Hydraulic Oil Market By Product Type (Mineral Oil, Synthetic Oil, Bio-Based Oil), By Application (Construction Machinery, Automotive & Transportation, Oil & Gas Equipment), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2023-2032

-

40806

-

Aug 2023

-

190

-

-

This report was compiled by Correspondence Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Report Overview

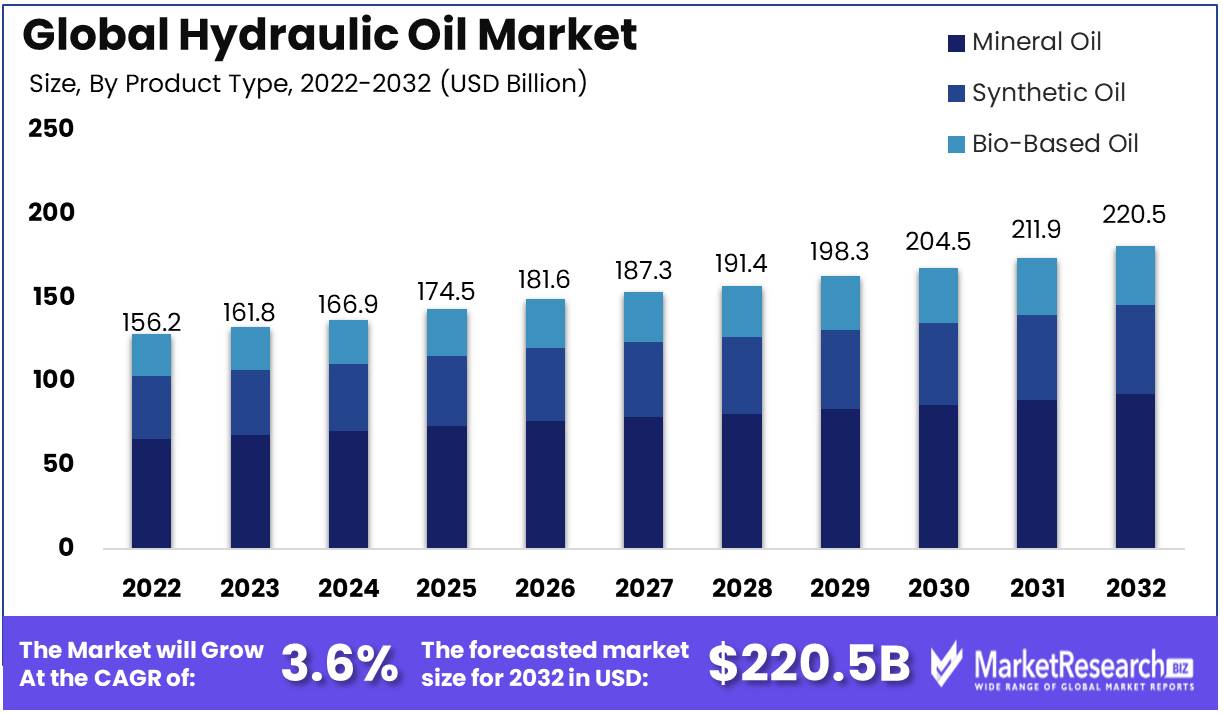

Hydraulic Oil Market size is expected to be worth around USD 220.5 Bn by 2032 from USD 156.2 Bn in 2022, growing at a CAGR of 3.6% during the forecast period from 2023 to 2032.

The hydraulic oil market is an industry centered on the production, distribution, and use of hydraulic lubricants. Hydraulic oil, also referred to as hydraulic fluid, is a crucial component of hydraulic systems, which are extensively utilized in machinery and equipment across industries. The primary objective of the hydraulic oil market is to provide hydraulic systems with dependable and effective lubricants. In these systems, hydraulic oil acts as a medium for power transfer, assuring smooth operation, reducing friction, and preventing wear and tear. In addition, hydraulic oil is essential for heat transfer and contamination control in hydraulic systems.

