Industry 5.0 Market By End-User(Manufacturing, Healthcare, Others), By Technology(Artificial Intelligence, Internet of Things (IoT), Others), By Size of Enterprise(Small and Medium Enterprises (SMEs), Large Enterprises, Others), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2023-2032

-

40674

-

Aug 2023

-

180

-

-

This report was compiled by Vishwa Gaul Vishwa is an experienced market research and consulting professional with over 8 years of expertise in the ICT industry, contributing to over 700 reports across telecommunications, software, hardware, and digital solutions. Correspondence Team Lead- ICT Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

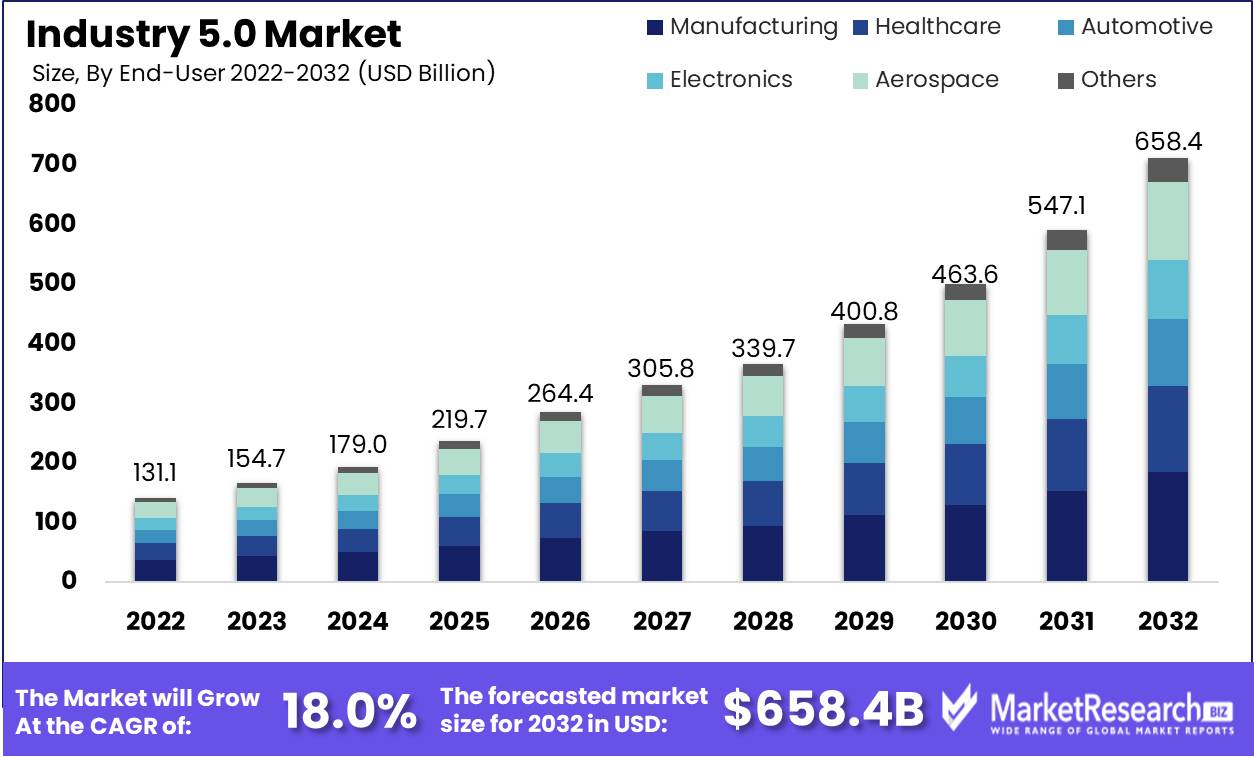

Industry 5.0 Market size is expected to be worth around USD 658.4 Bn by 2032 from USD 131.13 Bn in 2022, growing at a CAGR of 18.0% during the forecast period from 2023 to 2032.

