Licorice Market By Product Type (Food Grade, Feed Grade, Pharmaceutical Grade), By Form (Powder, Liquid, Block), By Application (Food & Beverages, Pharmaceutical, Tobacco, Others), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

48078

-

June 2024

-

300

-

-

This report was compiled by Shreyas Rokade Shreyas Rokade is a seasoned Research Analyst with CMFE, bringing extensive expertise in market research and consulting, with a strong background in Chemical Engineering. Correspondence Team Lead-CMFE Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

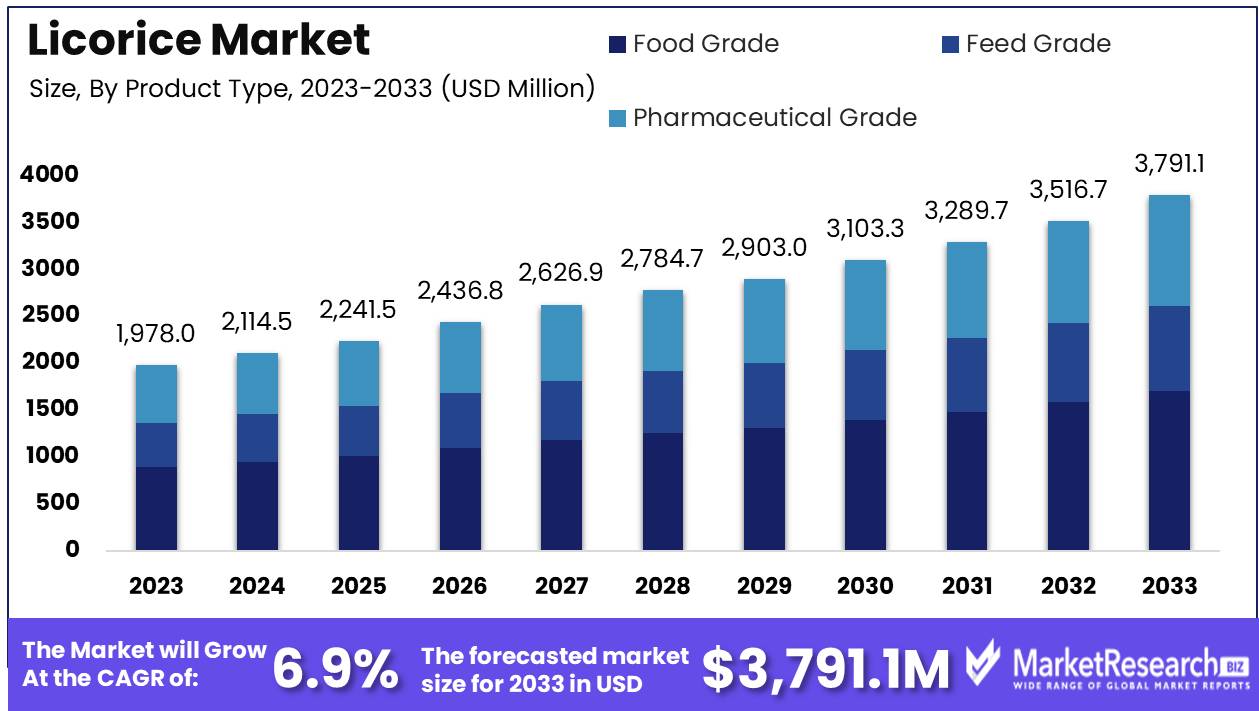

The Licorice Market was valued at USD 1,978 million in 2023. It is expected to reach USD 3,791.1 million by 2033, with a CAGR of 6.9% during the forecast period from 2024 to 2033.

