Frozen Food Market By Product Type (Frozen Fruits and Vegetables, Frozen Snacks, Frozen-cooked Ready Meals, Frozen Desserts, Frozen Meat and Fish, Frozen Pet Food), By Freezing Technique (Individual Quick Freezing (IQF), Blast Freezing, Belt Freezing), By Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores, Online Channels), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

-

1783

-

May 2023

-

170

-

-

This report was compiled by Shreyas Rokade Shreyas Rokade is a seasoned Research Analyst with CMFE, bringing extensive expertise in market research and consulting, with a strong background in Chemical Engineering. Correspondence Team Lead-CMFE Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

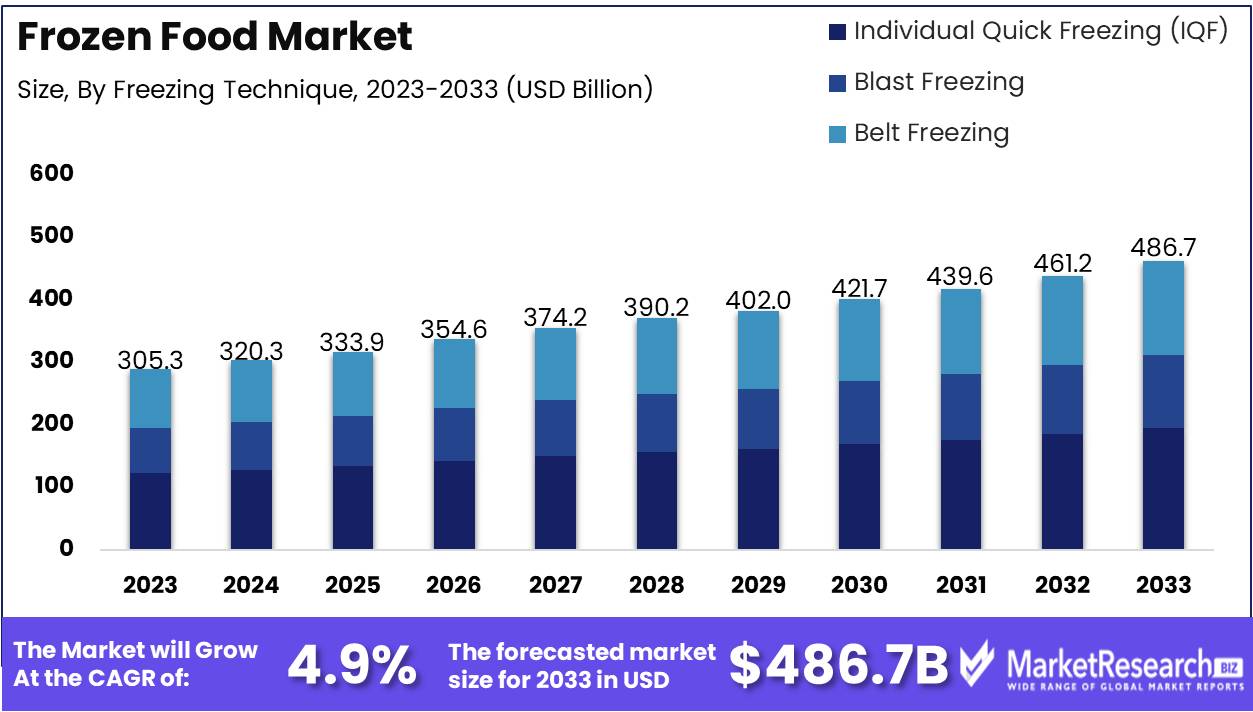

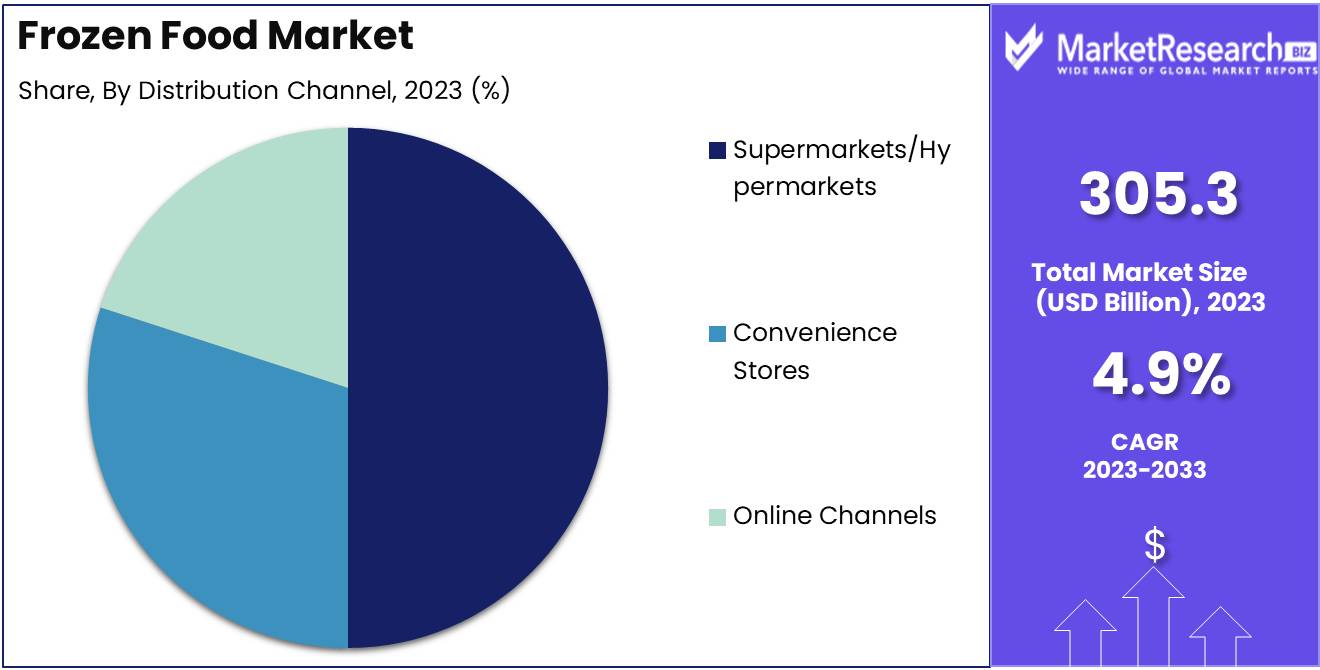

The Global Frozen Food Market was valued at USD 305.3 Bn in 2023. It is expected to reach USD 486.7 Bn by 2033, with a CAGR of 4.9% during the forecast period from 2024 to 2033.

The Frozen Food Market encompasses the production, distribution, and consumption of food products preserved through freezing. This market includes a wide range of items such as vegetables, fruits, meats, seafood, ready-to-eat meals, and desserts. Freezing extends the shelf life of foods while maintaining nutritional value and flavor, making frozen foods a convenient option for consumers. Advances in freezing technology, increasing consumer demand for convenience, and the growing popularity of ready-to-eat meals are key drivers of this market. The market also benefits from trends toward healthier eating, with many frozen food options now catering to health-conscious consumers.

