Lumi therapy Market By Type (Light Boxes, Dawn Simulators, Light Visors, Others), By Application (Seasonal Affective Disorder (SAD), Sleep Disorders, Skin Disorders, Others), By End-User (Homecare, Clinics, Hospitals), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

-

50521

-

Aug 2024

-

304

-

-

This report was compiled by Trishita Deb Trishita Deb is an experienced market research and consulting professional with over 7 years of expertise across healthcare, consumer goods, and materials, contributing to over 400 healthcare-related reports. Correspondence Team Lead- Healthcare Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

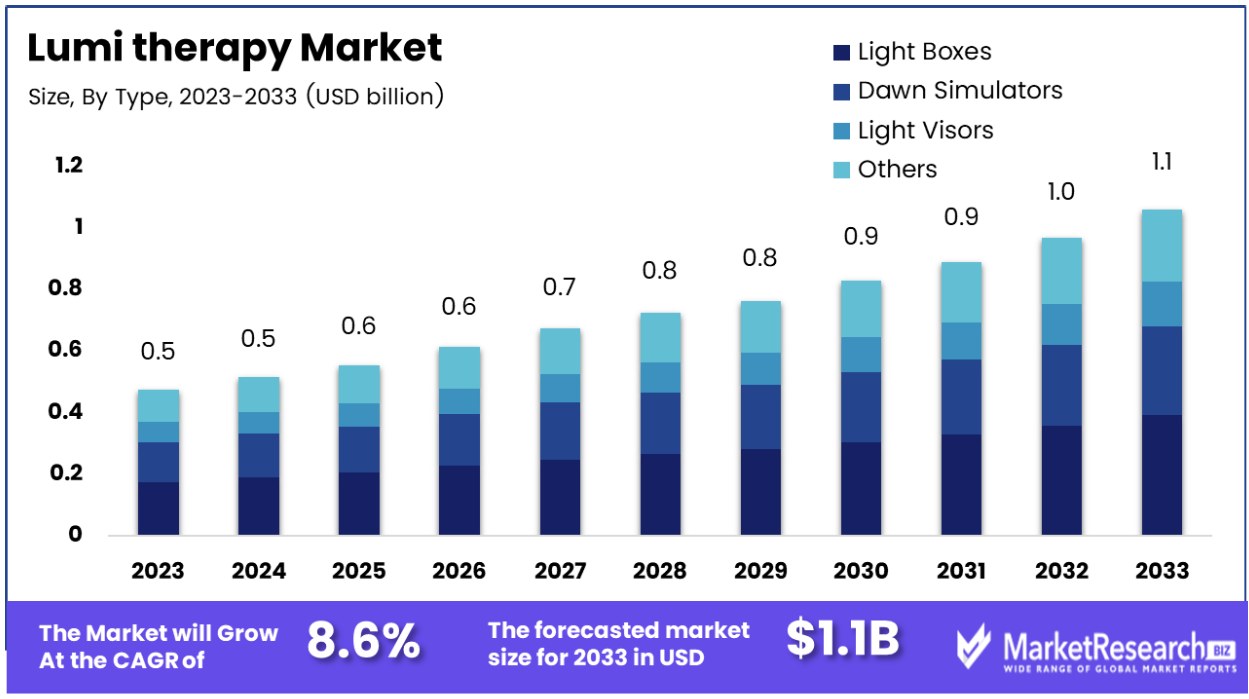

The Global Lumi therapy Market was valued at USD 0.5 Bn in 2023. It is expected to reach USD 1.1 Bn by 2033, with a CAGR of 8.6% during the forecast period from 2024 to 2033.

The Lumi Therapy Market includes products and services focused on light and cold therapy for pain relief, recovery, and wellness. This market is driven by the growing demand for non-invasive, drug-free therapeutic options, particularly among athletes and individuals seeking recovery solutions. Lumi Therapy's offerings, such as the Recovery Pod with advanced features like a patented inflatable top-ring and UFO Thermo Lid™, cater to the increasing consumer interest in effective and portable therapy solutions. The market is characterized by innovation and the integration of advanced technologies to enhance therapeutic outcomes.

The Lumi Therapy Market is positioned for significant growth, fueled by the rising demand for effective, non-invasive recovery solutions, particularly in the sports and wellness sectors. Founded in 2020, Lumi Therapy has quickly established itself as a leader in the market, capitalizing on the increasing popularity of cold therapy as a crucial component of athletic recovery.

