Global Butane Market By Type (Isobutane, N-Butane), By Application (Liquid Petroleum Gases, Petrochemicals, Refineries, and Others), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2023-2032

-

37653

-

June 2023

-

179

-

-

This report was compiled by Correspondence Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Report Overview

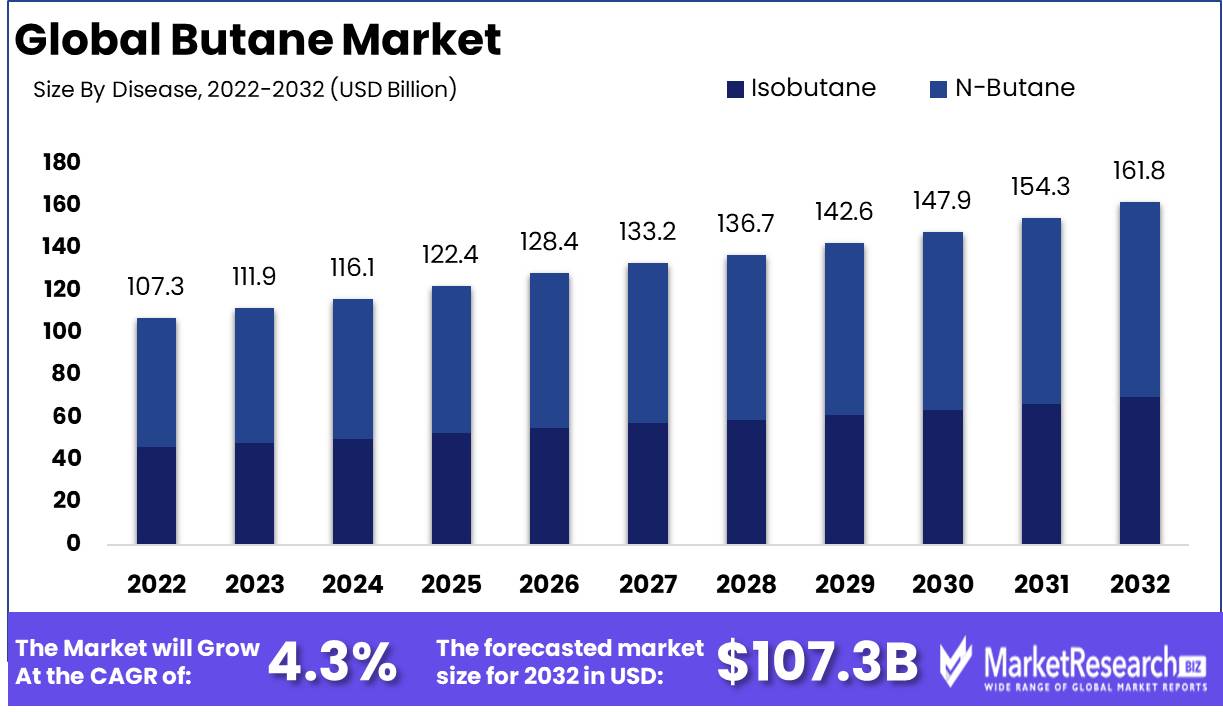

Global Butane Market size is expected to be worth around USD 161.8 Bn by 2032 from USD 107.3 Bn in 2022, growing at a CAGR of 4.3% during the forecast period from 2023 to 2032.

The vast and complex global butane market incorporates a versatile organic compound that serves as a vital source of fuel for numerous thriving industries, such as automobiles, construction, and manufacturing. This vast market reflects the pervasive presence and widespread utilization of butane on a global scale, resonating in a variety of applications, from the domain of heating and cooking to the very production of plastics and chemicals that define our contemporary world.

In recent annals, the global butane market has witnessed a multitude of remarkable innovations, each of which has contributed to its ever-expanding repertoire. Among these revolutionary developments, the introduction of Stabilized butane has unquestionably garnered the most attention and praise. This remarkable invention, the result of meticulous treatments to prevent the premature vaporization of butane, has not only raised the overall safety standards associated with its use but also granted it the ability to be transported and stored with the utmost ease, surpassing the limitations of conventional butane.

