Lignin Market Report By Product Type (Lignosulfonates, Kraft Lignin, Organosolv Lignin), By Application (Dispersants, Binders, Emulsifiers, Concrete Additives, Animal Feed Additives, Carbon Fiber Precursors, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

-

1227

-

March 2024

-

172

-

-

This report was compiled by Correspondence Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Report Overview

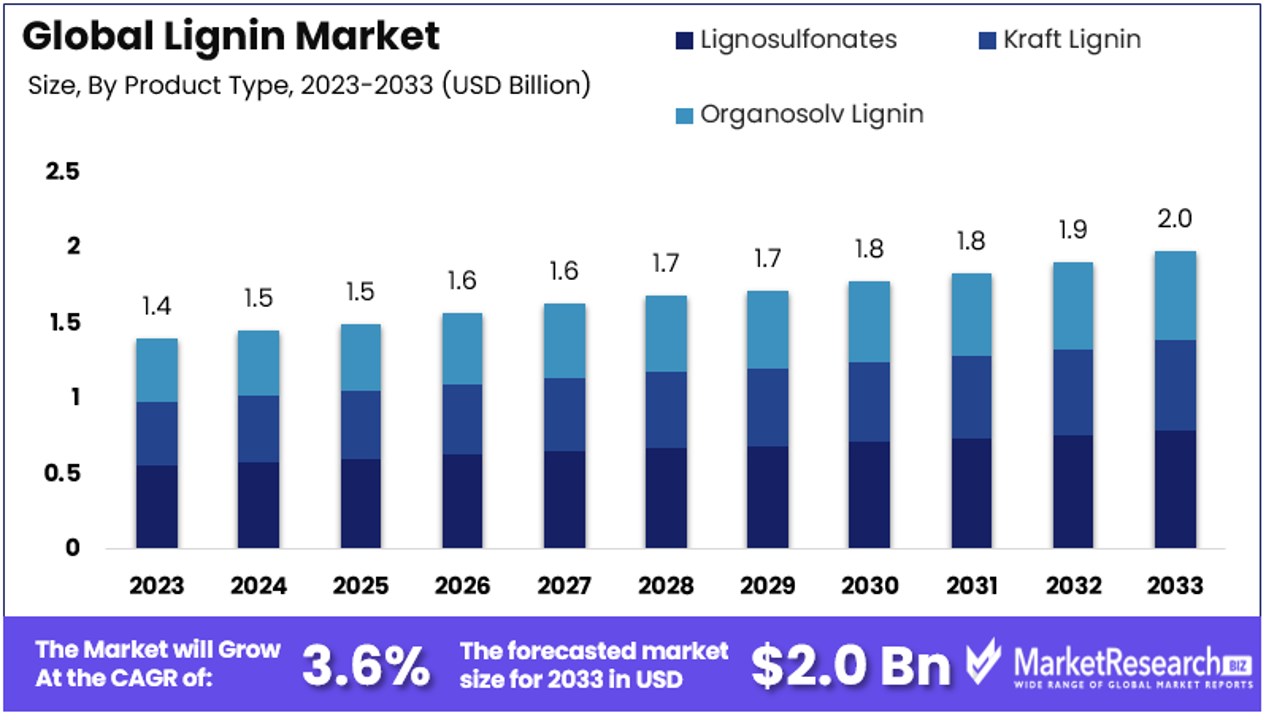

The Global Lignin Market size is expected to be worth around USD 2.0 Billion by 2033, from USD 1.4 Billion in 2023, growing at a CAGR of 3.60% during the forecast period from 2024 to 2033.

The surge in demand for utilization of biofuels and high funding for making lignin-based carbon fibres are some of the main key driving factors for the lignin market. The lignin is a type of polymer that are found in the cell walls of plants and is vital element of wood.

Lignin extracted fuels have aesthetically gain attention as a means of manufacturing biofuels from biomass in recent years. Lignin extracted fuels have the capability to decrease the reliance on fossil fuels and lessen greenhouse gas emissions.

Many researchers are analysing this method and require to enhance the manufacturing of lignin derived fuels and to regulate their environmental impact. These lignins can be transformed into wide range of fuels that comprises of gasoline, diesel and aviation fuels. These fuels have same elements to their fossil-based components, that makes them suitable for utilization in different types of applications. Moreover, lignin-based fuels can be mixed with traditional fossil fuels that aids to decrease the overall carbon intensity of the transportation industry.

Lignin has witnessed significant growth in the recent years as the potential renewable component for different applications. It can be utilized as biofuel feedstock, pioneer for the manufacturing of bio-based chemicals and substances, and a value-added resource product like lignin-based adhesive and mixtures.

The lignin-based carbon nanofibers are generally used in the production of less weight structural mixtures for automobiles and functional applications like the electromagnetic shields. The implementation of the lignin helps to decrease carbon footprints, as producers are gradually using renewable resources in the manufacturing methods.

The utilization of lignin and its end products as tangible additives in the form of dyes, dust, etc. is very basic. The insulation of the glass wool building is made up of lignin. It improves the efficacy of asphalt dye. Lignin is primarily used in the construction sector. It is more used by architects and construction engineers to implement them during the construction projects.

The demand for the lignin will gradually grow due to its high requirement in the construction sector as well as huge investment for lignin based carbon fibres, that will help in market expansion during the forecasted period.

Key Takeaways

- Market Value: The Global Lignin Market is projected to reach a value of approximately USD 2.0 Billion by 2033, marking a notable growth from its 2023 value, with a steady CAGR during the forecast period from 2024 to 2033.

- Dominant Segments:

- Product Type Analysis: Lignosulfonates emerge as the dominant sub-segment, commanding around 40% of the market share, driven by their versatility and eco-friendliness, finding applications in concrete, dyestuffs, pesticides, animal feed, and emulsifying agents.

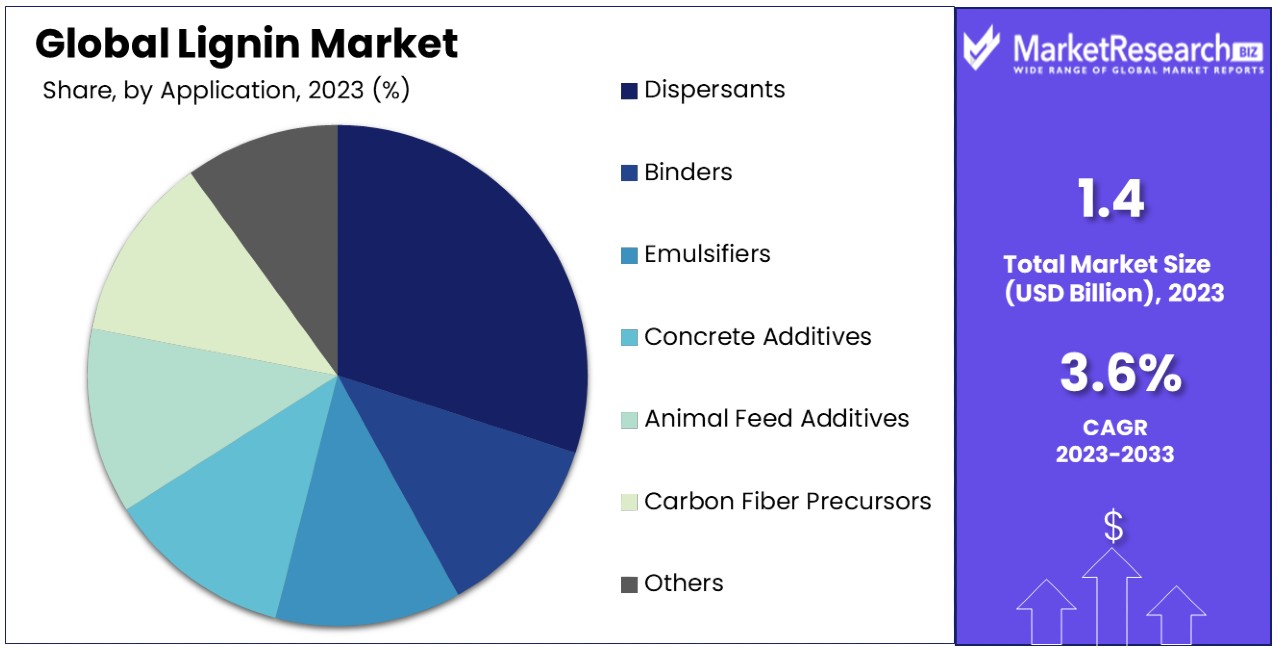

- Application Analysis: Dispersants hold the leading sub-segment position, with a 24% market share, driven by their crucial role across industries such as construction, agriculture, and pharmaceuticals, where lignin-based dispersants offer natural origin, biodegradability, and functional efficiency.

