Food Emulsifiers Market By Type Analysis (Lecithin,Sorbitan esters,Stearoyl lactylates, And Other ), by Source Analysis(Plant,Animal), By Application Analysis(Bakery products,Confectionery,Convenience foods and other), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2023-2032

-

2154

-

May 2023

-

175

-

-

This report was compiled by Correspondence Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

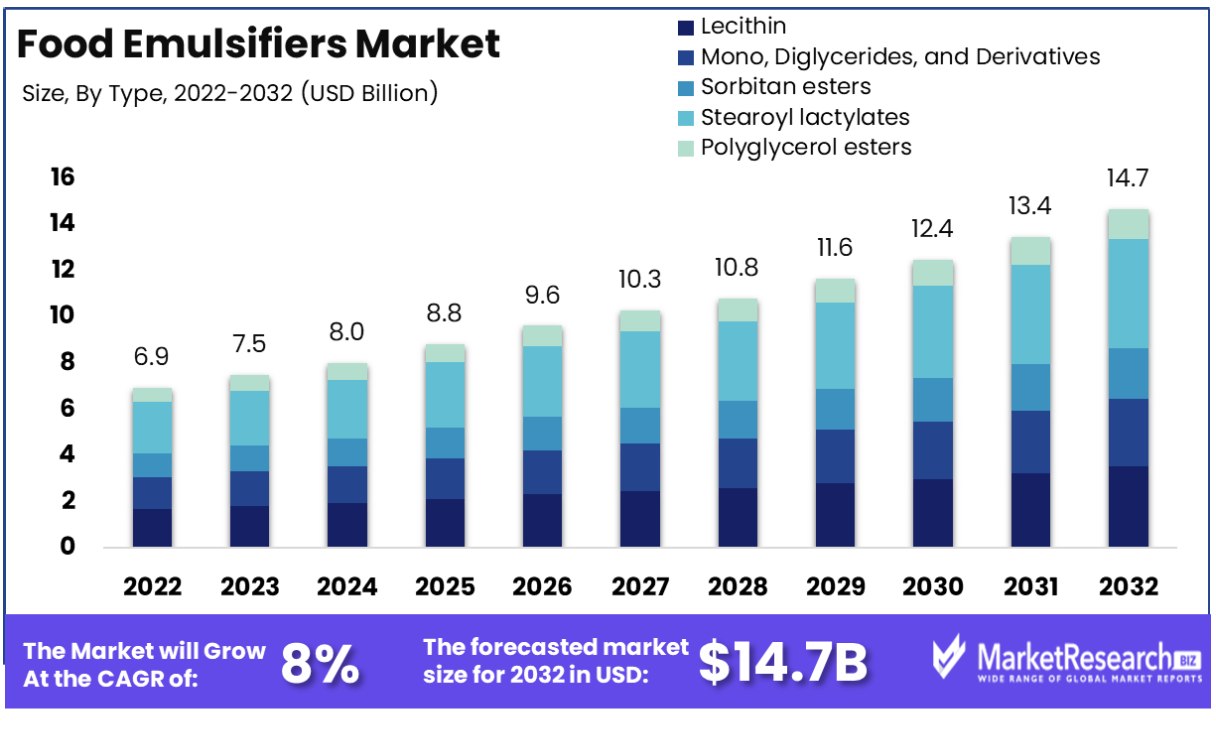

The food emulsifiers market was valued at USD 6.92 billion in 2022. It is expected to reach USD 11.45 billion by 2032, with a CAGR of 8% during the forecast period from 2023 to 2032.

The surge in demand for packaged food items and pharmaceuticals are some of the major driving factors for the food emulsifiers market growth.

Emulsifiers play a vital role in manufacturing food products by boosting their taste, flavors, longer preservative life, and appearance. Mayonnaise, creamy sauces, canned foods, confections, and different types of bakery products that we consume have the presence of emulsifiers.

Emulsifiers are generally used in food manufacturing are purified organic products or synthetic chemicals that have the same patterns as natural food items. For example, the E322 which is known as emulsifier lecithin is commonly used for making chocolate products that can be extracted from soybean oil, eggs, peanuts, and wheat grams.