In tandem with this milestone, the never-ending pursuit of progress has borne additional fruit in the form of cutting-edge technologies that improve the efficacy of butane as an indispensable fuel source while simultaneously advancing its pivotal role in the synthesis of chemicals and plastics into uncharted territories of innovation.

Not surprisingly, the allure of the global butane market has attracted significant investments from a wide range of industries, including energy, chemical, and manufacturing enterprises. These visionary entities have astutely recognized the numerous advantages of adopting butane as a cleaner, more resource-efficient alternative to conventional fossil fuels, thereby inspiring a paradigm shift in the automotive industry, where the development of butane-powered vehicles has emerged as an undeniable sign of progress

As we navigate the complex global butane market, the conscious pursuance of responsible and ethical business practices is a necessity for all companies operating within its boundaries. Transparency, explainability, and accountability are embedded within this ethos. It is incumbent upon these enterprises to cultivate an environment of unwavering transparency, in which the complexities of their production processes and the manner in which butane is incorporated into their products and services are made transparent to all.

In addition, it is incumbent upon them to articulate their utilization of butane in a manner that reflects responsibility and ethics, thereby elucidating the path to sustainable progress. In the end, these enterprises must assume responsibility for accountability, willingly embracing the repercussions of any negative environmental impact or violation of the rights of fellow inhabitants of our shared planet.

Driving factors

Butane Market Growth Fuelled by Rising LPG Demand

In the future years, the global butane market is expected to expand significantly. The increasing demand for LPG for cooking, heating, and transportation is one of the factors driving this growth. This demand is primarily due to the lower cost of LPG compared to other fuels, which is expected to lead to an increase in demand for butane in the coming years.

The Petrochemical Industry Drives Market Growth for Butane

In addition, the expansion of the petrochemical industry has contributed to the expansion of the global butane market. Butane is used as a feedstock by the petrochemical industry to manufacture a variety of chemicals, including ethylene and propylene. The increasing demand for these chemicals, predominantly due to their use in the packaging, automotive, and construction industries, is expected to increase butane demand.

Positive Impact of Regulation on the Butane Market

The global butane market is expected to benefit from a number of modifications in regulations. Several countries have incentivized the use of LPG over other fossil fuels due to the increasing focus on reducing greenhouse gas emissions. The butane market is expected to benefit from the introduction of regulations by several countries to increase the adoption of clean-burning fuels in the future years.

Potential Impact of Electric Vehicles on the Butane Market

The development of electric vehicles is one emerging technology that may affect the global butane market. Despite the fact that butane is primarily utilized in the transportation sector, the future adoption of electric vehicles may reduce the demand for butane.

Emerging Disruptors Renewable Energy and Alternative Feedstocks

The future competitive landscape of the global butane market could be influenced by a number of potentially disruptive forces. The emergence of alternative feedstocks in the petrochemical industry, as well as the increasing adoption of renewable energy sources, could reduce the demand for butane.

Changing consumer behavior and the Butane Market's Future

Changes in consumer behavior may also have an effect on the global butane market. The increasing demand for clean-burning fuels and eco-friendly products could lead to a shift away from fossil fuels in the future years, thereby affecting the demand for butane. Overall, the global butane market is expected to expand significantly over the coming years, primarily as a result of the aforementioned factors.

Restraining Factors

Surging LPG Demand Drives Butane Market Growth

In recent years, the global butane market has expanded significantly due to the soaring demand for liquefied petroleum gas (LPG), which has been predominantly driven by the rising consumption of butane in emerging economies. China is currently the largest LPG consumer in the globe, followed by India. Nevertheless, despite the growing demand, the market confronts a number of factors that hinder its growth and development.

Volatile Crude Oil Prices Impact Butane Market

The price of crude oil, the primary basic material for butane production, has a significant impact on butane prices in the global market. However, the volatility of petroleum oil prices in recent years has hindered the expansion of the butane market. Several factors, including geopolitical tensions, changes in global supply and demand, and currency value fluctuations, are predominantly responsible for the volatility of crude oil prices.

Butane Market Growth Is Hampered by Safety Concerns

The handling and storage of butane present a number of safety concerns that pose significant obstacles to the development of the global butane market. Butane is extremely combustible and explosive, and improper handling and storage can result in severe safety incidents. Risks associated with the handling and storage of butane necessitate stringent compliance with safety regulations and guidelines, which can significantly increase production and supply chain costs.

