Luxury Folding Carton Market By Material Type (Paperboard, Corrugated board, Kraft board, Others), By Structure (Straight tuck end, Reverse tuck end, Others), By Inserts (Rigid inserts, Flexible inserts, Others), By End-User Industry (Food and beverages, Cosmetics and personal care, Confectionery, Tobacco, Consumer goods, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

-

22251

-

May 2023

-

185

-

-

This report was compiled by Kalyani Khudsange Kalyani Khudsange is a Research Analyst at Prudour Pvt. Ltd. with 2.5 years of experience in market research and a strong technical background in Chemical Engineering and manufacturing. Correspondence Sr. Research Analyst Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

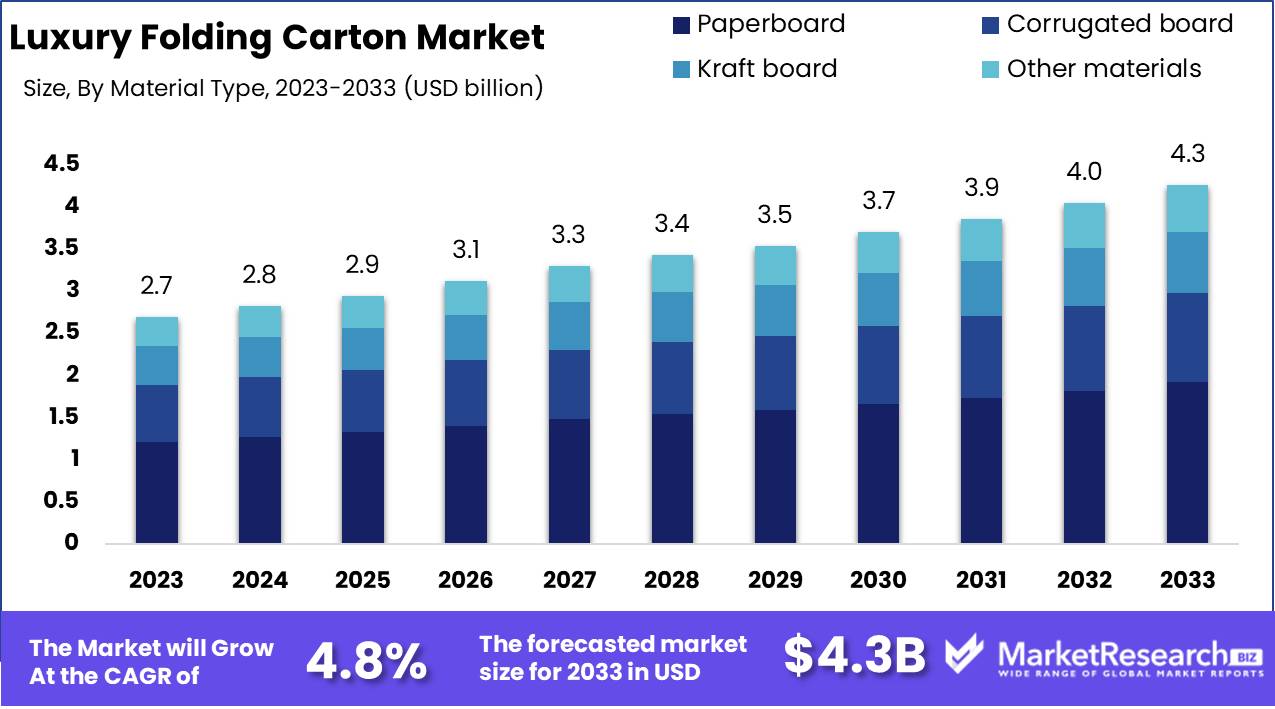

The Global Luxury Folding Carton Market was valued at USD 2.7 Bn in 2023. It is expected to reach USD 4.3 Bn by 2033, with a CAGR of 4.8% during the forecast period from 2024 to 2033.

The Luxury Folding Carton Market encompasses premium packaging solutions designed to enhance the presentation and protection of high-end products. This market includes sophisticated, customizable cartons crafted from high-quality materials, featuring intricate designs, embellishments, and finishes. Catering primarily to the cosmetics, personal care, gourmet food, and high-end retail sectors, these cartons provide both aesthetic appeal and structural integrity. The market's growth is driven by increasing consumer demand for luxurious packaging that reflects brand prestige and sustainability. Innovations in design and materials continue to elevate the market, offering brands the opportunity to differentiate their products and enhance customer experience.

