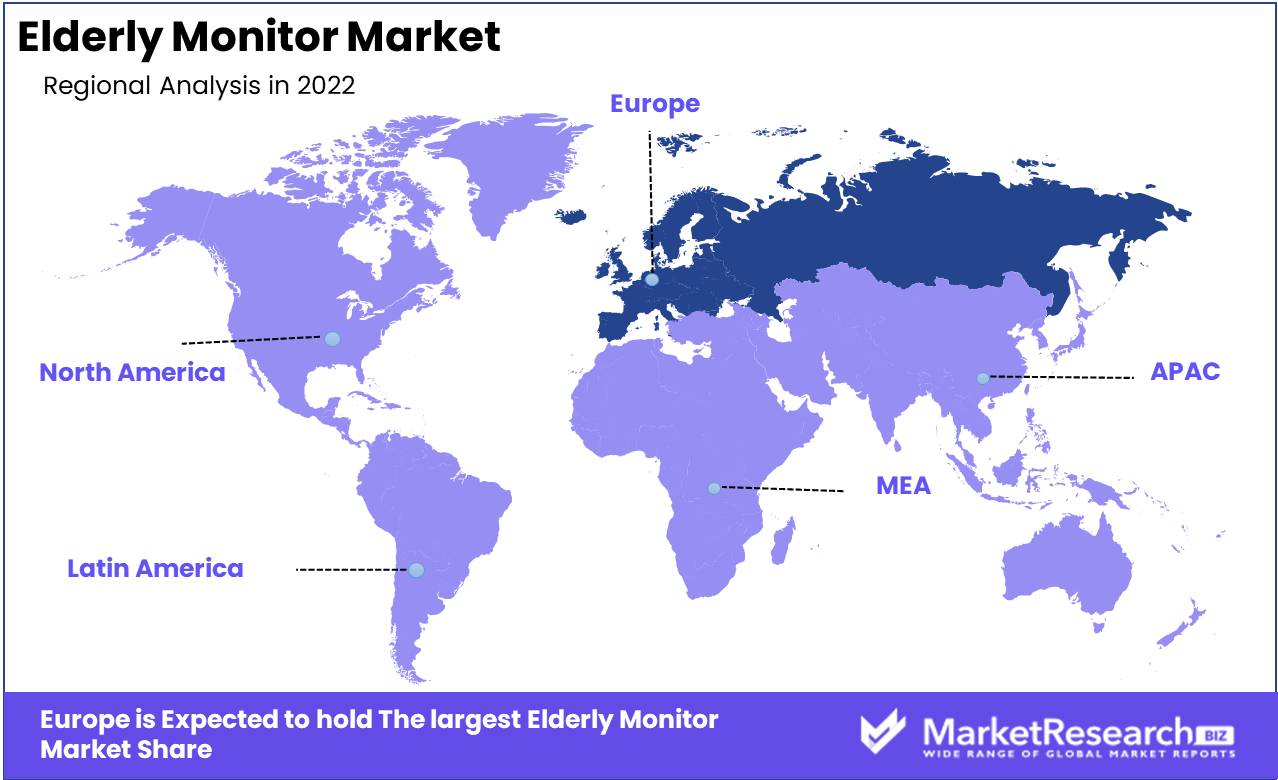

Regional Analysis

Europe Dominates the Market for Elderly Monitors: A Comprehensive Analysis. Europe's population is aging swiftly, with an estimated 19.4% of the population aged 65 or older. Europe's geriatric population is inextricably linked to the rising demand for elderly monitors. In comparison to other regions, the European market has a high proportion of elderly people who require medical care and continuous monitoring. The geriatric monitor market has seen an increase in demand over the years, as it directly serves this demographic.

Europe is also the center of technological innovation in the industry of geriatric monitors. The region has been at the vanguard of device innovation, software advancements, and data analytics, thereby enhancing our understanding of the health and well-being of the elderly. European manufacturers have been actively developing advanced hardware and software solutions tailored to the requirements of the elderly. They have been successful in designing devices that can measure vital signs, monitor activity levels, and detect medical conditions. These devices can provide micro-level insights into the health of the elderly and can be tailored to individual needs.

The shift toward connected healthcare is an additional factor in Europe's market dominance in geriatric monitors. Connected health refers to the concept of bridging the divide between patients and healthcare professionals using technology. Connected health devices, such as elderly monitors, provide physicians and family members with real-time data that can be shared, enabling them to make informed decisions regarding the health of the elderly.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

In recent years, the global elderly monitor market has expanded rapidly, propelled by the aging population. The purpose of elderly monitors is to allow caregivers or family members of senior citizens to remotely monitor their health and safety. These devices provide real-time measurements of vital signs including blood pressure, heart rate, oxygen saturation, and temperature.

Multinational corporations such as Philips Healthcare, Omron Healthcare, Fitbit, and Medtronic are among the leading competitors in the global elderly monitor market. These businesses manufacture a variety of elderly monitors with varying features, functionalities, and costs. For instance, Philips Healthcare offers an extensive selection of elderly monitors, including medication dispensers, fall sensors, and blood pressure monitors.

Omron Healthcare, a Japanese company that specializes in blood pressure monitors, has created a monitor for the elderly that can transmit blood pressure readings to a smartphone for remote monitoring. Fitbit has also entered the elderly monitor market with its Fitbit Blaze smartwatch, which analyzes steps, sleep, and heart rate and provides on-screen exercise guidance.

Medtronic is renowned for its glucose monitoring systems for diabetic patients. The company has recently introduced a monitor for the elderly that monitors glucose levels, blood pressure, and heart rate, providing a comprehensive view of the senior's health.

Top Key Players in Elderly Monitor Market

- Philips Lifeline

- Life Alert

- Medtronic

- ADT Inc

- Omron Healthcare

- Bay Alarm Medical

- GreatCall

- Medical Guardian

- MobileHelp

- Connect America

- Qmedic

- Other

Recent Development

- In 2021, Apple Inc. released the Apple Watch Series 6, which has a new fall detection feature that can autonomously call for assistance if the wearer falls and does not get up. The device's advanced health monitoring capabilities and real-time tracking features have contributed to its rising popularity.

- In 2022, Samsung Electronics Co Ltd released the Galaxy Watch4 with comparable fall detection capabilities, following in Apple's footsteps. In addition, the Galaxy Watch4 features a variety of health monitoring capabilities, including blood oxygen levels, ECG monitoring, and heart rate monitoring. Samsung's newest smartwatch is expected to compete with Apple's newest smartwatch.

- In 2023, Google announced that it is developing a new wearable device for monitoring elderly people's health. Medication reminders, vital signs monitoring, and fall detection are expected features of the device, which is still in development.

Report Scope

Report Features Description Market Value (2022) USD 3.0 Bn Forecast Revenue (2032) USD 7.5 Bn CAGR (2023-2032) 9.8% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product (Personal Emergency Response Systems (PERS), Smart Home Systems, Medical Alert Systems, GPS Tracking Devices, Wearable Devices)

By Application (Fall Prevention and Detection, Health Monitoring, Memory Aid, Movement and Mobility Monitoring, Safety and Security Monitoring)

By End-User (Home-based Care, Assisted Living Facilities, Nursing Homes and Hospitals, Personal Use)Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Philips Lifeline, Life Alert, ADT Inc, Bay Alarm Medical, GreatCall, Medical Guardian, MobileHelp, Connect America, Qmedic, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Philips Lifeline

- Life Alert

- ADT Inc

- Bay Alarm Medical

- GreatCall

- Medical Guardian

- MobileHelp

- Connect America

- Qmedic

- Other