Lip Care Products Market By Product Type(Lip Balms, Lipsticks, Lip Glosses, Lip Scrubs), By Ingredient Type(Chemical Ingredients, Natural/Organic Ingredients, Medicated Ingredients), By Packaging Type(Tubes, Jars, Bottles), By Distribution Channel(Hypermarkets & Supermarkets, Drugstores/Pharmacies, Specialty Beauty Stores, Online Retailers, Department Stores), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

15312

-

Feb 2024

-

185

-

-

This report was compiled by Correspondence Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Report Overview

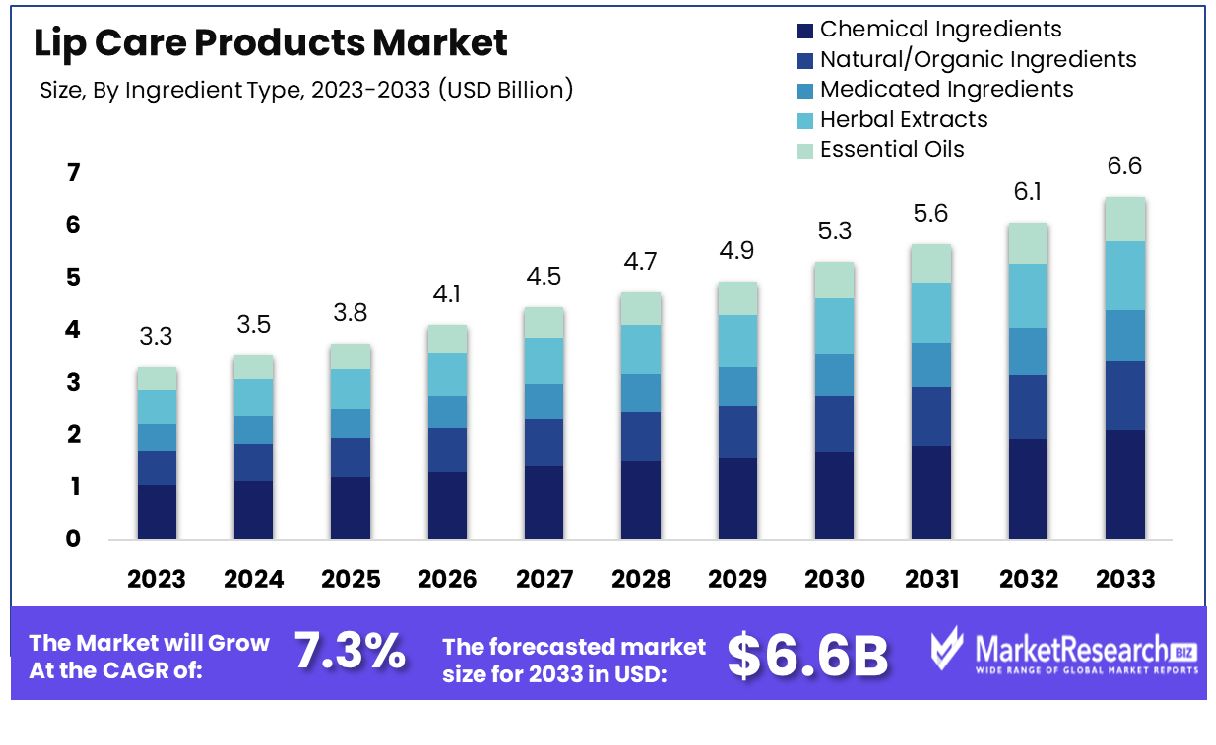

The lip care product market was valued at USD 3.3 billion in 2023, It is expected to reach USD 6.6 billion by 2033, with a CAGR of 7.3% during the forecast period from 2024 to 2033. The surge in demand of the changing lifestyles, rise in awareness regarding lip care and usage of organic products are some of the main key driving factors for the lip care product market.

Lip care refers to the maintenance and enhancement of both health and appearance for healthy lips. It also includes a wide range of practices and products that are developed to understand and address different types of lip-related concerns. Generally, it comprises hydration to avoid lip dryness and chapping, more often through the usage of lip balms, moistures, and oils. Sun protection is important, as lips are very soft and sensitive to ultraviolet rays, making lip balms with SPF an ideal choice.

