Hydroponics Market By Type Outlook(Aggregate Systems-(EBB & Flow Systems, Drip Systems, Wick Systems), Liquid Systems-(Deep Water Culture, Nutrient Film Technique (NFT), Aeroponics)), By Crop Type(Tomatoes, Lettuce, Peppers, Cucumbers, Herbs, Others), By Crop Area(Upto 1000 sq.ft., 1000-50000 sq.ft., Above 50000 sq.ft), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

11659

-

March 2024

-

173

-

-

This report was compiled by Shreyas Rokade Shreyas Rokade is a seasoned Research Analyst with CMFE, bringing extensive expertise in market research and consulting, with a strong background in Chemical Engineering. Correspondence Team Lead-CMFE Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

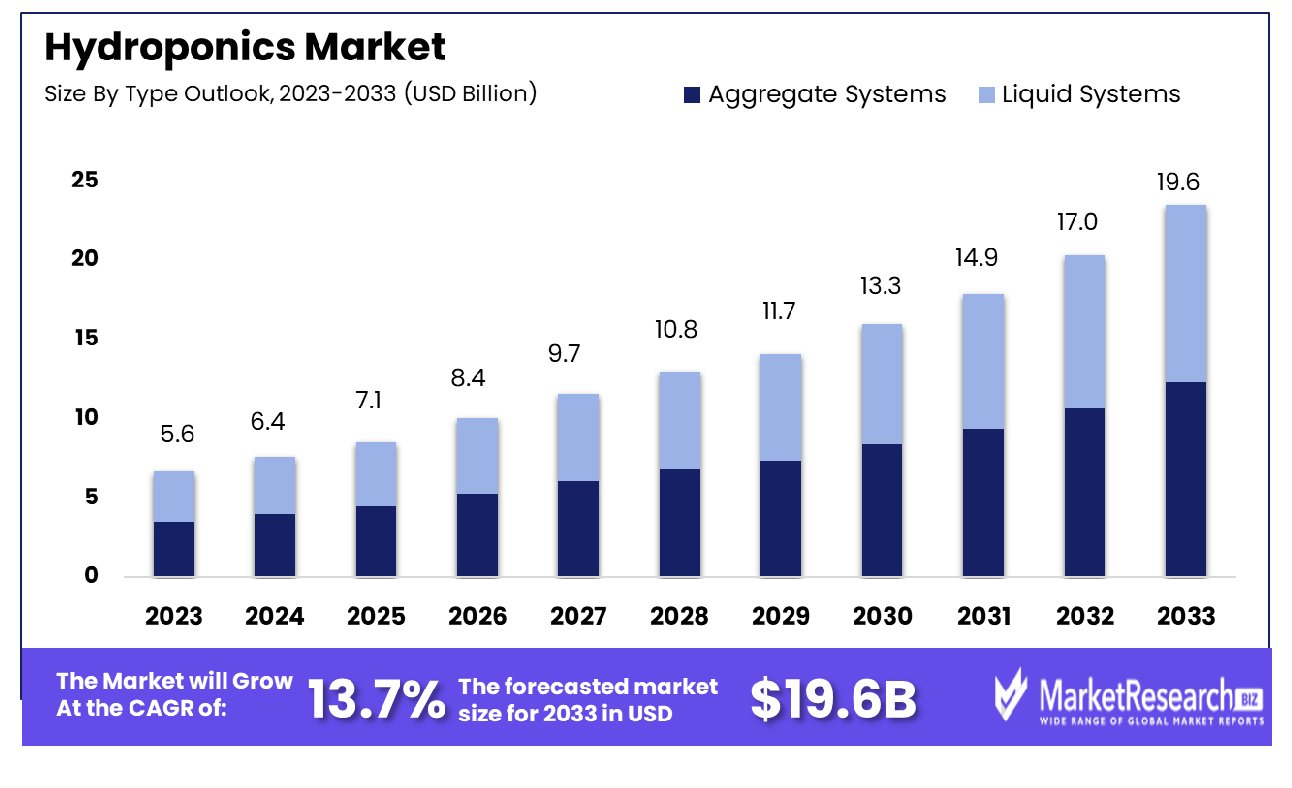

The hydroponics market was valued at USD 5.6 billion in 2023. It is expected to reach USD 19.6 billion by 2033, with a CAGR of 13.7% during the forecast period from 2024 to 2033. The surge in demand for the indoor cultivation of vegetables, the rise in urban living, and augmenting of the environmental issues are some of the main key driving factors for the hydroponics market.

Hydroponics is defined as the soil farming technique for cultivating plants by using nutrient-rich water solute ions to offer important and necessary minerals directly to the plant roots. This process permits accurate control over factors such as pH, environmental situations, and nutrient levels by nurturing enhanced plant growth and higher yields. In hydroponics systems generally, plants are supported by indolent growing mediums such as perlite and coconut coir.

The method is widely used in different settings from commercial agriculture and greenhouse farming to urban farming and home gardening. Hydroponics preserves water, decreases the need for pesticides, and makes year-round farming. The technique is versatile, offering a wide range of crops and its controlled environment reduces the impact of external factors by providing eco-friendly and efficient options for old soil-based cultivations.

According to BNN in February 2024, highlights that the Claysburg Education Foundation revealed an ambitious initiative to build a hydroponics educational facility that is substantially supported by philanthropists Mark and Karen Barnhart. The budget is allocated to have USD 200,000 for over 5 years, this project is poised to change the agricultural education in the Claysburg-Kimmel school district and make a perceptible impact on the local community’s fight against the food industry.

Moreover, according to Hindu Business Line in February 2022, highlights that Brio Hydroponics, an Ahmedabad-based agritech startup firm, entered into a joint venture with an Israeli company Pic-Plast Limited for a rain protection method that will aid in cultivating plants hydroponically throughout the year.

Using hydroponics has several advantages such as it augments automation through smart and advanced technologies by making accurate regulators over environmental parameters such as light, nutrient delivery, and temperature. Integrating with data analytics permits for enhancing resource management and crop supervising. Moreover, innovations in vertical farming and aeroponics systems have widened the range of cultivable spaces by enabling hydroponics to adapt to different urban and indoor environments.

Such developments contribute to improving efficacy, scalability, and sustainability, positioning hydroponics as an important element in the future of agriculture. The demand for hydroponics will increase due to its requirement in modern agriculture which will help in market expansion in the coming years.

Key Takeaways

- Market Growth: Hydroponics Market was valued at USD 5.6 billion in 2023. It is expected to reach USD 19.6 billion by 2033, with a CAGR of 13.7% during the forecast period from 2024 to 2033.

- Type Outlook: Aggregate systems lead with a 52.8% share, showcasing their popularity in hydroponic farming setups.

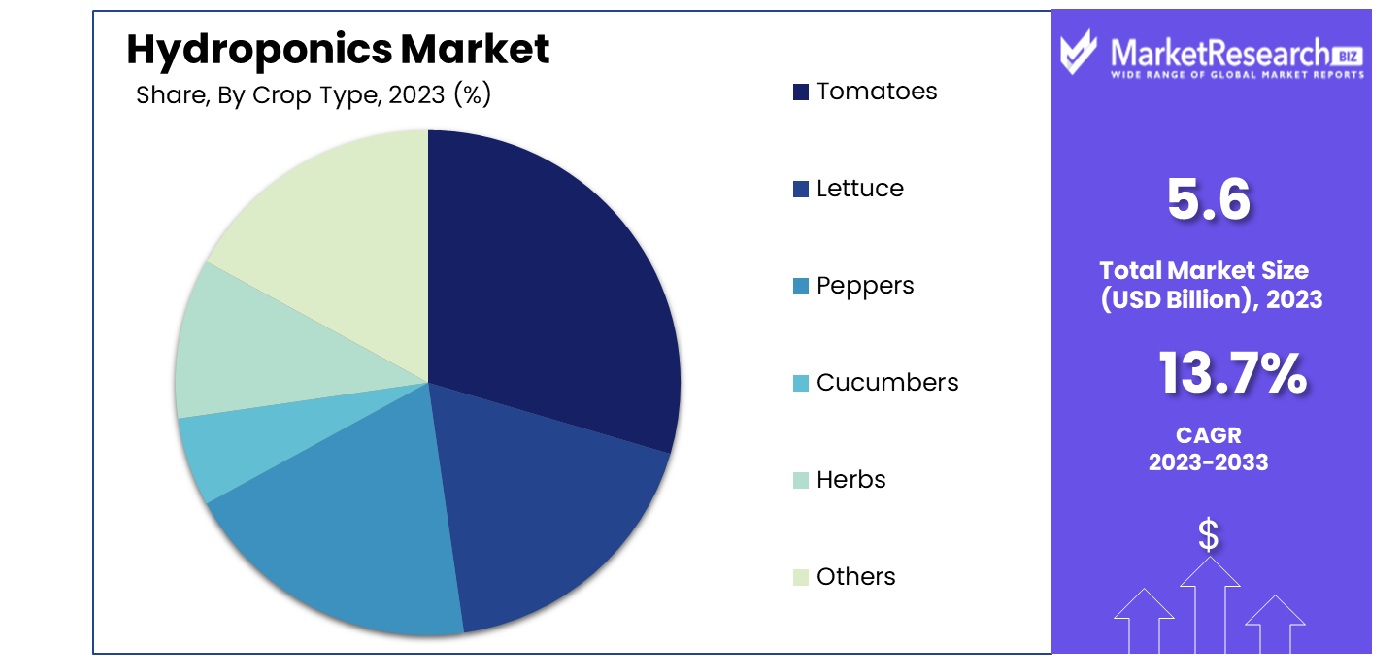

- Crop Type: Tomatoes emerge as the top crop in hydroponics, holding a substantial 44.8% market segment.

