Commercial Aircraft Battery Management System Market By Type (Lithium-Ion, Nickel-Cadmium, and Lead-Acid), By Application (OEM and Aftermarket), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032

-

40263

-

July 2023

-

137

-

-

This report was compiled by Correspondence Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Report Overview

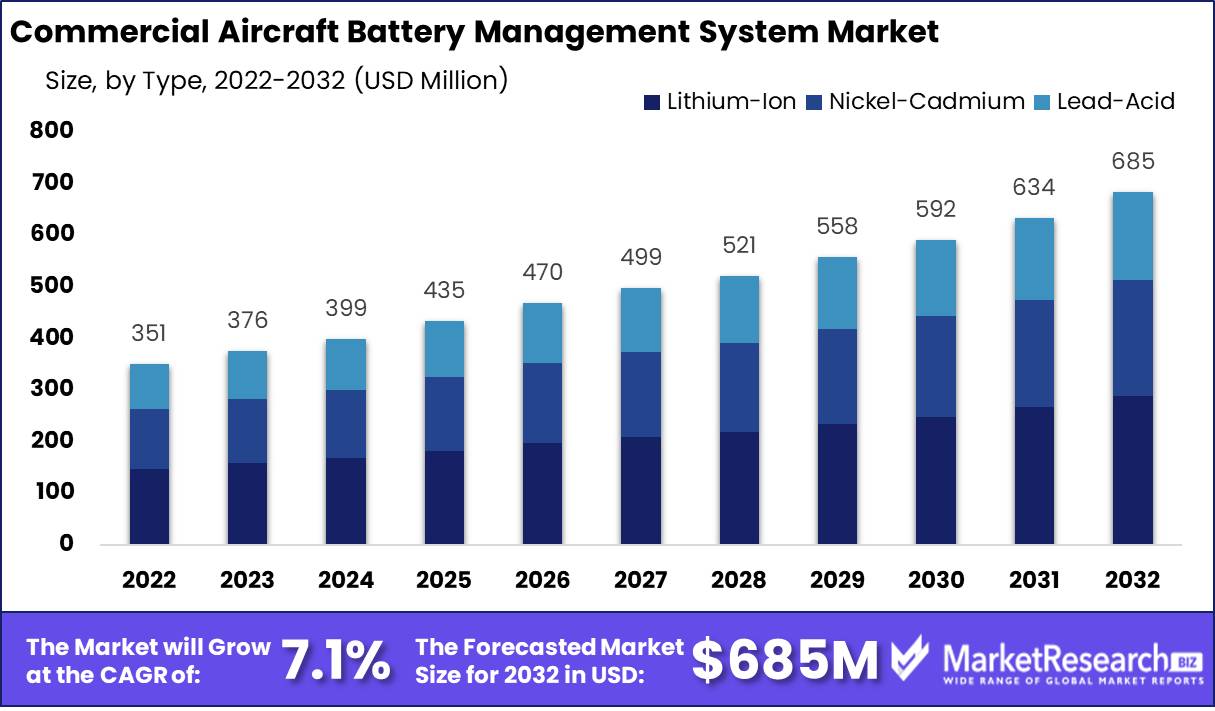

Commercial Aircraft Battery Management System Market size is expected to be worth around USD 685 Mn by 2032 from USD 351 Mn in 2022, growing at a CAGR of 7.1% during the forecast period from 2023 to 2032.

As the electrification of aircraft increases, there is steady growth in the market of aircraft batteries. The aviation industry is increasing its interest in aviation in electrification. New technological airplanes are designed and developed to resolve climatic problems. They may influence the future of aviation to be free from emissions, but due to overreliance on batteries, new aircraft poses an issue.

Driving factors

Increasing transportation and strict regulations help the market grow

Several key factors drive the global commercial aircraft battery management system market. The increasing demand for commercial aircraft, driven by the growing air travel industry and the need for efficient transportation, is propelling the market. The emphasis on safety and the need for reliable power sources in aircraft are also significant drivers. Battery management systems play a crucial role in monitoring and controlling the performance of aircraft batteries, ensuring their optimal functioning and longevity.

The rising focus on reducing carbon emissions and adopting greener technologies in the aviation sector pushes the market forward, as battery systems offer the potential for electric and hybrid aircraft applications. Additionally, stringent regulations and standards set by aviation authorities regarding battery safety and performance further contribute to the growth of the market as airlines and aircraft manufacturers seek compliant solutions. The global commercial aircraft battery management system market is growing due to increased aircraft demand, safety concerns, environmental considerations, and regulatory requirements.

