Humanoid Robots Market By Component (Hardware, Software), By Motion Type (Biped, Wheel-drive), By Application (Research & Space Exploration, Education & Entertainment, Personal Assistance & Caregiving, Hospitality, Search & Rescue, Others), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

51387

-

September 2024

-

300

-

-

This report was compiled by Vishwa Gaul Vishwa is an experienced market research and consulting professional with over 8 years of expertise in the ICT industry, contributing to over 700 reports across telecommunications, software, hardware, and digital solutions. Correspondence Team Lead- ICT Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

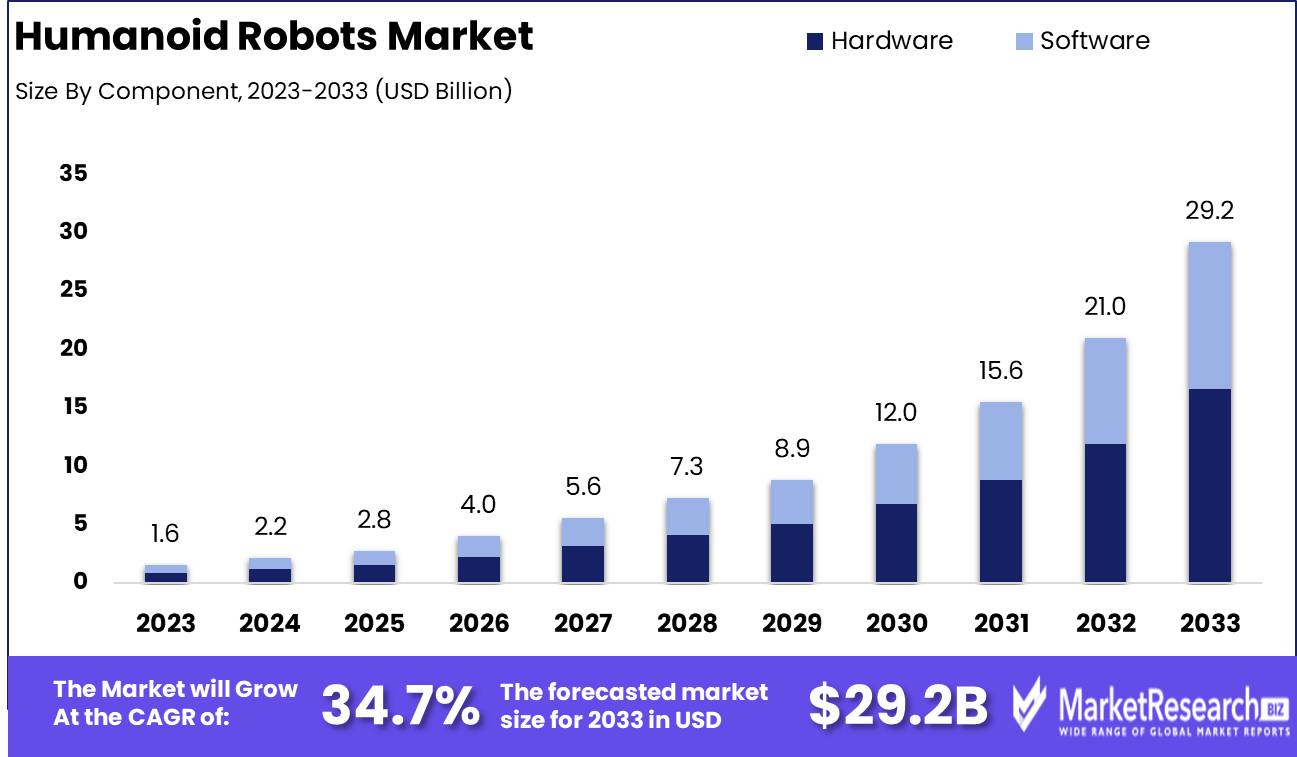

The Humanoid Robots Market was valued at USD 1.6 billion in 2023. It is expected to reach USD 29.2 billion by 2033, with a CAGR of 34.7% during the forecast period from 2024 to 2033.

