Insulin Pumps Market By Type (Tethered Pumps, Patch Pumps, Consumables) By End-User (Hospital And Clinics, Home Care, Laboratories, And Others), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2023-2032

-

589

-

Oct 2023

-

184

-

-

This report was compiled by Correspondence Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Report Overview

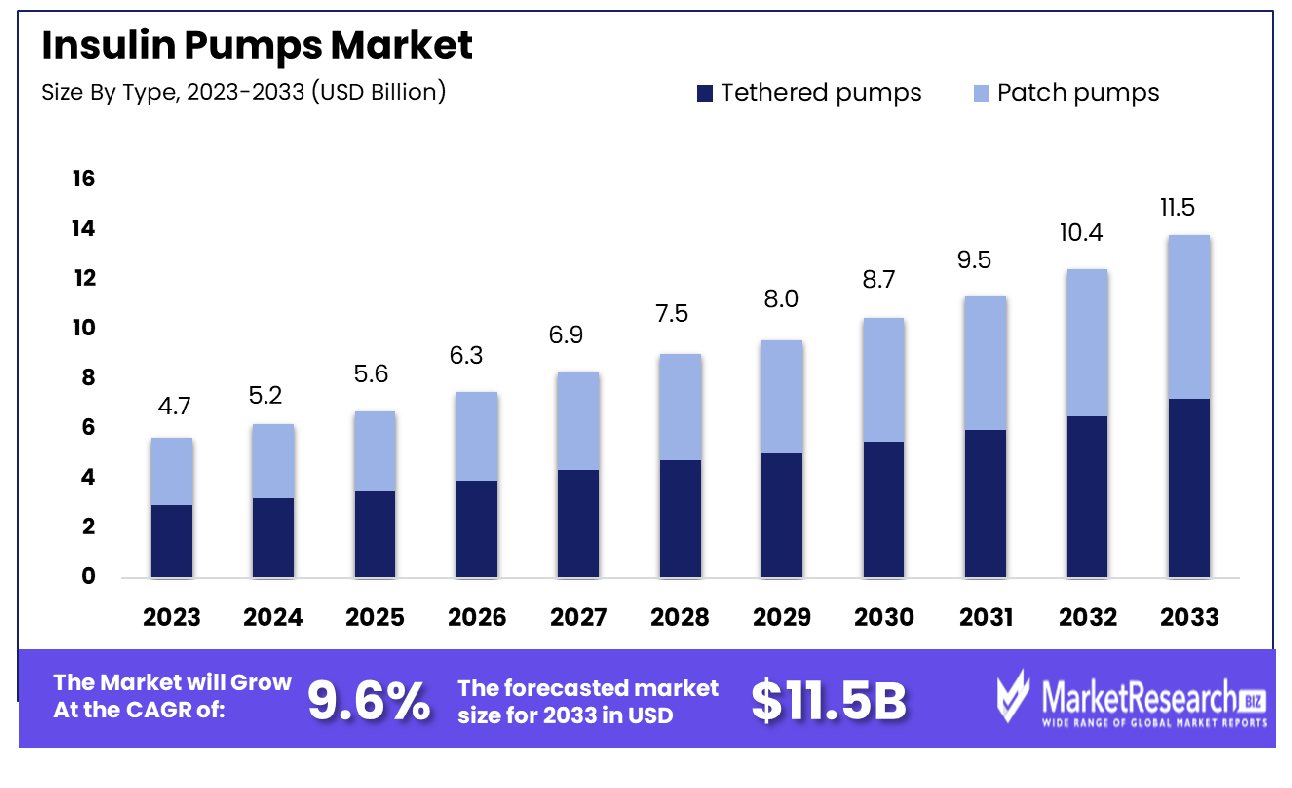

The Global Insulin Pumps Market was valued at USD 4.7 billion in 2023. It is expected to reach USD 11.5 billion by 2033, with a CAGR of 9.6% during the forecast period from 2024 to 2033. The surge in demand in the medical sector, rise in diabetes and other chronic disease, and change in customer lifestyles are some of the main key driving factors for Insulin pumps.