Butane Market Faces Alternative Energy Competition

Alternative energy sources such as natural gas, propane, and renewable energy sources such as solar and wind power pose a significant threat to the global butane market. Increasing awareness of environmental issues and the need for sustainable energy sources has led to a rise in the use of alternative energy sources, which has decreased the demand for butane. Alternative energy sources pose competition primarily due to their reduced costs, greater availability, and lower environmental impact.

Type Analysis

The global market for butane is dominated by the N-butane segment. N-butane is a combustible gas primarily used as a fuel. Due to its low cost, high calorific value, and simple availability, the demand for N-butane is increasing. Over the upcoming years, the segment is expected to register the highest growth rate.

The economic growth of emerging economies is driving the adoption of the N - butane segment. Population growth and rising living standards in countries such as China, India, and Brazil have resulted in a substantial increase in energy demand. N-butane is utilized as a fuel in industries such as the automotive, agricultural, and mining sectors. It is a popular option in emerging economies due to its low cost and high calorific value.

Positive consumer trends and behaviors exist for the N-butane segment. The rising demand for energy and the low cost of N - butane make it a popular choice among consumers. The automotive industry is the greatest N-butane consumer. N-butane-fueled hybrid vehicles are becoming increasingly popular, which is expected to increase demand.

The N-butane segment is also used for cooking and heating in the residential sector. An increase in household demand for N-butane has resulted from the growing population and rising living standards in emerging economies.

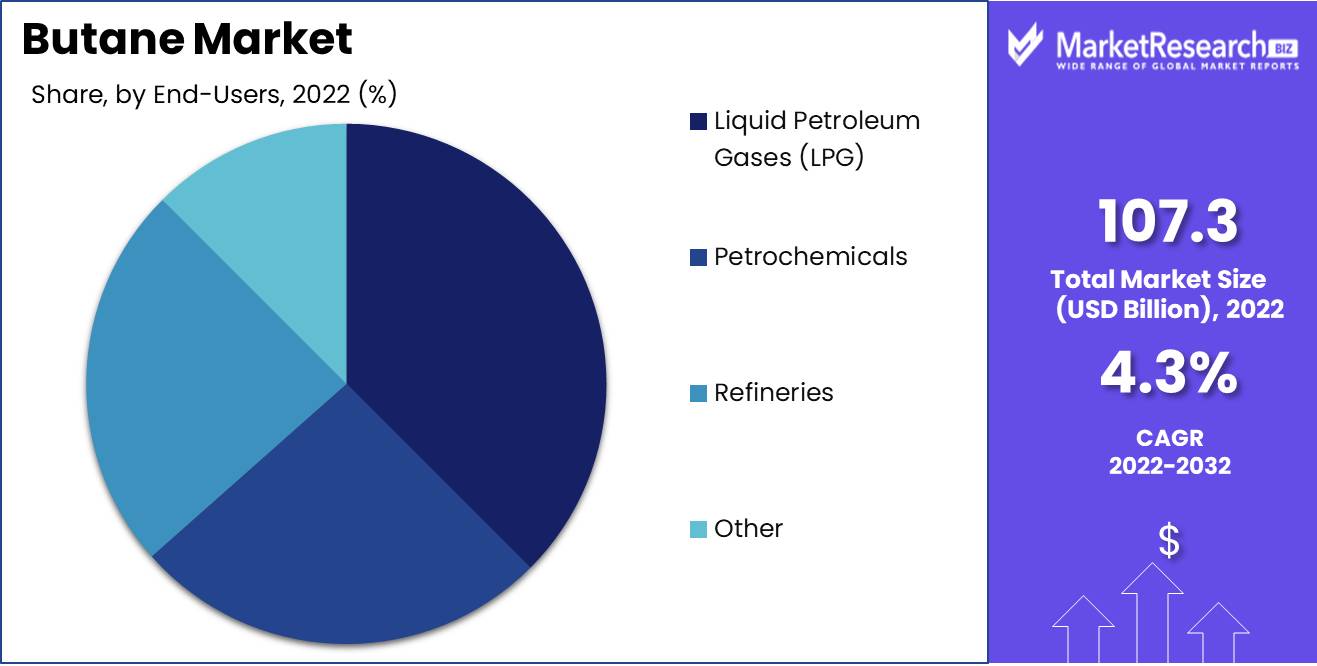

Application Analysis

The segment of the global butane market is dominated by liquid petroleum gases (LPG). LPG is an ignitable gas used primarily as a fuel. LPG is a popular option among consumers due to its low cost, cleaner combustion, and simple availability. Over the upcoming years, the segment is expected to register the highest growth rate.