The humanoid robots market refers to the global industry focused on the development, production, and commercialization of robots designed to replicate human form and behavior. These robots are equipped with advanced artificial intelligence, machine learning, and robotics technology to perform tasks traditionally carried out by humans, such as customer service, healthcare assistance, and industrial operations. The market is driven by rising demand for automation, growing labor shortages, and advancements in AI.

The humanoid robots market is poised for substantial growth, driven by advancements in artificial intelligence (AI) and robotics technologies. Innovations in machine learning, computer vision, and sensor technology have significantly enhanced the cognitive and operational capabilities of humanoid robots, enabling them to perform complex tasks with greater precision and adaptability. This evolution is particularly evident in sectors such as healthcare, where humanoid robots are increasingly being deployed to assist in patient care, rehabilitation, and surgery. The growing demand in this sector is expected to be a key driver of market expansion.

However, high initial costs remain a notable barrier to widespread adoption, particularly for smaller organizations. Despite this, the accelerated pace of technological advancements is expected to reduce production costs over time, making humanoid robots more accessible across various industries.

The healthcare sector is anticipated to witness the most significant growth in the humanoid robots market, as the demand for automated healthcare solutions continues to rise. With an aging population and a global shortage of healthcare professionals, humanoid robots offer promising solutions for tasks such as remote patient monitoring, diagnostics, and therapeutic interventions. Furthermore, their ability to support non-clinical tasks, such as sanitation and logistics, adds another dimension to their utility in healthcare settings. While high initial investments remain a concern, the long-term cost savings and improvements in healthcare delivery are expected to offset these challenges, positioning the humanoid robots market for robust growth in the coming years.

Key Takeaways

- Market Growth: The Humanoid Robots Market was valued at USD 1.6 billion in 2023. It is expected to reach USD 29.12 billion by 2033, with a CAGR of 34.7% during the forecast period from 2024 to 2033.

- By Component: Hardware dominated the humanoid robots component market, with growth.

