Mammalian Cell Fermentation Technology Market By Type(Chinese Hamster Ovary (CHO) Cell Fermentation, Human Embryonic Kidney (HEK) Cell Fermentation, Baby Hamster Kidney (BHK) Cell Fermentation), By Application(Monoclonal Antibodies, Recombinant Proteins), By End-Use(CMOs & CDMOs, Biopharmaceutical Companies), By Industry(Media And Entertainment, Education, Retail, Others), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2023-2032

-

42309

-

Dec 2023

-

179

-

-

This report was compiled by Correspondence Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

- Mammalian Cell Fermentation Technology Market Size, Share, Trends Analysis

- Mammalian Cell Fermentation Technology Market Dynamics

- Mammalian Cell Fermentation Technology Market Segmentation Analysis

- Mammalian Cell Fermentation Technology Industry Segments

- Mammalian Cell Fermentation Technology Market Growth Opportunity

- Mammalian Cell Fermentation Technology Market Regional Analysis

- Mammalian Cell Fermentation Technology Industry By Region

- Mammalian Cell Fermentation Technology Market Share Analysis

- Mammalian Cell Fermentation Technology Industry Key Players

- Mammalian Cell Fermentation Technology Market Recent Development

- Report Scope

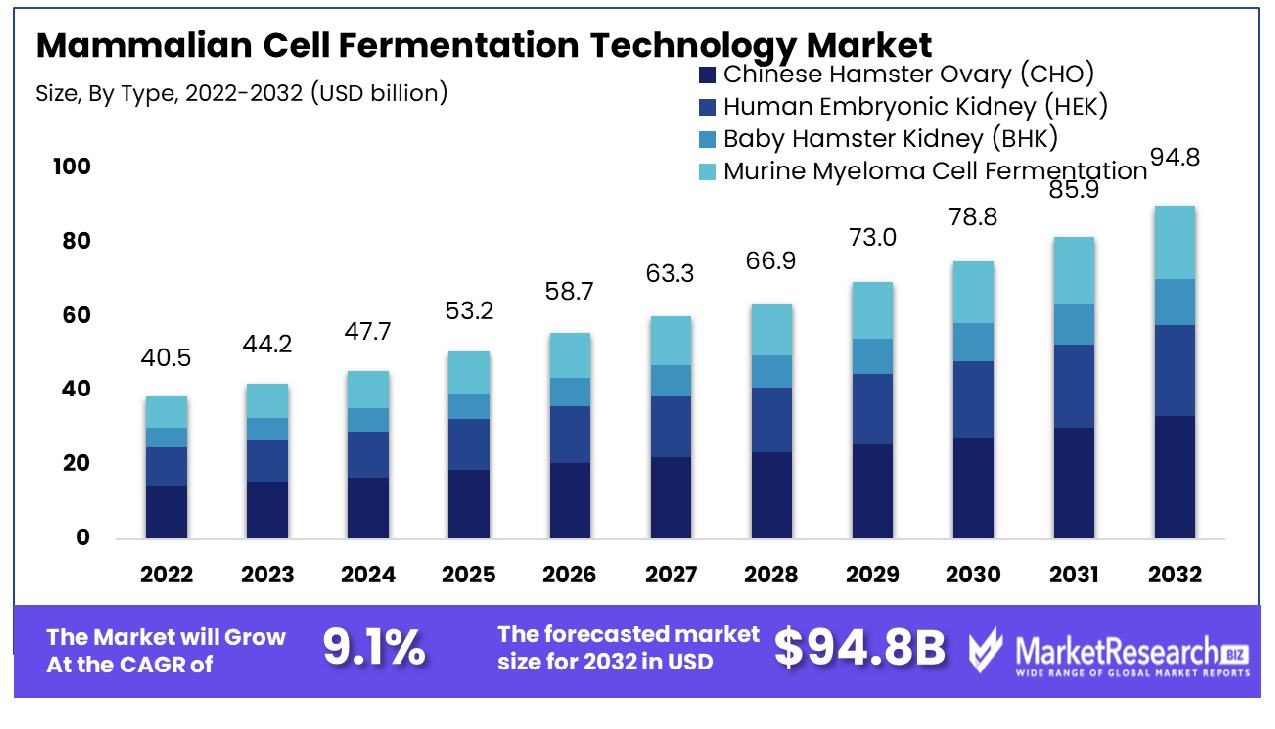

Mammalian Cell Fermentation Technology Market size is predicted to reach approximately USD 94.8 Bn by 2032, from a valuation of USD 40.5 Bn in 2022, growing at a CAGR of 9.1% during the forecast period from 2023 to 2032.

Mammalian cell fermentation technology refers to the use of mammalian cells like Chinese hamster ovary (CHO) cells or mouse myeloma cells (NS0, Sp2/0) for manufacturing biotherapeutics and vaccines. It involves genetically engineering such cells to produce desired therapeutic proteins, antibodies, vaccines, and gene therapy vectors. The bioactive compounds are then harvested from the cells' culture media.

The mammalian cell fermentation technology market is expected to grow significantly in the coming years. This growth is mainly driven by the increasing demand for biologics and biopharmaceuticals.

A significant growth driver is the rising necessity for therapeutic proteins and antibodies. These are mainly used for the treatment of chronic diseases like cancer, autoimmune disorders, and cardiovascular diseases. This is expanding patient populations and demand for new biologic treatments like monoclonal antibodies, cytokines, and enzymes which require mammalian cell fermentation.

