Global Jet Engine Market By Technology(Turboprop engine , Turbofan engine, Turbojet engine , Pulsejet engine, Others), By Platform(Fixed wings, Rotary wings), By Application(Military aviation, Business aviation, Commercial aviation), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

6851

-

March 2024

-

157

-

-

This report was compiled by Kalyani Khudsange Kalyani Khudsange is a Research Analyst at Prudour Pvt. Ltd. with 2.5 years of experience in market research and a strong technical background in Chemical Engineering and manufacturing. Correspondence Sr. Research Analyst Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

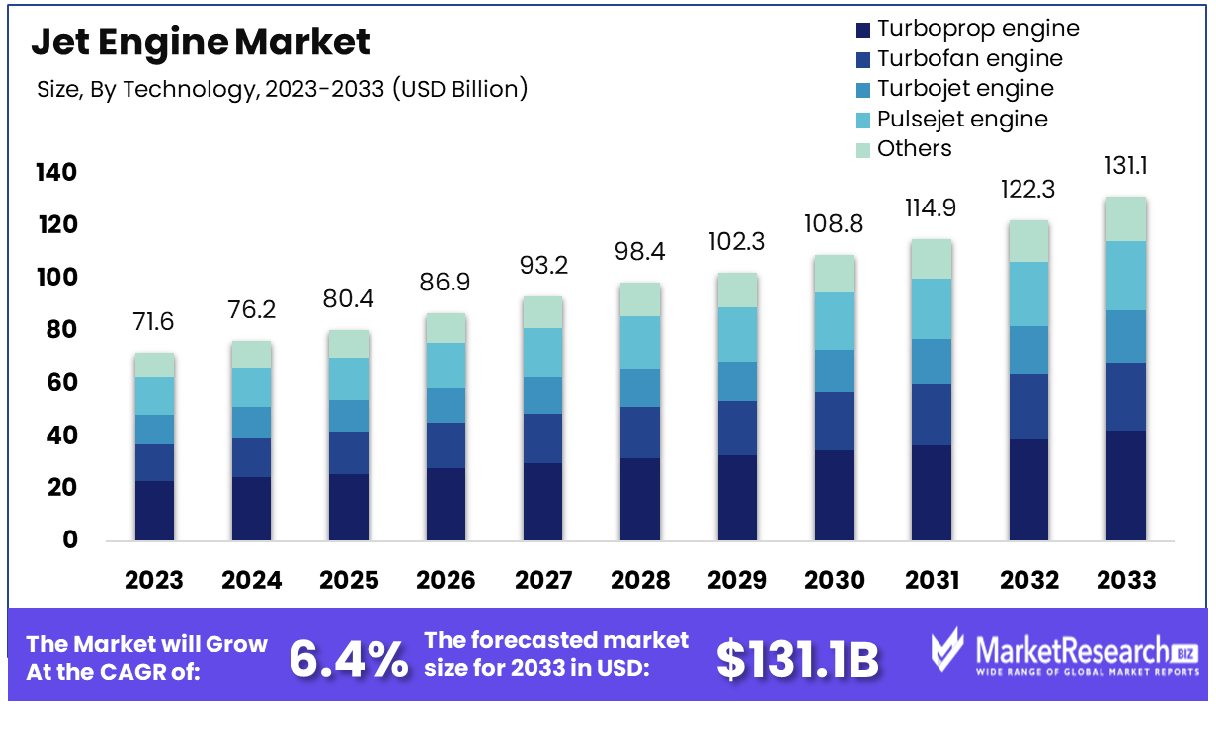

The global Jet Engine Market was valued at USD 71.6 billion in 2023, It is expected to reach USD 131.1 billion by 2033, with a CAGR of 6.4% during the forecast period from 2024 to 2033.

The Jet Engine Market encompasses the global demand and supply dynamics of aircraft propulsion systems, comprising turbofan, turboprop, and turbojet engines. It spans commercial aviation, military aircraft, and emerging sectors like unmanned aerial vehicles (UAVs) and supersonic transports. This market is propelled by rising air passenger traffic, military modernization initiatives, and technological advancements enhancing fuel efficiency and performance.

