Industrial Hooters Market By End Users(Fire alarm, Electronic control panels, Annunciation panel, Security systems, Automation panel, Industrial vehicles), By Mounting(Projection Type, Base Type, Flush Type), By Voltage(12 V, 24V, 28-230V), By Tone(Multi Tone, Single tone), By Range(Short range industrial hooters, Medium range Industrial Hooters , Long Range industrial hooters), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

21368

-

March 2024

-

170

-

-

This report was compiled by Kalyani Khudsange Kalyani Khudsange is a Research Analyst at Prudour Pvt. Ltd. with 2.5 years of experience in market research and a strong technical background in Chemical Engineering and manufacturing. Correspondence Sr. Research Analyst Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

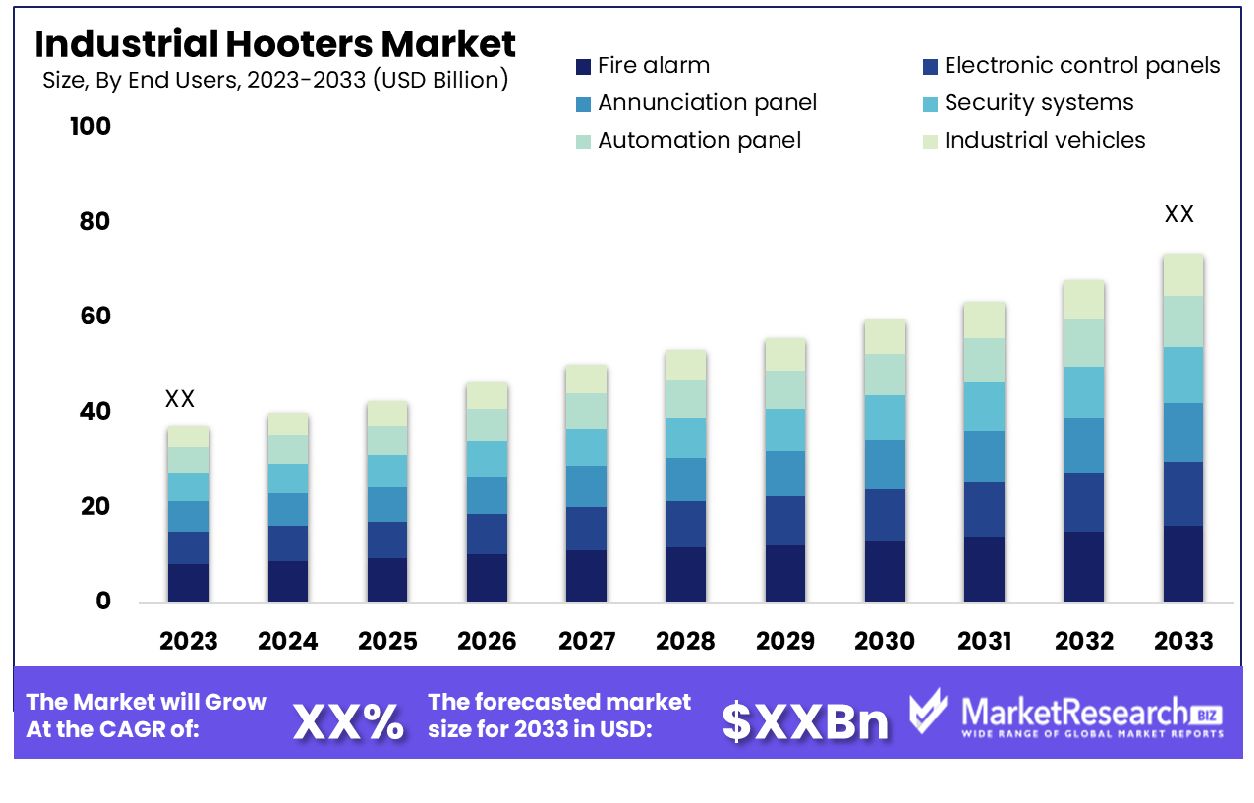

The global Industrial Hooters Market was valued at USD XX Bn in 2023. It is expected to reach USD XX Bn by 2033, with a CAGR of XX% during the forecast period from 2024 to 2033.