The COVID-19 pandemic has also highlighted the need for rapid and scalable manufacturing of vaccines and therapeutics using cell culture technology. The research by the Argentinian AntiCovid Consortium demonstrated how mammalian cells can be used in the expression and production of the receptor binding domain (RBD) from the severe acute respiratory syndrome coronavirus-2 (SARS-CoV-2) Spike protein.

The growing pipeline of biologics and increasing approval of protein therapeutics are expected to drive steady long-term demand for mammalian cell culture capacity. The market is also aided by technological advances in single-use equipment, media, and targeted protein optimization to enhance productivity.

For Instance, Culture Biosciences' innovative approach revolutionizes the Mammalian Cell Fermentation Technology Market by offering pharmaceutical developers an on-demand, cloud-based bioreactor platform. This eliminates infrastructure costs, fostering faster experimentation and process development, particularly for novel biologics.

Such streamlined, scalable solution enhances efficiency, accelerates innovation, and position companies at the forefront of cutting-edge bioprocessing in the evolving biopharmaceutical landscape.

A study by Nanjing Medical University presented a novel 3D cell culture technique that enables enhanced mammalian protein expression by adjusting hydrogel matrix properties to increase spheroid formation. This boosts translation efficiency through cytoskeletal signaling and ribosome recruitment, demonstrating scalable, controllable production potential.

In terms of growth opportunities, the market has huge potential in areas such as gene therapy and regenerative medicine. Cell and gene therapies often rely on viral vectors which require mammalian cells for propagation.

Additionally, applying this technology for personalized medicine and orphan drugs for rare diseases represents an emerging growth avenue. The scalability and flexibility of mammalian cell fermentation make it well-suited for catering to smaller patient populations.

Advances in genomics and proteomics are enabling more tailored therapies based on patients' biological makeup. These precision medicines often rely on mammalian cell lines for production. The trend toward targeted, individualized treatment regimens benefits the Market.

Mammalian Cell Fermentation Technology Market Dynamics

Biotechnology R&D Investments Propel Mammalian Cell Fermentation

The growing investments in biotechnology research and development are significantly driving the growth of the mammalian cell fermentation technology market. As biotech companies and academic institutions increase their funding in R&D, there is a surge in innovation and improvement of mammalian cell fermentation techniques.