The growth of emerging economies is driving the adoption of the LPG segment. Population growth and rising living standards in countries such as China, India, and Brazil have resulted in a substantial increase in energy demand. Several industries, including the automotive, agricultural, and mining sectors, use LPG as fuel. It is a popular option in emerging economies due to its low cost and healthier combustion.

Positive consumer trends and behavior are observed in the LPG market segment. LPG is a popular option among consumers due to its low cost and rising demand for energy. The automotive sector is the greatest LPG consumer. The rising popularity of hybrid vehicles that use LPG as a fuel is expected to increase demand.

The LPG segment is also used for cooking and heating in the residential sector. Population growth and rising living standards in emerging economies have resulted in an increase in residential demand for LPG.

Key Market Segments

By Type

- Isobutane

- N-Butane

By Application

- Liquid Petroleum Gases (LPG)

- Petrochemicals

- Refineries

- Other Applications

Growth Opportunity

The Global Butane Market Expands with a Promising Rate of Growth

As the world transitions toward sustainable fuel sources, the global butane market has recently emerged as a growth opportunity with considerable potential. Butane, a four-carbon hydrocarbon, is a clean and efficient fuel with applications in the energy, chemical, and manufacturing industries. The main growth drivers of the global butane market are the increased adoption of clean combustion technologies, the expansion of LPG infrastructure in developing regions, the rising demand for chemical manufacturing, and the growing collaboration between LPG suppliers and end-use industries.

Butane Market Growth Driven by Developing Economies

Due to increased government support and infrastructure investments, the LPG industry in developing economies has experienced significant growth. Countries in Asia, Africa, and the Middle East have been significantly investing in the development of LPG infrastructure to cater to the rising demand for clean, affordable energy. Since butane is the primary component of LPG fuel, the expansion of LPG infrastructure has generated new opportunities for the butane market.

Clean Combustion Technologies Drive Market for Butane

In the energy sector, there has been a significant transition toward the adoption of clean and efficient combustion technologies in response to the growing emphasis on reducing greenhouse gas emissions. Several clean butane combustion technologies have been developed in recent years, such as butane-fired combined heat and power (CHP) systems, which not only emit fewer emissions but also produce electricity and heat simultaneously.

The Role of Butane in the Chemical Industry Drives Demand

In addition to the energy industry, the chemical industry has been a major consumer of butane. Butane is a substrate for a variety of chemical manufacturing processes, including olefin production, isomerization, and alkylation. The rising demand for petrochemicals, which are widely used in numerous industries, including packaging, construction, textiles, and automotive, has increased the demand for butane as a chemical feedstock.

Butane Market Growth Is Boosted by Collaboration

Collaboration between LPG suppliers and end-use industries has been a major factor in the expansion of the global butane market. LPG suppliers are collaborating with end-use industries to increase the adoption of LPG fuel, which has increased butane demand. To cater to the unique requirements of end-use industries such as agriculture, transportation, and power generation, several LPG suppliers have been offering customized LPG solutions.

Latest Trends

Increasing Demand in Renewable Energy for Butane

As the world transitions to renewable energy sources, there is a developing trend of using butane as a fuel in renewable energy applications. Butane is used in fuel cells and micro-combined heat and power (CHP) systems, which offer pure and effective energy solutions.

Sustainable Packaging Solutions Employing Butane

Butane is emerging as an important component of eco-friendly packaging materials as the packaging industry embraces sustainability. Butane-based polymers are used to make biodegradable and recyclable packaging, reducing environmental impact.

Butane as a Feedstock for Biochemicals

With the growth of bio-based chemicals, butane is becoming a valuable feedstock for biochemical production. It functions as a renewable carbon source, allowing for the production of a vast array of sustainable chemicals, such as biofuels and bioplastics.