- Crop Area: Operations exceeding 50,000 sq. ft represent 30.3%, indicating a trend towards larger hydroponic farms.

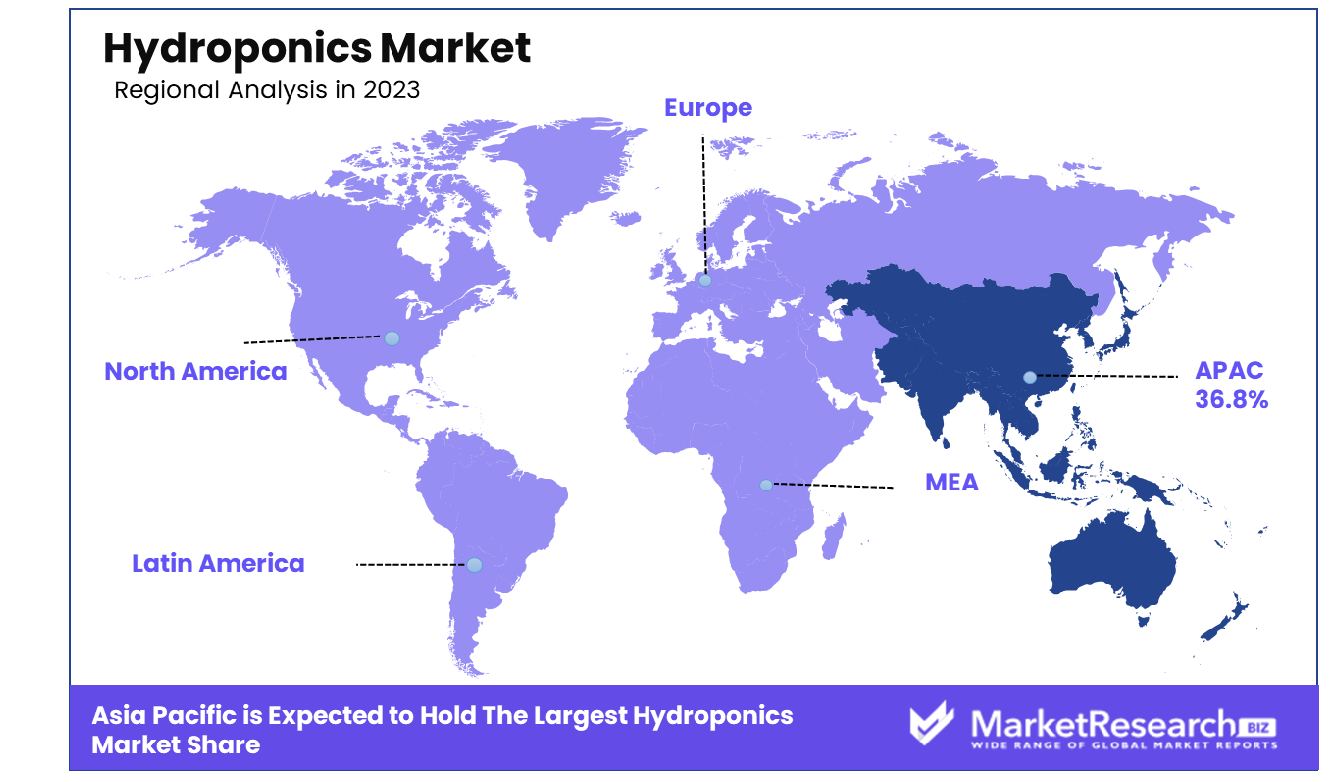

- Regional Dominance: The Hydroponics market in Asia Pacific is experiencing robust growth, with a significant 36.8% market share.

- Growth Opportunity: The global hydroponics market is set for growth, driven by water scarcity and sustainable agriculture needs, alongside advancements in controlled environment technologies enhancing efficiency and productivity in farming without soil.

Driving factors

Limited Arable Land: Catalyzing Hydroponic Adoption

The diminishing availability of arable land globally emerges as a formidable catalyst for the hydroponics market growth. Traditional farming methods are increasingly challenged by the degradation of soil quality due to overuse, climate change, and urbanization, which encroach upon lands previously deemed suitable for agriculture. This constraint necessitates alternative cultivation techniques that do not rely on soil quality, thereby positioning hydroponics as a compelling solution.

Hydroponic farming, which utilizes nutrient-rich water instead of soil, allows for the cultivation of crops in areas previously unsuitable for agriculture, including urban environments and regions with poor soil conditions. This adaptation not only mitigates the limitations posed by the scarcity of arable land but also expands the potential for agricultural productivity in diverse geographic locations. The growth of the hydroponics market can be attributed to its ability to provide viable agricultural practices in the face of diminishing arable land, hence ensuring food security and sustainability.

Water Scarcity Solutions: Efficiency through Hydroponics

Addressing water scarcity issues is paramount in the modern agricultural landscape, and hydroponic systems offer a sustainable solution by significantly reducing water consumption compared to traditional farming methods. These systems are designed to recycle and reuse water, minimizing waste and enhancing water use efficiency. Traditional soil-based agriculture is often criticized for its high water demand, with a substantial portion of the water used not reaching the intended crop plants due to runoff and evaporation.

In contrast, hydroponic systems can reduce water usage by up to 90%, according to various studies, by directly delivering water and nutrients to plant roots in a controlled environment. This efficiency is particularly crucial in regions facing acute water scarcity, making hydroponics an attractive option for sustainable cultivation. The ability of hydroponics to address water scarcity while maintaining agricultural productivity contributes significantly to its adoption and market growth, aligning with global efforts towards more sustainable farming practices.

Accelerated Crop Production: Meeting Consumer Demands

Hydroponic systems facilitate shorter times to harvest by providing optimal growth conditions for crops, including controlled temperature, light, and nutrient levels. This precision farming approach enables faster crop cycles, allowing for multiple harvests within a given period, compared to traditional farming methods. The efficiency of hydroponic farming in accelerating crop production meets the increasing consumer demand for fresh produce year-round, irrespective of seasonal constraints.

Moreover, the capacity to quickly respond to market demands makes hydroponic farming an attractive investment for producers looking to maximize yield and profitability. The integration of advanced technologies in hydroponic systems, such as artificial intelligence (AI) and Internet of Things (IoT) devices, further enhances the monitoring and optimization of growth conditions, leading to even shorter production cycles and higher-quality crops.

Consequently, the promise of accelerated crop production through hydroponics not only satisfies consumer demands more efficiently but also drives significant growth in the hydroponics market by appealing to both producers and consumers seeking reliability and sustainability in food production.

Restraining Factors

Navigating Water Management Complexities in Hydroponics

Hydroponic systems, renowned for their efficient water use, encounter specific growth restraints due to the intricacies of water management. These systems necessitate meticulous control over water usage, nutrient delivery, and drainage to forestall issues such as waterlogging, nutrient imbalances, and root diseases. The precision required in managing these factors can pose a significant challenge, particularly for those new to hydroponics or operating on a larger scale.

Inadequate management can lead to suboptimal growth conditions, affecting crop yield and quality. Despite these challenges, the hydroponics market continues to grow, driven by technological advancements that offer more sophisticated monitoring and control systems. These innovations help mitigate water management challenges, making hydroponics a viable and sustainable option for a broad spectrum of growers.

Addressing Limited Crop Diversity in Hydroponics

The issue of limited crop diversity represents another restraining factor for the hydroponics market. While hydroponic systems are capable of supporting a vast array of crops, not all varieties are equally suited to hydroponic cultivation. Some crops may yield lower than expected or require more resources than others, potentially limiting the economic viability of hydroponically grown produce.

However, this limitation has spurred innovation within the industry, leading to research and development efforts focused on optimizing hydroponic conditions for a wider range of crops. As a result, the market is gradually overcoming this restraint, expanding the variety of crops that can be economically and efficiently grown using hydroponic methods.

By Type Outlook Analysis

Aggregate systems command a 52.8% share, underscoring their preferred status in hydroponics.

In 2023, Aggregate Systems held a dominant market position in the Type Outlook segment of the Hydroponics Market, capturing more than a 52.8% share. This segment encompasses various methods of hydroponic cultivation, including Aggregate Systems, EBB & Flow Systems, Drip Systems, and Wick Systems. Among these, Aggregate Systems, characterized by their use of a solid medium for root support, have emerged as the preferred choice for commercial growers due to their efficiency in water and nutrient utilization.

The Hydroponics Market is further diversified into Liquid Systems, comprising Deep Water Culture, Nutrient Film Technique (NFT), and Aeroponics. Although these systems represent innovative approaches to hydroponic farming, they collectively accounted for a smaller portion of the market share compared to Aggregate Systems. This disparity in market share can be attributed to the higher initial setup and operational complexities associated with Liquid Systems, which may deter their adoption among small-scale growers.

The preference for Aggregate Systems is underpinned by their proven effectiveness in a wide range of hydroponic crops, ease of setup, and scalability, making them conducive to both small-scale and large-scale agricultural operations. The robust growth of this segment reflects the increasing recognition of hydroponics as a viable solution for sustainable agriculture, particularly in regions with limited arable land and water resources.

Despite the current dominance of Aggregate Systems, the Hydroponics Market is anticipated to witness gradual shifts in the coming years. Innovations in Liquid Systems, aimed at reducing costs and complexity, are expected to enhance their market appeal. Consequently, the landscape of the Hydroponics Market is poised for dynamic evolution, driven by technological advancements and the growing imperative for resource-efficient farming practices.

By Crop Type Analysis

Tomatoes dominate hydroponics with a 44.8% share, highlighting their widespread cultivation.