Industry 5.0 refers to the Fifth Industrial Revolution focused on creating a smarter, more customized and service-oriented manufacturing framework. While past industrial revolutions were centered on mechanization, mass production, and automation, Industry 5.0 aims to enhance productivity and economic growth through the convergence of cutting-edge technologies like artificial intelligence, big data analytics, cloud computing, robotics, augmented reality, additive manufacturing, and the Internet of Things (IoT).

The core pillars of Industry 5.0 are interconnectivity, information transparency, technical assistance and on-demand production. Interconnectivity via 5G and the IoT allows all machines, parts and systems to seamlessly communicate with each other in real-time. Information transparency means all relevant data is visible to every stakeholder across the value chain, enabling data-driven decision-making. Technical assistance from AI and advanced robotics gives human workers augmented capabilities. On-demand production via flexible, intelligent, and distributed manufacturing networks allows for mass customization aligned with customer needs.

Industry 5.0 enables the transition from mass production to lot size one, where every customer can get personalized products and services. It will lead to digitalized, self-optimizing smart factories that continuously improve processes through machine learning. Production will shift from centralized facilities to distributed nodes close to the end user. The human role will evolve from active operator to supervisor, with technologies assisting people. Work will focus on creative tasks rather than repetitive activities.

Driving factors

Advances in artificial intelligence and machine learning

Recent breakthroughs in AI and ML algorithms allow manufacturing systems to continuously optimize processes by identifying patterns in vast datasets. Machine vision enables automated quality inspection. Predictive maintenance reduces downtime via condition monitoring. smart robots can adapt to new tasks. AI is making production more efficient, flexible, and autonomous.

Growth of the Industrial Internet of Things

The IIoT allows all devices, smart machines, and assets on the factory floor to be interconnected via sensors, actuators and data communication technology. This creates a smart manufacturing environment with ubiquitous connectivity for data sharing. Real-time asset monitoring, remote control, and system-wide visibility enable faster data-driven decisions and process improvements.

Demand for mass customization

Customer expectations are shifting towards personalized products versus one-size-fits-all. Modular product designs, flexible manufacturing cells and additive techniques allow the production of customized products at scale. With lot size one manufacturing enabled by Industry 5.0, companies can align production directly with individual customer needs and on-demand orders. This allows new business models based on customization.

Restraining Factors

Data Security Concerns

In today's data-driven world, organizations adopting Industry 5.0 face security risks. Interconnected systems produce exponential data growth. Ensuring confidentiality and integrity is critical yet challenging. Potential breaches endanger finances, reputation, and legal standing. Comprehensive security like encryption, firewalls, and audits is essential. Regular assessments and training will also help secure data as organizations embrace Industry 5.0.

Lack of Skilled Workers

The talent shortage hinders Industry 5.0 adoption. Advanced technologies require workers able to operate, manage and optimize complex systems. But qualified labor able to leverage Industry 5.0 is scarce. Collaboration between educators, industry, and government can help. Educational institutes must update curricula to develop relevant skills. Specialized training programs, apprenticeships and certifications can also help fill the gap. Attractive packages and stimulating work environments will aid recruitment and retention. With coordinated efforts to build skilled workforces, the immense potential of Industry 5.0 can be realized.

End-User Analysis

The manufacturing segment drives Industry 5.0 adoption through integrating advanced technologies to enhance productivity, efficiency and processes. Manufacturing industries like automotive, electronics and aerospace are embracing Industry 5.0. Key factors propelling this include emerging market industrialization and technological advancement. These economies are investing heavily in Industry 5.0 to stay competitive globally.

Consumer awareness and demand for quality, customization and sustainability also boost manufacturing adoption of Industry 5.0. Technologies like robotics, IoT and big data allow manufacturers to meet consumer expectations. The manufacturing segment will see the fastest Industry 5.0 growth due to increased operational efficiency and productivity from technologies like automation. AI integration also optimizes processes through predictive maintenance and real-time monitoring. The rise of smart factories leveraging IoT, cloud computing and cyber-physical systems will further drive manufacturing Industry 5.0 growth.