Hydraulic oil's importance in industrial applications cannot be exaggerated. Its superior lubricating properties reduce friction and corrosion, thereby extending the service life of hydraulic components. In addition to providing efficient heat transfer, hydraulic oil maintains optimal operating temperatures and prevents overloading. In addition, its resistance to oxidation and stability at high pressures assure consistent performance, thereby enhancing the overall performance of hydraulic systems.

In recent years, the hydraulic oil market has witnessed a number of significant developments. The development of environmentally favorable hydraulic oils is a major advancement. The efficacy of these hydraulic fluids derived from renewable resources is comparable to that of conventional hydraulic oils derived from petroleum, while their environmental impact is reduced. The introduction of synthetic hydraulic fluids, which exhibit enhanced thermal stability, shear stability, and efficacy under extreme operating conditions, represents another innovation.

Over the years, the hydraulic oil market has grown steadily, fueled by rising industrialization, accelerated urbanization, and technological advances. The market's expansion can be attributed to the product's wide spectrum of industrial applications. In addition to the automotive and construction industries, hydraulic systems are used in agriculture, aerospace, marine, oil and gas, mining, and the manufacturing sector. Due to the adaptability of hydraulic systems and the requirement for efficient power transmission, hydraulic oil is an indispensable component in these industries.

Ethical considerations and responsible conduct have risen to prominence across industries, including the hydraulic oil market. In accordance with the principles of sustainability and responsibility, manufacturers are increasingly concentrating on developing biodegradable, non-toxic, and non-hazardous hydraulic lubricants. Recycling and responsible disposal of hydraulic lubricants are also crucial for minimizing environmental impact.

Driving Factors

The Growth of Industrial and Construction Sectors

The industrial and construction industries contribute significantly to the demand for hydraulic oil. As these industries continue to experience extraordinary growth, the demand for heavy machinery and equipment increases as well. Cranes, excavators, loaders, and forklifts use hydraulic fluid as an integral component. This rising demand for these machines and tools creates new opportunities for the hydraulic oil market. Moreover, infrastructure initiatives increase as a result of the growth of the construction industry, particularly in emerging economies. These undertakings necessitate hydraulic systems that depend on premium hydraulic oil for optimal performance. Consequently, this increases the market demand for hydraulic oil.

Expansion of the Automotive and Transportation Industries

Globally, the automotive and transportation industries are experiencing rapid expansion. Due to accelerated urbanization and rising disposable income, the demand for commercial and passenger vehicles continues to increase. Consequently, the demand for hydraulic systems, which are integral to these vehicles, is increasing. Hydraulic systems are responsible for a variety of vehicle functions, including power steering, braking, suspension, and transmission. Hydraulic lubricant is required for the effective operation and durability of these systems. Consequently, the expansion of the automotive and transportation industries serves as a driving force for the growth of the hydraulic oil market.

The Increasing Demand for Energy Efficient Hydraulic Systems

The increasing emphasis on sustainability and environmental protection compels businesses to adopt energy-efficient practices. In the field of hydraulics, manufacturers have devised innovative systems designed to reduce energy consumption without sacrificing performance. This shift toward energy-efficient hydraulic systems drives demand for innovative hydraulic lubricants. Low friction, exceptional thermal stability, and a high viscosity index are properties that must be present in hydraulic oil for energy-efficient hydraulic systems. These formulations aid in minimizing energy losses and improving overall system efficiency. As a consequence of the increased demand, the market for energy-efficient hydraulic oil is experiencing substantial growth.

Advancements in Hydraulic Oil Formulations and Additives

Continuous advancements in hydraulic oil formulations and additives have significantly contributed to the growth of the hydraulic oil market. Manufacturers of lubricants continually invest in research and development to improve the performance and effectiveness of hydraulic oils. These developments aim to enhance the viscosity index, oxidation resistance, and anti-wear properties of hydraulic lubricants. In addition, the introduction of sophisticated additives, such as anti-corrosion agents and detergents, contributes to the increased durability and dependability of hydraulic systems. As a result, the market is experiencing a surge in demand for these enhanced formulations and additives.