Key players, including aerospace giants and innovative startups, vie for market share through product innovation, strategic partnerships, and aftermarket services. With sustainability concerns driving demand for greener propulsion technologies, the Jet Engine Market presents lucrative opportunities for industry leaders adept at navigating regulatory landscapes and fostering innovation.

The jet engine market continues to exhibit resilience and steady growth, driven by a confluence of factors including technological advancements, burgeoning demand for air travel, and strategic investments in aviation infrastructure. In 2023, the general aviation industry experienced noteworthy expansion, with an uptick in overall shipments and billings. Preliminary data reveals that aircraft deliveries surged to a valuation of $27.8 billion, marking a commendable 3.6% increase from the preceding year.

Of particular significance are the robust increments witnessed across various aircraft categories. Piston engine airplane deliveries surged by an impressive 11.8%, while turboprop airplane deliveries registered a commendable uptick of 9.6%. Moreover, business jet deliveries exhibited a noteworthy escalation, ascending to 730 units from the previous 712.

Furthermore, the value of airplane deliveries in 2023 escalated to $23.4 billion, showcasing a commendable 2.2% augmentation compared to the antecedent year. These statistics underscore the sustained momentum within the aviation sector, boding well for the jet engine market's trajectory.

This surge in aircraft deliveries reflects a burgeoning demand for air travel, propelled by economic resurgence, expanding middle-class demographics, and the resumption of global mobility post-pandemic restrictions. Additionally, ongoing advancements in jet engine technology, including enhanced fuel efficiency and reduced emissions, are bolstering market sentiment and driving adoption across both commercial and military segments.

In light of these developments, industry stakeholders are advised to leverage this opportune momentum by prioritizing innovation, strategic partnerships, and customer-centric initiatives to capitalize on emerging market trends and solidify their competitive positioning in the dynamic jet engine landscape.

Key Takeaways

- Market Growth: The Jet Engine Market was valued at USD 71.6 billion in 2023, It is expected to reach USD 131.1 billion by 2033, with a CAGR of 6.4% during the forecast period from 2024 to 2033.

- By Technology: The technology sector sees turboprop engines dominate, reflecting advancements and efficiency in propulsion systems.

- By Platform: Fixed-wing platforms lead the segment, underlining their enduring importance and versatility across various applications.