The licorice market encompasses the global trade and production of licorice root and its derivatives, including extracts, powders, and candies. Valued for its distinct flavor and medicinal properties, licorice is a staple in confectionery, pharmaceuticals, and dietary supplements. Key drivers include rising consumer demand for natural ingredients, health benefits such as digestive and anti-inflammatory properties, and diverse applications in food and beverage industries. Leading producers are leveraging advancements in extraction technologies and sustainable farming practices to meet increasing regulatory and consumer scrutiny on quality and sourcing. The market is poised for growth, driven by innovation and expanding health-conscious consumer bases.

The licorice market is experiencing a notable uptick, driven primarily by increased consumer awareness of its health benefits. Licorice root, recognized for its digestive health support and anti-inflammatory properties, is gaining traction among health-conscious consumers and nutraceutical companies. This surge in demand is propelling the market forward, as manufacturers and suppliers strive to meet the growing needs. However, the market is not without its challenges. Climatic changes and geopolitical factors are introducing variability in licorice root supply, creating supply chain uncertainties that can potentially disrupt market dynamics. Companies are increasingly prioritizing sustainable and ethical sourcing practices to mitigate these risks, ensuring long-term supply chain stability and appealing to environmentally-conscious consumers.

Sustainable sourcing is becoming a critical focus area within the industry, as stakeholders recognize the need to balance demand with responsible environmental practices. This approach not only safeguards the supply chain against climatic and geopolitical disruptions but also aligns with broader corporate social responsibility goals. By investing in sustainable practices, companies are positioning themselves as leaders in an evolving market landscape where ethical considerations are becoming paramount. The commitment to sustainability is likely to enhance brand reputation and consumer trust, driving further market growth.

Overall, the licorice market is poised for continued expansion, contingent on effective supply chain management and the ongoing promotion of licorice’s health benefits. This strategic alignment with sustainability and health trends is expected to shape the market's trajectory, presenting opportunities for growth and innovation in the coming years.

Key Takeaways

- Market Growth: The Licorice Market was valued at USD 1,978 million in 2023. It is expected to reach USD 3,791.1 million by 2033, with a CAGR of 6.9% during the forecast period from 2024 to 2033.

- By Product Type: Food Grade licorice dominated the By Product Type segment.

- By Form: Powdered Licorice dominated due to its versatility and broad appeal.