In 2023, Tomatoes held a dominant market position in the Crop Type segment of the Hydroponics Market, capturing more than a 44.8% share. The Crop Type segment encompasses a variety of hydroponically grown produce, including Tomatoes, Lettuce, Peppers, Cucumbers, Herbs, and Other vegetables and fruits. Among these, tomatoes have emerged as the most cultivated crop in hydroponic systems, attributed to their high yield and profitability, alongside their substantial demand across global markets.

Lettuce follows as the second most popular crop, favored for its rapid growth cycle and minimal space requirements, making it an ideal candidate for hydroponic cultivation. Peppers and Cucumbers also occupy significant positions within the market due to their adaptability to controlled environments, yielding higher quality produce compared to traditional farming methods. Herbs, including basil, mint, and cilantro, represent a niche yet fast-growing segment, driven by the increasing culinary demand and their high value per unit area.

The "Others" category, encompassing a diverse range of crops such as strawberries and leafy greens, indicates the versatility and expanding scope of hydroponics in addressing the needs of varied markets. The substantial share held by tomatoes underscores the effectiveness of hydroponics in producing staple vegetables, highlighting the technology’s potential in securing food supplies and enhancing nutritional access globally.

By Crop Area Analysis

Large farms over 50,000 sq. ft account for 30.3%, showing a tilt towards expansive operations.

In 2023, the "Above 50000 sq. ft" category held a dominant market position in the By Crop Area segment of the Hydroponics Market, capturing more than a 30.3% share. This segment outlines the scale of hydroponic farming operations, segmented into three distinct categories: up to 1000 sq.ft., 1000-50000 sq.ft., and Above 50000 sq. ft. The significant share held by the "Above 50000 sq. ft" segment underscores the trend towards large-scale hydroponic farming operations, which are increasingly being recognized for their efficiency and sustainability in producing high yields within limited spatial footprints.

Large-scale hydroponic farms, encompassing areas above 50000 sq. ft, have become pivotal in meeting the rising global demand for fresh produce by leveraging advanced hydroponic technologies. These operations benefit from economies of scale, enabling them to optimize production costs and improve profitability. Moreover, the capacity for precise control over growing conditions in such large facilities enhances crop yield and quality, contributing to their dominant market share.

Despite the prominence of large-scale operations, the segments encompassing smaller areas, such as "To 1000 sq. ft" and "1000-50000 sq. ft," continue to play a crucial role in the Hydroponics Market. These segments cater to small-scale commercial growers and hobbyists who are drawn to hydroponics for its water efficiency and the feasibility of year-round cultivation in constrained spaces.

Key Market Segments

- By Type Outlook

- Aggregate Systems

- EBB & Flow Systems

- Drip Systems

- Wick Systems

- Liquid Systems

- Deep Water Culture

- Nutrient Film Technique (NFT)

- Aeroponics

- Aggregate Systems

- By Crop Type

- Tomatoes

- Lettuce

- Peppers

- Cucumbers

- Herbs

- Others

- By Crop Area

- Upto 1000 sq.ft.

- 1000-50000 sq.ft.

- Above 50000 sq.ft

Growth Opportunity

Water Scarcity and Sustainable Agriculture

The global hydroponics market is poised for significant growth, driven largely by the increasing scarcity of water resources and the need for more sustainable agricultural practices. Hydroponic farming, which relies on nutrient-rich water rather than soil for plant growth, offers a remarkably water-efficient solution. This method conserves water through recirculation, reducing water usage by as much as 90% compared to traditional soil-based agriculture.

As water scarcity becomes a more pressing concern worldwide, the demand for hydroponic systems is expected to surge, positioning hydroponics as a leading method in sustainable agriculture. This shift not only addresses critical environmental challenges but also aligns with global trends toward more eco-friendly and sustainable production methods. Consequently, regions experiencing water stress are likely to adopt hydroponic farming at an accelerated rate, further catalyzing the market's expansion.

Controlled Environment Agriculture (CEA) Technologies

Parallel to concerns about water scarcity, advancements in controlled environment agriculture (CEA) technologies are transforming the hydroponics market. Innovations in LED lighting, climate control systems, and nutrient delivery systems are enhancing the efficiency and productivity of hydroponic farms. These technological advancements enable precise control over the growing environment, optimizing conditions for plant growth year-round and minimizing resource waste.

As a result, hydroponic farming is becoming increasingly viable and attractive for a broad range of crops and settings, from urban rooftops to large-scale commercial greenhouses. The integration of these technologies into hydroponic systems not only boosts yield and quality but also reduces operational costs over time, making hydroponics a more accessible and profitable model for farmers. The continuous development and adoption of CEA technologies signify a bright future for the hydroponics market, with the potential for substantial growth and innovation in the years ahead.

Latest Trends

Expansion of Indoor Farming Operations for Year-Round Production

The global hydroponics market in 2023 has witnessed a notable trend towards the expansion of indoor farming operations, facilitated by the hydroponic method’s ability to support year-round production irrespective of external climatic conditions. This trend is driven by the growing demand for fresh produce throughout the year, coupled with the increasing scarcity of arable land. Indoor farming, underpinned by hydroponic systems, offers a scalable solution that not only maximizes space efficiency but also significantly enhances yield per square meter.

By controlling environmental factors such as light, temperature, and humidity, indoor hydroponic farms achieve higher productivity and faster growth cycles compared to traditional agriculture. This shift towards indoor farming is transforming the agricultural landscape, enabling urban areas to become self-sufficient in producing fresh fruits and vegetables, thereby reducing dependency on long supply chains and minimizing food miles.

Innovation in Nutrient Delivery Systems and Sustainable Cultivation Practices

In 2023, the hydroponics market has also seen significant innovation in nutrient delivery systems and the adoption of sustainable cultivation practices. These advancements are aimed at optimizing plant nutrition while minimizing environmental impact. Innovative nutrient delivery systems ensure a precise and efficient supply of essential elements to plants, enhancing growth rates and crop quality. Such systems are increasingly becoming automated, incorporating sensors and AI to adjust nutrient concentrations in real-time based on plant requirements.

Simultaneously, the hydroponics industry is embracing sustainable cultivation practices, including the use of organic nutrients and the integration of renewable energy sources. These practices not only improve the sustainability of hydroponic farming but also appeal to environmentally conscious consumers. Together, these innovations in nutrient delivery and sustainability efforts are making hydroponic farming more efficient, productive, and environmentally friendly, setting new standards for the agriculture sector.

Regional Analysis

The Hydroponics Market in Asia Pacific accounts for 36.8% of the global market share.

The global hydroponics market is segmented into several key regions: North America, Europe, Asia Pacific, Middle East & Africa, and Latin America, each exhibiting distinct growth dynamics and opportunities influenced by regional agricultural trends, technological advancements, and sustainability efforts.

In North America, the hydroponics sector is propelled by the increasing adoption of sustainable farming practices amidst urbanization and the rising demand for fresh produce. The region benefits from a well-established technological infrastructure and a high level of consumer awareness, leading to a significant market share. Europe, with its stringent environmental regulations and limited arable land, has embraced hydroponics as a viable solution to increase agricultural productivity. Countries like the Netherlands have become pioneers, leveraging hydroponic systems for year-round vegetable production, thus bolstering the European market segment.

Asia Pacific emerges as the dominating region, holding a substantial 36.8% share of the global market. This dominance is attributed to rapid urbanization, scarcity of water resources, and the need to enhance food security. Countries such as China and Japan are at the forefront, implementing innovative hydroponic techniques to meet their large population's food demands efficiently.

The Middle East & Africa region shows promising growth potential in hydroponics, driven by water scarcity issues and the increasing need for food security. Nations like the United Arab Emirates are investing heavily in vertical farming and hydroponics to reduce dependence on food imports.

Latin America is witnessing a gradual adoption of hydroponics, spurred by the need for sustainable agricultural practices and the optimization of water use. Countries like Mexico are incorporating hydroponic systems to bolster vegetable production, aiming to meet both domestic demand and export requirements.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of the Middle East & Africa

Key Players Analysis

In the dynamic landscape of the global hydroponics market in 2023, key players have exhibited remarkable adaptability and innovation, each contributing uniquely to the sector's growth and resilience. AeroFarms, with its advanced aeroponic technology, has continued to lead by example, showcasing how vertical farming can revolutionize urban agriculture by maximizing yield per square foot.

AmHydro has positioned itself as a crucial provider of hydroponic systems and solutions, catering to both commercial growers and educational institutions, thereby fostering a broader understanding and adoption of hydroponic farming.

Argus Control Systems Limited has excelled in offering integrated control systems, enabling precise environmental and irrigation control, critical for the success of hydroponic farms. This technological prowess has been pivotal in enhancing crop quality and yield. Emirates Hydroponics Farms stands out in the Middle East & Africa segment, demonstrating the viability of hydroponics in arid regions and contributing significantly to regional food security and sustainability.

Freight Farms, Inc. and BrightFarms have been at the forefront of the 'container farming' and 'local for local' movements, respectively. Their innovative approaches to modular farming and local production have not only reduced transportation costs and carbon footprints but have also brought fresh produce closer to consumers. Heliospectra and Signify Holding have made substantial contributions to the market through their advanced LED lighting solutions, optimizing plant growth while minimizing energy consumption.

Nutrifresh India and UrbanKisaan have tapped into the burgeoning demand for fresh, pesticide-free produce in India, showcasing the scalability of hydroponics in densely populated regions. Their success underscores the potential for hydroponics to contribute to food security and sustainable urban development.

Market Key Players

- AeroFarms

- AmHydro

- Argus Control Systems Limited

- Emirates Hydroponics Farms

- Freight Farms, Inc.

- BrightFarms.

