Climate Change Consulting Market By Service Type(Green Building Services, Corporate Strategy for Climate Change, Supply Chain and Ecosystem Services, Other), By Industry(Energy & Power, Mining, Large Corporations and SME's, Government and Public Sector, Others), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

42994

-

Jan 2024

-

177

-

-

This report was compiled by Vishwa Gaul Vishwa is an experienced market research and consulting professional with over 8 years of expertise in the ICT industry, contributing to over 700 reports across telecommunications, software, hardware, and digital solutions. Correspondence Team Lead- ICT Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

- Report Overview

- Driving Factors

- Restraining Factors

- Climate Change Consulting Market Segmentation Analysis

- Climate Change Consulting Industry Segments

- Growth Opportunities

- Climate Change Consulting Market Regional Analysis

- Climate Change Consulting Industry By Region

- Climate Change Consulting Market Key Player Analysis

- Climate Change Consulting Industry Key Players

- Market Recent Development

- Report Scope

Report Overview

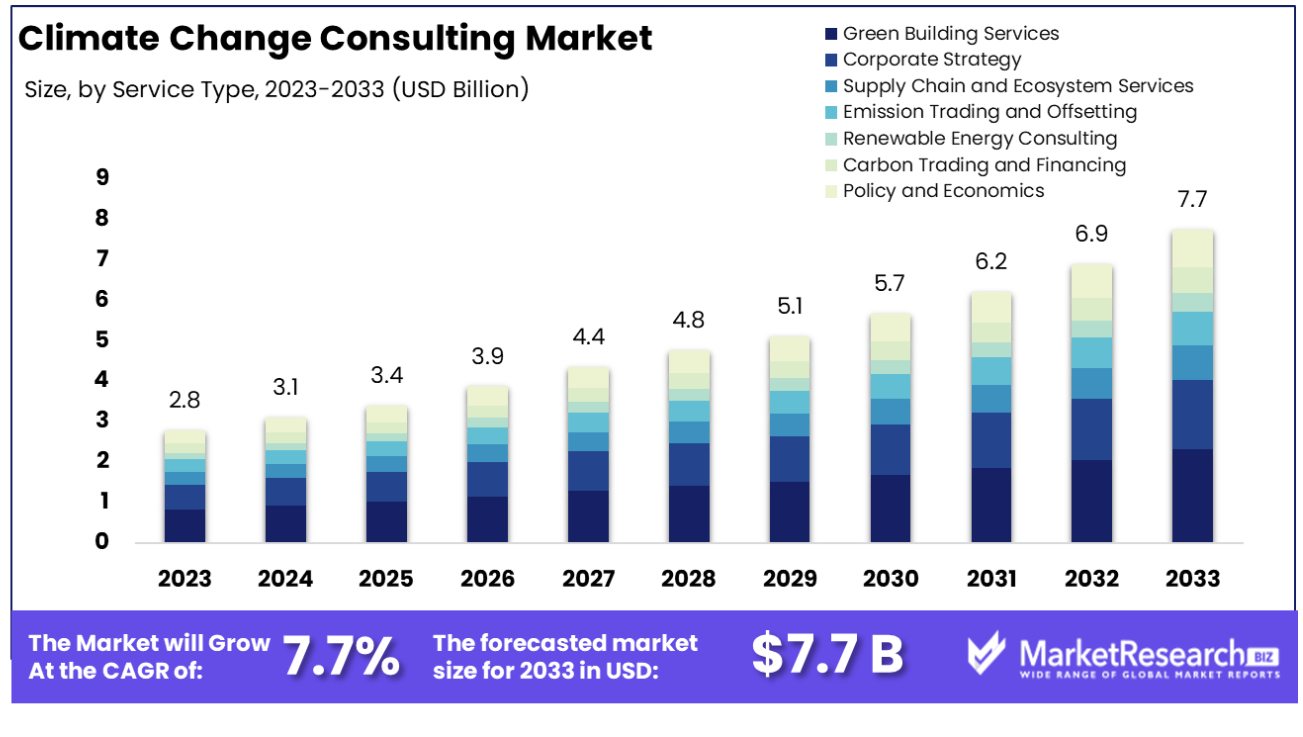

The climate change consulting market was valued at USD 2.8 billion in 2023. It is expected to reach USD 7.7 billion by 2033, with a CAGR of 7.7% during the forecast period from 2024 to 2033.