Restraining Factors

Potential environmental and sustainability concerns in the hydraulic oil market

Hydraulic oil, which is essential across industries, confronts environmental challenges in the context of rising ecological consciousness. The contamination of water and soil by spillage and improper disposal poses threats to aquatic life and ecosystems. To ensure its continued viability, the hydraulic oil market must prioritize responsible waste management, the prevention of leakage, and the promotion of eco-friendly alternatives to lessen its environmental impact.

Potential fluctuations in crude oil prices and their impact on the hydraulic oil market

The hydraulic oil market is highly dependent on the volatility of crude oil prices, which affects production costs and prices paid by end users. Prices that are too high can deter consumers and force industries to seek alternative power transmission methods. To combat this, hydraulic oil companies must diversify their supply chains, discover cost-effective production techniques, and invest in sustainable alternatives.

Potential regulatory restrictions and compliance requirements affecting the hydraulic oil market

Compliance with regulatory standards is crucial for the safety, performance, and environment of the hydraulic oil market. Compliance with regulations, particularly those issued by environmental agencies, is crucial for the continued operation of industry, despite the fact that they can sometimes inhibit market expansion. In order to navigate complex regulatory landscapes, it is necessary to adhere to emission standards and designate oil correctly. Noncompliance carries the risk of legal sanctions, reputational harm, and market loss. To conform to industry standards, businesses must prioritize awareness of evolving regulations, pursue certifications, and embrace sustainability.

Potential equipment compatibility and warranty considerations in the hydraulic oil marketplace

Compatibility factors, such as viscosity, additives, and formulation, must be carefully considered when using hydraulic oil in a variety of systems. Inappropriate oil selection can result in decreased performance, increased attrition, and premature equipment failure. Manufacturers frequently prescribe oil requirements for warranty coverage, and failure to comply can lead to monetary burdens. To mitigate these concerns, the hydraulic oil industry should provide precise utilization guidelines, collaborate with equipment manufacturers to develop compatible designs and conduct exhaustive compatibility tests, thereby enhancing system performance and durability.

Product Type Analysis

The Mineral Oil Segment has dominated the hydraulic oil market, proving to be the most popular and extensively used product type. Mineral oil, which is derived from crude oil, has superior lubrication properties and high resistance to oxidation and thermal degradation. Automotive, industrial machinery, and aerospace are among the industries that rely significantly on hydraulic systems because of these qualities.

Emerging economies' economic growth is one of the most important factors driving the adoption of the Mineral Oil Segment. As these nations continue to experience rapid economic expansion, their demand for hydraulic systems and apparatus grows. This, in turn, increases the demand for mineral oil-based hydraulic lubricants, causing this product type to dominate the market.

In addition to consumer trends and behaviors, the Mineral Oil Segment's popularity is significantly influenced by these factors. Mineral oil satisfies this criterion to perfection, as end-users prefer hydraulic oils that provide a balance between efficacy and cost. Its cost-effectiveness and wide availability make it a popular option for both small and large-scale industries, furthering its market dominance.