The Luxury Folding Carton Market is poised for substantial growth, driven by the rising demand for premium packaging solutions that enhance both product presentation and protection. High-end sectors such as cosmetics, personal care, gourmet food, and luxury retail are increasingly relying on sophisticated, customizable folding cartons to reflect their brand prestige and appeal to discerning consumers. A key material in this market is solid fiberboard, with a basis weight of at least 200 g/m² and a thickness of 400-900 microns, renowned for its recyclability and environmental friendliness. This aligns with the growing consumer preference for sustainable packaging options.

The Luxury Folding Carton Market is poised for substantial growth, driven by the rising demand for premium packaging solutions that enhance both product presentation and protection. High-end sectors such as cosmetics, personal care, gourmet food, and luxury retail are increasingly relying on sophisticated, customizable folding cartons to reflect their brand prestige and appeal to discerning consumers. A key material in this market is solid fiberboard, with a basis weight of at least 200 g/m² and a thickness of 400-900 microns, renowned for its recyclability and environmental friendliness. This aligns with the growing consumer preference for sustainable packaging options.Innovations in digital printing technology further bolster the market's potential by significantly reducing material waste—up to 90%—and lowering energy consumption and carbon footprint. This technological advancement not only supports sustainability goals but also allows for intricate, high-quality designs that enhance the luxury appeal of the packaging. Brands are increasingly adopting these advanced printing techniques to differentiate their products and provide a superior unboxing experience.

The market's trajectory is supported by a combination of consumer trends favoring sustainability and the continual evolution of packaging technologies. As luxury brands strive to meet these consumer expectations while maintaining high standards of aesthetic appeal and functionality, the Luxury Folding Carton Market is set to experience robust growth. Stakeholders must remain agile, adapting to advancements in materials and printing technologies to leverage these opportunities effectively and sustain their competitive edge in an evolving marketplace.

Key Takeaways

- Market Value: The Global Luxury Folding Carton Market was valued at USD 2.7 Bn in 2023. It is expected to reach USD 4.3 Bn by 2033, with a CAGR of 4.8% during the forecast period from 2024 to 2033.

- By Material Type: Paperboard is the material type used in 45% of luxury folding cartons.