An insulin pump is defined as a small, computerized equipment to help manage diabetes by offering insulin through a small tube injected under the skin. The pump functions to deliver a steady basal rate of insulin throughout the day, replicating the natural release of insulin by the pancreas. Moreover, it permits to maintenance of insulin doses based on factors such as meals, blood glucose levels, and exercise.

Such suppleness provides better control over blood sugar levels and decreases the chance of complications related to diabetes. Insulin pumps provide easy accessibility, freedom, and enhanced quality of life for people suffering from diabetes by making them better handle their condition and maintain unwavering blood sugar levels with greater accuracy and ease.

According to Fierce Biotech in March 2024, the Deka-designed, Tidepool-powered automated insulin pump makes a new way for type 1 diabetes. Sequel Med Tech plans to dispense the twist pump through various pharmacies as a convenient way for individuals with type 1 diabetes aged 6 and above, to start insulin delivery. Additionally, Medtronic in April 2023, highlights that the FDA has approved the Medtronic MiniMed TM 780G system which world’s first insulin pump with meal detection technology that features 5-minute auto-corrections.

This pump has an infusion set that can be used for up to 7 days which doubles the war time with advanced materials that can aid in decreasing the chance of insulin infusion pump set occlusion. Integrated with the new Guardian TM 4 sensors need no fingersticks with SmartGuard technology, the Minimed 780G system offers a user-friendly design with 94% of users mentioning satisfaction with the effect that the system has given in maintaining a good quality of life. Most importantly, the individuals who are using these pumps have also stated that SmartGuard TM technology is 95% of the time.

Insulin pumps have great advantages such as improving integration with constant glucose monitoring systems for real-time blood sugar monitoring, personalized basal rates to better match the individuals’ requirements, and smaller, more inconspicuous designs for enhanced comfort and easiness in everyday life. The demand for insulin pumps will increase due to their requirement in the medical sector which will help in market expansion in the coming years.

Key Takeaways

- Market Growth: Global Insulin Pumps Market was valued at USD 4.7 billion in 2023. It is expected to reach USD 11.5 billion by 2033, with a CAGR of 9.6% during the forecast period from 2024 to 2033.

- By Type: Tethered pumps lead market share, accounting for 79.6% dominance.

