Instant rice Market By Type (White Rice, Brown Rice, Flavored Rice, Organic Instant Rice), By Packaging Type (Pouches, Cups, Bulk Packaging), By Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores, Specialty Stores, Online Retail), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

-

41271

-

July 2024

-

160

-

-

This report was compiled by Shreyas Rokade Shreyas Rokade is a seasoned Research Analyst with CMFE, bringing extensive expertise in market research and consulting, with a strong background in Chemical Engineering. Correspondence Team Lead-CMFE Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

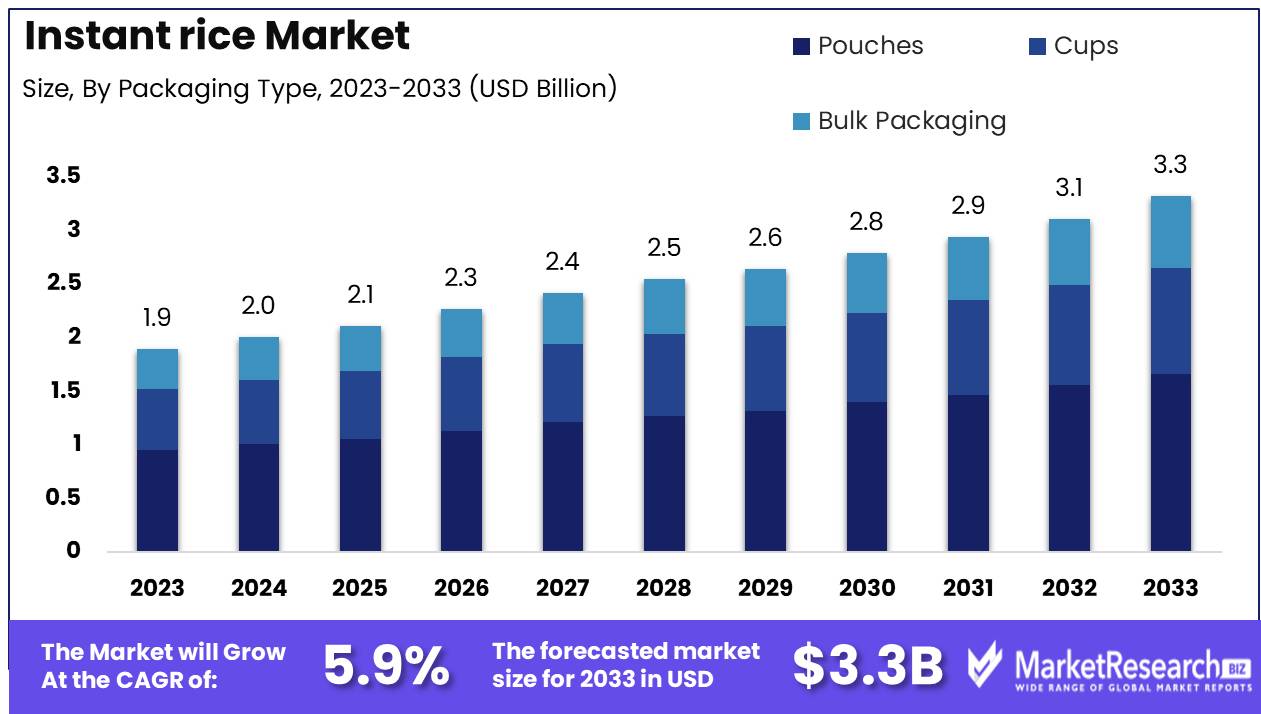

The Global Instant rice Market was valued at USD 1.9 Bn in 2023. It is expected to reach USD 3.3 Bn by 2033, with a CAGR of 5.9% during the forecast period from 2024 to 2033.