Restraining Factors

High cost, long development cycles, and slow adoption rates slow market growth

The global commercial aircraft battery management system market faces several restraints that may hinder its growth. One significant restraint is the high cost associated with implementing advanced battery management systems in commercial aircraft. These systems require sophisticated technologies, components, and integration, which can increase the overall cost of aircraft production and maintenance. Additionally, the stringent certification and testing processes imposed by aviation regulatory bodies pose challenges for the adoption of new battery management systems, as they need to meet strict safety and performance standards.

Furthermore, the limited availability of skilled professionals and expertise in developing and maintaining battery management systems for commercial aircraft can impede market growth. The long development cycles and slow adoption rates within the aviation industry also contribute to the restraints faced by the market. Despite the numerous advantages offered by battery management systems, these challenges pose barriers to their widespread adoption and may impact the growth of the global commercial aircraft battery management system market.

Type Analysis

By type, the market is divided into Lithium-Ion battery, Nickel-Cadmium battery, and Lead-Acid battery. The Li-Ion segment dominated the market in 2022 with 42% of the market share. Batteries have made significant new findings in recent years. Lithium-ion (Li-Ion), nickel-cadmium, and valve-regulated lead-acid (VLRA) are the latest critical batteries. Lead acid batteries are the most helpful Technology as they are less costly, reliable, and maintenance-free.

Also, they do not need to check electrolytes regularly. But they have corrosion issues and flammability due to the presence of acid. Hence, It is frequently used in general aviation, light military aircraft, and helicopters. Some examples are the Pilatus PC21 military trainer and Kopter SH09 rotorcraft. Due to increased demand, Nickel-Cadmium batteries are expected to have the highest CAGR during the forecast period.

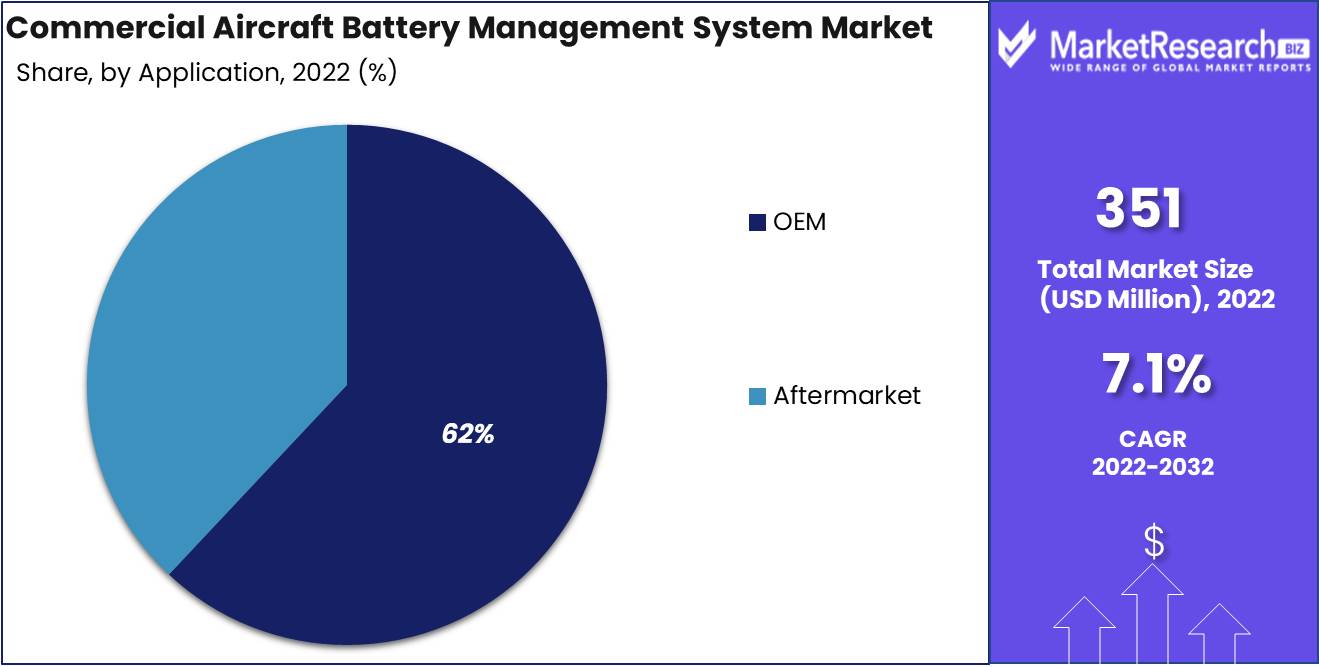

Application Analysis

By application, the market is divided into OEM and aftermarket. The OEM segment dominated the market with about 62% market share. GEC and Honeywell, among other original equipment manufacturers (OEMs), are actively engaged in the development and production of Battery Management Systems (BMS) specifically designed for use in commercial aircraft. These BMS units are seamlessly incorporated into the Aircraft Power Distribution System (APDS) to ensure efficient power distribution across all critical aircraft systems.