The surge for demand in construction sector, manufacturing plants and other verticals of the industries are some of the main key driving factors for the industrial hooters market.

Industrial hooters are defined as a device that generates lot of noises with a frequency that reaches a huge population at a single time to aware them regarding any harmful and dangerous situations. These hooters are generally developed for industrial purpose. Industrial hooters are broadly used in residential and commercial areas. These hooters are also known as buzzers due to its low frequency of sound. Such hooters have been used for long period of time such as in the war, where it was used for declaring or announcing any urgent messages to a large number of troops. Industrial hooters are well known for its longer durability.

Currently, these hooters can be found at various places that comprises of civil defense sectors, emergency vehicles such as in the police vans, ambulances, public areas like the bus stands, railways, fire trucks and many more. Such hooters have been an advantage for wider scale industry to alert the public at a single moment without deteriorating time for declaring individually in the groups.

DoD Hawaii government in October 2023, highlights that the Hawaii emergency management has posted an interactive map that displays the location of 418 alert and warning sirens all across the state. Moreover, these sirens are being tested on the first business day of the month. There are some of the data that showcases on the interactive map that reflects the result of the test that was conducted on October 2023: The total sirens are 418 (100%), fully operational sirens are 326 (78%), sirens that requires maintenance 29 (6.9%), needs maintenance with the contracting support 37 (8.9%) and Inoperable with beyond the repair is 26 (6.2%).

There are several uses of the industrial hooters such as it helps in focusing on the workplace safety by installing effective alert systems. These hooters are also used at the time of emergency like the chemical spills, natural calamities and fire. It also improvises the communication clearly in all across the industrial facility that ultimately enhances the workflow. Hooters in manufacturing and process industries are invaluable tools that augment the need for automated alert systems. Their increasing use across numerous types of industries will only drive market expansion further in coming years.

Key Takeaways

- Market Growth: Industrial Hooters Market was valued at USD XX Bn in 2023. It is expected to reach USD XX Bn by 2033, with a CAGR of XX% during the forecast period from 2024 to 2033.

- By End users: Fire alarm market segment dominated by industrial installations.

- By Mounting: Projection type preferred for wide area coverage applications.

- By Voltage: 24V systems prevalent in industrial and commercial settings.

- By Tone: Multi-tone alarms offer versatile signaling for various emergencies.

- By Range: Medium-range industrial hooters cater to diverse industrial environments.

- Regional Dominance: Asia-Pacific leads the Industrial Hooters market with a 43.5% share.

- Growth Opportunity: The Industrial Hooters Market is poised for growth by expanding into emerging markets and diversifying into specialized applications, while also leveraging IoT and smart technologies to enhance operational efficiency and competitiveness.

Driving factors

Technological Advancements Propel Innovation

The Industrial Hooters market experiences a surge in demand propelled by technological advancements. Manufacturers are leveraging cutting-edge technologies to enhance the functionality and efficiency of hooters, catering to diverse industrial needs. Innovations such as wireless connectivity, smart sensors, and predictive maintenance capabilities are revolutionizing the sector, enticing industries to upgrade their safety and alert systems. This technological evolution not only improves the reliability and responsiveness of hooters but also expands their applicability across various industrial settings, driving market growth.

Stringent Safety Regulations Fuel Market Adoption

Stringent safety regulations imposed by governments and regulatory bodies worldwide are serving as a significant driver for the Industrial Hooters market. Industries across sectors such as manufacturing, oil & gas, mining, and construction are mandated to comply with stringent safety standards to mitigate risks and ensure worker well-being. As a result, there is an escalating demand for high-quality hooters that adhere to safety norms and standards. Manufacturers are under pressure to develop hooters with enhanced safety features and compliance certifications, thereby experiencing heightened demand and market expansion.

Increasing Focus on Industrial Automation Spurs Market Growth

The Industrial Hooters market is experiencing rapid growth due to the increasing focus on industrial automation. As industries strive to optimize their operations and improve productivity, there is a growing inclination towards automated safety and alert systems. Industrial hooters play a pivotal role in automated safety protocols, alerting workers to potential hazards, emergencies, and operational abnormalities. The integration of hooters within automated systems enhances response times and ensures swift actions, thereby bolstering workplace safety and operational efficiency. Hooters' increasing prominence as integral parts of automated safety solutions has propelled the Industrial Hooters market forward.