This investment market trend is not only addressing current market needs but also setting the stage for future advancements in the field. The continuous flow of capital into R&D indicates a sustained expansion and evolution of the market, aligning with the rising demands of the biotechnology sector.

Technological Advancements Fuel Market Evolution

Technological advancements and research and development activities are key trends for the mammalian cell fermentation technology market. Continuously evolving bioprocessing technologies including better bioreactors, as well as cell culture systems, increase the efficacy and productivity of mammalian cell fermentation.

These developments are vital in responding to the ever-growing need for complex biopharmaceuticals. The trend toward technological sophistication suggests a market trajectory characterized by high-tech solutions, meeting the evolving needs of the biopharmaceutical industry.

Regulations and Industry Collaborations Shape Market Dynamics

Government regulations and industry collaborations significantly influence the mammalian cell fermentation technology market. Regulatory guidelines ensure the safety and efficacy of biopharmaceutical products, impacting the fermentation processes and technologies used.

Meanwhile, collaborations among industry players, academia, and regulatory bodies facilitate the sharing of knowledge and resources, driving innovation and compliance. These collaborations and regulations are likely to continue shaping the market, ensuring sustainable and responsible growth in the sector.

High Production Costs Restrain Mammalian Cell Fermentation Technology Market Growth

High production costs significantly limit the growth of the mammalian cell fermentation technology market. This technology, pivotal in biopharmaceutical manufacturing, involves complex processes requiring advanced bioreactors and stringent control systems to maintain the necessary cellular environment.

The cost of these specialized equipment and the high-quality inputs (like cell culture media) contribute to substantial operational expenses. Additionally, the process is labor-intensive and demands a prolonged development period, further escalating costs. These factors make the technology less accessible, particularly for smaller companies or regions with limited funding for biotechnological ventures, thereby restricting market expansion.

Regulatory Requirements and Technical Expertise Limit Mammalian Cell Fermentation Technology Market Growth

Regulatory requirements and the need for technical expertise also pose significant barriers to the mammalian cell fermentation technology market. Producing pharmaceuticals using this technology necessitates adherence to rigorous regulatory standards to ensure product safety and efficacy.

Complying with these regulations requires extensive documentation, validation, and quality control measures, which are resource-intensive. Additionally, the sophisticated nature of demands a high level of technical expertise and skilled personnel, which can be challenging to acquire and retain. These factors collectively heighten the entry barriers for new players and limit the capacity of existing ones to innovate and scale up, thus hindering the overall market growth.

Mammalian Cell Fermentation Technology Market Segmentation Analysis

By Type Analysis

CHO cell fermentation is the most dominant segment in the mammalian cell fermentation segment. The reason for its popularity is it is a result of CHO cells' capacity to create high-quality, complex proteins that are therapeutically useful. Cho cells have emerged as the preferred line of cells because of their ability to adapt to different conditions of culture and scalability as well as their proven performance in the production of various biologics, such as monoclonal antibodies and hormones. Ongoing research and technological advancements continue to optimize CHO cell lines for higher yields and stability, further solidifying their position in the market.

Other cell lines like HEK, BHK, and murine myeloma cells are used for specific applications where their unique properties are advantageous. HEK cells, for instance, are used for transient expression systems, while BHK and murine myeloma cells have niche applications in vaccine and antibody production. While smaller in market share, these cell lines are important for their specialized roles in biopharmaceutical production.

By Application Analysis

The production of monoclonal antibodies is the leading application of mammalian cell fermentation technology. The dominance of this segment is driven by the rising demand for monoclonal antibodies segment to aid in the treatment of many diseases such as cancer and auto-immune disorders. Monoclonal antibodies are sought-after due to their effectiveness and specificity in the treatment of disease-related cells. The advancement in cell line development services and bioreactor systems has significantly increased the production efficiency of monoclonal antibodies, supporting the segment's growth.