The Frozen Food Market is expected to see substantial growth, driven by the increasing demand for convenient and nutritious food options. Freezing preserves the nutritional value of foods, with cryogenic freezing being the quickest and most efficient method. Using ultra-low liquid nitrogen temperatures of -196°C (-320°F), this method ensures that 80% of the vitamin C in frozen vegetables is retained, compared to just 50% in fresh vegetables. This significant preservation of nutrients makes frozen foods an attractive option for health-conscious consumers.

The market's growth is further fueled by the busy lifestyles of modern consumers who prioritize convenience without compromising on nutrition and taste. Ready-to-eat frozen meals, in particular, are gaining popularity as they offer a quick and easy solution for time-pressed individuals and families. Additionally, advancements in freezing technology have enabled the production of high-quality frozen products that closely resemble their fresh counterparts in taste and texture.

Retailers are capitalizing on this trend by expanding their frozen food offerings and enhancing their cold chain logistics to ensure product quality and safety. The rise of online grocery shopping has also contributed to the market's expansion, with e-commerce platforms providing easy access to a wide variety of frozen food products.

The Frozen Food Market is poised for robust growth, driven by the demand for convenient, nutritious, and high-quality food options. The market's ability to deliver these benefits, coupled with technological advancements and evolving consumer preferences, positions it as a key segment in the global food industry.

Key Takeaways

- Market Growth: The Global Frozen Food Market was valued at USD 305.3 Bn in 2023. It is expected to reach USD 486.7 Bn by 2033, with a CAGR of 4.9% during the forecast period from 2024 to 2033.