By integrating with the APDS, these advanced systems enhance the overall reliability by continuously monitoring various battery parameters, including condition, voltage, and current. In addition to their monitoring capabilities, these OEM solutions also contribute to cost reduction through streamlined maintenance processes. They offer a unified point of contact for technical support and incorporate sophisticated features like predictive maintenance, which leverages historical data from the aircraft's engine-control computers.

Key Market Segments

By Type

- Lithium-Ion

- Nickel-Cadmium

- Lead-Acid

By Application

- OEM

- Aftermarket

Growth Opportunity

Increasing focus on electric and hybrid aircraft

The global commercial aircraft battery management system market presents several opportunities for growth and development. Firstly, the increasing focus on electric and hybrid aircraft opens up significant opportunities for battery management systems. As the aviation industry strives to reduce carbon emissions and improve sustainability, the demand for advanced battery technologies and management systems is expected to surge. This creates an opportunity for market players to develop innovative solutions that can efficiently monitor, control, and optimize the performance of batteries in electric and hybrid aircraft.

Moreover, the integration of the Internet of Things (IoT) and data analytics technologies with battery management systems can enhance their functionality and provide valuable insights for predictive maintenance and performance optimization. The ongoing advancements in battery technology, such as the development of high-energy-density and fast-charging batteries, also offer opportunities for the market to introduce more efficient and reliable battery management systems.

The growing aftermarket services sector in the aviation industry presents avenues for providing maintenance, repair, and upgrade services for existing battery management systems. Overall, the global commercial aircraft battery management system market has promising opportunities driven by the increasing adoption of electric and hybrid aircraft, the integration of IoT and data analytics, advancements in battery technology, and the aftermarket services sector.

Latest Trends

Fuel efficiency and environmental sustainability are getting prioritized even more now.

The global commercial aircraft battery management system market has witnessed significant growth in recent years and is expected to continue its upward trajectory. The increasing demand for commercial aircraft, coupled with the growing emphasis on electric and hybrid-electric aircraft, has driven the adoption of advanced battery management systems. These systems play a critical role in ensuring aircraft batteries' safe and efficient operation, enhancing their performance, monitoring their health, and optimizing their charging and discharging cycles.

The rising focus on fuel efficiency, environmental sustainability, and the need for reliable power sources in aircraft have further propelled the market growth. Advancements in battery technologies, such as lithium-ion batteries with improved energy density and longer life cycles, have also expanded the market. With the aviation industry's ongoing efforts to reduce emissions and explore electric aircraft options, the commercial aircraft battery management system market is anticipated to experience continuous growth in the coming years.

