Lung Cancer Diagnostics Market By Diagnostic Test (Imaging Test, Sputum Cytology, Biopsy, Molecular Tests, Blood Test, Biomarkers Test, Others), By Cancer Type (Non-small Cell Lung Cancer, Small Cell Lung Cancer), By End-user (Hospitals, Diagnostic Laboratories), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

-

48661

-

Feb 2025

-

136

-

-

This report was compiled by Trishita Deb Trishita Deb is an experienced market research and consulting professional with over 7 years of expertise across healthcare, consumer goods, and materials, contributing to over 400 healthcare-related reports. Correspondence Team Lead- Healthcare Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

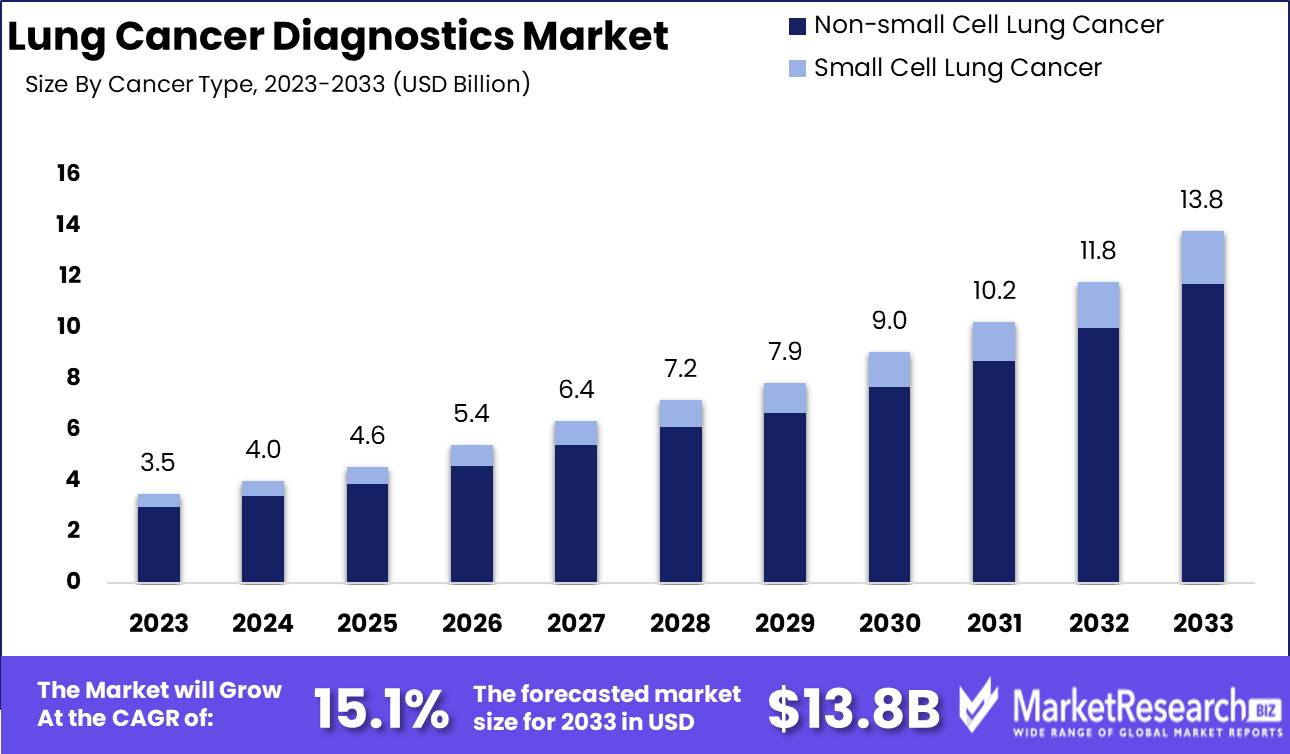

The Global Lung Cancer Diagnostics Market was valued at USD 3.5 Bn in 2023. It is expected to reach USD 13.8 Bn by 2033, with a CAGR of 15.1% during the forecast period from 2024 to 2033.