- By Product Type: Frozen Fruits and Vegetables account for 25% of the market, offering convenience and year-round availability.

- By Freezing Technique: Individual Quick Freezing (IQF) leads with 40%, preserving the quality and nutritional value of food products.

- By Distribution Channel: Supermarkets/Hypermarkets are the major distribution channel, commanding 50% of sales, reflecting their widespread consumer accessibility.

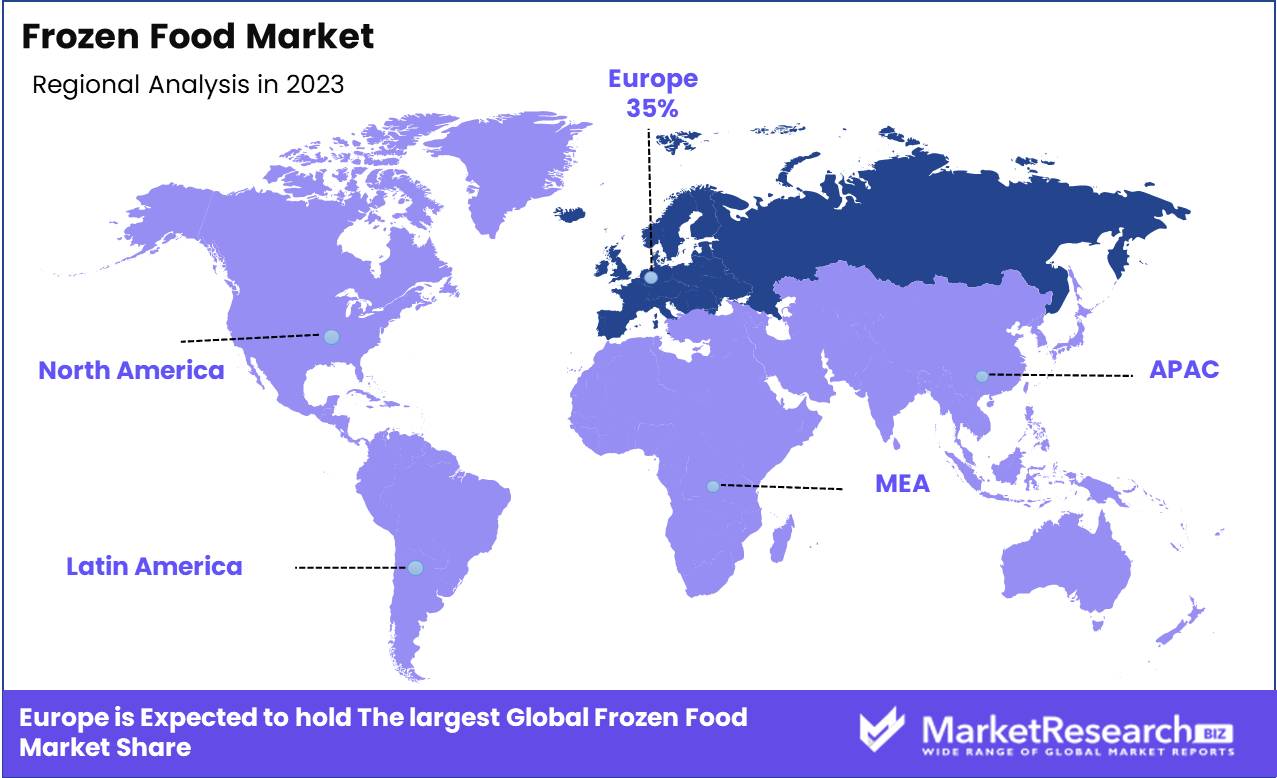

- Regional Dominance: Europe is a significant player with a 35% market share, influenced by consumer preferences for convenience and quality.

- Growth Opportunity: Innovations in freezing technology that enhance texture and taste can spur further growth in the frozen food sector.

Driving factors

Busy Lifestyles Driving Demand for Convenient Food Options

The acceleration of busy lifestyles globally is a primary driver of the frozen food market. As consumers juggle work, family, and social commitments, the need for convenient meal solutions has soared. Frozen foods, which require minimal preparation time, cater perfectly to this demand. According to market data, the convenience food sector is expanding rapidly, with frozen foods representing a significant portion of this growth due to their long shelf life and ease of use.

