Global Inhalation Anesthesia Market By Drug(Sevoflurane, Desflurane, Isoflurane, Others), By Application(Induction, Maintenance), By End-Use(Hospitals, Ambulatory Surgical Centers, Others), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

2367

-

June 2024

-

300

-

-

This report was compiled by Trishita Deb Trishita Deb is an experienced market research and consulting professional with over 7 years of expertise across healthcare, consumer goods, and materials, contributing to over 400 healthcare-related reports. Correspondence Team Lead- Healthcare Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

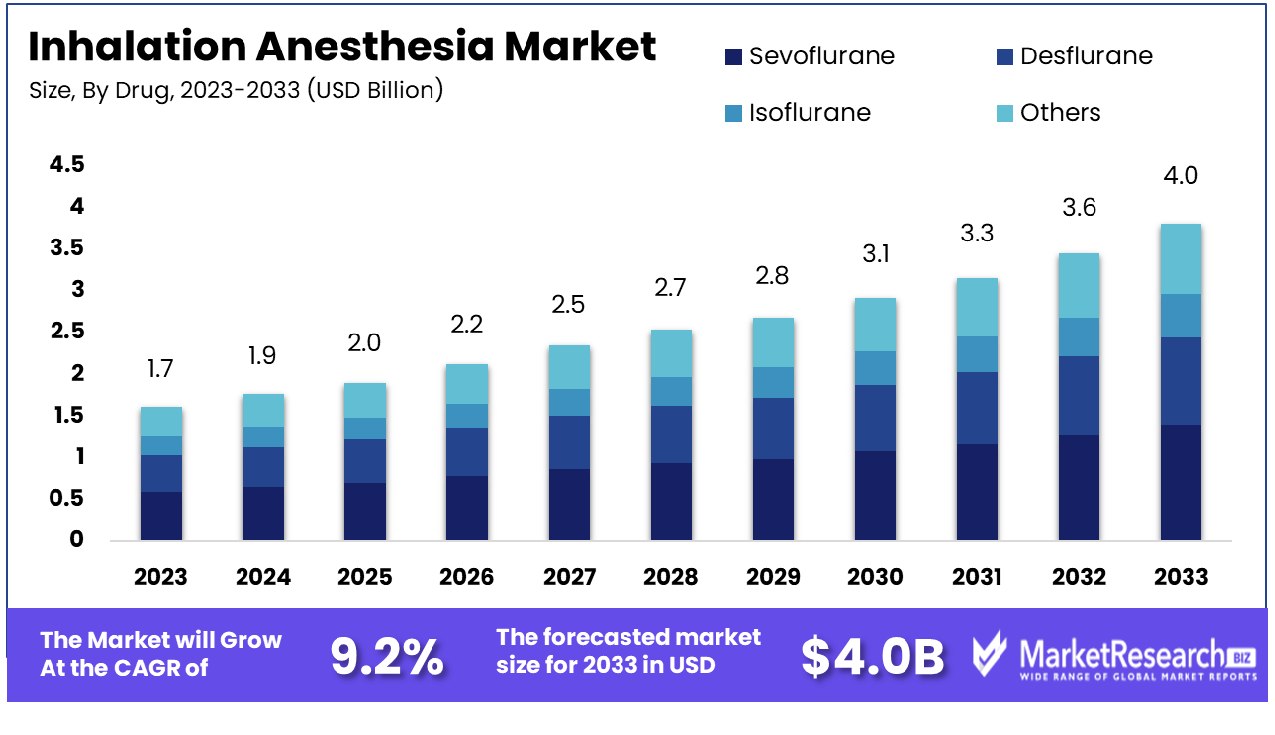

The Global Inhalation Anesthesia Market was valued at USD 1.7 billion in 2023. It is expected to reach USD 4.0 billion by 2033, with a CAGR of 9.2% during the forecast period from 2024 to 2033.