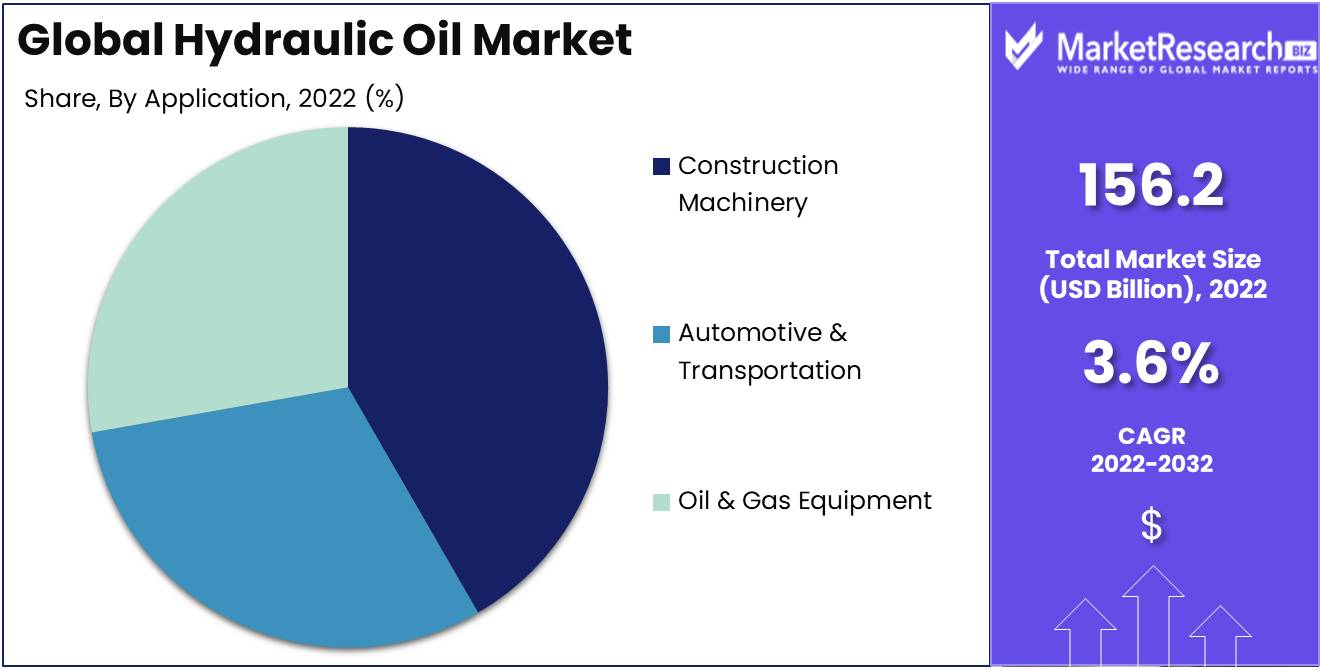

Application Analysis

The Construction Machinery Segment is the dominant force in the hydraulic oil market. Construction equipment, such as excavators, loaders, bulldozers, and cranes, necessitates effective hydraulic systems in order to perform their duties accurately and safely. As the global construction industry continues to expand, demand for construction machinery and, consequently, hydraulic lubricants used in these machines grows.

Similar to the Mineral Oil Segment, the Construction Machinery Segment is driven by economic growth in emerging economies. Construction activities, including infrastructure development, residential and commercial initiatives, and industrial expansions, are expanding rapidly in developing nations. These elements contribute to the high demand for construction equipment and, in turn, hydraulic lubricants.

In addition to consumer trends and behaviors, the dominance of the Construction Machinery Segment is also influenced by these factors. End-users in the construction industry prioritize hydraulic lubricants with superior performance, dependable lubrication, and increased equipment longevity. The harsh conditions under which construction equipment operates include extreme temperatures, hefty loads, and frequent use. Therefore, it is essential to choose hydraulic lubricants that can withstand these conditions and deliver optimal performance.

Key Market Segments

By Product Type

- Mineral Oil

- Synthetic Oil

- Bio-Based Oil

By Application

- Construction Machinery

- Automotive & Transportation

- Oil & Gas Equipment

Growth Opportunity

Development of Environmentally Friendly and Biodegradable Hydraulic Oils

As environmental consciousness grows, eco-friendly hydraulic oils represent a promising market niche. Due to the presence of hazardous compounds, conventional oils pose a threat to ecosystems due to their potential to cause pollution. However, sustainable innovations have emerged. New formulations of hydraulic oil provide efficient lubrication, functionality, and biodegradability, thereby mitigating environmental damage. Through strategic marketing and product alignment, businesses that venture into these oils can attract environmentally conscious consumers and industries, securing a competitive advantage and fueling market expansion.