Exfoliation is a different aspect that helps in eliminating dead skin cells and promotes smoothness. Some of the lip care products include ingredients like vitamins, antioxidants, and soothing agents to nurture and protect the skin over the lips. Whether it is for health, aesthetics, or both, lip care is a whole approach to maintaining softness, and supple, and healthy lips.

Cosmetics Designs In August 2022, Pilgrim, a D2C vegan products renowned skincare brand launched a squalene lip care range which is a part of the company’s, “Secrets of Seville” Spain-inspired range in March 2022. Additionally, the range has also contributed 10% to the company’s total sales revenue. Moreover, the new pilgrim squalene lip range ranges from USD 3 to USD 4.40. For any type of marketing purpose, the range of the products targets the audience aged from 20 to 25 but it can be used by any age group. The brand hopes to sell up to 30,000 units under the squalene range and add more flavors with time.

Lip care products are essential in maintaining healthy and comfortable lips. With the delicate skin on the lips being disposed to dryness and various kinds of environmental stressors, lip balms, and moisturizers provide vital hydration, by avoiding chapping and discomfort. Such products provide sun protection against UV damage while the ingredients that nourish contribute to whole lip health. Daily use makes sure for smoother texture, improved appearance, and relief from dryness by giving much importance to dedicated lip care for ideal lip well-being. The demand for lip care products will increase due to customer requirements and various availability in online platforms as well as offline stores which will help in market expansion in the coming years.

Key Takeaways

- Market Growth: The lip care product market was valued at USD 3.3 billion in 2023, It is expected to reach USD 6.6 billion by 2033, with a CAGR of 7.3% during the forecast period from 2024 to 2033.

- By Product Type: The lip balms segment reigns supreme in product type, favored for their nourishing properties and convenience in daily use.

- By Ingredient Type: Chemical ingredients prevail in formulation, offering effective solutions for hydration and protection against environmental stressors.