The Inhalation Anesthesia Market comprises the sale and distribution of inhalation anesthetics used to induce and maintain general anesthesia during surgical procedures. This market caters to anesthetics that are administered through the respiratory system using gases or volatile liquids. Essential for surgeries requiring a controlled and reversible unconscious state, these anesthetics are integral in healthcare settings.

Key market drivers include advances in surgical practices, rising surgical procedures globally, and ongoing enhancements in anesthesia technologies. As industry leaders, understanding this market's dynamics aids in strategic decision-making regarding procurement, technological upgrades, and alignment with healthcare regulations.

The Inhalation Anesthesia Market is poised for significant growth, driven by the increasing prevalence of digestive diseases and the growing number of surgical procedures worldwide. The study reported that digestive diseases affect more than 40 million people globally and account for millions of clinical visits annually, with healthcare expenditures totaling $119.6 billion in 2018. This surge in healthcare needs propels the demand for effective anesthesia solutions. Inhalation anesthesia, recognized for its rapid onset and ease of administration, is gaining traction in both developed and emerging markets.

The global burden of digestive diseases decreased from 1990 to 2019, with the age-standardized DALY rate decreasing from 1570.35 in 1990 to 1096.99 in 2019 per 100,000. This reduction underscores improvements in healthcare systems and the adoption of advanced medical technologies, including anesthesia. However, the aging global population and rising incidence of chronic conditions necessitate ongoing surgical interventions, bolstering the inhalation anesthesia market.

Technological advancements and product innovations further stimulate market growth. Manufacturers are focusing on enhancing the efficacy and safety profiles of anesthetic agents. Moreover, the development of new inhalation anesthesia delivery systems aligns with the increasing emphasis on patient-centric care and safety standards.

Key Takeaways

- Market Growth: The Global Inhalation Anesthesia Market was valued at USD 1.7 billion in 2023. It is expected to reach USD 4.0 billion by 2033, with a CAGR of 9.2% during the forecast period from 2024 to 2033.

- By Drug: Sevoflurane led the drug segment with a 63% market share dominance.