The Instant Rice Market encompasses the production, distribution, and sale of pre-cooked rice products that require minimal cooking time. These products are made through a process that includes blanching, steaming, and dehydrating regular white rice to a moisture content of 12% or less. The market features a variety of offerings from both well-established brands and new entrants, catering to the growing consumer demand for convenient, time-saving meal solutions. The sector is influenced by factors such as product innovation, quality, and the expanding preference for quick and easy meal kits preparation options.

The Instant Rice Market is experiencing notable growth, driven by the increasing demand for convenient and quick meal solutions. This market is characterized by well-established brands such as Minute Rice, which was first mass-marketed in 1946, as well as a diverse range of products from both Asian and American companies. The production process of instant rice involves blanching, steaming, and dehydrating regular white rice to a moisture content of 12% or less, significantly reducing cooking time and enhancing convenience for consumers.

The rise in dual-income households and the fast-paced lifestyle of modern consumers are key factors contributing to the growth of the instant rice market. The convenience of instant rice products aligns well with the needs of busy individuals and families seeking quick meal preparation options without compromising on quality and taste. Additionally, the increasing popularity of ready-to-eat food and the expansion of retail distribution channels have further propelled market growth.

Product innovation plays a crucial role in this market, with companies continuously developing new flavors, packaging, and preparation methods to attract a wider consumer base. The emphasis on health and wellness has also led to the introduction of healthier variants, including brown rice, quinoa, and other nutrient-rich grains, catering to the growing demand for nutritious and wholesome meal options.

The instant rice market is benefiting from the rising trend of home cooking and the growing interest in diverse cuisines. Consumers are increasingly experimenting with different recipes and flavors, boosting the demand for versatile and easy-to-prepare rice products.

Key Takeaways

- Market Value: The Global Instant rice Market was valued at USD 1.9 Bn in 2023. It is expected to reach USD 3.3 Bn by 2033, with a CAGR of 5.9% during the forecast period from 2024 to 2033.

- By Type: White Rice constitutes 40% of the market, favored for its versatility and quick preparation time.

- By Packaging Type: Pouches are the most common, making up 50%, offering convenience and portion control.