The Lumi Therapy Market is positioned for significant growth, fueled by the rising demand for effective, non-invasive recovery solutions, particularly in the sports and wellness sectors. Founded in 2020, Lumi Therapy has quickly established itself as a leader in the market, capitalizing on the increasing popularity of cold therapy as a crucial component of athletic recovery.The company's flagship product, the Recovery Pod, exemplifies the market's innovation trajectory. Featuring a patented inflatable top-ring and UFO Thermo Lid™, the Recovery Pod offers easy portability and a spacious 480-liter capacity, providing users with a comfortable and efficient cold therapy experience. These advanced features cater to the needs of athletes and wellness enthusiasts who prioritize convenience and effectiveness in their recovery routines.

The market's growth is further driven by the expanding consumer awareness of the benefits of cold therapy, including reduced muscle soreness, faster recovery times, and enhanced performance. As more individuals seek to optimize their recovery processes, the demand for high-quality, portable, and user-friendly therapy products is expected to rise.

Lumi Therapy's focus on innovation and product development positions the company well within this dynamic market. By continuously improving its offerings and expanding its product line, Lumi Therapy is likely to maintain its competitive edge and capture a larger share of the growing market.

The Lumi Therapy Market is characterized by strong growth potential, driven by consumer demand for advanced, portable recovery solutions. Companies that prioritize innovation and cater to the specific needs of athletes and wellness consumers are well-positioned to thrive in this competitive market.

Key Takeaways

- Market Value: The Global Lumi therapy Market was valued at USD 0.5 Bn in 2023. It is expected to reach USD 1.1 Bn by 2033, with a CAGR of 8.6% during the forecast period from 2024 to 2033.

- By Type: Light Boxes represent 45% of the market, essential for delivering effective light therapy.

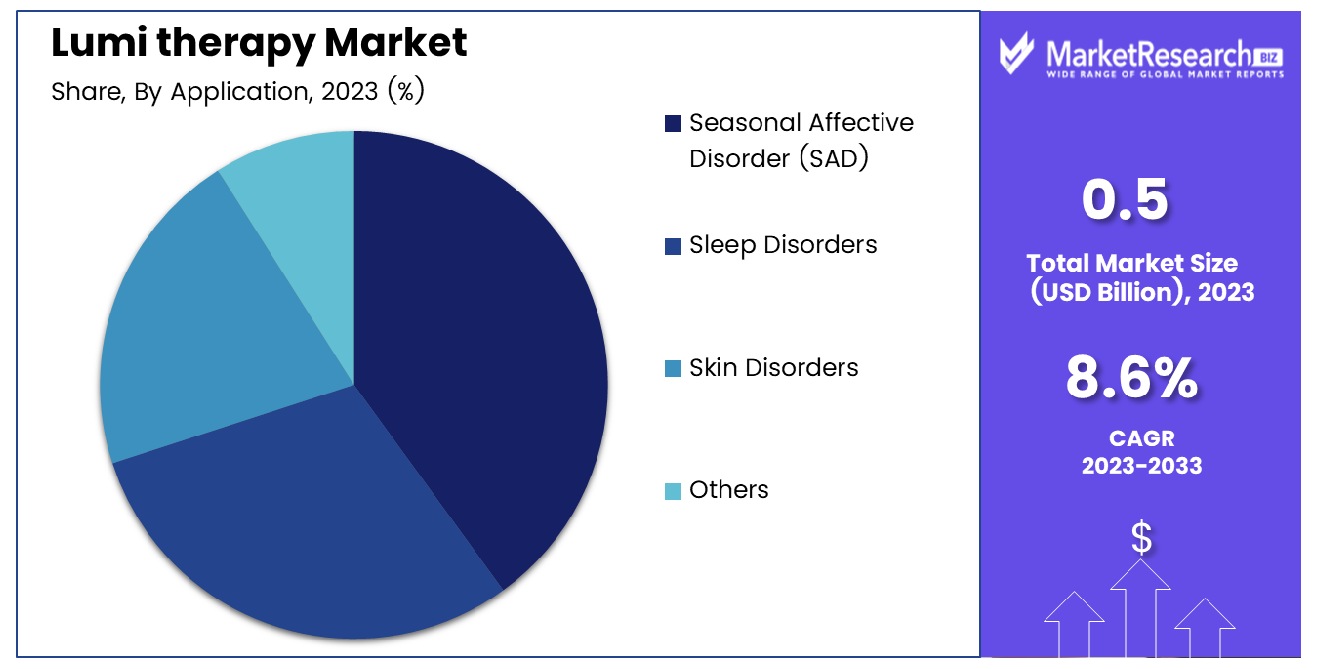

- By Application: Seasonal Affective Disorder (SAD) accounts for 40%, highlighting the demand for therapeutic solutions to mood disorders.