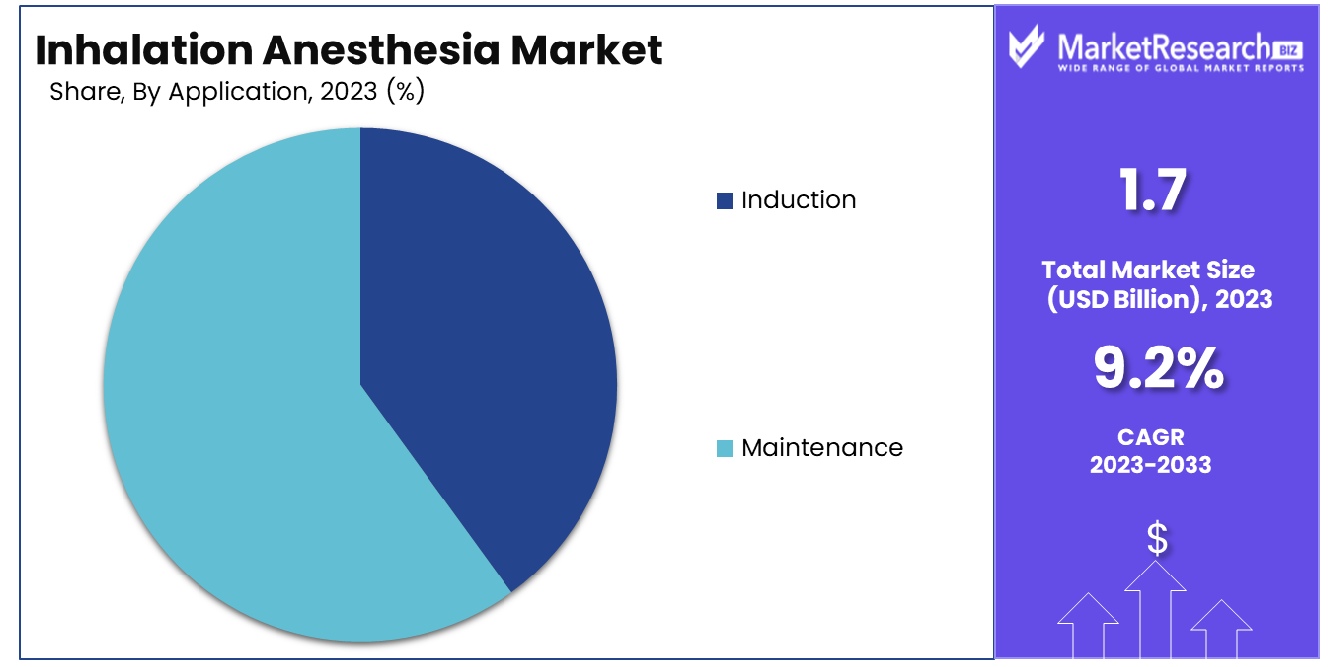

- By Application: Maintenance applications held a commanding 85% dominance in usage scenarios.

- By End-Use: Hospitals were the primary end-users, dominating with a 69% market share.

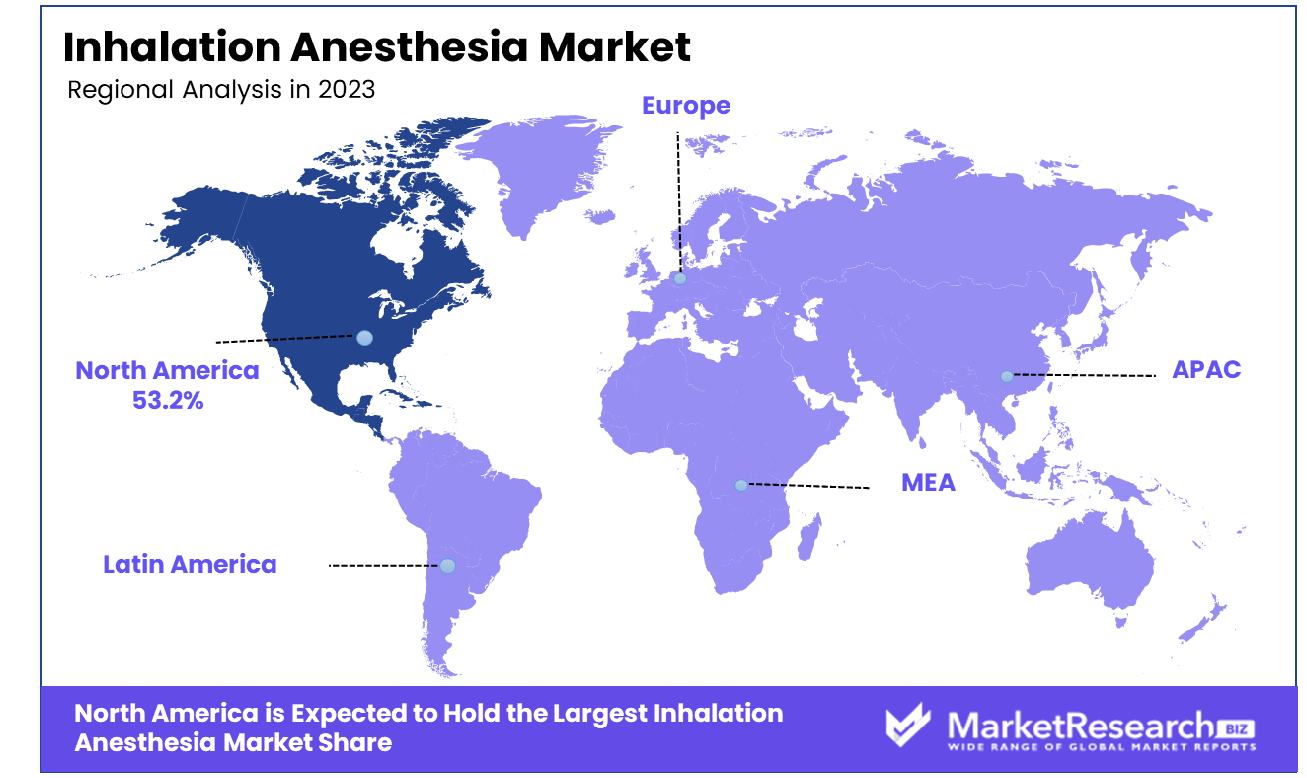

- Regional Dominance: North America holds 53.2% of the global inhalation anesthesia market share.