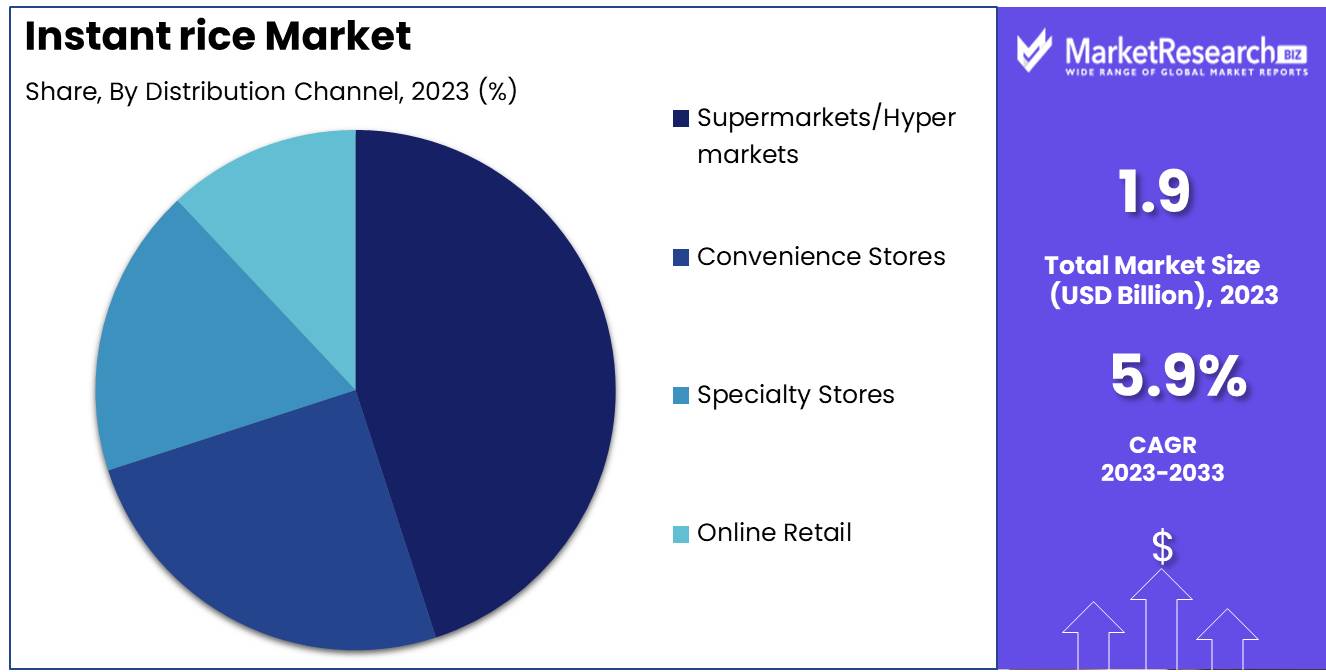

- By Distribution Channel: Supermarkets/Hypermarkets dominate distribution with 45%, providing easy access for consumers.

