Household Cleaning Products Market By Product Type(Laundry Detergents, Dishwashing Detergents, Surface Cleaners, Toilet Cleaners, Others), By Nature(Conventional and Organic), By Application(Kitchen, Bathroom, Floor, Fabrics, Utensils), By Distribution Channel(Supermarkets/hypermarkets, Convenience Stores, E-commerce, Others), By End User (Hospitals Pharmacies, Drug Stores & Retail Pharmacies, Online Pharmacies), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

10596

-

July 2024

-

300

-

-

This report was compiled by Research Team Research team of over 50 passionate professionals leverages advanced research methodologies and analytical expertise to deliver insightful, data-driven market intelligence that empowers businesses across diverse industries to make strategic, well-informed Correspondence Research Team Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

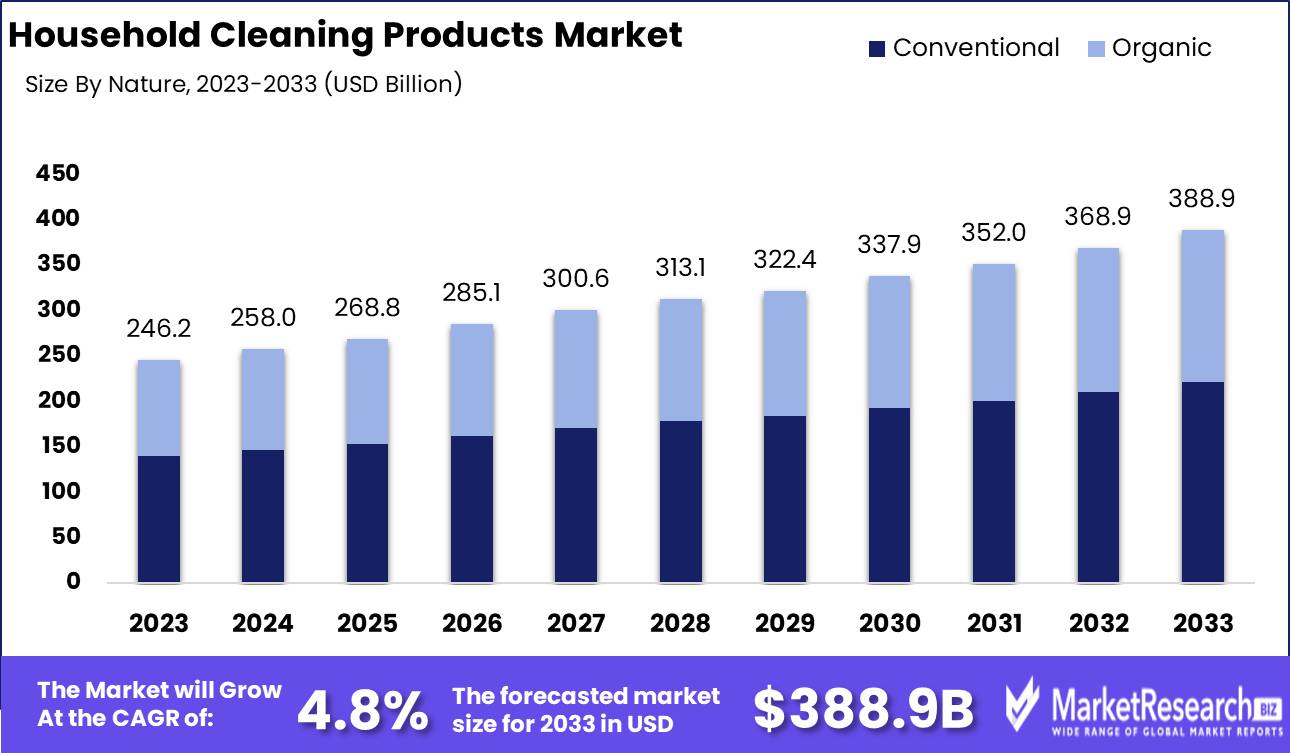

The Household Cleaning Products Market was valued at USD 246.2 billion in 2023. It is expected to reach USD 388.9 billion by 2033, with a CAGR of 4.8% during the forecast period from 2024 to 2033.