The surge in demand for global sustainability standards and technological advancements are some of the main key driving factors for the climate change consulting market. A major transformation in the climate regulatory landscape is increasing the stakeholder interest and increasing awareness of the threat climate change poses to business are compelling many organizations to create climate change transition tactics. Handling the climate change transformation requires companies to fund internal management, governance, and implementation techniques and consider how to display performance to external markets. Such demands have led global services organizations from varied backgrounds to build climate change consulting offerings, integrating past distinct net zero and climate-risk-related solutions. The climate change consulting market is therefore in a rapid transformation phase.

According to a report published by KPMG in 2023, in August 2022, the Federal Inflation Reduction Act was declared. It demonstrates the most substantial global investment policy for climate change to date. Over USD 394 billion is focused on energy shift, and some USD 270 billion includes incentives for private funding in the form of tax credits alongside loan guarantees and grants. Such incentives will compel substantial private funding in areas like renewable energy, electrified transport, and manufacturing. Companies need services to support them in guiding the incentive landscape design tactics and executing plans to create such new assets.

Climate-changing consulting providers have several offerings all across certain services that are related to climate change such as emission reporting. The providers are doing with best to combine these offerings within overarching service tactics to get tractions within the market as a whole. Climate change providers are skilled specialists who often have strong legacies in broader sustainability and environmental consulting. Global consulting providers from engineering, and tax consulting backgrounds and design specialized are refining their service offerings to compete in the climate change consulting market. For example, EY has created a cross-functional team of disclosure experts integrating sustainability specialists from the EY climate change and sustainability service training with financial reporting professionals from the EY financial accounting advisory service practices.

These climate change consulting providers are offering several digital tools to aid data accumulation and reporting efforts. Many providers have collaborated with global technology organizations such as AWS, Microsoft, Google, or other specialized software for carbon and climate risk management. KPMG, EY, and ERM have developed their internal platforms for climate risk quantifications and situation analysis for emission management. The demand for climate change consulting will increase due to its requirement in several businesses and organizations that will help in market expansion during the coming years.

Driving Factors

Stringent Regulations Catalyze Market Expansion

The increasing implementation of environmental regulations by governments is a pivotal driver for the climate change consulting market. Stringent emission limits and guidelines, like those proposed by the EPA in May 2023, necessitate expert guidance for compliance, particularly for fossil fuel-fired power plants. Moreover, ambitious national targets, such as the Biden administration's goal to significantly reduce U.S. greenhouse gas emissions by 2030 and achieve carbon-neutral electricity by 2035, underscore the urgency for businesses to adapt. These regulatory pressures compel companies to seek specialized consulting services, ensuring they not only comply with the evolving legal framework but also contribute positively to global climate objectives.

Stakeholder Pressures Fuel Demand for Expertise

The surge in stakeholder demands for corporate action on climate change is significantly propelling the climate change consulting market. As highlighted by PwC, the growing emphasis on ESG initiatives within private equity firms, where 70% view value creation as a primary ESG driver, reflects the escalating need for specialized consulting. McKinsey's report further illuminates this trend, noting a 2.5-fold increase in private equity investments in climate solutions from 2019 to 2022. These pressures from investors, customers, and the public necessitate expert climate change consultancy to align business strategies with environmental commitments and stakeholder expectations.

Growing Demand for Green Products and Services Spurs Market Growth

The escalating consumer demand for low-carbon products and services is another significant growth driver for the climate change consulting market. With NielsenIQ reporting that 78% of U.S. consumers prioritize a sustainable lifestyle, the need for green technology and sustainable business models is more pronounced than ever. Consultants play a critical role in this transition, assisting companies in developing and marketing low-carbon alternatives. Hydro’s projection of a 20% annual increase in demand for its low-carbon aluminum products until 2030 exemplifies the burgeoning market for environmentally friendly products. This trend underscores the importance of consulting services in guiding companies through green innovation and sustainable market positioning.

Restraining Factors

Budget Constraints Limit Investment in Climate Change Consulting

Budget constraints play a significant role in limiting the growth of the climate change consulting market. Addressing climate change effectively requires major investments, which can be challenging for many companies, particularly small and medium-sized businesses (SMBs). These businesses often have limited budgets for discretionary spending, including consulting services. The 2008 recession exemplified this challenge when businesses were forced to cut consulting budgets drastically. This financial limitation makes it difficult for climate change consulting firms to penetrate a broader market, as potential clients are unable to allocate sufficient resources for these essential services.