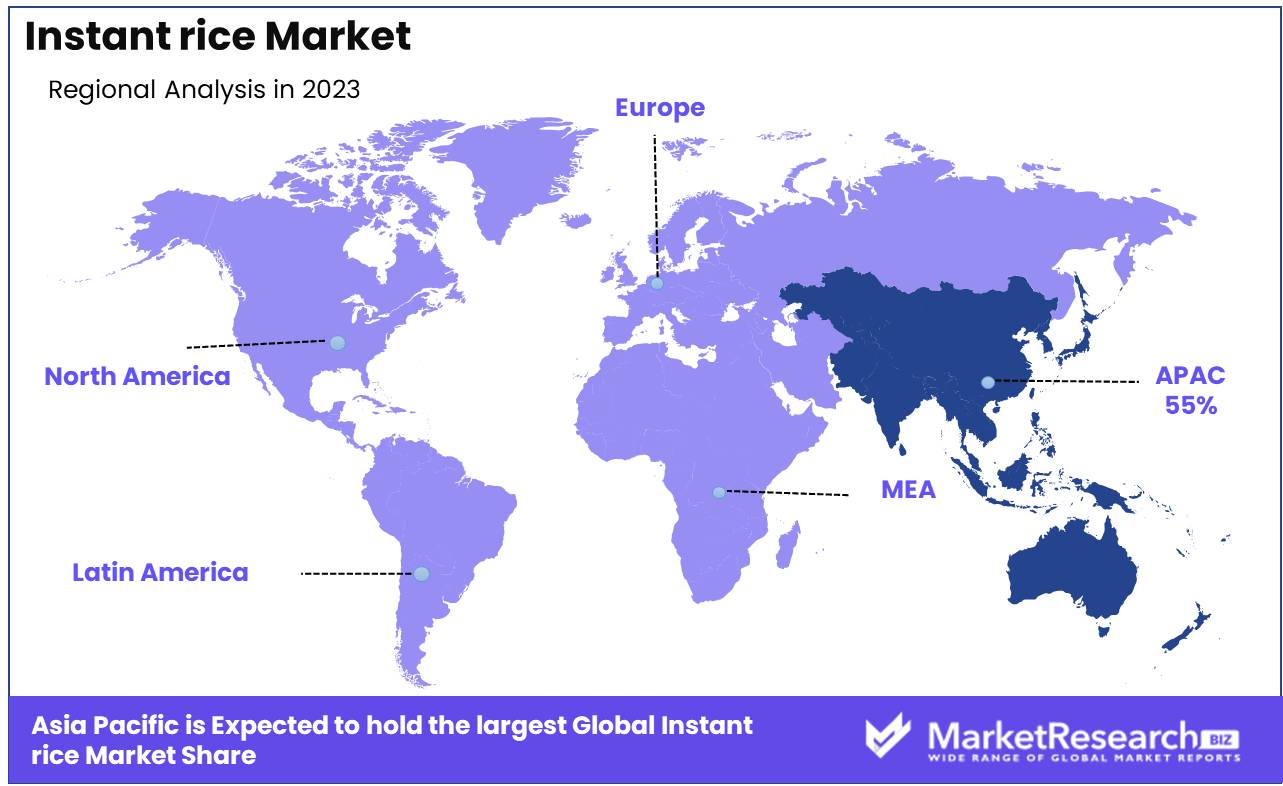

- Regional Dominance: Asia Pacific leads with a 55% share, supported by fast-paced lifestyles and high rice consumption.

- Growth Opportunity: Developing flavored and nutrient-enhanced instant rice products can cater to health-conscious consumers and expand market reach.

Driving factors

Growing Demand for Convenient and Quick Meal Solutions

The growing demand for convenient and quick meal solutions is a significant driver of the instant rice market. Modern lifestyles, characterized by busy schedules and time constraints, have led consumers to seek meal options that require minimal preparation time. Instant rice, which can be prepared in a matter of minutes, aligns perfectly with this need for convenience. The increasing number of working professionals, students, and individuals with hectic routines has amplified the demand for quick meal solutions, making instant rice a popular choice.

This trend is particularly evident in urban areas where the pace of life is faster, and the need for time-saving food options is more pronounced. The convenience factor not only appeals to individual consumers but also to the food service disposable, which values quick-prep ingredients for efficiency in meal preparation.

Increasing Consumer Preference for Ready-to-Eat Products

The rising consumer preference for ready-to-eat (RTE) products is another crucial factor propelling the instant rice market. Consumers are increasingly opting for RTE products due to their ease of use, extended shelf life, and availability in diverse flavors and varieties. Instant rice fits seamlessly into this category, offering a versatile base for various meals without the need for lengthy cooking processes.

This preference is driven by a desire for hassle-free meal preparation and a growing inclination towards products that offer both convenience and quality. The shift towards RTE products is further supported by advancements in food technology that enhance the taste, texture, and nutritional value of instant rice, making it an attractive option for health-conscious consumers.

Expansion of Retail and Online Grocery Channels

The expansion of retail and online grocery channels significantly contributes to the growth of the instant rice market. The proliferation of supermarkets, hypermarkets, and convenience stores has increased the accessibility of instant rice products, making them readily available to a broader audience. Additionally, the rapid growth of e-commerce platforms and online grocery delivery services has revolutionized the way consumers purchase food products.

The convenience of online shopping, combined with the ability to browse a wide range of products and read reviews, has made it easier for consumers to discover and buy instant rice. This expansion in retail and online channels ensures that instant rice products are widely distributed and easily accessible, driving market growth.

Restraining Factors

Perception of Lower Nutritional Value Compared to Regular Rice

One of the primary restraining factors for the growth of the instant rice market is the perception that instant rice has a lower nutritional value compared to regular rice. Many health-conscious consumers believe that the processing involved in making instant rice can strip away essential nutrients, vitamins, and minerals, making it a less healthy option. This perception is further reinforced by dietary guidelines and nutrition experts who often recommend whole, unprocessed foods.

Consumers who prioritize nutrition may opt for traditional rice or other whole grains, viewing them as more wholesome and beneficial for their health. This negative perception can hinder market growth by limiting the potential consumer base to those who prioritize convenience over nutrition.

High Competition from Other Convenience Foods

The instant rice market faces significant competition from a wide array of other convenience foods. Ready-to-eat meals, frozen food, pre-packaged salads, and meal kits offer similar benefits of convenience and time savings. These alternatives often come in a variety of cuisines and dietary options, catering to diverse consumer preferences.