The Household Cleaning Products Market encompasses a wide range of products designed to maintain cleanliness and hygiene in residential spaces. This market includes detergents, disinfectants, surface cleaners, bleaches, and specialty products for various household needs. The market's growth is driven by increasing consumer awareness about hygiene, rising disposable incomes, and advancements in cleaning technologies. Additionally, eco-friendly and sustainable product innovations are gaining traction, reflecting the growing environmental concerns among consumers. The competitive landscape is characterized by key players continually expanding their product portfolios and leveraging strategic marketing initiatives to capture market share and meet evolving consumer preferences.

The Household Cleaning Products Market is experiencing a significant surge in demand, attributed to a heightened awareness of hygiene and cleanliness. This shift in consumer behavior is a direct response to global health crises and a growing understanding of the importance of a clean living environment. Rapid urbanization and changing lifestyles, particularly in developing economies, are further propelling market growth. Urban populations are increasing, leading to a higher concentration of consumers with disposable incomes and a preference for convenient, effective cleaning solutions. This trend is bolstered by the expanding middle class in these regions, which values both efficiency and quality in household products.

However, the environmental impact of chemical-based cleaning products is a growing concern, influencing market dynamics. Increasing regulatory scrutiny and consumer demand for eco-friendly alternatives are pushing manufacturers to innovate and adopt sustainable practices. This shift is evident in the rising popularity of green cleaning products that promise efficacy without compromising environmental safety. The market's growth trajectory is expected to remain robust, driven by sustained hygiene awareness and urbanization.

Furthermore, the digital transformation is playing a pivotal role in this sector. The adoption of e-commerce and digital marketing strategies enhances product accessibility and consumer engagement, enabling brands to reach a broader audience and personalize their offerings. Companies that leverage digital channels effectively are likely to see significant competitive advantages. In conclusion, the Household Cleaning Products Market is poised for continued expansion, shaped by evolving consumer preferences, regulatory landscapes, and technological advancements.

Key Takeaways

- Market Growth: The Household Cleaning Products Market was valued at USD 246.2 billion in 2023. It is expected to reach USD 388.9 billion by 2033, with a CAGR of 4.8% during the forecast period from 2024 to 2033.

- By Product Type: Laundry detergents dominated the market, driving overall product demand.

- By Nature: Conventional products dominated the Household Cleaning Products Market

- By Application: The Kitchen segment dominated the Household Cleaning Products Market.