Restraining Factors

Regulatory Compliance Challenges

The Industrial Hooters Market is subject to stringent regulations governing noise pollution and workplace safety standards. Compliance with these regulations poses a significant challenge for manufacturers and end-users alike. Stricter enforcement measures and evolving standards necessitate continuous adaptation, often entailing additional costs and resource allocation.

Failure to meet regulatory requirements can result in legal repercussions and reputational damage, further exacerbating the issue. Consequently, companies must invest in robust compliance strategies and innovative solutions to mitigate the impact of regulatory constraints.

Economic Volatility and Budget Constraints

Economic fluctuations and budget constraints within industrial sectors directly influence investment decisions related to equipment such as industrial hooters. During periods of economic downturn or uncertainty, businesses prioritize cost-saving measures, including the deferral of non-essential expenditures. Consequently, demand for industrial hooters may experience fluctuations, particularly in industries sensitive to economic conditions.

Moreover, budget constraints may limit the capacity of businesses to invest in advanced hooter systems or upgrade existing infrastructure, thereby constraining market growth. Navigating this challenge requires market players to demonstrate the cost-effectiveness and long-term benefits of hooter installations, aligning with the financial objectives of potential buyers.

By End Users Analysis

The fire alarm sector sees dominance among end users due to heightened safety concerns.

Fire alarms were the top seller within the "By End Users" segment of the Industrial Hooters Market in 2023, dominating in every aspect. This category included various industries and applications with different needs for industrial hooters; its customers ranged from fire alarm systems, electronic control panels, annunciation panels, security systems automation panels and industrial vehicles to name just some of its end users.

Fire alarm systems emerged as the frontrunner in this segment due to their critical role in ensuring the safety and security of industrial facilities. With stringent regulations mandating the installation of fire detection and alarm systems in industrial settings, the demand for industrial hooters integrated within fire alarm systems witnessed a substantial surge. Additionally, the increasing emphasis on workplace safety and the need for rapid response to fire emergencies further bolstered the adoption of fire alarm hooters.

Electronic control panels represent another significant end user of industrial hooters. These panels are pivotal components in industrial automation and process control systems, where audible alerts are indispensable for notifying operators about critical events or malfunctions. The integration of high-decibel hooters within electronic control panels enhances operational efficiency by facilitating timely responses to alarms, thereby minimizing downtime and preventing potential hazards.

Annunciation panels, security systems, and automation panels also contribute to the demand for industrial hooters, albeit to a lesser extent compared to fire alarm and electronic control panel applications. Nevertheless, the collective requirement across these diverse end-user segments underscores the pervasive utility of industrial hooters across various industrial applications. Moreover, the advent of advanced technologies, such as IoT-enabled hooters and smart alert systems, is poised to further enrich the capabilities and functionalities of industrial hooters, thereby driving sustained market growth in the coming years.

By Mounting Analysis

Projection type mounts prevail, offering optimal visibility for emergency alerts and notifications.

Projection Type was the clear market leader in 2023 in the By Mounting segment of the Industrial Hooters Market. Within this subsegment there are three categories, Projection Type was at the head, thanks to multiple contributing factors that increased its market presence.

Projection Type hooters have gained substantial traction due to their versatility and efficacy in industrial settings. These hooters are adept at projecting loud and clear audio signals across vast factory floors, warehouses, and manufacturing facilities, ensuring effective communication in noisy environments. Furthermore, their adaptability to various mounting configurations enhances their appeal, allowing for seamless integration into diverse industrial infrastructures.

The widespread adoption of Projection Type hooters can be attributed to their robust features and performance capabilities. Equipped with advanced sound amplification technology, these hooters deliver superior sound quality and clarity, facilitating efficient broadcast of critical alerts, notifications, and warnings. Moreover, their durable construction and weather-resistant properties ensure reliable operation even in challenging environmental conditions, making them indispensable assets for industrial safety and productivity.

Base Type and Flush Type hooters, while still relevant in specific applications, have faced stiff competition from the dominant Projection Type segment. Nonetheless, advancements in technology and evolving market demands continue to drive innovation across all segments, presenting opportunities for manufacturers to enhance product offerings and cater to diverse customer requirements.