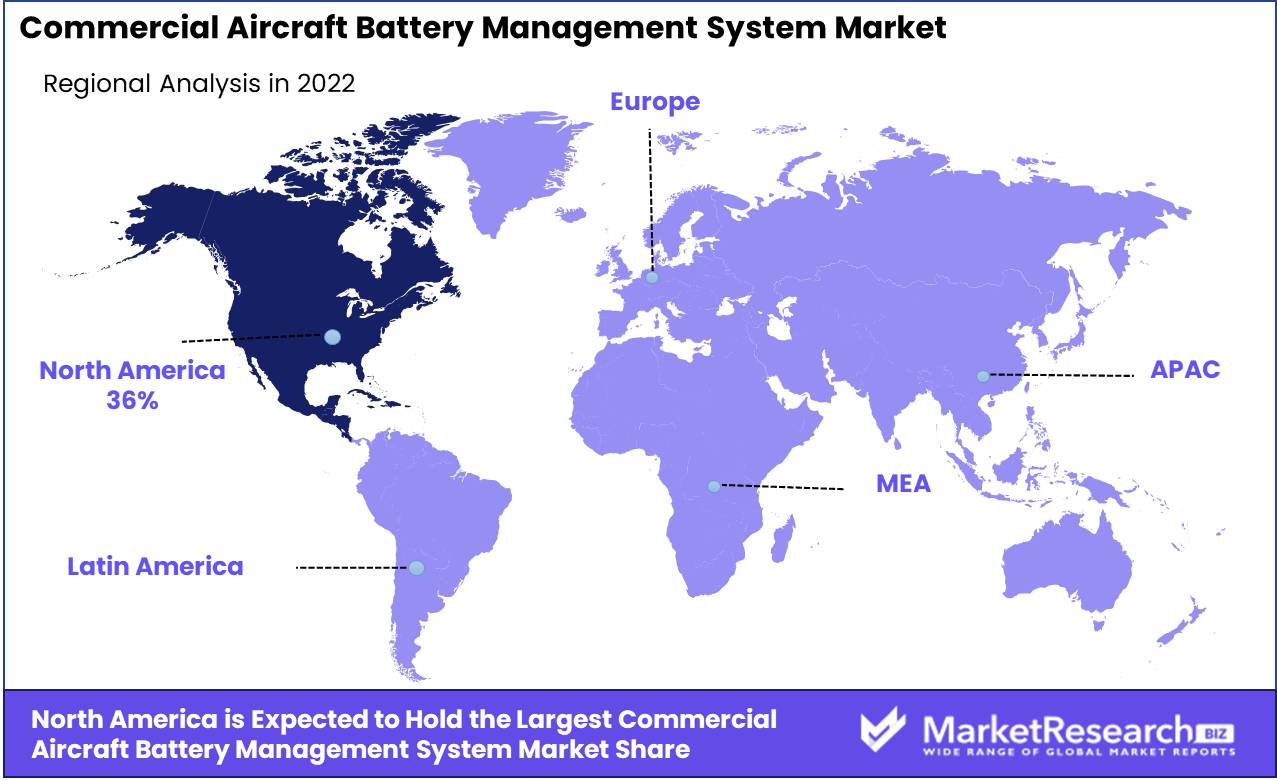

Regional Analysis

North America had the highest revenue of 36% in the global revenue market in 2022. Also, key players are increasing activities in the region for this market. Let's take the example of SkyDrive Inc. in Japan, which develops cargo drones and flying cars with the growing use of electric power. They chose electric power systems Inc. as a partner to develop, produce and design a battery system for SD- 05.

The most developing chance is in the Asia-Pacific, with the fastest revenue CAGR over the forecasting period as Key activities players are increasing. For example, a Chinese factory is expected to start an aviation lithium battery technology company for sines batteries of electric vehicles in Portugal in 2025. Hence, increased demand for aircraft batteries is expanding due to increasing activities.

The European market expected a steady increase over the forecasting period due to government advances in reducing carbon emissions. Transportation Secretary Grant Shapps and business secretary Kwasi Kwarteng find a new team of aviation professionals from businesses and governments for zero emissions. The new ZEF delivery group will strengthen Britain's participation in international decarbonization. Due to government initiatives, demand for aircraft batteries is increasing, which helps to boost market revenue growth.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

Some players are large and medium-sized for a large share of market revenue. Strategies like mergers and acquisitions, agreements, contracts, developing, introducing, and testing are deployed to increase market share. Some companies focus on opportunities to target constraints to accelerate the company's growth compared to other prominent players in the industry.

Top Key Players in Commercial Aircraft Battery Management System Market

- Acme Aerospace Inc and Avionic Instruments LLC

- Axter Aerospace

- Creare LLC

- EaglePicher Technologies LLC

- Kanto Aircraft Instrument Co. Ltd.

- Mid-Continent Instrument Co. Inc.

- LION Smart GmbH

- MarathonNorco Aerospace Inc.

- Elithion Inc.

- MGM COMPRO

- Other Key Players

Recent Development

- In 2022, Airbus announced it would develop a hydrogen fuel cell engine.

- In 2021, United Airlines is tending as earlier a battery-powered electric aircraft formed a deal with energy ventures, heart aerospace, and mesa airlines through its investment fund.

Report Scope:

Report Features Description Market Value (2022) USD 351 Mn Forecast Revenue (2032) USD 685 Mn CAGR (2023-2032) 7.1% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type: Lithium-Ion, Nickel-Cadmium, and Lead-Acid; By Application: OEM and Aftermarket Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Acme Aerospace Inc and Avionic Instruments LLC, Axter Aerospace, Creare LLC, EaglePicher Technologies LLC, Kanto Aircraft Instrument Co. Ltd., Mid-Continent Instrument Co. Inc., LION Smart GmbH, MarathonNorco Aerospace Inc., Elithion Inc., MGM COMPRO, and Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Acme Aerospace Inc and Avionic Instruments LLC

- Axter Aerospace

- Creare LLC

- EaglePicher Technologies LLC

- Kanto Aircraft Instrument Co. Ltd.

- Mid-Continent Instrument Co. Inc.

- LION Smart GmbH

- MarathonNorco Aerospace Inc.

- Elithion Inc.

- MGM COMPRO

- Other Key Players