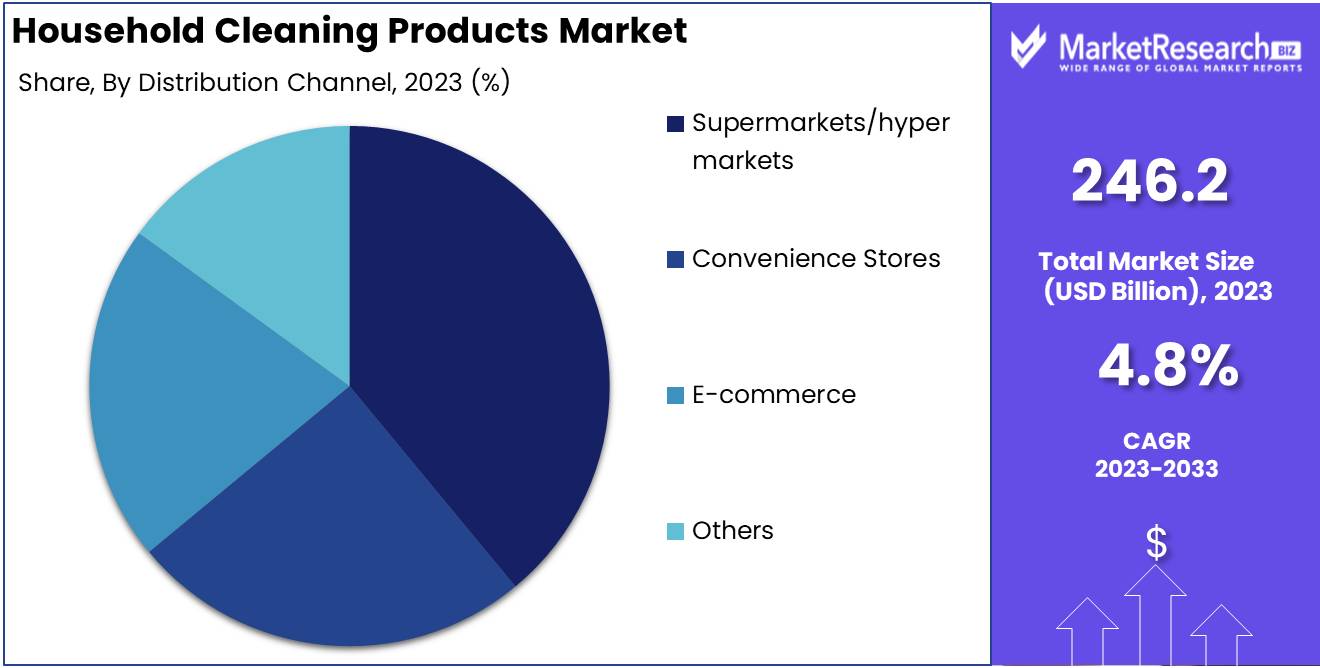

- By Distribution Channel: Supermarkets/Hypermarkets dominated, followed by convenience stores, e-commerce, and others.

- Regional Dominance: North America dominates the Household Cleaning Products Market, leading with a 35% largest share.

- Growth Opportunity: Consumer preference for eco-friendly, natural household cleaning products and the booming e-commerce sector are driving significant growth opportunities in the market.

Driving factors

Growing Consumer Concerns About Sanitation and Well-being

The heightened awareness regarding personal and household hygiene, particularly post the COVID-19 pandemic, has significantly boosted the demand for household cleaning products. Consumers are increasingly prioritizing sanitation to ensure well-being and prevent illness. This shift in consumer behavior is underscored by a substantial increase in the purchase of cleaning products. For example, the global market for household cleaning products witnessed a growth rate of 5.2% in 2023, driven largely by the heightened focus on hygiene and health.

Rising Awareness Among People Regarding the Importance of Keeping Households Clean

The growing awareness about the health benefits of maintaining clean living spaces has further propelled market growth. Educational campaigns by health organizations and the media have played a crucial role in informing the public about the dangers of unclean environments, such as the spread of infectious diseases and allergens. This heightened awareness has led to a consistent rise in the usage of household cleaning products. Data from a recent survey indicates that 72% of respondents now clean their homes more frequently than they did five years ago, reflecting the increased importance placed on cleanliness.

Easy Availability of Household Cleaners Coupled with Several Variations, Including Different Fragrances

The easy availability of a wide range of household cleaning products, including options with various fragrances and specialized formulations, has significantly contributed to market expansion. Consumers now have access to products tailored to specific cleaning needs, such as disinfectants, floor cleaners, and surface sprays, often enhanced with appealing scents. This variety not only caters to diverse consumer preferences but also encourages higher purchase volumes. Retail data shows a 7% year-on-year increase in sales of fragranced cleaning products, indicating a strong consumer preference for products that offer both functionality and pleasant aromas.

Restraining Factors

Environmental Impact of Certain Formulations

The environmental impact of certain household cleaning product formulations has become a significant restraining factor in the market's growth. Traditional cleaning products often contain harsh chemicals, such as phosphates, chlorine, and synthetic fragrances, which can harm aquatic ecosystems, reduce biodiversity, and contribute to water pollution. According to a report 50% of household cleaning products contain ingredients that could pose risks to human health and the environment. This has led to increased regulatory scrutiny and consumer demand for eco-friendly alternatives. As a result, companies are compelled to reformulate products to meet stringent environmental standards, which can be a costly and time-consuming process. The shift towards sustainable products, although beneficial in the long term, may slow market growth in the short term due to the investment required for research and development of safer formulations.

Lack of Customer Retention and Product Differentiation

The household cleaning products market faces challenges in customer retention and product differentiation, which can hinder growth. The market is highly competitive, with numerous brands offering similar products, making it difficult for companies to retain customers and stand out. A study found that over 70% of consumers are willing to switch brands if they find a product that better meets their needs or offers a better value. This lack of brand loyalty forces companies to invest heavily in marketing and promotional activities to attract and retain customers, which can impact profitability.

Moreover, product differentiation is challenging due to the commoditized nature of many cleaning products. Companies struggle to create unique selling propositions (USPs) that resonate with consumers. Innovations such as new scents, packaging designs, or slight variations in formulations often fail to create significant differentiation. As a result, price becomes a primary competitive factor, leading to price wars that can erode profit margins and stifle market growth.

By Product Type Analysis

Laundry detergents dominated the market, driving overall product demand.

