Global Isosorbide Market By End-use(Resins & Polymers, Additives, Others), By Application(Polyethylene Isosorbide Terephthalate (PEIT), Polycarbonate, Polyurethane, Polyester Polyisosorbide Succinate (PIS), Isosorbide Diesters, Others), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

6696

-

April 2024

-

300

-

-

This report was compiled by Shreyas Rokade Shreyas Rokade is a seasoned Research Analyst with CMFE, bringing extensive expertise in market research and consulting, with a strong background in Chemical Engineering. Correspondence Team Lead-CMFE Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

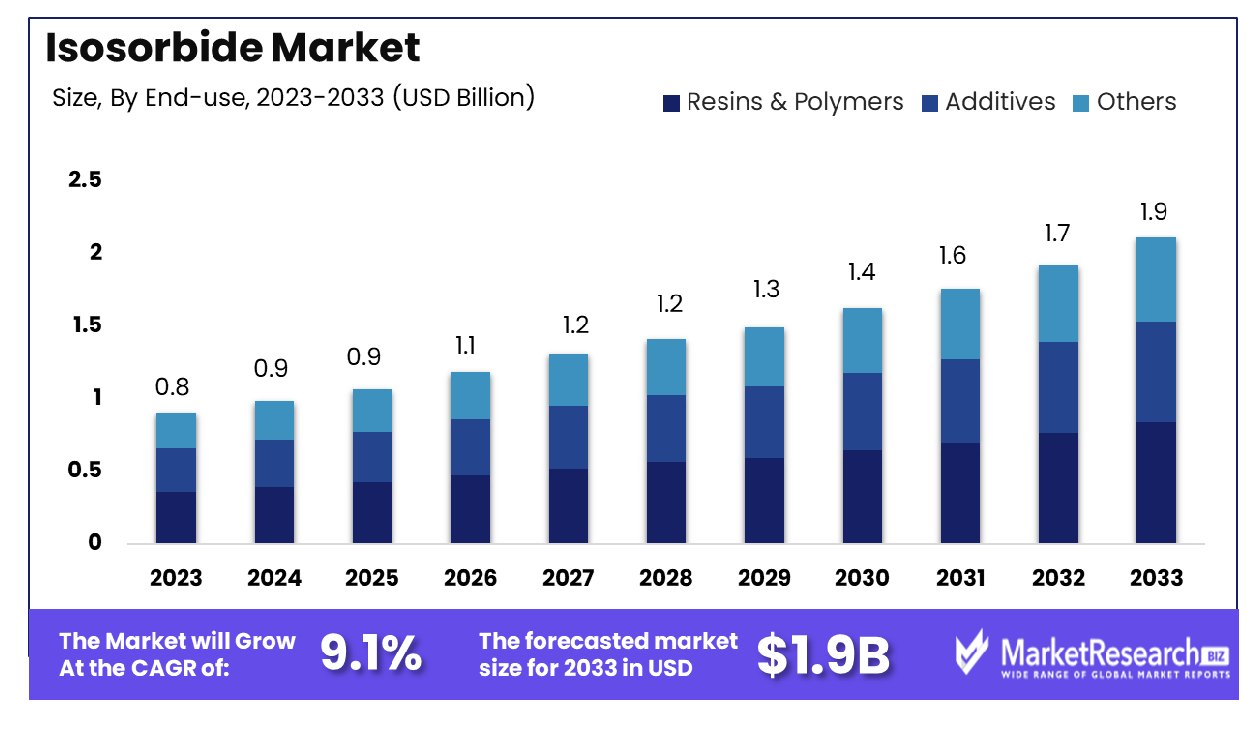

The Global Isosorbide Market was valued at USD 0.8 billion in 2023. It is expected to reach USD 1.9 billion by 2033, with a CAGR of 9.1% during the forecast period from 2024 to 2033.

The surge in demand for Isosorbide bioplastic manufacturing, extensive product usage in the cosmetics and personal care industry, and new environmentally friendly product innovations are some of the main key driving factors for the Isosorbide market. Isosorbide is a bio-based element extracted from the desiccation of sorbitol, a sugar alcohol. It is generated from corn starch and other agricultural bio-feedstock making the Isosorbide a renewable, plant-based element.

It is generally used in medical or pharmaceuticals, polymers, resins, packaging, and other personal care products. These are a cost-effective and resourceful product that provides ideal biocompatibility, high heat stability, and sturdiness. These are renewable in nature which decreases the carbon footprints, lowers severe environmental hazards, and lessens dependence on fossil fuel-based raw materials.

Isosorbide is majorly used in the pharmaceutical or medical sector. According to the National Centre of Biotechnology Information in May 2023, Isosorbide is a type of medication that is used for the treatment and avoid angina pectoris in individuals with coronary heart diseases. These come under the nitrate class of drugs. It elaborates on the signs, actions, and contraindications for Isosorbide as a significant agent for treating angina pectoris due to coronary artery disease, heart failure with decreased expulsion fraction, and achalasia.

According to Centres for Disease Control and Prevention in May 2023, heart disease is one of the main causes of death among individuals. Every person dies in 33 seconds in the US due to cardiovascular disease. Coronary heart disease is one of the most common types of heart disease that has killed almost 375,476 individuals in 2021. Similarly, more than 805,000 individuals have died due to heart attacks. Among that 1 in 5 heart attacks are silent heart strokes.

Isosorbide is majorly used as a monomer in the manufacturing the production of bio-based polymers like polyethylene Isosorbide terephthalate, which is well-known for its ultimate heat resistance and mechanical durability. However, it is popularly used as a feedstock in the manufacturing of polycarbonate Isosorbide, which utilizes several applications in the production of automotive industry elements, electronic devices, and other optical lenses.

The extensive use of Isosorbide in the preparation of Isosorbide polyesters that are majorly used in coatings, adhesives, and foams. The demand for Isosorbide will gradually increase due to its various utilization in different sectors that will help in market expansion in the coming years.

Key Takeaways

- Market Growth: The Global Isosorbide Market was valued at USD 0.8 billion in 2023. It is expected to reach USD 1.9 billion by 2033, with a CAGR of 9.1% during the forecast period from 2024 to 2033.

- By End-use: Resins & Polymers dominate the market with a 52.4% share.