Some of these convenience foods may also address nutritional concerns more effectively by incorporating vegetables, proteins, and other balanced ingredients. The intense competition from these varied convenience food options can divert potential customers away from instant rice, thereby restraining its market growth. To remain competitive, instant rice manufacturers must continuously innovate and enhance their product offerings to differentiate themselves in a crowded market.

By Type Analysis

White Rice held a dominant market position in the By Type segment of the Instant Rice Market, capturing more than a 40% share.

In 2023, White Rice held a dominant market position in the By Type segment of the Instant Rice Market, capturing more than a 40% share. This dominance is driven by its widespread acceptance and preference across various demographics and regions. White rice is favored for its neutral taste, quick cooking time, and versatility in numerous recipes. It is a staple in many households, particularly in Asia Pacific, where rice consumption is integral to daily diets. The convenience of instant white rice, combined with advancements in processing technology that retain nutritional value, supports its strong market position.

Brown Rice is gaining traction due to its health benefits, including higher fiber content and more nutrients compared to white rice. Despite its growing popularity among health-conscious consumers, its market share remains smaller due to a longer cooking time and a distinct taste that may not appeal to everyone.

Flavored Rice caters to the demand for convenience and variety, offering pre-seasoned options that save preparation time. Its market share is growing but remains modest as it appeals to a niche segment looking for quick, tasty meal solutions.

Organic Instant Rice is becoming increasingly popular, driven by the rising consumer awareness of organic and non-GMO products. However, its higher price point and limited availability result in a smaller market share compared to conventional white rice.

By Packaging Type Analysis

Pouches held a dominant market position in the By Packaging Type segment of the Instant Rice Market, capturing more than a 50% share.

In 2023, Pouches held a dominant market position in the By Packaging Type segment of the Instant Rice Market, capturing more than a 50% share. Pouches are favored for their convenience, portability, and ability to preserve the freshness and flavor of instant rice. They are lightweight, easy to store, and often designed for single servings, which cater to the fast-paced lifestyles of modern consumers. The rise in single-person households and the increasing demand for on-the-go meal solutions further drive the preference for pouch packaging.

Cups are also popular, particularly among students and working professionals who seek quick and convenient meal options. While cups offer similar benefits to pouches, their market share is smaller due to higher production costs and bulkier packaging.

Bulk Packaging appeals to larger households and institutions that require cost-effective and larger quantities of instant rice. Despite its importance, bulk packaging holds a smaller market share compared to pouches due to limited consumer segments and the preference for portion-controlled options.

By Distribution Channel Analysis

Supermarkets/Hypermarkets held a dominant market position in the By Distribution Channel segment of the Instant Rice Market, capturing more than a 45% share.

In 2023, Supermarkets/Hypermarkets held a dominant market position in the By Distribution Channel segment of the Instant Rice Market, capturing more than a 45% share. These retail outlets offer a wide variety of instant rice products, providing consumers with ample choices and the convenience of one-stop shopping. Supermarkets and hypermarkets often run promotions and discounts, making them attractive to cost-conscious buyers. Their extensive reach and established presence in both urban and rural areas ensure a broad consumer base.

Convenience Stores are significant for quick and easy purchases, especially in urban areas. However, their market share is smaller due to limited product variety and higher prices compared to larger retail formats.

Specialty Stores cater to niche markets, offering premium and unique instant rice products such as organic or gourmet options. While they attract specific consumer segments, their overall market share remains modest due to their specialized nature and higher price points.

Online Retail is rapidly growing, driven by the increasing popularity of e-commerce and the convenience of home delivery. Despite its fast growth, online retail’s market share is smaller compared to traditional retail channels, as many consumers still prefer to physically inspect and purchase food items in-store.