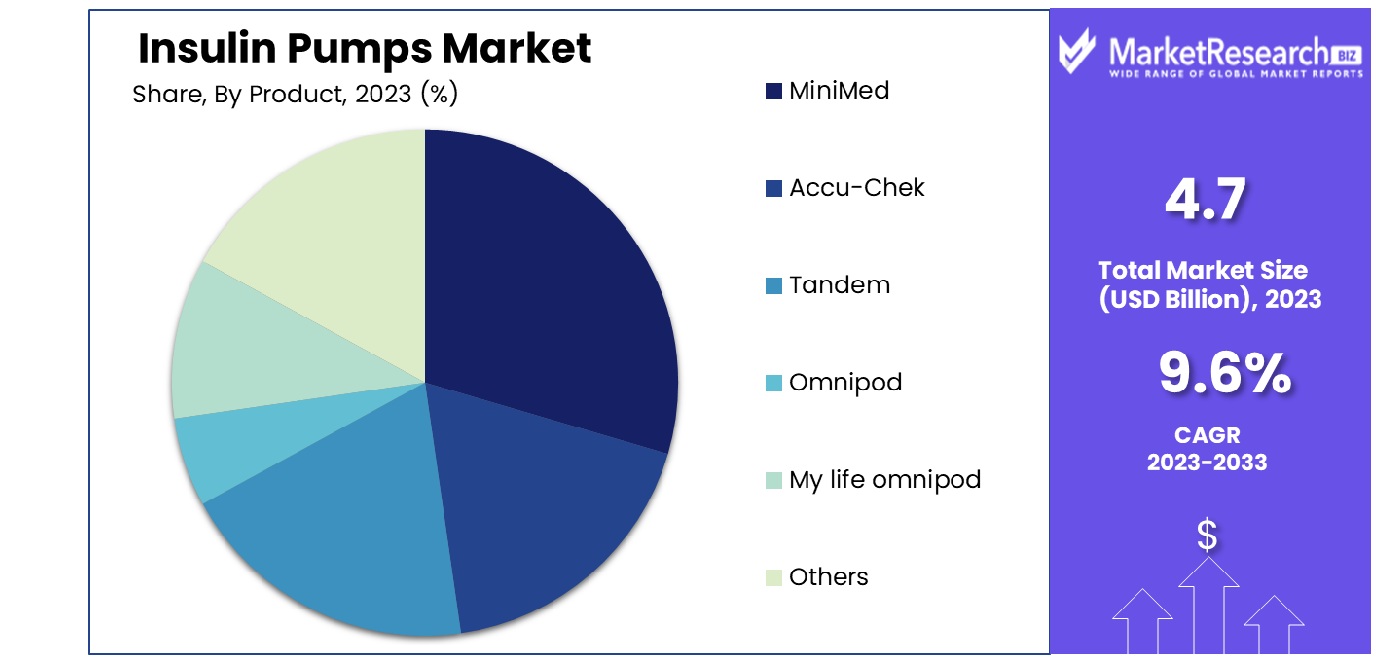

- By Product: MiniMed products secure a dominant position with a 51.3% share.

- By Accessories: Insulin set insertion devices lead accessories, capturing 42.1% segment.

- By End-use: Hospitals & clinics dominate end-use, commanding a 45.2% share.

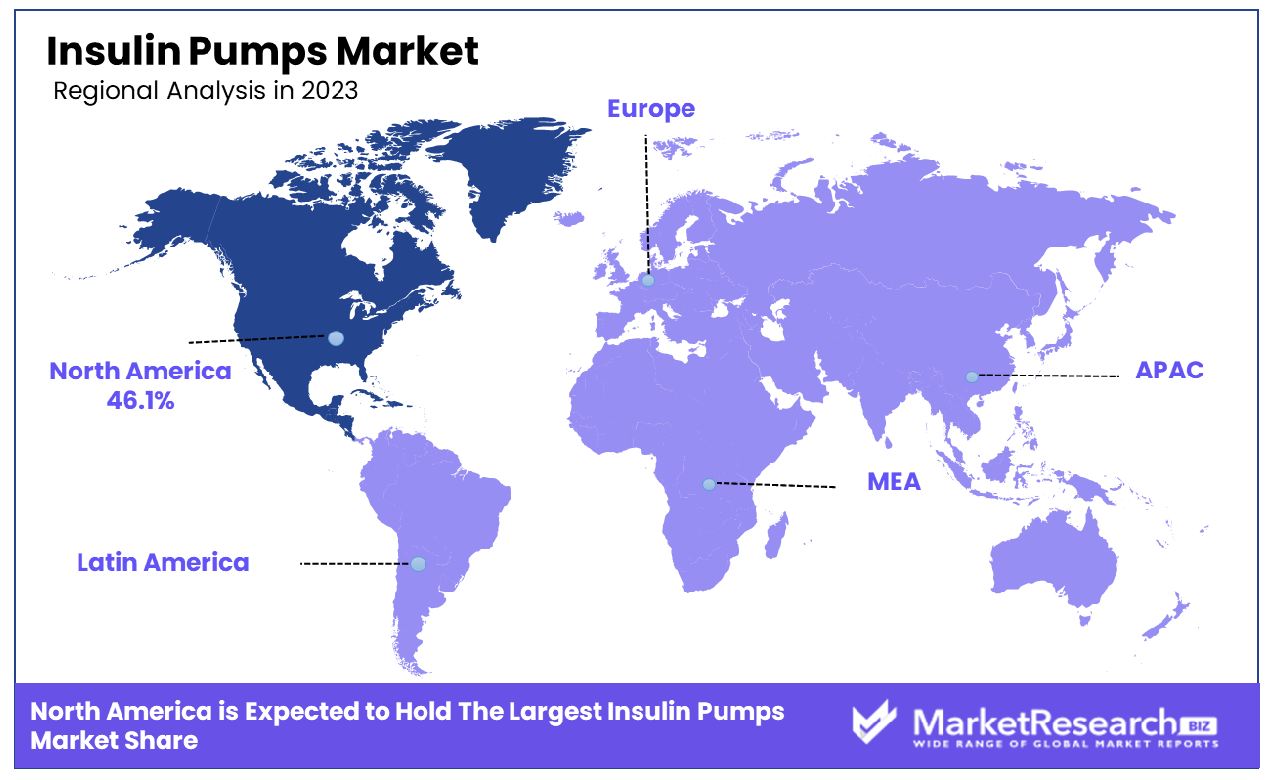

- Regional Dominance: In North America, the insulin pump market holds a share of 46.1%.