The Lung Cancer Diagnostics Market encompasses the spectrum of tools, technologies, and methodologies employed in the detection and diagnosis of lung cancer. This market includes imaging techniques such as CT scans and X-ray detectors, molecular diagnostics like genetic testing and biomarker analysis, and advanced biopsy methods. Driven by rising lung cancer incidence and technological advancements, the market aims to enhance early detection, accuracy, and patient outcomes. Continuous innovation, coupled with increasing awareness and healthcare expenditure, positions this market for significant growth, transforming diagnostic capabilities and enabling more personalized and effective treatment strategies.

The Lung Cancer Diagnostics Market is experiencing robust growth driven by the critical need for early detection and accurate diagnosis of lung cancer. As lung cancer remains one of the leading causes of cancer-related mortality globally, early and precise diagnostic tools are paramount. Tumor markers such as miRNA and circulating tumor DNA (ctDNA) are pivotal in this endeavor, offering insights into the molecular landscape of lung cancer. Advanced biosensors, including Electrochemical Impedance Spectroscopy (EIS) and Surface Plasmon Resonance (SPR), are significantly enhancing diagnostic accuracy. These technologies facilitate the detection of lung cancer at earlier stages, potentially improving patient outcomes through timely intervention.

The Lung Cancer Diagnostics Market is experiencing robust growth driven by the critical need for early detection and accurate diagnosis of lung cancer. As lung cancer remains one of the leading causes of cancer-related mortality globally, early and precise diagnostic tools are paramount. Tumor markers such as miRNA and circulating tumor DNA (ctDNA) are pivotal in this endeavor, offering insights into the molecular landscape of lung cancer. Advanced biosensors, including Electrochemical Impedance Spectroscopy (EIS) and Surface Plasmon Resonance (SPR), are significantly enhancing diagnostic accuracy. These technologies facilitate the detection of lung cancer at earlier stages, potentially improving patient outcomes through timely intervention.Moreover, the development of biosensors targeting specific lung cancer biomarkers like Neuron-Specific Enolase (NSE) and Cytokeratin Fragment 21-1 (CYFRA 21-1) is noteworthy. These biosensors present a promising alternative to traditional diagnostic methods, providing higher sensitivity, convenience, and cost-effectiveness. The integration of such advanced diagnostic technologies into clinical practice not only streamlines the diagnostic process but also reduces healthcare costs and enhances the overall patient experience.

The market is poised for continued expansion as ongoing research and technological advancements yield more sophisticated and accessible diagnostic solutions. Increased awareness, coupled with rising healthcare expenditure, is expected to further propel market growth. Stakeholders, including healthcare providers and policymakers, must remain attuned to these developments to capitalize on the evolving landscape of lung cancer diagnostics, ultimately driving improved patient outcomes and operational efficiencies in the healthcare sector.

Key Takeaways

- Market Value: The Global Lung Cancer Diagnostics Market was valued at USD 3.5 Bn in 2023. It is expected to reach USD 13.8 Bn by 2033, with a CAGR of 15.1% during the forecast period from 2024 to 2033.

- By Diagnostic Test: Imaging tests account for 30% of the diagnostic tests in the lung cancer diagnostics market.

- By Cancer Type: Non-small cell lung cancer constitutes 85% of the lung cancer types diagnosed.

- By End-user: Hospitals are the end-users for 60% of lung cancer diagnostics.

- Regional Dominance: North America holds 40% of the lung cancer diagnostics market.

- Growth Opportunity: The increasing prevalence of lung cancer and advancements in diagnostic technologies present significant growth opportunities.

Driving factors

Rising Incidence of Lung Cancer Globally

The increasing prevalence of lung cancer worldwide significantly propels the demand for advanced diagnostic solutions. As the leading cause of cancer-related deaths, lung cancer's growing incidence underscores the necessity for early and accurate detection methods. This surge is driven by factors such as aging populations, higher smoking rates in certain regions, and exposure to environmental pollutants.

Consequently, healthcare systems and providers are under mounting pressure to adopt and enhance lung cancer diagnostic capabilities to manage and mitigate the disease effectively. This demand not only fuels market growth but also stimulates continuous investment in innovative diagnostic technologies.