- Heliospectra

- Signify Holding

- Nutrifresh India

- UrbanKisaan

Recent Development

- In March 2024, Kinley Wangmo pioneers hydroponic farming in Bhutan, leveraging innovative techniques to increase crop yield and sustainability. Facing initial challenges, she receives support from the agriculture ministry for her visionary project.

- In February 2024, Nagoya University and Meijo University in Japan developed plasma-based disinfection technology for hydroponic crops, eliminating chemical fertilizers and reducing environmental pollution. Published in Environmental Technology & Innovations.

- In February 2024, Horticulture Wales will expand facilities through a partnership with Wrexham University and councils, backed by SPF funding until Dec 2024. Emphasizes transparency, innovation, and education, integrating hydroponic tech for sustainable growth.

Report Scope

Report Features Description Market Value (2023) USD 5.6 Billion Forecast Revenue (2033) USD 19.6 Billion CAGR (2024-2032) 13.7% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type Outlook(Aggregate Systems-(EBB & Flow Systems, Drip Systems, Wick Systems), Liquid Systems-(Deep Water Culture, Nutrient Film Technique (NFT), Aeroponics)), By Crop Type(Tomatoes, Lettuce, Peppers, Cucumbers, Herbs, Others), By Crop Area(Upto 1000 sq.ft., 1000-50000 sq.ft., Above 50000 sq.ft) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape AeroFarms, AmHydro, Argus Control Systems Limited, Emirates Hydroponics Farms, Freight Farms, Inc., BrightFarms., Heliospectra, Signify Holding, Nutrifresh India, UrbanKisaan Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

- 1. Executive Summary

- 1.1. Definition

- 1.2. Taxonomy

- 1.3. Research Scope

- 1.4. Key Analysis

- 1.5. Key Findings by Major Segments

- 1.6. Top strategies by Major Players

- 2. Global Hydroponics Market Overview

- 2.1. Hydroponics Market Dynamics

- 2.1.1. Drivers

- 2.1.2. Opportunities

- 2.1.3. Restraints

- 2.1.4. Challenges

- 2.2. Macro-economic Factors

- 2.3. Regulatory Framework

- 2.4. Market Investment Feasibility Index

- 2.5. PEST Analysis

- 2.6. PORTER’S Five Force Analysis

- 2.7. Drivers & Restraints Impact Analysis

- 2.8. Industry Chain Analysis

- 2.9. Cost Structure Analysis

- 2.10. Marketing Strategy

- 2.11. Russia-Ukraine War Impact Analysis

- 2.12. Opportunity Map Analysis

- 2.13. Market Competition Scenario Analysis

- 2.14. Product Life Cycle Analysis

- 2.15. Opportunity Orbits

- 2.16. Manufacturer Intensity Map

- 2.17. Major Companies sales by Value & Volume

- 2.1. Hydroponics Market Dynamics

- 3. Global Hydroponics Market Analysis, Opportunity and Forecast, 2016-2032

- 3.1. Global Hydroponics Market Analysis, 2016-2021

- 3.2. Global Hydroponics Market Opportunity and Forecast, 2023-2032

- 3.3. Global Hydroponics Market Analysis, Opportunity and Forecast, By Type Outlook, 2016-2032

- 3.3.1. Global Hydroponics Market Analysis by Type Outlook: Introduction

- 3.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Type Outlook, 2016-2032

- 3.3.3. Aggregate Systems

- 3.3.3.1. EBB & Flow Systems

- 3.3.3.2. Drip Systems

- 3.3.3.3. Wick Systems

- 3.3.4. Liquid Systems

- 3.3.4.1. Deep Water Culture

- 3.3.4.2. Nutrient Film Technique (NFT)

- 3.3.4.3. Aeroponics

- 3.4. Global Hydroponics Market Analysis, Opportunity and Forecast, By Crop Type , 2016-2032

- 3.4.1. Global Hydroponics Market Analysis by Crop Type : Introduction

- 3.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Crop Type , 2016-2032

- 3.4.3. Tomatoes

- 3.4.4. Lettuce

- 3.4.5. Peppers

- 3.4.6. Cucumbers

- 3.4.7. Herbs

- 3.4.8. Others

- 3.5. Global Hydroponics Market Analysis, Opportunity and Forecast, By Crop Area, 2016-2032

- 3.5.1. Global Hydroponics Market Analysis by Crop Area: Introduction

- 3.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Crop Area, 2016-2032

- 3.5.3. Upto 1000 sq.ft.

- 3.5.4. 1000-50000 sq.ft.

- 3.5.5. Above 50000 sq.ft

- 4. North America Hydroponics Market Analysis, Opportunity and Forecast, 2016-2032

- 4.1. North America Hydroponics Market Analysis, 2016-2021

- 4.2. North America Hydroponics Market Opportunity and Forecast, 2023-2032

- 4.3. North America Hydroponics Market Analysis, Opportunity and Forecast, By Type Outlook, 2016-2032

- 4.3.1. North America Hydroponics Market Analysis by Type Outlook: Introduction

- 4.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Type Outlook, 2016-2032

- 4.3.3. Aggregate Systems

- 4.3.3.1. EBB & Flow Systems

- 4.3.3.2. Drip Systems

- 4.3.3.3. Wick Systems

- 4.3.4. Liquid Systems

- 4.3.4.1. Deep Water Culture

- 4.3.4.2. Nutrient Film Technique (NFT)

- 4.3.4.3. Aeroponics

- 4.4. North America Hydroponics Market Analysis, Opportunity and Forecast, By Crop Type , 2016-2032

- 4.4.1. North America Hydroponics Market Analysis by Crop Type : Introduction

- 4.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Crop Type , 2016-2032

- 4.4.3. Tomatoes

- 4.4.4. Lettuce

- 4.4.5. Peppers

- 4.4.6. Cucumbers

- 4.4.7. Herbs

- 4.4.8. Others

- 4.5. North America Hydroponics Market Analysis, Opportunity and Forecast, By Crop Area, 2016-2032

- 4.5.1. North America Hydroponics Market Analysis by Crop Area: Introduction

- 4.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Crop Area, 2016-2032

- 4.5.3. Upto 1000 sq.ft.

- 4.5.4. 1000-50000 sq.ft.

- 4.5.5. Above 50000 sq.ft

- 4.6. North America Hydroponics Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 4.6.1. North America Hydroponics Market Analysis by Country : Introduction

- 4.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 4.6.2.1. The US

- 4.6.2.2. Canada

- 4.6.2.3. Mexico

- 5. Western Europe Hydroponics Market Analysis, Opportunity and Forecast, 2016-2032

- 5.1. Western Europe Hydroponics Market Analysis, 2016-2021

- 5.2. Western Europe Hydroponics Market Opportunity and Forecast, 2023-2032

- 5.3. Western Europe Hydroponics Market Analysis, Opportunity and Forecast, By Type Outlook, 2016-2032

- 5.3.1. Western Europe Hydroponics Market Analysis by Type Outlook: Introduction

- 5.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Type Outlook, 2016-2032

- 5.3.3. Aggregate Systems

- 5.3.3.1. EBB & Flow Systems

- 5.3.3.2. Drip Systems

- 5.3.3.3. Wick Systems

- 5.3.4. Liquid Systems

- 5.3.4.1. Deep Water Culture

- 5.3.4.2. Nutrient Film Technique (NFT)

- 5.3.4.3. Aeroponics

- 5.4. Western Europe Hydroponics Market Analysis, Opportunity and Forecast, By Crop Type , 2016-2032

- 5.4.1. Western Europe Hydroponics Market Analysis by Crop Type : Introduction

- 5.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Crop Type , 2016-2032

- 5.4.3. Tomatoes

- 5.4.4. Lettuce

- 5.4.5. Peppers

- 5.4.6. Cucumbers

- 5.4.7. Herbs

- 5.4.8. Others

- 5.5. Western Europe Hydroponics Market Analysis, Opportunity and Forecast, By Crop Area, 2016-2032

- 5.5.1. Western Europe Hydroponics Market Analysis by Crop Area: Introduction

- 5.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Crop Area, 2016-2032

- 5.5.3. Upto 1000 sq.ft.

- 5.5.4. 1000-50000 sq.ft.

- 5.5.5. Above 50000 sq.ft

- 5.6. Western Europe Hydroponics Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 5.6.1. Western Europe Hydroponics Market Analysis by Country : Introduction

- 5.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 5.6.2.1. Germany

- 5.6.2.2. France

- 5.6.2.3. The UK

- 5.6.2.4. Spain

- 5.6.2.5. Italy

- 5.6.2.6. Portugal

- 5.6.2.7. Ireland

- 5.6.2.8. Austria

- 5.6.2.9. Switzerland

- 5.6.2.10. Benelux

- 5.6.2.11. Nordic

- 5.6.2.12. Rest of Western Europe

- 6. Eastern Europe Hydroponics Market Analysis, Opportunity and Forecast, 2016-2032

- 6.1. Eastern Europe Hydroponics Market Analysis, 2016-2021

- 6.2. Eastern Europe Hydroponics Market Opportunity and Forecast, 2023-2032

- 6.3. Eastern Europe Hydroponics Market Analysis, Opportunity and Forecast, By Type Outlook, 2016-2032

- 6.3.1. Eastern Europe Hydroponics Market Analysis by Type Outlook: Introduction

- 6.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Type Outlook, 2016-2032

- 6.3.3. Aggregate Systems

- 6.3.3.1. EBB & Flow Systems

- 6.3.3.2. Drip Systems

- 6.3.3.3. Wick Systems

- 6.3.4. Liquid Systems

- 6.3.4.1. Deep Water Culture

- 6.3.4.2. Nutrient Film Technique (NFT)

- 6.3.4.3. Aeroponics

- 6.4. Eastern Europe Hydroponics Market Analysis, Opportunity and Forecast, By Crop Type , 2016-2032

- 6.4.1. Eastern Europe Hydroponics Market Analysis by Crop Type : Introduction

- 6.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Crop Type , 2016-2032

- 6.4.3. Tomatoes

- 6.4.4. Lettuce

- 6.4.5. Peppers

- 6.4.6. Cucumbers

- 6.4.7. Herbs

- 6.4.8. Others

- 6.5. Eastern Europe Hydroponics Market Analysis, Opportunity and Forecast, By Crop Area, 2016-2032

- 6.5.1. Eastern Europe Hydroponics Market Analysis by Crop Area: Introduction

- 6.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Crop Area, 2016-2032

- 6.5.3. Upto 1000 sq.ft.