Technology Analysis

AI drives Industry 5.0 transformation by automating tasks, analyzing data and enabling intelligent decisions. This includes machine learning, natural language processing and computer vision. Economic growth in emerging markets also propels AI adoption to enhance productivity, customer experience and competitiveness. Increasing data availability, computing power and R&D investments further fuel AI Industry 5.0 growth.

Evolving consumer demand for personalized, intelligent experiences across sectors also spurs AI adoption. AI analysis of customer data provides customized offerings and automated interactions for improved satisfaction. The AI segment will see the fastest Industry 5.0 growth given its potential to optimize processes, identify insights in big data and integrate with other technologies for interconnected, intelligent systems.

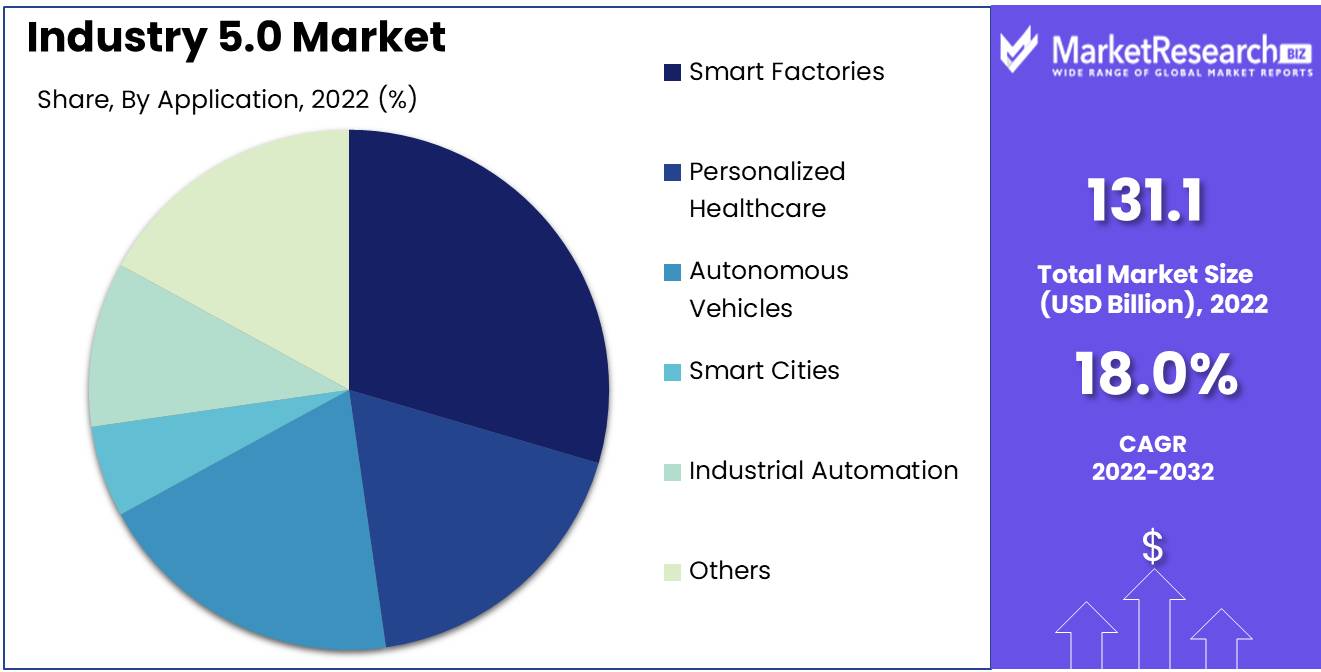

Application Analysis

Smart factories are revolutionizing manufacturing through advanced technologies enabling a connected, intelligent ecosystem. Applications span automotive, electronics, pharmaceuticals and food production. Economic growth in emerging markets drives smart factory adoption to boost industrial capabilities and global competitiveness.