Pectin are widely used emulsifier that is found in fruits like apples and pears. Emulsifiers are not restricted to one product like chocolates but it is used by many other manufacturers for making the ice-cream, margarine, bread, and processed meat.

Consumers are now becoming conscious about their diet and the food they intake. They are seeking gluten-free, organic, and vegan food items that have unique formulations that can be only done by the usage of specialized emulsifiers in order to achieve the proper consistency and shelf life.

These food emulsifiers make sure that the added nutrients are mixed up in the food products, thereby enhancing the effectiveness of the nutritional fortification. This has become crucial as consumers are focusing on the nutritional labels and surge greater value from their food preferences.

As the demands are rising these customized food grows which provides a new opportunity for innovation in the food emulsifiers market. Many organizations are putting their efforts into R&D to build customized emulsifiers to meet the requirements of these niche products by expanding the product categories. These specialty foods are gaining popularity in many retail stores which is endorsing the significance of food emulsifiers in meeting the consumer’s requirements.

Emulsifiers are also widely utilized by the pharmaceutical industry for use in tablet and syrup drug formulation. Their wide application in various industrial fields will drive demand, further contributing to food emulsifier market expansion over the forecast period.

Driving Factors

Increasing Demand for Processed and Convenience Foods Drives Market Growth

The escalating consumer preference for processed and convenience foods acts as a catalyst for the food emulsifier market expansion. This trend is rooted in the evolving lifestyle dynamics, where time constraints and the pursuit of convenience drive food choices. Emulsifiers play a pivotal role in enhancing the texture, consistency, and shelf-life of such products, thus becoming indispensable to manufacturers. This demand surge is not in isolation; it's synergistically linked with the rising health consciousness among consumers. Manufacturers are increasingly incorporating emulsifiers that align with health and nutritional values, further propelling market growth. The anticipated long-term effect is a sustained rise in demand for innovative emulsifiers that balance convenience with health, potentially leading to significant R&D investments in the food sector.

Growing Demand for Longer Shelf Life of Food Products

The need for extended shelf life in food products is a significant lever pulling the food emulsifier market upwards. This demand originates from both consumer preference for longer-lasting products and the logistical needs of the supply chain. Emulsifiers, by their nature, improve product stability and quality over time, making them essential in meeting these requirements. This factor doesn't operate in a vacuum; it's closely linked with global trade and distribution dynamics, where longer shelf life equates to broader market reach and reduced wastage. The long-term implications include a probable shift towards more natural and sustainable emulsifiers, driven by consumer awareness and environmental considerations, marking a potential area for innovation and growth in the emulsifier market.

Restraining Factors

High Cost of Natural Food Emulsifiers Restrains Market Growth

Food emulsifiers extracted from natural sources present a major barrier to market growth, due to the complex and resource-intensive extraction processes required. As such, production costs increase significantly.

Regulators present significant obstacles for manufacturers, including increased compliance costs, longer time-to-market for new products, and restrictions on certain emulsifiers. While such restrictions aim at providing consumer protection, they can inhibit innovation by delaying the introduction of potentially more effective food emulsifiers - effectively impeding growth and diversification in this niche market.

Stringent Regulation Restrains Market Growth

Stringent regulations surrounding food emulsifiers have become one of the biggest roadblocks to the industry's expansion. Global regulatory bodies have implemented tight controls over their use and mandate stringent testing and approval processes for any emulsifier products to ensure safety and compliance.

Manufacturers face several regulatory challenges in today's environment, such as increased compliance costs, longer product development times, and possible usage limitations on certain emulsifiers. Although such regulatory hurdles ensure product safety and consumer protection, they also stifle innovation by delaying the introduction of potentially more efficient emulsifiers - ultimately restricting growth and diversification within the food emulsifier market.

Market Segment Analysis of the Food Emulsifiers Market

By Type

Lecithin holds the dominant position in the food emulsifiers market by type. It's primarily favored due to its multifunctionality, natural source, and compatibility with various food applications. Lecithin's versatility in enhancing texture, emulsification, and shelf-life makes it indispensable in a broad range of products, from baked goods to confectionery.