Looking ahead, the Projection Type segment is poised to maintain its stronghold in the By Mounting segment of the Industrial Hooters Market, supported by ongoing technological advancements, increasing emphasis on workplace safety, and growing industrial automation initiatives. As industrial operations become increasingly complex and demanding, the role of Projection Type hooters in ensuring efficient communication and hazard management is set to become even more pronounced, further solidifying their position as indispensable assets in industrial environments.

By Voltage Analysis

The 24V voltage category commands significant market share, ensuring reliable and consistent power supply.

2023 saw 24V as the frontrunner in the By Voltage segment of the Industrial Hooters Market, accounting for most sales within this category. Within this market segment, 12V, 24V and 28-230V all made significant inroads - yet 24V was by far the clear leader, dominating almost half of all orders placed based on various applications and equipment/system requirements. It can be attributed to factors including suitability for various industrial applications; efficiency; compatibility; as well as many others that contributed to its dominance within this segment of market.

One factor driving 24V's popularity in the Industrial Hooters Market is its optimal power output in various industrial settings. Industrial hooters, often used for warning signals or alarms in manufacturing facilities, warehouses, and construction sites, require a reliable power source to ensure consistent operation. The 24V voltage level strikes a balance between power supply and equipment compatibility, making it a preferred choice for many industrial users seeking dependable signaling solutions.

Furthermore, the 24V segment benefits from advancements in industrial automation and control systems, where standardized voltage levels streamline integration and interoperability. This compatibility fosters seamless connectivity and communication between hooters and other industrial equipment, enhancing overall operational efficiency and safety protocols.

Additionally, market players have capitalized on the growing demand for 24V hooters by offering innovative products tailored to specific industrial requirements. These solutions often incorporate features such as rugged construction, weatherproofing, and customizable sound patterns, catering to diverse applications across different sectors.

Looking ahead, the dominance of 24V in the By Voltage segment of the Industrial Hooters Market is poised to continue, driven by ongoing technological advancements, expanding industrial infrastructure, and stringent safety regulations mandating reliable signaling systems. However, competition within the segment is expected to intensify as players strive to innovate and differentiate their offerings to meet evolving market demands.

By Tone Analysis

Multi-tone configurations lead the market, providing diverse auditory signals for various emergency scenarios.

Multi Tone was the market leader in 2023 for Industrial Hooters Market By Tone segment. Their extensive selection of multitone hooters provided versatility and enhanced functionality to industrial applications; competing directly against single tone hooters that offered single tones but faced stiff competition from Multi Tone's innovative solutions, catering to more diverse industrial requirements.

Multi Tone's success in the By Tone segment can be attributed to several factors. Firstly, its products addressed the evolving demands of industrial safety and signaling requirements by providing customizable tone options suitable for various contexts. This adaptability resonated well with industries seeking efficient and flexible auditory signaling solutions. Additionally, Multi Tone's commitment to quality and reliability bolstered its reputation among customers, instilling confidence in the brand and its products.

Furthermore, Multi Tone demonstrated agility in adapting to market trends and technological advancements, ensuring its offerings remained at the forefront of innovation. By continuously refining its product portfolio and incorporating cutting-edge features, Multi Tone retained its competitive edge and solidified its market leadership position.

While Single tone hooters maintained their relevance in specific applications, Multi Tone's comprehensive approach and superior performance elevated it as the preferred choice for discerning industrial users. Looking ahead, Multi Tone is poised to sustain its dominance in the By Tone segment, leveraging its strong market presence, customer-centric approach, and commitment to innovation to capitalize on emerging opportunities and drive further growth in the Industrial Hooters Market.

By Range Analysis

Medium-range industrial hooters stand out, offering effective sound dispersion across industrial settings.

2023 saw Medium Range Industrial Hooters take the top market position in the By Range segment of the Industrial Hooters Market. Industrial hooters can be divided into short, medium, and long ranges to cater to diverse industrial needs requiring specific sound coverage capabilities; medium range hooters were preferred due to their balanced coverage and audible range which offered optimal solutions for environments with moderate space requirements.