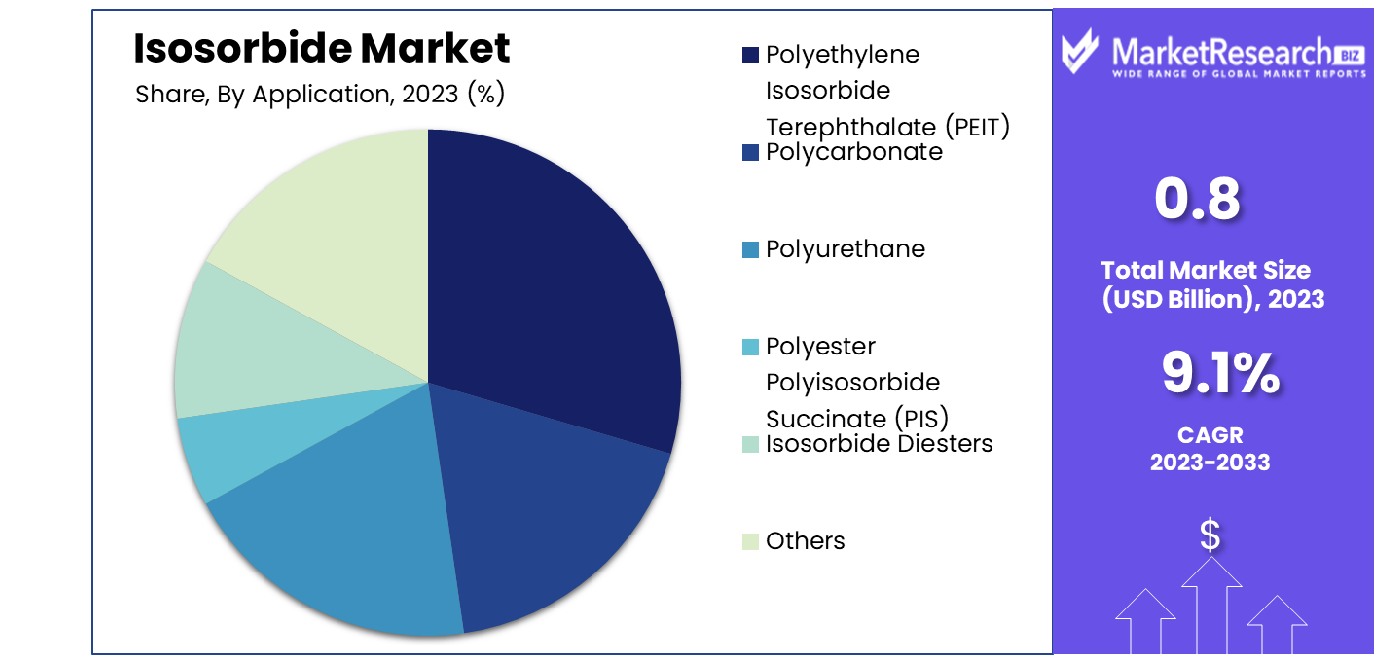

- By Application: PEIT leads applications, holding a 26.3% market share.

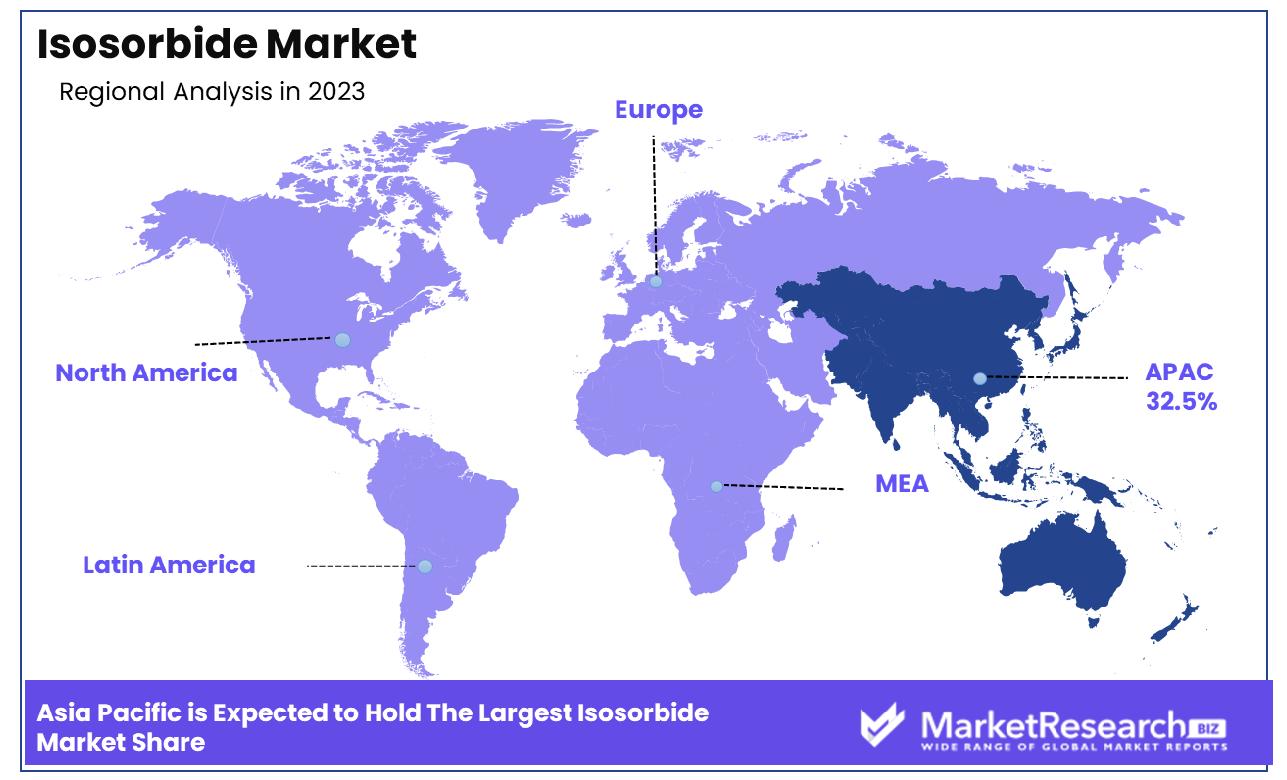

- Regional Dominance: The Isosorbide market in Asia Pacific commands a significant 32.5% share.

- Growth Opportunity: The global Isosorbide market benefits from increased interest in supercar racing and growing wealth in developing regions, driving demand for sustainable, high-performance materials in automotive and consumer products.

Driving factors

Growing Demand for Sustainable and Eco-Friendly Materials

The Isosorbide Market is experiencing significant growth, primarily driven by the increasing demand for sustainable and eco-friendly materials across various industries. This surge in demand can be attributed to heightened global awareness of environmental issues and the consequent regulatory pressures to reduce reliance on fossil-based chemicals.

As industries such as pharmaceuticals, personal care, and food packaging seek greener alternatives, isosorbide emerges as a favored solution due to its biodegradability and lower carbon footprint. The trend towards sustainability is not only a response to consumer preferences but also aligns with global initiatives for carbon neutrality, thereby boosting the market for bio-based products like isosorbide.

Significance in the Bio-Refining Industry

Isosorbide holds a pivotal role in the bio-refining industry, underscored by its utility in developing bio-based polymers and chemicals. As a diol, it is crucial in the synthesis of polymers like polyesters and polycarbonates, which are increasingly replacing conventional materials in the automotive, construction industry, and packaging sectors.

This transformation is facilitated by technological advancements in bio-refining, enabling more efficient and cost-effective conversion processes. The integration of isosorbide in bio-refining not only enhances the environmental appeal of end products but also contributes to the industry's economic viability, which is essential for its growth and sustainability.

Focus on High-Quality Products and Sustainability

The market's expansion is further supported by a focus on high-quality, sustainable products. Manufacturers of isosorbide are investing in R&D to improve the performance and application range of isosorbide-based derivatives, making them competitive with, or superior to, their petrochemical counterparts.

This investment not only meets the regulatory standards and eco-conscious market demands but also elevates the overall quality of products available. Consequently, the enhanced properties of these bio-based products, such as increased durability and safety, make them highly attractive to end-users, propelling market growth.

Restraining Factors

High Initial Investment Required for Development

The expansion of the Isosorbide Market is notably hindered by the high initial investments required for the development and production of isosorbide. Establishing bio-refining facilities, which are essential for the production of isosorbide, demands significant capital due to the sophisticated technology and equipment needed.

This high capital requirement can be a substantial barrier, especially for new entrants and smaller firms that may struggle to secure the necessary funding. Additionally, the costs associated with research and development of isosorbide-based products further escalate the financial burden. These economic challenges can slow down the pace of innovation and market entry, limiting the growth potential of the isosorbide market.