- Growth Opportunity: The global inhalation anesthesia market is expanding with innovations in pediatric devices and a shift towards sevoflurane and desflurane, favored for their efficiency and reduced environmental impact.

Driving factors

Advancements in Inhalation Anesthesia Techniques

The Inhalation Anesthesia Market is witnessing significant growth, largely driven by technological advancements in anesthesia techniques. Modern inhalation anesthetics are designed to be more efficient and safer, reducing both the induction and recovery times during surgical procedures. These improvements enhance patient throughput and reduce potential complications, making surgeries more accessible and frequent.

Innovations such as the development of multi-gas monitors and computer-controlled anesthesia systems allow for precise drug administration, minimizing human error and enhancing patient safety. Such advancements are pivotal in increasing the adoption of inhalation anesthesia in complex surgeries, thereby expanding the market.

Increasing Prevalence of Chronic Diseases

Chronic diseases often require surgical interventions, which directly influences the demand for inhalation anesthesia. The global increase in conditions such as cardiovascular diseases, cancer, and diabetes has led to a surge in surgeries. For instance, the rise in cancer incidences worldwide necessitates more surgical procedures, which in turn boosts the use of inhalation anesthesia.

According to the World Health Organization, chronic diseases are projected to account for almost three-quarters of all deaths worldwide, indicating a growing need for medical interventions that include anesthesia services. This ongoing trend significantly propels market growth as healthcare providers seek effective and safe anesthesia methods for lengthy and repeated surgeries.

Expanding Healthcare Infrastructure

The expansion of healthcare infrastructure globally complements the other driving factors of the Inhalation Anesthesia Market. Developing regions are particularly witnessing a rapid increase in healthcare facilities equipped to perform surgeries, including the installation of modern anesthesia technologies. This expansion is supported by government initiatives and investments from private sectors aiming to improve healthcare accessibility and quality.

For example, countries like China and India are substantially investing in healthcare, which includes modernizing hospitals and increasing the number of healthcare professionals trained in anesthesia. This broader access to advanced medical facilities increases the demand for inhalation anesthesia products, contributing to the market.

Restraining Factors

Risks Associated with Certain Therapeutic and Diagnostic Devices

The growth of the Inhalation Anesthesia Market is notably hampered by the risks and complications associated with the use of certain therapeutic and diagnostic devices in medical procedures. Inhalation anesthetics, while widely used, can pose serious health risks including respiratory complications, cardiovascular instability, and potential toxicity if not administered accurately.

These risks are magnified in patients with pre-existing conditions and can lead to postoperative complications, thereby discouraging the use of inhalation anesthesia in sensitive patient groups. The fear of litigation and the high costs associated with potential medical errors further restrain healthcare providers from adopting these techniques extensively, impacting the overall market expansion.

Low Adoption Rate of New Technologies

The low adoption rate of new technologies in the field of inhalation anesthesia also acts as a significant barrier to market growth. Despite the availability of advanced anesthesia machines and monitoring systems, many healthcare facilities, particularly in developing countries, continue to rely on older and sometimes less safe methods due to high costs and a lack of training among medical professionals.

The reluctance to transition to newer, technologically advanced systems is compounded by a resistance to change among some practitioners who are accustomed to traditional practices. This slow uptake not only limits market growth but also restricts improvements in patient care quality and safety, which are crucial for the widespread acceptance and use of inhalation anesthesia technologies.

By Drug Analysis

Sevoflurane dominated the drug segment with a commanding 63% market share.