Expansion into Emerging Markets with Industrial Growth

Expansion into emerging markets with rapid industrial development represents a second growth opportunity for the hydraulic oil industry. As developing nations pursue industrialization, the demand for hydraulic oils to power machinery and equipment will skyrocket. In these emerging markets, industries such as manufacturing, construction, mining, and agriculture require reliable hydraulic oils to ensure seamless operations. By expanding into these markets, manufacturers of hydraulic oil can establish new customer bases and capitalize on previously unrealized opportunities.

Collaboration with Equipment Manufacturers and Distributors

Collaboration with equipment manufacturers and distributors provides the hydraulic oil market with yet another avenue for expansion. Frequently, manufacturers of heavy machinery and equipment collaborate closely with hydraulic oil companies to guarantee optimal product performance and durability. By collaborating with equipment manufacturers, hydraulic oil manufacturers are able to develop specialized lubricants that meet the requirements of specific types of machinery. These partnerships can result in increased brand visibility, consumer confidence, and ultimately increased sales volumes. Similarly, strategic alignment with distributors enables hydraulic oil manufacturers to enter new markets and reach customers who rely on these distributors for equipment maintenance.

Adoption of Predictive Maintenance and Condition Monitoring Solutions

Adoption of predictive maintenance and condition monitoring solutions has the potential to revolutionize the hydraulic oil market in the era of digital transformation. Traditional maintenance procedures typically involve periodic inspections and oil changes, independent of the hydraulic oil or machinery's actual condition. Nevertheless, with the incorporation of IoT technologies, sensors, and data analytics, businesses can now monitor the condition of hydraulic oils and equipment in real-time, thereby making maintenance more efficient and cost-effective. Before any potential malfunctions occur, preventative measures can be taken to reduce downtime, optimize performance, and extend the lifespan of both the hydraulic oil and the machinery it operates in.

Latest Trends

Growth of Synthetic and High-Performance Hydraulic Oils

With the industry's increasing emphasis on efficiency and performance, synthetic and high-performance hydraulic oils have acquired tremendous popularity. These lubricants have superior thermal and oxidative stability, enabling them to withstand higher operating temperatures and prolong the life of hydraulic systems. In addition, their extraordinary shear stability ensures consistent viscosity and minimizes energy losses, resulting in an enhanced system's overall performance. In addition to their superior cold-starting capabilities, synthetic hydraulic lubricants are suitable for use in extreme weather conditions. As demand for high-performance hydraulic systems continues to rise, the market for synthetic hydraulic lubricants is anticipated to experience substantial growth.

High Demand for Low Viscosity and Energy Efficient Hydraulic Fluids

Efficiency and energy savings have emerged as paramount concerns for industries worldwide. In accordance with this, the demand for low-viscosity hydraulic fluids that reduce internal friction and minimize power losses within hydraulic systems is increasing. By using these fluids, industries can increase operational efficiency and reduce energy consumption, resulting in environmental and financial benefits. The market for hydraulic fluids with low viscosity and high energy efficiency is anticipated to experience substantial growth as industries increasingly recognize the importance of sustainable practices and endeavor to comply with stricter environmental regulations.

Utilization of Bio-Based and Renewable Hydraulic Oils

The market for hydraulic oil has been significantly impacted by the global transition towards sustainable and eco-friendly solutions. Bio-based and renewable hydraulic lubricants are becoming an increasingly popular alternative to conventional petroleum-based products. These oils are derived from renewable resources, such as vegetable oils, and then refined to improve their performance characteristics. In the event of leaks or spills, bio-based hydraulic lubricants offer superior biodegradability and low toxicity, minimizing the potential environmental impact. In the coming years, demand for bio-based and renewable hydraulic oils is anticipated to increase substantially due to an increasing emphasis on environmental sustainability.