Advances in Freezing Technologies

Technological advancements in freezing methods have significantly contributed to the growth of the frozen food market. Innovations such as flash freezing and individually quick frozen (IQF) technologies have improved the quality, texture, and nutritional retention of frozen foods. These advancements have reduced the gap between fresh and frozen food quality, encouraging more consumers to opt for frozen options. The enhanced preservation capabilities of modern freezing technologies are driving market growth by ensuring that frozen foods remain nutritious and appealing.

Growing Consumer Preference for Ready-to-Eat Meals

The increasing consumer preference for ready-to-eat meals is another key driver for the frozen food market. Ready-to-eat frozen meals provide a quick and convenient solution for busy individuals and families. Market trends indicate a robust growth in this segment, with consumers valuing the variety and quality of meals available. As this preference grows, the frozen food market is poised to expand, driven by the convenience and time-saving benefits that these products offer.

Restraining Factors

High Energy Costs for Storage and Transportation

A significant restraining factor for the frozen food market is the high energy costs associated with the storage and transportation of frozen products. Maintaining the cold chain requires substantial energy, leading to increased operational costs. This factor can impact the pricing and profitability of frozen food products, posing a challenge for market growth.

Perception of Frozen Food Being Less Nutritious

The perception that frozen food is less nutritious compared to fresh alternatives continues to hinder market growth. Despite technological advancements that preserve the nutritional value of frozen foods, some consumers remain skeptical about their health benefits. This perception can limit the adoption of frozen foods, particularly among health-conscious consumers.

By Product Type Analysis

Frozen Fruits and Vegetables dominated the By Product Type segment of the Frozen Food Market in 2023, capturing more than a 25% share.

In 2023, Frozen Fruits and Vegetables held a dominant market position in the By Product Type segment of the Frozen Food Market, capturing more than a 25% share. This dominance is driven by the increasing consumer demand for convenient and nutritious food options. Frozen fruits and vegetables offer the advantage of long shelf life while preserving essential nutrients and freshness, making them a popular choice among health-conscious consumers. The rising awareness of healthy eating habits and the growing need for time-saving meal preparations further bolster the market for frozen fruits and vegetables.

Frozen Snacks also hold a significant share, driven by the rising demand for quick and easy-to-prepare snack options. The convenience factor and the variety of available products make frozen snacks appealing to a broad consumer base, particularly among busy professionals and families.

Frozen-cooked Ready Meals cater to the growing trend of on-the-go lifestyles and the need for hassle-free meal solutions. These meals provide a quick alternative to home-cooked food, appealing to consumers seeking convenience without compromising on taste and quality. Despite their popularity, their market share is smaller compared to frozen fruits and vegetables due to the higher cost and specific dietary preferences.

Frozen Desserts include a range of products such as ice creams, cakes, and pastries. The indulgence factor and the variety of flavors and types available drive the demand in this segment. However, their market share is less dominant due to the seasonal nature of some frozen desserts and the competition from fresh alternatives.

Frozen Meat and Fish provide essential proteins and are favored for their convenience and long shelf life. The demand for frozen meat and fish is significant, but the market share is smaller than that of frozen fruits and vegetables due to the higher cost and specific storage requirements.

Frozen Pet Food is an emerging segment driven by the growing trend of pet humanization and the demand for high-quality, nutritious pet food options. While gaining popularity, its market share remains smaller due to its niche market compared to human food products.

By Freezing Technique Analysis

Individual Quick Freezing (IQF) dominated the By Freezing Technique segment of the Frozen Food Market in 2023, capturing more than a 40% share.

In 2023, Individual Quick Freezing (IQF) held a dominant market position in the By Freezing Technique segment of the Frozen Food Market, capturing more than a 40% share. IQF technology is highly favored for its ability to freeze individual pieces of food rapidly, preventing the formation of large ice crystals and preserving the texture, flavor, and nutritional value of the food. This method is particularly popular for freezing fruits, vegetables, seafood, and small meat portions, as it allows for easy portioning and minimizes waste. The efficiency and quality preservation offered by IQF technology drive its widespread adoption in the frozen food industry.

Blast Freezing is another important freezing technique, known for its rapid freezing capabilities suitable for larger food items. While effective, its market share is smaller compared to IQF due to the higher energy consumption and less suitability for individually portioned items.