This segment's growth is fueled by the increasing consumer demand for natural ingredients and clean-label products. As for other sub-segments like Mono, Diglycerides and Derivatives, Sorbitan Esters, Stearoyl Lactylates, and Polyglycerol Esters, they contribute significantly by offering specific functional benefits suited for particular applications. However, their market share is relatively smaller compared to lecithin, primarily due to higher production costs and varying consumer preferences.

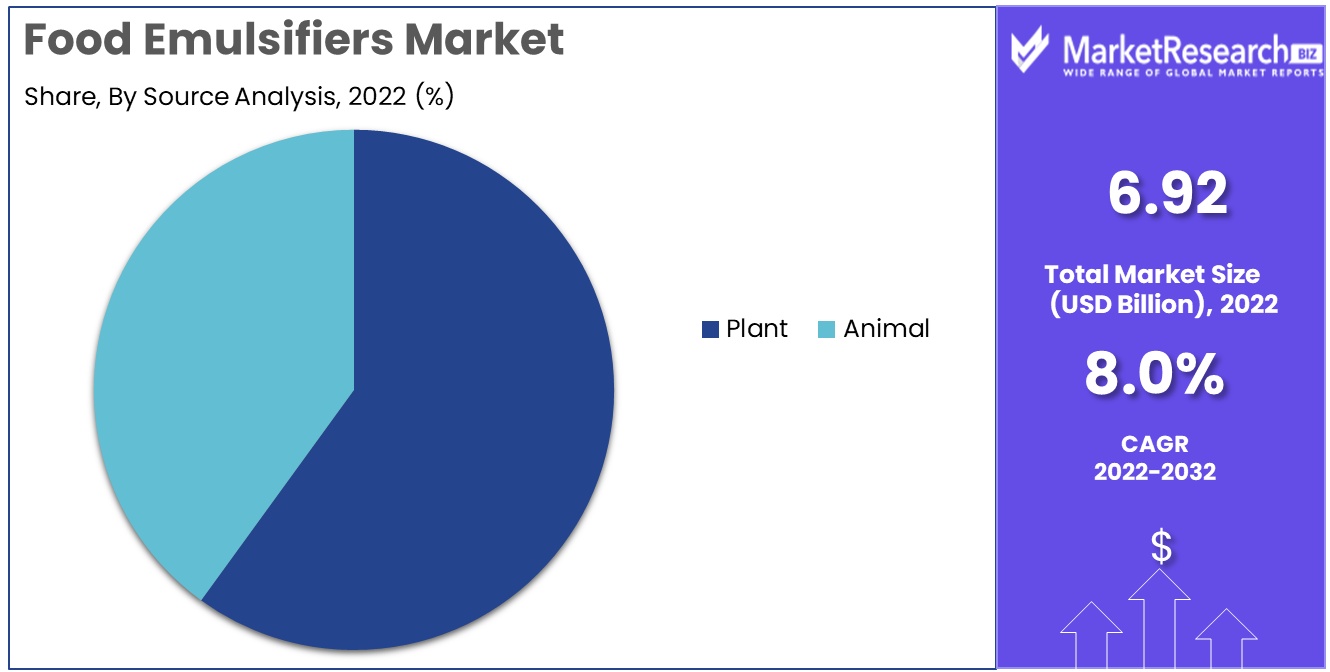

By Source

The plant-based segment leads in the source category, driven by the growing vegan trend and concerns about animal-derived ingredients among consumers. Plant-sourced emulsifiers like soy and sunflower lecithin are increasingly preferred for their sustainability and perceived health benefits.

This shift towards plant-based ingredients is also a response to the rising awareness of environmental and ethical concerns associated with animal sourcing. In contrast, the animal-sourced segment, though significant, faces challenges due to these consumer perceptions and regulatory constraints in some regions, affecting its growth potential compared to its plant-based counterpart.

By Function

Emulsification is the most prominent function of food emulsifiers, essential for achieving desired textures and product stability in a variety of food products. This segment's dominance is due to the fundamental need for emulsification in a vast array of food products, ranging from bakery items to dressings.