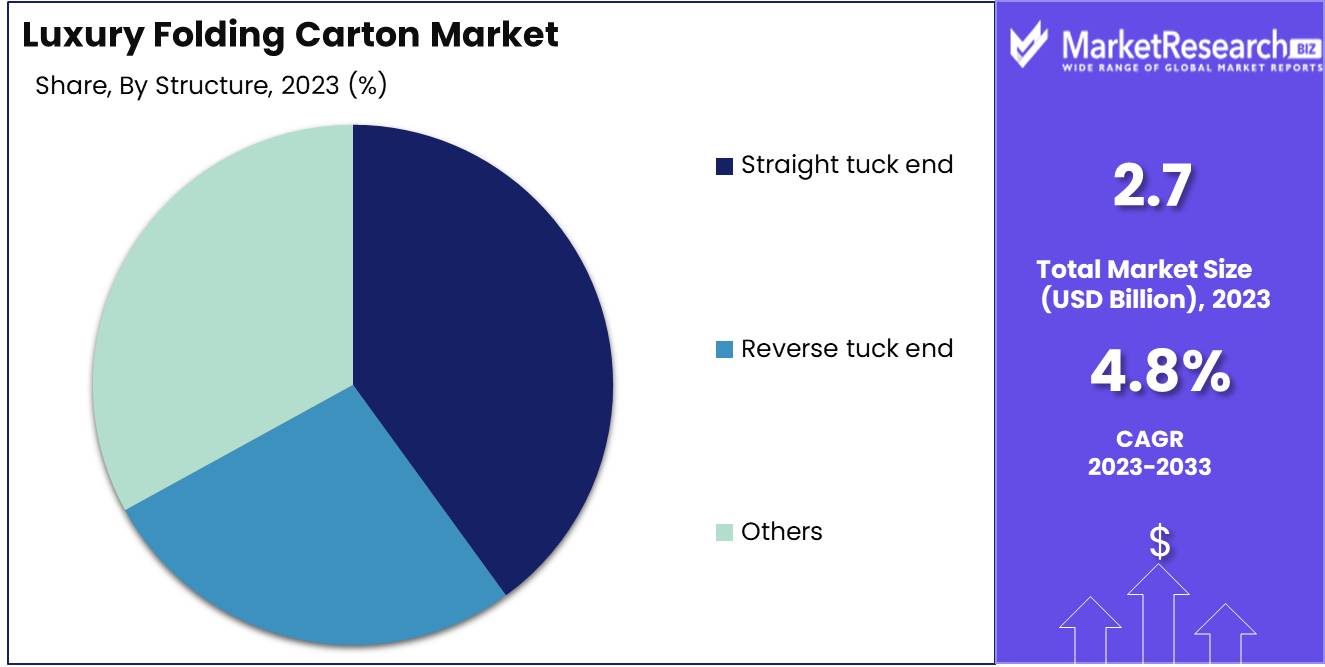

- By Structure: Straight tuck end structures represent 40% of the luxury folding carton market.

- By Inserts: Rigid inserts are used in 50% of luxury folding cartons.

- By End-User Industry: The cosmetics and personal care industry accounts for 30% of the end-user industry in the luxury folding carton market.

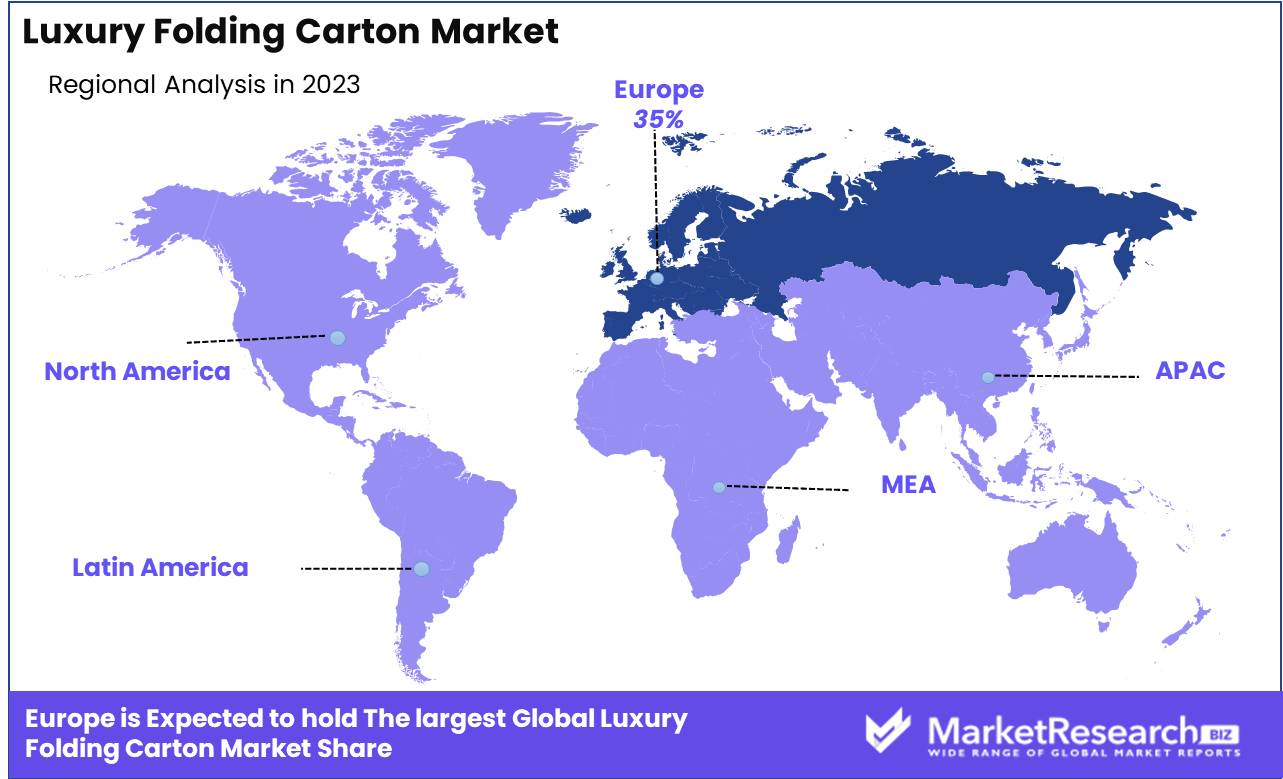

- Regional Dominance: Europe represents 35% of the luxury folding carton market.