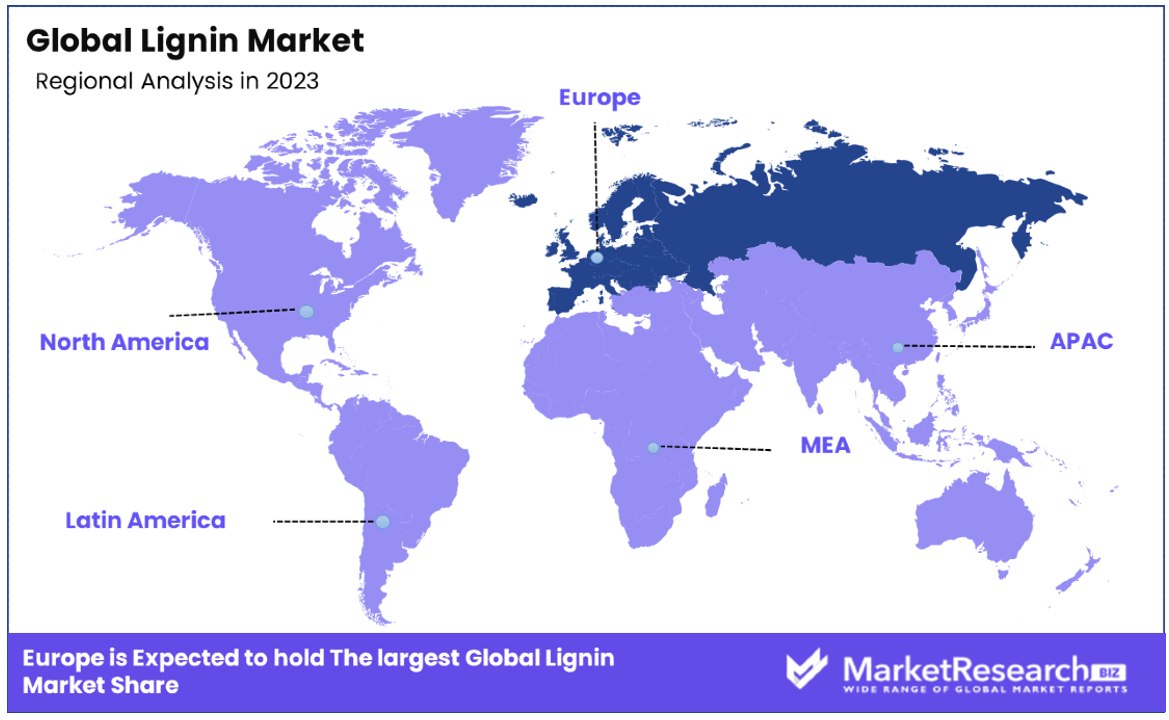

- Regional Analysis: Europe dominates the market with a substantial 42% market share, followed by the Asia Pacific region, witnessing rapid growth fueled by expanding industrialization and rising sustainability initiatives.

- Analyst Viewpoint: The lignin market's growth is propelled by expanding applications across industries, driven by the demand for sustainable and eco-friendly materials. Opportunities lie in penetrating high-value markets with kraft and organosolv lignins, leveraging the push towards sustainability and renewable materials.

- Market Key Players: Key players in the global lignin market include Domtar Corporation, Stora Enso, Nippon Paper Industries Co., Ltd., Domsjo Fabriker AB, UPM-Kymmene Corporation, and others, reflecting a mix of established industry players and emerging innovators driving market growth and innovation.

Driving Factors

Growth of the Biorefinery Industry Drives Market Growth

The expansion of the biorefinery industry stands as a pivotal factor propelling the growth of the lignin market. Biorefineries, engaging in the conversion of biomass into biofuels, biochemicals, and other bio-based products, generate lignin as a significant byproduct. This shift has repositioned lignin from a previously overlooked waste to a valuable commodity, fostering its market expansion.

Notably, enterprises like Borregaard and Stora Enso have spearheaded the development of lignin extraction and purification facilities, underlining the industry's recognition of lignin's potential. This evolution is indicative of a broader industry trend towards valorizing all components of biomass, thereby driving demand for lignin in various applications. The strategic positioning of lignin extraction within the biorefinery process underscores a symbiotic relationship, enhancing the sustainability and efficiency of biomass utilization and amplifying the market for lignin-based products.

Demand for Sustainable and Renewable Materials Boosts Market Potential

Sustainability considerations are increasingly pivotal in the industrial sector, as evidenced by a recent SAP survey where 46% of business leaders emphasized sustainability in manufacturing, and 68% reported efforts to curtail energy consumption. This heightened focus on sustainability bolsters the lignin market, as lignin offers a renewable alternative to fossil-based materials.

Its adoption aligns with the global transition towards a circular economy and mitigating environmental footprints. Industries such as construction, automotive, and packaging are gravitating towards lignin-based solutions, like lignin-derived concrete admixtures and plastics, to enhance their eco-credentials. This trend not only illustrates the market's response to sustainability demands but also showcases lignin's versatility and compatibility with diverse industry requirements, driving its market growth.

Applications in Biochemicals and Biofuels Propel Market Expansion

Lignin's role in the production of biochemicals and biofuels marks a significant avenue for market growth. Its unique chemical structure and aromatic composition render it an ideal raw material for synthesizing a range of high-value chemicals, such as phenolic resins and vanillin, alongside its application in renewable energy through pyrolysis and gasification.

Entities like Vertere and Bloom Biorenewables are at the forefront of exploring lignin's potential in these domains. This development not only diversifies lignin's applicability but also aligns with the growing demand for renewable energy sources and sustainable chemical production, further stimulating the lignin market. The integration of lignin in biochemical and biofuel production exemplifies the material's adaptability and its emerging role in the sustainable economy, reinforcing its market growth trajectory.

Restraining Factors

Inconsistent Quality and Supply Restrains Market Growth

The variability of lignin's quality and supply significantly hinders its market expansion. Being a heterogeneous polymer, lignin's properties vary with the source of biomass, extraction, and purification methods. This inconsistency affects the performance and reproducibility of lignin-based products, posing a challenge for end-users who require reliability in their applications.

The U.S. Department of Energy's Bioenergy Technologies Office highlights that differences in lignin's reactivity and suitability for specific applications, such as biochemicals or biofuels production, can be substantial. The diverse nature of biomass feedstocks and the absence of standardized extraction processes complicate the achievement of consistent and high-quality lignin supply. This limitation restricts its broader adoption across various industries, as the demand for predictable performance standards is not met, slowing down the integration of lignin in new markets.

Competition from Established Materials and Technologies Limits Market Acceptance

Lignin's market growth is further constrained by competition from established materials and technologies across various sectors. In the construction realm, for instance, lignin-based products, such as concrete admixtures and adhesives, are up against traditional petroleum-based counterparts, which boast long-standing track records and robust supply chains. Similarly, in the biochemicals and biofuels sectors, lignin must prove its cost-effectiveness and superior performance to displace existing technologies.