Other functions like starch complexing, protein interaction, aeration, and stabilization, though crucial, are more specialized and cater to specific product needs, resulting in a smaller market share. The emulsification segment's growth is further bolstered by continuous innovation in emulsifier blends that cater to evolving food technology and consumer preferences.

By Application

In the application category, bakery products are the leading segment. Emulsifiers are critical in beverage Industry applications for dough conditioning, product texture, and shelf-life extension. The rising global consumption of bakery products, coupled with the demand for improved quality and variety, drives this segment's growth.

Other applications like confectionery, convenience foods, dairy, and meat products also significantly contribute to the market but are overshadowed by the sheer volume and diversity of bakery products. The expansion in these other segments is propelled by the need for specialized emulsifiers that cater to unique texture, taste, and preservation requirements in different food categories.

By Type

- Lecithin

- Mono, Diglycerides, and Derivatives

- Sorbitan esters

- Stearoyl lactylates

- Polyglycerol esters

- Others (polyglycerol polyricinoleate and polyproline glycol esters)

By Source

- Plant

- Animal

By Function

- Emulsification

- Starch Complexing

- Protein Interaction

- Aeration and Stabilization

- Crystal Modification

- Oil Structuring

- Lubrication

- Processing Aids

By Application

- Bakery products

- Confectionery

- Convenience foods

- Dairy products

- Meat products

- Others (fats & oils, dry powders, beverage base, and extruded products)

Growth opportunities

Increasing Demand for Natural and Bio-Based Ingredients Offers Growth Opportunity

The surging demand for natural and bio-based ingredients presents a significant growth opportunity in the food emulsifiers market. This trend is anchored in the growing consumer awareness and preference for products perceived as healthy and environmentally sustainable. Natural emulsifiers, such as lecithin derived from soy or sunflower, are increasingly favored for their clean-label appeal. This shift is not just consumer-driven; it aligns with the global move towards more sustainable production practices. The opportunity lies in the innovation of new natural emulsifiers and the optimization of extraction and processing techniques to meet this demand cost-effectively.

Increasing Demand for Low-Fat Food Products Offers Growth Opportunity

The escalating demand for low-fat food products catalyzes opportunities within the food emulsifiers market. Emulsifiers are key in producing low-fat versions of popular food items without compromising texture or taste. This demand is propelled by a heightened health consciousness among consumers, who are increasingly seeking healthier dietary options. The growth potential in this segment lies in developing emulsifiers that can effectively mimic the mouthfeel and texture of fats, thereby enabling manufacturers to create low-fat products that align with consumer preferences for health without sacrificing taste or quality.

Rising Demand for Lecithin Offers Growth Opportunity

The increasing demand for lecithin, a versatile and widely used emulsifier, signals a substantial growth opportunity in the market. Lecithin's popularity stems from its natural origin, functionality, and compatibility with a range of food products. The opportunity for market expansion is rooted in its diverse applications, from bakery products to confectionery. With consumers gravitating towards ingredients with natural labeling, lecithin stands to gain significantly. The growth potential also includes exploring sustainable sources and innovative extraction methods for lecithin to cater to this burgeoning demand.