Advancements in Diagnostic Technologies

Technological advancements in lung cancer diagnostics are revolutionizing the market, leading to more precise, less invasive, and quicker diagnostic methods. Innovations such as liquid biopsies, next-generation sequencing (NGS), and advanced imaging techniques like low-dose computed tomography (LDCT) significantly enhance early detection and diagnostic accuracy. These cutting-edge technologies allow for the identification of genetic mutations and biomarkers, facilitating personalized treatment plans.

The ongoing development and integration of artificial intelligence (AI) and machine learning (ML) in diagnostic tools further streamline processes, reduce error rates, and improve patient outcomes. As a result, the continuous innovation in diagnostic technologies directly contributes to the robust growth of the lung cancer diagnostics market.

Increasing Awareness and Screening Programs

Growing awareness of lung cancer and the importance of early detection are critical drivers of the lung cancer diagnostics market. Public health campaigns and education initiatives by governments, non-profits, and healthcare organizations have increased awareness about the risk factors and symptoms of lung cancer, leading to a higher rate of early-stage detection.

The implementation of organized screening programs, particularly for high-risk populations such as long-term smokers, has been pivotal in identifying lung cancer at treatable stages. These programs often employ advanced diagnostic tools, which, in turn, heighten the demand for sophisticated diagnostic solutions. The cumulative effect of heightened awareness and structured screening programs ensures a steady increase in market demand for lung cancer diagnostics.

Restraining Factors

High Cost of Diagnostic Procedures

The high cost of lung cancer diagnostic procedures poses a significant barrier to market growth, particularly in regions with constrained healthcare budgets. Advanced diagnostic technologies, while highly effective, often come with substantial costs for equipment, maintenance, and specialist training. These expenses can be prohibitive for healthcare systems and patients, especially in low- and middle-income countries.

The high financial burden associated with these diagnostics can limit their widespread adoption, slowing down market penetration and overall growth. To address this, there is a pressing need for cost-reduction strategies and funding mechanisms to make these essential diagnostics more accessible and affordable.

Limited Accessibility to Advanced Diagnostic Facilities

Limited accessibility to advanced diagnostic facilities in developing regions significantly impacts the global lung cancer diagnostics market. Many developing countries lack the infrastructure, resources, and trained personnel required to implement sophisticated diagnostic technologies. This disparity results in delayed diagnoses and treatment, adversely affecting patient outcomes and contributing to lower overall market growth in these regions.

Addressing these challenges requires substantial investment in healthcare infrastructure, capacity-building initiatives, and international collaboration to bridge the gap between developed and developing regions. Enhancing accessibility in underserved areas is crucial for ensuring equitable healthcare delivery and driving global market expansion.

By Diagnostic Test Analysis

Imaging Test held a dominant market position in the By Diagnostic Test segment of the Lung Cancer Diagnostics Market, capturing more than a 30% share.

In 2023, Accounting for over 30% of the market share, imaging tests such as CT scans, X-rays, and PET scans have become essential in diagnosing lung cancer. This dominance can be attributed to its widespread application, accuracy, and advancements in imaging technology, making it a crucial tool for early detection and treatment planning. The high accuracy and non-invasive nature of these tests contribute significantly to their dominant position.

Sputum Cytology test, while less dominant, remains a vital diagnostic tool, particularly for detecting cancer cells in sputum. Its role is crucial in the early detection of lung cancer, especially in patients who are not candidates for invasive procedures.

Biopsy remains a cornerstone in lung cancer diagnostics, providing definitive diagnosis through tissue analysis. Despite being invasive, it holds a significant market share due to its reliability in confirming cancer type and stage.

Molecular Tests tests are gaining traction due to their ability to detect specific genetic mutations and biomarkers, enabling personalized treatment plans. Their increasing adoption reflects a shift towards precision medicine in lung cancer treatment.

Blood tests, including liquid biopsies, are emerging as non-invasive alternatives for circulating tumor DNA diagnostics. Their growing popularity is driven by the ease of sample collection and potential for early detection.

Biomarker testing plays a critical role in identifying patients who might benefit from targeted therapies. The increasing use of biomarkers in treatment decision-making is contributing to their rising market share.

Others category includes various other diagnostic methods such as bronchoscopy and mediastinoscopy. While collectively they hold a smaller market share, their role in comprehensive diagnostic evaluation is indispensable.