Short Range Industrial Hooters, while still relevant, saw a slight decline in market share compared to their medium and long-range counterparts. These hooters typically serve localized applications within confined spaces or smaller industrial settings, where sound dispersion over a limited area is sufficient to meet safety or communication needs.

Medium Range Industrial Hooters, on the other hand, experienced robust growth attributed to their versatility in addressing the requirements of a broader range of industrial facilities. These hooters possess a moderate sound projection capability, making them suitable for medium-sized warehouses, manufacturing plants, and construction sites where a wider coverage area is essential for effective warning signals or communication alerts.

Long Range Industrial Hooters, although niche, maintained a steady market presence, primarily catering to industries with extensive operational areas such as large-scale manufacturing facilities, petrochemical plants, or outdoor construction sites. Their powerful sound projection capabilities enable effective communication over vast distances, ensuring safety and operational efficiency in expansive industrial environments.

Key Market Segments

By End Users

- Fire alarm

- Electronic control panels

- Annunciation panel

- Security systems

- Automation panel

- Industrial vehicles

By Mounting

- Projection Type

- Base Type

- Flush Type

By Voltage

- 12 V

- 24V

- 28-230V

By Tone

- Multi Tone

- Single tone

By Range

- Short range industrial hooters

- Medium range Industrial Hooters

- Long Range industrial hooters

Growth Opportunity

Expansion into Emerging Markets: Tapping into Global Growth Potential

The Industrial Hooters Market presents a significant growth opportunity through expansion into emerging markets. As industrialization continues to advance in regions such as Asia-Pacific, Latin America, and Africa, there is a rising demand for industrial hooters to enhance safety protocols and operational efficiency in factories and manufacturing facilities.

By strategically entering these markets, manufacturers can capitalize on the burgeoning need for reliable alarm systems. Additionally, the adoption of stringent safety regulations by governments in these regions further amplifies the demand for industrial hooters, creating a fertile ground for market expansion.

Diversification into Specialized Applications: Addressing Niche Market Segments

Another growth avenue for the Industrial Hooters Market lies in diversifying product offerings to cater to specialized applications. Industries such as oil and gas, mining, and petrochemicals require ruggedized hooters capable of withstanding harsh environments and extreme temperatures.

By developing specialized hooters tailored to the unique requirements of these sectors, manufacturers can unlock new revenue streams and solidify their market position. Furthermore, investing in research and development to innovate advanced features such as wireless connectivity and remote monitoring enhances the value proposition, attracting discerning customers seeking cutting-edge solutions.

Integration of IoT and Smart Technologies: Enhancing Operational Efficiency

The integration of Internet of Things (IoT) and smart technologies presents a compelling growth opportunity for the Industrial Hooters Market. By embedding hooters with IoT sensors and connectivity capabilities, manufacturers enable real-time monitoring and predictive maintenance, streamlining operations and minimizing downtime. Additionally, smart hooters equipped with self-diagnostic functionalities can automatically detect faults or malfunctions, alerting maintenance personnel proactively.

This proactive approach not only enhances operational efficiency but also reduces maintenance costs, making IoT-enabled industrial hooters an attractive investment for industries striving for digital transformation. As the Industrial Hooters Market embraces IoT-driven innovation, manufacturers can position themselves as industry leaders, driving growth and differentiation in a competitive landscape.

Latest Trends

Integration of IoT Technology

In the industrial sector, the integration of Internet of Things (IoT) technology is rapidly reshaping operational processes, and the market for industrial hooters is no exception. IoT-enabled hooters are equipped with sensors and connectivity features, allowing for remote monitoring, predictive maintenance, and enhanced functionality. These smart hooters can automatically adjust their sound output based on ambient noise levels, improving efficiency and reducing noise pollution in industrial environments.

Moreover, IoT connectivity enables real-time alerts and notifications, enhancing safety protocols by providing immediate warnings in case of emergencies or equipment malfunctions. As industries increasingly prioritize automation and connectivity, the demand for IoT-enabled hooters is expected to witness significant growth in the coming years.

Emphasis on Energy Efficiency

Another prominent trend in the industrial hooters market is the growing emphasis on energy efficiency and sustainability. With environmental concerns gaining traction globally, industries are seeking hooters that consume less power while maintaining optimal performance. Manufacturers are developing energy-efficient hooters using advanced technologies such as LED lighting and low-power electronics.