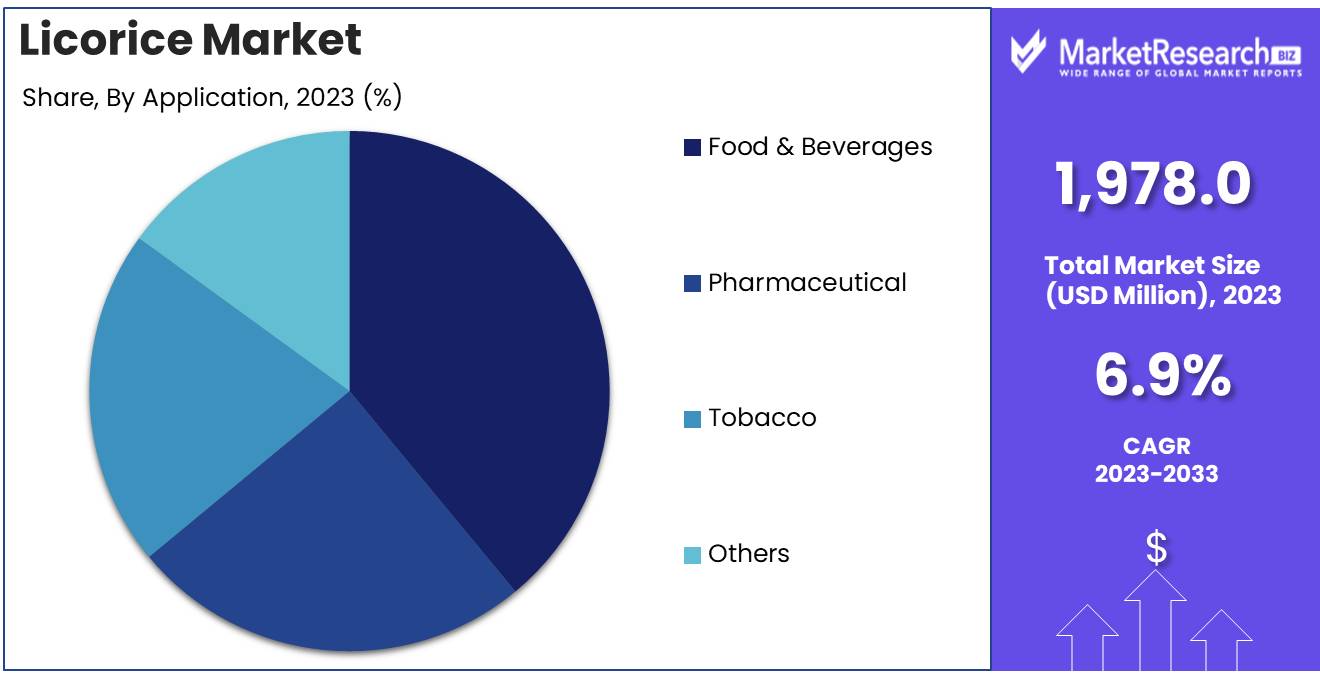

- By Application: Food & Beverages dominated the licorice market across applications.