By Cancer Type Analysis

Non-small Cell Lung Cancer (NSCLC) held a dominant market position in the By Cancer Type segment of the Lung Cancer Diagnostics Market, capturing more than an 85% share.

In 2023, Representing over 85% of the market share, Non-small Cell Lung Cancer (NSCLC) encompasses various subtypes including adenocarcinoma, squamous cell carcinoma, and large cell carcinoma. This significant dominance is driven by the higher prevalence of NSCLC compared to other types of and advancements in diagnostic technologies tailored to this cancer type. The high incidence rate of NSCLC, coupled with the availability of multiple diagnostic tools such as imaging, molecular testing, and biopsies, solidifies its leading position in the market. Continuous research and development in targeted therapies and personalized medicine further bolster the demand for precise diagnostics in NSCLC.

While SCLC accounts for a smaller portion of the market, it remains a critical area of focus due to its aggressive nature and tendency to spread rapidly. Diagnostic methods for SCLC, such as imaging tests, biopsies, and molecular tests, are essential for early detection and treatment planning. Although it holds a lesser market share compared to NSCLC, ongoing advancements in diagnostic techniques and an increasing emphasis on early diagnosis are expected to drive growth in this segment.

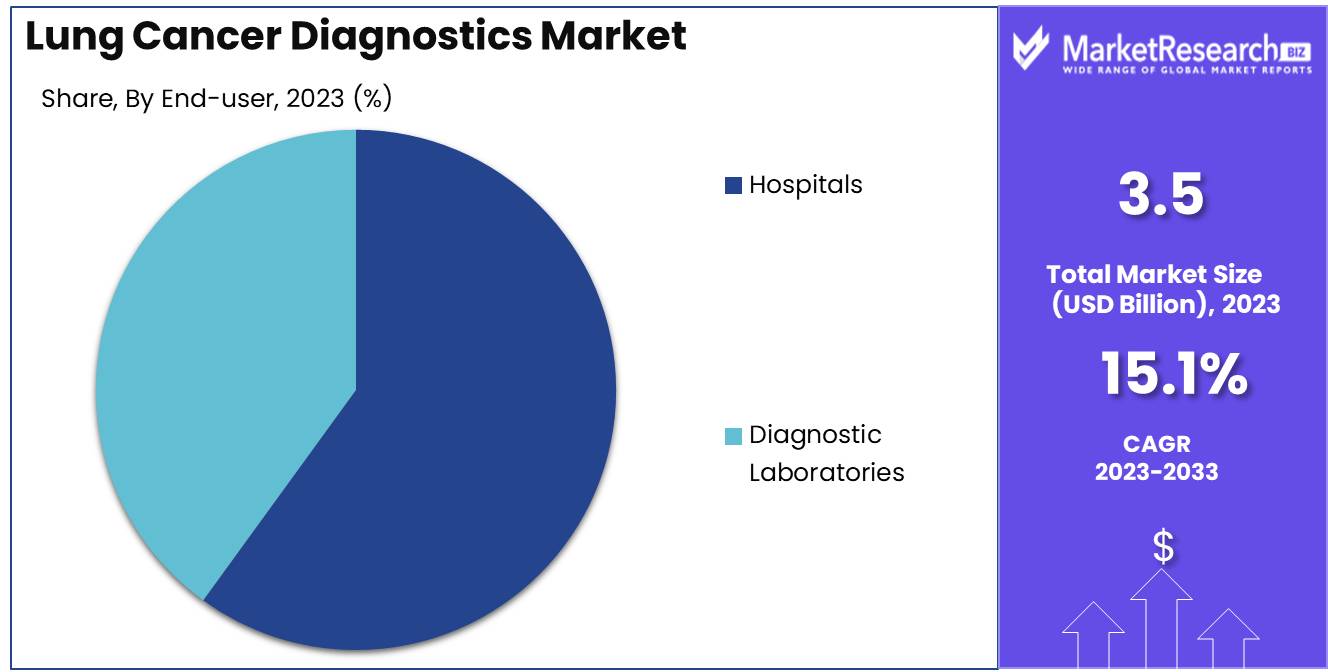

By End-user Analysis

Hospitals are the primary settings for lung cancer diagnostics, with over 60% of the market share.