Regulatory Challenges Impacting Market Growth

Regulatory challenges also play a crucial role in shaping the isosorbide market, often acting as a brake on its growth. The production and use of bio-based chemicals are subject to stringent regulations, including safety, environmental impact assessments, and product certifications. Navigating these regulatory landscapes can be time-consuming and costly, deterring market entry and expansion.

Moreover, inconsistency in regulations across different regions or countries can complicate the global trade of isosorbide and its derivatives, affecting market scalability and operational efficiency. These regulatory hurdles can impede the pace at which new bio-based products are introduced to the market, thus restraining the overall market growth.

By End-use Analysis

Resins & Polymers lead Isosorbide's end-use, holding a dominant share of 52.4% in the market.

In 2023, Resins & Polymers held a dominant market position in the By End-use segment of the Isosorbide Market, capturing more than 52.4% share. This significant market share can be attributed to the increasing demand for sustainable and bio-based polymers across various industries, including automotive, packaging, and construction sectors. The robust properties of isosorbide-based resins, such as enhanced durability and heat resistance, coupled with their eco-friendly nature, have accelerated their adoption.

Following Resins & Polymers, the Additives segment also demonstrated a notable performance, leveraging isosorbide's application in improving polymer functionalities. This segment utilizes isosorbide as a plasticizer and a durability enhancer in polymers, which has promoted its integration into a range of consumer products, thereby driving market growth.

The 'Others' category, encompassing applications in sectors like pharmaceuticals, cosmetics, and food, although smaller in comparison, is experiencing gradual expansion. The utilization of isosorbide in these sectors can be largely linked to its biocompatibility and lower toxicity, making it a preferred ingredient in formulations that require stringent safety standards.

The collective expansion of these segments underscores the diversifying applications of isosorbide and its growing relevance in modern industrial applications. As industries continue to pivot towards sustainable raw materials, the isosorbide market is expected to maintain a steady growth trajectory, propelled by innovations and increasing environmental regulations. This trend suggests a promising outlook for the market's future, emphasizing the critical role of bio-based compounds in achieving broader sustainability goals.

By Application Analysis

Polyethylene Isosorbide Terephthalate (PEIT) is the top application, accounting for 26.3% of usage.

In 2023, Polyethylene Isosorbide Terephthalate (PEIT) held a dominant market position in the By Application segment of the Isosorbide Market, capturing more than a 26.3% share. The substantial market share of PEIT can be primarily attributed to its growing utilization in the packaging industry, where there is a high demand for sustainable and recyclable materials. PEIT offers superior thermal stability and mechanical properties, making it highly suitable for various packaging applications, which has fueled its adoption.

Following PEIT, the Polycarbonate segment marked its presence with significant growth, driven by the demand for high-performance, biobased plastics. Polycarbonates incorporating isosorbide are known for their enhanced optical properties and heat resistance, positioning them as ideal materials for automotive and electronics applications.

The Polyurethane foam segment also showed considerable growth, with isosorbide-based polyurethanes being used increasingly in foams and elastomers for their bio-based content and lower environmental impact. Similarly, Polyester Polyisosorbide Succinate (PIS) has been gaining traction due to its biodegradability, primarily in agricultural and packaging films.

Isosorbide Diesters have found applications in niche markets like personal care and cosmetics, attributed to their non-toxic and skin-friendly properties. The 'Others' category, which includes various emerging applications, is also contributing steadily to the market expansion.

Key Market Segments

By End-use

- Resins & Polymers

- Additives

- Others

By Application

- Polyethylene Isosorbide Terephthalate (PEIT)

- Polycarbonate

- Polyurethane

- Polyester Polyisosorbide Succinate (PIS)

- Isosorbide Diesters

- Others

Growth Opportunity

Growing Interest in Supercar Racing and Motorsports

The global Isosorbide market is poised to capitalize significantly from the burgeoning interest in supercar racing and motorsports. As these sports gain traction, particularly in affluent markets, the demand for high-performance materials that offer enhanced durability and weight reduction advantages increases.

Isosorbide, known for its rigidity and excellent thermal stability, emerges as a favorable biobased alternative for manufacturing components that require high mechanical strength and thermal resistance. This growing interest can be attributed to the continuous advancements in racing technologies and the increasing popularity of motorsports events, which stimulates demand for innovative materials in the automotive sector.

Increasing Disposable Income and Wealth in Developing Countries

The rise in disposable income and accumulating wealth in developing regions, particularly in Asia and Latin America, presents a substantial growth opportunity for the Isosorbide market. As economic conditions improve, there is a noticeable shift towards more sustainable and environmentally friendly products among middle-class consumers. Isosorbide, being a sustainable derivative of bio-based feedstock, aligns well with the evolving consumer preferences towards greener alternatives.

This shift is likely to drive the adoption of Isosorbide in various applications such as pharmaceuticals, personal care products, and bioplastics, where it serves as a key component in the formulation of eco-friendly products. The growth of the market in these regions can be largely attributed to the increased awareness and preference for sustainable living practices among the expanding middle class.

Latest Trends

Penetration into the Agriculture Sector

The global Isosorbide market is witnessing a notable trend as it penetrates deeper into the agriculture sector. With the intensifying need for sustainable agricultural practices, Isosorbide is increasingly utilized in the formulation of biodegradable polymers used for agricultural films and controlled-release agrochemicals. These applications benefit from Isosorbide's low toxicity and biodegradability, which minimize environmental impact while enhancing crop yield and soil health.

This trend reflects a broader shift within the agriculture industry towards more sustainable inputs, driven by regulatory pressures and growing environmental consciousness among farmers and agribusinesses. The market's expansion into this sector is further propelled by innovations that optimize the effectiveness and economic viability of Isosorbide-based products in agricultural applications.

Utilization in Printing Inks and Coatings

Another significant trend shaping the global Isosorbide market in 2023 is its increased utilization in printing inks and coatings. As industries seek safer and more sustainable alternatives to traditional petrochemical-based products, Isosorbide offers a viable solution with its excellent properties, such as high glass transition temperature and strong UV resistance. These attributes make it ideal for developing high-performance inks and coatings that are both environmentally friendly and capable of meeting the stringent demands of modern printing techniques.

The trend towards eco-friendly printing materials is driven by consumer preferences for greener products and regulatory mandates aimed at reducing VOC emissions. Isosorbide's role in this domain underscores its potential as a key ingredient in the formulation of next-generation coatings and inks that align with current environmental and safety standards.

Regional Analysis

The Isosorbide market in Asia Pacific commands a significant 32.5% share of the global market.

The Isosorbide market exhibits varied growth dynamics across global regions, influenced by regional industrial policies, end-use sectors, and technological adoption rates. North America, characterized by rigorous environmental regulations and high adoption of sustainable materials, shows a steady demand in sectors like pharmaceuticals and bioplastics. The presence of major pharmaceutical key companies and a shift towards eco-friendly materials support this growth, although specific numerical data would enhance precision in market sizing.

In Europe, the market benefits from strong governmental support for bio-based products, aligning with stringent EU sustainability directives. This region sees significant applications in the personal care and pharmaceutical sectors, driven by consumer preferences for natural ingredients and sustainable products. Europe's market dynamics are further bolstered by advanced chemical manufacturing capabilities and research & development initiatives.

Asia-Pacific is the dominant region in the Isosorbide market, holding a 53.8% share. This region's leadership is underpinned by rapid industrialization, expanding manufacturing sectors, and increasing penetration of biodegradable plastics. China and India, in particular, contribute significantly to regional demand due to their large agricultural sectors and governmental policies favoring bio-based chemicals.

The Middle East & Africa, though a smaller market, is gradually recognizing the potential of Isosorbide in water treatment and pharmaceuticals. Market growth in this region is likely to accelerate with economic diversification and industrial growth strategies that include sustainability.