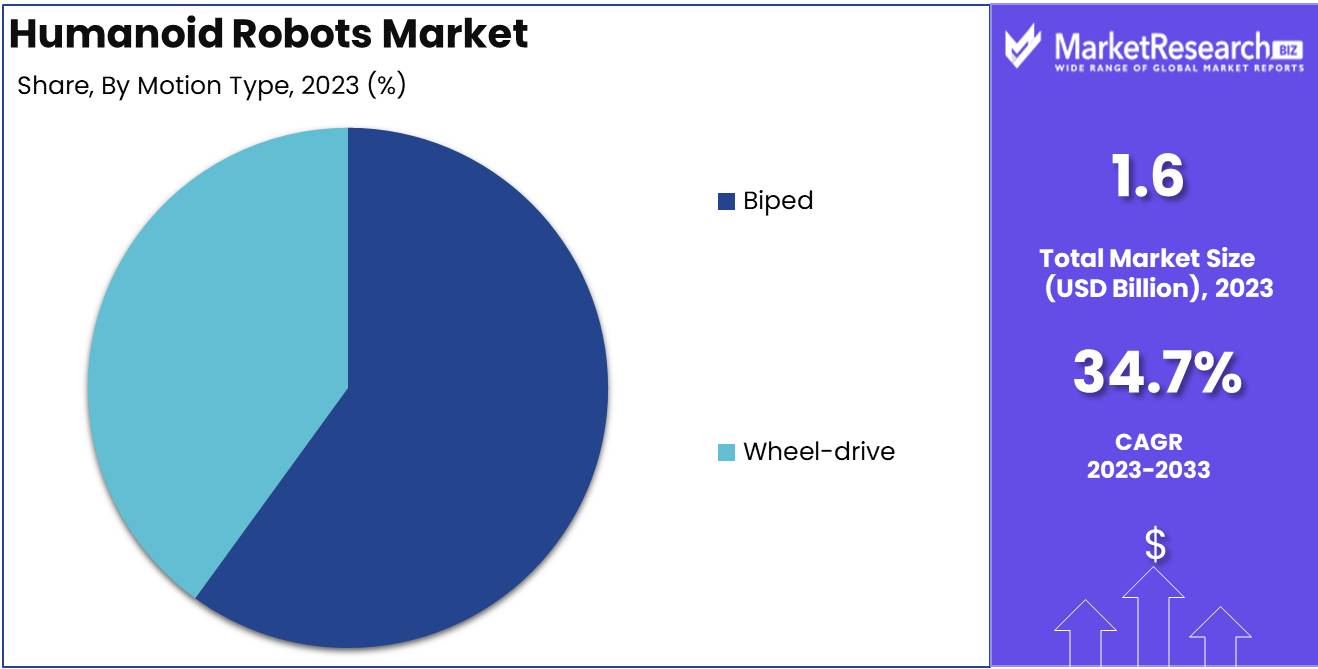

- By Motion Type: Biped humanoid robots dominated the global humanoid robots market.

- By Application: Research & Space Exploration dominated the humanoid robots market applications.

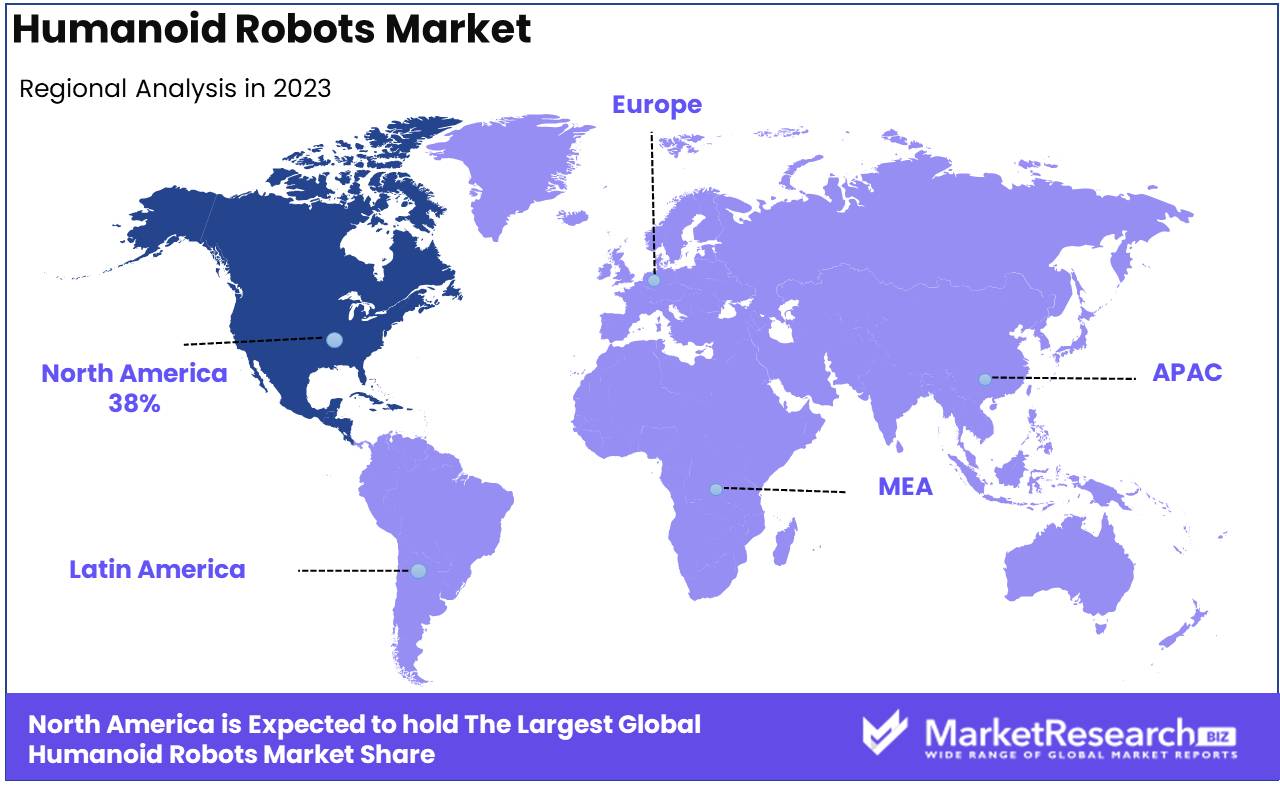

- Regional Dominance: North America dominates the humanoid robots market with a 38% largest share.