- 6.5.4. 1000-50000 sq.ft.

- 6.5.5. Above 50000 sq.ft

- 6.6. Eastern Europe Hydroponics Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 6.6.1. Eastern Europe Hydroponics Market Analysis by Country : Introduction

- 6.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 6.6.2.1. Russia

- 6.6.2.2. Poland

- 6.6.2.3. The Czech Republic

- 6.6.2.4. Greece

- 6.6.2.5. Rest of Eastern Europe

- 7. APAC Hydroponics Market Analysis, Opportunity and Forecast, 2016-2032

- 7.1. APAC Hydroponics Market Analysis, 2016-2021

- 7.2. APAC Hydroponics Market Opportunity and Forecast, 2023-2032

- 7.3. APAC Hydroponics Market Analysis, Opportunity and Forecast, By Type Outlook, 2016-2032

- 7.3.1. APAC Hydroponics Market Analysis by Type Outlook: Introduction

- 7.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Type Outlook, 2016-2032

- 7.3.3. Aggregate Systems

- 7.3.3.1. EBB & Flow Systems

- 7.3.3.2. Drip Systems

- 7.3.3.3. Wick Systems

- 7.3.4. Liquid Systems

- 7.3.4.1. Deep Water Culture

- 7.3.4.2. Nutrient Film Technique (NFT)

- 7.3.4.3. Aeroponics

- 7.4. APAC Hydroponics Market Analysis, Opportunity and Forecast, By Crop Type , 2016-2032

- 7.4.1. APAC Hydroponics Market Analysis by Crop Type : Introduction

- 7.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Crop Type , 2016-2032

- 7.4.3. Tomatoes

- 7.4.4. Lettuce

- 7.4.5. Peppers

- 7.4.6. Cucumbers

- 7.4.7. Herbs

- 7.4.8. Others

- 7.5. APAC Hydroponics Market Analysis, Opportunity and Forecast, By Crop Area, 2016-2032

- 7.5.1. APAC Hydroponics Market Analysis by Crop Area: Introduction

- 7.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Crop Area, 2016-2032

- 7.5.3. Upto 1000 sq.ft.

- 7.5.4. 1000-50000 sq.ft.

- 7.5.5. Above 50000 sq.ft

- 7.6. APAC Hydroponics Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 7.6.1. APAC Hydroponics Market Analysis by Country : Introduction

- 7.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 7.6.2.1. China

- 7.6.2.2. Japan

- 7.6.2.3. South Korea

- 7.6.2.4. India

- 7.6.2.5. Australia & New Zeland

- 7.6.2.6. Indonesia

- 7.6.2.7. Malaysia

- 7.6.2.8. Philippines

- 7.6.2.9. Singapore

- 7.6.2.10. Thailand

- 7.6.2.11. Vietnam

- 7.6.2.12. Rest of APAC

- 8. Latin America Hydroponics Market Analysis, Opportunity and Forecast, 2016-2032

- 8.1. Latin America Hydroponics Market Analysis, 2016-2021

- 8.2. Latin America Hydroponics Market Opportunity and Forecast, 2023-2032

- 8.3. Latin America Hydroponics Market Analysis, Opportunity and Forecast, By Type Outlook, 2016-2032

- 8.3.1. Latin America Hydroponics Market Analysis by Type Outlook: Introduction

- 8.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Type Outlook, 2016-2032

- 8.3.3. Aggregate Systems

- 8.3.3.1. EBB & Flow Systems

- 8.3.3.2. Drip Systems

- 8.3.3.3. Wick Systems

- 8.3.4. Liquid Systems

- 8.3.4.1. Deep Water Culture

- 8.3.4.2. Nutrient Film Technique (NFT)

- 8.3.4.3. Aeroponics

- 8.4. Latin America Hydroponics Market Analysis, Opportunity and Forecast, By Crop Type , 2016-2032

- 8.4.1. Latin America Hydroponics Market Analysis by Crop Type : Introduction

- 8.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Crop Type , 2016-2032

- 8.4.3. Tomatoes

- 8.4.4. Lettuce

- 8.4.5. Peppers

- 8.4.6. Cucumbers

- 8.4.7. Herbs

- 8.4.8. Others

- 8.5. Latin America Hydroponics Market Analysis, Opportunity and Forecast, By Crop Area, 2016-2032

- 8.5.1. Latin America Hydroponics Market Analysis by Crop Area: Introduction

- 8.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Crop Area, 2016-2032

- 8.5.3. Upto 1000 sq.ft.

- 8.5.4. 1000-50000 sq.ft.

- 8.5.5. Above 50000 sq.ft

- 8.6. Latin America Hydroponics Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 8.6.1. Latin America Hydroponics Market Analysis by Country : Introduction

- 8.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 8.6.2.1. Brazil

- 8.6.2.2. Colombia

- 8.6.2.3. Chile

- 8.6.2.4. Argentina

- 8.6.2.5. Costa Rica

- 8.6.2.6. Rest of Latin America

- 9. Middle East & Africa Hydroponics Market Analysis, Opportunity and Forecast, 2016-2032

- 9.1. Middle East & Africa Hydroponics Market Analysis, 2016-2021

- 9.2. Middle East & Africa Hydroponics Market Opportunity and Forecast, 2023-2032

- 9.3. Middle East & Africa Hydroponics Market Analysis, Opportunity and Forecast, By Type Outlook, 2016-2032

- 9.3.1. Middle East & Africa Hydroponics Market Analysis by Type Outlook: Introduction

- 9.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Type Outlook, 2016-2032

- 9.3.3. Aggregate Systems

- 9.3.3.1. EBB & Flow Systems

- 9.3.3.2. Drip Systems

- 9.3.3.3. Wick Systems

- 9.3.4. Liquid Systems

- 9.3.4.1. Deep Water Culture

- 9.3.4.2. Nutrient Film Technique (NFT)

- 9.3.4.3. Aeroponics

- 9.4. Middle East & Africa Hydroponics Market Analysis, Opportunity and Forecast, By Crop Type , 2016-2032

- 9.4.1. Middle East & Africa Hydroponics Market Analysis by Crop Type : Introduction

- 9.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Crop Type , 2016-2032

- 9.4.3. Tomatoes

- 9.4.4. Lettuce

- 9.4.5. Peppers

- 9.4.6. Cucumbers

- 9.4.7. Herbs

- 9.4.8. Others

- 9.5. Middle East & Africa Hydroponics Market Analysis, Opportunity and Forecast, By Crop Area, 2016-2032

- 9.5.1. Middle East & Africa Hydroponics Market Analysis by Crop Area: Introduction

- 9.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Crop Area, 2016-2032

- 9.5.3. Upto 1000 sq.ft.

- 9.5.4. 1000-50000 sq.ft.

- 9.5.5. Above 50000 sq.ft

- 9.6. Middle East & Africa Hydroponics Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 9.6.1. Middle East & Africa Hydroponics Market Analysis by Country : Introduction

- 9.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 9.6.2.1. Algeria

- 9.6.2.2. Egypt

- 9.6.2.3. Israel

- 9.6.2.4. Kuwait

- 9.6.2.5. Nigeria

- 9.6.2.6. Saudi Arabia

- 9.6.2.7. South Africa

- 9.6.2.8. Turkey

- 9.6.2.9. The UAE

- 9.6.2.10. Rest of MEA

- 10. Global Hydroponics Market Analysis, Opportunity and Forecast, By Region , 2016-2032

- 10.1. Global Hydroponics Market Analysis by Region : Introduction

- 10.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Region , 2016-2032

- 10.2.1. North America

- 10.2.2. Western Europe

- 10.2.3. Eastern Europe

- 10.2.4. APAC

- 10.2.5. Latin America

- 10.2.6. Middle East & Africa

- 11. Global Hydroponics Market Competitive Landscape, Market Share Analysis, and Company Profiles

- 11.1. Market Share Analysis

- 11.2. Company Profiles

- 11.3. AeroFarms

- 11.3.1. Company Overview

- 11.3.2. Financial Highlights

- 11.3.3. Product Portfolio

- 11.3.4. SWOT Analysis

- 11.3.5. Key Strategies and Developments

- 11.4. AmHydro

- 11.4.1. Company Overview

- 11.4.2. Financial Highlights

- 11.4.3. Product Portfolio

- 11.4.4. SWOT Analysis

- 11.4.5. Key Strategies and Developments

- 11.5. Argus Control Systems Limited

- 11.5.1. Company Overview

- 11.5.2. Financial Highlights

- 11.5.3. Product Portfolio

- 11.5.4. SWOT Analysis

- 11.5.5. Key Strategies and Developments

- 11.6. Emirates Hydroponics Farms

- 11.6.1. Company Overview

- 11.6.2. Financial Highlights

- 11.6.3. Product Portfolio

- 11.6.4. SWOT Analysis

- 11.6.5. Key Strategies and Developments

- 11.7. Freight Farms, Inc.

- 11.7.1. Company Overview

- 11.7.2. Financial Highlights

- 11.7.3. Product Portfolio

- 11.7.4. SWOT Analysis

- 11.7.5. Key Strategies and Developments

- 11.8. BrightFarms.