Latin America shows potential for growth in the Isosorbide market, driven by its burgeoning pharmaceutical and cosmetic industries. Brazil and Argentina are pivotal, with their agricultural backgrounds providing raw materials for bio-based product manufacturing, though market development is uneven across the region.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of Middle East & Africa

Key Players Analysis

In 2023, the global Isosorbide market witnessed significant contributions from key players, including J&K Scientific Ltd., Jinan Hongbaifeng Industry & Trade Co., Ltd., Novaphene, Roquette Frères, and MANUS AKTTEVA BIOPHARMA LLP. These major companies played pivotal roles in shaping market dynamics through their strategic initiatives, product innovations, and market expansion efforts.

J&K Scientific Ltd., known for its expertise in chemical manufacturing and distribution, strengthened its position by focusing on research and development endeavors aimed at enhancing product quality and expanding application areas. The company's commitment to sustainability and regulatory compliance further bolstered its reputation among environmentally conscious consumers and industry stakeholders.

Jinan Hongbaifeng Industry & Trade Co., Ltd. capitalized on its extensive manufacturing capabilities and market presence to cater to the growing demand for Isosorbide in diverse industries. By leveraging its production efficiency and supply chain management expertise, the company ensured the timely delivery of high-quality Isosorbide products to global markets, thereby solidifying its position as a key player in the industry.

Novaphene emerged as a prominent player in the Isosorbide market by focusing on technological innovation and product differentiation. The company's investments in advanced manufacturing processes and product development initiatives enabled it to offer a diverse portfolio of Isosorbide derivatives tailored to meet specific customer requirements and market demands.

Roquette Frères, a global leader in plant-based ingredients, continued to expand its presence in the Isosorbide market by leveraging its extensive research capabilities and market insights. The company's strategic collaborations and partnerships facilitated the development of innovative Isosorbide-based solutions for various applications, ranging from pharmaceuticals to personal care products.

MANUS AKTTEVA BIOPHARMA LLP, with its focus on bio-based chemicals and pharmaceutical intermediates, contributed to the Isosorbide market through its commitment to quality, innovation, and sustainability. The company's emphasis on research-driven solutions and customer-centric approach positioned it as a reliable partner for Isosorbide supply chain requirements, thereby strengthening its foothold in the global market.

Market Key Players

- J&K Scientific Ltd.

- Jinan Hongbaifeng Industry & Trade Co., Ltd.

- Novaphene

- Roquette Frères

- MANUS AKTTEVA BIOPHARMA LLP

Recent Development

- In February 2024, Isosorbide, derived from sorbitol, offers oral care benefits by regulating the oral microbiome, reducing bad breath, and preventing tooth decay. It also hydrates skin and serves as a natural preservative booster.

- In January 2024, Roquette achieves ISCC PLUS certification for POLYSORB® isosorbide, showcasing its commitment to sustainable practices in plant-based ingredient production for various industries.

- In December 2021, Tokyo Institute of Technology developed an environmentally friendly process to chemically recycle bioplastics into fertilizers. The procedure is simple and uses ammonolysis to convert poly (isosorbide carbonate) into urea, benefiting agriculture and sustainability efforts.

Report Scope

Report Features Description Market Value (2023) USD 0.8 Billion Forecast Revenue (2033) USD 1.9 Billion CAGR (2024-2032) 9.1% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By End-use(Resins & Polymers, Additives, Others), By Application(Polyethylene Isosorbide Terephthalate (PEIT), Polycarbonate, Polyurethane, Polyester Polyisosorbide Succinate (PIS), Isosorbide Diesters, Others) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape J&K Scientific Ltd., Jinan Hongbaifeng Industry & Trade Co., Ltd., Novaphene, Roquette Frères, MANUS AKTTEVA BIOPHARMA LLP Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

- 1. Executive Summary

- 1.1. Definition

- 1.2. Taxonomy

- 1.3. Research Scope

- 1.4. Key Analysis

- 1.5. Key Findings by Major Segments

- 1.6. Top strategies by Major Players

- 2. Global Isosorbide Market Overview

- 2.1. Isosorbide Market Dynamics

- 2.1.1. Drivers

- 2.1.2. Opportunities

- 2.1.3. Restraints

- 2.1.4. Challenges

- 2.2. Macro-economic Factors

- 2.3. Regulatory Framework

- 2.4. Market Investment Feasibility Index

- 2.5. PEST Analysis

- 2.6. PORTER’S Five Force Analysis

- 2.7. Drivers & Restraints Impact Analysis

- 2.8. Industry Chain Analysis

- 2.9. Cost Structure Analysis

- 2.10. Marketing Strategy

- 2.11. Russia-Ukraine War Impact Analysis

- 2.12. Opportunity Map Analysis

- 2.13. Market Competition Scenario Analysis

- 2.14. Product Life Cycle Analysis

- 2.15. Opportunity Orbits

- 2.16. Manufacturer Intensity Map

- 2.17. Major Companies sales by Value & Volume

- 2.1. Isosorbide Market Dynamics

- 3. Global Isosorbide Market Analysis, Opportunity and Forecast, 2016-2032

- 3.1. Global Isosorbide Market Analysis, 2016-2021

- 3.2. Global Isosorbide Market Opportunity and Forecast, 2023-2032

- 3.3. Global Isosorbide Market Analysis, Opportunity and Forecast, By By End-use, 2016-2032

- 3.3.1. Global Isosorbide Market Analysis by By End-use: Introduction

- 3.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By End-use, 2016-2032

- 3.3.3. Resins & Polymers

- 3.3.4. Additives

- 3.3.5. Others

- 3.4. Global Isosorbide Market Analysis, Opportunity and Forecast, By By Application, 2016-2032

- 3.4.1. Global Isosorbide Market Analysis by By Application: Introduction

- 3.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Application, 2016-2032

- 3.4.3. Polyethylene Isosorbide Terephthalate (PEIT)

- 3.4.4. Polycarbonate

- 3.4.5. Polyurethane

- 3.4.6. Polyester Polyisosorbide Succinate (PIS)

- 3.4.7. Isosorbide Diesters

- 3.4.8. Others

- 4. North America Isosorbide Market Analysis, Opportunity and Forecast, 2016-2032

- 4.1. North America Isosorbide Market Analysis, 2016-2021

- 4.2. North America Isosorbide Market Opportunity and Forecast, 2023-2032

- 4.3. North America Isosorbide Market Analysis, Opportunity and Forecast, By By End-use, 2016-2032

- 4.3.1. North America Isosorbide Market Analysis by By End-use: Introduction

- 4.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By End-use, 2016-2032

- 4.3.3. Resins & Polymers

- 4.3.4. Additives

- 4.3.5. Others

- 4.4. North America Isosorbide Market Analysis, Opportunity and Forecast, By By Application, 2016-2032

- 4.4.1. North America Isosorbide Market Analysis by By Application: Introduction

- 4.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Application, 2016-2032

- 4.4.3. Polyethylene Isosorbide Terephthalate (PEIT)

- 4.4.4. Polycarbonate

- 4.4.5. Polyurethane

- 4.4.6. Polyester Polyisosorbide Succinate (PIS)

- 4.4.7. Isosorbide Diesters

- 4.4.8. Others

- 4.5. North America Isosorbide Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 4.5.1. North America Isosorbide Market Analysis by Country : Introduction

- 4.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 4.5.2.1. The US

- 4.5.2.2. Canada

- 4.5.2.3. Mexico

- 5. Western Europe Isosorbide Market Analysis, Opportunity and Forecast, 2016-2032