- Growth Opportunity: The global humanoid robots market presents significant growth opportunities, driven by expanding applications in education, research, and healthcare, particularly in personalized learning, patient care, and elderly assistance.

Driving factors

Technological Advancements as a Catalyst for Innovation and Growth

Technological advancements are the backbone of growth in the humanoid robots market. Innovations in artificial intelligence (AI), machine learning (ML), and robotics have significantly enhanced the capabilities of humanoid robots, making them more adaptable, responsive, and intelligent. AI enables robots to process complex tasks, interact with humans, and learn from their environments, improving operational efficiency across industries. Furthermore, advancements in sensor technologies and materials have improved robots’ dexterity, allowing them to perform intricate tasks such as medical surgeries, manufacturing processes, and human interaction simulations.

The continuous improvement of battery technologies also extends the operational longevity of humanoid robots, making them more practical for a variety of sectors. According to a 2022 report, the global AI in robotics market is projected to reach $22.6 billion by 2028, which further underpins the synergy between AI advancements and humanoid robot proliferation. As these technologies evolve, the capabilities and applications of humanoid robots are expected to expand, driving substantial growth in the market.

Demand for Automation Drives Industry Adoption of Humanoid Robots

The increasing demand for automation across sectors such as healthcare, manufacturing, logistics, and customer service is a significant factor contributing to the growth of humanoid robots. Automation enables organizations to streamline operations, reduce human errors, and increase efficiency, and humanoid robots provide a versatile and interactive solution to meet this need. In the manufacturing sector, for example, humanoid robots can be deployed to handle repetitive tasks with high precision, reducing production time and errors while increasing output.

Healthcare is another sector experiencing rapid adoption of humanoid robots, where they are used for patient care, surgeries, and rehabilitation processes. A report highlighted that automation in healthcare is anticipated to grow by 14.3% annually, showcasing the increasing reliance on robotic solutions. The ongoing shift toward automation aligns with the growing capabilities of humanoid robots, fostering broader market adoption and growth.

Rising Labor Costs Fuel Adoption of Cost-Effective Humanoid Solutions

Rising labor costs, especially in developed economies, push industries to explore cost-effective alternatives such as humanoid robots. As the cost of human labor increases, particularly for routine and repetitive tasks, businesses are increasingly turning to automation as a means of maintaining profitability while reducing operational expenses. Humanoid robots can work continuously without fatigue in the manufacturing and logistics industries, offering a cost-effective solution to rising wage demands.

In regions like North America and Europe, where labor costs are notably higher, the market for humanoid robots is expected to grow significantly as companies seek to mitigate labor expenses. According to the report, the global robotic automation market is projected to expand by approximately 13% annually between 2021 and 2026, driven partly by labor cost concerns. By replacing or augmenting human workers, humanoid robots help businesses adapt to rising labor costs while improving productivity, further contributing to market growth.

Restraining Factors

Technical Complexity: Hindering Innovation and Market Scalability

The technical complexity associated with humanoid robots represents a significant restraining factor in the growth of this market. The development and integration of advanced robotics technologies, including artificial intelligence (AI), machine learning, and mechanical engineering, demand high expertise and substantial financial investment. These complexities make it difficult for many companies to bring humanoid robots to market on a larger scale.

Robotics technologies require extensive research and development (R&D) to ensure the accuracy, safety, and adaptability of these machines, particularly when interacting with humans in real-world environments. As humanoid robots are expected to emulate human-like movements, speech recognition, and decision-making capabilities, the intricacies involved in the precise programming of such features pose challenges. This increases the time to market for these products, thereby slowing overall market expansion.

For instance, the development of lifelike robots with sophisticated capabilities, such as dexterous manipulation or complex emotional recognition, can become cost-prohibitive. The expenses involved in creating and refining these technologies often deter smaller companies from entering the market, resulting in a competitive landscape dominated by a few established players. Consequently, the market's scalability is restricted, as innovation is concentrated among firms with greater resources.