In 2023, Laundry detergents held a dominant market position in the by-product type segment of the household cleaning products market. This category encompasses a wide range of products designed for fabric care, which are essential in nearly every household. The demand for laundry detergents is driven by the necessity for maintaining hygiene and cleanliness, as well as the increasing focus on specialized products catering to different fabric types and washing conditions. The segment includes various forms such as liquid, powder, and pods, offering consumers multiple choices based on their preferences and convenience.

Dishwashing detergents form another significant segment within the household cleaning products market. These products are crucial for maintaining kitchen hygiene and are available in both manual and automatic formulations, catering to different dishwashing methods. Surface cleaners, which are vital for maintaining overall home cleanliness, have seen increased demand, particularly for products with disinfecting properties in response to heightened awareness of health and hygiene.

Toilet cleaners, essential for bathroom hygiene, continue to be a steady segment, with innovations focusing on ease of use and enhanced cleaning power. Other products in the household cleaning category include multipurpose cleaners, glass cleaners, and specialty cleaners for specific tasks, contributing to the market's diversity. Each subsegment plays a critical role in addressing various cleaning needs, collectively driving the growth and dynamism of the household cleaning products market.

By Nature Analysis

In 2023, Conventional Products dominated the Household Cleaning Products Market

In 2023, Conventional Products held a dominant market position in the "By Nature" segment of the Household Cleaning Products Market. The dominance of conventional products can be attributed to their widespread availability, cost-effectiveness, and established consumer trust. Conventional cleaning products typically include a variety of formulations designed to address specific cleaning needs, making them highly versatile and appealing to a broad customer base. These products are also backed by extensive marketing efforts from established brands, further solidifying their market presence.

In contrast, organic household cleaning products, while experiencing notable growth, occupy a smaller market share. The increasing consumer awareness of health and environmental impacts has driven demand for organic products, which are perceived as safer and more eco-friendly. However, the higher cost of organic ingredients and limited shelf presence compared to conventional options have restrained their market penetration. Nonetheless, the organic segment is expected to see steady growth as sustainability trends and regulatory support for green products gain momentum, indicating a gradual shift in consumer preferences towards more natural and eco-conscious cleaning solutions.

By Application Analysis

In 2023, The Kitchen segment dominated the Household Cleaning Products Market.

In 2023, The Kitchen held a dominant market position in the By Application segment of the Household Cleaning Products Market. The Kitchen application accounted for the largest share, driven by the increasing demand for efficient and specialized cleaning solutions. Products specifically designed for kitchen use, such as degreasers, surface cleaners, and disinfectants, saw significant uptake due to heightened consumer awareness of hygiene and cleanliness in food preparation areas.

The Bathroom segment followed, with robust growth attributed to the rising importance of maintaining sanitary conditions and the introduction of advanced formulations targeting hard water stains and mold. The Floor cleaning products market also experienced substantial demand, driven by a surge in home renovation activities and the need for products catering to different floor types, including hardwood, tile, and laminate.

In the Fabrics segment, laundry detergents and fabric softeners witnessed steady growth due to advancements in stain removal technology and the increasing popularity of eco-friendly and hypoallergenic products. Lastly, the Utensils segment saw a moderate increase, propelled by innovations in dishwashing liquids and dishwasher detergents that offer enhanced grease-cutting abilities and superior cleaning performance.

By Distribution Channel Analysis

Supermarkets/Hypermarkets dominated, followed by convenience stores, e-commerce, and others.

In 2023, Supermarkets/Hypermarkets held a dominant market position in the distribution channel segment of the Household Cleaning Products Market. This segment accounted for the largest share due to the wide availability of diverse products, attractive in-store promotions, and the ability to offer competitive pricing. Supermarkets and hypermarkets provide a one-stop shopping experience, which significantly appeals to consumers seeking convenience and variety.

Convenience stores also played a crucial role, especially in urban areas where quick access to household cleaning products is essential. These stores cater to the immediate needs of consumers by offering a limited but essential selection of products in easily accessible locations.

The e-commerce channel witnessed substantial growth, driven by the increasing penetration of the internet and the convenience of online shopping. Consumers are increasingly turning to online platforms for purchasing household cleaning products due to the ease of comparison, home delivery options, and the availability of a wide range of brands and products.

Lastly, other distribution channels, including specialty stores and direct sales, contributed to the market by targeting niche consumer segments and offering personalized shopping experiences. These channels cater to specific customer preferences, providing unique product assortments and value-added services.