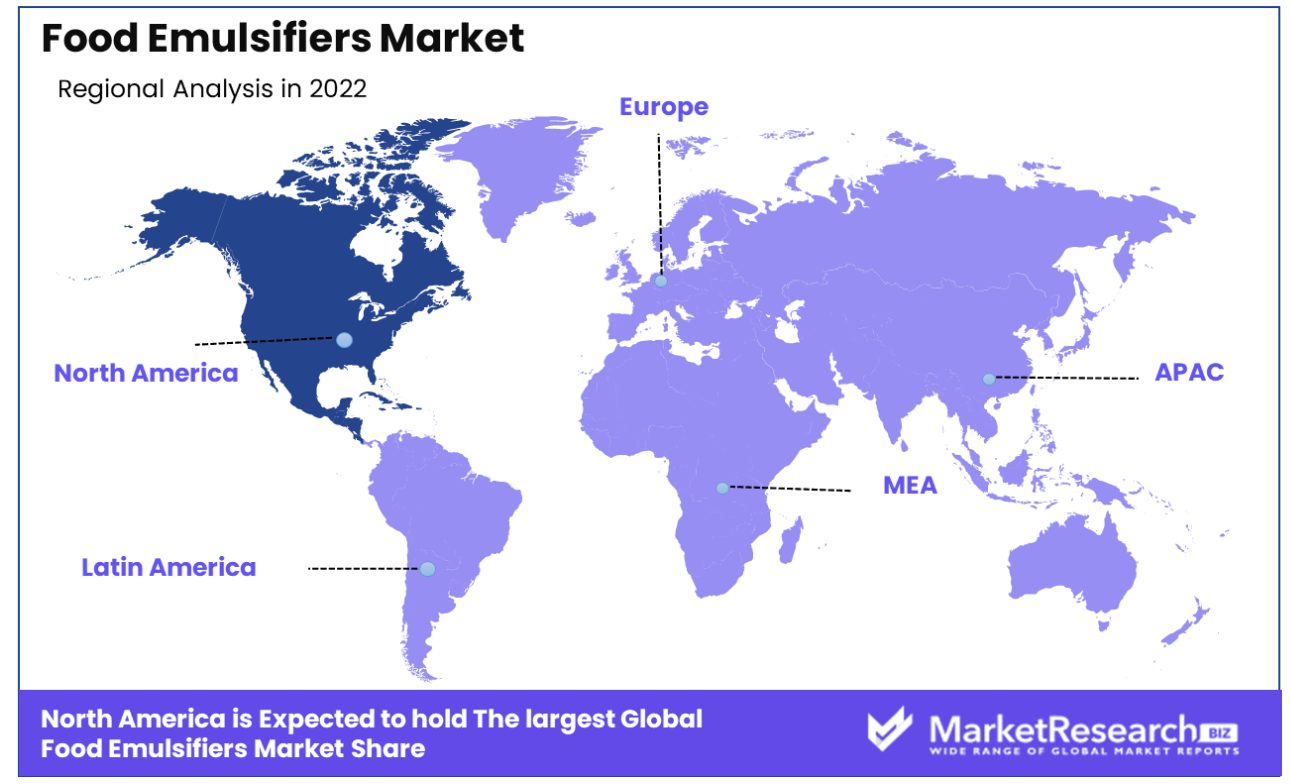

Regional Analysis

North America

North America's commanding position in the food emulsifiers market is attributable to several key factors. The region's sophisticated food processing industry, combined with high consumer spending power, drives substantial demand for various food emulsifiers. This demand is further fueled by the region's robust focus on health and wellness trends, leading to increased consumption of products containing natural and clean-label ingredients. Additionally, the presence of leading food emulsifier manufacturers and intense R&D activities in North America contribute to its market dominance.

The North American market is characterized by a highly developed food industry, stringent food quality and safety regulations, and a growing preference for convenience foods. These dynamics foster an environment conducive to innovation and adoption of advanced emulsifiers, particularly those aligned with health and environmental sustainability trends.

Looking forward, North America's influence in the global food emulsifiers market is anticipated to remain strong. The region's continued focus on health-conscious products and sustainable practices is likely to drive further growth and innovation in this sector. Moreover, the ongoing development of new and improved emulsifiers to meet diverse consumer demands may reinforce the region's market leadership.

Europe:

Europe maintains a significant share in the food emulsifiers market, driven by its advanced food processing industry and stringent food safety regulations. European consumers' increasing awareness of food ingredients and their health impacts boosts demand for natural and clean-label emulsifiers.

The market in Europe is shaped by a strong focus on food quality, safety, and sustainability. The regulatory framework in Europe, emphasizing transparency and consumer safety, impacts the types of emulsifiers that can be used in food products.

Asia-Pacific:

Asia-Pacific is emerging as a rapidly growing market in the food emulsifiers sector. This growth is primarily driven by the expanding food processing industry, rising urbanization, and growing middle-class population with increasing disposable incomes.