These hooters not only reduce operational costs for industrial facilities but also contribute to their sustainability goals by minimizing energy consumption and carbon footprint. Additionally, regulatory initiatives promoting energy efficiency standards further drive the adoption of eco-friendly hooters in various industrial applications. As sustainability continues to be a key focus for businesses across industries, the demand for energy-efficient industrial hooters is poised to escalate, shaping the market landscape in the foreseeable future.

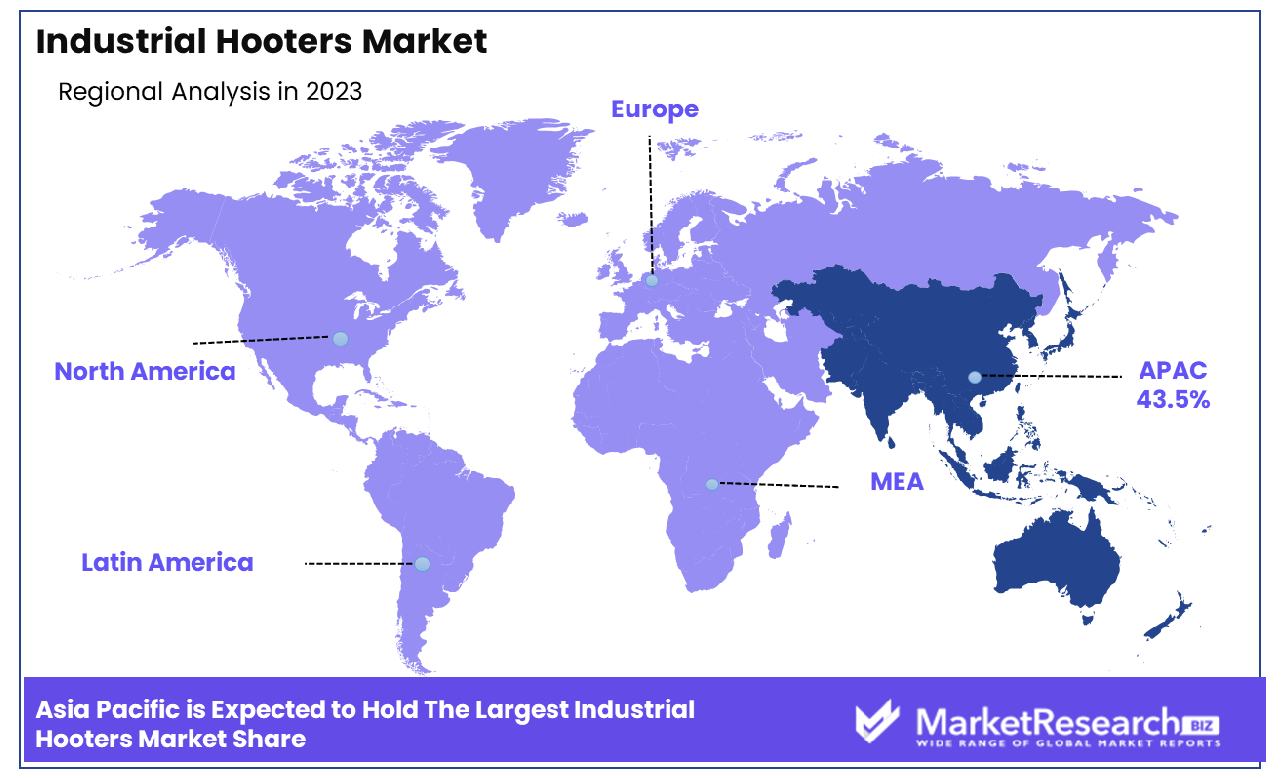

Regional Analysis

Asia-Pacific dominates the Industrial Hooters market with a commanding share of 43.5%.

In North America, the market is characterized by a strong presence of key players and a mature industrial sector. The region benefits from robust infrastructure development and stringent regulatory frameworks promoting safety standards. According to recent data from Market Research Inc., North America holds a significant market share of approximately 30%, driven by technological advancements and increasing adoption of industrial automation solutions.