Belt Freezing is used for continuous freezing processes, often in large-scale industrial applications. Although crucial for certain types of food processing, its market share remains limited due to its specialized nature and higher operational costs compared to other freezing methods.

By Distribution Channe Analysis

Supermarkets/Hypermarkets dominated the By Distribution Channel segment of the Frozen Food Market in 2023, capturing more than a 50% share.

In 2023, Supermarkets/Hypermarkets held a dominant market position in the By Distribution Channel segment of the Frozen Food Market, capturing more than a 50% share. These retail giants are preferred by consumers due to their extensive product range, convenient locations, and frequent promotions. The one-stop-shop nature of supermarkets and hypermarkets, combined with the availability of various frozen food options, drives significant foot traffic and sales. Additionally, the increasing trend of organized retail and the development of cold chain infrastructure support the dominance of this distribution channel.

Convenience Stores also play a vital role in the distribution of frozen foods, offering quick and easy access to essential items. Their smaller size and strategic locations make them a popular choice for immediate purchases, although their market share is smaller compared to supermarkets and hypermarkets due to the limited product range.

Online Channels are rapidly growing, driven by the convenience of home delivery and the increasing penetration of e-commerce. While the market share for online channels is expanding, it remains smaller than traditional retail formats due to consumer preferences for physically inspecting food products before purchase and concerns about the quality of frozen items during delivery.

Key Market Segments

By Product Type

- Frozen Fruits and Vegetables

- Frozen Snacks

- Frozen-cooked Ready Meals

- Frozen Desserts

- Frozen Meat and Fish

- Frozen Pet Food

By Freezing Technique

- Individual Quick Freezing (IQF)

- Blast Freezing

- Belt Freezing

By Distribution Channel

- Supermarkets/Hypermarkets

- Convenience Stores

- Online Channels

Growth Opportunity

Innovation in Healthy and Organic Frozen Food Products

Innovation in healthy and organic frozen food products presents a significant opportunity for market growth in 2024. As consumers become more health-conscious and environmentally aware, there is a rising demand for nutritious and organic food options. Developing frozen products that cater to these preferences can attract a broader consumer base. Organic frozen foods, in particular, are expected to gain traction, driven by their perceived health benefits and sustainable production methods.

Improved Supply Chain and Logistics

Enhancements in supply chain and logistics offer another crucial opportunity for the frozen food market. Improved logistics and advanced cold chain management can reduce energy costs and increase the efficiency of storage and transportation. As companies invest in better infrastructure and technologies, the reliability and accessibility of frozen foods will improve, supporting market expansion. Efficient supply chains also help in maintaining the quality of frozen products, thereby boosting consumer confidence and demand.

Latest Trends

Rise in Plant-Based Frozen Food Products

The rise in plant-based frozen food products is a prominent trend expected to shape the market in 2024. As consumers shift towards plant-based diets for health and environmental reasons, the demand for frozen vegetarian and vegan options is increasing. These products cater to the growing number of consumers seeking meat alternatives, providing a convenient and nutritious option. The plant-based frozen food segment is anticipated to experience substantial growth, driven by these evolving dietary preferences.

Increased Focus on Sustainable Packaging

An increased focus on sustainable packaging is another trend influencing the frozen food market. Consumers and regulatory bodies are pushing for eco-friendly packaging solutions to reduce environmental impact. Innovations in biodegradable, recyclable, and compostable packaging materials are gaining popularity. Adopting sustainable packaging not only meets regulatory requirements but also appeals to environmentally conscious consumers, enhancing brand reputation and market share. This trend is expected to drive innovation and growth in the frozen food market, as companies strive to align with sustainability goals.

Regional Analysis

Frozen Food Market by Region: North America, Europe, Asia Pacific, Middle East & Africa, Latin America

In 2023, Europe dominated the Frozen Food Market, capturing a substantial 35% share. This leadership is driven by high consumer demand for convenient and ready-to-eat food products, coupled with advanced cold chain logistics infrastructure. Countries such as Germany, France, and the UK lead the market with a strong preference for high-quality frozen meals, vegetables, and desserts. The increasing focus on healthy and organic frozen food options also supports market growth in this region.

North America holds a significant share of the frozen food market, driven by busy lifestyles and the high demand for convenience foods. The United States and Canada see a growing trend of health-conscious consumers opting for frozen fruits and vegetables. The presence of major market players and continuous product innovations further bolster market growth.