Overcoming the market inertia and the perceived risks tied to new materials adoption represents a significant hurdle, especially in tightly regulated industries that demand high performance standards. The slow adoption of lignin-based phenolic resins in wood adhesives, facing stiff competition from established formaldehyde-based resins, exemplifies these challenges. Industries' reluctance to deviate from tried-and-tested materials and processes stifles lignin's market penetration, underscoring the need for strategic initiatives to demonstrate its value proposition.

Product Type Analysis

In the lignin market, product types are categorized mainly into lignosulfonates, kraft lignin, and organosolv lignin. Lignosulfonates emerge as the dominant sub-segment, accounting for approximately 40% of the market share. This prominence is attributed to their wide-ranging applications and cost-effectiveness. Lignosulfonates are extensively used as water-reducing agents in concrete, dispersants in dyestuffs and pesticides, binders in animal feed, and as emulsifying agents, capitalizing on their natural polymer properties. Their versatility and eco-friendliness drive their demand in various industries, supporting the sustainability trend.

Kraft lignin and organosolv lignin, while holding smaller market shares, contribute significantly to the market's diversity and growth potential. Kraft lignin, a byproduct of the kraft process of wood pulp production, is increasingly being utilized in high-value applications like carbon fibers and phenolic resins due to its purity and consistent quality. Organosolv lignin, obtained from a relatively eco-friendly process using organic solvents, is noted for its application in producing renewable chemicals and materials due to its cleaner and more uniform properties compared to kraft lignin.

The growth of the lignin market is underpinned by the expanding applications of these product types. Lignosulfonates' dominant position is bolstered by their established market presence and broad application range. However, the potential for kraft and organosolv lignins to penetrate high-value markets presents an opportunity for overall market expansion. The push towards sustainability and renewable materials across industries further amplifies the significance of all lignin types, particularly organosolv lignin, due to its environmentally friendly extraction process.

Application Analysis

Within the lignin market, applications span across dispersants, binders, emulsifiers, concrete additives, animal feed additives, carbon fiber precursors, among others. Dispersants constitute the leading sub-segment, holding a 24% share of the application market.

This dominance is rooted in the essential role dispersants play in a wide array of industries, including construction, agriculture, and pharmaceuticals, where lignin-based dispersants are favored for their natural origin, biodegradability, and effectiveness in improving the properties of concrete, pesticides, and drug formulations. The environmental benefits of lignin-based dispersants, coupled with their functional efficiency, align with the increasing regulatory and consumer demand for sustainable and green products.

The remaining sub-segments, though smaller in individual market shares, collectively contribute to the lignin market's growth and diversification. Binders and emulsifiers find extensive use in the food and feed industry, leveraging lignin's natural binding properties to enhance the quality of pellets and emulsions. Concrete additives represent a significant application area, with lignin-based products improving the performance and sustainability of building materials.

In animal feed, lignin acts as a nutritional and functional additive, supporting animal health and production efficiency. The role of lignin as a precursor for carbon fiber highlights its potential in high-performance materials, contributing to lightweight and energy-efficient automotive and aerospace components.

The application of lignin in these diverse areas underscores its versatility and growing importance in the shift towards more sustainable materials and processes. While dispersants lead the application segment due to their widespread use and direct impact on product performance, other applications like concrete additives and carbon fiber precursors are expected to witness robust growth. This expansion is driven by the increasing emphasis on sustainable construction practices and the demand for advanced materials in technology and transportation sectors.

Key Market Segments

By Product Type

- Lignosulfonates

- Kraft Lignin

- Organosolv Lignin

By Application

- Dispersants

- Binders

- Emulsifiers

- Concrete Additives

- Animal Feed Additives

- Carbon Fiber Precursors

- Others

Growth Opportunities

Valorization of Lignin for High-Value Applications Offers Growth Opportunity

The initiative to valorize lignin into high-value applications presents a significant avenue for market expansion. By tapping into lignin's unique properties, companies can venture into the production of renewable chemicals, advanced materials, and specialty products. This approach not only diversifies the use of lignin but also elevates its status from a low-value byproduct to a critical raw material for high-performance applications.

Companies are leading the way, investigating the production of lignin-based carbon fibers and specialty chemicals, respectively. These developments indicate a shift towards recognizing and exploiting the intrinsic value of lignin, potentially transforming industries such as automotive, aerospace, and electronics. The innovation in processing technologies and product development centered around lignin can unlock new revenue streams and contribute significantly to the growth of the lignin market.

Collaboration and Strategic Partnerships Enhance Market Potential

The formation of strategic collaborations and partnerships emerges as a key driver for the lignin market's growth. Engaging in partnerships across the value chain, from biomass suppliers and technology innovators to end-user industries, can facilitate the development and commercialization of lignin-based solutions.

Such collaborative efforts are essential in overcoming technical and market barriers, enabling the creation of tailored lignin-based products that meet the demands of various industries. This approach accelerates the adoption of lignin in new markets and applications, expanding its potential beyond traditional uses. The synergy from combining diverse expertise and resources underpins the development of innovative applications for lignin, fostering market expansion and sustainability initiatives. Collaboration also promotes knowledge sharing and risk distribution, crucial for navigating the complexities of bringing new materials to market and ensuring the lignin market's robust growth.

Trending Factors

Emphasis on Circular Economy and Waste Valorization Are Trending Factors

The shift towards a circular economy and the valorization of waste materials are defining trends in the Lignin Market. This trend stems from the global movement to reduce environmental impact and enhance resource efficiency across industries. Lignin, as a byproduct from biomass processing, has gained significant attention for its potential in contributing to sustainability goals.

Companies are investing in innovative technologies to recover lignin from diverse waste streams, including agricultural residues and pulp and paper mill effluents. This approach not only supports the circular economy by turning waste into valuable products but also opens up new avenues for lignin utilization in various sectors. The trend towards waste valorization is driven by the need for sustainable materials and the recognition of lignin's untapped potential, positioning it as a key player in the push for greener industries and products.

Development of Advanced Lignin Modification Techniques Are Trending Factors

The advancement of lignin modification techniques is a prominent trend in the lignin market, aimed at broadening the scope of lignin's applications and improving its performance characteristics. Innovations in chemical, physical, and enzymatic treatments are enabling the customization of lignin properties to meet specific industry requirements.

Techniques such as oxidation, grafting, and enzymatic depolymerization are being explored to enhance lignin's solubility, reactivity, and thermal stability. These advancements are crucial for developing lignin-based products that can compete with or even outperform conventional materials. Companies like Rhizerinc and MetGen are at the forefront of this trend, working on modified lignin products that promise improved functionality and greater market potential. The push for advanced modification techniques reflects the market's direction towards leveraging lignin's versatility and sustainability profile, fueling innovation and expanding its use in a wider range of applications.

Regional Analysis

Europe Dominates with 42% Market Share

Europe's commanding 42% share in the Lignin Market can be attributed to several key factors, including strong regulatory support for sustainable materials, a robust biorefinery infrastructure, and significant investments in research and development. The region's emphasis on circular economy principles and waste valorization aligns with lignin's sustainable attributes, driving its adoption across various industries. European companies and research institutions are at the forefront of developing advanced lignin modification techniques and exploring high-value applications, further reinforcing the region's market position.

The regional dynamics, characterized by stringent environmental regulations and a high degree of environmental awareness among consumers and businesses, favor the growth of green and sustainable industries. This context has fostered a conducive environment for lignin utilization in applications such as renewable chemicals, biofuels, and green composites.

Europe's influence on the global lignin market is expected to persist, driven by ongoing policy support, technological advancements, and the increasing demand for sustainable materials. The region's leadership in lignin innovation and application development is poised to continue shaping the market trends and dynamics on a global scale.

North America:

North America holds approximately 25% of the lignin market share, supported by a growing bioeconomy and increasing sustainable practices in industries like construction and automotive. The region's commitment to renewable energy and sustainable materials, coupled with its advanced technological infrastructure, positions it as a key player in the lignin market. Research and development efforts, particularly in the United States and Canada, are focusing on unlocking new applications for lignin, further propelling market growth.