- Growth Opportunity: In 2023, the global insulin pump market sees growth opportunities due to technological advancements improving efficiency, rising diabetes prevalence, and expanding distribution networks targeting underserved regions.

Driving factors

Rising Incidence of Obesity and Associated Health Conditions Driving Market Expansion

The escalating prevalence of obesity, often accompanied by type 2 diabetes, serves as a significant catalyst propelling the growth of the Insulin Pumps Market. Obesity rates have surged globally, with the World Health Organization (WHO) reporting that obesity has nearly tripled since 1975. As obesity rates rise, so does the incidence of type 2 diabetes, a condition often managed with insulin therapy. This correlation between obesity and diabetes fuels the demand for insulin pumps, as they offer a convenient and efficient method for insulin delivery, particularly for individuals with insulin resistance.

Regulatory Approvals for Insulin Pump Products Enhancing Market Growth

Regulatory approvals play a pivotal role in fostering confidence among consumers and healthcare professionals, thereby stimulating market growth. As regulatory bodies such as the FDA and EMA continue to streamline approval processes for insulin pump products, manufacturers can swiftly bring innovative devices to market. These approvals signify adherence to rigorous safety and efficacy standards, instilling assurance in both healthcare providers and patients regarding the reliability and effectiveness of insulin pump therapy. Moreover, the expansion of approved indications for insulin pump use broadens the addressable market, further fueling growth opportunities for manufacturers.

Increasing Utilization of Insulin Pumps Over Traditional Injection Methods

The gradual shift towards insulin pump therapy over traditional injection methods reflects evolving preferences among diabetes patients and healthcare providers. Insulin pumps offer several advantages over injections, including more precise insulin dosing, improved glycemic control, and greater flexibility in meal planning and physical activity. Additionally, advancements in insulin pump technology, such as continuous glucose monitoring integration and automated insulin delivery algorithms, enhance user experience and therapeutic outcomes. As awareness of these benefits grows within the diabetes community and healthcare sector, adoption rates of insulin pumps are expected to rise steadily, driving market expansion.

Restraining Factors

High Cost of Insulin Pump Devices

The formidable barrier posed by the high cost of insulin pump devices significantly impedes market growth, particularly in regions with limited healthcare budgets and constrained consumer purchasing power. The expense associated with acquiring an insulin pump, which can amount to several thousand dollars, presents a financial challenge for many patients, even in developed economies. Moreover, the ongoing need for supplies and maintenance further compounds the overall cost burden associated with insulin pump therapy.

Limited Reimbursement Policies for Insulin Pump Therapy

The limited reimbursement policies for insulin pump therapy represent a formidable constraint on market expansion, as they restrict access to these devices for a sizable segment of the population. In many healthcare systems, reimbursement coverage for insulin pumps is inadequate or subject to stringent eligibility criteria, creating disparities in access to advanced diabetes management technologies.

The lack of comprehensive reimbursement policies not only hampers patient affordability but also deters healthcare providers from prescribing insulin pumps due to concerns over reimbursement uncertainties.

By Type Analysis

In the realm of tethered pumps, this segment reigns with an imposing dominance of 79.6%.

Insulin Pumps Market Research Project 2023 found tethered pumps holding an overwhelming market share at more than 79.6% in terms of the by-type segment. This can be attributed to their rising popularity among diabetic patients due to their reliable performance and ease of use; particularly those needing precise insulin dosage management. Tethered pumps also offered continuous insulin delivery through tubing which proved extremely popular with this particular cohort of users.

Following closely behind tethered pumps, patch pumps emerged as another notable player in the market, although with a comparatively smaller share. Despite the increasing popularity of patch pumps for their discreet and wearable design, tethered pumps continue to maintain a stronghold in the market, owing to their established track record and robust performance.