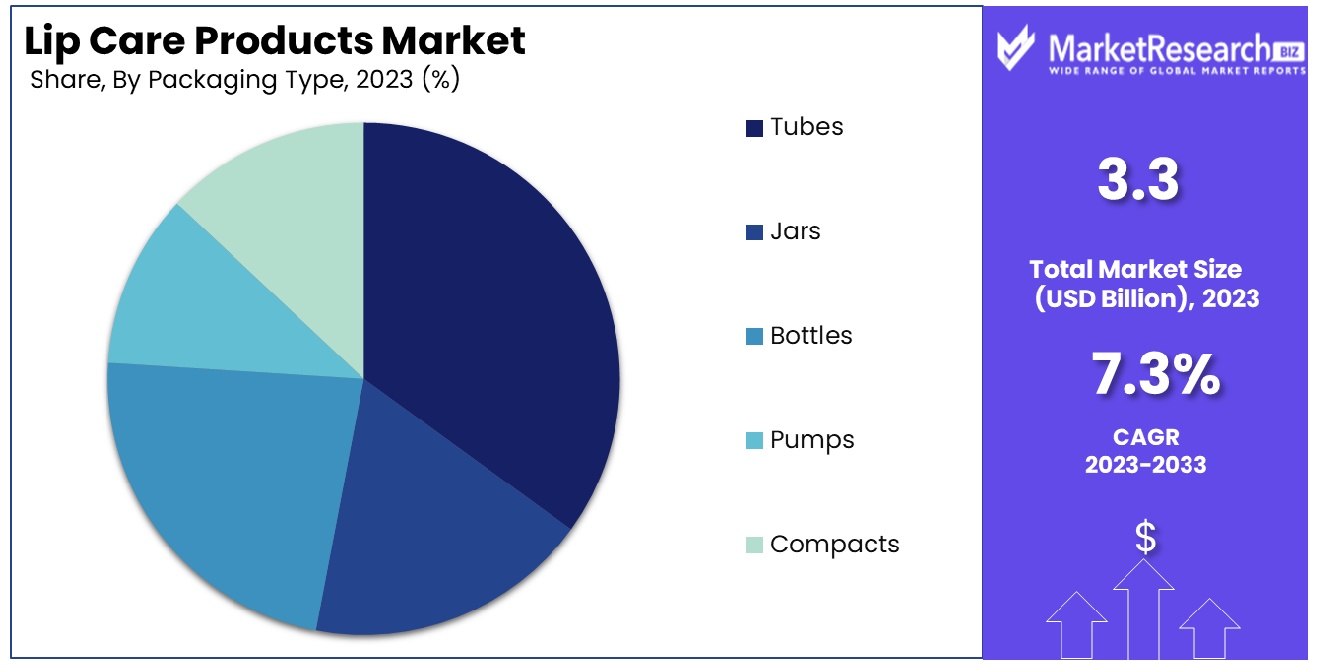

- By Packaging Type: Tubes emerge as the preferred packaging, providing practicality and ease of application for consumers on the go.

- By Distribution Channel: Hypermarkets & supermarkets dominate distribution, offering a wide array of lip care products to cater to diverse consumer preferences.