The region's diverse food culture and growing demand for convenience and processed foods play a significant role in the market's expansion. Additionally, the rising awareness of health and wellness among consumers in Asia-Pacific influences the demand for natural and clean-label emulsifiers.

The future of the food emulsifiers market in Asia-Pacific looks promising, with expectations of continued growth. The increasing economic power and consumer awareness in the region are likely to drive further demand for innovative and health-aligned emulsifier products.

Food Enzyme Industry by Region

North America

- The US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of Asia Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of the Middle East & Africa

Key Player Overview in the Food Emulsifiers Market

In the dynamic landscape of the food emulsifiers market, key players like Archer Daniels Midland Company, EI duPont de Nemours and Company, Cargill India Pvt. Ltd., and others, exhibit significant influence and strategic positioning. These companies, with their extensive portfolios and global reach, are pivotal in shaping market key trends and driving innovation.

Archer Daniels Midland Company (ADM) and DuPont stand out for their robust R&D capabilities and comprehensive range of emulsifier products. Their focus on sustainability and natural ingredients aligns well with current market trends, enhancing their market presence. Cargill India Pvt. Ltd., Corbion NV, and Kerry Group Plc are notable for their strategic expansions and targeted product development, catering to regional taste preferences and dietary needs. This approach enables them to capture diverse market segments and bolster their global standing.

Collectively, these companies' strategies, ranging from mergers and acquisitions to sustainability initiatives, significantly impact the market's trajectory. Their influence extends beyond product offerings, encompassing supply chain management, regulatory compliance, and adaptation to shifting consumer preferences. This dynamic interplay of strategies and market responses underscores the competitive and ever-evolving nature of the food emulsifiers industry.

Major Companies in the Food Emulsifiers Market

- Archer Daniels Midland Company

- I. du Pont de Nemours and Company

- Cargill India Pvt. Ltd.

- Kerry Group Plc

- Ingredion Incorporated

- Corbion NV

- Lonza Group Ltd.

- Palsgaard A/S

- Riken Vitamin Co. Ltd.

- Beldem S.A.

Recent Developments

- In September 2023, a study was conducted on mice to investigate the potential detrimental effects of emulsifiers in processed food and possible ways to combat them. The study aimed to understand how emulsifiers might alter the gut microbiome, leading to chronic intestinal inflammation.

- In 2022, Kencko, a B-corp plant-based food company, raised $10 million in Series A funding. They specialize in reducing food waste through freeze-dried technology and have seen their sales grow by 500% per year. Kencko plans to expand into a new ready-to-heat product category in February 2022.

- In 2022, PurePlus, a plant-based ingredients supplier, secured a $1.56 million pre-seed funding round to launch its own branded candy called Faves, made with upcycled fruits and vegetables. This initiative aims to provide a healthy alternative to conventional confectionery while addressing climate change.

- In 2022, Waterdrop, an Austrian hydration company that recently entered the U.S. market, closed a series B funding round of approximately $66.8 million. They plan to use the capital for global expansion and continuous R&D efforts, including the development of Lucy, a smart cap capable of filtering water through a UV-C system.

Report Scope

Report Features Description Market Value (2022) USD 6.92 Bn Forecast Revenue (2032) USD 11.45 Bn CAGR (2023-2032) 8.0% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type Analysis (Lecithin, Sorbitan esters, Stearoyl lactylates, And Others), by Source Analysis(Plant, Animal), By Application Analysis(Bakery products,Confectionery, Convenience foods and others) Regional Analysis North America - The US, Canada, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Archer Daniels Midland Company, I. du Pont de Nemours and Company, Cargill India Pvt. Ltd., Ingredion Incorporated, Lonza Group Ltd., Palsgaard A/S, Riken Vitamin Co. Ltd., Beldem S.A. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Archer Daniels Midland Company

- I. du Pont de Nemours and Company

- Cargill India Pvt. Ltd.

- Kerry Group Plc

- Ingredion Incorporated

- Corbion NV

- Lonza Group Ltd.

- Palsgaard A/S

- Riken Vitamin Co. Ltd.

- Beldem S.A.