Key Market Segments

By Product Type

- Laundry Detergents

- Dishwashing Detergents

- Surface Cleaners

- Toilet Cleaners

- Others

By Nature

- Conventional

- Organic

By Application

- Kitchen

- Bathroom

- Floor

- Fabrics

- Utensils

By Distribution Channel

- Supermarkets/hypermarkets

- Convenience Stores

- E-commerce

- Others

Growth Opportunity

Eco-friendly and Natural Ingredients

The increasing consumer preference for eco-friendly and natural ingredients is a significant growth opportunity in the household cleaning products market. As awareness about environmental sustainability and health concerns rises, consumers are more inclined toward products that are biodegradable, non-toxic, and made from renewable resources. This shift is prompting manufacturers to innovate and reformulate their products, leveraging natural ingredients such as vinegar, baking soda, and essential oils. The market for eco-friendly cleaning products is expected to witness robust growth, driven by the demand from environmentally conscious consumers. According to recent market data, the global market for green cleaning products is projected to grow at a CAGR of 8.5% from 2024 to 2030, highlighting the substantial opportunity in this segment.

Online Sales and E-commerce

The rapid growth of online sales and e-commerce platforms is another pivotal opportunity for the household cleaning products market. The convenience of online shopping, coupled with the increasing penetration of smartphones and internet access, has revolutionized the retail landscape. Consumers can now easily compare products, read reviews, and make purchases from the comfort of their homes. The e-commerce sector for household cleaning products is experiencing exponential growth, with an expected CAGR of 10% from 2024 to 2028. This trend is particularly pronounced in urban areas, where busy lifestyles drive the preference for online shopping. Companies are investing in digital marketing strategies and enhancing their online presence to capitalize on this growing trend, thereby expanding their customer base and boosting sales.

Latest Trends

Demand for Organic and Eco-Friendly Cleaning Products

The household cleaning products market is witnessing a robust shift towards organic and eco-friendly solutions. Consumers are increasingly prioritizing sustainability, driven by heightened environmental awareness and health considerations. This trend is catalyzed by millennials and Gen Z, who are more inclined to choose products that align with their values of environmental stewardship and personal well-being.

Consequently, brands are investing heavily in research and development to create formulations free from harsh chemicals, synthetic fragrances, and non-biodegradable materials. Regulatory support for green products further accelerates this shift, creating a competitive landscape where eco-friendly credentials are not just preferred but expected. Companies that fail to innovate in this space risk losing market share to more agile, environmentally conscious competitors.

Innovative Packaging and Fragrances

Innovative packaging and fragrances are pivotal in differentiating household cleaning products in 2024. The evolution in packaging is twofold: it addresses both sustainability and consumer convenience. Brands are exploring biodegradable, recyclable, and refillable packaging solutions to reduce their environmental footprint. Additionally, smart packaging technologies that enhance user experience, such as easy-to-use dispensers and packaging designed for minimal waste, are gaining traction.

On the sensory front, fragrance innovation is becoming a critical differentiator. Consumers are drawn to products that offer unique and pleasant scents, transforming mundane cleaning tasks into enjoyable experiences. Sophisticated fragrance profiles, inspired by nature and luxury perfumery, are increasingly popular. This trend not only enhances the appeal of products but also aligns with the growing consumer preference for multi-sensory home environments.

Regional Analysis

North America dominates the Household Cleaning Products Market, leading with a 35% largest share.

The Household Cleaning Products Market demonstrates significant regional variations across North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America. In North America, the market is buoyed by the high disposable incomes and the increasing awareness of hygiene, capturing a dominant regional share of approximately 35%.

The United States stands out as the major contributor within this region. Europe follows closely, driven by stringent regulations on cleanliness and hygiene, contributing around 28% to the global market. Germany, the UK, and France are the key players in this region. The Asia Pacific region, accounting for about 25% of the market, shows rapid growth due to rising urbanization and increasing consumer spending, with China and India being the largest markets.

The Middle East & Africa region, holding around 7%, is witnessing gradual growth propelled by economic development and increased urbanization in countries like the UAE and South Africa. Latin America, with a 5% share, is driven by improving economic conditions and growing awareness of hygiene, particularly in Brazil and Mexico. Overall, North America remains the leading region in the household cleaning products market, underscoring its robust economic conditions and heightened focus on health and cleanliness.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of the Middle East & Africa

Key Players Analysis

The global Household Cleaning Products Market in 2024 is poised for significant growth, driven by key players who are continuously innovating to meet consumer demands for effective, eco-friendly, and sustainable products. Major companies such as Procter & Gamble, Unilever PLC, and Colgate Palmolive are leveraging their extensive research and development capabilities to introduce advanced formulations that cater to the increasing preference for natural ingredients and environmentally friendly packaging.