Consumer demand for quick delivery, customization and sustainability also influences smart factory Industry 5.0 growth. Advanced technologies meet customer expectations through real-time monitoring, efficient allocation and optimized production. Smart factory growth will be fastest given factors like predictive maintenance from IoT devices, enhanced efficiency from automation, and optimized processes from AI and advanced analytics.

Key Market Segments

By End-User

- Manufacturing

- Healthcare

- Automotive

- Electronics

- Aerospace

- Others

By Technology

- Artificial Intelligence

- Internet of Things (IoT)

- Robotics

- Virtual Reality (VR) and Augmented Reality (AR)

- 3D Printing

- Others

By Size of Enterprise

- Small and Medium Enterprises (SMEs)

- Large Enterprises

By Application

- Smart Factories

- Personalized Healthcare

- Autonomous Vehicles

- Smart Cities

- Industrial Automation

- Others

By Industry Vertical

- Manufacturing and Production

- Healthcare and Life Sciences

- Transportation and Logistics

- Retail and Consumer Goods

- Energy and Utilities

- Others

Growth Opportunity

Advanced Robotics and Automation

One major growth opportunity in the Industry 5.0 market is advanced robotics and automation. As manufacturing and supply chains become more complex, there will be increasing demand for robotic systems that can work collaboratively with human workers to improve productivity and quality. Key areas of innovation include human-robot collaboration, autonomous mobile robots, modular robotics, and the use of AI to enable more flexible and intelligent automation. Market growth will be driven by the need for mass customization, faster changeovers, and the ability to automate complex tasks. Companies that provide advanced robotic solutions tailored for smart factories, along with associated software, will see substantial opportunities in this market.

AI and Big Data Analytics

The application of AI and advanced data analytics will be a crucial enabler of the autonomous, self-optimizing production systems that define Industry 5.0. There will be strong demand for AI solutions applied to areas like predictive maintenance, supply chain optimization, industrial IoT, and the modeling of complex manufacturing processes. Big data platforms that can gather, analyze, and translate vast amounts of real-time data from smart factories into actionable insights will provide companies with competitive advantages. Firms that provide robust industrial IoT solutions combined with AI and analytics capabilities will be well-positioned to benefit from this market growth. Data-driven AI and analytics solutions will become an indispensable part of the smart, connected factories of the future.

AR/VR for Next-Gen Interfaces

Another major growth area is AR/VR technology for immersive, next-generation human-machine interfaces. Industry 5.0 production environments will rely on AR/VR to provide workers with real-time operational data in context. This technology can also facilitate remote collaboration and training. Demand will rise for AR/VR interfaces that are ergonomic, intuitive, and tailored to complex industrial use cases. Companies that leverage AR/VR to improve human productivity and efficiency in smart factories will reap significant benefits. With advances in wearables and connectivity, AR/VR-enabled smart interfaces for humans working alongside intelligent machines will become a vital component of the Industry 5.0 ecosystem.

Latest Trends

Transition to Service-Based Business Models

There will be a major shift from traditional machinery sales to "Machinery-as-a-Service" business models. Rather than selling equipment, manufacturers will retain ownership and charge usage fees. This aligns incentives for suppliers to provide predictive maintenance and optimize performance over the lifetime of machinery. It also reduces capital expenditures for manufacturers. More flexible, service-centric business models will be a defining trend.

Democratization of Advanced Manufacturing

Maker spaces, fablabs, cloud manufacturing, and production-as-a-service will democratize access to advanced manufacturing capabilities. Small businesses will be able to leverage networked manufacturing platforms to rapidly prototype, test, and scale production. This will disrupt traditional economies of scale in manufacturing and open up opportunities for micro-factories. Democratized production will be a key trend.