In 2023, Hospitals held a dominant market position in the By End-user segment of the Lung Cancer Diagnostics Market, capturing more than a 60% share. This predominance is driven by the comprehensive diagnostic facilities available in hospitals, the presence of specialized healthcare professionals, and the integrated approach to patient care.

The availability of advanced diagnostic equipment, multidisciplinary teams, and the ability to provide immediate treatment options contribute to their leading position. Hospitals offer a wide range of diagnostic tests, from imaging and biopsies to molecular and blood tests, ensuring comprehensive diagnostic coverage for lung cancer patients.

Diagnostic laboratories, while holding a smaller market share compared to hospitals, play a crucial role in the lung cancer diagnostics market. These laboratories provide specialized testing services, including advanced molecular tests and biomarker analysis, which are essential for personalized treatment plans. The growing trend towards outsourcing complex diagnostic tests to specialized laboratories is expected to drive growth in this segment.

Key Market Segments

By Diagnostic Test

- Imaging Test

- Sputum Cytology

- Biopsy

- Molecular Tests

- Blood Test

- Biomarkers Test

- Others

By Cancer Type

- Non-small Cell Lung Cancer

- Small Cell Lung Cancer

By End-user

- Hospitals

- Diagnostic Laboratories

Growth Opportunity

Innovation in Non-Invasive Diagnostic Methods

The development of non-invasive diagnostic methods is a critical driver of market growth. Techniques such as liquid biopsies and advanced imaging technologies offer less intrusive, more patient-friendly options for early detection of lung cancer. These innovations not only improve patient compliance but also reduce the overall cost and time associated with traditional biopsy methods.

As these non-invasive techniques become more refined and widely adopted, they are expected to significantly enhance diagnostic accuracy and early detection rates, thereby driving market growth.

Technological Advancements

Continued advancements in diagnostic technologies, including the integration of artificial intelligence (AI) and machine learning (ML), are set to revolutionize the lung cancer diagnostics landscape. AI and ML can streamline diagnostic processes, reduce human error, and provide more precise results.

These technologies also enable personalized medicine approaches by identifying specific genetic mutations and biomarkers, which are crucial for tailored treatment plans. As technology continues to evolve, the adoption of these sophisticated tools will likely accelerate, offering substantial growth opportunities for market players.

Latest Trends

Integration of Artificial Intelligence in Diagnostic Tools

The integration of artificial intelligence (AI) into diagnostic tools is a transformative trend expected to dominate the lung cancer diagnostics market in 2024. AI-powered algorithms enhance diagnostic accuracy by analyzing complex imaging data and identifying patterns that may be overlooked by human eyes. These systems can also streamline workflows, reducing the time needed for diagnosis and allowing healthcare providers to make faster, more informed decisions.

The growing adoption of AI in diagnostics is not only improving patient outcomes but also driving efficiency and cost-effectiveness in healthcare settings. As AI technology continues to advance, its role in lung cancer diagnostics is set to expand further, making it an indispensable component of modern healthcare.

Increasing Use of Liquid Biopsy for Early Detection

Liquid biopsy is emerging as a game-changer in the early detection of lung cancer. This non-invasive method involves analyzing a simple blood sample to detect cancer-related biomarkers, offering a less intrusive alternative to traditional tissue biopsies. In 2024, the use of liquid biopsy is expected to increase significantly, driven by its potential for early detection and monitoring of lung cancer.

The ability to identify genetic mutations and track tumor progression in real-time makes liquid biopsy a valuable tool in personalized medicine. Its growing adoption is likely to improve early diagnosis rates, leading to better patient outcomes and contributing to the overall growth of the lung cancer diagnostics market.