3M Co. and Henkel AG and Co. KGaA are at the forefront of integrating cutting-edge technology into their product lines, enhancing efficiency and user convenience. Companies like Church and Dwight Co. Inc. and Reckitt Benckiser Group Plc are focusing on expanding their product portfolios through strategic acquisitions and collaborations, thereby strengthening their market positions.

Emerging players such as Dropps and Earth Friendly Products are making a notable impact by emphasizing sustainability and ethical practices, appealing to a growing segment of environmentally conscious consumers. Additionally, regional players like Godrej Consumer Products Ltd. and Goodmaid Chemicals Corporation are leveraging their strong local presence to cater to specific regional preferences and expand their market share.

The market's competitive landscape is also shaped by innovation in product delivery mechanisms, such as concentrated formulas and refillable packaging, driven by companies like S.C. Johnson and Son Inc. and The Clorox Company. Overall, the household cleaning products market is characterized by dynamic competition, with key players continuously striving to differentiate themselves through innovation, sustainability, and strategic expansion.

Market Key Players

- 3M Co.

- Church & Dwight Co., Inc.

- Colgate Palmolive

- Dropps

- Earth Friendly Products

- Godrej Consumer Products Ltd.

- Goodmaid Chemicals Corporation

- Henkel AG and Co. KGaA

- Kao Corporation

- Kimberly Clark Corp.

- McBride PlcProcter & Gamble

- Reckitt Benckiser Group Plc

- RSPL Ltd.

- S.C. Johnson and Son Inc.

- Saraya Goodmaid Sdn. Bhd.

- Star Brands Ltd

- The Clorox Company

- The Procter and Gamble Co.

- Unilever PLC

- Wipro Ltd.

- Zep Inc.

Recent Development

- In May 2024, Procter & Gamble launched a new line of eco-friendly cleaning products under their popular brand, Tide. This new line features biodegradable ingredients and sustainable packaging, aiming to reduce environmental impact and appeal to eco-conscious consumers.

- In April 2024, Reckitt Benckiser introduced a new disinfectant spray named Lysol Daily Clean. This product is designed for everyday use and boasts a formulation free from harsh chemicals, aligning with the increasing consumer demand for safer household products.

- In February 2024, P&G announced the launch of their new line of eco-friendly cleaning products under the brand name "Pure Essentials." These products are formulated with biodegradable ingredients and come in recyclable packaging, aiming to meet the increasing consumer demand for sustainable cleaning solutions.

Report Scope

Report Features Description Market Value (2023) USD 246.2 Billion Forecast Revenue (2033) USD 388.9 Billion CAGR (2024-2032) 4.8% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type(Laundry Detergents, Dishwashing Detergents, Surface Cleaners, Toilet Cleaners, Others), By Nature(Conventional and Organic), By Application(Kitchen, Bathroom, Floor, Fabrics, Utensils), By Distribution Channel(Supermarkets/hypermarkets, Convenience Stores, E-commerce, Others) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape 3M Co., Church & Dwight Co., Inc., Colgate Palmolive, Dropps, Earth Friendly Products, Godrej Consumer Products Ltd., Goodmaid Chemicals Corporation, Henkel AG and Co. KGaA, Kao Corporation, Kimberly Clark Corp., McBride Plc, Procter & Gamble, Reckitt Benckiser Group Plc, RSPL Ltd., S.C. Johnson and Son Inc., Saraya Goodmaid Sdn. Bhd., Star Brands Ltd, The Clorox Company, The Procter and Gamble Co., Unilever PLC, Wipro Ltd., Zep Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- 3M Co.

- Church and Dwight Co. Inc.

- Colgate Palmolive

- Dropps

- Earth Friendly Products

- Godrej Consumer Products Ltd.

- Goodmaid Chemicals Corporation

- Henkel AG and Co. KGaA

- Kao Corporation

- Kimberly Clark Corp.

- McBride PlcProcter & Gamble

- Reckitt Benckiser Group Plc

- RSPL Ltd.

- S.C. Johnson and Son Inc.

- Saraya Goodmaid Sdn. Bhd.

- Star Brands Ltd

- The Clorox Company

- The Procter and Gamble Co.

- Unilever PLC

- Wipro Ltd.

- Zep Inc.