Rise of Hydraulic Oil Additives for Improved Performance

Increasing numbers of hydraulic systems are incorporating hydraulic oil additives to improve performance and prolong service life. These additives are specially formulated to address common issues such as erosion, oxidation, foaming, and corrosion, thereby enhancing the performance and dependability of the system as a whole. Anti-wear additives, for instance, provide superior protection against friction and wear, whereas anti-foam additives prevent the formation of foam to ensure the consistent operation of hydraulic systems. As businesses strive to optimize the performance and efficiency of their hydraulic systems, the market for hydraulic oil additives is experiencing significant growth.

Regional Analysis

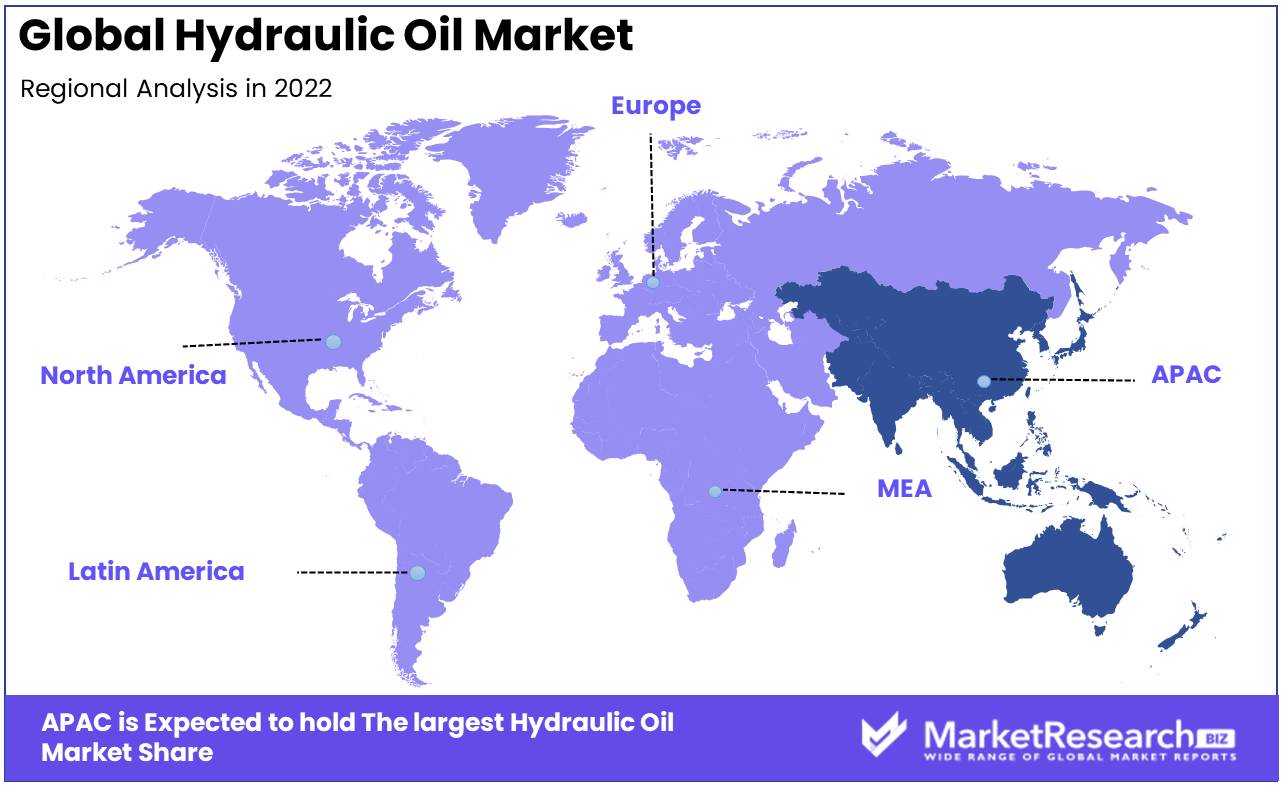

Asia-Pacific Region Dominates the Hydraulic Oil Market The hydraulic oil market has experienced robust growth over the past few years, with the Asia-Pacific region emerging as the industry's dominant player. As technological advances continue to transform various industries, the demand for high-quality hydraulic oil has increased, especially in emerging economies such as China and India.