- Market Value: The rising demand for premium packaging solutions in the cosmetics and personal care industry drives growth opportunities.

Driving factors

Growing Demand for Premium Packaging Solutions

The luxury folding carton market is experiencing substantial growth driven by the increasing demand for premium packaging solutions. High-end brands across various sectors, including cosmetics, perfumes, and high-end beverages, are leveraging luxury folding cartons to enhance their brand perception and provide an exceptional unboxing experience. Premium packaging is not just about protection but also about creating a memorable experience that reflects the brand’s values and quality.

This demand is fueled by companies’ recognition that luxurious packaging can significantly influence consumer purchasing decisions and brand loyalty. Investment in high-quality, customizable folding cartons is on the rise, driving market growth.

Increasing Consumer Preference for Aesthetically Appealing Packaging

Consumer preference for aesthetically appealing packaging is another significant factor contributing to the growth of the luxury folding carton market. In an era where visual appeal heavily influences consumer behavior, brands are prioritizing sophisticated and elegant packaging designs to attract and retain customers. Luxurious folding cartons offer a canvas for creative and intricate designs, incorporating elements such as embossing, foil stamping, and unique color palettes that resonate with premium consumers.

This trend is particularly prominent in industries such as beauty and personal care, where packaging plays a crucial role in product differentiation and consumer attraction. The heightened emphasis on aesthetic appeal and design innovation directly contributes to the market’s expansion.

Expansion of the Luxury Goods Market

The ongoing expansion of the luxury goods market globally acts as a powerful catalyst for the luxury folding carton market. As disposable incomes rise, particularly in emerging economies, and consumer spending on luxury products increases, the demand for high-quality packaging that reflects the exclusivity and sophistication of luxury goods also grows. Luxury brands are continually launching new products and expanding their portfolios, necessitating a consistent supply of premium packaging solutions.

This expansion is not limited to traditional luxury markets in Europe and North America but is also significant in rapidly growing markets in Asia-Pacific and the Middle East. The broader market for luxury goods ensures sustained demand for luxury folding cartons, driving market growth.

Restraining Factors

High Production Costs

High production costs are a significant challenge for the luxury folding carton market, potentially limiting its growth. Premium materials, intricate designs, and advanced manufacturing processes drive up the cost of producing luxury folding cartons. This economic pressure can affect the pricing strategies of luxury brands, potentially leading to higher prices for end consumers.

Smaller brands or those with limited budgets might struggle to afford such high-end packaging solutions, restricting market access and growth. To mitigate these costs, companies must seek efficiencies through economies of scale, technological advancements in production, and strategic supplier partnerships. Nevertheless, the high production costs remain a substantial barrier that the industry must continuously address to sustain growth.

Environmental Concerns Related to Packaging Waste

Environmental concerns related to packaging waste are increasingly influencing the luxury folding carton market. Consumers and regulatory bodies are becoming more aware of the environmental impact of packaging, particularly in the luxury segment, where packaging is often more elaborate and substantial. The push for sustainability is prompting brands to reconsider their packaging choices and seek eco-friendly alternatives that do not compromise on luxury appeal.

Sustainable materials, recyclable options, and innovations in biodegradable packaging are becoming critical considerations. Brands that successfully integrate sustainability into their luxury packaging can differentiate themselves positively in the market, aligning with consumer values and regulatory requirements. The emphasis on sustainability is driving innovation and reshaping market dynamics, pushing the industry towards greener solutions.

By Material Type Analysis

Paperboard is the preferred material for luxury folding cartons, which accounting for over 45% of the market share.

In 2023, Paperboard held a dominant market position in the By Material Type segment of the Luxury Folding Carton Market, capturing more than a 45% share. The extensive use of paperboard in luxury packaging is driven by its versatility, superior print quality, and eco-friendly attributes. Its ability to be easily customized and its sustainability credentials make it a popular choice among luxury brands seeking to enhance their packaging appeal and environmental footprint.