Maintenance and Upkeep Requirements: Increasing Operational Costs and Affecting ROI

Another significant restraining factor impacting the growth of the humanoid robots market is the high maintenance and upkeep requirements. Humanoid robots, by nature, are complex machines with a multitude of moving parts, sensors, and AI systems that require regular updates, repairs, and calibration to function efficiently. The sophisticated hardware and software systems embedded in humanoid robots, including actuators, sensors, and control systems, are subject to wear and tear, necessitating ongoing maintenance.

This ongoing requirement results in increased operational costs for end-users, which negatively affects the return on investment (ROI). For businesses that adopt humanoid robots in industries such as healthcare, retail, or manufacturing, the additional costs incurred from frequent repairs or system upgrades can outweigh the benefits these robots provide. As a result, many companies may be reluctant to invest in humanoid robots, particularly in cost-sensitive markets or industries where profit margins are low.

Moreover, the dependency on specialized technicians to perform maintenance further escalates costs, as these professionals are often limited in availability and demand high fees. The lack of standardized parts or systems across different humanoid robot models exacerbates this issue, making it more challenging to find suitable replacements or technicians familiar with specific systems.

By Component Analysis

In 2023, Hardware dominated the humanoid robot component market, with growth.

In 2023, Hardware held a dominant market position in the "By Component" segment of the humanoid robots market. This dominance can be attributed to the significant demand for advanced mechanical components, sensors, actuators, and power systems, which are critical for enabling humanoid robots to mimic human-like movements and functionalities. The increasing need for high-performance materials and complex hardware systems, such as robust motors and exoskeletons, has driven investments in the hardware sector. Additionally, continuous advancements in artificial intelligence (AI) and robotics technology have increased the complexity of humanoid robots, further reinforcing the importance of sophisticated hardware solutions.

On the other hand, the software segment is also expected to experience rapid growth during the forecast period. Software enables the control, interaction, and learning capabilities of humanoid robots through advanced algorithms, machine learning, and neural networks. The growing focus on enhancing robot autonomy, cognitive learning, and adaptability is driving software innovations, especially in areas like AI, natural language processing, and computer vision. While hardware leads, the rising demand for intelligent software underscores its crucial role in shaping the future of humanoid robots.

By Motion Type Analysis

In 2023, Biped humanoid robots dominated the global humanoid robots market.

In 2023, Biped humanoid robots held a dominant position in the By Motion Type segment of the global humanoid robots market. The bipedal motion type segment, characterized by robots designed to mimic human locomotion, accounted for a significant market share due to its increasing adoption across industries such as healthcare, defense, and entertainment. Biped robots, with their advanced ability to navigate complex terrains and environments similar to humans, have witnessed growing demand, particularly in applications requiring agility and dexterity.

In contrast, the wheel-drive motion type, while advantageous for speed and simplicity, was observed to cater more effectively to industrial and logistical applications where smooth, flat surfaces dominate. Despite the efficiency of wheel-driven robots in specific operational environments, biped robots remain preferred in sectors where human-like movement and interaction are critical.

The continued advancements in artificial intelligence (AI) and machine learning (ML) have further propelled the growth of the biped segment, making it the most sought-after motion type in the humanoid robot market. This trend is expected to continue as bipedal robots evolve to become more cost-effective and capable.

By Application Analysis

In 2023, Research & Space Exploration dominated the humanoid robots market applications.

In 2023, The Research & Space Exploration segment held a dominant market position in the Humanoid Robots Market by application. This leadership can be attributed to the increasing demand for advanced robotic systems capable of assisting in complex space missions and scientific research. Humanoid robots, due to their anthropomorphic design, are increasingly utilized in environments where human-like dexterity and cognitive skills are required, such as in autonomous operations or interacting with other astronauts.

The Education & Entertainment segment has also seen notable growth, driven by the adoption of humanoid robots in classrooms, interactive learning platforms, and immersive entertainment experiences. In Personal Assistance & Caregiving, the deployment of humanoid robots has surged due to aging populations and the need for home care solutions, particularly in developed economies. The Hospitality sector is utilizing humanoid robots for tasks ranging from customer service to concierge functions, enhancing guest experiences in hotels and restaurants.