- 11.8.1. Company Overview

- 11.8.2. Financial Highlights

- 11.8.3. Product Portfolio

- 11.8.4. SWOT Analysis

- 11.8.5. Key Strategies and Developments

- 11.9. Heliospectra

- 11.9.1. Company Overview

- 11.9.2. Financial Highlights

- 11.9.3. Product Portfolio

- 11.9.4. SWOT Analysis

- 11.9.5. Key Strategies and Developments

- 11.10. Signify Holding

- 11.10.1. Company Overview

- 11.10.2. Financial Highlights

- 11.10.3. Product Portfolio

- 11.10.4. SWOT Analysis

- 11.10.5. Key Strategies and Developments

- 11.11. Nutrifresh India

- 11.11.1. Company Overview

- 11.11.2. Financial Highlights

- 11.11.3. Product Portfolio

- 11.11.4. SWOT Analysis

- 11.11.5. Key Strategies and Developments

- 11.12. UrbanKisaan

- 11.12.1. Company Overview

- 11.12.2. Financial Highlights

- 11.12.3. Product Portfolio

- 11.12.4. SWOT Analysis

- 11.12.5. Key Strategies and Developments

- 11.13.1. Company Overview

- 11.13.2. Financial Highlights

- 11.13.3. Product Portfolio

- 11.13.4. SWOT Analysis

- 11.13.5. Key Strategies and Developments

- 12. Assumptions and Acronyms

- 13. Research Methodology

- 14. Contact

"

- List of Figures

- "

- Figure 1: Global Hydroponics Market Revenue (US$ Mn) Market Share by Type Outlook in 2022

- Figure 2: Global Hydroponics Market Market Attractiveness Analysis by Type Outlook, 2016-2032

- Figure 3: Global Hydroponics Market Revenue (US$ Mn) Market Share by Crop Type in 2022

- Figure 4: Global Hydroponics Market Market Attractiveness Analysis by Crop Type , 2016-2032

- Figure 5: Global Hydroponics Market Revenue (US$ Mn) Market Share by Crop Areain 2022

- Figure 6: Global Hydroponics Market Market Attractiveness Analysis by Crop Area, 2016-2032

- Figure 7: Global Hydroponics Market Revenue (US$ Mn) Market Share by Region in 2022

- Figure 8: Global Hydroponics Market Market Attractiveness Analysis by Region, 2016-2032

- Figure 9: Global Hydroponics Market Market Revenue (US$ Mn) (2016-2032)

- Figure 10: Global Hydroponics Market Market Revenue (US$ Mn) Comparison by Region (2016-2032)

- Figure 11: Global Hydroponics Market Market Revenue (US$ Mn) Comparison by Type Outlook (2016-2032)

- Figure 12: Global Hydroponics Market Market Revenue (US$ Mn) Comparison by Crop Type (2016-2032)

- Figure 13: Global Hydroponics Market Market Revenue (US$ Mn) Comparison by Crop Area (2016-2032)

- Figure 14: Global Hydroponics Market Market Y-o-Y Growth Rate Comparison by Region (2016-2032)

- Figure 15: Global Hydroponics Market Market Y-o-Y Growth Rate Comparison by Type Outlook (2016-2032)

- Figure 16: Global Hydroponics Market Market Y-o-Y Growth Rate Comparison by Crop Type (2016-2032)

- Figure 17: Global Hydroponics Market Market Y-o-Y Growth Rate Comparison by Crop Area (2016-2032)

- Figure 18: Global Hydroponics Market Market Share Comparison by Region (2016-2032)

- Figure 19: Global Hydroponics Market Market Share Comparison by Type Outlook (2016-2032)

- Figure 20: Global Hydroponics Market Market Share Comparison by Crop Type (2016-2032)

- Figure 21: Global Hydroponics Market Market Share Comparison by Crop Area (2016-2032)

- Figure 22: North America Hydroponics Market Revenue (US$ Mn) Market Share by Type Outlookin 2022

- Figure 23: North America Hydroponics Market Market Attractiveness Analysis by Type Outlook, 2016-2032

- Figure 24: North America Hydroponics Market Revenue (US$ Mn) Market Share by Crop Type in 2022

- Figure 25: North America Hydroponics Market Market Attractiveness Analysis by Crop Type , 2016-2032

- Figure 26: North America Hydroponics Market Revenue (US$ Mn) Market Share by Crop Areain 2022

- Figure 27: North America Hydroponics Market Market Attractiveness Analysis by Crop Area, 2016-2032

- Figure 28: North America Hydroponics Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 29: North America Hydroponics Market Market Attractiveness Analysis by Country, 2016-2032

- Figure 30: North America Hydroponics Market Market Revenue (US$ Mn) (2016-2032)

- Figure 31: North America Hydroponics Market Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 32: North America Hydroponics Market Market Revenue (US$ Mn) Comparison by Type Outlook (2016-2032)

- Figure 33: North America Hydroponics Market Market Revenue (US$ Mn) Comparison by Crop Type (2016-2032)

- Figure 34: North America Hydroponics Market Market Revenue (US$ Mn) Comparison by Crop Area (2016-2032)

- Figure 35: North America Hydroponics Market Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 36: North America Hydroponics Market Market Y-o-Y Growth Rate Comparison by Type Outlook (2016-2032)

- Figure 37: North America Hydroponics Market Market Y-o-Y Growth Rate Comparison by Crop Type (2016-2032)

- Figure 38: North America Hydroponics Market Market Y-o-Y Growth Rate Comparison by Crop Area (2016-2032)

- Figure 39: North America Hydroponics Market Market Share Comparison by Country (2016-2032)

- Figure 40: North America Hydroponics Market Market Share Comparison by Type Outlook (2016-2032)

- Figure 41: North America Hydroponics Market Market Share Comparison by Crop Type (2016-2032)

- Figure 42: North America Hydroponics Market Market Share Comparison by Crop Area (2016-2032)

- Figure 43: Western Europe Hydroponics Market Revenue (US$ Mn) Market Share by Type Outlookin 2022

- Figure 44: Western Europe Hydroponics Market Market Attractiveness Analysis by Type Outlook, 2016-2032

- Figure 45: Western Europe Hydroponics Market Revenue (US$ Mn) Market Share by Crop Type in 2022

- Figure 46: Western Europe Hydroponics Market Market Attractiveness Analysis by Crop Type , 2016-2032

- Figure 47: Western Europe Hydroponics Market Revenue (US$ Mn) Market Share by Crop Areain 2022

- Figure 48: Western Europe Hydroponics Market Market Attractiveness Analysis by Crop Area, 2016-2032

- Figure 49: Western Europe Hydroponics Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 50: Western Europe Hydroponics Market Market Attractiveness Analysis by Country, 2016-2032

- Figure 51: Western Europe Hydroponics Market Market Revenue (US$ Mn) (2016-2032)

- Figure 52: Western Europe Hydroponics Market Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 53: Western Europe Hydroponics Market Market Revenue (US$ Mn) Comparison by Type Outlook (2016-2032)

- Figure 54: Western Europe Hydroponics Market Market Revenue (US$ Mn) Comparison by Crop Type (2016-2032)

- Figure 55: Western Europe Hydroponics Market Market Revenue (US$ Mn) Comparison by Crop Area (2016-2032)

- Figure 56: Western Europe Hydroponics Market Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 57: Western Europe Hydroponics Market Market Y-o-Y Growth Rate Comparison by Type Outlook (2016-2032)

- Figure 58: Western Europe Hydroponics Market Market Y-o-Y Growth Rate Comparison by Crop Type (2016-2032)

- Figure 59: Western Europe Hydroponics Market Market Y-o-Y Growth Rate Comparison by Crop Area (2016-2032)

- Figure 60: Western Europe Hydroponics Market Market Share Comparison by Country (2016-2032)

- Figure 61: Western Europe Hydroponics Market Market Share Comparison by Type Outlook (2016-2032)

- Figure 62: Western Europe Hydroponics Market Market Share Comparison by Crop Type (2016-2032)

- Figure 63: Western Europe Hydroponics Market Market Share Comparison by Crop Area (2016-2032)

- Figure 64: Eastern Europe Hydroponics Market Revenue (US$ Mn) Market Share by Type Outlookin 2022

- Figure 65: Eastern Europe Hydroponics Market Market Attractiveness Analysis by Type Outlook, 2016-2032

- Figure 66: Eastern Europe Hydroponics Market Revenue (US$ Mn) Market Share by Crop Type in 2022

- Figure 67: Eastern Europe Hydroponics Market Market Attractiveness Analysis by Crop Type , 2016-2032

- Figure 68: Eastern Europe Hydroponics Market Revenue (US$ Mn) Market Share by Crop Areain 2022

- Figure 69: Eastern Europe Hydroponics Market Market Attractiveness Analysis by Crop Area, 2016-2032

- Figure 70: Eastern Europe Hydroponics Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 71: Eastern Europe Hydroponics Market Market Attractiveness Analysis by Country, 2016-2032

- Figure 72: Eastern Europe Hydroponics Market Market Revenue (US$ Mn) (2016-2032)

- Figure 73: Eastern Europe Hydroponics Market Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 74: Eastern Europe Hydroponics Market Market Revenue (US$ Mn) Comparison by Type Outlook (2016-2032)

- Figure 75: Eastern Europe Hydroponics Market Market Revenue (US$ Mn) Comparison by Crop Type (2016-2032)

- Figure 76: Eastern Europe Hydroponics Market Market Revenue (US$ Mn) Comparison by Crop Area (2016-2032)

- Figure 77: Eastern Europe Hydroponics Market Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 78: Eastern Europe Hydroponics Market Market Y-o-Y Growth Rate Comparison by Type Outlook (2016-2032)