Asia Pacific:

With a market share of 20%, the Asia Pacific region is witnessing rapid growth in the lignin market, driven by expanding industrialization and rising sustainability initiatives. Countries like China and India are investing heavily in biomass utilization and renewable material research, tapping into lignin's potential to meet the demand for eco-friendly products. The region's vast agricultural sector provides a significant biomass source, offering ample opportunities for lignin extraction and application development.

Middle East & Africa:

The Middle East & Africa region, holding an 8% market share, is gradually recognizing the importance of sustainable materials, with investments in renewable energy and green building practices contributing to the lignin market's growth. Although at a nascent stage, the region's interest in diversifying its economy and reducing reliance on oil presents opportunities for lignin's adoption in various sectors.

Latin America:

Latin America, with a 5% share of the lignin market, is poised for growth, leveraging its rich biomass resources and growing interest in sustainable development. Countries like Brazil, with its vast agricultural sector, are exploring the use of lignin in biofuels and biochemicals, aligning with global trends towards sustainability and the circular economy. The region's potential for lignin production and application is significant, given its renewable resources and evolving industrial landscape.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

In the dynamic Lignin Market, companies like Domtar Corporation, Stora Enso, and Nippon Paper Industries Co., Ltd. lead with strategic positioning and significant market influence. These major players, along with others such as Domsjo Fabriker AB and UPM-Kymmene Corporation, have shaped the market through their focus on innovation and sustainable practices. The utilization of lignin extends beyond traditional paper manufacturing into emerging applications like biofuels, bioplastics, and concrete additives, showcasing the versatility and environmental benefits of this natural polymer.

Companies like Borregaard LignoTech and Rayonier Advanced Materials stand out for their specialized approaches to lignin extraction and application, offering high-value lignin-based products to diverse industries. The technological advancements spearheaded by these companies have expanded the lignin market's reach, enabling new uses that capitalize on lignin's unique properties.

Regional markets are also significantly impacted by the presence of global players like Aditya Birla Group, Metsa Group, and West Fraser, which have leveraged their vast resources and industry knowledge to optimize lignin's commercial potential. Their strategic moves, including capacity expansions and partnerships, have bolstered the global supply chain for lignin products.

The collective efforts of these companies have propelled the Lignin Market forward, marking it as a key area of growth within the broader push towards sustainable and eco-friendly materials. Their ongoing commitment to innovation and sustainability is set to drive the lignin market's expansion in the years to come.

Market Key Players

- Domtar Corporation

- Stora Enso

- Nippon Paper Industries Co., Ltd.

- Domsjo Fabriker AB

- UPM-Kymmene Corporation

- Burgo Group S.p.A.

- WestRock Company

- Tokyo Chemical Industry Co, Ltd.

- Sigma Aldrich

- Borregaard LignoTech

- Rayonier Advanced Materials

- Aditya Birla Group

- Metsa Group

- West Fraser

Recent Developments

- In April 2023, Borregaard ASA announced the launch of a novel lignin-based product designed for use in the construction industry. This innovative product is anticipated to provide cost savings and environmental benefits to the construction industry.

- In March 2023, Stora Enso announced intentions to invest heavily in a new lignin production facility in Finland. This growth demonstrates the increasing demand for lignin as a sustainable alternative to conventional petroleum-based products. It is anticipated that the facility will be entirely operational by the end of 2024.

- In February 2023, UPM-Kymmene Corporation made a significant move in the lignin market by acquiring a German lignin production facility. This acquisition demonstrates UPM-Kymmene Corporation's commitment to expanding its renewable energy market offerings.

- In January 2023, the University of British Columbia unveiled a ground-breaking lignin extraction technique that could revolutionize how wood fiber manufacturers extract lignin. This technology is anticipated to significantly reduce energy and chemical consumption during extraction, thereby enhancing the overall sustainability of lignin production.

- In December 2022, Domtar Corporation announced the release of a novel lignin-based textile industry-specific product. This new product is anticipated to provide environmental and economic benefits to the textile industry, which is notorious for its negative impact on the environment.

Report Scope

Report Features Description Market Value (2023) USD 1.4 Billion Forecast Revenue (2033) USD 2.0 Billion CAGR (2024-2033) 3.60% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Lignosulfonates, Kraft Lignin, Organosolv Lignin), By Application (Dispersants, Binders, Emulsifiers, Concrete Additives, Animal Feed Additives, Carbon Fiber Precursors, Others) Regional Analysis North America - The US, Canada, & Mexico; Western Europe - Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe - Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC - China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America - Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa - Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Domtar Corporation, Stora Enso, Nippon Paper Industries Co., Ltd., Domsjo Fabriker AB, UPM-Kymmene Corporation, Burgo Group S.p.A., WestRock Company, Tokyo Chemical Industry Co, Ltd., Sigma Aldrich, Borregaard LignoTech, Rayonier Advanced Materials, Aditya Birla Group, Metsa Group, West Fraser, Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

- 1. Executive Summary

- 1.1. Definition

- 1.2. Taxonomy

- 1.3. Research Scope

- 1.4. Key Analysis

- 1.5. Key Findings by Major Segments

- 1.6. Top strategies by Major Players

- 2. Global Lignin Market Overview

- 2.1. Lignin Market Dynamics

- 2.1.1. Drivers

- 2.1.2. Opportunities

- 2.1.3. Restraints

- 2.1.4. Challenges

- 2.2. Macro-economic Factors

- 2.3. Regulatory Framework

- 2.4. Market Investment Feasibility Index

- 2.5. PEST Analysis

- 2.6. PORTER’S Five Force Analysis

- 2.7. Drivers & Restraints Impact Analysis

- 2.8. Industry Chain Analysis

- 2.9. Cost Structure Analysis

- 2.10. Marketing Strategy

- 2.11. Russia-Ukraine War Impact Analysis

- 2.12. Opportunity Map Analysis

- 2.13. Market Competition Scenario Analysis

- 2.14. Product Life Cycle Analysis

- 2.15. Opportunity Orbits

- 2.16. Manufacturer Intensity Map

- 2.17. Major Companies sales by Value & Volume

- 2.1. Lignin Market Dynamics

- 3. Global Lignin Market Analysis, Opportunity and Forecast, 2016-2032

- 3.1. Global Lignin Market Analysis, 2016-2021

- 3.2. Global Lignin Market Opportunity and Forecast, 2023-2032

- 3.3. Global Lignin Market Analysis, Opportunity and Forecast, By By Source, 2016-2032

- 3.3.1. Global Lignin Market Analysis by By Source: Introduction

- 3.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Source, 2016-2032

- 3.3.3. Kraft Lignin

- 3.3.4. Organosolv Lignin

- 3.3.5. Ligno-Sulphonates

- 3.3.6. Others

- 3.4. Global Lignin Market Analysis, Opportunity and Forecast, By By Application, 2016-2032

- 3.4.1. Global Lignin Market Analysis by By Application: Introduction

- 3.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Application, 2016-2032

- 3.4.3. Concrete Additive

- 3.4.4. Aromatics

- 3.4.5. Dye stuff

- 3.4.6. Macromolecules

- 3.4.7. Animal Feed

- 3.4.8. Absorbents

- 4. North America Lignin Market Analysis, Opportunity and Forecast, 2016-2032

- 4.1. North America Lignin Market Analysis, 2016-2021

- 4.2. North America Lignin Market Opportunity and Forecast, 2023-2032

- 4.3. North America Lignin Market Analysis, Opportunity and Forecast, By By Source, 2016-2032

- 4.3.1. North America Lignin Market Analysis by By Source: Introduction

- 4.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Source, 2016-2032

- 4.3.3. Kraft Lignin

- 4.3.4. Organosolv Lignin

- 4.3.5. Ligno-Sulphonates

- 4.3.6. Others

- 4.4. North America Lignin Market Analysis, Opportunity and Forecast, By By Application, 2016-2032