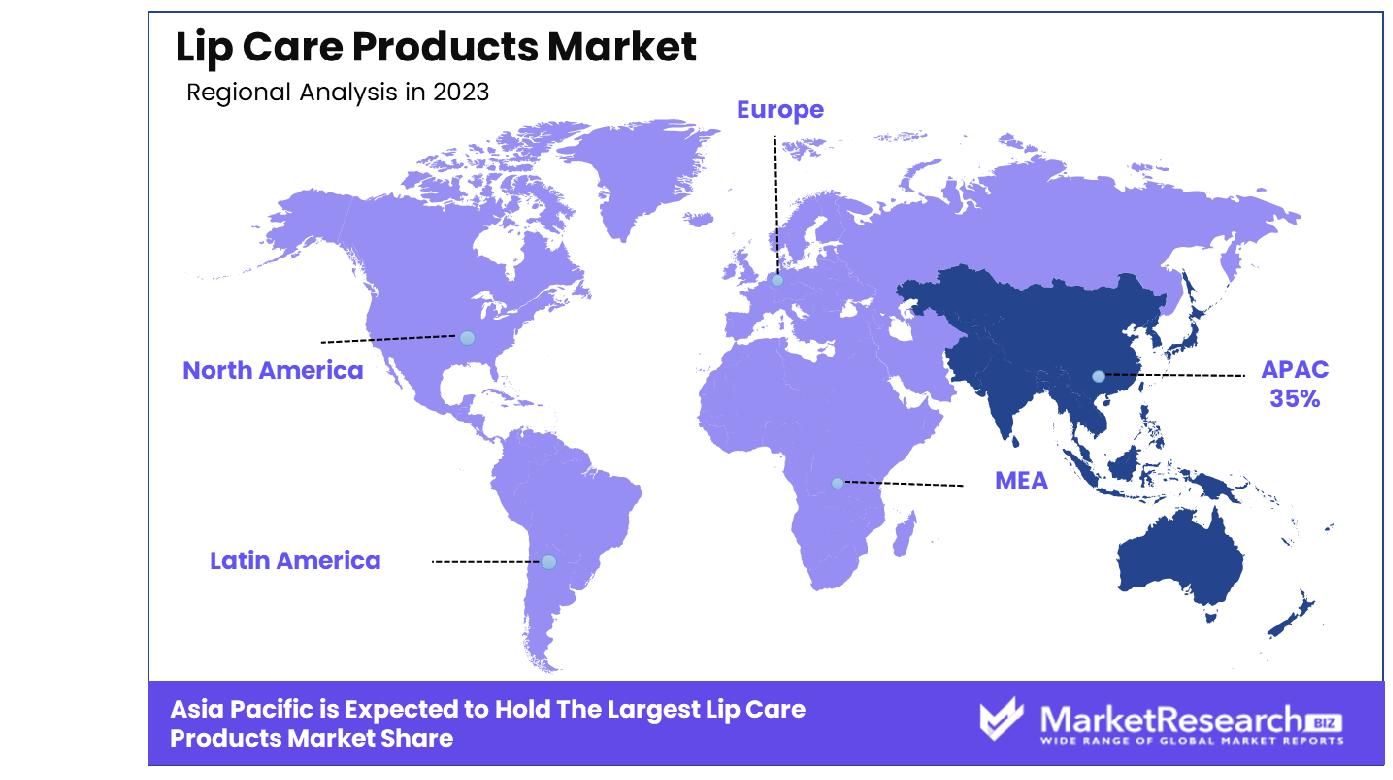

- Regional Dominance: Asia Pacific dominates the lip care product market with a commanding 35% market share, indicating significant regional preference.

- Growth Opportunity: The men's lip care segment offers substantial growth potential by targeting underpenetrated male consumers with matte, natural finish products aligned with active lifestyles. Nutricosmetics, enriched with vitamins and antioxidants, capitalize on health-conscious beauty trends.

Driving factors

Increasing Awareness About Lip Care Drives Market Growth

Awareness of lip care's significance in maintaining healthy and attractive lips has contributed substantially to market expansion. As consumers become more knowledgeable about the need to protect lips from environmental damage, brands are responding by educating and offering products that meet these concerns. This heightened awareness, coupled with targeted education efforts by brands, is creating a more informed consumer base, driving demand for lip care products. The long-term implication is a more discerning customer base that values product efficacy and protection, ensuring sustained growth in this sector.

Growth in E-commerce and Social Media Expands Market Reach

The explosion of e-commerce and social media has transformed the visibility and accessibility of lip care products. Brands leveraging online platforms for marketing and sales are experiencing broader reach and easier consumer access. This digital shift makes it simpler for consumers to discover and purchase lip care products, significantly impacting market growth. The integration of e-commerce and social media strategies is expected to continue driving market expansion, with long-term implications for how brands engage with consumers and distribute products.

Product Innovation Spurs Market Interest

Innovative product launches in the lip care market, featuring new textures, flavors, and effects, are generating consumer interest and trial. Schwan Cosmetics and other brands' focus on combining sustainability with performance in 2023 exemplifies this trend. Such innovation not only attracts consumers but also sets the stage for ongoing evolution within the market. The introduction of products with natural/organic ingredients and sustainable packaging is appealing to consumer preferences for health and environmental consciousness, likely leading to sustained growth.

Premiumization Elevates Market Standards

The growth of premium and luxury lip care products, as seen with brands like Dior and Fresh, reflects consumers' increasing desire for high-quality and indulgent products. Dior's 2023 launch of Lip Maximizer with 90% natural components exemplifies this shift towards premiumization. This trend is elevating market standards and expectations, as consumers are willing to invest in higher-priced products that promise superior quality and experience. The premium segment's expansion is anticipated to continue, influencing product development and market dynamics in the long term.

Restraining Factors

Market Saturation Restrains Market Growth

Market saturation in developed regions severely limits the expansion of lip care product sales. With a high penetration rate of lip care usage among consumers, the market faces challenges in attracting new users. Many individuals have established lip care routines, incorporating products like lip balm segments into their daily lives.

This saturation leads to a plateau in demand, as the majority of potential customers are already engaged, leaving limited room for market expansion. The challenge for brands in saturated markets is to innovate within a space where consumer habits are well-established, making it difficult to generate significant growth.

Competition from DIY and Indie Brands Limits Market Expansion

DIY (do-it-yourself) and independent brands pose a formidable threat to the development of mainstream lip care product markets. These smaller entities captivate a segment of the consumer base with their artisanal appeal, high-quality ingredients, and personalized experiences that mass-market brands often struggle to match.

This competition diverts a portion of consumer spending away from established brands, impacting their market share and growth prospects. Indie and DIY brands cater to niche preferences for natural and organic ingredients, further intensifying the competition for mass-market major players and restraining overall market growth.

Product Type Analysis

In the lip balm market, dominant products are those in the lip balm category.