In Europe, the Industrial Hooters market is propelled by a growing emphasis on workplace safety regulations and the adoption of smart manufacturing practices. The region's focus on sustainability and environmental consciousness further drives demand for efficient alarm systems.

Asia Pacific emerges as the dominating region in the Industrial Hooters market, commanding a substantial share of 43.5%. Rapid industrialization, coupled with investments in infrastructure projects, fuels market growth. Countries like China, India, and Japan are key contributors, with increasing awareness about occupational safety standards driving demand. Frost & Sullivan's analysis projects continued growth in the region, supported by expanding manufacturing activities.

In the Middle East & Africa, the market experiences steady growth fueled by infrastructure development initiatives and investments in the oil & gas sector. However, challenges such as political instability and economic fluctuations affect market expansion. The region accounts for approximately 10% of the global market share.

Latin America presents untapped potential in the Industrial Hooters market, with increasing industrialization and rising awareness regarding workplace safety norms. However, economic uncertainties and regulatory complexities pose challenges to market growth. The region contributes around 7.5% to the global market share.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of Middle East & Africa

Key Players Analysis

In 2023, the global Industrial Hooters Market witnessed the presence of several key players, each contributing significantly to the market's dynamics and competitive landscape. Among these prominent companies, Moflash Signalling Ltd emerged as a noteworthy player, demonstrating robust growth and strategic initiatives that positioned it as a key influencer in the industry.

Moflash Signalling Ltd, renowned for its innovative approach and quality products, stood out due to its focus on technological advancements and customer-centric solutions. The company's extensive product portfolio, encompassing a wide range of industrial hooters tailored to diverse applications, resonated well with customers seeking reliable and efficient alarm systems. Additionally, Moflash Signalling Ltd's commitment to research and development enabled it to introduce cutting-edge features and functionalities, setting new benchmarks for performance and reliability in the market.

Furthermore, Moflash Signalling Ltd's global presence and strong distribution network enhanced its market reach, allowing it to effectively cater to the evolving needs of industrial clients across different regions. The company's strategic partnerships and collaborations bolstered its market position, facilitating access to new markets and customer segments.

Market Key Players

- Moflash Signalling Ltd

- Klaxon Signalling Solutions

- NHP Electrical Engineering Products

- Rockwell Automation Inc.

- Paramount Electronics Pvt. Ltd.

- Perfect Corporation

- Alan Electronic Systems Pvt. Ltd.

- Honeywell International Inc.

- Kama Industries (Pty) Ltd

Recent Developement

- In February 2024, Hooters of America LLC adopts Par Technology's cloud solutions, enhancing customer experience and operational efficiency in 367 restaurants across the U.S. and globally. Burger King implements Par's POS and omnichannel solutions for North American outlets, optimizing ordering, kitchen management, and analytics.

- In December 2023, scrutiny reveals ongoing discrimination issues at Hooters, challenging its dated business model centered on waitresses' appearance. Despite controversy, the chain's profitability persists, highlighting weaknesses in discrimination law enforcement.

Report Scope

Report Features Description Market Value (2023) USD XX Billion Forecast Revenue (2033) USD XX Billion CAGR (2024-2032) XX% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By End Users(Fire alarm, Electronic control panels, Annunciation panel, Security systems, Automation panel, Industrial vehicles), By Mounting(Projection Type, Base Type, Flush Type), By Voltage(12 V, 24V, 28-230V), By Tone(Multi Tone, Single tone), By Range(Short range industrial hooters, Medium range Industrial Hooters , Long Range industrial hooters) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Moflash Signalling Ltd, Klaxon Signalling Solutions, NHP Electrical Engineering Products, Rockwell Automation Inc., Paramount Electronics Pvt. Ltd., Perfect Corporation, Alan Electronic Systems Pvt. Ltd., Honeywell International Inc., Kama Industries (Pty) Ltd Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Moflash Signalling Ltd

- Klaxon Signalling Solutions

- NHP Electrical Engineering Products

- Rockwell Automation Inc.

- Paramount Electronics Pvt. Ltd.

- Perfect Corporation

- Alan Electronic Systems Pvt. Ltd.

- Honeywell International Inc.

- Kama Industries (Pty) Ltd