Short-Term Focus of Executives and Investors Hinders Long-Term Climate Initiatives

A short-term focus among executives and investors often hinders the growth of the climate change consulting market. There's a prevalent trend where immediate financial performance is prioritized over long-term climate change initiatives. For example, some oil companies have been known to lobby against climate regulations to protect short-term interests. This approach poses a significant challenge for climate change consultants, whose work primarily involves implementing long-term sustainability strategies. The reluctance of companies to invest in long-term environmental sustainability due to immediate financial concerns limits the scope and impact of climate change consulting services in the broader market.

Climate Change Consulting Market Segmentation Analysis

By Service Type Analysis

Green Building Services dominates the climate change consulting market. This segment's significance is underscored by the substantial environmental impact of the construction industry. Buildings contribute approximately 40% of worldwide carbon emissions, with substantial energy use, water consumption, and electricity usage.

In the United States alone, buildings account for 39% of total energy use, 12% of total water consumption, 68% of total electricity consumption, and 38% of carbon dioxide emissions. Green building services focus on designing, constructing, and operating buildings more sustainably. This involves utilizing energy-efficient technologies, sustainable materials, and innovative designs to reduce environmental impact. The economic benefit is also significant, with green buildings seeing an average operating cost reduction of 16.9% over five years.

Other service types, such as Corporate Strategy for Climate Change, Supply Chain and Ecosystem Services, Emission Trading and Offsetting, Renewable Energy Consulting, Carbon Trading and Financing, Policy and Economics, and Energy Audits, also play vital roles in addressing various aspects of climate change. However, the direct impact and measurable benefits of Green Building Services in reducing carbon footprint and operational costs make it the leading segment in climate change consulting.