The lip balms segment dominates the lip care products market due to their indispensable role in daily lip care regimens. Their primary function to moisturize and protect lips from harsh environmental conditions has made them indispensable for consumers worldwide. The ubiquity of lip balms, combined with their affordability and the vast array of available formulations, flavors, and brands, has solidified their market dominance. In the cosmetics industry research, lip balms account for a significant portion of the market share, driven by consumer demand for products that offer hydration, sun protection, and healing benefits.

Other sub-segments, such as lipsticks, lip gloss, lip balm and lip scrubs, lip masks, lip oils, lip sunscreens, and others, contribute to the market's diversity and growth. Lipsticks and glosses cater to the cosmetic industry side of lip care, offering color and shine, while scrubs, masks, and oils address specific care needs like exfoliation, deep hydration, and nourishment. Lip cosmetics sunscreens have gained importance for their protective properties against UV damage. Each of these segments meets different consumer preferences and needs, enriching the market's product offerings and driving innovation.

Ingredient Type Analysis

Chemical ingredients lead in lip balm formulations, dominating ingredient preferences.

Chemical ingredients have long dominated the lip care product ingredient segment due to their efficacy in product development and cost-efficiency for manufacturers. These ingredients enable a wide range of product textures, long shelf lives, and specific benefits such as SPF protection. However, this dominance is increasingly challenged by the fast-growing segment of natural/organic ingredients, which appeals to consumers' growing preference for clean, sustainable, and health-conscious products.

Natural and organic ingredients are rapidly gaining market share, driven by consumer demand for products free from synthetic chemicals and aligned with eco-friendly and ethical values. This shift reflects a broader trend in personal care and beauty towards natural and sustainable products. Medicated ingredients cater to niche needs for therapeutic benefits, addressing issues like severe dryness or chapped lips. Herbal extracts and essential oils are also gaining traction for their natural healing properties and are often highlighted in product marketing to attract health-conscious consumers.

Packaging Type Analysis

Tubes prevail as the dominant packaging type for lip balm products.

Tubes have become the dominant packaging type for lip care products on the market. This preference can be attributed to their convenience, portability, and ease of application. Tubes offer a hygienic way to apply the product directly to the lips without the need for finger application, making them a favored choice among consumers for daily use. Furthermore, the cost-effectiveness of tube packaging for manufacturers, coupled with the ability to easily brand and design eye-catching products, contributes to their widespread adoption. According to market analysis, tubes account for a significant portion of the market's packaging segment, underlining their appeal to both consumers and producers.

Other packaging formats, including jars, bottles, pumps, and compacts, play crucial roles in the market by catering to diverse consumer preferences and product types. Jars are often preferred for thicker formulas like lip masks and scrubs, where finger application is more common. Bottles and pumps find use in liquid lip care products, such as oils and serums, offering precise application. Compacts, while less common in lip care, appeal to consumers seeking portable, multi-use products, such as tinted lip balms. Each of these packaging types supports the lip care market expansion by accommodating a wide range of product viscosities and application preferences, driving innovation and consumer choice.

Distribution Channel Analysis

Hypermarkets & supermarkets stand out as the primary distribution channel for lip balm sales.

Hypermarkets and supermarkets remain the primary distribution channels for Lip Care Products due to their wide reach and convenience for consumers. These retail formats provide easy access to a broad assortment of lip care products, from basic lip balms to premium lip treatments, under one roof. The ability to physically evaluate products before purchase is a significant factor driving consumer preference for these outlets. Market research indicates that hypermarkets and supermarkets play an essential part in the lip care product distribution ecosystem.

Other distribution channels, including drugstores/pharmacies, specialty beauty stores, online retailers, department stores, and direct sales (brand outlets), each contribute uniquely to the market. Drugstores/pharmacies are critical for distributing medicated or therapeutic lip care industry solutions. Specialty beauty stores offer a curated selection of premium and niche brands, providing a personalized shopping experience. Online segment retailers have enjoyed great success thanks to the ease and convenience of home shopping as well as extensive product reviews and comparisons available on these platforms. Department stores provide a luxury shopping experience with a focus on high-end brands.