As a result of its robust industrial foundation, the Asia-Pacific region has witnessed a significant increase in construction activities and manufacturing facilities, driving the demand for hydraulic oil. In addition, the region is home to a significant number of automakers, which contributes to the rising demand for hydraulic oil in the auto industry. Consequently, the Asia-Pacific region has become the focal point for major industry actors eager to capitalize on the exponential growth opportunities it provides.

The rapid expansion of infrastructure initiatives is one of the primary factors contributing to Asia-Pacific's dominance in the hydraulic oil market. The governments of nations such as China and India have made substantial investments in infrastructure development, including the construction of bridges, roads, and significant urban projects. Such endeavors necessitate the use of hydraulic equipment, thereby increasing the demand for hydraulic oil.

In addition, the increasing adoption of automation across multiple industries has boosted the demand for hydraulic equipment, further contributing to the Asia-Pacific region's dominance. As automation becomes the norm in the manufacturing and construction industries, hydraulic systems are essential for the efficient operation of heavy apparatus and equipment. As a result, the demand for hydraulic oil has increased, establishing Asia-Pacific as a leading market player.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

Chevron Corporation has established itself as a major participant in the hydraulic oil industry. The company offers an extensive selection of high-performance hydraulic oils designed to satisfy the stringent demands of hydraulic systems. Chevron has developed a vast distribution network, ensuring that their products are available to consumers in a variety of regions, in light of their strong global presence. In addition, Chevron's commitment to innovation and continuous development has enabled the company to produce hydraulic oils of superior quality that improve machinery performance and extend equipment life.

Exxon Mobil Corporation is a global frontrunner in the hydraulic oil market. They provide a variety of hydraulic lubricants with exceptional anti-wear properties and oxidation resistance, ensuring optimal system performance and protection. Exxon Mobil's commitment to research and development has enabled the company to develop innovative hydraulic lubricants that improve energy efficiency and reduce maintenance costs. Through their extensive marketing and distribution network, they have met the requirements of a variety of industries worldwide.

South Korean-based S-OIL CORPORATION has made significant contributions to the hydraulic oil market with its high-quality products. S-OIL assures a steady supply of premium hydraulic oils that meet stringent industry standards by concentrating on refining and producing base oils. Their investments in technology and sustainable practices have allowed them to develop environmentally friendly hydraulic lubricants in response to the rising demand for eco-friendly solutions. S-OIL's commitment to customer satisfaction and its extensive product selection has strengthened its market position.

In the United States, Motiva Enterprises LLC has established itself as a major participant in the hydraulic oil market. Motiva, renowned for its innovative products and cutting-edge technology, offers an extensive selection of hydraulic lubricants designed to increase equipment dependability and productivity. Their focus on research and development ensures that their products are continuously improved, keeping them at the vanguard of their industry. Motiva is able to provide dependable hydraulic oil solutions to a variety of customers as a result of its customer-centric philosophy and robust supply chain.

Top Key Players in Hydraulic Oil Market

- Chevron Corporation (U.S.)

- Exxon Mobil Corporation (U.S.)

- S-OIL CORPORATION (South Korea)

- Motiva Enterprises LLC (U.S.)

- SK innovation Co.Ltd. (South Korea)

- Shell (Netherlands)

- Neste (Finland)

- AVISTA OIL Deutschland GmbH (Germany)

- Nynas AB (Sweden)

- Repsol (Spain)

- Ergon Inc. (U.S.)

- Calumet Specialty Products Partners L.P. (U.S.)