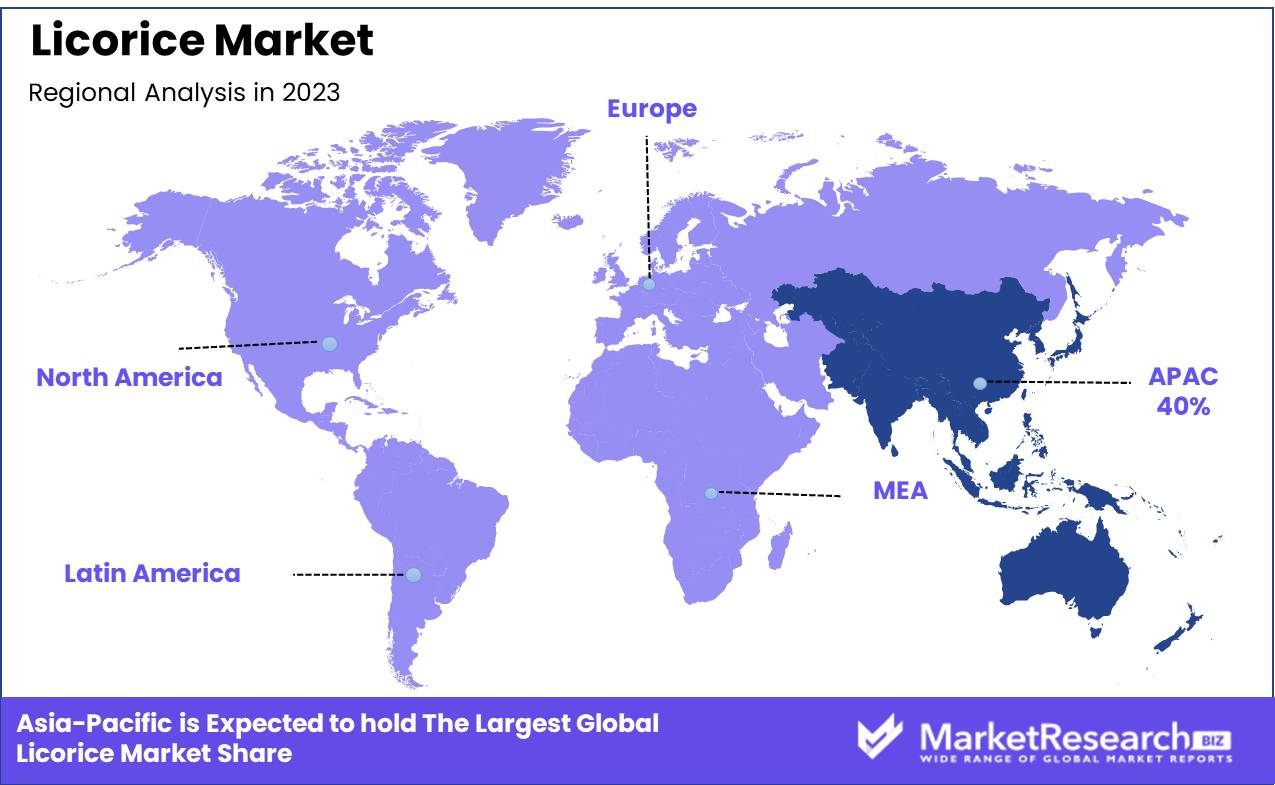

- Regional Dominance: Asia Pacific leads the global licorice market with a 40% share.

- Growth Opportunity: The global licorice market is set for robust growth driven by demand in cosmetics and animal feed applications.

Driving factors

Increasing Demand for Natural and Organic Products

The licorice market has witnessed substantial growth due to the rising consumer preference for natural and organic products. This trend is driven by increasing health consciousness and awareness about the adverse effects of synthetic ingredients. According to a recent market analysis, the natural products sector has been growing at an annual rate of 8%, and licorice, as a natural ingredient, benefits significantly from this trend. The global shift towards sustainability and eco-friendly products further accelerates this demand, positioning licorice as a desirable ingredient in various consumer goods, ranging from confectioneries to health supplements.

Growing Use of Licorice in Pharmaceutical and Medicinal Applications

Licorice has gained prominence in the pharmaceutical and medicinal sectors due to its therapeutic properties. It is widely recognized for its anti-inflammatory, antiviral, and antimicrobial benefits, making it a valuable component in various treatments and health products. The pharmaceutical application of licorice is expanding, with market research indicating a 6% annual growth rate in its use in medicinal products. Licorice extracts are increasingly utilized in treatments for respiratory issues, digestive disorders, and skin conditions. This growing application in the healthcare industry is a critical driver of the licorice market's expansion.

Expanding Applications in the Food and Beverage Industry

The versatility of licorice in the food and beverage industry significantly contributes to its market growth. Licorice is used as a flavoring agent in a wide array of products, including candies, beverages, and baked goods. The increasing trend towards unique and exotic flavors has driven manufacturers to incorporate licorice into their product lines. In the beverage sector alone, the use of licorice has seen a 5% annual increase, attributed to its distinctive taste and potential health benefits. This expansion is further bolstered by consumer demand for innovative and healthier food options, integrating licorice into a variety of culinary applications.

Restraining Factors

Risk of Alternatives and Advanced Technology: A Major Restraint on the Licorice Market

The licorice market faces significant challenges due to the availability of alternative products and the adoption of advanced technologies. These alternatives, often derived from synthetic or natural sources, can mimic the flavor and properties of licorice while offering cost and supply stability advantages. As consumers and manufacturers seek more consistent and potentially cheaper substitutes, the demand for traditional licorice products may decline. Furthermore, advanced technologies in food production and flavor engineering enable the creation of customized flavors that can replace licorice in various applications, from confectionery to pharmaceuticals. The continuous improvement in these technologies means that alternatives are becoming more appealing both in terms of quality and economic viability.

Fluctuations in Raw Material Prices: A Persistent Challenge for Licorice Market Stability

The licorice market is highly sensitive to fluctuations in the prices of raw materials. Licorice root, the primary raw material, is subject to the vagaries of agricultural production, which can be influenced by weather conditions, pest infestations, and geopolitical factors affecting trade. For instance, adverse weather conditions in key licorice-growing regions can lead to reduced harvests, driving up prices. Additionally, geopolitical instability can disrupt supply chains, causing sudden spikes in raw material costs. These price fluctuations can severely impact the profitability of licorice manufacturers, who may struggle to pass increased costs on to consumers. The volatility in raw material prices thus introduces a level of financial uncertainty that can hinder long-term investment and growth within the market.