- Figure 79: Eastern Europe Hydroponics Market Market Y-o-Y Growth Rate Comparison by Crop Type (2016-2032)

- Figure 80: Eastern Europe Hydroponics Market Market Y-o-Y Growth Rate Comparison by Crop Area (2016-2032)

- Figure 81: Eastern Europe Hydroponics Market Market Share Comparison by Country (2016-2032)

- Figure 82: Eastern Europe Hydroponics Market Market Share Comparison by Type Outlook (2016-2032)

- Figure 83: Eastern Europe Hydroponics Market Market Share Comparison by Crop Type (2016-2032)

- Figure 84: Eastern Europe Hydroponics Market Market Share Comparison by Crop Area (2016-2032)

- Figure 85: APAC Hydroponics Market Revenue (US$ Mn) Market Share by Type Outlookin 2022

- Figure 86: APAC Hydroponics Market Market Attractiveness Analysis by Type Outlook, 2016-2032

- Figure 87: APAC Hydroponics Market Revenue (US$ Mn) Market Share by Crop Type in 2022

- Figure 88: APAC Hydroponics Market Market Attractiveness Analysis by Crop Type , 2016-2032

- Figure 89: APAC Hydroponics Market Revenue (US$ Mn) Market Share by Crop Areain 2022

- Figure 90: APAC Hydroponics Market Market Attractiveness Analysis by Crop Area, 2016-2032

- Figure 91: APAC Hydroponics Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 92: APAC Hydroponics Market Market Attractiveness Analysis by Country, 2016-2032

- Figure 93: APAC Hydroponics Market Market Revenue (US$ Mn) (2016-2032)

- Figure 94: APAC Hydroponics Market Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 95: APAC Hydroponics Market Market Revenue (US$ Mn) Comparison by Type Outlook (2016-2032)

- Figure 96: APAC Hydroponics Market Market Revenue (US$ Mn) Comparison by Crop Type (2016-2032)

- Figure 97: APAC Hydroponics Market Market Revenue (US$ Mn) Comparison by Crop Area (2016-2032)

- Figure 98: APAC Hydroponics Market Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 99: APAC Hydroponics Market Market Y-o-Y Growth Rate Comparison by Type Outlook (2016-2032)

- Figure 100: APAC Hydroponics Market Market Y-o-Y Growth Rate Comparison by Crop Type (2016-2032)

- Figure 101: APAC Hydroponics Market Market Y-o-Y Growth Rate Comparison by Crop Area (2016-2032)

- Figure 102: APAC Hydroponics Market Market Share Comparison by Country (2016-2032)

- Figure 103: APAC Hydroponics Market Market Share Comparison by Type Outlook (2016-2032)

- Figure 104: APAC Hydroponics Market Market Share Comparison by Crop Type (2016-2032)

- Figure 105: APAC Hydroponics Market Market Share Comparison by Crop Area (2016-2032)

- Figure 106: Latin America Hydroponics Market Revenue (US$ Mn) Market Share by Type Outlookin 2022

- Figure 107: Latin America Hydroponics Market Market Attractiveness Analysis by Type Outlook, 2016-2032

- Figure 108: Latin America Hydroponics Market Revenue (US$ Mn) Market Share by Crop Type in 2022

- Figure 109: Latin America Hydroponics Market Market Attractiveness Analysis by Crop Type , 2016-2032

- Figure 110: Latin America Hydroponics Market Revenue (US$ Mn) Market Share by Crop Areain 2022

- Figure 111: Latin America Hydroponics Market Market Attractiveness Analysis by Crop Area, 2016-2032

- Figure 112: Latin America Hydroponics Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 113: Latin America Hydroponics Market Market Attractiveness Analysis by Country, 2016-2032

- Figure 114: Latin America Hydroponics Market Market Revenue (US$ Mn) (2016-2032)

- Figure 115: Latin America Hydroponics Market Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 116: Latin America Hydroponics Market Market Revenue (US$ Mn) Comparison by Type Outlook (2016-2032)

- Figure 117: Latin America Hydroponics Market Market Revenue (US$ Mn) Comparison by Crop Type (2016-2032)

- Figure 118: Latin America Hydroponics Market Market Revenue (US$ Mn) Comparison by Crop Area (2016-2032)

- Figure 119: Latin America Hydroponics Market Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 120: Latin America Hydroponics Market Market Y-o-Y Growth Rate Comparison by Type Outlook (2016-2032)

- Figure 121: Latin America Hydroponics Market Market Y-o-Y Growth Rate Comparison by Crop Type (2016-2032)

- Figure 122: Latin America Hydroponics Market Market Y-o-Y Growth Rate Comparison by Crop Area (2016-2032)

- Figure 123: Latin America Hydroponics Market Market Share Comparison by Country (2016-2032)

- Figure 124: Latin America Hydroponics Market Market Share Comparison by Type Outlook (2016-2032)

- Figure 125: Latin America Hydroponics Market Market Share Comparison by Crop Type (2016-2032)

- Figure 126: Latin America Hydroponics Market Market Share Comparison by Crop Area (2016-2032)

- Figure 127: Middle East & Africa Hydroponics Market Revenue (US$ Mn) Market Share by Type Outlookin 2022

- Figure 128: Middle East & Africa Hydroponics Market Market Attractiveness Analysis by Type Outlook, 2016-2032

- Figure 129: Middle East & Africa Hydroponics Market Revenue (US$ Mn) Market Share by Crop Type in 2022

- Figure 130: Middle East & Africa Hydroponics Market Market Attractiveness Analysis by Crop Type , 2016-2032

- Figure 131: Middle East & Africa Hydroponics Market Revenue (US$ Mn) Market Share by Crop Areain 2022

- Figure 132: Middle East & Africa Hydroponics Market Market Attractiveness Analysis by Crop Area, 2016-2032

- Figure 133: Middle East & Africa Hydroponics Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 134: Middle East & Africa Hydroponics Market Market Attractiveness Analysis by Country, 2016-2032

- Figure 135: Middle East & Africa Hydroponics Market Market Revenue (US$ Mn) (2016-2032)

- Figure 136: Middle East & Africa Hydroponics Market Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 137: Middle East & Africa Hydroponics Market Market Revenue (US$ Mn) Comparison by Type Outlook (2016-2032)

- Figure 138: Middle East & Africa Hydroponics Market Market Revenue (US$ Mn) Comparison by Crop Type (2016-2032)

- Figure 139: Middle East & Africa Hydroponics Market Market Revenue (US$ Mn) Comparison by Crop Area (2016-2032)

- Figure 140: Middle East & Africa Hydroponics Market Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 141: Middle East & Africa Hydroponics Market Market Y-o-Y Growth Rate Comparison by Type Outlook (2016-2032)

- Figure 142: Middle East & Africa Hydroponics Market Market Y-o-Y Growth Rate Comparison by Crop Type (2016-2032)

- Figure 143: Middle East & Africa Hydroponics Market Market Y-o-Y Growth Rate Comparison by Crop Area (2016-2032)

- Figure 144: Middle East & Africa Hydroponics Market Market Share Comparison by Country (2016-2032)

- Figure 145: Middle East & Africa Hydroponics Market Market Share Comparison by Type Outlook (2016-2032)

- Figure 146: Middle East & Africa Hydroponics Market Market Share Comparison by Crop Type (2016-2032)

- Figure 147: Middle East & Africa Hydroponics Market Market Share Comparison by Crop Area (2016-2032)

"

- List of Tables

- "

- Table 1: Global Hydroponics Market Market Comparison by Type Outlook (2016-2032)

- Table 2: Global Hydroponics Market Market Comparison by Crop Type (2016-2032)

- Table 3: Global Hydroponics Market Market Comparison by Crop Area (2016-2032)

- Table 4: Global Hydroponics Market Revenue (US$ Mn) Comparison by Region (2016-2032)

- Table 5: Global Hydroponics Market Market Revenue (US$ Mn) (2016-2032)

- Table 6: Global Hydroponics Market Market Revenue (US$ Mn) Comparison by Region (2016-2032)

- Table 7: Global Hydroponics Market Market Revenue (US$ Mn) Comparison by Type Outlook (2016-2032)

- Table 8: Global Hydroponics Market Market Revenue (US$ Mn) Comparison by Crop Type (2016-2032)

- Table 9: Global Hydroponics Market Market Revenue (US$ Mn) Comparison by Crop Area (2016-2032)

- Table 10: Global Hydroponics Market Market Y-o-Y Growth Rate Comparison by Region (2016-2032)

- Table 11: Global Hydroponics Market Market Y-o-Y Growth Rate Comparison by Type Outlook (2016-2032)

- Table 12: Global Hydroponics Market Market Y-o-Y Growth Rate Comparison by Crop Type (2016-2032)

- Table 13: Global Hydroponics Market Market Y-o-Y Growth Rate Comparison by Crop Area (2016-2032)

- Table 14: Global Hydroponics Market Market Share Comparison by Region (2016-2032)

- Table 15: Global Hydroponics Market Market Share Comparison by Type Outlook (2016-2032)

- Table 16: Global Hydroponics Market Market Share Comparison by Crop Type (2016-2032)

- Table 17: Global Hydroponics Market Market Share Comparison by Crop Area (2016-2032)

- Table 18: North America Hydroponics Market Market Comparison by Crop Type (2016-2032)

- Table 19: North America Hydroponics Market Market Comparison by Crop Area (2016-2032)

- Table 20: North America Hydroponics Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 21: North America Hydroponics Market Market Revenue (US$ Mn) (2016-2032)

- Table 22: North America Hydroponics Market Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 23: North America Hydroponics Market Market Revenue (US$ Mn) Comparison by Type Outlook (2016-2032)

- Table 24: North America Hydroponics Market Market Revenue (US$ Mn) Comparison by Crop Type (2016-2032)

