Homogenizers Market By Type (Ultrasonic, Mechanical, Pressure), By Technology (Single-Valve Assembly, Two-Valve Assembly), By Application (Pharmaceuticals, Personal Care, Food & Beverages, Chemical, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

-

9004

-

July 2024

-

163

-

-

This report was compiled by Kalyani Khudsange Kalyani Khudsange is a Research Analyst at Prudour Pvt. Ltd. with 2.5 years of experience in market research and a strong technical background in Chemical Engineering and manufacturing. Correspondence Sr. Research Analyst Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

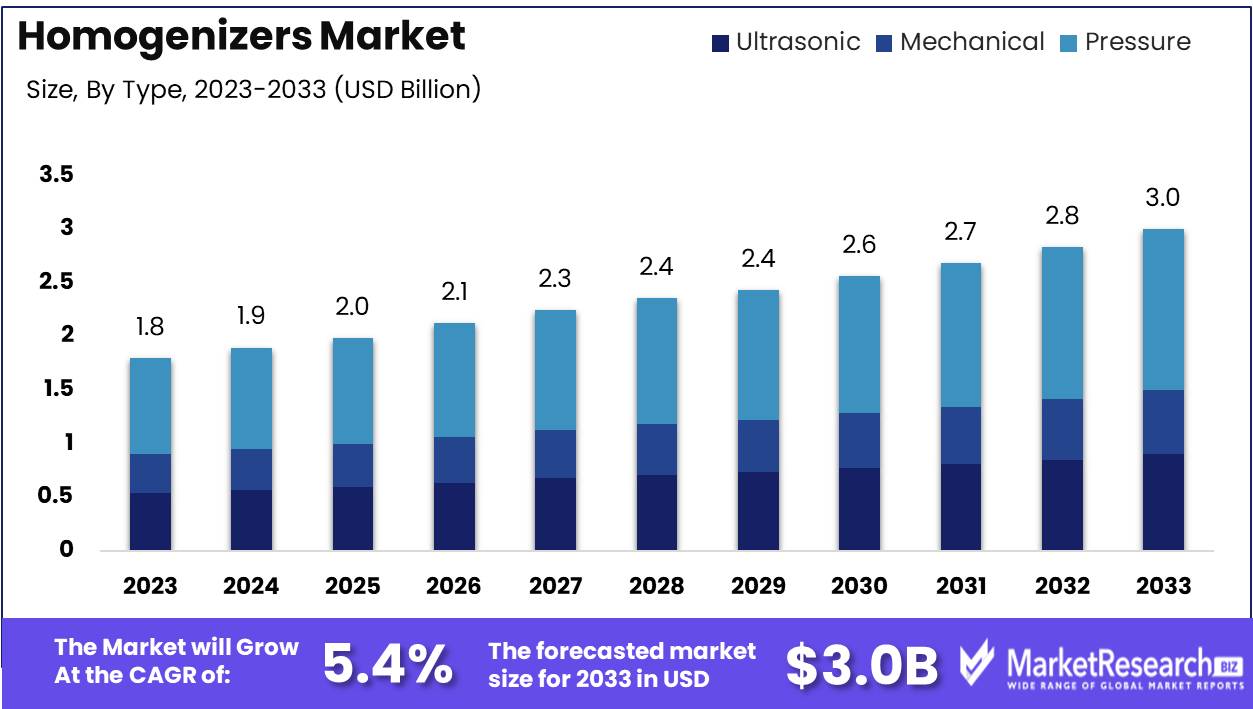

The Global Homogenizers Market was valued at USD 1.8 Bn in 2023. It is expected to reach USD 3.0 Bn by 2033, with a CAGR of 5.4% during the forecast period from 2024 to 2033.

The Homogenizers Market involves the development, manufacturing, and distribution of equipment designed to blend and emulsify various substances into uniform mixtures. These devices are essential in industries such as food and beverage, pharmaceuticals, biotechnology, and cosmetics, where product consistency and quality are paramount. Key drivers include technological advancements, increasing demand for processed foods, and the growing need for efficient production processes in pharmaceuticals.

The Homogenizers Market is witnessing robust growth driven by technological advancements and increasing demand across various industries. Originally invented by Auguste Gaulin in the early 1900s, the first homogenizer for milk featured a three-piston, positive displacement pump with capillary tubes at the discharge, setting the foundation for modern homogenization technology. Today, homogenizers are crucial in the food and pharmaceutical industries, operating at pressures ranging from 8,000 psi to 40,000 psi (550 to 2,750 bars), to achieve the desired product consistency and quality.

The Homogenizers Market is witnessing robust growth driven by technological advancements and increasing demand across various industries. Originally invented by Auguste Gaulin in the early 1900s, the first homogenizer for milk featured a three-piston, positive displacement pump with capillary tubes at the discharge, setting the foundation for modern homogenization technology. Today, homogenizers are crucial in the food and pharmaceutical industries, operating at pressures ranging from 8,000 psi to 40,000 psi (550 to 2,750 bars), to achieve the desired product consistency and quality.The food and beverage sector extensively utilizes homogenizers to improve texture, stability, and shelf life of products. In the pharmaceutical industry, these devices play a critical role in creating uniform and stable mixtures essential for drug formulation and efficacy. The rising demand for processed foods, coupled with stringent regulatory standards in pharmaceuticals, propels the need for advanced homogenization technologies.