Sustainable Manufacturing Focus

With concerns about climate change growing, manufacturers will be under pressure to dramatically improve sustainability. The focus will be on innovations that optimize energy, reduce waste, and create circular production systems. Life cycle analysis and meeting evolving sustainability regulations will also become more prominent. The trend toward environmentally sound manufacturing practices will only accelerate.

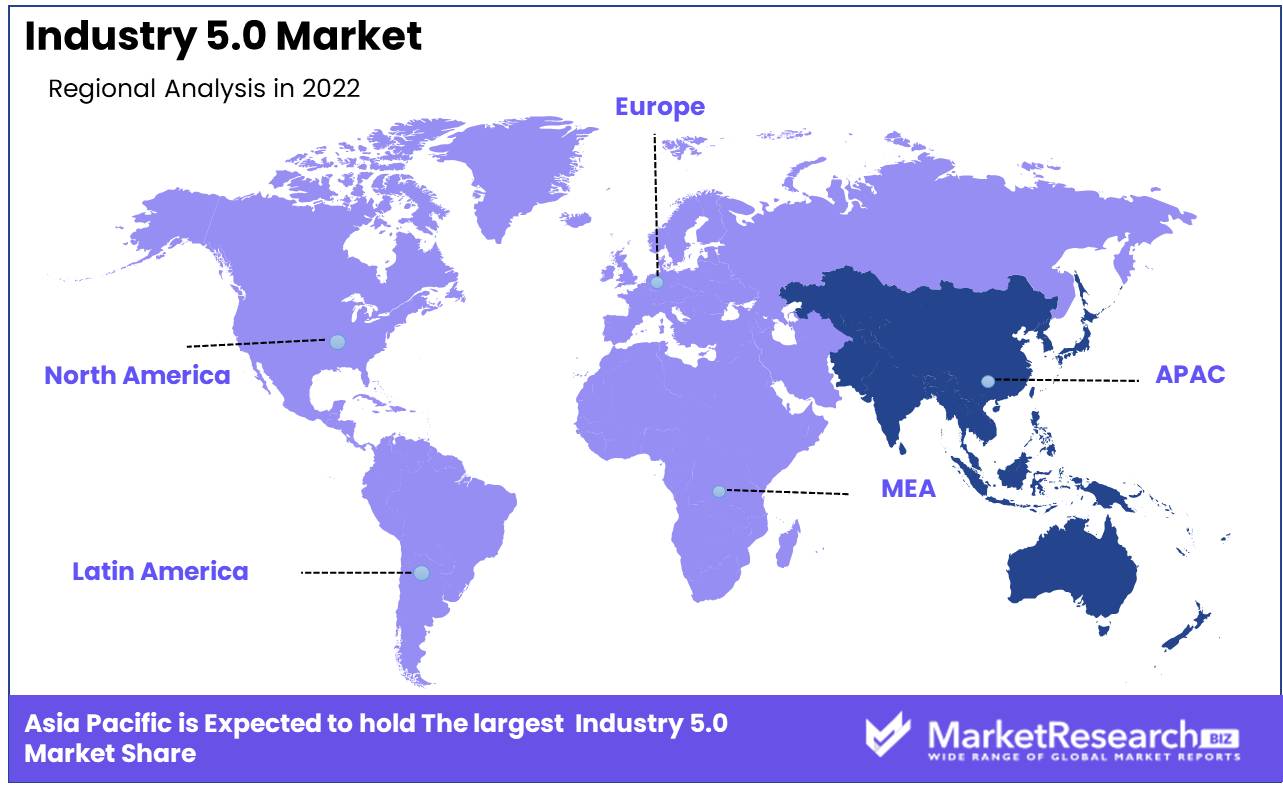

Regional Analysis

The Asia-Pacific region Dominates the Industry 5.0 Market, driven by its economic might, manufacturing capabilities, technological leadership, government initiatives, and collaborative ecosystems. Major economies like China, Japan, India, and South Korea possess immense market potential and extensive infrastructures to support Industry 5.0. Their strengths in technologies like robotics, AI, and automation strategically position them as pioneers.