By Product Type Analysis

In 2023, Food Grade licorice dominated the By Product Type segment.

In 2023, Food Grade held a dominant market position in the By Product Type segment of the Licorice Market. This segment, comprising food-grade, feed-grade, and pharmaceutical-grade products, has seen a significant shift driven by evolving consumer preferences and regulatory trends. Food Grade licorice, renowned for its use in confectionery, beverages, and as a flavoring agent, captured the largest market share due to its broad application base and rising demand for natural flavoring agents. The growing consumer inclination towards healthier, organic ingredients further propelled this segment's dominance. Feed-grade licorice, although essential for enhancing animal feed palatability and improving livestock health, held a smaller market share, influenced by the agricultural sector's slower adoption rates and limited awareness.

Pharmaceutical Grade licorice, valued for its therapeutic properties and use in traditional and modern medicine formulations, displayed robust growth potential, albeit starting from a smaller base. The increasing recognition of licorice’s anti-inflammatory and antimicrobial benefits is expected to drive future demand in this segment. Collectively, these trends underscore the pivotal role of Food Grade licorice in shaping the market dynamics and future growth trajectories of the licorice industry.

By Form Analysis

In 2023, Powdered Licorice dominated due to its versatility and broad appeal.

In 2023, Powder held a dominant market position in the "By Form" segment of the licorice market. This segment encompasses three primary forms: powder, liquid, and block. Powdered licorice has surged in popularity due to its versatile applications across various industries, including food and beverages, pharmaceuticals, and cosmetics. Its ease of use, extended shelf life, and convenient storage contribute to its market leadership. Additionally, the rising demand for natural and organic flavoring agents has propelled powdered licorice to the forefront, as it integrates seamlessly into a wide array of products.

Liquid licorice, while also significant, serves a niche market, primarily driven by its usage in confectionery, beverages, and as a syrup base in herbal formulations. The liquid form offers distinct advantages such as ease of incorporation into recipes and consistent flavor dispersion, catering to specific manufacturing needs.

The block form, though less prevalent, remains vital for traditional applications and regions where artisanal production methods are still in practice. Despite its smaller market share, the block form's unique properties and historical significance ensure its continued relevance.

By Application Analysis

In 2023, Food & Beverages dominated the licorice market across applications.

In 2023, The Food & Beverages segment held a dominant market position in the By Application segment of the licorice market. This preeminence can be attributed to the increasing consumer preference for natural and healthy ingredients, driving demand for licorice as a flavoring and sweetening agent in various food and beverage products. The versatile application of licorice in confectionery, baked goods, and beverages, including herbal teas and soft drinks, underpins its substantial market share.

Simultaneously, the pharmaceutical segment demonstrated significant growth, leveraging licorice’s medicinal properties for applications in cough syrups, lozenges, and gastrointestinal treatments. The anti-inflammatory and antioxidant benefits of licorice root extract are increasingly recognized in therapeutic formulations, boosting its market penetration.

The tobacco segment also maintained a notable position, where licorice is utilized for its ability to enhance flavor and reduce the harshness of tobacco products. Despite regulatory challenges, the enduring demand in this segment underscores licorice’s unique properties that cater to consumer preferences for tobacco products.

Lastly, the Others category, encompassing cosmetics, personal care products, and dietary supplements, reflected a steady demand driven by the health and wellness trend. Licorice’s skin-soothing and brightening properties have made it a preferred ingredient in skincare formulations, while its use in dietary supplements is supported by its perceived health benefits. Collectively, these diverse applications highlight the robust and multi-faceted demand for licorice across various industries.