- By End-User: Homecare makes up 50% of the market, reflecting the convenience and accessibility of at-home therapy.

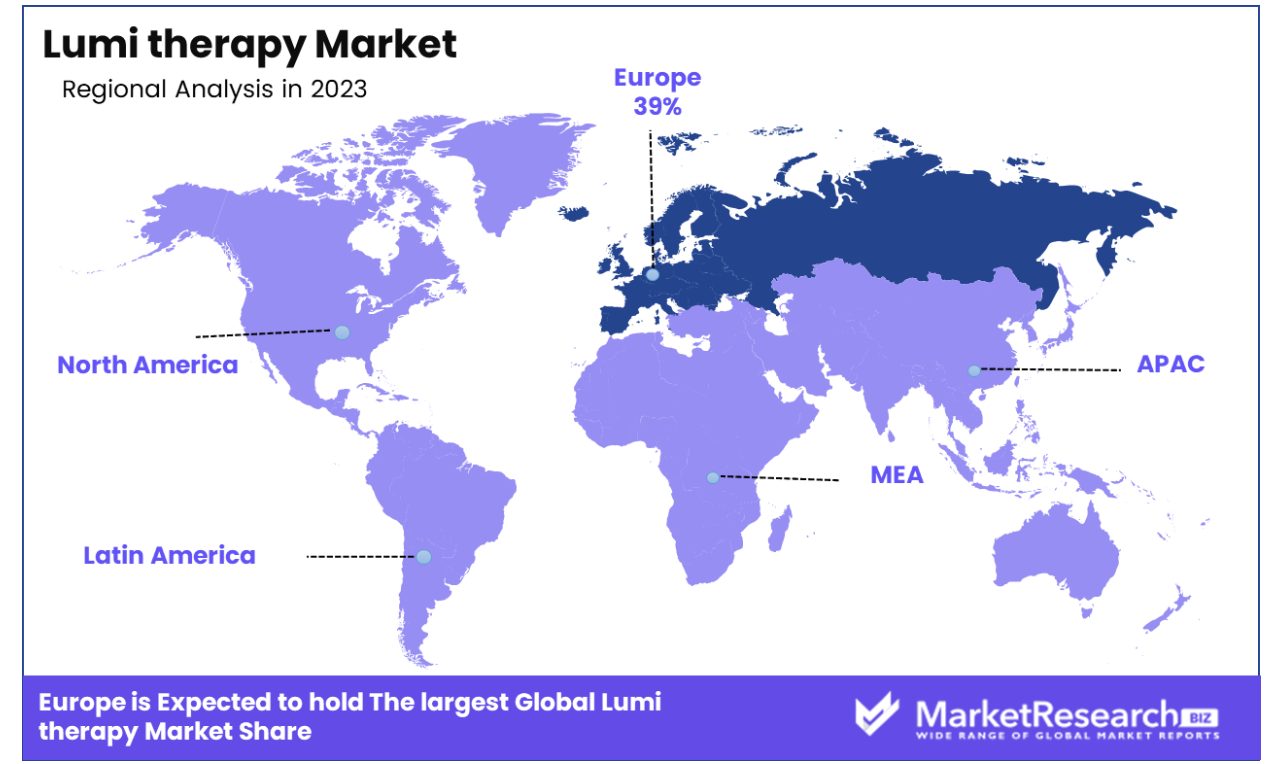

- Regional Dominance: Europe holds a 39% market share, driven by high prevalence of SAD and awareness of light therapy.

- Growth Opportunity: Developing portable and travel-friendly light therapy devices can increase adoption and drive market growth.

Driving factors

Increasing Awareness of Light Therapy for Treating Mood Disorders Driving Market Expansion

The growing awareness of light therapy as an effective treatment for mood disorders, particularly Seasonal Affective Disorder (SAD), is a key driver of the Lumi Therapy Market. Light therapy has been clinically proven to alleviate symptoms of SAD by mimicking natural sunlight, thereby regulating the body's internal clock and boosting mood.