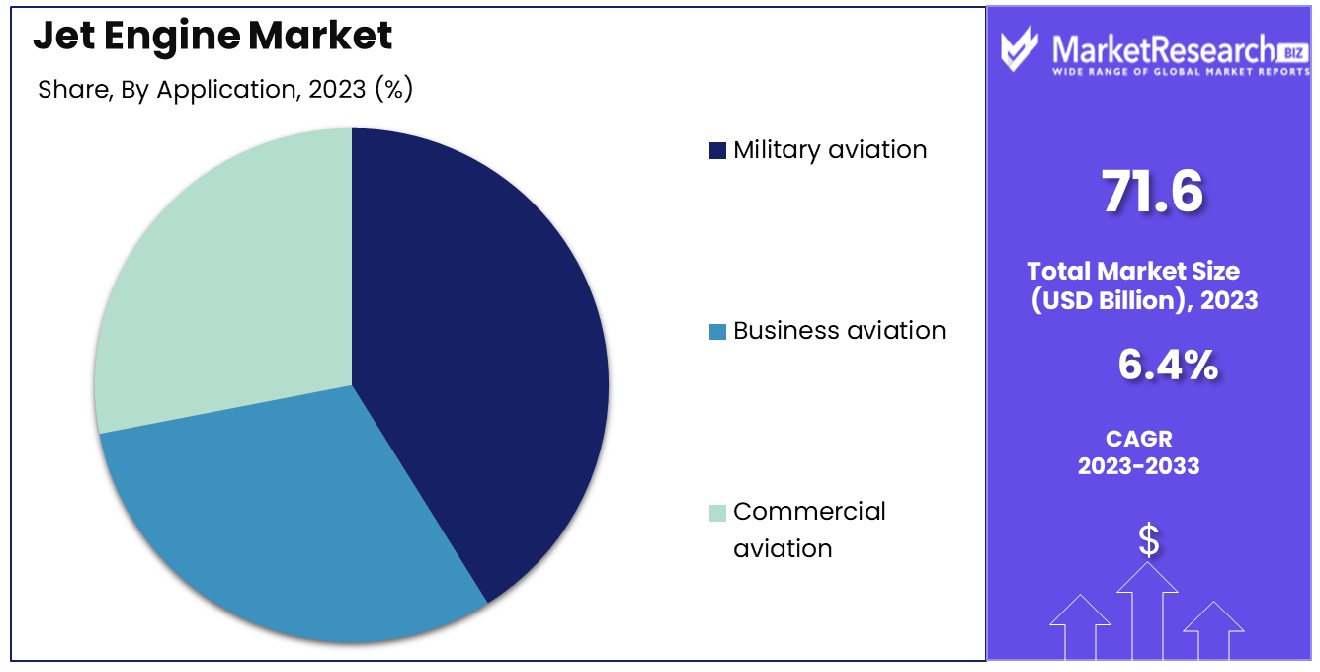

- By Application: Military aviation emerges as the dominant application, emphasizing its strategic significance and evolving operational requirements.

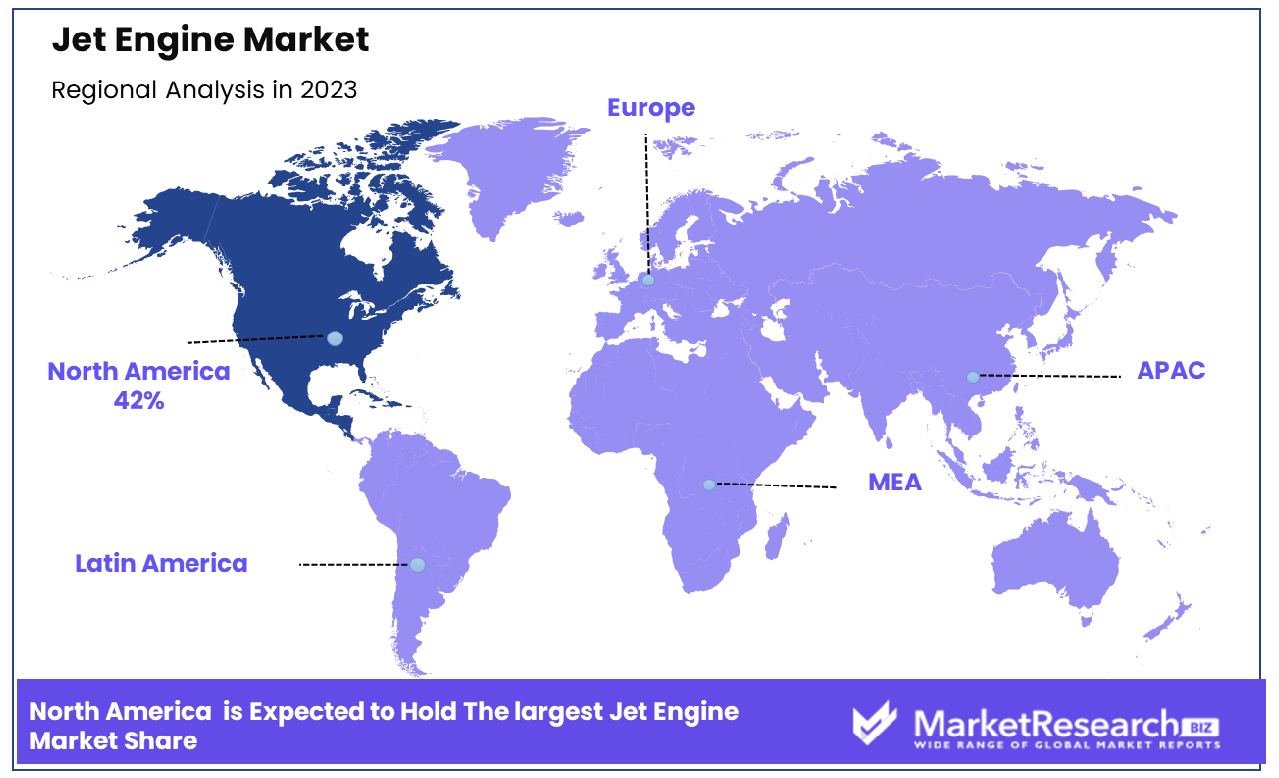

- Regional Dominance: North America Dominates with a 42% Market Share in the Jet Engine Industry.