- 5.1. Western Europe Isosorbide Market Analysis, 2016-2021

- 5.2. Western Europe Isosorbide Market Opportunity and Forecast, 2023-2032

- 5.3. Western Europe Isosorbide Market Analysis, Opportunity and Forecast, By By End-use, 2016-2032

- 5.3.1. Western Europe Isosorbide Market Analysis by By End-use: Introduction

- 5.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By End-use, 2016-2032

- 5.3.3. Resins & Polymers

- 5.3.4. Additives

- 5.3.5. Others

- 5.4. Western Europe Isosorbide Market Analysis, Opportunity and Forecast, By By Application, 2016-2032

- 5.4.1. Western Europe Isosorbide Market Analysis by By Application: Introduction

- 5.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Application, 2016-2032

- 5.4.3. Polyethylene Isosorbide Terephthalate (PEIT)

- 5.4.4. Polycarbonate

- 5.4.5. Polyurethane

- 5.4.6. Polyester Polyisosorbide Succinate (PIS)

- 5.4.7. Isosorbide Diesters

- 5.4.8. Others

- 5.5. Western Europe Isosorbide Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 5.5.1. Western Europe Isosorbide Market Analysis by Country : Introduction

- 5.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 5.5.2.1. Germany

- 5.5.2.2. France

- 5.5.2.3. The UK

- 5.5.2.4. Spain

- 5.5.2.5. Italy

- 5.5.2.6. Portugal

- 5.5.2.7. Ireland

- 5.5.2.8. Austria

- 5.5.2.9. Switzerland

- 5.5.2.10. Benelux

- 5.5.2.11. Nordic

- 5.5.2.12. Rest of Western Europe

- 6. Eastern Europe Isosorbide Market Analysis, Opportunity and Forecast, 2016-2032

- 6.1. Eastern Europe Isosorbide Market Analysis, 2016-2021

- 6.2. Eastern Europe Isosorbide Market Opportunity and Forecast, 2023-2032

- 6.3. Eastern Europe Isosorbide Market Analysis, Opportunity and Forecast, By By End-use, 2016-2032

- 6.3.1. Eastern Europe Isosorbide Market Analysis by By End-use: Introduction

- 6.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By End-use, 2016-2032

- 6.3.3. Resins & Polymers

- 6.3.4. Additives

- 6.3.5. Others

- 6.4. Eastern Europe Isosorbide Market Analysis, Opportunity and Forecast, By By Application, 2016-2032

- 6.4.1. Eastern Europe Isosorbide Market Analysis by By Application: Introduction

- 6.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Application, 2016-2032

- 6.4.3. Polyethylene Isosorbide Terephthalate (PEIT)

- 6.4.4. Polycarbonate

- 6.4.5. Polyurethane

- 6.4.6. Polyester Polyisosorbide Succinate (PIS)

- 6.4.7. Isosorbide Diesters

- 6.4.8. Others

- 6.5. Eastern Europe Isosorbide Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 6.5.1. Eastern Europe Isosorbide Market Analysis by Country : Introduction

- 6.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 6.5.2.1. Russia

- 6.5.2.2. Poland

- 6.5.2.3. The Czech Republic

- 6.5.2.4. Greece

- 6.5.2.5. Rest of Eastern Europe

- 7. APAC Isosorbide Market Analysis, Opportunity and Forecast, 2016-2032

- 7.1. APAC Isosorbide Market Analysis, 2016-2021

- 7.2. APAC Isosorbide Market Opportunity and Forecast, 2023-2032

- 7.3. APAC Isosorbide Market Analysis, Opportunity and Forecast, By By End-use, 2016-2032

- 7.3.1. APAC Isosorbide Market Analysis by By End-use: Introduction

- 7.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By End-use, 2016-2032

- 7.3.3. Resins & Polymers

- 7.3.4. Additives

- 7.3.5. Others

- 7.4. APAC Isosorbide Market Analysis, Opportunity and Forecast, By By Application, 2016-2032

- 7.4.1. APAC Isosorbide Market Analysis by By Application: Introduction

- 7.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Application, 2016-2032

- 7.4.3. Polyethylene Isosorbide Terephthalate (PEIT)

- 7.4.4. Polycarbonate

- 7.4.5. Polyurethane

- 7.4.6. Polyester Polyisosorbide Succinate (PIS)

- 7.4.7. Isosorbide Diesters

- 7.4.8. Others

- 7.5. APAC Isosorbide Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 7.5.1. APAC Isosorbide Market Analysis by Country : Introduction

- 7.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 7.5.2.1. China

- 7.5.2.2. Japan

- 7.5.2.3. South Korea

- 7.5.2.4. India

- 7.5.2.5. Australia & New Zeland

- 7.5.2.6. Indonesia

- 7.5.2.7. Malaysia

- 7.5.2.8. Philippines

- 7.5.2.9. Singapore

- 7.5.2.10. Thailand

- 7.5.2.11. Vietnam

- 7.5.2.12. Rest of APAC

- 8. Latin America Isosorbide Market Analysis, Opportunity and Forecast, 2016-2032

- 8.1. Latin America Isosorbide Market Analysis, 2016-2021

- 8.2. Latin America Isosorbide Market Opportunity and Forecast, 2023-2032

- 8.3. Latin America Isosorbide Market Analysis, Opportunity and Forecast, By By End-use, 2016-2032

- 8.3.1. Latin America Isosorbide Market Analysis by By End-use: Introduction

- 8.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By End-use, 2016-2032

- 8.3.3. Resins & Polymers

- 8.3.4. Additives

- 8.3.5. Others

- 8.4. Latin America Isosorbide Market Analysis, Opportunity and Forecast, By By Application, 2016-2032

- 8.4.1. Latin America Isosorbide Market Analysis by By Application: Introduction

- 8.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Application, 2016-2032

- 8.4.3. Polyethylene Isosorbide Terephthalate (PEIT)

- 8.4.4. Polycarbonate

- 8.4.5. Polyurethane

- 8.4.6. Polyester Polyisosorbide Succinate (PIS)

- 8.4.7. Isosorbide Diesters

- 8.4.8. Others

- 8.5. Latin America Isosorbide Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 8.5.1. Latin America Isosorbide Market Analysis by Country : Introduction

- 8.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 8.5.2.1. Brazil

- 8.5.2.2. Colombia

- 8.5.2.3. Chile

- 8.5.2.4. Argentina

- 8.5.2.5. Costa Rica

- 8.5.2.6. Rest of Latin America

- 9. Middle East & Africa Isosorbide Market Analysis, Opportunity and Forecast, 2016-2032

- 9.1. Middle East & Africa Isosorbide Market Analysis, 2016-2021

- 9.2. Middle East & Africa Isosorbide Market Opportunity and Forecast, 2023-2032

- 9.3. Middle East & Africa Isosorbide Market Analysis, Opportunity and Forecast, By By End-use, 2016-2032

- 9.3.1. Middle East & Africa Isosorbide Market Analysis by By End-use: Introduction

- 9.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By End-use, 2016-2032

- 9.3.3. Resins & Polymers

- 9.3.4. Additives

- 9.3.5. Others

- 9.4. Middle East & Africa Isosorbide Market Analysis, Opportunity and Forecast, By By Application, 2016-2032

- 9.4.1. Middle East & Africa Isosorbide Market Analysis by By Application: Introduction

- 9.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Application, 2016-2032

- 9.4.3. Polyethylene Isosorbide Terephthalate (PEIT)

- 9.4.4. Polycarbonate

- 9.4.5. Polyurethane

- 9.4.6. Polyester Polyisosorbide Succinate (PIS)