- 4.4.1. North America Lignin Market Analysis by By Application: Introduction

- 4.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Application, 2016-2032

- 4.4.3. Concrete Additive

- 4.4.4. Aromatics

- 4.4.5. Dye stuff

- 4.4.6. Macromolecules

- 4.4.7. Animal Feed

- 4.4.8. Absorbents

- 4.5. North America Lignin Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 4.5.1. North America Lignin Market Analysis by Country : Introduction

- 4.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 4.5.2.1. The US

- 4.5.2.2. Canada

- 4.5.2.3. Mexico

- 5. Western Europe Lignin Market Analysis, Opportunity and Forecast, 2016-2032

- 5.1. Western Europe Lignin Market Analysis, 2016-2021

- 5.2. Western Europe Lignin Market Opportunity and Forecast, 2023-2032

- 5.3. Western Europe Lignin Market Analysis, Opportunity and Forecast, By By Source, 2016-2032

- 5.3.1. Western Europe Lignin Market Analysis by By Source: Introduction

- 5.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Source, 2016-2032

- 5.3.3. Kraft Lignin

- 5.3.4. Organosolv Lignin

- 5.3.5. Ligno-Sulphonates

- 5.3.6. Others

- 5.4. Western Europe Lignin Market Analysis, Opportunity and Forecast, By By Application, 2016-2032

- 5.4.1. Western Europe Lignin Market Analysis by By Application: Introduction

- 5.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Application, 2016-2032

- 5.4.3. Concrete Additive

- 5.4.4. Aromatics

- 5.4.5. Dye stuff

- 5.4.6. Macromolecules

- 5.4.7. Animal Feed

- 5.4.8. Absorbents

- 5.5. Western Europe Lignin Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 5.5.1. Western Europe Lignin Market Analysis by Country : Introduction

- 5.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 5.5.2.1. Germany

- 5.5.2.2. France

- 5.5.2.3. The UK

- 5.5.2.4. Spain

- 5.5.2.5. Italy

- 5.5.2.6. Portugal

- 5.5.2.7. Ireland

- 5.5.2.8. Austria

- 5.5.2.9. Switzerland

- 5.5.2.10. Benelux

- 5.5.2.11. Nordic

- 5.5.2.12. Rest of Western Europe

- 6. Eastern Europe Lignin Market Analysis, Opportunity and Forecast, 2016-2032

- 6.1. Eastern Europe Lignin Market Analysis, 2016-2021

- 6.2. Eastern Europe Lignin Market Opportunity and Forecast, 2023-2032

- 6.3. Eastern Europe Lignin Market Analysis, Opportunity and Forecast, By By Source, 2016-2032

- 6.3.1. Eastern Europe Lignin Market Analysis by By Source: Introduction

- 6.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Source, 2016-2032

- 6.3.3. Kraft Lignin

- 6.3.4. Organosolv Lignin

- 6.3.5. Ligno-Sulphonates

- 6.3.6. Others

- 6.4. Eastern Europe Lignin Market Analysis, Opportunity and Forecast, By By Application, 2016-2032

- 6.4.1. Eastern Europe Lignin Market Analysis by By Application: Introduction

- 6.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Application, 2016-2032

- 6.4.3. Concrete Additive

- 6.4.4. Aromatics

- 6.4.5. Dye stuff

- 6.4.6. Macromolecules

- 6.4.7. Animal Feed

- 6.4.8. Absorbents

- 6.5. Eastern Europe Lignin Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 6.5.1. Eastern Europe Lignin Market Analysis by Country : Introduction

- 6.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 6.5.2.1. Russia

- 6.5.2.2. Poland

- 6.5.2.3. The Czech Republic

- 6.5.2.4. Greece

- 6.5.2.5. Rest of Eastern Europe

- 7. APAC Lignin Market Analysis, Opportunity and Forecast, 2016-2032

- 7.1. APAC Lignin Market Analysis, 2016-2021

- 7.2. APAC Lignin Market Opportunity and Forecast, 2023-2032

- 7.3. APAC Lignin Market Analysis, Opportunity and Forecast, By By Source, 2016-2032

- 7.3.1. APAC Lignin Market Analysis by By Source: Introduction

- 7.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Source, 2016-2032

- 7.3.3. Kraft Lignin

- 7.3.4. Organosolv Lignin

- 7.3.5. Ligno-Sulphonates

- 7.3.6. Others

- 7.4. APAC Lignin Market Analysis, Opportunity and Forecast, By By Application, 2016-2032

- 7.4.1. APAC Lignin Market Analysis by By Application: Introduction

- 7.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Application, 2016-2032

- 7.4.3. Concrete Additive

- 7.4.4. Aromatics

- 7.4.5. Dye stuff

- 7.4.6. Macromolecules

- 7.4.7. Animal Feed

- 7.4.8. Absorbents

- 7.5. APAC Lignin Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 7.5.1. APAC Lignin Market Analysis by Country : Introduction

- 7.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 7.5.2.1. China

- 7.5.2.2. Japan

- 7.5.2.3. South Korea

- 7.5.2.4. India

- 7.5.2.5. Australia & New Zeland

- 7.5.2.6. Indonesia

- 7.5.2.7. Malaysia

- 7.5.2.8. Philippines

- 7.5.2.9. Singapore

- 7.5.2.10. Thailand

- 7.5.2.11. Vietnam

- 7.5.2.12. Rest of APAC

- 8. Latin America Lignin Market Analysis, Opportunity and Forecast, 2016-2032

- 8.1. Latin America Lignin Market Analysis, 2016-2021

- 8.2. Latin America Lignin Market Opportunity and Forecast, 2023-2032

- 8.3. Latin America Lignin Market Analysis, Opportunity and Forecast, By By Source, 2016-2032

- 8.3.1. Latin America Lignin Market Analysis by By Source: Introduction

- 8.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Source, 2016-2032

- 8.3.3. Kraft Lignin

- 8.3.4. Organosolv Lignin

- 8.3.5. Ligno-Sulphonates

- 8.3.6. Others

- 8.4. Latin America Lignin Market Analysis, Opportunity and Forecast, By By Application, 2016-2032

- 8.4.1. Latin America Lignin Market Analysis by By Application: Introduction

- 8.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Application, 2016-2032

- 8.4.3. Concrete Additive

- 8.4.4. Aromatics

- 8.4.5. Dye stuff

- 8.4.6. Macromolecules

- 8.4.7. Animal Feed

- 8.4.8. Absorbents

- 8.5. Latin America Lignin Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 8.5.1. Latin America Lignin Market Analysis by Country : Introduction

- 8.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 8.5.2.1. Brazil

- 8.5.2.2. Colombia

- 8.5.2.3. Chile

- 8.5.2.4. Argentina

- 8.5.2.5. Costa Rica

- 8.5.2.6. Rest of Latin America

- 9. Middle East & Africa Lignin Market Analysis, Opportunity and Forecast, 2016-2032

- 9.1. Middle East & Africa Lignin Market Analysis, 2016-2021

- 9.2. Middle East & Africa Lignin Market Opportunity and Forecast, 2023-2032

- 9.3. Middle East & Africa Lignin Market Analysis, Opportunity and Forecast, By By Source, 2016-2032

- 9.3.1. Middle East & Africa Lignin Market Analysis by By Source: Introduction

- 9.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Source, 2016-2032

- 9.3.3. Kraft Lignin

- 9.3.4. Organosolv Lignin

- 9.3.5. Ligno-Sulphonates

- 9.3.6. Others

- 9.4. Middle East & Africa Lignin Market Analysis, Opportunity and Forecast, By By Application, 2016-2032

- 9.4.1. Middle East & Africa Lignin Market Analysis by By Application: Introduction