In terms of Product segmentation, MiniMed emerged as the frontrunner, commanding a dominant 51.3% share in the market. MiniMed's success can be attributed to its innovative product offerings and continuous efforts in research and development to meet the evolving needs of diabetic patients. The brand's reputation for quality and reliability has solidified its position as the preferred choice among both patients and healthcare professionals.

By Product Analysis

MiniMed asserts its dominance in the product category, commanding a hefty 51.3% share.

MiniMed held an overwhelming 51.3% market share in the by-product segment of the Insulin Pumps Market by 2023, thanks to their innovative product offerings, strong brand recognition, and robust distribution network. MiniMed's commitment to research and development enabled it to introduce cutting-edge insulin pump technologies that met patients' changing needs with diabetes.

Accu-Chek, another prominent player in the market, maintained a solid presence with a significant market share. The company's focus on precision, reliability, and user-friendly design has resonated well with both healthcare professionals and patients. Accu-Chek's range of insulin pumps offers advanced features such as integrated continuous glucose monitoring systems, enhancing convenience and effectiveness in diabetes management.

Tandem Diabetes Care also made notable strides in the Insulin Pumps Market, leveraging its expertise in insulin delivery systems. Tandem's portfolio includes technologically advanced pumps with customizable settings, empowering users to tailor their insulin therapy according to individual requirements. The company's emphasis on user experience and connectivity features has positioned it as a preferred choice among consumers seeking personalized diabetes management solutions.

Omnipod, renowned for its tubeless insulin delivery system, secured a substantial market share in 2023. Omnipod's discreet and hassle-free design appeals to users seeking freedom and flexibility in their daily routines. With a focus on simplicity and convenience, Omnipod continues to expand its market presence by addressing the diverse needs of the diabetes community.

My Life Omnipod, another key player in the Insulin Pumps Market, differentiated itself through a combination of innovative technology and a patient-centric approach. By offering customizable insulin delivery solutions and comprehensive support services, My Life Omnipod has fostered strong customer loyalty and satisfaction.

By Accessories Analysis

Insulin set insertion devices lead the accessories segment with a significant dominance of 42.1%.

In 2023, Insulin set insertion devices held a dominant market position in the Accessories segment of the Insulin Pumps Market, capturing more than a 42.1% share. This indicates a significant reliance on such devices within the industry, highlighting their pivotal role in facilitating the effective administration of insulin. Insulin set insertion devices play a critical function in the delivery of insulin, ensuring precise and controlled insertion of the set for optimal patient comfort and treatment efficacy.

Alongside Insulin set insertion devices, other essential accessories contributing to the market landscape include Insulin reservoirs or cartridges and batteries. Insulin reservoirs or cartridges serve as containers for insulin, providing a reservoir from which the insulin pump draws medication for delivery into the body. The battery component is crucial for powering the insulin pump, enabling its continuous operation and ensuring seamless insulin delivery to patients.

The dominance of Insulin set insertion devices underscores the importance placed by healthcare providers and patients on efficient and reliable insulin delivery mechanisms. Factors such as technological advancements, ease of use, and patient preference likely contribute to the popularity of these devices within the market. Moreover, with the increasing prevalence of diabetes globally and the growing emphasis on personalized healthcare solutions, the demand for innovative insulin pump accessories is anticipated to witness sustained growth in the foreseeable future.

By End-use Analysis

Hospitals & clinics stand out as the dominant end-use segment, capturing a substantial 45.2% share.

In 2023, Hospitals & clinics held a dominant market position in the By End-use segment of the Insulin Pumps Market, capturing more than a 45.2% share. This significant market share can be attributed to the widespread adoption of insulin pumps in hospital settings for the management of diabetes, coupled with the increasing prevalence of diabetes worldwide. Hospitals and clinics segment are preferred settings for insulin pump therapy due to the availability of trained healthcare professionals who can assist patients in pump initiation, titration, and troubleshooting.