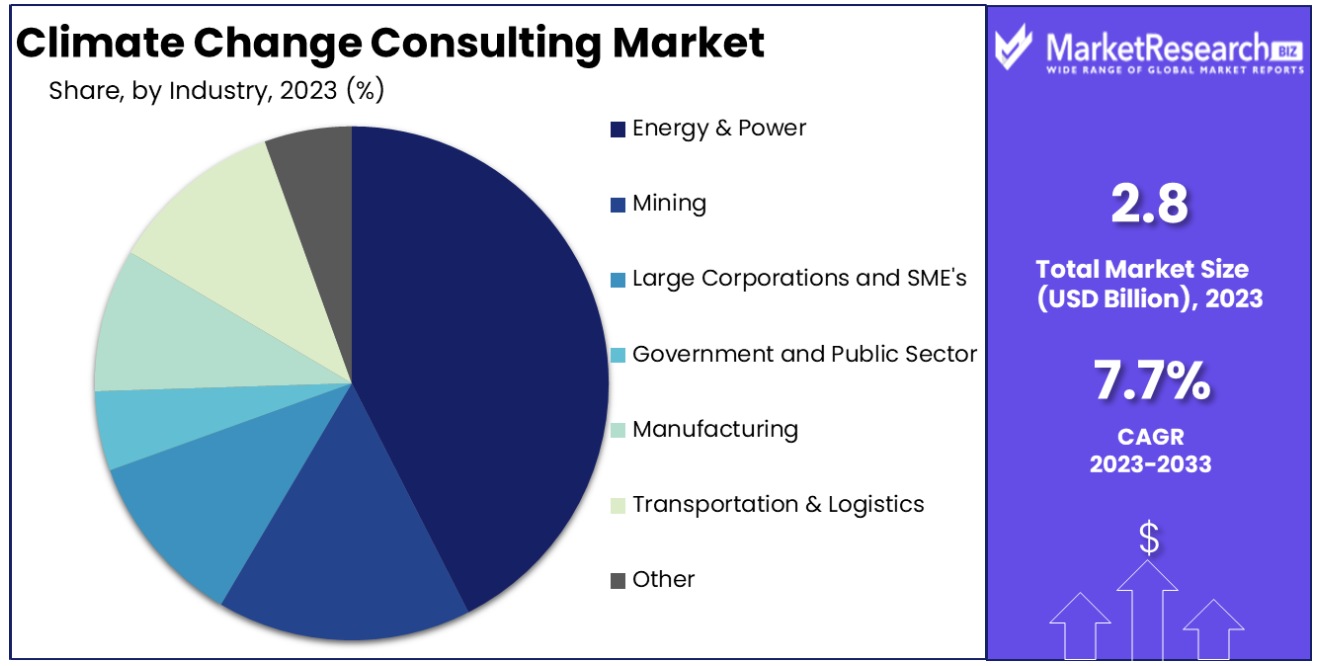

By Industry Analysis

Energy & Power is the leading industry in the climate change consulting market. This industry is pivotal due to its significant contribution to global greenhouse gas emissions and its potential for substantial emission reductions. The sector is undergoing a major transformation, shifting towards renewable energy sources and implementing more efficient technologies to reduce its environmental impact. Climate change consultants play a crucial role in this transition, advising on renewable energy adoption, energy efficiency improvements, regulatory compliance, and sustainable practices.

Other industries, including Mining, Government and Public Sector, Manufacturing, Transportation & Logistics, and Others, are also engaging in climate change consulting services. In Mining, consultants help in implementing sustainable mining practices and reducing environmental impact. The Government and Public Sector seek advice on policy-making, regulatory frameworks, and sustainable urban planning.

Manufacturing industries utilize consulting services to reduce emissions and integrate sustainable practices in production. Transportation & Logistics focuses on optimizing fuel efficiency and adopting greener transportation methods. Despite the important contributions of these industries, the Energy & Power sector's central role in both contributing to and mitigating climate change positions it as the dominant industry in the climate change consulting market. The ongoing global focus on transitioning to renewable energy and reducing dependence on fossil fuels further underscores the significance of this sector.

Climate Change Consulting Industry Segments

By Service Type

- Green Building Services

- Corporate Strategy for Climate Change

- Supply Chain and Ecosystem Services

- Emission Trading and Offsetting

- Renewable Energy Consulting

- Carbon Trading and Financing

- Policy and Economics

- Energy Audits

By Industry

- Energy & Power

- Mining

- Large Corporations and SME's

- Government and Public Sector

- Manufacturing

- Transportation & Logistics

- Others

Growth Opportunities

Growing Demand from High-Emitting Industries Offers Growth Opportunity

Industries with high carbon footprints, such as oil & gas, transportation, manufacturing, and utilities, are at the forefront of regulatory scrutiny and transition challenges. These sectors are under increasing pressure to develop and implement comprehensive net-zero strategies. This urgency translates into a significant growth opportunity for climate change consulting firms. Consultants specializing in sustainability solutions can provide crucial guidance on reducing emissions, complying with evolving regulations, and transitioning towards greener practices. The growing awareness and commitment to ESG (Environmental, Social, and Governance) principles further amplify this demand, creating a burgeoning market for expert advisory services in carbon-intensive industries.

High Potential in Financial Services Offers Growth Opportunity

The financial sector, particularly banks, is increasingly recognizing climate change as a pivotal factor affecting credit risk and investment decision-making. This sector's need to integrate climate considerations into their frameworks presents a substantial growth opportunity for climate change consulting. Consultants can offer expertise in assessing climate-related financial risks, advising on green financing projects, and aiding in the development of sustainable investment portfolios. The burgeoning market for green bonds and sustainable investments underscores this trend. Additionally, financial institutions are seeking guidance to comply with climate disclosure regulations and to capitalize on opportunities to fund environmentally beneficial projects, further driving demand for climate change consultancy services.