In 2023, Sevoflurane held a dominant market position in the "By Drug" segment of the Inhalation Anesthesia Market, capturing more than 63% share. This segment's leadership can be attributed to Sevoflurane's widespread acceptance in clinical settings due to its rapid onset and minimal side effects, making it a preferred choice among anesthesiologists for a variety of surgical procedures.

Following Sevoflurane, Isoflurane, and Desflurane also maintained significant market shares, with Isoflurane being favored for its cost-effectiveness and lower blood gas solubility compared to other agents. Although Desflurane has a faster recovery rate which is beneficial for outpatient surgery, its higher cost and pungency that may cause respiratory irritation limit its use compared to Sevoflurane.

The segment labeled "Others," which includes newer and less common inhalation anesthetics, held the smallest market share. This portion of the market faces challenges due to the strong establishment and clinical familiarity with Sevoflurane, Isoflurane, and Desflurane. However, ongoing research and development into safer and more effective inhalation anesthetics could potentially alter market dynamics in the future, increasing competition within this segment.

Overall, the Inhalation Anesthesia Market is characterized by a strong preference for established drugs, with Sevoflurane leading due to its optimal balance of safety, effectiveness, and patient comfort. However, evolving surgical requirements and advancements in anesthetic formulations are expected to influence future market trends and competitive scenarios.

By Application Analysis

Maintenance applications held a dominant position, accounting for 85% of the usage.

In 2023, Maintenance held a dominant market position in the "By Application" segment of the Inhalation Anesthesia Market, capturing more than an 85% share. This overwhelming dominance can be primarily attributed to the extended duration of many surgical procedures, which necessitates prolonged anesthesia, thereby increasing the demand for maintenance anesthetics.

Maintenance inhalation anesthesia is crucial for ensuring stable and controlled sedation throughout surgical operations. The high share of this segment reflects its indispensable role in a wide array of surgeries, from minor procedures to major operations requiring extended periods of anesthesia. The preference for maintenance anesthetics is further supported by their ability to allow adjustable depth of anesthesia, rapid recovery upon discontinuation, and minimal post-operative complications, which are key factors in their widespread adoption.

On the other hand, the Induction segment, which involves the initial administration of anesthesia to make a patient unconscious, held a significantly smaller market share. While induction is a critical phase of the anesthesia process, it is relatively brief compared to the maintenance phase, thereby accounting for a smaller proportion of the market. Induction agents are typically potent and fast-acting, designed to transition patients smoothly into unconsciousness, but their usage is limited to the initial phase of anesthesia.

The current market dynamics highlight the critical importance of maintenance inhalation anesthesia in the healthcare setting, driven by the need for sustained and safe sedation techniques. The segment's growth is further propelled by advancements in anesthetic drugs that enhance patient safety and outcomes, cementing its dominance in the market.

By End-Use Analysis

Hospitals emerged as the primary end-users, dominating 69% of the market sector.

In 2023, Hospitals held a dominant market position in the "By End-Use" segment of the Inhalation Anesthesia Market, capturing more than a 69% share. This significant market share is primarily due to the comprehensive range of surgical procedures performed in hospitals, which require reliable and effective anesthesia solutions. Hospitals, as primary healthcare facilities, often handle complex surgeries that necessitate prolonged anesthesia, thus driving the high utilization of inhalation anesthetics.

The infrastructure and resources available in hospitals, including specialized anesthesia teams and advanced monitoring equipment, further support the extensive use of inhalation anesthesia. This setting ensures that patient safety and procedural efficacy are maintained at high standards, contributing to the segment’s dominant position.

In contrast, Ambulatory Surgical Centers (ASCs) accounted for a smaller share of the market. Although ASCs have been growing in number due to the shift towards outpatient surgery for cost efficiency and convenience, they typically handle less complex procedures that may not always require the depth of anesthesia provided in hospitals.

The segment labeled "Others" includes clinics and specialty surgical centers that also use inhalation anesthesia but on a much smaller scale compared to hospitals and ASCs. This segment is limited by the scope and number of procedures performed, which are often less intensive and require shorter recovery times.