- Growth Opportunity: The global jet engine market is experiencing growth driven by environmental sustainability concerns in aviation, prompting innovation in fuel efficiency and emissions reduction. Additionally, advancements in 3D printing enhance manufacturing processes and product performance.

Driving factors

Increase in Demand for Turbofan Aircraft Engines

The growth of the Jet Engine Market is significantly fueled by the increasing demand for turbofan aircraft engines. Turbofan engines have become the preferred choice for the modern aircraft engines industry due to their higher fuel efficiency and quieter operation compared to older engine types. This demand surge can be attributed to the escalating global air travel, driven by factors such as rising disposable incomes, expanding middle-class population, and increasing urbanization.

According to industry reports, the turbofan segment is projected to witness robust growth, with a CAGR of over 6% during the forecast period. This surge in demand not only propels the sales of jet aircraft but also stimulates investments in research and development to enhance engine performance, fuel efficiency, and durability, further boosting market expansion.

Rise in Preference for Civil Aviation

The Jet Engine Market experiences a notable uplift due to the rising preference for civil aviation over other modes of transportation. With growing awareness of time efficiency and convenience, more people are opting for air travel, especially for long-distance journeys. This shift is particularly evident in emerging economies where infrastructural developments and liberalization of airspace regulations have made air travel more accessible and affordable.

As a result, airlines are expanding their fleets to cater to the increasing passenger traffic, leading to a surge in demand for jet aircraft. Moreover, the burgeoning trend of international tourism and business travel further drives the rapid growth of the civil aviation sector, thereby augmenting the demand for jet engines.

Increase in Operations in the Commercial Aircraft Industry

The commercial aircraft industry's expanding operations serve as a substantial catalyst for the growth of the Jet Engine Market. With airlines seeking to meet the escalating demand for air travel, there is a continuous need to modernize and expand their fleets. This necessitates the procurement of new aircraft equipped with advanced jet engines to ensure operational efficiency, safety, and compliance with stringent emission regulations.

Furthermore, the growing emphasis on fleet renewal and replacement, driven by the need to reduce maintenance costs and enhance fuel efficiency, bolsters the demand for modern jet engines. As a result, engine manufacturers are witnessing an uptick in orders from commercial aircraft operators, fostering market growth.

Restraining Factors

Cost of Development and Installation

The development and installation of jet engines necessitate substantial initial investment, acting as a significant restraining factor in market expansion. Companies involved in manufacturing jet engines must allocate considerable resources towards research, development, and production infrastructure. Such investments involve not only monetary outlays but also time and expertise. However, this factor also contributes to market growth indirectly.

The high entry barriers created by the substantial initial investment deter new entrants, resulting in a consolidated market landscape dominated by established players. This consolidation enhances the competitive advantage of leading companies, fostering innovation and technological advancement within the industry. Despite the initial financial burden, the long-term benefits of technological progress and market dominance outweigh the restraining effect on market growth.

Competitor Analysis and Market Competitiveness

Identifying key competitors and their market ranks provides valuable insights into market competitiveness, thereby influencing the growth trajectory of the jet engine market. Understanding the strategies, strengths, and weaknesses of competitors enables companies to fine-tune their strategies, differentiate their products, and seize market opportunities. Furthermore, a comprehensive analysis of competitor positioning facilitates informed decision-making regarding pricing, marketing, and product development.

By leveraging competitor intelligence, companies can enhance their market presence, expand their customer base, and drive revenue growth. Moreover, healthy competition stimulates innovation and encourages continuous improvement, ultimately benefitting consumers through technological advancements and enhanced product offerings. Thus, while competitor analysis initially presents challenges in navigating a crowded marketplace, it ultimately fuels market growth by fostering a dynamic and competitive environment conducive to innovation and value creation.

By Technology Analysis

In the realm of technology, the turboprop engine asserts dominance, showcasing superior efficiency and reliability in propulsion systems.

In 2023, the turboprop engine maintained a commanding market position within the technology segment of the jet engine market. Turboprop engines, renowned for their efficiency in propelling regional and small aircraft, accounted for a substantial share of the overall market. This dominance can be attributed to their versatility, offering optimal performance for short-haul flights and operations in diverse environments. Additionally, advancements in turboprop technology, such as improved fuel efficiency and reduced emissions, further solidified their appeal to aircraft manufacturers and operators alike.