Advancements in Butane Storage and Handling Technologies

Innovations in butane storage and handling technologies are making operations safer and reducing the risks associated with the combustibility of the substance. To meet the rising demand for butane, innovative storage systems, and enhanced safety measures are being created.

Butane in the Precision Cleaning and Electronics Industry

Precision cleaning processes are essential to the electronics industry, and butane-based cleaning solvents are gaining popularity as effective solution. Butane is optimal for removing contaminants from sensitive electronic components due to its low surface tension and superior cleaning properties.

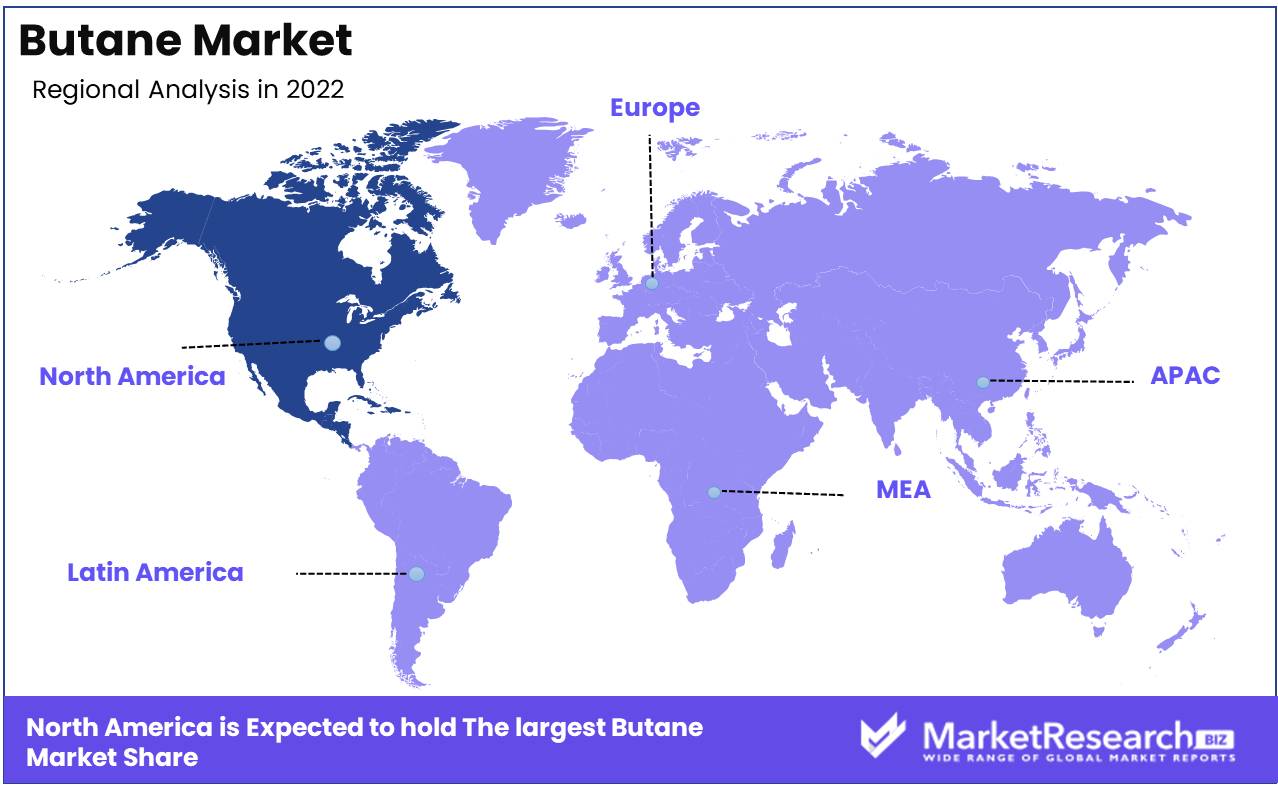

Regional Analysis

North America dominates the butane market. Liquefied Petroleum Gas (LPG) usage is growing worldwide as a greener and safer fuel source. Butane is a common LPG product due to its low boiling point and high flammability. It fuels camping stoves and lighters.

Butane is produced by multiple refineries in North America, giving them a production edge. Since 1950, the US has dominated butane production. Canada's assets boost the global butane market. Shale gas production produces natural gas liquids like butane in the Canadian Rockies.