Overall, the dominance of hospitals in the inhalation anesthesia market is reinforced by their critical role in delivering comprehensive medical care, particularly for complex and emergency surgeries that require sophisticated anesthetic management.

Key Market Segments

By Drug

- Sevoflurane

- Desflurane

- Isoflurane

- Others

By Application

- Induction

- Maintenance

By End-Use

- Hospitals

- Ambulatory Surgical Centers

- Others

Growth Opportunity

Development of Inhalation Anesthesia Devices for Pediatric Use

The development of inhalation anesthesia devices specifically tailored for pediatric use represents a significant growth opportunity in the global inhalation anesthesia market. The unique physiological requirements of children necessitate specialized anesthesia equipment and formulations to ensure safety and efficacy. Innovations in this area, such as devices that offer precise dosing and reduced risk of complications, are poised to meet the increasing demand for pediatric surgeries and procedures.

This segment's growth is driven by the rising global birth rate and the heightened focus on pediatric healthcare staffing infrastructure. Additionally, regulatory bodies are increasingly emphasizing the safety standards for pediatric anesthesia devices, which encourages manufacturers to invest in research and development, thereby propelling market expansion.

Shift Toward Sevoflurane and Desflurane

Another pivotal growth trend in the global inhalation anesthesia market is the shift towards the use of sevoflurane and desflurane, driven by their favorable pharmacokinetic profiles. These agents are preferred due to their rapid onset and recovery times, which make them ideal for outpatient surgical procedures, a rapidly growing sector. The shift is also influenced by the reduced environmental impact of these agents compared to older anesthetics like halothane and isoflurane.

As healthcare providers and facilities continue to prioritize sustainability alongside efficacy, the demand for sevoflurane and desflurane is expected to surge. This trend is supported by ongoing innovations in anesthesia technology that optimize the delivery and effectiveness of these agents, enhancing their appeal in both developed and emerging markets.

Latest Trends

Integration of Digital Monitoring Technologies

In 2023, the integration of digital monitoring technologies in inhalation anesthesia is a leading trend in enhancing patient safety and operational efficiency. Digital solutions facilitate real-time monitoring of patient vitals and anesthesia depth, allowing anesthesiologists to make more precise adjustments. This integration not only improves the accuracy of anesthesia administration but also reduces the risk of anesthesia-related complications.

As hospitals and clinics continue to embrace digital transformation, the adoption of smart anesthesia devices equipped with IoT capabilities is on the rise. These advancements are crucial for the development of personalized anesthesia practices and are expected to drive significant growth in the market.

Expansion of Healthcare Infrastructure in Emerging Markets

The expansion of healthcare infrastructure in emerging markets presents a robust growth avenue for the global inhalation anesthesia market. Countries in Asia, Africa, and Latin America are experiencing rapid advancements in healthcare facilities, spurred by increasing government investments and partnerships with private sectors. This expansion is particularly relevant to the anesthesia market as the volume of surgical procedures grows, necessitating more extensive and advanced anesthesia services.

Furthermore, the rising healthcare standards and growing middle-class populations in these regions are increasing the demand for elective surgeries, thereby boosting the market for inhalation anesthetics. The trend is expected to continue as emerging markets strive to match global healthcare standards, providing significant opportunities for market players.

Regional Analysis

North America holds a 53.2% share of the global inhalation anesthesia market.

The global Inhalation Anesthesia market showcases varied regional dynamics, significantly influenced by healthcare infrastructure, regulatory policies, and the prevalence of surgical procedures.

North America emerges as the dominant region, accounting for approximately 53.2% of the market share. This can largely be attributed to advanced healthcare facilities, high healthcare expenditure, and the presence of key market players in the U.S. and Canada. The region's focus on innovative surgical procedures and high adoption rates of anesthesia drugs further propel market growth.

In Europe, the market is driven by well-established healthcare systems and increasing investments in healthcare technologies. The region's strict regulations regarding patient safety and product approvals ensure high standards and reliability of inhalation anesthesia products. Asia Pacific is identified as a rapidly growing segment due to increasing healthcare infrastructure, rising medical tourism, and growing awareness about minimally invasive surgeries that require reliable anesthesia.