Corrugated board, while less dominant than paperboard, remains a significant material in the luxury folding carton market. Its durability and cushioning properties make it ideal for packaging high-end products that require extra protection. The growing emphasis on sustainable packaging solutions is also driving the demand for recyclable corrugated board in the luxury segment.

Kraft board holds a notable share in the luxury folding carton market due to its natural and rustic appearance, which appeals to environmentally conscious consumers. Its strength and eco-friendly nature make it a suitable choice for luxury brands aiming to convey a sustainable image on Kraft paper.

Others category includes various other materials such as specialty papers and synthetic boards, which cater to niche markets within the luxury packaging sector. These materials are selected for their unique textures, finishes, and properties that add a distinctive touch to luxury products.

By Structure Analysis

Straight Tuck End held a dominant market position in the By Structure segment of the Luxury Folding Carton Market, capturing more than a 40% share.

In 2023, straight tuck end cartons are favored for their sleek appearance, simplicity, and ease of use, representing over 40% of the market share, . These cartons are commonly used in the luxury market due to their clean lines and the ability to securely house high-end products. Their straightforward design allows for efficient production and appealing presentation, making them a preferred choice for premium brands.

Reverse tuck end cartons hold a significant portion of the market, recognized for their practical design and efficient space usage. While not as dominant as straight tuck end cartons, they offer an alternative that balances functionality with aesthetic appeal. These cartons are particularly valued for their secure closure and versatility in packaging various luxury goods.

Others category includes a variety of other carton structures such as sealed end, auto-lock bottom, and sleeve cartons. These structures cater to specific packaging needs within the luxury sector, offering unique features such as enhanced security, easy assembly, and premium presentation. Although they hold a smaller market share, their specialized designs contribute to the overall diversity and innovation in luxury folding carton packaging.

By Inserts Analysis

Rigid Inserts held a dominant market position in the By Inserts segment of the Luxury Folding Carton Market, capturing more than a 50% share.

In 2023, Rigid inserts are preferred for their robust structure and ability to securely hold products in place, representing over 50% of the market share. These inserts provide an upscale look and feel, which aligns with the brand image of luxury goods. The use of high-quality materials in rigid inserts not only protects delicate items but also adds to the unboxing experience, making them a top choice in the luxury folding carton market.

Flexible inserts hold a significant portion of the market, recognized for their adaptability and cost-effectiveness. While not as dominant as rigid inserts, they offer versatility in accommodating various product shapes and sizes. Flexible inserts, often made from materials like foam or molded pulp, are valued for their cushioning properties and ability to be customized for different luxury items.

Others category includes various other types of inserts such as foam, molded pulp, and specialty inserts that cater to specific packaging requirements within the luxury sector. These inserts, although holding a smaller market share, offer unique features such as enhanced protection, custom fit, and sustainable options. Their specialized designs contribute to the overall diversity and innovation in luxury folding carton packaging.

By End-User Industry Analysis

Accounting for over 30% of the market share, the cosmetics and personal care industry relies heavily on luxury folding cartons to convey a sense of sophistication and quality.

In 2023, Cosmetics and Personal Care held a dominant market position in the By End-User Industry segment of the Luxury Folding Carton Market, capturing more than a 30% share. This significant dominance is attributed to the high demand for premium packaging solutions that enhance product appeal and provide a luxurious unboxing experience. The demand for visually appealing and durable packaging is paramount in this sector, driving innovation and adoption of luxury folding cartons.

The food and beverages segment, while not as dominant as cosmetics and personal care, represents a substantial portion of the luxury folding carton market. Premium food and beverage brands increasingly utilize luxury folding cartons to differentiate their products and appeal to high-end consumers.

The confectionery segment is a significant player in the luxury folding carton market, with premium chocolates and sweets often packaged in elaborate and decorative cartons. The festive and gift-giving nature of confectionery products necessitates attractive packaging that enhances product presentation and consumer appeal.

Tobacco products, especially premium cigars and cigarettes, utilize luxury folding cartons to emphasize brand prestige and product quality. The segment remains important due to the high value placed on packaging aesthetics and the need for protective and tamper-evident features.

Consumer Goods segment encompasses a wide range of products, from electronics to household items, that benefit from luxury folding cartons for their premium appearance and protective qualities. The growth in high-end consumer goods drives demand for sophisticated packaging solutions.