Recombinant proteins segment and vaccines form significant segments, with mammalian cells providing the necessary post-translational modifications for these therapeutics. Hormones and enzymes produced via mammalian cell fermentation are crucial in various medical treatments and industrial applications. Each of these applications leverages the unique capabilities of mammalian cells, contributing to the diversity and growth of the market.

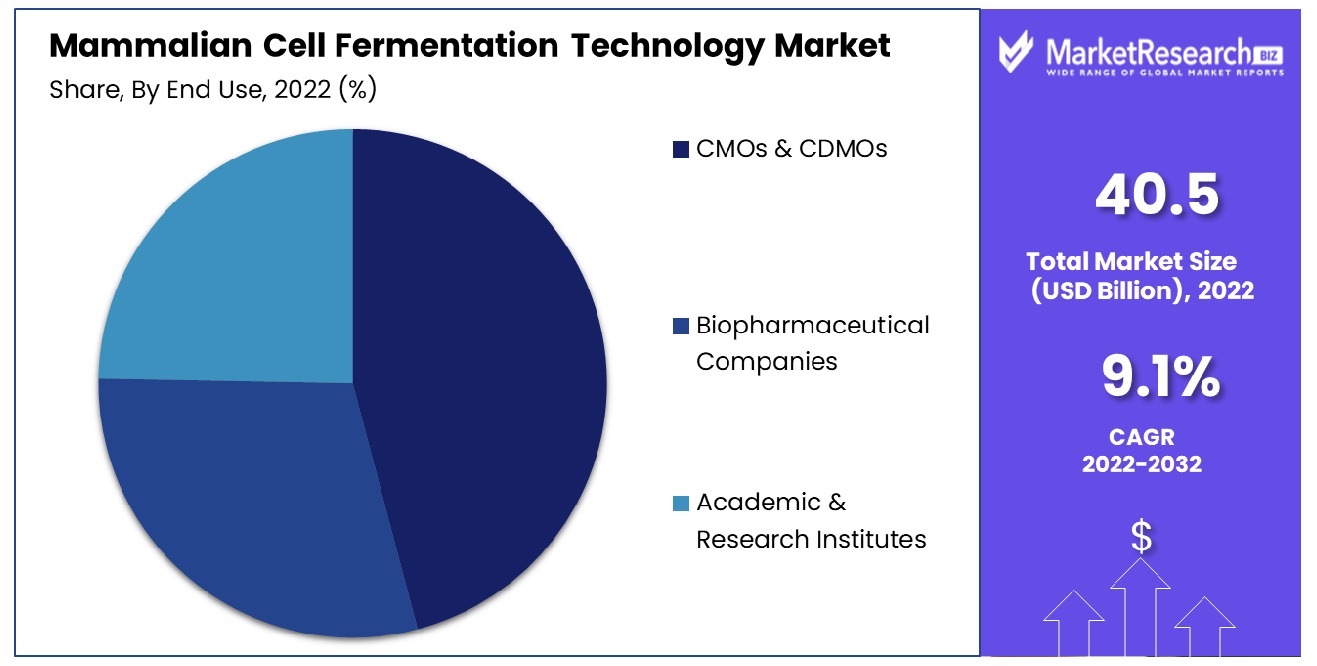

By End-Use Analysis

Contract Manufacturing Organizations (CMOs) and Contract Development and Manufacturing Organizations (CDMOs) are the most significant market segments for end-use. Their ability to provide the necessary expertise and capacity for biopharmaceutical manufacturing, particularly for companies with no internal facilities, is a major market factor. These organizations offer services from cell line development to large-scale production, catering to the increasing outsourcing trend in the pharmaceutical industry.

Biopharmaceutical companies use mammalian cell fermentation for their in-house production of biological therapeutics. Academic and research institutes utilize this technology for research and development purposes, contributing to scientific advancements and novel therapeutic discoveries. These end-users are essential for the ongoing development and innovation in the field of mammalian cell fermentation.