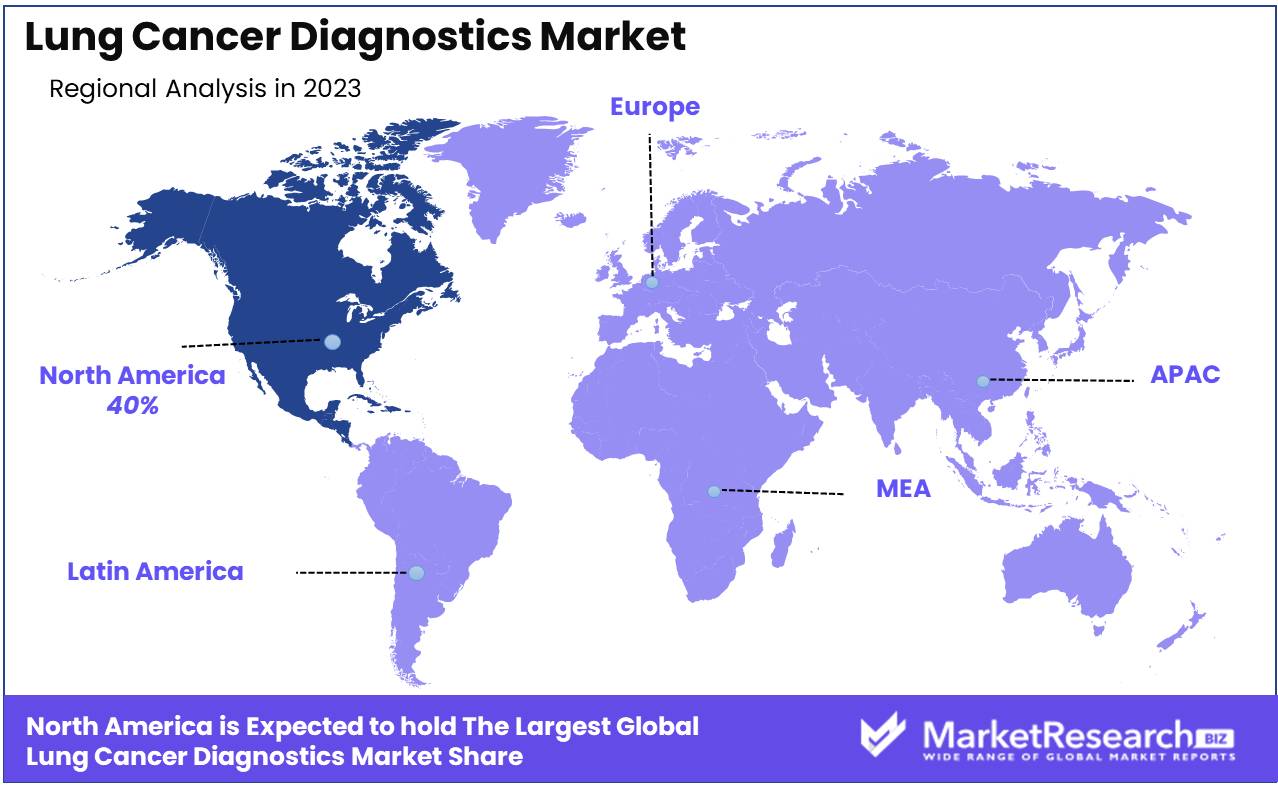

Regional Analysis

North America remains the dominating region with a 40% market share

North America dominates the Lung Cancer Diagnostics Market, accounting for approximately 40% of the global share. This region's leadership is attributed to advanced healthcare infrastructure, substantial investment in research and development, and high awareness about early cancer detection. The U.S. and Canada, in particular, benefit from robust healthcare policies and extensive insurance coverage, facilitating access to cutting-edge diagnostic technologies such as CT scans and molecular diagnostics.

Europe holds a significant portion of the market, driven by increasing healthcare expenditure and a strong emphasis on early detection and personalized medicine. Countries such as Germany, the UK, and France are at the forefront, supported by governmental initiatives to combat cancer and the presence of leading diagnostic companies.

The Asia Pacific region is experiencing the fastest growth in the Lung Cancer Diagnostics Market, fueled by rising incidences of lung cancer, improving healthcare infrastructure, and growing awareness about early detection. China and India are key contributors, with large populations and increasing healthcare investments.

The Middle East & Africa region is gradually expanding its market share due to improving healthcare systems and increased investments in medical technology. Although the market is smaller compared to other regions, there is a growing emphasis on early cancer detection and access to advanced diagnostic tools, particularly in countries like the UAE and South Africa.