- 9.4.7. Isosorbide Diesters

- 9.4.8. Others

- 9.5. Middle East & Africa Isosorbide Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 9.5.1. Middle East & Africa Isosorbide Market Analysis by Country : Introduction

- 9.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 9.5.2.1. Algeria

- 9.5.2.2. Egypt

- 9.5.2.3. Israel

- 9.5.2.4. Kuwait

- 9.5.2.5. Nigeria

- 9.5.2.6. Saudi Arabia

- 9.5.2.7. South Africa

- 9.5.2.8. Turkey

- 9.5.2.9. The UAE

- 9.5.2.10. Rest of MEA

- 10. Global Isosorbide Market Analysis, Opportunity and Forecast, By Region , 2016-2032

- 10.1. Global Isosorbide Market Analysis by Region : Introduction

- 10.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Region , 2016-2032

- 10.2.1. North America

- 10.2.2. Western Europe

- 10.2.3. Eastern Europe

- 10.2.4. APAC

- 10.2.5. Latin America

- 10.2.6. Middle East & Africa

- 11. Global Isosorbide Market Competitive Landscape, Market Share Analysis, and Company Profiles

- 11.1. Market Share Analysis

- 11.2. Company Profiles

- 11.3. J&K Scientific Ltd.

- 11.3.1. Company Overview

- 11.3.2. Financial Highlights

- 11.3.3. Product Portfolio

- 11.3.4. SWOT Analysis

- 11.3.5. Key Strategies and Developments

- 11.4. Jinan Hongbaifeng Industry & Trade Co., Ltd.

- 11.4.1. Company Overview

- 11.4.2. Financial Highlights

- 11.4.3. Product Portfolio

- 11.4.4. SWOT Analysis

- 11.4.5. Key Strategies and Developments

- 11.5. Novaphene

- 11.5.1. Company Overview

- 11.5.2. Financial Highlights

- 11.5.3. Product Portfolio

- 11.5.4. SWOT Analysis

- 11.5.5. Key Strategies and Developments

- 11.6. Roquette Frères

- 11.6.1. Company Overview

- 11.6.2. Financial Highlights

- 11.6.3. Product Portfolio

- 11.6.4. SWOT Analysis

- 11.6.5. Key Strategies and Developments

- 11.7. MANUS AKTTEVA BIOPHARMA LLP

- 11.7.1. Company Overview

- 11.7.2. Financial Highlights

- 11.7.3. Product Portfolio

- 11.7.4. SWOT Analysis

- 11.7.5. Key Strategies and Developments

- 11.13.1. Company Overview

- 11.13.2. Financial Highlights

- 11.13.3. Product Portfolio

- 11.13.4. SWOT Analysis

- 11.13.5. Key Strategies and Developments

- 12. Assumptions and Acronyms

- 13. Research Methodology

- 14. Contact

"

- List of Figures

- "

- Figure 1: Global Isosorbide Market Revenue (US$ Mn) Market Share by By End-use in 2022

- Figure 2: Global Isosorbide Market Market Attractiveness Analysis by By End-use, 2016-2032

- Figure 3: Global Isosorbide Market Revenue (US$ Mn) Market Share by By Applicationin 2022

- Figure 4: Global Isosorbide Market Market Attractiveness Analysis by By Application, 2016-2032

- Figure 5: Global Isosorbide Market Revenue (US$ Mn) Market Share by Region in 2022

- Figure 6: Global Isosorbide Market Market Attractiveness Analysis by Region, 2016-2032

- Figure 7: Global Isosorbide Market Market Revenue (US$ Mn) (2016-2032)

- Figure 8: Global Isosorbide Market Market Revenue (US$ Mn) Comparison by Region (2016-2032)

- Figure 9: Global Isosorbide Market Market Revenue (US$ Mn) Comparison by By End-use (2016-2032)

- Figure 10: Global Isosorbide Market Market Revenue (US$ Mn) Comparison by By Application (2016-2032)

- Figure 11: Global Isosorbide Market Market Y-o-Y Growth Rate Comparison by Region (2016-2032)

- Figure 12: Global Isosorbide Market Market Y-o-Y Growth Rate Comparison by By End-use (2016-2032)

- Figure 13: Global Isosorbide Market Market Y-o-Y Growth Rate Comparison by By Application (2016-2032)

- Figure 14: Global Isosorbide Market Market Share Comparison by Region (2016-2032)

- Figure 15: Global Isosorbide Market Market Share Comparison by By End-use (2016-2032)

- Figure 16: Global Isosorbide Market Market Share Comparison by By Application (2016-2032)

- Figure 17: North America Isosorbide Market Revenue (US$ Mn) Market Share by By End-usein 2022

- Figure 18: North America Isosorbide Market Market Attractiveness Analysis by By End-use, 2016-2032

- Figure 19: North America Isosorbide Market Revenue (US$ Mn) Market Share by By Applicationin 2022

- Figure 20: North America Isosorbide Market Market Attractiveness Analysis by By Application, 2016-2032

- Figure 21: North America Isosorbide Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 22: North America Isosorbide Market Market Attractiveness Analysis by Country, 2016-2032

- Figure 23: North America Isosorbide Market Market Revenue (US$ Mn) (2016-2032)

- Figure 24: North America Isosorbide Market Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 25: North America Isosorbide Market Market Revenue (US$ Mn) Comparison by By End-use (2016-2032)

- Figure 26: North America Isosorbide Market Market Revenue (US$ Mn) Comparison by By Application (2016-2032)

- Figure 27: North America Isosorbide Market Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 28: North America Isosorbide Market Market Y-o-Y Growth Rate Comparison by By End-use (2016-2032)

- Figure 29: North America Isosorbide Market Market Y-o-Y Growth Rate Comparison by By Application (2016-2032)

- Figure 30: North America Isosorbide Market Market Share Comparison by Country (2016-2032)

- Figure 31: North America Isosorbide Market Market Share Comparison by By End-use (2016-2032)

- Figure 32: North America Isosorbide Market Market Share Comparison by By Application (2016-2032)

- Figure 33: Western Europe Isosorbide Market Revenue (US$ Mn) Market Share by By End-usein 2022

- Figure 34: Western Europe Isosorbide Market Market Attractiveness Analysis by By End-use, 2016-2032

- Figure 35: Western Europe Isosorbide Market Revenue (US$ Mn) Market Share by By Applicationin 2022

- Figure 36: Western Europe Isosorbide Market Market Attractiveness Analysis by By Application, 2016-2032

- Figure 37: Western Europe Isosorbide Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 38: Western Europe Isosorbide Market Market Attractiveness Analysis by Country, 2016-2032

- Figure 39: Western Europe Isosorbide Market Market Revenue (US$ Mn) (2016-2032)

- Figure 40: Western Europe Isosorbide Market Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 41: Western Europe Isosorbide Market Market Revenue (US$ Mn) Comparison by By End-use (2016-2032)

- Figure 42: Western Europe Isosorbide Market Market Revenue (US$ Mn) Comparison by By Application (2016-2032)

- Figure 43: Western Europe Isosorbide Market Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 44: Western Europe Isosorbide Market Market Y-o-Y Growth Rate Comparison by By End-use (2016-2032)

- Figure 45: Western Europe Isosorbide Market Market Y-o-Y Growth Rate Comparison by By Application (2016-2032)

- Figure 46: Western Europe Isosorbide Market Market Share Comparison by Country (2016-2032)

- Figure 47: Western Europe Isosorbide Market Market Share Comparison by By End-use (2016-2032)

- Figure 48: Western Europe Isosorbide Market Market Share Comparison by By Application (2016-2032)