Mammalian Cell Fermentation Technology Industry Segments

By Type

- Chinese Hamster Ovary (CHO) Cell Fermentation

- Human Embryonic Kidney (HEK) Cell Fermentation

- Baby Hamster Kidney (BHK) Cell Fermentation

- Murine Myeloma Cell Fermentation

By Application

- Monoclonal Antibodies

- Recombinant Proteins

- Vaccines

- Hormones

- Enzymes

By End-Use

- CMOs & CDMOs

- Biopharmaceutical Companies

- Academic & Research Institutes

Mammalian Cell Fermentation Technology Market Growth Opportunity

Increasing Demand for Biologics Offers Growth Opportunity in Mammalian Cell Fermentation Technology Market

The increasing demand for biologics is a significant growth driver for the mammalian cell fermentation technology market. Biologics, which include vaccines, antibodies, and proteins, are essential in treating various diseases and are increasingly preferred due to their specificity and efficacy.

Mammalian cell fermentation is crucial in producing these complex biological products. The rising prevalence of chronic diseases and the global focus on personalized medicine have heightened the demand for biologics, thereby driving the expansion of technologies. This trend underscores the need for advanced fermentation techniques to meet the growing production demands for biologics.

Emerging Markets and Contract Manufacturing Organizations Fuel Growth in Mammalian Cell Fermentation Technology Market

The emergence of new markets and the growing role of Contract Manufacturing Organizations (CMOs) present substantial growth opportunities for the market. Emerging markets are rapidly developing their biopharmaceutical sectors, increasing the demand for mammalian cell fermentation to produce biologics.

CMOs are also playing an essential part in this growth through the provision of special manufacturing services, like mammalian cell fermentation to biopharmaceutical firms. This will allow for more efficient and affordable manufacturing of biologics. Collaboration among emerging markets as well as CMOs facilitates the accessibility to biopharmaceuticals across the globe and accelerates the development of mammalian cell-based fermentation technology.