The Search & Rescue application has gained traction as humanoid robots demonstrate the capability to navigate dangerous environments and support emergency personnel in disaster management. Finally, other applications, such as Retail and Manufacturing, continue to contribute to market growth, reflecting the expanding versatility of humanoid robots across industries.

Key Market Segments

By Component

- Hardware

- Software

By Motion Type

- Biped

- Wheel-drive

By Application

- Research & Space Exploration

- Education & Entertainment

- Personal Assistance & Caregiving

- Hospitality

- Search & Rescue

- Others

Growth Opportunity

Growth Potential in Education and Research

The global humanoid robots market is poised for significant growth driven by increasing demand in sectors like education and research. Educational institutions are progressively integrating humanoid robots into classrooms, where they assist in personalized learning, language acquisition, and STEM education. With the rise of artificial intelligence (AI) and machine learning, humanoid robots can simulate human-like behavior, making them valuable tools for educational research.

Furthermore, governments and private organizations are investing in robotics research, driving innovation in the field. By 2024, these trends are expected to accelerate, fostering a demand for advanced humanoid robots capable of complex tasks in academic settings.

Expanding Applications in Healthcare

Healthcare remains a critical area where humanoid robots are witnessing heightened adoption. Opportunities for humanoid robots will grow substantially in medical environments, particularly for patient care, rehabilitation, and elderly assistance. The ability of these robots to perform repetitive tasks, such as monitoring vital signs, delivering medication, and assisting with mobility, alleviates the burden on healthcare workers. The aging population worldwide further increases the demand for humanoid robots as they offer consistent support in eldercare and physical therapy. These advancements in healthcare applications highlight a key growth segment in the global humanoid robots market.

Latest Trends

Public Services Expansion

Humanoid robots are increasingly being deployed in public services such as healthcare, education, and hospitality. This trend is expected to accelerate, with governments and private institutions recognizing the potential for humanoid robots to improve service efficiency. Robots are becoming integral in elderly care, acting as companions and providing support in rehabilitation tasks. In education, they are being used for teaching assistance and interactive learning, especially in underserved regions. The expansion of humanoid robots in public services can be attributed to their ability to enhance productivity, reduce operational costs, and meet the growing demand for automated services.

Material Handling Innovations

Another critical trend is the development of humanoid robots for material handling applications in logistics and manufacturing. Innovations in sensor technology, artificial intelligence, and robotic dexterity are enabling humanoid robots to handle more complex tasks, such as picking, packing, and transporting goods in warehouse environments. These innovations are expected to lead to more efficient supply chains and smarter manufacturing operations, reducing reliance on human labor for physically demanding tasks. This trend will likely attract significant investments from industries seeking to improve operational efficiency and reduce workplace hazards.

Regional Analysis

North America dominates the humanoid robots market with a 38% largest share.

The humanoid robots market exhibits significant regional variations, driven by differing levels of technological advancement, industrial automation, and research investments across key geographies. North America holds a dominant position in the global humanoid robots market, accounting for approximately 38% of the market share. This leadership is attributed to the robust technological infrastructure, high adoption rates in industries such as healthcare, defense, and education, and the presence of major market players like Boston Dynamics and Tesla. The U.S. government’s emphasis on robotics and AI advancements further accelerates market growth in this region.

Europe follows closely, contributing around 28% of the market share, driven by increasing investments in AI, robotics research, and automation in countries like Germany, the U.K., and France. The European Union's focus on industrial automation and the integration of humanoid robots into the workforce supports this growth trajectory.

The Asia-Pacific region is witnessing rapid growth, holding around 22% of the market share, with countries like Japan, South Korea, and China leading in robotics innovation and deployment. Japan, in particular, is a frontrunner due to its aging population and focus on robots for caregiving and social interactions.

The Middle East & Africa, along with Latin America, account for smaller shares of the humanoid robots market, around 7% and 5% respectively, but these regions are gradually adopting humanoid robots for security, education, and hospitality services, particularly in emerging economies. The increasing focus on automation and technology adoption signals future growth potential across all regions.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of the Middle East & Africa

Key Players Analysis

The global humanoid robots market is expected to witness significant growth driven by advancements in artificial intelligence (AI), robotics, and automation. Several key players are shaping the competitive landscape of this industry, each contributing unique capabilities and innovations.