Following turboprop engines, turbofan engines emerged as another significant player in the technology segment. Characterized by their high bypass ratio and ability to generate thrust efficiently, turbofan engines found extensive application across various aircraft types, including commercial airliners and military aircraft. Their popularity stemmed from a balance between fuel efficiency and power, meeting the demands of long-haul flights while complying with stringent environmental regulations.

In contrast, turbojet engines occupied a niche within the market, primarily utilized in supersonic and military aircraft where high thrust-to-weight ratios are paramount. While their market share was comparatively modest, turbojet engines remained indispensable in certain specialized applications, showcasing robust performance in high-speed scenarios.

Pulsejet engines and other emerging technologies constituted a smaller portion of the market, primarily due to their limited applicability and ongoing development efforts. Despite niche applications in unmanned aerial vehicles (UAVs) and experimental aircraft, pulsejet engines faced challenges related to efficiency and noise levels, constraining their widespread adoption.

Looking ahead, the jet engine market is poised for further evolution driven by technological innovations and growing demand for more sustainable aviation solutions. As manufacturers continue to invest in research and development, advancements in propulsion technologies are expected to shape the competitive landscape, presenting opportunities for market expansion and differentiation.

By Platform Analysis

On the platform front, fixed wings reign supreme, illustrating their enduring relevance and adaptability across diverse contexts.

In 2023, Fixed Wings held a dominant market position in the By Platform segment of the Jet Engine Market. Fixed-wing aircraft are typically used for long-haul flights, military operations, and commercial passenger transport. They offer high speed, stability, and efficiency, making them ideal for various applications.

The dominance of fixed-wing platforms can be attributed to several factors. Firstly, the increasing demand for air travel, both commercial and military purposes, has driven the growth of fixed-wing aircraft production. The expanding global economy and rising disposable incomes have led to a surge in passenger traffic, boosting the sales of commercial airliners. Additionally, governments around the world are investing heavily in defense modernization programs, fueling the demand for military aircraft equipped with advanced jet engines.

Moreover, technological advancements in jet engine design have significantly enhanced the performance and efficiency of fixed-wing aircraft. Manufacturers are constantly innovating to develop engines that are more fuel-efficient, environmentally friendly, and capable of delivering higher thrust. These advancements have further strengthened the market position of fixed-wing platforms, as they offer superior range and speed compared to rotary-wing aircraft.

Furthermore, the versatility of fixed-wing aircraft makes them suitable for a wide range of applications, including transportation of passengers and cargo, surveillance and reconnaissance, aerial firefighting, and medical evacuation. This versatility has contributed to their widespread adoption across various industries, further consolidating their dominant position in the jet engine market.

By Application Analysis

Within the application sphere, military aviation stands as the dominant force, highlighting its critical role and evolving operational demands.

In 2023, Military aviation held a dominant market position in the By Application segment of the Jet Engine Market. This can be attributed to several factors including increased defense spending, modernization initiatives by various countries, and the growing demand for technologically advanced military aircraft. Military aviation encompasses a wide array of applications ranging from fighter jets and transport planes to reconnaissance aircraft and unmanned aerial vehicles (UAVs). The need for superior performance, reliability, and efficiency in military aircraft drives the demand for cutting-edge jet engine technologies.

Simultaneously, Business aviation emerged as a significant player within the By Application segment. The rise in corporate travel, coupled with the expansion of business enterprises globally, has fueled the demand for business jets equipped with advanced jets. These are designed to offer enhanced fuel efficiency, longer-range capabilities, and reduced environmental impact, aligning with the sustainability goals of many businesses.

Furthermore, Commercial aircraft engines aviation remained a cornerstone of the Jet Engine Market's By Application segment. Despite challenges posed by the COVID-19 pandemic, the commercial aviation sector witnessed a gradual recovery with increasing passenger traffic and airline fleet expansion. Jet-powering commercial airliners continue to evolve, emphasizing fuel efficiency, lower emissions, and quieter operations to meet stringent regulatory standards and address environmental concerns.