Key Market Segments

By Type

- White Rice

- Brown Rice

- Flavored Rice

- Organic Instant Rice

By Packaging Type

- Pouches

- Cups

- Bulk Packaging

By Distribution Channel

- Supermarkets/Hypermarkets

- Convenience Stores

- Specialty Stores

- Online Retail

Growth Opportunity

Development of Healthier and Fortified Instant Rice Options

The development of healthier and fortified instant rice options presents a significant growth opportunity for the global instant rice market in 2024. Addressing the perception of lower nutritional value, manufacturers are increasingly focusing on enhancing the health benefits of instant rice. Fortification with essential vitamins and minerals, such as iron, B vitamins, and folic acid, can significantly improve the nutritional profile of instant rice.

The introduction of whole grain and brown rice variants provides healthier alternatives that appeal to health-conscious consumers. These innovations not only cater to the growing demand for nutritious convenience foods but also help in mitigating the negative perceptions associated with instant rice. By emphasizing the health benefits and nutritional enhancements, manufacturers can attract a broader consumer base and drive market growth.

Introduction of Diverse Flavors and Regional Varieties

The introduction of diverse flavors and regional varieties is another key opportunity for the instant rice market in 2024. Consumers are increasingly seeking new and exciting culinary experiences, and offering a variety of flavors can meet this demand. Regional varieties, such as basmati, jasmine, or Arborio rice, along with flavor-infused options like herb and spice blends, can attract consumers looking for convenience without compromising on taste.

This diversification not only enhances the appeal of instant rice but also positions it as a versatile meal component that can cater to different culinary preferences. By expanding the flavor and variety options, manufacturers can capture the interest of a wider audience and differentiate their products in a competitive market.

Latest Trends

Rising Popularity of Organic and Gluten-Free Instant Rice

In 2024, the global instant rice market is expected to witness a significant trend towards organic and gluten-free options. As consumers become more health-conscious and environmentally aware, the demand for organic products has surged. Organic instant rice, free from synthetic pesticides and GMOs, appeals to consumers seeking natural and healthy food choices. Similarly, the rise in gluten intolerance and the preference for gluten-free diets have driven the demand for gluten-free instant rice.

These products cater to a growing segment of consumers who prioritize clean labels and dietary restrictions. By offering organic and gluten-free options, manufacturers can tap into these expanding consumer bases, fostering market growth and differentiation.

Adoption of Sustainable and Eco-Friendly Packaging

The adoption of sustainable and eco-friendly packaging is another prominent trend shaping the instant rice market in 2024. Environmental concerns are increasingly influencing consumer purchasing decisions, with a significant preference for products that minimize ecological impact. Manufacturers are responding by adopting recyclable, biodegradable, and compostable packaging materials. This shift not only reduces the environmental footprint of instant rice products but also enhances brand reputation and consumer trust.

Sustainable packaging solutions align with global sustainability goals and regulatory requirements, positioning companies as responsible and forward-thinking. The move towards eco-friendly packaging is expected to become a standard practice, driving market growth through enhanced consumer loyalty and regulatory compliance.

Regional Analysis

In 2023, Asia Pacific dominated the Instant Rice Market, capturing a significant market share.

In 2023, Asia Pacific dominated the Instant Rice Market, capturing a significant market share of around 55%. This dominance is driven by the region's high rice consumption and the increasing demand for convenient and quick meal solutions. The growing urban population, busy lifestyles, and rising disposable incomes have led to a surge in demand for instant rice products that offer convenience without compromising on taste and nutrition. The presence of numerous local and international brands, coupled with the expansion of modern retail channels and e-commerce platforms, further enhances the market's growth in Asia Pacific.

North America holds a substantial share in the instant rice market, driven by the demand for ready-to-eat meals and convenience foods in the US and Canada. Health-conscious consumers favor healthier variants like brown and organic rice, supported by product innovation in flavors and packaging.

Europe's significant share in the instant rice market is driven by demand for convenience foods and meal prepping trends in the UK, Germany, and France. The market is shifting towards premium and organic products, with strong support from established retail chains and online platforms.