- H&R Group (Germany)

- Sinopec Corp. (China)

- PetroChina Company Limited (China)

- Saudi Aramco (Saudi Arabia)

- Abu Dhabi National Oil Company (ADNOC) (UAE)

- PT Pertamina (Persero) (Indonesia)

- Phillips 66 Company (U.S.)

- Petroliam Nasional Berhad (PETRONAS) (Malaysia)

Recent Development

- In 2023, Shell announced plans to introduce an innovative line of hydraulic oil products that are expressly designed to be more environmentally responsible. Shell seeks to address the industry's environmental concerns by revolutionizing hydraulic oil production techniques, in recognition of the growing global demand for sustainable solutions. This forward-thinking strategy demonstrates the company's dedication to reducing its carbon footprint and satisfying the evolving demands of environmentally conscious consumers.

- In 2022, ExxonMobil, a significant player in the hydraulic oil market, has emphasized its intention to expand, particularly in China. ExxonMobil has announced a considerable increase in its Chinese hydraulic oil production capacity in response to rising demand. This action not only demonstrates their commitment to meeting the increasing demands of consumers but also highlights the significance of the Asian market in influencing the global hydraulic oil industry.

- In 2021, An innovative partnership, Total, and Bosch, a renowned technology and engineering company, are pioneering the development of a hydraulic oil made from recycled materials. Their collaboration, which was announced, aims to create a more sustainable fluid without sacrificing performance or efficiency. Using Bosch's expertise and Total's environmental commitment, the collaboration aims to redefine industry standards and establish a new standard for environmentally friendly hydraulic oil.

- In 2020, BP announced its strategic intent to acquire Fuchs Petrolub, a prominent provider of hydraulic oil solutions, in a significant acquisition. By integrating Fuchs Petrolub's expertise and resources, BP reinforces its commitment to sustainability and strengthens its market position. This acquisition enables BP to strengthen its product lineup, increase its customer base, and intensify its efforts to develop more environmentally favorable hydraulic oil solutions.

Report Scope

Report Features Description Market Value (2022) USD 156.2 Bn Forecast Revenue (2032) USD 220.5 Bn CAGR (2023-2032) 3.6% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Mineral Oil, Synthetic Oil, Bio-Based Oil)

By Application (Construction Machinery, Automotive & Transportation, Oil & Gas Equipment)Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Chevron Corporation (U.S.), Exxon Mobil Corporation (U.S.), S-OIL CORPORATION (South Korea), Motiva Enterprises LLC (U.S.), SK innovation Co.Ltd. (South Korea), Shell (Netherlands), Neste (Finland), AVISTA OIL Deutschland GmbH (Germany), Nynas AB (Sweden), Repsol (Spain), Ergon Inc. (U.S.), Calumet Specialty Products Partners L.P. (U.S.), H&R Group (Germany), Sinopec Corp. (China), PetroChina Company Limited (China), Saudi Aramco (Saudi Arabia), Abu Dhabi National Oil Company (ADNOC) (UAE), PT Pertamina (Persero) (Indonesia), Phillips 66 Company (U.S.), Petroliam Nasional Berhad (PETRONAS) (Malaysia) Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Chevron Corporation (U.S.)

- Exxon Mobil Corporation (U.S.)

- S-OIL CORPORATION (South Korea)

- Motiva Enterprises LLC (U.S.)

- SK innovation Co.Ltd. (South Korea)

- Shell (Netherlands)

- Neste (Finland)

- AVISTA OIL Deutschland GmbH (Germany)

- Nynas AB (Sweden)

- Repsol (Spain)

- Ergon Inc. (U.S.)

- Calumet Specialty Products Partners L.P. (U.S.)

- H&R Group (Germany)

- Sinopec Corp. (China)

- PetroChina Company Limited (China)

- Saudi Aramco (Saudi Arabia)

- Abu Dhabi National Oil Company (ADNOC) (UAE)

- PT Pertamina (Persero) (Indonesia)

- Phillips 66 Company (U.S.)

- Petroliam Nasional Berhad (PETRONAS) (Malaysia)