Climate Change Consulting Market Regional Analysis

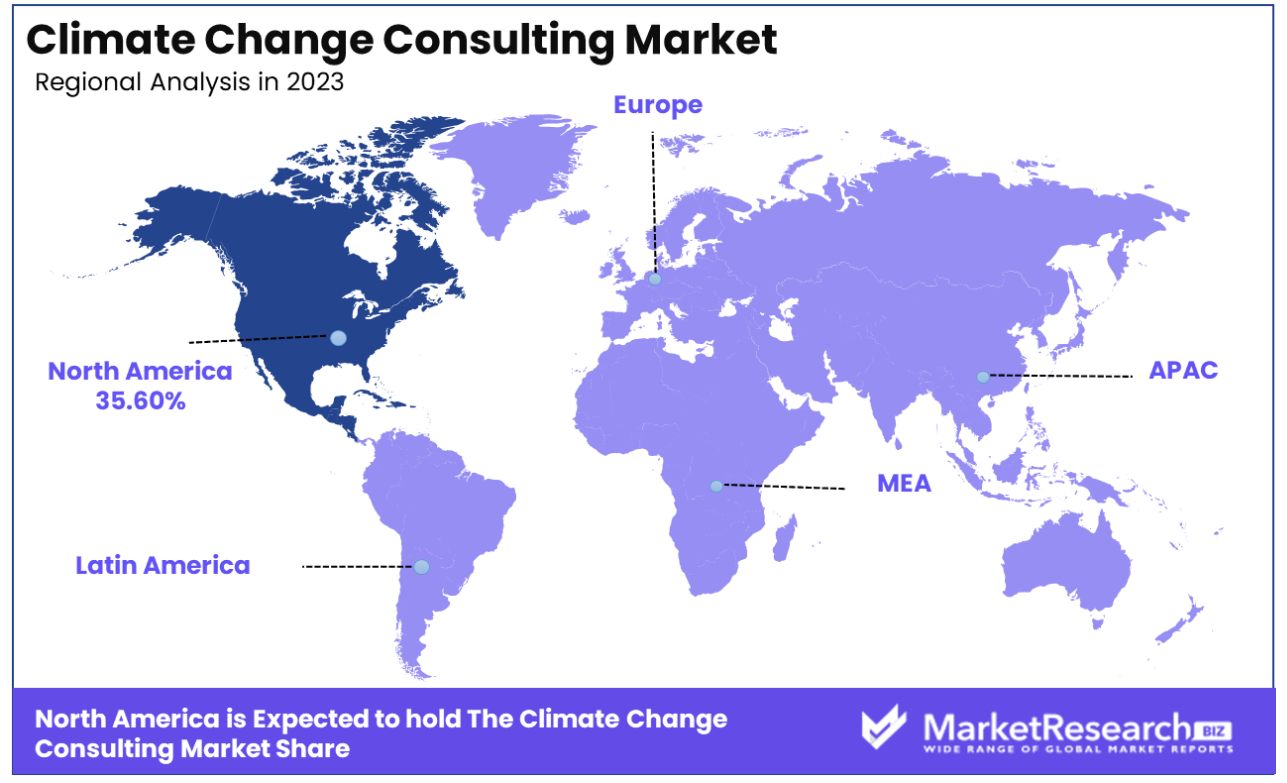

North America Dominates with 35.60% Market Share in Climate Change Consulting Market

North America's significant 35.60% share in the global climate change consulting market is largely driven by the region's increasing awareness and response to climate change challenges. The region's greenhouse gas (GHG) emissions, which have risen by almost 18% since 1990, coupled with the United States' responsibility for a significant portion of global carbon emissions, particularly from the construction and energy sectors, have necessitated robust climate change strategies. The demand for consulting services is further spurred by governmental policies, corporate sustainability goals, and the growing public concern about environmental impact.

The climate change consulting market in North America is characterized by a comprehensive approach to tackling GHG emissions across various sectors. The construction sector, responsible for a significant portion of carbon emissions and energy use, is a major focus area for consulting services, driving the adoption of sustainable practices and technologies. Additionally, the energy sector's shift towards renewable sources and the implementation of energy-efficient practices are crucial market dynamics. The involvement of major corporations in sustainability initiatives and the integration of climate change strategies in business operations are also key aspects driving the consulting market.

Europe: Leading in Sustainability Initiatives

Europe’s climate change consulting market is driven by its leadership in global sustainability initiatives and stringent environmental regulations. The European Union's aggressive targets for reducing GHG emissions and the transition to a circular economy create a substantial demand for consulting services. The market benefits from Europe's advanced research in climate science and strong policy frameworks.

Asia-Pacific: Rapid Industrialization and Environmental Challenges

In Asia-Pacific, the climate change consulting market is growing due to rapid industrialization and the associated environmental challenges. Countries like China and India, facing significant environmental impact due to their economic growth, are increasingly seeking consulting services for sustainable development and climate change mitigation strategies. The region’s vulnerability to climate change impacts, such as rising sea levels and extreme weather events, also boosts the demand for consulting services focused on adaptation and resilience.