As more individuals and healthcare providers recognize the benefits of light therapy, there is a rising demand for Lumi Therapy products. This increased awareness is further supported by the growing body of research and endorsements from medical professionals, making light therapy a mainstream solution for mood-related conditions, thus driving market growth.

Rising Demand for Non-Invasive Wellness Therapies Boosting Market Adoption

The rising consumer demand for non-invasive wellness therapies is another significant factor contributing to the growth of the Lumi Therapy Market. In an era where individuals are increasingly seeking alternatives to pharmaceuticals and invasive procedures, light therapy offers a safe and effective solution for improving mental and physical well-being.

The non-invasive nature of Lumi Therapy, combined with its minimal side effects, makes it an attractive option for a broad range of consumers. This trend is particularly strong among those who are looking for preventive wellness measures or complementary therapies to traditional treatments, further fueling market expansion.

Consumer Preference for Holistic and Natural Treatments Propelling Market Growth

The growing consumer preference for holistic and natural treatments is also playing a pivotal role in the expansion of the Lumi Therapy Market. As awareness of the potential side effects of conventional medical treatments increases, more people are turning to natural and holistic approaches to health and wellness. Lumi Therapy, which harnesses the natural benefits of light, aligns perfectly with this trend.

The therapy’s ability to provide a natural remedy for conditions like SAD, sleep disorders, and even skin issues, without the use of chemicals or invasive techniques, is driving its popularity among health-conscious consumers.

Restraining Factors

High Cost of Professional Light Therapy Devices Limiting Market Accessibility

One of the primary restraining factors for the Lumi Therapy Market is the high cost associated with professional light therapy devices. High-quality, clinically effective light therapy devices, which are often used in medical settings or by individuals seeking advanced treatment options, come with a significant price tag.

These costs can be prohibitive for many consumers, especially those looking for at-home solutions. The high initial investment required for these devices limits their accessibility, particularly in lower-income regions or among consumers with budget constraints, thereby restricting the overall market growth.

Limited Clinical Evidence for Some Therapeutic Claims Creating Consumer Hesitancy

The Lumi Therapy Market also faces challenges due to the limited clinical evidence supporting certain therapeutic claims associated with light therapy. While there is robust evidence supporting the effectiveness of light therapy for conditions like Seasonal Affective Disorder (SAD), the scientific backing for other claims, such as its benefits for skin conditions or general wellness, is less conclusive.

This lack of comprehensive clinical validation can lead to consumer skepticism, reducing the likelihood of widespread adoption. Regulatory scrutiny regarding the marketing of such claims can further inhibit market growth, as manufacturers may face challenges in promoting their products based on these unproven benefits.

High Cost of Professional Light Therapy Devices Limiting Market Accessibility

One of the primary restraining factors for the Lumi Therapy Market is the high cost associated with professional light therapy devices. High-quality, clinically effective light therapy devices, which are often used in medical settings or by individuals seeking advanced treatment options, come with a significant price tag.

These costs can be prohibitive for many consumers, especially those looking for at-home solutions. The high initial investment required for these devices limits their accessibility, particularly in lower-income regions or among consumers with budget constraints, thereby restricting the overall market growth.

Limited Clinical Evidence for Some Therapeutic Claims Creating Consumer Hesitancy

The Lumi Therapy Market also faces challenges due to the limited clinical evidence supporting certain therapeutic claims associated with light therapy. While there is robust evidence supporting the effectiveness of light therapy for conditions like Seasonal Affective Disorder (SAD), the scientific backing for other claims, such as its benefits for skin conditions or general wellness, is less conclusive. This lack of comprehensive clinical validation can lead to consumer skepticism, reducing the likelihood of widespread adoption. Regulatory scrutiny regarding the marketing of such claims can further inhibit market growth, as manufacturers may face challenges in promoting their products based on these unproven benefits.

By Type Analysis

Light boxes dominate the Lumi Therapy Market with a 45% share.

In 2023, Light Boxes held a dominant market position in the By Type segment of the Lumi Therapy Market, capturing more than a 45% share. Light boxes have become the preferred choice for light therapy treatments due to their effectiveness, ease of use, and widespread availability. These devices are specifically designed to provide intense light exposure, mimicking natural sunlight, which is crucial for treating conditions like Seasonal Affective Disorder (SAD). Their user-friendly design and the ability to use them at home have made them popular among consumers seeking non-invasive and convenient therapeutic options. The dominance of light boxes is particularly strong in North America and Europe, where awareness of light therapy benefits is high, and consumers have greater access to these devices through various retail and online channels.