Key Market Segments

By Product Type

- Lip Balms

- Lipsticks

- Lip Glosses

- Lip Scrubs

- Lip Masks

- Lip Oils

- Lip Sunscreens

- Others

By Ingredient Type

- Chemical Ingredients

- Natural/Organic Ingredients

- Medicated Ingredients

- Herbal Extracts

- Essential Oils

By Packaging Type

- Tubes

- Jars

- Bottles

- Pumps

- Compacts

By Distribution Channel

- Hypermarkets & Supermarkets

- Drugstores/Pharmacies

- Specialty Beauty Stores

- Online Retailers

- Department Stores

- Direct Sales (Brand Outlets)

- Others

Growth Opportunity

Men's Segment Offers Growth Opportunity

Men represent an exciting opportunity in the Lip Care Products Market. With male consumers traditionally underpenetrated in this sector, there is a burgeoning demand for products tailored to their preferences, such as matte and natural finishes, rather than glossy textures. This demographic is increasingly interested in lip care products that align with an active lifestyle, emphasizing protection and hydration without the shine.

By focusing marketing efforts on the practical benefits and incorporating masculine branding, major companies can tap into this untapped market, potentially driving substantial growth. The trend towards male grooming and organic skin care products indicates a promising expansion path for brands willing to innovate in product development and communication strategies.

Nutricosmetics Offer Growth Opportunity

Nutricosmetics in lip care, featuring products packed with vitamins, antioxidants, and natural oils to meet consumer demand for health-oriented beauty products, are becoming more and more popular. These ingredients not only enhance the appearance of the lips but also provide tangible health benefits, such as improved hydration, reduced inflammation, and protection against environmental damage.

Consumer awareness of natural and healthful ingredients used in beauty products demonstrates their potential for market expansion. Brands that successfully harness the appeal of nutricosmetic lip care products can differentiate themselves and capture a significant share of consumers seeking beauty solutions with added health benefits.

Latest Trends

Mask-proof Lip Care On Rise

The widespread use of face masks has propelled the demand for mask-proof lip care products. Consumers are seeking formulas that promise extended wear without transferring onto masks, a need that has only grown in the current health-conscious environment. Brands that develop and market long-lasting, transfer-proof lip care solutions can capture a niche yet growing segment of the market. This trend underscores the industry's capacity for innovation in response to changing consumer behaviors and preferences, offering a clear path for growth among brands that can quickly adapt to these new demands.

Growing CBD Lip Care

Consumer awareness of natural and healthful ingredients used in beauty products demonstrates their potential for market expansion. Touted for their moisturizing and soothing properties, CBD lip balms and oils align with the trend towards natural and therapeutic beauty solutions. As consumers continue to seek out innovative products incorporating natural ingredients for their perceived health benefits, CBD lip care represents a promising growth avenue. Brands that leverage the natural, soothing benefits of CBD skincare and communicate these effectively to health-conscious consumers are well-positioned to capitalize on this trend.

Regional Analysis

Asia Pacific Dominates with a 35% Market Share

Asia Pacific holds an impressive 35% of the Lip Care Products Market. This impressive statistic speaks volumes of its vibrant consumer population and steady economic development. Key factors contributing to this dominance include a large and increasingly affluent population, a growing awareness of personal care and beauty products, and the influence of local beauty standards that emphasize meticulous skincare routines, including lip care.

The region's market dynamics are characterized by a strong preference for innovative and natural ingredients, driving product development and marketing strategies. Additionally, the rapid expansion of e-commerce platforms has made lip care products more accessible to consumers across this diverse region. The forecast implications suggest that Asia Pacific will continue to lead market growth, fueled by increasing disposable income, digital penetration, and consumer demand for premium and specialized lip care products.

North America Holds Substantial Market Influence

North America remains an influential player in the Lip Care Products Market. This region's performance is buoyed by a high consumer spending power, a robust retail infrastructure, and a keen interest in innovative and organic lip care solutions. The North American market is distinguished by its swift adoption of key trends such as CBD-infused and eco-friendly products, reflecting consumers' growing preferences for sustainability and wellness in beauty care. With ongoing innovations and a strong emphasis on quality, North America is poised for steady growth, continuing to influence global market trends and product developments.