Latin America shows moderate growth, with countries like Brazil and Mexico leading the way. The region's market expansion is supported by the increasing prevalence of lung cancer and efforts to enhance healthcare infrastructure.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

In 2024, the Lung Cancer Diagnostics Market is characterized by the strategic advancements and innovations of several key players. Companies such as MedGenome, Boditech Med, Inc., and Oncocyte Corporation are leveraging next-generation sequencing and advanced biomarker technologies to enhance early detection and precision diagnostics. MedGenome, known for its genomic testing capabilities, is expanding its portfolio to include comprehensive lung cancer panels that improve diagnostic accuracy and patient outcomes.

Abbott and Bio-Rad Laboratories, Inc. continue to dominate with their robust platforms for molecular diagnostics and immunoassays, focusing on the development of highly sensitive tests for early lung cancer detection. INOVIQ and Biodesix are gaining traction with their novel liquid biopsy technologies, which offer minimally invasive diagnostic solutions that provide real-time insights into tumor progression and treatment efficacy.

QIAGEN and Thermo Fisher Scientific, Inc. are pivotal in providing a broad range of diagnostic tools, including PCR-based assays and next-generation sequencing platforms. These companies are enhancing their product lines to support personalized medicine approaches, tailoring treatment plans based on individual genetic profiles.

F. Hoffmann-La Roche Ltd. and Illumina are at the forefront of integrating advanced sequencing technologies with comprehensive diagnostic workflows, driving innovations that facilitate early and accurate lung cancer diagnosis. Paige AI, Inc. is revolutionizing the market with its artificial intelligence-driven pathology solutions, which enhance diagnostic precision and efficiency.

Quest Diagnostics Incorporated and Danaher are expanding their diagnostic services and laboratory automation solutions, focusing on improving turnaround times and diagnostic accuracy. Amoy Diagnostics Co. is making significant strides in the Asia-Pacific region, offering advanced diagnostic tests that cater to the growing demand for lung cancer diagnostics.

Market Key Players

- MedGenome

- Boditech Med, Inc.

- Oncocyte Corporation

- Abbott

- INOVIQ

- Bio-Rad Laboratories, Inc.

- QIAGEN

- Thermo Fisher Scientific, Inc.

- F. Hoffmann-La Roche Ltd.

- Biodesix

- Paige AI, Inc.

- Quest Diagnostics Incorporated

- Danaher

- Amoy Diagnostics Co.

- Illumina

Recent Development

- In March 2024, Foundation Medicine launched a new liquid biopsy test, aimed at enhancing early lung cancer detection through comprehensive genomic profiling.

- In April 2024, Guardant Health introduced the Guardant360 CDx test for lung cancer, providing advanced precision oncology solutions through blood-based diagnostic testing.

Report Scope

Report Features Description Market Value (2023) USD 3.5 Bn Forecast Revenue (2033) USD 13.8 Bn CAGR (2024-2033) 15.1% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Diagnostic Test (Imaging Test, Sputum Cytology, Biopsy, Molecular Tests, Blood Test, Biomarkers Test, Others), By Cancer Type (Non-small Cell Lung Cancer, Small Cell Lung Cancer), By End-user (Hospitals, Diagnostic Laboratories) Regional Analysis North America - The US, Canada, & Mexico; Western Europe - Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe - Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC - China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America - Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa - Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape MedGenome, Boditech Med, Inc., Oncocyte Corporation, Abbott, INOVIQ, Bio-Rad Laboratories, Inc., QIAGEN, Thermo Fisher Scientific, Inc., F. Hoffmann-La Roche Ltd., Biodesix, Paige AI, Inc., Quest Diagnostics Incorporated, Danaher, Amoy Diagnostics Co., Illumina Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- MedGenome

- Boditech Med, Inc.

- Oncocyte Corporation

- Abbott

- INOVIQ

- Bio-Rad Laboratories, Inc.

- QIAGEN

- Thermo Fisher Scientific, Inc.

- F. Hoffmann-La Roche Ltd.

- Biodesix

- Paige AI, Inc.

- Quest Diagnostics Incorporated

- Danaher

- Amoy Diagnostics Co.

- Illumina