Others category includes various other industries such as pharmaceuticals, jewelry, and high-end apparel, where luxury folding cartons provide added value through superior protection and premium presentation.

Key Market Segments

By Material Type

- Paperboard

- Corrugated board

- Kraft board

- Other materials

By Structure

- Straight tuck end

- Reverse tuck end

- Others

By Inserts

- Rigid inserts

- Flexible inserts

- Others

By End-User Industry

- Food and beverages

- Cosmetics and personal care

- Confectionery

- Tobacco

- Consumer goods

- Others

Growth Opportunity

Adoption of Sustainable and Eco-Friendly Materials

The adoption of sustainable and eco-friendly materials presents a significant opportunity for the luxury folding carton market in 2024. With increasing consumer awareness about environmental issues and regulatory pressures, brands are prioritizing sustainability in their packaging strategies. The shift towards recyclable, biodegradable, and responsibly sourced materials not only addresses environmental concerns but also enhances brand reputation and consumer trust.

Companies that lead in sustainable packaging are likely to attract eco-conscious consumers and differentiate themselves in a competitive market. This trend encourages innovation in material science and design, driving the market forward while aligning with global sustainability goals.

Technological Advancements in Packaging Design and Production

Technological advancements in packaging design and production are set to revolutionize the luxury folding carton market. Innovations such as digital printing, smart packaging, and automation enhance production efficiency, reduce costs, and allow for greater customization. These technologies enable brands to create highly intricate and personalized packaging solutions that meet the demands of luxury consumers.

Advancements in production processes can help mitigate the high costs traditionally associated with premium packaging. By leveraging these technologies, companies can offer unique, high-quality packaging solutions at competitive prices, thereby expanding their market reach and enhancing profitability.

Latest Trends

Use of Innovative Printing Techniques and Finishes

In 2024, the use of innovative printing techniques and finishes is expected to be a major trend in the luxury folding carton market. High-quality printing technologies such as digital printing, embossing, foil stamping, and UV coating are being increasingly adopted to create visually stunning and tactile packaging. These advanced techniques not only enhance the aesthetic appeal but also enable brands to create distinctive and memorable packaging that stands out on retail shelves.

Luxury brands are leveraging these innovations to reinforce their brand identity and communicate a sense of exclusivity and quality. As consumers continue to seek unique and premium experiences, the demand for such high-end finishes in packaging will drive market growth.

Customization and Personalization in Luxury Packaging

Customization and personalization are becoming central trends in luxury packaging, reflecting the evolving consumer preference for unique and tailored experiences. Brands are increasingly offering personalized packaging options, such as bespoke designs, individualized messages, and limited-edition releases. This trend is particularly prominent in the luxury market, where consumers expect exclusivity and a personal touch.

Technological advancements in printing and production allow for greater flexibility and efficiency in creating customized packaging. By catering to the specific tastes and preferences of their target audience, brands can enhance customer loyalty and create a more engaging and personal connection with their consumers. This focus on personalization is expected to significantly influence purchasing decisions and drive the growth of the luxury folding carton market.

Regional Analysis

Europe leads the Luxury Folding Carton Market with a 35% share

Europe dominates the Luxury Folding Carton Market, capturing 35% of the global market share. This leadership is driven by a strong presence of luxury brands in sectors such as cosmetics, personal care, and gourmet foods. Countries like France, Germany, and Italy are major contributors, supported by advanced manufacturing capabilities and a high demand for premium packaging solutions. The region's focus on sustainability and recyclability, along with stringent regulations, further boosts the adoption of luxury folding cartons crafted from eco-friendly materials.

North America holds a significant share in the Luxury Folding Carton Market, driven by the high consumption of luxury goods and a strong retail sector. The U.S. and Canada are key players, benefiting from advanced packaging technologies and a consumer base that values premium, aesthetically appealing packaging.

The Asia Pacific region is experiencing rapid growth in the Luxury Folding Carton Market, fueled by increasing disposable incomes and a burgeoning middle class with a growing appetite for luxury goods. China, Japan, and South Korea are major markets, with significant investments in packaging technology and rising consumer awareness of sustainable packaging.