The North American market has the infrastructure to process butane for industrial and domestic use, making it technically proficient. Butane is volatile, thus storage, transit, and usage must be careful. North American market participants have substantially invested in cutting-edge butane treatment and optimization technology.

His growth is fueled by the demand for clean fuels and their many uses. North America, with its large production capacity, is poised to profit from butane market growth.

Butane is used in synthetic rubber and chemical production. The US and Canada dominate this market because of their flourishing petrochemical industry and new technology. The growth of this industry will increase demand for butane in the North American market. Butane is a favored feedstock for the production of various petrochemicals.

Environmental regulations encouraging cleaner fuel sources in the car industry have helped the North American market dominate. Butane is a clean-burning fuel. The demand for such cleaner fuels has surged as a result of stronger environmental rules being implemented globally, favoring butane.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The global butane market is extremely competitive and dynamic, with key players competing for market share. ExxonMobil, British Petroleum, Royal Dutch Shell, Total S.A., and Sinopec are just a few of the major players in the industry. These companies have a substantial presence in the global butane market and are continuously expanding their operations in key geographic regions.

ExxonMobil is one of the dominant players in the global butane market, with a robust portfolio of butane products and robust distribution. The company operates in over 200 countries and has a diversified portfolio of enterprises. Its downstream segment, which includes the production and sale of butane, is a key driver of the company's overall business.

British Petroleum is another significant player in the global butane market, focusing on both traditional and renewable energy sources. The corporation has a significant presence in the global petrochemicals and refining industry, with a diverse product portfolio that includes butane. Its solid brand reputation and vast distribution network make it a formidable market competitor.

Royal Dutch Shell is a multinational petroleum corporation with a significant presence in the butane market. The corporation is involved in every aspect of the oil and gas value chain, from exploration and production to refining and marketing. It is a key participant in the industry due to its diverse portfolio of businesses and solid financial position.

Total S.A. is a multinational energy corporation with operations in over 130 nations. It derives a significant portion of its revenue from its petrochemicals and refining segment, which includes butane products. The company's commitment to sustainability and renewable energy positions it at the forefront of the global energy market.

Sinopec is a prominent player in the global butane market, with a diversified business portfolio that includes the production and marketing of butane. It is one of the world's largest energy companies, and its expanding presence in key markets makes it a major player in the butane industry.

Top Key Players in Butane Market

- British Petroleum

- Chevron Corporation

- Conocco Phillips Inc.

- Devron Energy Corporation

- Exxon Mobil Corporation

- Proton Gases India Pvt. Ltd.

- China National Petroleum Corporation (CNPC)

- Valero Energy Corporation

- Royal Dutch Shell plc

- Linde AG

- TotalEnergies

Recent Development

- In 2023, Butane is being investigated as a potential energy storage medium in the year energy storage.

- In 2022, Butane as a Clean Fuel 2022 butane gained prominence as a cleaner alternative to conventional fossil fuels.

- In 2022, There were advancements in the development of butane storage technologies. These include improved tank designs, composite materials, and safety measures to increase the efficacy, durability, and safety of butane storage and transport.

- In 2021, Butane, which is frequently used as a liquefied petroleum gas (LPG), saw a surge in demand.

Report Scope:

Report Features Description Market Value (2022) USD 107.3 Bn Forecast Revenue (2032) USD 161.8 Bn CAGR (2023-2032) 4.3% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Isobutane, N-Butane), By Application (Liquid Petroleum Gases, Petrochemicals, Refineries, and Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape British Petroleum, Chevron Corporation, Conocco Phillips Inc., Devron Energy Corporation, Exxon Mobil Corporation, Proton Gases India Pvt. Ltd., China National Petroleum Corporation (CNPC), Valero Energy Corporation, Royal Dutch Shell plc, Linde AG, TotalEnergies Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- British Petroleum

- Chevron Corporation

- Conocco Phillips Inc.

- Devron Energy Corporation

- Exxon Mobil Corporation

- Proton Gases India Pvt. Ltd.

- China National Petroleum Corporation (CNPC)

- Valero Energy Corporation

- Royal Dutch Shell plc

- Linde AG

- TotalEnergies