Homecare emerged as another crucial segment in the Insulin Pumps Market, exhibiting promising growth prospects. With advancements in technology, insulin pump manufacturers are introducing user-friendly devices suitable for self-management of diabetes at home. The convenience and flexibility offered by insulin pumps empower patients to maintain better glycemic control without frequent visits to healthcare facilities, thereby driving the demand for insulin pumps in the homecare segment.

Laboratories also contributed to the Insulin Pump industry, albeit to a lesser extent compared to hospitals, clinics, and home care settings. Laboratories primarily utilize insulin pumps for research purposes, such as studying insulin delivery mechanisms, optimizing pump algorithms, and conducting clinical trials. Additionally, laboratories play a vital role in providing calibration and quality control services for insulin pump devices, ensuring their accuracy and reliability in clinical practice.

Key Market Segments

By Type

- Tethered pumps

- Patch pumps

By Product

- MiniMed

- Accu-Chek

- Tandem

- Omnipod

- My life omnipod

- Others

By Accessories

- Insulin set insertion devices

- Insulin reservoir or cartridges

- Battery

By End-use

- Hospitals & clinics

- Homecare

- Laboratories

Growth Opportunity

Technological Advancements Fueling Improved Pump Efficiency

In 2023, the global insulin pump market is poised for substantial growth, primarily driven by remarkable technological advancements enhancing pump efficiency. Innovations such as closed-loop systems and continuous glucose monitoring integration have revolutionized insulin delivery, offering more precise and personalized treatment options for diabetic patients. These advancements not only improve patient outcomes but also contribute to increased adoption rates, as individuals seek more convenient and effective ways to manage their diabetes.

Rising Prevalence of Diabetes and Increasing Adoption of Insulin Therapy

The escalating prevalence of diabetes worldwide remains a significant driver for the growth of the insulin pump market. With diabetes reaching epidemic proportions globally, there is a heightened awareness regarding the importance of insulin therapy in managing the disease. As a result, there has been a notable surge in the adoption of insulin pumps as a preferred method of insulin delivery, especially among patients seeking better glycemic control and improved quality of life.

Expansion of Distribution Networks to Reach Underserved Regions

In 2023, the global insulin pump market presents promising opportunities for expansion, particularly through the extension of distribution networks to reach underserved regions. Companies are increasingly focusing on penetrating emerging markets where diabetes prevalence is on the rise but access to advanced medical technologies remains limited. By expanding their reach and accessibility, manufacturers can tap into previously untapped market segments, driving significant growth in the insulin pumps sector.

Latest Trends

Increasing Prevalence of Diabetes and Rising Awareness

The prevalence of diabetes continues to rise globally, driving the demand for advanced diabetes management devices such as insulin pumps. With growing awareness among patients and healthcare professionals about the benefits of continuous glucose monitoring and insulin pump therapy, there is a notable shift towards more proactive management of diabetes. This trend is fueling the adoption of insulin pumps as a preferred treatment option, especially among individuals seeking better glycemic control and improved quality of life.

Technological Innovations Driving Market Growth

Technological advancements play a pivotal role in driving innovation within the insulin pump market. In 2023, there is a notable focus on developing user-friendly and automated insulin pumps that offer enhanced convenience and functionality. These innovations aim to simplify the insulin delivery process, reduce user burden, and improve overall treatment outcomes. Features such as closed-loop systems, wireless connectivity, and smartphone integration are becoming increasingly common, making insulin pump therapy more accessible and appealing to a wider patient population.

Regional Analysis

In North America, the insulin pump market accounts for a substantial share of 46.1%.

In the global insulin pump market, region-specific dynamics play a pivotal role in shaping market trends and growth trajectories. North America emerges as a dominant force, commanding a substantial market share of 46.1%. This stronghold can be attributed to factors such as the high prevalence of diabetes, advanced healthcare infrastructure, and robust reimbursement policies. In this region, the adoption of insulin pump therapy is notably high, driven by increasing awareness about its benefits in managing diabetes effectively.

Europe, another significant market, showcases a strong inclination towards insulin pump usage, fueled by supportive regulatory frameworks and a rising diabetic population. The region's healthcare expenditure and emphasis on technological advancements further contribute to the market expansion. With initiatives promoting patient-centric care and continuous glucose monitoring, Europe stands as a key player in the global landscape.