Dawn simulators and light visors also play significant roles in the market but hold smaller shares compared to light boxes. Dawn simulators are gaining popularity for their ability to help regulate sleep patterns by gradually increasing light intensity to mimic a natural sunrise. Light visors, though less common, offer portability and flexibility, appealing to users who need light therapy on the go.

By Application Analysis

Seasonal Affective Disorder (SAD) applications hold a 40% share in the Lumi Therapy Market.

In 2023, Seasonal Affective Disorder (SAD) held a dominant market position in the By Application segment of the Lumi Therapy Market, capturing more than a 40% share. The high prevalence of SAD, particularly in regions with long winter months and limited sunlight, has driven the demand for lumi therapy as an effective treatment. SAD affects a significant portion of the population, leading to increased adoption of light therapy devices such as light boxes. The growing awareness of SAD and its symptoms, combined with the availability of effective light therapy treatments, has solidified this segment's dominance. Markets in Northern Europe and North America, where seasonal changes are more pronounced, see higher adoption rates, contributing significantly to this segment's market share.

Other applications of lumi therapy, such as treating sleep disorders and skin disorders, are also important but capture smaller shares. Sleep disorders like insomnia and circadian rhythm disruptions benefit from light therapy's ability to regulate the body's internal clock, while skin disorders are treated with specific light wavelengths, although these applications are more niche compared to SAD treatment.

By End-User Analysis

By End-User AnalysisHomecare leads the Lumi Therapy Market with a 50% end-user share.

In 2023, Homecare held a dominant market position in the By End-User segment of the Lumi Therapy Market, capturing more than a 50% share. The increasing preference for at-home treatment options has driven the growth of the homecare segment in the lumi therapy market. Consumers are increasingly seeking convenient and cost-effective solutions that allow them to manage their conditions without frequent visits to healthcare facilities. Light therapy devices, particularly light boxes, are designed for easy use in a home setting, which has further fueled their popularity for smart homes systems. This trend is particularly evident in developed regions such as North America and Europe, where homecare solutions are well-integrated into healthcare practices and supported by a strong distribution network.

Clinics and hospitals remain important end-users of lumi therapy devices, especially for more severe cases of SAD or other conditions requiring professional oversight. However, their market share is smaller compared to the homecare segment, as the trend towards self-managed care continues to grow. The availability of high-quality, consumer-friendly light therapy devices has made homecare the preferred option for many patients.

Key Market Segments

By Type

- Light Boxes

- Dawn Simulators

- Light Visors

- Others

By Application

- Seasonal Affective Disorder (SAD)

- Sleep Disorders

- Skin Disorders

- Others

By End-User

- Homecare

- Clinics

- Hospitals

Growth Opportunity

Portable and Affordable Devices

The development of portable and affordable Lumi Therapy devices represents a significant growth opportunity for the market in 2024. As technological advancements continue, manufacturers are focusing on creating compact, user-friendly, and cost-effective light therapy devices that can be easily used at home.

These innovations are expected to lower the barriers to entry for a broader range of consumers, making Lumi Therapy more accessible to individuals who may have been deterred by the high costs of professional-grade devices. The shift towards affordability and portability will likely drive increased adoption, particularly among consumers seeking convenient, at-home wellness solutions.

Expansion into Home Healthcare and Wellness Markets

The expansion of Lumi Therapy into the home healthcare and wellness markets offers another substantial opportunity for growth. As consumers increasingly prioritize preventive health and wellness practices, there is a rising demand for at-home therapies that support mental and physical well-being.

Lumi Therapy, with its proven benefits for mood disorders like SAD and its potential for improving sleep and skin health, is well-positioned to capitalize on this trend. By targeting the home healthcare market, manufacturers can cater to a growing segment of consumers who are looking for non-invasive, natural, and effective treatments that they can incorporate into their daily routines.

Latest Trends

Enhancing User Convenience

In 2024, the integration of Lumi Therapy devices with smart home systems is expected to be a key trend driving the market. As smart home technology becomes more prevalent, consumers are increasingly looking for ways to integrate their wellness routines into their connected living environments. Lumi Therapy devices that can be controlled via smart home hubs, voice assistants, or mobile apps offer enhanced convenience and ease of use.

This integration allows users to schedule therapy sessions, adjust settings, and monitor their usage seamlessly, making Lumi Therapy an integral part of their daily routines. The growing adoption of smart home technology is likely to drive demand for these advanced, connected Lumi Therapy solutions.