- 9.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Application, 2016-2032

- 9.4.3. Concrete Additive

- 9.4.4. Aromatics

- 9.4.5. Dye stuff

- 9.4.6. Macromolecules

- 9.4.7. Animal Feed

- 9.4.8. Absorbents

- 9.5. Middle East & Africa Lignin Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 9.5.1. Middle East & Africa Lignin Market Analysis by Country : Introduction

- 9.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 9.5.2.1. Algeria

- 9.5.2.2. Egypt

- 9.5.2.3. Israel

- 9.5.2.4. Kuwait

- 9.5.2.5. Nigeria

- 9.5.2.6. Saudi Arabia

- 9.5.2.7. South Africa

- 9.5.2.8. Turkey

- 9.5.2.9. The UAE

- 9.5.2.10. Rest of MEA

- 10. Global Lignin Market Analysis, Opportunity and Forecast, By Region , 2016-2032

- 10.1. Global Lignin Market Analysis by Region : Introduction

- 10.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Region , 2016-2032

- 10.2.1. North America

- 10.2.2. Western Europe

- 10.2.3. Eastern Europe

- 10.2.4. APAC

- 10.2.5. Latin America

- 10.2.6. Middle East & Africa

- 11. Global Lignin Market Competitive Landscape, Market Share Analysis, and Company Profiles

- 11.1. Market Share Analysis

- 11.2. Company Profiles

- 11.3. Borregaard LignoTech

- 11.3.1. Company Overview

- 11.3.2. Financial Highlights

- 11.3.3. Product Portfolio

- 11.3.4. SWOT Analysis

- 11.3.5. Key Strategies and Developments

- 11.4. Rayonier

- 11.4.1. Company Overview

- 11.4.2. Financial Highlights

- 11.4.3. Product Portfolio

- 11.4.4. SWOT Analysis

- 11.4.5. Key Strategies and Developments

- 11.5. Domtar Corporation

- 11.5.1. Company Overview

- 11.5.2. Financial Highlights

- 11.5.3. Product Portfolio

- 11.5.4. SWOT Analysis

- 11.5.5. Key Strategies and Developments

- 11.6. West Fraser

- 11.6.1. Company Overview

- 11.6.2. Financial Highlights

- 11.6.3. Product Portfolio

- 11.6.4. SWOT Analysis

- 11.6.5. Key Strategies and Developments

- 11.7. Tembec Inc.

- 11.7.1. Company Overview

- 11.7.2. Financial Highlights

- 11.7.3. Product Portfolio

- 11.7.4. SWOT Analysis

- 11.7.5. Key Strategies and Developments

- 11.8. Asian Lignin Manufacturing Pvt. Ltd.

- 11.8.1. Company Overview

- 11.8.2. Financial Highlights

- 11.8.3. Product Portfolio

- 11.8.4. SWOT Analysis

- 11.8.5. Key Strategies and Developments

- 11.9. Domsjö Fabriker (Aditya Birla Group)

- 11.9.1. Company Overview

- 11.9.2. Financial Highlights

- 11.9.3. Product Portfolio

- 11.9.4. SWOT Analysis

- 11.9.5. Key Strategies and Developments

- 11.10. West Rock

- 11.10.1. Company Overview

- 11.10.2. Financial Highlights

- 11.10.3. Product Portfolio

- 11.10.4. SWOT Analysis

- 11.10.5. Key Strategies and Developments

- 11.11. Changzhou Shanfeng Chemical Industry Co. Ltd.

- 11.11.1. Company Overview

- 11.11.2. Financial Highlights

- 11.11.3. Product Portfolio

- 11.11.4. SWOT Analysis

- 11.11.5. Key Strategies and Developments

- 11.12. CIMV (Compagnie Industrielle de la Matière Végétale)

- 11.12.1. Company Overview

- 11.12.2. Financial Highlights

- 11.12.3. Product Portfolio

- 11.12.4. SWOT Analysis

- 11.12.5. Key Strategies and Developments

- 11.13. Hubei zhengdong chemical Co. Ltd.

- 11.13.1. Company Overview

- 11.13.2. Financial Highlights

- 11.13.3. Product Portfolio

- 11.13.4. SWOT Analysis

- 11.13.5. Key Strategies and Developments

- 11.14. Weyerhaeuser

- 11.14.1. Company Overview

- 11.14.2. Financial Highlights

- 11.14.3. Product Portfolio

- 11.14.4. SWOT Analysis

- 11.14.5. Key Strategies and Developments

- 11.15. Nippon Paper Industries Co. Ltd.

- 11.15.1. Company Overview

- 11.15.2. Financial Highlights

- 11.15.3. Product Portfolio

- 11.15.4. SWOT Analysis

- 11.15.5. Key Strategies and Developments

- 11.16. Northway Lignin Chemica

- 11.16.1. Company Overview

- 11.16.2. Financial Highlights

- 11.16.3. Product Portfolio

- 11.16.4. SWOT Analysis

- 11.16.5. Key Strategies and Developments

- 11.17. Stora Enso

- 11.17.1. Company Overview

- 11.17.2. Financial Highlights

- 11.17.3. Product Portfolio

- 11.17.4. SWOT Analysis

- 11.17.5. Key Strategies and Developments

- 11.18. Innventia AB

- 11.18.1. Company Overview

- 11.18.2. Financial Highlights

- 11.18.3. Product Portfolio

- 11.18.4. SWOT Analysis

- 11.18.5. Key Strategies and Developments

- 12. Assumptions and Acronyms

- 13. Research Methodology

- 14. Contact

List of Figures

- Figure 1: Global Lignin Market Revenue (US$ Mn) Market Share by By Source in 2022

- Figure 2: Global Lignin Market Attractiveness Analysis by By Source, 2016-2032

- Figure 3: Global Lignin Market Revenue (US$ Mn) Market Share by By Applicationin 2022

- Figure 4: Global Lignin Market Attractiveness Analysis by By Application, 2016-2032

- Figure 5: Global Lignin Market Revenue (US$ Mn) Market Share by Region in 2022

- Figure 6: Global Lignin Market Attractiveness Analysis by Region, 2016-2032

- Figure 7: Global Lignin Market Revenue (US$ Mn) (2016-2032)

- Figure 8: Global Lignin Market Revenue (US$ Mn) Comparison by Region (2016-2032)

- Figure 9: Global Lignin Market Revenue (US$ Mn) Comparison by By Source (2016-2032)

- Figure 10: Global Lignin Market Revenue (US$ Mn) Comparison by By Application (2016-2032)

- Figure 11: Global Lignin Market Y-o-Y Growth Rate Comparison by Region (2016-2032)

- Figure 12: Global Lignin Market Y-o-Y Growth Rate Comparison by By Source (2016-2032)

- Figure 13: Global Lignin Market Y-o-Y Growth Rate Comparison by By Application (2016-2032)

- Figure 14: Global Lignin Market Share Comparison by Region (2016-2032)

- Figure 15: Global Lignin Market Share Comparison by By Source (2016-2032)

- Figure 16: Global Lignin Market Share Comparison by By Application (2016-2032)

- Figure 17: North America Lignin Market Revenue (US$ Mn) Market Share by By Sourcein 2022

- Figure 18: North America Lignin Market Attractiveness Analysis by By Source, 2016-2032

- Figure 19: North America Lignin Market Revenue (US$ Mn) Market Share by By Applicationin 2022

- Figure 20: North America Lignin Market Attractiveness Analysis by By Application, 2016-2032

- Figure 21: North America Lignin Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 22: North America Lignin Market Attractiveness Analysis by Country, 2016-2032

- Figure 23: North America Lignin Market Revenue (US$ Mn) (2016-2032)

- Figure 24: North America Lignin Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 25: North America Lignin Market Revenue (US$ Mn) Comparison by By Source (2016-2032)

- Figure 26: North America Lignin Market Revenue (US$ Mn) Comparison by By Application (2016-2032)

- Figure 27: North America Lignin Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 28: North America Lignin Market Y-o-Y Growth Rate Comparison by By Source (2016-2032)