Key Market Segments

By Product Type

- Food Grade

- Feed Grade

- Pharmaceutical Grade

By Form

- Powder

- Liquid

- Block

By Application

- Food & Beverages

- Pharmaceutical

- Tobacco

- Others

Growth Opportunity

Rising Demand for Personal Care and Cosmetics

The global licorice market is poised for significant growth, driven primarily by the increasing demand for licorice extracts in personal care and cosmetic products. The cosmetic industry is leveraging the natural anti-inflammatory and skin-brightening properties of licorice extract, which is becoming a key ingredient in skincare products such as creams, lotions, and serums. As consumers shift towards natural and organic ingredients, licorice extract’s appeal grows, underpinned by its efficacy in treating hyperpigmentation and its soothing effects on sensitive skin. This trend aligns with the broader movement towards clean beauty, presenting lucrative opportunities for market players to innovate and expand their product lines.

Expanding Applications in Animal Feed

Another promising avenue for growth lies in the expanding use of licorice in animal feed. Licorice root and its derivatives are increasingly recognized for their health benefits in livestock, such as enhancing gut health and providing anti-inflammatory benefits. This application is particularly relevant in the context of rising concerns over antibiotic use in animal husbandry. As the agricultural industry seeks natural alternatives to promote animal health and productivity, licorice presents a viable solution. Companies in the licorice market can capitalize on this trend by developing specialized products tailored to livestock needs, thereby tapping into a new and expanding customer base.

Latest Trends

Growing Preference for Sugar-Free and Low-Calorie Licorice Candies

The licorice market is set to witness a significant shift towards sugar-free and low-calorie options. Health-conscious consumers are increasingly seeking alternatives that align with their dietary preferences and health goals. This trend is driven by rising awareness of the health risks associated with high sugar consumption, including obesity and diabetes. Manufacturers are responding by innovating with natural sweeteners like stevia and erythritol, which provide the desired sweetness without adverse health effects. The move towards healthier options is expected to broaden the market's appeal, attracting not only traditional licorice enthusiasts but also new consumer segments focused on wellness.

Increasing Popularity Among Younger Consumers

Younger demographics, particularly millennials and Gen Z, are showing a growing interest in licorice candy. This trend is fueled by several factors, including the resurgence of nostalgic flavors and the influence of social media in promoting unique and exotic confectionery. Licorice candy, with its distinct taste and versatile forms, is becoming a favored choice for younger consumers who are constantly seeking new and exciting snacking experiences. Additionally, the vibrant and engaging marketing strategies targeted at these tech-savvy groups are enhancing the product's visibility and appeal. Brands are leveraging digital platforms to create compelling narratives and interactive campaigns that resonate with the younger audience, thereby driving increased consumption.

Regional Analysis

Asia Pacific leads the global licorice market with a 40% share.

The global licorice market exhibits varied dynamics across different regions, driven by distinct consumer preferences, regulatory environments, and market penetration. In North America, the market is buoyed by a growing demand for natural and organic products, alongside significant applications in pharmaceuticals and confectionery. The United States, in particular, leads with a strong focus on health benefits, contributing to a substantial market share. Europe follows closely, characterized by a deep-rooted cultural affinity for licorice, especially in countries like Germany and the Netherlands, where it is a staple in traditional confectionery. Stringent quality standards and a mature food and beverage sector further bolster market growth in this region.

Asia Pacific stands out as the dominant region, commanding approximately 40% of the global market share. This dominance is fueled by the extensive use of licorice in traditional medicine, particularly in China and India, and its increasing incorporation into the cosmetic and pharmaceutical industries. The region's burgeoning population and rising health awareness amplify the demand, positioning Asia Pacific as a critical growth engine for the licorice market.