Europe: A Key Player in Lip Care Innovation

Europe's market share in the Lip Care Products sector is underscored by its rich cosmetic industry heritage and stringent product quality standards. European consumers' high awareness and preference for luxury and natural beauty products drive demand in this region. Europe is renowned for its pioneering role in cosmetic regulations and sustainability, influencing product formulation and packaging innovations. The region's commitment to eco-friendly and organic ingredients appeals to a global audience, setting trends that resonate worldwide. Europe's influence is expected to persist, with its market share growth propelled by continuous innovation and an unwavering commitment to quality and sustainability in beauty products.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of Middle East & Africa

Key Players Analysis

Lip Care Products Market players with strategic positioning and market clout stand out amongst their rivals as being stand-out performers. Burt's Bees, EOS, and ChapStick are renowned for their focus on natural and organic ingredients, appealing to consumers seeking environmentally friendly and health-conscious options. Carmex and Blistex are trusted for their medicated products, offering solutions for severe lip conditions.

NIVEA, Vaseline, and Neutrogena have leveraged their strong brand presence in the skin care industry to establish a solid footing in lip care, offering products that emphasize hydration and protection. High-end brands like Clinique, Kiehl's, and Fresh are distinguished by their premium offerings, targeting consumers looking for luxury and specialty lip care solutions.

Maybelline New York, L'Oréal Paris, and Revlon, traditionally known for their makeup, have successfully expanded into the lip care segment, innovating with products that combine color and care. Avon, with its direct selling model, has effectively reached a broad audience, offering a range of lip care products that cater to various consumer needs.

Collectively, these companies drive the market through a blend of innovation, brand loyalty, and diverse product offerings, from everyday hydration to luxury indulgence. Their strategies, ranging from leveraging natural ingredients to integrating lip care with color cosmetics, highlight the dynamic nature of the market and their role in shaping consumer preferences and trends.

Market Key Players

- Burt's Bees

- EOS (Evolution of Smooth)

- ChapStick

- Carmex

- NIVEA

- Maybelline New York

- L'Oréal Paris

- Vaseline

- Revlon

- Clinique

- Neutrogena

- Blistex

- Avon

- Kiehl's

- Fresh

Recent Development

- In February 2024, Uriage introduces its Thermal Water Moisturizing Lipstick, harnessing 99.6% natural origin ingredients for lasting hydration. Enriched with Borage Oil and Shea Butter, it fortifies lips while protecting with antioxidant-rich Vitamin E and C.

- In January 2024, Hidden Valley Ranch teams up with Burt's Bees for a lip balm collaboration, offering flavors inspired by wings. This cross-industry partnership introduces playful lip balm choices, merging beauty and food trends.

- In January 2024, YSL Beauty's Scent-Sation gauges neural responses to fragrances, L'Oréal's Coloursonic offers eco-friendly hair care, and Amorepacific's Lipcure Beam combines lip care with makeup.

Report Scope

Report Features Description Market Value (2023) USD 3.3 Billion Forecast Revenue (2033) USD 6.6 Billion CAGR (2024-2032) 7.3% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type(Lip Balms, Lipsticks, Lip Glosses, Lip Scrubs, Lip Masks, Lip Oils, Lip Sunscreens, Others), By Ingredient Type(Chemical Ingredients, Natural/Organic Ingredients, Medicated Ingredients, Herbal Extracts, Essential Oils), By Packaging Type(Tubes, Jars, Bottles, Pumps, Compacts), By Distribution Channel(Hypermarkets & Supermarkets, Drugstores/Pharmacies, Specialty Beauty Stores, Online Retailers, Department Stores, Direct Sales (Brand Outlets), Others) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Burt's Bees, EOS (Evolution of Smooth), ChapStick, Carmex, NIVEA, Maybelline New York, L'Oréal Paris, Vaseline, Revlon, Clinique, Neutrogena, Blistex, Avon, Kiehl's, Fresh Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Burt's Bees

- EOS (Evolution of Smooth)

- ChapStick

- Carmex

- NIVEA

- Maybelline New York

- L'Oréal Paris

- Vaseline

- Revlon

- Clinique

- Neutrogena

- Blistex

- Avon

- Kiehl's

- Fresh