The Middle East & Africa region shows steady growth, driven by a growing luxury market and increasing investments in high-end retail infrastructure. The UAE and South Africa are notable contributors, with a rising demand for premium packaging in sectors like cosmetics and gourmet foods.

Latin America presents moderate growth in the Luxury Folding Carton Market, with Brazil and Mexico leading the way. The market is driven by the expanding luxury goods sector and an increasing preference for premium, visually appealing packaging.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

In 2024, the Luxury Folding Carton Market is significantly influenced by a diverse group of key players known for their innovative packaging solutions and advanced manufacturing capabilities. Companies like BioMark Diagnostics, Advpharma, and Roche Diagnostics are integrating cutting-edge technologies and sustainable practices to meet the increasing demand for high-quality, aesthetically pleasing packaging. BioMark Diagnostics, for instance, is leveraging its expertise in biomaterials to create eco-friendly, durable folding cartons that appeal to environmentally conscious luxury brands.

Advpharma and Roche Diagnostics are enhancing their packaging lines with sophisticated printing technologies and customizable designs, which are crucial for brands aiming to differentiate their products in a competitive market. Their focus on sustainability and precision in packaging solutions aligns well with the luxury market's evolving needs.

DiagnoCure and Qiagen are also notable contributors, employing advanced material science to produce innovative and resilient packaging. Their cartons often feature unique structural designs and premium finishes that cater to high-end products in sectors like cosmetics, personal care, and gourmet foods.

Thermo Fisher Scientific and Courtagen Life Sciences are at the forefront of integrating digital printing technologies, which allow for high-definition graphics and intricate designs while minimizing material waste and energy consumption. This technological edge is crucial for meeting the bespoke needs of luxury brands and ensuring minimal environmental impact.

Illumina Inc. and Agilent Technologies, Inc. are pushing the boundaries with smart packaging solutions that incorporate QR codes and NFC technology, providing enhanced consumer engagement and product authentication.

F. Hoffmann-La Roche Ltd and AIT Austrian Institute of Technology are investing in research and development to create innovative, sustainable packaging materials that do not compromise on luxury or functionality. Meanwhile, BioMérieux and AstraZeneca plc are exploring bio-based materials and recyclable solutions, aligning with the market's shift towards sustainability.

Market Key Players

- BioMark Diagnostics

- Advpharma

- Mayo Clinic

- Roche Diagnostics

- DiagnoCure

- Qiagen

- HalioDx SAS

- Thermo Fisher Scientific

- Courtagen Life Sciences

- Illumina Inc.

- Agilent Technologies, Inc.

- F. Hoffmann-La Roche Ltd

- AIT Austrian Institute of Technology

- BioMérieux

- AstraZeneca plc

Recent Development

- In May 2024, WestRock launched a new sustainable luxury folding carton line, focusing on eco-friendly materials and high-end packaging solutions.

- In June 2024, AR Packaging introduced innovative, digitally printed luxury folding, cartons enhancing customization options for premium brands.

Report Scope

Report Features Description Market Value (2023) USD 2.7 Bn Forecast Revenue (2033) USD 4.3 Bn CAGR (2024-2033) 4.8% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Material Type (Paperboard, Corrugated board, Kraft board, Others), By Structure (Straight tuck end, Reverse tuck end, Others), By Inserts (Rigid inserts, Flexible inserts, Others), By End-User Industry (Food and beverages, Cosmetics and personal care, Confectionery, Tobacco, Consumer goods, Others) Regional Analysis North America - The US, Canada, & Mexico; Western Europe - Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe - Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC - China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America - Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa - Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape BioMark Diagnostics, Advpharma, Mayo Clinic, Roche Diagnostics, DiagnoCure, Qiagen, HalioDx SAS, Thermo Fisher Scientific, Courtagen Life Sciences, Illumina Inc., Agilent Technologies, Inc., F. Hoffmann-La Roche Ltd, AIT Austrian Institute of Technology, BioMérieux, AstraZeneca plc Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- BioMark Diagnostics

- Advpharma

- Mayo Clinic

- Roche Diagnostics

- DiagnoCure

- Qiagen

- HalioDx SAS

- Thermo Fisher Scientific

- Courtagen Life Sciences

- Illumina Inc.

- Agilent Technologies, Inc.

- F. Hoffmann-La Roche Ltd

- AIT Austrian Institute of Technology

- BioMérieux

- AstraZeneca plc