The region has been at the forefront of groundbreaking R&D and innovations in 5G, IoT, big data, and machine learning. Such technological advancements enable the connectivity and automation that are central to Industry 5.0. Governments have implemented policies and programs like "Made in China 2025" and "Society 5.0" to catalyze Industry 5.0 adoption. These demonstrate the region's commitment to fostering supportive ecosystems.

Collaborative partnerships between businesses, academia, and research institutions drive innovation and knowledge exchange. This collaborative culture enhances the region's competitive edge globally. Surging demand for digitization across manufacturing, healthcare, logistics, and finance sectors is fueling Industry 5.0 market.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

Siemens is a leading company in Industry 5.0, renowned for its expertise in electrification, automation, and digitization. Siemens offers innovative solutions that enable human-machine collaboration and help businesses unlock their full potential. The company's extensive experience and global presence make it a prominent player in shaping the Industry 5.0 landscape.

ABB is another key player, a leading technology company specializing in robotics, power, and automation solutions. ABB combines human and machine capabilities to boost productivity and empower workers in various industries. With its strong focus on collaboration and sustainable development, ABB is well-positioned to drive Industry 5.0's growth.

General Electric (GE) is also a significant player in this market, offering advanced industrial technologies that blend automation and human expertise seamlessly. GE's range of solutions, from renewable energy to digital industrial transformation, contributes to the development of Industry 5.0. The company's commitment to innovation and its diverse portfolio solidify its position as a key player in the market.

Top Key Players in Industry 5.0 Market

- Siemens AG

- ABB Ltd.

- Fanuc Corporation

- Mitsubishi Electric Corporation

- Schneider Electric SE

- IBM Corporation

- Cisco Systems, Inc.

- General Electric (GE) Company

- Rockwell Automation, Inc.

- Microsoft Corporation

Recent Development

- In 2021, Rockwell Automation unveiled its much-anticipated Industry 5.0 platform, which aims to optimize manufacturing operations by harnessing Industrial Internet of Things (IIoT), artificial intelligence, and machine learning. By integrating real-time data analytics with automation and human-robot collaboration, Rockwell Automation seeks to enhance productivity and minimize downtime. This groundbreaking platform cements their position as a frontrunner in Industry 5.0.

- In 2019, ABB announced the development of a flexible and adaptable robot explicitly designed for Industry 5.0 applications. This collaborative robot allows humans and machines to work in harmony, unlocking immense productivity gains. With its advanced capabilities and safety mechanisms, ABB's robot signifies a paradigm shift in industrial workflows, establishing them as a key Industry 5.0 contributor.

- In 2019, GE Digital launched an ambitious Industry 5.0 initiative to bridge physical and digital realms through sensor data, algorithms, and analytics. By enabling data-driven decisions, GE Digital aims to empower sustainable, efficient operations. Their technology-focused approach highlights their role in maximizing Industry 5.0's potential.

Report Scope

Report Features Description Market Value (2022) USD 131.1 Bn Forecast Revenue (2032) USD 658.4 Bn CAGR (2023-2032) 18.0% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By End-User(Manufacturing, Healthcare, Others), By Technology(Artificial Intelligence, Internet of Things (IoT), Others), By Size of Enterprise(Small and Medium Enterprises (SMEs), Large Enterprises, Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Siemens AG, ABB Ltd., Fanuc Corporation, Mitsubishi Electric Corporation, Schneider Electric SE, IBM Corporation, Cisco Systems, Inc., General Electric (GE) Company, Rockwell Automation, Inc., Microsoft Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Siemens AG

- ABB Ltd.

- Fanuc Corporation

- Mitsubishi Electric Corporation

- Schneider Electric SE

- IBM Corporation

- Cisco Systems, Inc.

- General Electric (GE) Company

- Rockwell Automation, Inc.

- Microsoft Corporation