Mammalian Cell Fermentation Technology Market Regional Analysis

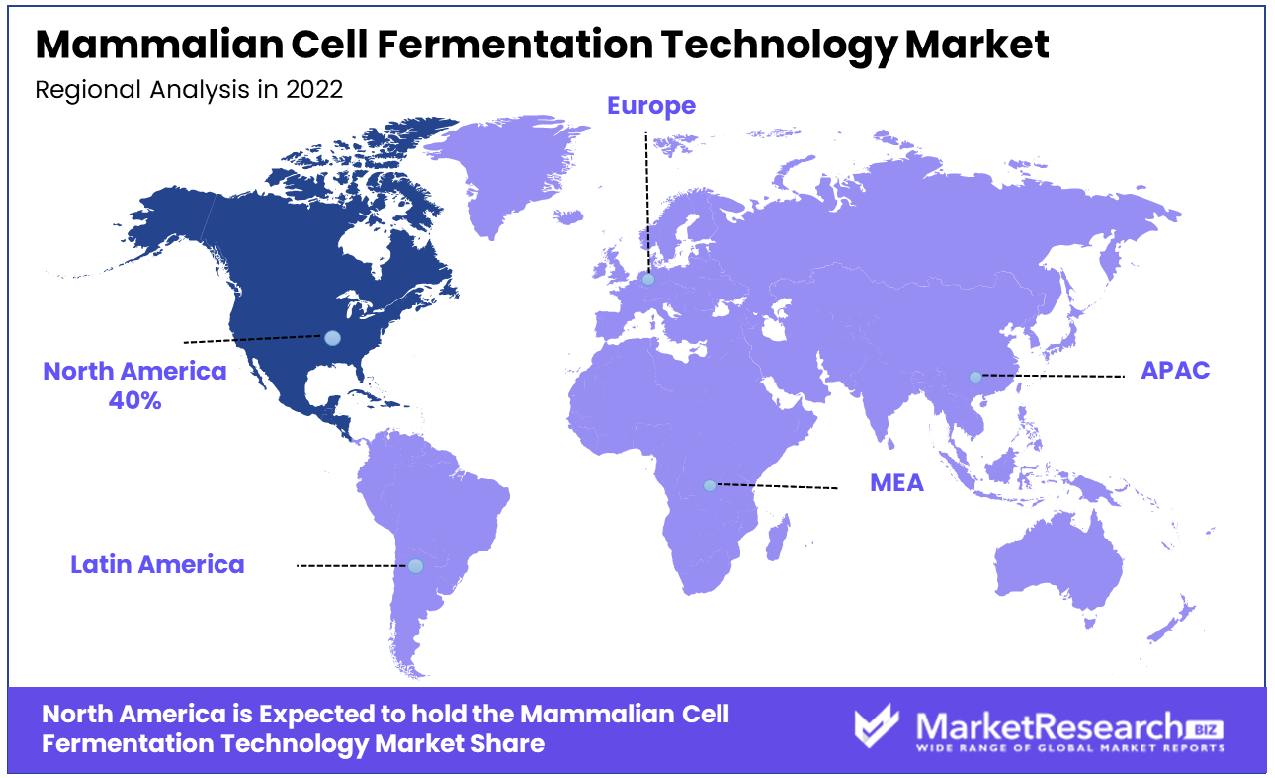

North America Dominates with a 40% Market Share

North America’s commanding 40% share of the Mammalian Cell Market is primarily driven by the region's advanced biotechnology and pharmaceutical sectors. The presence of prominent biopharmaceutical companies, in addition to significant investments in research and development, plays an important role. The region's strong focus on innovative drug development, particularly biologics, and biosimilars, which often require mammalian cell fermentation processes, significantly contributes to this market dominance.

The dynamics of the market in North America are influenced by the region’s cutting-edge technological infrastructure in bioprocessing and fermentation technology. The strong regulatory framework and emphasis on quality and safety in drug production further bolster the market. Additionally, the increasing demand for monoclonal antibodies, vaccines, and other therapeutic proteins, which are produced using mammalian cell fermentation, supports the market’s growth in this region.

Looking ahead, the future of North America appears robust. The growing focus on personalized medicine and the continuous evolution of biotechnology are likely to drive further advancements and applications in this field. The increasing prevalence of chronic diseases and the need for novel therapeutics will continue to spur demand for mammalian cell fermentation, maintaining North America’s leadership in the market.

Europe: A Hub for Biopharmaceutical Innovation

Europe's mammalian cell fermentation market is driven by its strong biopharmaceutical industry and commitment to research and development. The region's focus on innovative drug development, supported by a favorable regulatory environment and collaborations between academic institutions and the biopharmaceutical industry, fosters growth in this sector. Additionally, Europe's strategic focus on biologics in the pharmaceutical market supports the demand for advanced fermentation technologies.

Asia-Pacific: Rapid Growth and Expanding Capabilities

The mammalian cell market in Asia-Pacific is experiencing rapid growth, fueled by the region's expanding biopharmaceutical sector and increasing investments in life sciences. Countries like China, South Korea, and India are becoming increasingly prominent in biopharmaceutical manufacturing, driven by government support and a growing skilled workforce. The region’s improving technological capabilities and increasing adoption of advanced bioprocessing techniques position Asia-Pacific as an emerging force in the global mammalian cell fermentation market.

Mammalian Cell Fermentation Technology Industry By Region

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of Asia Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of Middle East & Africa

In the Mammalian Cell Fermentation Technology Market, the companies listed play a crucial role in shaping its landscape through innovation and strategic positioning. Thermo Fisher Scientific, Inc. and Merck KGaA are pivotal in providing advanced bioprocessing technologies and solutions, emphasizing the market's focus on efficiency and scalability in cell culture technologies.