Middle East & Africa show potential in the instant rice market, driven by urbanization, rising incomes, and demand in the UAE and Saudi Arabia. The market benefits from modern retail expansion but faces challenges due to economic disparities and varying consumer awareness.

Latin America's instant rice market is growing, led by Brazil and Mexico, due to urbanization and rising living standards. The market features both local and international brands, though economic variability limits its overall share compared to more developed regions.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The Instant Rice Market in 2024 is anticipated to witness substantial growth, driven by the increasing demand for convenient and quick meal solutions. Key players such as Riviana Foods Inc., Mars, Incorporated, Producers Rice Mill, Inc., Satake Corporation, Nissin Food Products Co. Ltd., QVC FOODS, J.D. Food Products Co. Ltd., KOREA BIO PLANT CO., LTD., Riceland Foods, Inc., and American Rice Inc. are at the forefront of this market evolution.

Riviana Foods Inc. and Mars, Incorporated lead the market with their extensive product portfolios and global distribution networks. Their continuous innovation in product offerings and focus on quality ensure a strong market presence and consumer loyalty.

Producers Rice Mill, Inc. and Riceland Foods, Inc. leverage their expertise in rice production and processing to offer a wide range of instant rice products. Their focus on sustainable farming practices and traceability resonates well with environmentally conscious consumers.

Satake Corporation and Nissin Food Products Co. Ltd. emphasize technological advancements in rice processing. Their investments in cutting-edge processing equipment and techniques enhance product quality and shelf life, driving market growth.

QVC FOODS and J.D. Food Products Co. Ltd. cater to diverse consumer preferences with their innovative product variations, including flavored and fortified instant rice options. Their ability to quickly adapt to changing market trends positions them favorably in the competitive landscape.

KOREA BIO PLANT CO., LTD. focuses on health-oriented instant rice products, appealing to the growing segment of health-conscious consumers. Their emphasis on nutritional value and organic ingredients differentiates them from traditional offerings.

American Rice Inc. leverages its strong distribution network and brand reputation to maintain a significant market share. Their commitment to quality and consumer satisfaction drives brand loyalty and repeat purchases.

Market Key Players

- Riviana Foods Inc.

- Mars, Incorporated

- Producers Rice Mill, Inc.

- Satake Corporation

- Nissin Food Products Co. Ltd.

- QVC FOODS

- J.D. Food Products Co. Ltd.

- KOREA BIO PLANT CO., LTD.

- Riceland Foods, Inc.

- American Rice Inc

Recent Development

- In May 2024, Riceland Foods, Inc. invested $20 million in upgrading their production facilities. This investment aims to enhance production efficiency and meet the rising demand for instant rice products.

- In March 2024, Mars, Incorporated acquired a regional instant rice manufacturer to expand its production capabilities and market reach. This acquisition is expected to increase their market share by 15%.

Report Scope

Report Features Description Market Value (2023) USD 1.9 Bn Forecast Revenue (2033) USD 3.3 Bn CAGR (2024-2033) 5.9% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (White Rice, Brown Rice, Flavored Rice, Organic Instant Rice), By Packaging Type (Pouches, Cups, Bulk Packaging), By Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores, Specialty Stores, Online Retail) Regional Analysis North America - The US, Canada, & Mexico; Western Europe - Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe - Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC - China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America - Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa - Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Riviana Foods Inc., Mars, Incorporated, Producers Rice Mill, Inc., Satake Corporation, Nissin Food Products Co. Ltd., QVC FOODS, J.D. Food Products Co. Ltd., KOREA BIO PLANT CO., LTD., Riceland Foods, Inc., American Rice Inc Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Riviana Foods Inc.

- Mars, Incorporated

- Producers Rice Mill, Inc.

- Satake Corporation

- Nissin Food Products Co. Ltd.

- QVC FOODS

- J.D. Food Products Co. Ltd.

- KOREA BIO PLANT CO., LTD.

- Riceland Foods, Inc.

- American Rice Inc