Asia Pacific is experiencing rapid growth in the frozen food market, fueled by increasing urbanization, rising disposable incomes, and changing dietary habits. Countries like China, Japan, and India are witnessing a surge in demand for frozen snacks, ready-to-cook meals, and seafood. The expanding retail sector and improving cold chain logistics infrastructure contribute to the market's expansion.

Middle East & Africa show promising potential for growth in the frozen food market, supported by the growing urban population and increasing disposable incomes. The demand for convenient and longer shelf-life food products is rising, particularly in urban areas. However, the overall market share remains modest due to economic constraints and limited cold chain infrastructure in some regions.

Latin America is emerging as a growing market for frozen food, with Brazil and Mexico leading the demand. The region benefits from the increasing availability of frozen food products in supermarkets and hypermarkets. While the market share is expanding, it remains smaller compared to dominant regions due to economic variability and slower adoption of frozen food products.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The global frozen food market is anticipated to experience robust growth in 2024, driven by shifting consumer preferences towards convenience and longer shelf life products. Key players such as Aryzta AG, Nestle, and General Mills Inc. are set to dominate this evolving landscape through strategic innovation and extensive distribution networks.

Aryzta AG continues to lead the bakery segment, capitalizing on its strong brand portfolio and focus on high-quality frozen baked goods. Their investment in automation and technology enhances production efficiency and product consistency.

Nestle remains a formidable player with its diverse range of frozen meals and snacks. The company's commitment to nutrition and health aligns with rising consumer demand for healthier frozen food options. Their global reach and strong marketing capabilities ensure sustained market leadership.

General Mills Inc. and Kraft Foods Group Inc. leverage their extensive brand portfolios to offer a wide variety of frozen products, from meals to desserts. Their focus on innovation and understanding of consumer trends enable them to introduce new products that cater to evolving tastes and preferences.

Ajinomoto Co., Inc. and Cargill Incorporated are expanding their presence in the frozen food sector through strategic acquisitions and partnerships. Their expertise in food ingredients and commitment to quality enhance their competitive positioning.

Europastry S.A. and Kellogg Company are strengthening their market foothold by diversifying their product offerings and expanding into new geographical markets. Their focus on convenience and quality aligns with the growing demand for ready-to-eat frozen foods.

Unilever Plc and Flower Foods are leveraging their strong brand equity and innovative product development to capture market share. Their emphasis on sustainability and eco-friendly packaging resonates well with environmentally conscious consumers.

Allens, Inc. continues to focus on the vegetable segment, offering a wide range of frozen vegetables that meet the demand for healthy and convenient meal options.

Market Key Players

- Aryzta AG

- Nestle

- General Mills Inc.

- Kraft Foods Group Inc.

- Ajinomoto Co. Inc.

- Cargill Incorporated

- Europastry S.A.

- Kellogg Company

- Unilever Plc

- Flower Foods

- Allens, Inc.

Recent Development

- In May 2024, Nestlé launched a new range of plant-based frozen meals under its Garden Gourmet brand, targeting health-conscious consumers.

- In April 2024, Conagra Brands expanded its Healthy Choice line with new low-calorie frozen dinners aimed at the diet-conscious segment.

Report Scope

Report Features Description Market Value (2023) USD 305.3 Bn Forecast Revenue (2033) USD 486.7 Bn CAGR (2024-2033) 4.9% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Frozen Fruits and Vegetables, Frozen Snacks, Frozen-cooked Ready Meals, Frozen Desserts, Frozen Meat and Fish, Frozen Pet Food), By Freezing Technique (Individual Quick Freezing (IQF), Blast Freezing, Belt Freezing), By Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores, Online Channels) Regional Analysis North America - The US, Canada, & Mexico; Western Europe - Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe - Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC - China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America - Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa - Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Aryzta AG, Nestle, General Mills Inc., Kraft Foods Group Inc., Ajinomoto Co. Inc., Cargill Incorporated, Europastry S.A., Kellogg Company, Unilever Plc, Flower Foods, Allens, Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Aryzta AG

- Nestle

- General Mills Inc.

- Kraft Foods Group Inc.

- Ajinomoto Co. Inc.

- Cargill Incorporated

- Europastry S.A.

- Kellogg Company

- Unilever Plc

- Flower Foods

- Allens, Inc.