Overall, the By Application segment of the Jet Engine Market in 2023 witnessed significant contributions from Military aviation, Business aviation, and Commercial aviation sectors. The sustained growth in these segments reflects the dynamic nature of the aerospace sector industry and the continuous pursuit of innovation to meet evolving market demands and regulatory requirements.

Key Market Segments

By Technology

- Turboprop engine

- Turbofan engine

- Turbojet engine

- Pulsejet engine

- Others

By Platform

- Fixed wings

- Rotary wings

By Application

- Military aviation

- Business aviation

- Commercial aviation

Growth Opportunity

Environmental Sustainability Driving Market Growth:

The global jet engine market in 2023 is poised for significant opportunities, primarily fueled by a growing focus on environmental sustainability within the aviation industry. Regulatory pressures and increasing consumer awareness regarding carbon emissions have prompted airlines and aircraft manufacturers to seek more fuel-efficient and eco-friendly propulsion systems.

This shift towards sustainability presents a substantial opportunity for aircraft engine market manufacturers to develop and market that offers superior fuel efficiency and reduced emissions, thus aligning with environmental regulations and meeting consumer demands.

Technological Innovations, Particularly in 3D Printing:

Technological advancements, notably in additive manufacturing or 3D printing, continue to revolutionize the jet engine manufacturing process. 3D printing enables the production of complex engine components with greater precision, reduced weight, and enhanced durability compared to traditional manufacturing methods.

The adoption of 3D printing not only streamlines the production process but also offers cost savings and facilitates rapid prototyping, allowing for faster innovation cycles and customized engine designs. Jet engine manufacturers investing in research and development of 3D printing technologies are likely to gain a competitive edge in the market by offering lighter, more efficient with improved performance characteristics.

Latest Trends

Extended Lifespan of Engines

Engine manufacturers have focused on enhancing the durability and longevity of jets, aiming to reduce maintenance costs and increase operational efficiency. Advanced materials and manufacturing techniques have contributed to the development of capable of withstanding higher operating temperatures and pressures, thus extending their lifespan.

The implementation of predictive maintenance solutions leveraging data analytics has enabled the proactive identification of potential issues, facilitating timely repairs and maintenance, thereby prolonging engine life.

Exploring Electric Propulsion

With growing concerns over environmental sustainability and emissions reduction, the aviation industry has intensified efforts to explore alternative propulsion systems, including electric propulsion. Electric propulsion technologies, such as hybrid-electric and all-electric propulsion systems, have gained traction as potential solutions to mitigate greenhouse gas emissions and noise pollution.

Research and development initiatives by aerospace companies and startups have focused on overcoming challenges related to energy storage, power distribution, and efficiency to make electric propulsion feasible for commercial aircraft applications. Collaborations between industry stakeholders, government agencies, and academia have accelerated innovation in electric propulsion, with pilot projects and demonstrations showcasing the feasibility and potential benefits of electrified aircraft propulsion systems.

Regional Analysis

With a commanding market share of 42%, North America leads the global jet engines market.

The global jet engine market is dynamically segmented across major regions including North America, Europe, Asia Pacific, Middle East & Africa, and Latin America, each exhibiting unique characteristics and contributing distinctively to the industry landscape.

In North America, the market enjoys a dominant position, with a significant share of approximately 42%. This region is propelled by robust technological advancements, extensive aerospace infrastructure, and strong demand from both commercial and defense sectors. Additionally, strategic partnerships between industry major players and government initiatives further bolster market growth. According to the Federal Aviation Administration (FAA), North America continues to witness a steady rise in air traffic, driving the demand for jet engines. Moreover, the presence of leading manufacturers such as General Electric and Pratt & Whitney reinforces the region's prominence in the global market.

Europe represents another pivotal market segment, characterized by a sophisticated aviation industry and stringent regulatory frameworks promoting eco-friendly aviation solutions. The European Union Aviation Safety Agency (EASA) mandates stringent emission norms, fostering the adoption of fuel-efficient and environmentally sustainable jet engines. Furthermore, collaborations between aerospace giants and research institutions drive innovation, positioning Europe as a frontrunner in green aviation technologies.