Market participants are increasingly focusing on innovation to enhance the efficiency and capabilities of homogenizers. This includes the development of high-pressure homogenizers that offer superior performance and energy efficiency. Furthermore, there is a growing emphasis on compliance with industry standards and regulations, driving the adoption of state-of-the-art equipment.

The expanding applications of homogenizers in emerging sectors such as biotechnology and cosmetics present significant growth opportunities. The integration of homogenizers in these industries is driven by the need for precise and consistent product formulations.

Key Takeaways

- Market Value: The Global Homogenizers Market was valued at USD 1.8 Bn in 2023. It is expected to reach USD 3.0 Bn by 2033, with a CAGR of 5.4% during the forecast period from 2024 to 2033.

- By Type: Pressure homogenizers lead the market, accounting for 50%, driven by their efficiency in processing various products.

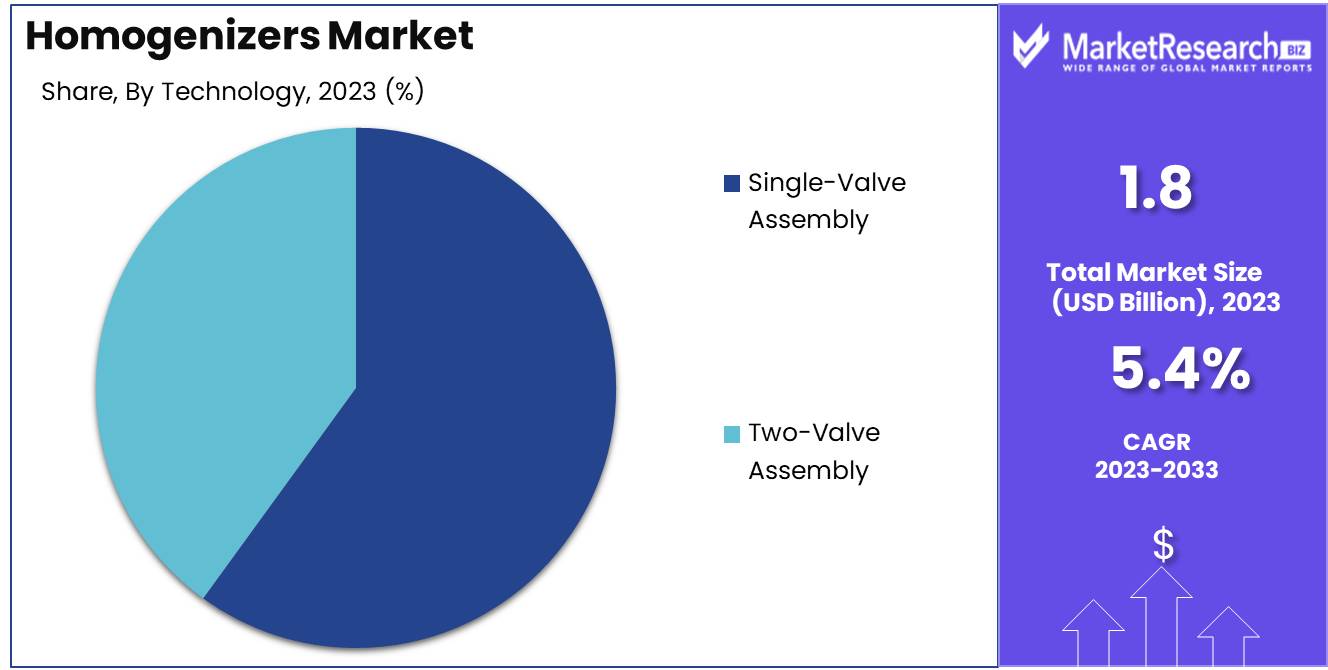

- By Technology: Single-Valve Assembly technology dominates with a 60% share, owing to its advanced homogenizing capabilities.

- By Application: The food and beverages sector represents 35% of the market, underscoring the importance of homogenizers in this industry.