- Figure 29: North America Lignin Market Y-o-Y Growth Rate Comparison by By Application (2016-2032)

- Figure 30: North America Lignin Market Share Comparison by Country (2016-2032)

- Figure 31: North America Lignin Market Share Comparison by By Source (2016-2032)

- Figure 32: North America Lignin Market Share Comparison by By Application (2016-2032)

- Figure 33: Western Europe Lignin Market Revenue (US$ Mn) Market Share by By Sourcein 2022

- Figure 34: Western Europe Lignin Market Attractiveness Analysis by By Source, 2016-2032

- Figure 35: Western Europe Lignin Market Revenue (US$ Mn) Market Share by By Applicationin 2022

- Figure 36: Western Europe Lignin Market Attractiveness Analysis by By Application, 2016-2032

- Figure 37: Western Europe Lignin Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 38: Western Europe Lignin Market Attractiveness Analysis by Country, 2016-2032

- Figure 39: Western Europe Lignin Market Revenue (US$ Mn) (2016-2032)

- Figure 40: Western Europe Lignin Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 41: Western Europe Lignin Market Revenue (US$ Mn) Comparison by By Source (2016-2032)

- Figure 42: Western Europe Lignin Market Revenue (US$ Mn) Comparison by By Application (2016-2032)

- Figure 43: Western Europe Lignin Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 44: Western Europe Lignin Market Y-o-Y Growth Rate Comparison by By Source (2016-2032)

- Figure 45: Western Europe Lignin Market Y-o-Y Growth Rate Comparison by By Application (2016-2032)

- Figure 46: Western Europe Lignin Market Share Comparison by Country (2016-2032)

- Figure 47: Western Europe Lignin Market Share Comparison by By Source (2016-2032)

- Figure 48: Western Europe Lignin Market Share Comparison by By Application (2016-2032)

- Figure 49: Eastern Europe Lignin Market Revenue (US$ Mn) Market Share by By Sourcein 2022

- Figure 50: Eastern Europe Lignin Market Attractiveness Analysis by By Source, 2016-2032

- Figure 51: Eastern Europe Lignin Market Revenue (US$ Mn) Market Share by By Applicationin 2022

- Figure 52: Eastern Europe Lignin Market Attractiveness Analysis by By Application, 2016-2032

- Figure 53: Eastern Europe Lignin Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 54: Eastern Europe Lignin Market Attractiveness Analysis by Country, 2016-2032

- Figure 55: Eastern Europe Lignin Market Revenue (US$ Mn) (2016-2032)

- Figure 56: Eastern Europe Lignin Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 57: Eastern Europe Lignin Market Revenue (US$ Mn) Comparison by By Source (2016-2032)

- Figure 58: Eastern Europe Lignin Market Revenue (US$ Mn) Comparison by By Application (2016-2032)

- Figure 59: Eastern Europe Lignin Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 60: Eastern Europe Lignin Market Y-o-Y Growth Rate Comparison by By Source (2016-2032)

- Figure 61: Eastern Europe Lignin Market Y-o-Y Growth Rate Comparison by By Application (2016-2032)

- Figure 62: Eastern Europe Lignin Market Share Comparison by Country (2016-2032)

- Figure 63: Eastern Europe Lignin Market Share Comparison by By Source (2016-2032)

- Figure 64: Eastern Europe Lignin Market Share Comparison by By Application (2016-2032)

- Figure 65: APAC Lignin Market Revenue (US$ Mn) Market Share by By Sourcein 2022

- Figure 66: APAC Lignin Market Attractiveness Analysis by By Source, 2016-2032

- Figure 67: APAC Lignin Market Revenue (US$ Mn) Market Share by By Applicationin 2022

- Figure 68: APAC Lignin Market Attractiveness Analysis by By Application, 2016-2032

- Figure 69: APAC Lignin Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 70: APAC Lignin Market Attractiveness Analysis by Country, 2016-2032

- Figure 71: APAC Lignin Market Revenue (US$ Mn) (2016-2032)

- Figure 72: APAC Lignin Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 73: APAC Lignin Market Revenue (US$ Mn) Comparison by By Source (2016-2032)

- Figure 74: APAC Lignin Market Revenue (US$ Mn) Comparison by By Application (2016-2032)

- Figure 75: APAC Lignin Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 76: APAC Lignin Market Y-o-Y Growth Rate Comparison by By Source (2016-2032)

- Figure 77: APAC Lignin Market Y-o-Y Growth Rate Comparison by By Application (2016-2032)

- Figure 78: APAC Lignin Market Share Comparison by Country (2016-2032)

- Figure 79: APAC Lignin Market Share Comparison by By Source (2016-2032)

- Figure 80: APAC Lignin Market Share Comparison by By Application (2016-2032)

- Figure 81: Latin America Lignin Market Revenue (US$ Mn) Market Share by By Sourcein 2022

- Figure 82: Latin America Lignin Market Attractiveness Analysis by By Source, 2016-2032

- Figure 83: Latin America Lignin Market Revenue (US$ Mn) Market Share by By Applicationin 2022

- Figure 84: Latin America Lignin Market Attractiveness Analysis by By Application, 2016-2032

- Figure 85: Latin America Lignin Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 86: Latin America Lignin Market Attractiveness Analysis by Country, 2016-2032

- Figure 87: Latin America Lignin Market Revenue (US$ Mn) (2016-2032)

- Figure 88: Latin America Lignin Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 89: Latin America Lignin Market Revenue (US$ Mn) Comparison by By Source (2016-2032)

- Figure 90: Latin America Lignin Market Revenue (US$ Mn) Comparison by By Application (2016-2032)

- Figure 91: Latin America Lignin Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 92: Latin America Lignin Market Y-o-Y Growth Rate Comparison by By Source (2016-2032)

- Figure 93: Latin America Lignin Market Y-o-Y Growth Rate Comparison by By Application (2016-2032)

- Figure 94: Latin America Lignin Market Share Comparison by Country (2016-2032)

- Figure 95: Latin America Lignin Market Share Comparison by By Source (2016-2032)

- Figure 96: Latin America Lignin Market Share Comparison by By Application (2016-2032)

- Figure 97: Middle East & Africa Lignin Market Revenue (US$ Mn) Market Share by By Sourcein 2022

- Figure 98: Middle East & Africa Lignin Market Attractiveness Analysis by By Source, 2016-2032

- Figure 99: Middle East & Africa Lignin Market Revenue (US$ Mn) Market Share by By Applicationin 2022

- Figure 100: Middle East & Africa Lignin Market Attractiveness Analysis by By Application, 2016-2032

- Figure 101: Middle East & Africa Lignin Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 102: Middle East & Africa Lignin Market Attractiveness Analysis by Country, 2016-2032

- Figure 103: Middle East & Africa Lignin Market Revenue (US$ Mn) (2016-2032)

- Figure 104: Middle East & Africa Lignin Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 105: Middle East & Africa Lignin Market Revenue (US$ Mn) Comparison by By Source (2016-2032)

- Figure 106: Middle East & Africa Lignin Market Revenue (US$ Mn) Comparison by By Application (2016-2032)

- Figure 107: Middle East & Africa Lignin Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 108: Middle East & Africa Lignin Market Y-o-Y Growth Rate Comparison by By Source (2016-2032)

- Figure 109: Middle East & Africa Lignin Market Y-o-Y Growth Rate Comparison by By Application (2016-2032)

- Figure 110: Middle East & Africa Lignin Market Share Comparison by Country (2016-2032)

- Figure 111: Middle East & Africa Lignin Market Share Comparison by By Source (2016-2032)

- Figure 112: Middle East & Africa Lignin Market Share Comparison by By Application (2016-2032)

List of Tables

- Table 1: Global Lignin Market Comparison by By Source (2016-2032)

- Table 2: Global Lignin Market Comparison by By Application (2016-2032)

- Table 3: Global Lignin Market Revenue (US$ Mn) Comparison by Region (2016-2032)