Asia Pacific emerged as a burgeoning market for jet engines, fueled by rapid urbanization, expanding middle-class population, and escalating air travel demand. With burgeoning economies like China and India investing heavily in aviation infrastructure, the region witnesses substantial orders for new aircraft, propelling the demand for advanced jet engines. Moreover, increasing military expenditure across countries like China and India further augments market growth, presenting lucrative opportunities for jet engine manufacturers.

In the Middle East & Africa and Latin America, although the market is relatively nascent, steady economic growth, rising tourism, and government initiatives to bolster aviation infrastructure contribute to market expansion. However, challenges such as geopolitical tensions and fluctuating oil prices may temper growth in these regions in the short term.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of Middle East & Africa

Key Players Analysis

In 2023, the global jet engine market continued to witness significant traction, largely propelled by key industry players maintaining competitive strategies and innovative advancements. Among the notable key players driving the market dynamics, CFM International SA, a renowned French-American joint venture between GE Aviation and Safran SA, maintained its prominent position. With its established reputation for reliability and efficiency, CFM International continued to deliver cutting-edge jet engines, catering to diverse aviation needs worldwide.

Meanwhile, Honeywell International Inc., a stalwart in aerospace technology, fortified its foothold in the market through relentless innovation and strategic partnerships. Leveraging its expertise in avionics and propulsion systems, Honeywell remained pivotal in shaping the trajectory of the global jet engine market.

GE Aviation, Rolls-Royce Holdings Plc., and Safran SA, representing stalwarts in the industry, continued to drive innovation and excellence. Their relentless pursuit of technological advancements and commitment to sustainability reinforced their positions as leaders in the global jet engine landscape.

Furthermore, International Aero Engines AG, MTU Aero Engines AG, Textron Inc., and United Technologies Corporation played integral roles in diversifying the market landscape. With their collective expertise spanning across various segments of the aviation industry, these major companies contributed significantly to the overall growth and resilience of the jet engine market.

Market Key Players

- CFM International SA (France)

- Honeywell International Inc. (U.S.)

- GE Aviation (U.S.)

- Rolls-Royce Holdings Plc. (U.K.)

- Safran SA (France)

- International Aero Engines AG (U.S.)

- MTU Aero Engines AG (Germany)

- Textron Inc. (U.S.)

- United Technologies Corporation (U.S.)

Recent Development

- In February 2024, Onto Innovation Inc.'s 4Di InSpecTM Automated Metrology System revolutionized engine component manufacturing with non-contact 3D optical metrology, reducing scrap and rework, and enhancing quality control. Awarded 2024 Innovative System of the Year by FANUC America.

- In January 2024, Cirrus Aircraft's CAPS parachutes, standard on all models, ensure safe emergency landings with a single T-handle pull. Vision Jet's Safe Return Autoland system, powered by Garmin, received the prestigious 2020 Collier Trophy.

- In January 2024, GE Aerospace awarded NASA HyTEC Phase 2 contract to advance fuel-efficient aircraft engines. Collaborating for over 50 years, they aim to achieve net-zero emissions by 2050, testing hybrid electric systems and Sustainable Aviation Fuel combustion.

- In December 2023, Firefly Green Fuels successfully developed aviation fuel from human waste, verified by industry regulators. The SAF, equivalent to A1 fuel, offers the potential for significant emissions reduction in the aviation sector.

Report Scope

Report Features Description Market Value (2023) USD 71.6 Billion Forecast Revenue (2033) USD 131.1 Billion CAGR (2024-2032) 6.4% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Technology(Turboprop engine , Turbofan engine, Turbojet engine , Pulsejet engine, Others), By Platform(Fixed wings, Rotary wings), By Application(Military aviation, Business aviation, Commercial aviation) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape CFM International SA (France), Honeywell International Inc. (U.S.), GE Aviation (U.S.), Rolls-Royce Holdings Plc. (U.K.), Safran SA (France), International Aero Engines AG (U.S.), MTU Aero Engines AG (Germany), Textron Inc. (U.S.), United Technologies Corporation (U.S.) Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- CFM International SA (France)

- Honeywell International Inc. (U.S.)

- GE Aviation (U.S.)

- Rolls-Royce Holdings Plc. (U.K.)

- Safran SA (France)

- International Aero Engines AG (U.S.)

- MTU Aero Engines AG (Germany)

- Textron Inc. (U.S.)

- United Technologies Corporation (U.S.)