Danaher and Lonza, with their specialized biotechnological capabilities, underscore the importance of precision and customization in fermentation processes to meet the rigorous demands of biopharmaceutical production. F. Hoffmann-La Roche Ltd and Sartorius AG, renowned for their contributions to pharmaceutical and biotechnology research, reflect the industry's trend towards integrating advanced bioreactors and fermentation systems for enhanced drug development.

AstraZeneca and Bristol-Myers Squibb, as major pharmaceutical companies, demonstrate the significant demand for fermentation in drug discovery and therapeutic protein production. Their investment in this technology underscores its critical role in developing novel biological drugs.

Amgen and Gilead Sciences, with their focus on innovative therapies, highlight the market's orientation towards using mammalian cell fermentation for complex biologics, including monoclonal antibodies and vaccines. Moderna, Inc., known for its mRNA technology, and Regeneron Pharmaceuticals, with their cutting-edge research, showcase the evolving applications of mammalian cell fermentation in addressing diverse healthcare challenges, including the rapid development of vaccines.

Collectively, these key players not only drive technological advancements in the market but also represent a spectrum of strategies from drug development to advanced bioprocessing, crucial in catering to the growing demands of modern biopharmaceutical production.

Mammalian Cell Fermentation Technology Industry Key Players

- Thermo Fisher Scientific, Inc.

- Merck KGaA

- Danaher

- Lonza

- F. Hoffmann-La Roche Ltd

- Sartorius AG

- AstraZeneca

- Bristol-Myers Squibb

- Amgen

- Gilead Sciences

- Moderna, Inc.

- Regeneron Pharmaceuticals

Mammalian Cell Fermentation Technology Market Recent Development

- In October 2023, Tanvex BioPharma USA Inc. launched Tanvex CDMO, a comprehensive biologic contract development and manufacturing service provider. This launch aimed to provide services to early-stage biopharmaceutical companies, helping them bring mammalian and microbial-derived biologics from concept to commercialization.

- In 2023, Avid Bioservices completed two expansions within its mammalian cell facilities in Myford, California. Two new Current Good Manufacturing Practice (CGMP) mammalian cell manufacturing suites were added at the Myford facility.

- In January 2023, Shanghai Henlius Biotech, Inc. (2696. HK) signed an exclusive license agreement together with Fosun Pharma to commercialize Henlius independently created monoclonal anti-PD-1 antibody (mAb) Hansizuang in the United States (US).

- In June 2022, Brown Foods, a US- and India-based startup, raised $2.36 million in seed funding. The funding came from investors such as Y Combinator, AgFunder, SRI Capital, Amino Capital, Collaborative Fund, and individual angel investors. The funds are intended to support the development of a milk alternative made using mammalian cell culture technology.

Report Scope

Report Features Description Market Value (2022) USD 40.5 Billion Forecast Revenue (2032) USD 94.8 Billion CAGR (2023-2032) 9.1% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type(Chinese Hamster Ovary (CHO) Cell Fermentation, Human Embryonic Kidney (HEK) Cell Fermentation, Baby Hamster Kidney (BHK) Cell Fermentation, Murine Myeloma Cell Fermentation), By Application(Monoclonal Antibodies, Recombinant Proteins, Vaccines, Hormones, Enzymes), By End-Use(CMOs & CDMOs, Biopharmaceutical Companies, Academic & Research Institutes) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Thermo Fisher Scientific, Inc., Merck KGaA, Danaher, Lonza, F. Hoffmann-La Roche Ltd, Sartorius AG, AstraZeneca, Bristol-Myers Squibb, Amgen, Moderna, Inc., Regeneron Pharmaceuticals Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Thermo Fisher Scientific, Inc.

- Merck KGaA

- Danaher

- Lonza

- F. Hoffmann-La Roche Ltd

- Sartorius AG

- AstraZeneca

- Bristol-Myers Squibb

- Amgen

- Gilead Sciences

- Moderna, Inc.

- Regeneron Pharmaceuticals