The Middle East & Africa, and Latin America regions are expected to witness gradual growth. Factors such as improving healthcare facilities, economic development, and government initiatives to reform healthcare systems contribute to the market expansion in these areas. However, the market in these regions faces challenges such as limited access to advanced healthcare and a lower number of healthcare professionals per capita compared to more developed regions.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of Middle East & Africa

Key Players Analysis

In the global Inhalation Anesthesia Market of 2023, Halocarbon Products Corporation, Baxter, AbbVie Inc., Lunan Pharmaceutical Group, Piramal Enterprises Ltd., Sandoz International GmbH, and Fresenius Kabi AG emerge as significant players. Each company contributes uniquely to the market dynamics, driven by innovation, regulatory approvals, and strategic market expansions.

Halocarbon Products Corporation is renowned for its expertise in the development and manufacturing of specialty chemicals, including inhalation anesthetics. The company's focus on fluorinated compounds has positioned it as a niche player, offering specialized solutions in anesthesia care.

Baxter, a global medical products giant, continues to expand its anesthesia portfolio by focusing on safety and efficiency improvements. Their products are widely recognized for their reliability and quality, enhancing Baxter's market reach and customer trust.

AbbVie Inc. leverages its robust R&D capabilities to innovate in the anesthesia sector, contributing to its growth. The company's commitment to high standards in product development and patient safety makes it a formidable market presence.

Lunan Pharmaceutical Group, a key player from China, emphasizes expanding its anesthesia product range and enhancing global accessibility. Their strategic focus on emerging markets highlights their role in addressing global healthcare disparities.

Piramal Enterprises Ltd. has made significant strides in the market with its strategic partnerships and global distribution networks. The company focuses on affordable and accessible anesthesia solutions, catering to diverse healthcare settings.

Sandoz International GmbH, a division of Novartis, is known for its generic pharmaceuticals, including inhalation anesthetics. By offering cost-effective alternatives, Sandoz strengthens healthcare systems worldwide.

Fresenius Kabi AG specializes in pharmaceuticals and medical devices for critical care, including anesthesia. Their commitment to quality and innovation supports safer surgical outcomes and positions them strongly in the market.

Market Key Players

- Halocarbon Products Corporation

- Baxter

- AbbVie Inc.

- Lunan Pharmaceutical Group

- Piramal Enterprises Ltd.

- Sandoz International GmbH

- Fresenius Kabi AG

Recent Development

- In January 2024, Piramal Pharma Q3FY24: Revenue up 14.14% Y-o-Y, PAT at Rs 19.36 crore. CDMO, CHG, and ICH segments drive growth. EBITDA rises by 94%. Initiatives focus on sustainability and innovation.

- In October 2023, LTC Charles S. Kettles VAMC led VA Ann Arbor Healthcare System in decommissioning the nitrous oxide pipeline, reducing greenhouse gas emissions, and promoting climate sustainability in operating rooms.

- In October 2023, Abby Hess and Cincinnati Children’s innovated an anesthesia assessment tool, CIBA, quickly licensed to Epic by Cincinnati Children’s Innovation Ventures. Research collaboration with the Hospital for Sick Children continues.

Report Scope

Report Features Description Market Value (2023) USD 1.7 Billion Forecast Revenue (2033) USD 4.0 Billion CAGR (2024-2032) 9.2% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Drug(Sevoflurane, Desflurane, Isoflurane, Others), By Application(Induction, Maintenance), By End-Use(Hospitals, Ambulatory Surgical Centers, Others) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Halocarbon Products Corporation, Baxter, AbbVie Inc., Lunan Pharmaceutical Group, Piramal Enterprises Ltd., Sandoz International GmbH, Fresenius Kabi AG Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Halocarbon Products Corporation

- Baxter

- AbbVie Inc.

- Lunan Pharmaceutical Group

- Piramal Enterprises Ltd.

- Sandoz International GmbH

- Fresenius Kabi AG