Personalizing Therapy for Optimal Results

The use of customizable light settings for personalized treatment is another significant trend shaping the Lumi Therapy Market in 2024. As consumers become more aware of their unique health and wellness needs, there is an increasing demand for therapies that can be tailored to individual preferences and conditions. Lumi Therapy devices with customizable light intensity, color, and duration settings allow users to personalize their treatment, optimizing the effectiveness of the therapy.

This trend towards personalization not only enhances user satisfaction but also drives the adoption of Lumi Therapy as consumers seek treatments that cater specifically to their needs.

Regional Analysis

In 2023, Europe held a dominant position in the Lumi Therapy Market, capturing approximately 39% of the global market share.

This leadership is primarily attributed to the high prevalence of Seasonal Affective Disorder (SAD) in northern European countries, where shorter daylight hours during the winter months significantly impact the population's mental health. The growing awareness and acceptance of light therapy as an effective treatment for SAD and other related conditions, such as sleep disorders and depression, have fueled the demand for lumi therapy devices in this region.

Europe's market dominance is further strengthened by a well-established healthcare infrastructure and supportive government initiatives aimed at improving mental health. Countries like Sweden, Norway, and Finland, where the winter season can result in prolonged periods of darkness, have seen particularly strong adoption of light therapy devices.

North America and the Asia Pacific regions are also significant contributors to the global lumi therapy market. North America's market growth is driven by rising awareness about mental health, the increasing prevalence of depression and sleep disorders, and the availability of advanced light therapy devices.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The global lumi therapy market, driven by increasing awareness of Seasonal Affective Disorder (SAD) and other mood-related conditions, is expected to see robust growth in 2024. Leading players such as Northern Light Technologies, Verilux, Inc., and Carex Health Brands are at the forefront of innovation, offering a range of light therapy devices that cater to consumers seeking non-invasive treatment options. These companies are investing in R&D to improve product efficacy, enhance design, and ensure portability, making light therapy more accessible to a broader audience.

Philips Lighting and Beurer GmbH stand out for their strong brand recognition and global presence, offering advanced light therapy lamps with integrated features such as adjustable brightness and timers, which are increasingly preferred by tech-savvy consumers. Aura Daylight and Lumie are capitalizing on the growing demand for aesthetic and effective solutions, producing compact, stylish devices that appeal to younger demographics.

Companies like Nature Bright and Duronic are focused on affordability and accessibility, targeting budget-conscious consumers with reliable yet cost-effective lumi therapy products. As the market expands, these brands are expected to capture a larger market share due to their competitive pricing strategies.

Overall, the lumi therapy market is poised for continued growth in 2024, driven by increased mental health awareness and demand for home-based wellness solutions. Key players are expected to maintain their strong positions through product innovation, quality, and competitive pricing.

Market Key Players

- Northern Light Technologies

- Verilux, Inc.

- Carex Health Brands

- Nature Bright

- Aura Daylight

- Beurer GmbH

- Philips Lighting

- Duronic

- Circadian Optics

- Lumie

Recent Development

- In January 2024, Verilux, Inc. launched a new light therapy lamp designed to treat seasonal affective disorder (SAD). This product is expected to increase their market share by 20% as it offers enhanced brightness and portability.

- In March 2024, Lumie introduced an advanced lumi therapy device with customizable light settings to cater to individual needs. This new product is anticipated to improve sales by 15%, targeting consumers seeking personalized light therapy solutions.

Report Scope

Report Features Description Market Value (2023) USD 0.5 Bn Forecast Revenue (2033) USD 1.1 Bn CAGR (2024-2033) 8.6% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Light Boxes, Dawn Simulators, Light Visors, Others), By Application (Seasonal Affective Disorder (SAD), Sleep Disorders, Skin Disorders, Others), By End-User (Homecare, Clinics, Hospitals) Regional Analysis North America - The US, Canada, & Mexico; Western Europe - Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe - Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC - China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America - Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa - Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Northern Light Technologies, Verilux, Inc., Carex Health Brands, Nature Bright, Aura Daylight, Beurer GmbH, Philips Lighting, Duronic, Circadian Optics, Lumie Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Northern Light Technologies

- Verilux, Inc.

- Carex Health Brands

- Nature Bright

- Aura Daylight

- Beurer GmbH

- Philips Lighting

- Duronic

- Circadian Optics

- Lumie