Asia Pacific presents lucrative growth opportunities, propelled by expanding healthcare access, rising disposable incomes, and escalating diabetes prevalence. Countries like China and India exhibit a considerable diabetic population, prompting increased adoption of insulin pumps. Moreover, collaborations between industry major players and healthcare providers facilitate market penetration in this region.

The Middle East & Africa, while currently a smaller market segment, is witnessing gradual uptake of insulin pump therapy, driven by improving healthcare infrastructure and growing awareness about diabetes management. Latin America, similarly, demonstrates promising growth rate prospects, supported by rising healthcare expenditure and government initiatives to combat diabetes.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of the Middle East & Africa

Key Players Analysis

In 2023, the global insulin pumps market witnessed dynamic competition and strategic maneuvers among key players, each vying for a larger share in this rapidly evolving landscape. Among these, Medtronic plc emerged as a pivotal force, leveraging its extensive product portfolio and robust distribution network to maintain a prominent position. With a legacy of innovation and a strong focus on research and development, Medtronic plc continues to set industry standards, offering cutting-edge insulin pump solutions tailored to diverse patient needs. The company's strategic collaborations with healthcare providers and relentless pursuit of technological advancements further solidify its market leadership.

Hoffmann-La Roche Ltd, another key player, stands out for its commitment to delivering high-quality insulin pump systems coupled with comprehensive diabetes management solutions. Its strong emphasis on user-centric design and integration of advanced features underscores its dedication to enhancing patient experience and outcomes.

Tandem Diabetic Care, Inc. has carved a niche for itself through its innovative approach to insulin pump therapy, characterized by sleek designs, user-friendly interfaces, and advanced connectivity options. The company's focus on continuous product improvement and customer engagement strategies has propelled its growth trajectory, garnering accolades from both patients and healthcare professionals alike.

Insulet Corporation, Ypsomed, Cellenovo, Sooil Development, Valeritas, Inc., and JingasuDelfu Co., Ltd. also play significant roles in the global insulin pump market, each contributing unique strengths and capabilities to the competitive landscape. As these key players navigate through evolving market dynamics and regulatory challenges, their strategic decisions and market initiatives will continue to shape the trajectory of the insulin pump market in the coming years.

Market Key Players

- Medtronic plc

- Hoffmann-La Roche Ltd

- Tandem Diabetic Care, Inc.

- Insulet Corporation

- Ypsomed

- Cellenovo

- Sooil Development

- Valeritas, Inc

- JingasuDelfu Co., Ltd.

Recent Development

- In March 2024, Deka Research & Development unveils an FDA-cleared twist insulin pump, co-developed with Sequel Med Tech. The device integrates Tidepool's software for personalized insulin delivery, aiming to simplify diabetes management.

- In March 2024, Recent medical advancements include NASA's sponsorship of clinical trials on light technology by the Marshall Space Flight Center, aiding in reducing chemotherapy side effects for cancer patients, and partnering with a Wisconsin company.

- In January 2024, Dexcom's pending FDA clearance for Stelo, a CGM tailored for non-insulin-dependent diabetes patients, promises enhanced management and insights. It aligns with the broader trend of expanding diabetes technology accessibility.

Report Scope

Report Features Description Market Value (2023) USD 4.7 Billion Forecast Revenue (2033) USD 11.5 Billion CAGR (2024-2032) 9.6% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type(Tethered pumps, Patch pumps), By Product(MiniMed, Accu-Chek, Tandem, Omnipod, My life omnipod, Others), By Accessories(Insulin set insertion devices, Insulin reservoir or cartridges, Battery), By End-use(Hospitals & clinics, Homecare, Laboratories) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Medtronic plc, Hoffmann-La Roche Ltd, Tandem Diabetic Care, Inc., Insulet Corporation, Ypsomed, Cellenovo, Sooil Development, Valeritas, Inc, JingasuDelfu Co., Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Medtronic plc

- Hoffmann-La Roche Ltd

- Tandem Diabetic Care, Inc.

- Insulet Corporation

- Ypsomed

- Cellenovo

- Sooil Development

- Valeritas, Inc

- JingasuDelfu Co., Ltd.