In the Middle East & Africa, licorice enjoys significant popularity due to its traditional use in beverages and sweets, especially during Ramadan. Countries like Egypt and Saudi Arabia are key markets, with expanding consumer bases and rising health consciousness driving demand. Latin America, though a smaller market, is experiencing gradual growth, supported by a growing preference for natural ingredients in both food products and traditional remedies. Brazil and Mexico are pivotal markets in this region, showcasing a steady increase in licorice consumption. Overall, Asia Pacific's robust growth trajectory and substantial market share underscore its critical role in the global licorice market landscape.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of the Middle East & Africa

Key Players Analysis

The global licorice market in 2024 is characterized by a robust competitive landscape, driven by significant players who contribute to the sector's dynamic growth and innovation. Key companies, such as Sichuan Union Herb and Shaanxi Jiahe Phytochemicals, stand out for their expansive production capacities and deep expertise in phytochemicals. Their strategic focus on high-quality licorice extraction aligns with rising consumer demand for natural and organic ingredients in the food, pharmaceutical, and cosmetics industries.

Zhejiang Kangling and Hebei Jingu leverage their advanced processing technologies to ensure superior product consistency and purity, crucial for meeting stringent international standards. Meanwhile, Hunan Huakang’s diversified product portfolio positions it well to cater to varied market needs, enhancing its competitive edge.

European entities like Norevo GmbH and Aushadhi Herba are noted for their strong distribution networks and sustainable sourcing practices, addressing the growing consumer emphasis on ethical products. MAFCO Worldwide LLC and F&C Licorice, with their extensive market presence and innovative formulations, drive the market's evolution, particularly in the confectionery and health sectors.

Emerging players such as VPL Chemicals and Zagros Licorice are capitalizing on regional market expansions and increasing investments in R&D. Companies like Ransom Naturals and Sepidan Osareh are at the forefront of integrating advanced extraction techniques, ensuring high-potency licorice products that appeal to a health-conscious demographic.

Collectively, these key players are not only fueling market growth through strategic initiatives and technological advancements but also setting industry benchmarks for quality and sustainability in the global licorice market.

Market Key Players

- Sichuan Union Herb

- Shaanxi Jiahe Phytochemicals

- Zhejiang Kangling

- Hebei Jingu

- Hunan Huakang

- Norevo GmbH

- Aushadhi Herba

- MAFCO Worldwide LLC

- F&C Licorice

- VPL Chemicals

- Zagros Licorice

- Ransom Naturals

- Sepidan Osareh

Recent Development

- In April 2024, The Hershey Company expanded its Twizzler brand by introducing new licorice candy flavors and healthier options. This move aligns with the increasing consumer demand for diverse and health-conscious confectionery products.

- In March 2024, Haribo announced its commitment to sustainable packaging for its licorice products. This initiative aims to reduce environmental impact by utilizing recyclable materials, reflecting the broader industry trend towards sustainability.

- In January 2024, Red Vines, known for its classic red licorice twists, expanded its distribution network into several European and Asian markets. This strategic move aims to capitalize on the growing global demand for licorice candies.

- The Licorice Market was valued at USD 1,978 million in 2023. It is expected to reach USD 3,351 million by 2033, with a CAGR of 6.9% during the forecast period from 2024 to 2033.

Report Scope

Report Features Description Market Value (2023) USD 1,978 Million Forecast Revenue (2033) USD 3,791.1 Million CAGR (2024-2032) 6.9% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Food Grade, Feed Grade, Pharmaceutical Grade), By Form (Powder, Liquid, Block), By Application (Food & Beverages, Pharmaceutical, Tobacco, Others) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Sichuan Union Herb, Shaanxi Jiahe Phytochemicals, Zhejiang Kangling, Hebei Jingu, Hunan Huakang, Norevo GmbH, Aushadhi Herba, MAFCO Worldwide LLC, F&C Licorice, VPL Chemicals, Zagros Licorice, Ransom Naturals, Sepidan Osareh Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Sichuan Union Herb

- Shaanxi Jiahe Phytochemicals

- Zhejiang Kangling

- Hebei Jingu

- Hunan Huakang

- Norevo GmbH

- Aushadhi Herba

- MAFCO Worldwide LLC

- F&C Licorice

- VPL Chemicals

- Zagros Licorice

- Ransom Naturals

- Sepidan Osareh