Softbank Robotics remains a dominant force, with its widely recognized Pepper and NAO robots serving various industries, including education, retail, and healthcare. Boston Dynamics is notable for its cutting-edge robotics technology, particularly its Atlas humanoid, which is known for its advanced mobility and agility, pushing the boundaries of what humanoid robots can achieve.

Agility Robotics and PAL Robotics are making substantial advancements in mobile and bipedal robots, focusing on applications such as logistics and service industries, while UBTECH Robotics continues to expand its presence in consumer and educational sectors with humanoid and interactive robots. Tesla, with its forward-looking strategy, has entered the market through its humanoid robot prototype, Optimus, reflecting the growing integration of robotics in automotive and industrial applications.

Asian players such as HYULIM Robot Co., Ltd., Hanson Robotics, and Honda Motor are leveraging their strengths in robotics and AI, contributing to healthcare and eldercare sectors. Toshiba Corp. and KAWADA Robotics also play vital roles by developing sophisticated robots for manufacturing and industrial automation.

The competitive landscape is further enriched by emerging companies like Engineered Arts Ltd. and Sanbot Co., enhancing humanoid robots' interactive and social capabilities. These players are expected to drive the growth and adoption of humanoid robots globally, expanding their applications across multiple sectors.

Market Key Players

- Softbank Robotics

- PAL Robotics

- Boston Dynamics

- Agility Robotics

- UBTECH Robotics

- Tesla

- HYULIM Robot Co., Ltd.

- Hanson Robotics Ltd.

- Engineered Arts Ltd.

- Honda Motor

- KAWADA Robotics Corp.

- Sanbot Co.

- ROBOTIS Co. Ltd.

- Toshiba Corp.

- Other key players

Recent Development

- In April 2024, Boston Dynamics, a leader in robotics, introduced an all-new electric version of its humanoid robot, Atlas. This model succeeds its hydraulic predecessor, aiming to revolutionize the industry with enhanced agility and task execution. This launch highlights the push toward more efficient, human-like robots that can operate in various environments, including industries such as construction and logistics.

- In April 2024, Tesla unveiled the second generation of its humanoid robot, Optimus Gen-2. This iteration includes advanced features such as a 30% improvement in walking speed, enhanced balance, and improved tactile sensing in its hands, which allows for precise manipulation of objects like fragile items. Tesla continues to push the boundaries of humanoid robotics, aiming to address labor shortages and support industrial applications.

- In February 2024, Kepler Exploration Robot Co., Ltd., based in China, introduced the Kepler Forerunner series, which consists of general-purpose humanoid robots. These robots stand 178 cm tall and weigh 85 kg, designed for a range of industrial applications. The company aims to scale production as part of China's broader ambitions to lead the global humanoid robot market.

Report Scope

Report Features Description Market Value (2023) USD 1.6 Billion Forecast Revenue (2033) USD 19.2 Billion CAGR (2024-2032) 34.7% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Component (Hardware, Software), By Motion Type (Biped, Wheel-drive), By Application (Research & Space Exploration, Education & Entertainment, Personal Assistance & Caregiving, Hospitality, Search & Rescue, Others) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Softbank Robotics, PAL Robotics, Boston Dynamics, Agility Robotics, UBTECH Robotics, Tesla, HYULIM Robot Co., Ltd., Hanson Robotics Ltd., Engineered Arts Ltd., Honda Motor, KAWADA Robotics Corp., Sanbot Co., ROBOTIS Co. Ltd., Toshiba Corp., Other key players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Softbank Robotics

- PAL Robotics

- Boston Dynamics

- Agility Robotics

- UBTECH Robotics

- Tesla

- HYULIM Robot Co., Ltd.

- Hanson Robotics Ltd.

- Engineered Arts Ltd.

- Honda Motor

- KAWADA Robotics Corp.

- Sanbot Co.

- ROBOTIS Co. Ltd.

- Toshiba Corp.

- Other key players