- Figure 49: Eastern Europe Isosorbide Market Revenue (US$ Mn) Market Share by By End-usein 2022

- Figure 50: Eastern Europe Isosorbide Market Market Attractiveness Analysis by By End-use, 2016-2032

- Figure 51: Eastern Europe Isosorbide Market Revenue (US$ Mn) Market Share by By Applicationin 2022

- Figure 52: Eastern Europe Isosorbide Market Market Attractiveness Analysis by By Application, 2016-2032

- Figure 53: Eastern Europe Isosorbide Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 54: Eastern Europe Isosorbide Market Market Attractiveness Analysis by Country, 2016-2032

- Figure 55: Eastern Europe Isosorbide Market Market Revenue (US$ Mn) (2016-2032)

- Figure 56: Eastern Europe Isosorbide Market Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 57: Eastern Europe Isosorbide Market Market Revenue (US$ Mn) Comparison by By End-use (2016-2032)

- Figure 58: Eastern Europe Isosorbide Market Market Revenue (US$ Mn) Comparison by By Application (2016-2032)

- Figure 59: Eastern Europe Isosorbide Market Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 60: Eastern Europe Isosorbide Market Market Y-o-Y Growth Rate Comparison by By End-use (2016-2032)

- Figure 61: Eastern Europe Isosorbide Market Market Y-o-Y Growth Rate Comparison by By Application (2016-2032)

- Figure 62: Eastern Europe Isosorbide Market Market Share Comparison by Country (2016-2032)

- Figure 63: Eastern Europe Isosorbide Market Market Share Comparison by By End-use (2016-2032)

- Figure 64: Eastern Europe Isosorbide Market Market Share Comparison by By Application (2016-2032)

- Figure 65: APAC Isosorbide Market Revenue (US$ Mn) Market Share by By End-usein 2022

- Figure 66: APAC Isosorbide Market Market Attractiveness Analysis by By End-use, 2016-2032

- Figure 67: APAC Isosorbide Market Revenue (US$ Mn) Market Share by By Applicationin 2022

- Figure 68: APAC Isosorbide Market Market Attractiveness Analysis by By Application, 2016-2032

- Figure 69: APAC Isosorbide Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 70: APAC Isosorbide Market Market Attractiveness Analysis by Country, 2016-2032

- Figure 71: APAC Isosorbide Market Market Revenue (US$ Mn) (2016-2032)

- Figure 72: APAC Isosorbide Market Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 73: APAC Isosorbide Market Market Revenue (US$ Mn) Comparison by By End-use (2016-2032)

- Figure 74: APAC Isosorbide Market Market Revenue (US$ Mn) Comparison by By Application (2016-2032)

- Figure 75: APAC Isosorbide Market Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 76: APAC Isosorbide Market Market Y-o-Y Growth Rate Comparison by By End-use (2016-2032)

- Figure 77: APAC Isosorbide Market Market Y-o-Y Growth Rate Comparison by By Application (2016-2032)

- Figure 78: APAC Isosorbide Market Market Share Comparison by Country (2016-2032)

- Figure 79: APAC Isosorbide Market Market Share Comparison by By End-use (2016-2032)

- Figure 80: APAC Isosorbide Market Market Share Comparison by By Application (2016-2032)

- Figure 81: Latin America Isosorbide Market Revenue (US$ Mn) Market Share by By End-usein 2022

- Figure 82: Latin America Isosorbide Market Market Attractiveness Analysis by By End-use, 2016-2032

- Figure 83: Latin America Isosorbide Market Revenue (US$ Mn) Market Share by By Applicationin 2022

- Figure 84: Latin America Isosorbide Market Market Attractiveness Analysis by By Application, 2016-2032

- Figure 85: Latin America Isosorbide Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 86: Latin America Isosorbide Market Market Attractiveness Analysis by Country, 2016-2032

- Figure 87: Latin America Isosorbide Market Market Revenue (US$ Mn) (2016-2032)

- Figure 88: Latin America Isosorbide Market Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 89: Latin America Isosorbide Market Market Revenue (US$ Mn) Comparison by By End-use (2016-2032)

- Figure 90: Latin America Isosorbide Market Market Revenue (US$ Mn) Comparison by By Application (2016-2032)

- Figure 91: Latin America Isosorbide Market Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 92: Latin America Isosorbide Market Market Y-o-Y Growth Rate Comparison by By End-use (2016-2032)

- Figure 93: Latin America Isosorbide Market Market Y-o-Y Growth Rate Comparison by By Application (2016-2032)

- Figure 94: Latin America Isosorbide Market Market Share Comparison by Country (2016-2032)

- Figure 95: Latin America Isosorbide Market Market Share Comparison by By End-use (2016-2032)

- Figure 96: Latin America Isosorbide Market Market Share Comparison by By Application (2016-2032)

- Figure 97: Middle East & Africa Isosorbide Market Revenue (US$ Mn) Market Share by By End-usein 2022

- Figure 98: Middle East & Africa Isosorbide Market Market Attractiveness Analysis by By End-use, 2016-2032

- Figure 99: Middle East & Africa Isosorbide Market Revenue (US$ Mn) Market Share by By Applicationin 2022

- Figure 100: Middle East & Africa Isosorbide Market Market Attractiveness Analysis by By Application, 2016-2032

- Figure 101: Middle East & Africa Isosorbide Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 102: Middle East & Africa Isosorbide Market Market Attractiveness Analysis by Country, 2016-2032

- Figure 103: Middle East & Africa Isosorbide Market Market Revenue (US$ Mn) (2016-2032)

- Figure 104: Middle East & Africa Isosorbide Market Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 105: Middle East & Africa Isosorbide Market Market Revenue (US$ Mn) Comparison by By End-use (2016-2032)

- Figure 106: Middle East & Africa Isosorbide Market Market Revenue (US$ Mn) Comparison by By Application (2016-2032)

- Figure 107: Middle East & Africa Isosorbide Market Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 108: Middle East & Africa Isosorbide Market Market Y-o-Y Growth Rate Comparison by By End-use (2016-2032)

- Figure 109: Middle East & Africa Isosorbide Market Market Y-o-Y Growth Rate Comparison by By Application (2016-2032)

- Figure 110: Middle East & Africa Isosorbide Market Market Share Comparison by Country (2016-2032)

- Figure 111: Middle East & Africa Isosorbide Market Market Share Comparison by By End-use (2016-2032)

- Figure 112: Middle East & Africa Isosorbide Market Market Share Comparison by By Application (2016-2032)

"

- List of Tables

- "

- Table 1: Global Isosorbide Market Market Comparison by By End-use (2016-2032)

- Table 2: Global Isosorbide Market Market Comparison by By Application (2016-2032)

- Table 3: Global Isosorbide Market Revenue (US$ Mn) Comparison by Region (2016-2032)

- Table 4: Global Isosorbide Market Market Revenue (US$ Mn) (2016-2032)

- Table 5: Global Isosorbide Market Market Revenue (US$ Mn) Comparison by Region (2016-2032)

- Table 6: Global Isosorbide Market Market Revenue (US$ Mn) Comparison by By End-use (2016-2032)

- Table 7: Global Isosorbide Market Market Revenue (US$ Mn) Comparison by By Application (2016-2032)

- Table 8: Global Isosorbide Market Market Y-o-Y Growth Rate Comparison by Region (2016-2032)

- Table 9: Global Isosorbide Market Market Y-o-Y Growth Rate Comparison by By End-use (2016-2032)

- Table 10: Global Isosorbide Market Market Y-o-Y Growth Rate Comparison by By Application (2016-2032)