Climate Change Consulting Industry By Region

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of Asia Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of the Middle East & Africa

Climate Change Consulting Market Key Player Analysis

In the Climate Change Consulting Market, a sector pivotal for guiding businesses and governments through environmental challenges and sustainability goals, the companies listed are instrumental in shaping strategies and policies. EY (Ernst & Young) and PricewaterhouseCoopers LLP (PwC) are prominent players, offering comprehensive consulting services that integrate sustainability into core business practices. Their strategic positioning emphasizes risk management, regulatory compliance, and sustainable growth, significantly influencing how organizations approach climate change.

Deloitte LLP and KPMG International provide expert advisory services in environmental sustainability and climate risk, reflecting the industry's shift towards integrating environmental considerations into all aspects of business planning and decision-making. McKinsey & Company, Inc. and Boston Consulting Group (BCG), with their global reach and expertise, play crucial roles in offering strategic insights and solutions for complex climate-related challenges faced by various sectors.

Climate Change Consulting Industry Key Players

- Coastal Risk Consulting, LLC

- EY (Ernst & Young)

- A.T. Kearney, Inc.

- PricewaterhouseCoopers LLP (PwC)

- Deloitte LLP

- Ramboll Environ, Inc.

- McKinsey & Company, Inc.

- Booz & Company

- KPMG International

- CH2M HILL Companies, Ltd. (Jacobs Engineering Group)

- Material Economics

- Boston Consulting Group (BCG)

- WSP

- Greenfish

- Trinomics B.V.

- ICF International, Inc.

- Avieco

- ERM Group, Inc.

- Bain & Company

Market Recent Development

- In January 2024, Kenya launched the Building Climate Resilience for the Urban Poor (BCRUP) program at COP28 in Dubai, aiming to enhance adaptive capacity against climate change for urban dwellers. Supported by UN-Habitat, the 10-year initiative targets 12 African countries with an estimated urban poor population of 112 million, requiring approximately $5 billion for implementation.

- In January 2024, El Paso City Council approved a $1.2 million contract with AECOM to develop the region's first comprehensive Climate Action Plan. This plan, funded by a $5 million bond, aims to address climate change through measures such as high-density development incentives, renewable energy investments, and transitioning fleets to electric vehicles.

- In January 2024, Boston Consulting Group (BCG) entered a strategic agreement with 1PointFive, a subsidiary of Occidental, to purchase 21,000 metric tons of carbon dioxide removal (CDR) credits over three years. BCG will also collaborate with 1PointFive on consulting services, including the development of business processes supporting Direct Air Capture CDR credits.

- In December 2023, UNDP emphasized the vital role of migrants in climate adaptation and sustainable growth. Remittances from migrants contribute over 20% of GDP in vulnerable countries, supporting resilience, reducing poverty, and aiding disaster recovery. Initiatives like tree planting in Uzbekistan involve migrants, showcasing their potential in green transitions and skill gaps.

Report Scope

Report Features Description Market Value (2023) USD 2.8 Billion Forecast Revenue (2033) USD 7.7 Billion CAGR (2024-2032) 7.7% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Service Type(Green Building Services - Dominant Segment, Corporate Strategy for Climate Change, Supply Chain and Ecosystem Services, Emission Trading and Offsetting, Renewable Energy Consulting, Carbon Trading and Financing, Policy and Economics, Energy Audits), By Industry(Energy & Power, Mining, Large Corporations and SME's, Government and Public Sector, Manufacturing, Transportation & Logistics, Others) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Coastal Risk Consulting, LLC, EY (Ernst & Young), A.T. Kearney, Inc., PricewaterhouseCoopers LLP (PwC), Deloitte LLP, Ramboll Environ, Inc., McKinsey & Company, Inc., Booz & Company, KPMG International, CH2M HILL Companies, Ltd. (Jacobs Engineering Group), Material Economics, Boston Consulting Group (BCG), WSP, Greenfish, Trinomics B.V., ICF International, Inc., Avieco, ERM Group, Inc., Bain & Company Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Coastal Risk Consulting, LLC

- EY (Ernst & Young)

- A.T. Kearney, Inc.

- PricewaterhouseCoopers LLP (PwC)

- Deloitte LLP

- Ramboll Environ, Inc.

- McKinsey & Company, Inc.

- Booz & Company

- KPMG International

- CH2M HILL Companies, Ltd. (Jacobs Engineering Group)

- Material Economics

- Boston Consulting Group (BCG)

- WSP

- Greenfish

- Trinomics B.V.

- ICF International, Inc.

- Avieco

- ERM Group, Inc.

- Bain & Company