- Table 25: North America Hydroponics Market Market Revenue (US$ Mn) Comparison by Crop Area (2016-2032)

- Table 26: North America Hydroponics Market Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 27: North America Hydroponics Market Market Y-o-Y Growth Rate Comparison by Type Outlook (2016-2032)

- Table 28: North America Hydroponics Market Market Y-o-Y Growth Rate Comparison by Crop Type (2016-2032)

- Table 29: North America Hydroponics Market Market Y-o-Y Growth Rate Comparison by Crop Area (2016-2032)

- Table 30: North America Hydroponics Market Market Share Comparison by Country (2016-2032)

- Table 31: North America Hydroponics Market Market Share Comparison by Type Outlook (2016-2032)

- Table 32: North America Hydroponics Market Market Share Comparison by Crop Type (2016-2032)

- Table 33: North America Hydroponics Market Market Share Comparison by Crop Area (2016-2032)

- Table 34: Western Europe Hydroponics Market Market Comparison by Type Outlook (2016-2032)

- Table 35: Western Europe Hydroponics Market Market Comparison by Crop Type (2016-2032)

- Table 36: Western Europe Hydroponics Market Market Comparison by Crop Area (2016-2032)

- Table 37: Western Europe Hydroponics Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 38: Western Europe Hydroponics Market Market Revenue (US$ Mn) (2016-2032)

- Table 39: Western Europe Hydroponics Market Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 40: Western Europe Hydroponics Market Market Revenue (US$ Mn) Comparison by Type Outlook (2016-2032)

- Table 41: Western Europe Hydroponics Market Market Revenue (US$ Mn) Comparison by Crop Type (2016-2032)

- Table 42: Western Europe Hydroponics Market Market Revenue (US$ Mn) Comparison by Crop Area (2016-2032)

- Table 43: Western Europe Hydroponics Market Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 44: Western Europe Hydroponics Market Market Y-o-Y Growth Rate Comparison by Type Outlook (2016-2032)

- Table 45: Western Europe Hydroponics Market Market Y-o-Y Growth Rate Comparison by Crop Type (2016-2032)

- Table 46: Western Europe Hydroponics Market Market Y-o-Y Growth Rate Comparison by Crop Area (2016-2032)

- Table 47: Western Europe Hydroponics Market Market Share Comparison by Country (2016-2032)

- Table 48: Western Europe Hydroponics Market Market Share Comparison by Type Outlook (2016-2032)

- Table 49: Western Europe Hydroponics Market Market Share Comparison by Crop Type (2016-2032)

- Table 50: Western Europe Hydroponics Market Market Share Comparison by Crop Area (2016-2032)

- Table 51: Eastern Europe Hydroponics Market Market Comparison by Type Outlook (2016-2032)

- Table 52: Eastern Europe Hydroponics Market Market Comparison by Crop Type (2016-2032)

- Table 53: Eastern Europe Hydroponics Market Market Comparison by Crop Area (2016-2032)

- Table 54: Eastern Europe Hydroponics Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 55: Eastern Europe Hydroponics Market Market Revenue (US$ Mn) (2016-2032)

- Table 56: Eastern Europe Hydroponics Market Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 57: Eastern Europe Hydroponics Market Market Revenue (US$ Mn) Comparison by Type Outlook (2016-2032)

- Table 58: Eastern Europe Hydroponics Market Market Revenue (US$ Mn) Comparison by Crop Type (2016-2032)

- Table 59: Eastern Europe Hydroponics Market Market Revenue (US$ Mn) Comparison by Crop Area (2016-2032)

- Table 60: Eastern Europe Hydroponics Market Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 61: Eastern Europe Hydroponics Market Market Y-o-Y Growth Rate Comparison by Type Outlook (2016-2032)

- Table 62: Eastern Europe Hydroponics Market Market Y-o-Y Growth Rate Comparison by Crop Type (2016-2032)

- Table 63: Eastern Europe Hydroponics Market Market Y-o-Y Growth Rate Comparison by Crop Area (2016-2032)

- Table 64: Eastern Europe Hydroponics Market Market Share Comparison by Country (2016-2032)

- Table 65: Eastern Europe Hydroponics Market Market Share Comparison by Type Outlook (2016-2032)

- Table 66: Eastern Europe Hydroponics Market Market Share Comparison by Crop Type (2016-2032)

- Table 67: Eastern Europe Hydroponics Market Market Share Comparison by Crop Area (2016-2032)

- Table 68: APAC Hydroponics Market Market Comparison by Type Outlook (2016-2032)

- Table 69: APAC Hydroponics Market Market Comparison by Crop Type (2016-2032)

- Table 70: APAC Hydroponics Market Market Comparison by Crop Area (2016-2032)

- Table 71: APAC Hydroponics Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 72: APAC Hydroponics Market Market Revenue (US$ Mn) (2016-2032)

- Table 73: APAC Hydroponics Market Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 74: APAC Hydroponics Market Market Revenue (US$ Mn) Comparison by Type Outlook (2016-2032)

- Table 75: APAC Hydroponics Market Market Revenue (US$ Mn) Comparison by Crop Type (2016-2032)

- Table 76: APAC Hydroponics Market Market Revenue (US$ Mn) Comparison by Crop Area (2016-2032)

- Table 77: APAC Hydroponics Market Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 78: APAC Hydroponics Market Market Y-o-Y Growth Rate Comparison by Type Outlook (2016-2032)

- Table 79: APAC Hydroponics Market Market Y-o-Y Growth Rate Comparison by Crop Type (2016-2032)

- Table 80: APAC Hydroponics Market Market Y-o-Y Growth Rate Comparison by Crop Area (2016-2032)

- Table 81: APAC Hydroponics Market Market Share Comparison by Country (2016-2032)

- Table 82: APAC Hydroponics Market Market Share Comparison by Type Outlook (2016-2032)

- Table 83: APAC Hydroponics Market Market Share Comparison by Crop Type (2016-2032)

- Table 84: APAC Hydroponics Market Market Share Comparison by Crop Area (2016-2032)

- Table 85: Latin America Hydroponics Market Market Comparison by Type Outlook (2016-2032)

- Table 86: Latin America Hydroponics Market Market Comparison by Crop Type (2016-2032)

- Table 87: Latin America Hydroponics Market Market Comparison by Crop Area (2016-2032)

- Table 88: Latin America Hydroponics Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 89: Latin America Hydroponics Market Market Revenue (US$ Mn) (2016-2032)

- Table 90: Latin America Hydroponics Market Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 91: Latin America Hydroponics Market Market Revenue (US$ Mn) Comparison by Type Outlook (2016-2032)

- Table 92: Latin America Hydroponics Market Market Revenue (US$ Mn) Comparison by Crop Type (2016-2032)

- Table 93: Latin America Hydroponics Market Market Revenue (US$ Mn) Comparison by Crop Area (2016-2032)

- Table 94: Latin America Hydroponics Market Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 95: Latin America Hydroponics Market Market Y-o-Y Growth Rate Comparison by Type Outlook (2016-2032)

- Table 96: Latin America Hydroponics Market Market Y-o-Y Growth Rate Comparison by Crop Type (2016-2032)

- Table 97: Latin America Hydroponics Market Market Y-o-Y Growth Rate Comparison by Crop Area (2016-2032)

- Table 98: Latin America Hydroponics Market Market Share Comparison by Country (2016-2032)

- Table 99: Latin America Hydroponics Market Market Share Comparison by Type Outlook (2016-2032)

- Table 100: Latin America Hydroponics Market Market Share Comparison by Crop Type (2016-2032)

- Table 101: Latin America Hydroponics Market Market Share Comparison by Crop Area (2016-2032)

- Table 102: Middle East & Africa Hydroponics Market Market Comparison by Type Outlook (2016-2032)

- Table 103: Middle East & Africa Hydroponics Market Market Comparison by Crop Type (2016-2032)

- Table 104: Middle East & Africa Hydroponics Market Market Comparison by Crop Area (2016-2032)

- Table 105: Middle East & Africa Hydroponics Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 106: Middle East & Africa Hydroponics Market Market Revenue (US$ Mn) (2016-2032)

- Table 107: Middle East & Africa Hydroponics Market Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 108: Middle East & Africa Hydroponics Market Market Revenue (US$ Mn) Comparison by Type Outlook (2016-2032)

- Table 109: Middle East & Africa Hydroponics Market Market Revenue (US$ Mn) Comparison by Crop Type (2016-2032)

- Table 110: Middle East & Africa Hydroponics Market Market Revenue (US$ Mn) Comparison by Crop Area (2016-2032)

- Table 111: Middle East & Africa Hydroponics Market Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 112: Middle East & Africa Hydroponics Market Market Y-o-Y Growth Rate Comparison by Type Outlook (2016-2032)

- Table 113: Middle East & Africa Hydroponics Market Market Y-o-Y Growth Rate Comparison by Crop Type (2016-2032)

- Table 114: Middle East & Africa Hydroponics Market Market Y-o-Y Growth Rate Comparison by Crop Area (2016-2032)

- Table 115: Middle East & Africa Hydroponics Market Market Share Comparison by Country (2016-2032)

- Table 116: Middle East & Africa Hydroponics Market Market Share Comparison by Type Outlook (2016-2032)

- Table 117: Middle East & Africa Hydroponics Market Market Share Comparison by Crop Type (2016-2032)

- Table 118: Middle East & Africa Hydroponics Market Market Share Comparison by Crop Area (2016-2032)

- 1. Executive Summary

-

- AeroFarms

- AmHydro

- Argus Control Systems Limited

- Emirates Hydroponics Farms

- Freight Farms, Inc.

- BrightFarms.

- Heliospectra

- Signify Holding

- Nutrifresh India

- UrbanKisaan