- Table 11: Global Isosorbide Market Market Share Comparison by Region (2016-2032)

- Table 12: Global Isosorbide Market Market Share Comparison by By End-use (2016-2032)

- Table 13: Global Isosorbide Market Market Share Comparison by By Application (2016-2032)

- Table 14: North America Isosorbide Market Market Comparison by By Application (2016-2032)

- Table 15: North America Isosorbide Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 16: North America Isosorbide Market Market Revenue (US$ Mn) (2016-2032)

- Table 17: North America Isosorbide Market Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 18: North America Isosorbide Market Market Revenue (US$ Mn) Comparison by By End-use (2016-2032)

- Table 19: North America Isosorbide Market Market Revenue (US$ Mn) Comparison by By Application (2016-2032)

- Table 20: North America Isosorbide Market Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 21: North America Isosorbide Market Market Y-o-Y Growth Rate Comparison by By End-use (2016-2032)

- Table 22: North America Isosorbide Market Market Y-o-Y Growth Rate Comparison by By Application (2016-2032)

- Table 23: North America Isosorbide Market Market Share Comparison by Country (2016-2032)

- Table 24: North America Isosorbide Market Market Share Comparison by By End-use (2016-2032)

- Table 25: North America Isosorbide Market Market Share Comparison by By Application (2016-2032)

- Table 26: Western Europe Isosorbide Market Market Comparison by By End-use (2016-2032)

- Table 27: Western Europe Isosorbide Market Market Comparison by By Application (2016-2032)

- Table 28: Western Europe Isosorbide Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 29: Western Europe Isosorbide Market Market Revenue (US$ Mn) (2016-2032)

- Table 30: Western Europe Isosorbide Market Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 31: Western Europe Isosorbide Market Market Revenue (US$ Mn) Comparison by By End-use (2016-2032)

- Table 32: Western Europe Isosorbide Market Market Revenue (US$ Mn) Comparison by By Application (2016-2032)

- Table 33: Western Europe Isosorbide Market Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 34: Western Europe Isosorbide Market Market Y-o-Y Growth Rate Comparison by By End-use (2016-2032)

- Table 35: Western Europe Isosorbide Market Market Y-o-Y Growth Rate Comparison by By Application (2016-2032)

- Table 36: Western Europe Isosorbide Market Market Share Comparison by Country (2016-2032)

- Table 37: Western Europe Isosorbide Market Market Share Comparison by By End-use (2016-2032)

- Table 38: Western Europe Isosorbide Market Market Share Comparison by By Application (2016-2032)

- Table 39: Eastern Europe Isosorbide Market Market Comparison by By End-use (2016-2032)

- Table 40: Eastern Europe Isosorbide Market Market Comparison by By Application (2016-2032)

- Table 41: Eastern Europe Isosorbide Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 42: Eastern Europe Isosorbide Market Market Revenue (US$ Mn) (2016-2032)

- Table 43: Eastern Europe Isosorbide Market Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 44: Eastern Europe Isosorbide Market Market Revenue (US$ Mn) Comparison by By End-use (2016-2032)

- Table 45: Eastern Europe Isosorbide Market Market Revenue (US$ Mn) Comparison by By Application (2016-2032)

- Table 46: Eastern Europe Isosorbide Market Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 47: Eastern Europe Isosorbide Market Market Y-o-Y Growth Rate Comparison by By End-use (2016-2032)

- Table 48: Eastern Europe Isosorbide Market Market Y-o-Y Growth Rate Comparison by By Application (2016-2032)

- Table 49: Eastern Europe Isosorbide Market Market Share Comparison by Country (2016-2032)

- Table 50: Eastern Europe Isosorbide Market Market Share Comparison by By End-use (2016-2032)

- Table 51: Eastern Europe Isosorbide Market Market Share Comparison by By Application (2016-2032)

- Table 52: APAC Isosorbide Market Market Comparison by By End-use (2016-2032)

- Table 53: APAC Isosorbide Market Market Comparison by By Application (2016-2032)

- Table 54: APAC Isosorbide Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 55: APAC Isosorbide Market Market Revenue (US$ Mn) (2016-2032)

- Table 56: APAC Isosorbide Market Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 57: APAC Isosorbide Market Market Revenue (US$ Mn) Comparison by By End-use (2016-2032)

- Table 58: APAC Isosorbide Market Market Revenue (US$ Mn) Comparison by By Application (2016-2032)

- Table 59: APAC Isosorbide Market Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 60: APAC Isosorbide Market Market Y-o-Y Growth Rate Comparison by By End-use (2016-2032)

- Table 61: APAC Isosorbide Market Market Y-o-Y Growth Rate Comparison by By Application (2016-2032)

- Table 62: APAC Isosorbide Market Market Share Comparison by Country (2016-2032)

- Table 63: APAC Isosorbide Market Market Share Comparison by By End-use (2016-2032)

- Table 64: APAC Isosorbide Market Market Share Comparison by By Application (2016-2032)

- Table 65: Latin America Isosorbide Market Market Comparison by By End-use (2016-2032)

- Table 66: Latin America Isosorbide Market Market Comparison by By Application (2016-2032)

- Table 67: Latin America Isosorbide Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 68: Latin America Isosorbide Market Market Revenue (US$ Mn) (2016-2032)

- Table 69: Latin America Isosorbide Market Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 70: Latin America Isosorbide Market Market Revenue (US$ Mn) Comparison by By End-use (2016-2032)

- Table 71: Latin America Isosorbide Market Market Revenue (US$ Mn) Comparison by By Application (2016-2032)

- Table 72: Latin America Isosorbide Market Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 73: Latin America Isosorbide Market Market Y-o-Y Growth Rate Comparison by By End-use (2016-2032)

- Table 74: Latin America Isosorbide Market Market Y-o-Y Growth Rate Comparison by By Application (2016-2032)

- Table 75: Latin America Isosorbide Market Market Share Comparison by Country (2016-2032)

- Table 76: Latin America Isosorbide Market Market Share Comparison by By End-use (2016-2032)

- Table 77: Latin America Isosorbide Market Market Share Comparison by By Application (2016-2032)

- Table 78: Middle East & Africa Isosorbide Market Market Comparison by By End-use (2016-2032)

- Table 79: Middle East & Africa Isosorbide Market Market Comparison by By Application (2016-2032)

- Table 80: Middle East & Africa Isosorbide Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 81: Middle East & Africa Isosorbide Market Market Revenue (US$ Mn) (2016-2032)

- Table 82: Middle East & Africa Isosorbide Market Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 83: Middle East & Africa Isosorbide Market Market Revenue (US$ Mn) Comparison by By End-use (2016-2032)

- Table 84: Middle East & Africa Isosorbide Market Market Revenue (US$ Mn) Comparison by By Application (2016-2032)

- Table 85: Middle East & Africa Isosorbide Market Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 86: Middle East & Africa Isosorbide Market Market Y-o-Y Growth Rate Comparison by By End-use (2016-2032)

- Table 87: Middle East & Africa Isosorbide Market Market Y-o-Y Growth Rate Comparison by By Application (2016-2032)

- Table 88: Middle East & Africa Isosorbide Market Market Share Comparison by Country (2016-2032)

- Table 89: Middle East & Africa Isosorbide Market Market Share Comparison by By End-use (2016-2032)

- Table 90: Middle East & Africa Isosorbide Market Market Share Comparison by By Application (2016-2032)

- 1. Executive Summary

-

- J&K Scientific Ltd.

- Jinan Hongbaifeng Industry & Trade Co., Ltd.

- Novaphene

- Roquette Frères

- MANUS AKTTEVA BIOPHARMA LLP