- Table 4: Global Lignin Market Revenue (US$ Mn) (2016-2032)

- Table 5: Global Lignin Market Revenue (US$ Mn) Comparison by Region (2016-2032)

- Table 6: Global Lignin Market Revenue (US$ Mn) Comparison by By Source (2016-2032)

- Table 7: Global Lignin Market Revenue (US$ Mn) Comparison by By Application (2016-2032)

- Table 8: Global Lignin Market Y-o-Y Growth Rate Comparison by Region (2016-2032)

- Table 9: Global Lignin Market Y-o-Y Growth Rate Comparison by By Source (2016-2032)

- Table 10: Global Lignin Market Y-o-Y Growth Rate Comparison by By Application (2016-2032)

- Table 11: Global Lignin Market Share Comparison by Region (2016-2032)

- Table 12: Global Lignin Market Share Comparison by By Source (2016-2032)

- Table 13: Global Lignin Market Share Comparison by By Application (2016-2032)

- Table 14: North America Lignin Market Comparison by By Application (2016-2032)

- Table 15: North America Lignin Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 16: North America Lignin Market Revenue (US$ Mn) (2016-2032)

- Table 17: North America Lignin Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 18: North America Lignin Market Revenue (US$ Mn) Comparison by By Source (2016-2032)

- Table 19: North America Lignin Market Revenue (US$ Mn) Comparison by By Application (2016-2032)

- Table 20: North America Lignin Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 21: North America Lignin Market Y-o-Y Growth Rate Comparison by By Source (2016-2032)

- Table 22: North America Lignin Market Y-o-Y Growth Rate Comparison by By Application (2016-2032)

- Table 23: North America Lignin Market Share Comparison by Country (2016-2032)

- Table 24: North America Lignin Market Share Comparison by By Source (2016-2032)

- Table 25: North America Lignin Market Share Comparison by By Application (2016-2032)

- Table 26: Western Europe Lignin Market Comparison by By Source (2016-2032)

- Table 27: Western Europe Lignin Market Comparison by By Application (2016-2032)

- Table 28: Western Europe Lignin Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 29: Western Europe Lignin Market Revenue (US$ Mn) (2016-2032)

- Table 30: Western Europe Lignin Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 31: Western Europe Lignin Market Revenue (US$ Mn) Comparison by By Source (2016-2032)

- Table 32: Western Europe Lignin Market Revenue (US$ Mn) Comparison by By Application (2016-2032)

- Table 33: Western Europe Lignin Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 34: Western Europe Lignin Market Y-o-Y Growth Rate Comparison by By Source (2016-2032)

- Table 35: Western Europe Lignin Market Y-o-Y Growth Rate Comparison by By Application (2016-2032)

- Table 36: Western Europe Lignin Market Share Comparison by Country (2016-2032)

- Table 37: Western Europe Lignin Market Share Comparison by By Source (2016-2032)

- Table 38: Western Europe Lignin Market Share Comparison by By Application (2016-2032)

- Table 39: Eastern Europe Lignin Market Comparison by By Source (2016-2032)

- Table 40: Eastern Europe Lignin Market Comparison by By Application (2016-2032)

- Table 41: Eastern Europe Lignin Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 42: Eastern Europe Lignin Market Revenue (US$ Mn) (2016-2032)

- Table 43: Eastern Europe Lignin Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 44: Eastern Europe Lignin Market Revenue (US$ Mn) Comparison by By Source (2016-2032)

- Table 45: Eastern Europe Lignin Market Revenue (US$ Mn) Comparison by By Application (2016-2032)

- Table 46: Eastern Europe Lignin Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 47: Eastern Europe Lignin Market Y-o-Y Growth Rate Comparison by By Source (2016-2032)

- Table 48: Eastern Europe Lignin Market Y-o-Y Growth Rate Comparison by By Application (2016-2032)

- Table 49: Eastern Europe Lignin Market Share Comparison by Country (2016-2032)

- Table 50: Eastern Europe Lignin Market Share Comparison by By Source (2016-2032)

- Table 51: Eastern Europe Lignin Market Share Comparison by By Application (2016-2032)

- Table 52: APAC Lignin Market Comparison by By Source (2016-2032)

- Table 53: APAC Lignin Market Comparison by By Application (2016-2032)

- Table 54: APAC Lignin Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 55: APAC Lignin Market Revenue (US$ Mn) (2016-2032)

- Table 56: APAC Lignin Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 57: APAC Lignin Market Revenue (US$ Mn) Comparison by By Source (2016-2032)

- Table 58: APAC Lignin Market Revenue (US$ Mn) Comparison by By Application (2016-2032)

- Table 59: APAC Lignin Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 60: APAC Lignin Market Y-o-Y Growth Rate Comparison by By Source (2016-2032)

- Table 61: APAC Lignin Market Y-o-Y Growth Rate Comparison by By Application (2016-2032)

- Table 62: APAC Lignin Market Share Comparison by Country (2016-2032)

- Table 63: APAC Lignin Market Share Comparison by By Source (2016-2032)

- Table 64: APAC Lignin Market Share Comparison by By Application (2016-2032)

- Table 65: Latin America Lignin Market Comparison by By Source (2016-2032)

- Table 66: Latin America Lignin Market Comparison by By Application (2016-2032)

- Table 67: Latin America Lignin Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 68: Latin America Lignin Market Revenue (US$ Mn) (2016-2032)

- Table 69: Latin America Lignin Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 70: Latin America Lignin Market Revenue (US$ Mn) Comparison by By Source (2016-2032)

- Table 71: Latin America Lignin Market Revenue (US$ Mn) Comparison by By Application (2016-2032)

- Table 72: Latin America Lignin Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 73: Latin America Lignin Market Y-o-Y Growth Rate Comparison by By Source (2016-2032)

- Table 74: Latin America Lignin Market Y-o-Y Growth Rate Comparison by By Application (2016-2032)

- Table 75: Latin America Lignin Market Share Comparison by Country (2016-2032)

- Table 76: Latin America Lignin Market Share Comparison by By Source (2016-2032)

- Table 77: Latin America Lignin Market Share Comparison by By Application (2016-2032)

- Table 78: Middle East & Africa Lignin Market Comparison by By Source (2016-2032)

- Table 79: Middle East & Africa Lignin Market Comparison by By Application (2016-2032)

- Table 80: Middle East & Africa Lignin Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 81: Middle East & Africa Lignin Market Revenue (US$ Mn) (2016-2032)

- Table 82: Middle East & Africa Lignin Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 83: Middle East & Africa Lignin Market Revenue (US$ Mn) Comparison by By Source (2016-2032)

- Table 84: Middle East & Africa Lignin Market Revenue (US$ Mn) Comparison by By Application (2016-2032)

- Table 85: Middle East & Africa Lignin Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 86: Middle East & Africa Lignin Market Y-o-Y Growth Rate Comparison by By Source (2016-2032)

- Table 87: Middle East & Africa Lignin Market Y-o-Y Growth Rate Comparison by By Application (2016-2032)

- Table 88: Middle East & Africa Lignin Market Share Comparison by Country (2016-2032)

- Table 89: Middle East & Africa Lignin Market Share Comparison by By Source (2016-2032)

- Table 90: Middle East & Africa Lignin Market Share Comparison by By Application (2016-2032)

- 1. Executive Summary

-

- Borregaard LignoTech

- Rayonier

- Domtar Corporation

- West Fraser

- Tembec Inc.

- Asian Lignin Manufacturing Pvt. Ltd.

- Domsjö Fabriker (Aditya Birla Group)

- West Rock

- Changzhou Shanfeng Chemical Industry Co. Ltd.

- CIMV (Compagnie Industrielle de la Matière Végétale)

- Hubei zhengdong chemical Co. Ltd.

- Weyerhaeuser

- Nippon Paper Industries Co. Ltd.

- Northway Lignin Chemica

- Stora Enso

- Innventia AB