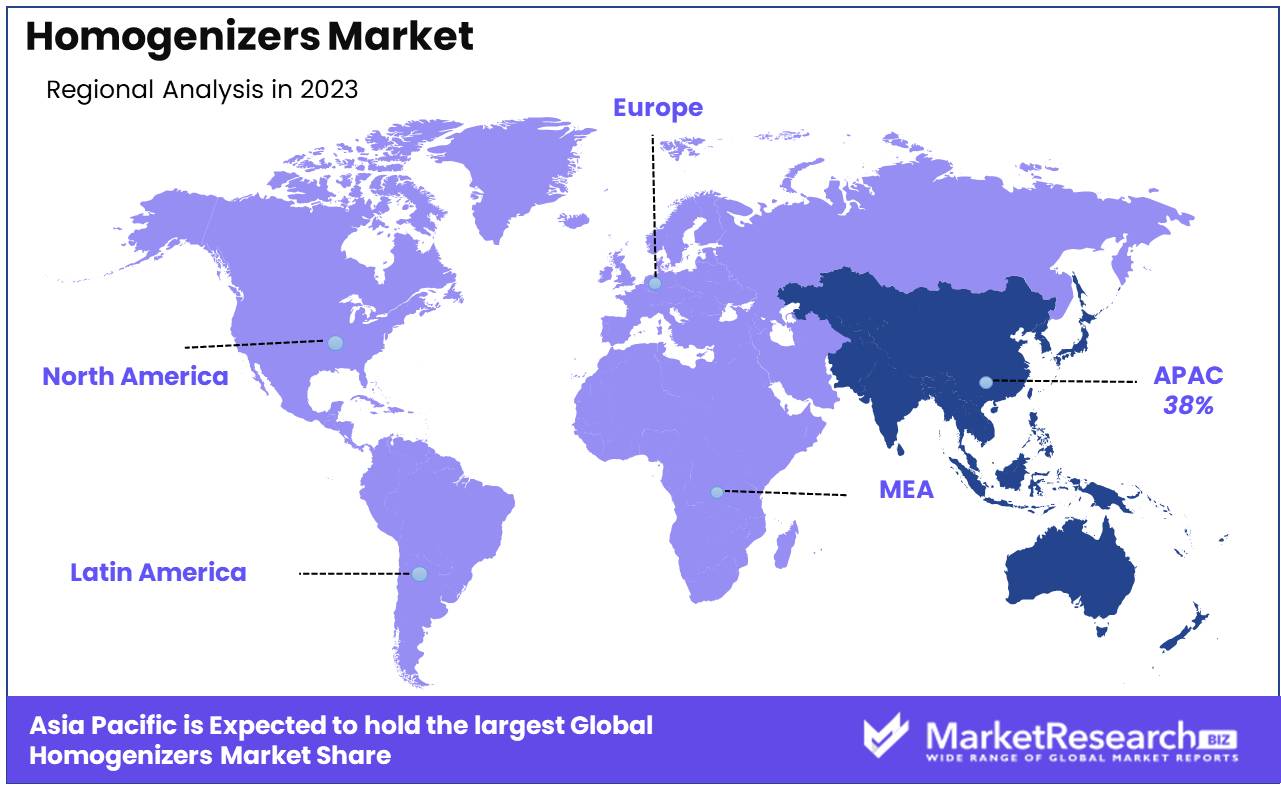

- Regional Dominance: The Homogenizers Market sees the Asia Pacific region as the leading force, contributing 38% to the overall market share.

- Growth Opportunity: Significant growth potential exists in the rising demand for homogenized food and beverage products, particularly in emerging markets with expanding middle-class populations.

Driving factors

High Demand in Food and Beverage Industries

The homogenizers market is experiencing significant growth due to the high demand in the food and beverage industries. The increasing consumption of dairy products, beverages, and processed foods necessitates the use of homogenizers to ensure product consistency, stability, and quality. Homogenizers are essential in creating uniform mixtures and improving the texture and shelf life of products.

The food and beverage sector accounts for a substantial share of the homogenizers market, driven by the need for efficient processing technologies. As consumer preferences shift towards healthier and more convenient food options, manufacturers are increasingly adopting homogenization techniques to meet these demands, thereby boosting the market's growth.

Technological Advancements

Technological advancements play a crucial role in the expansion of the homogenizers market. Innovations such as high-pressure homogenizers and ultrasonic homogenizers have enhanced the efficiency and effectiveness of homogenization processes. These advancements allow for better control over particle size reduction, improved product quality, and energy efficiency. The integration of automation and digitalization in homogenizers has further optimized operations, reducing manual intervention and operational costs.

These technological improvements have made homogenizers more attractive to various industries, contributing to their widespread adoption and driving market growth. For instance, the introduction of nanotechnology in homogenization has opened new avenues for product development, particularly in pharmaceuticals and cosmetics, where precise particle size control is critical.

Growth in Pharmaceuticals and Cosmetics

The growth in the pharmaceuticals and cosmetics industries is a significant driver of the homogenizers market. In pharmaceuticals, homogenizers are essential for producing stable emulsions and suspensions, critical for drug formulation and delivery. The increasing demand for personalized medicine and advanced drug delivery systems has heightened the need for high-quality homogenization.

In the cosmetics industry, homogenizers are used to create fine, stable emulsions for creams, lotions, and other skincare products. The rising consumer awareness and demand for high-performance beauty and personal care products have led to increased investment in homogenization technologies. According to industry statistics, the pharmaceuticals and cosmetics sectors are among the fastest-growing end-users of homogenizers, significantly contributing to the market's overall expansion.

Restraining Factors

High Initial Costs

High initial costs present a significant barrier to the expansion of the homogenizers market. The advanced technology and specialized equipment required for homogenization processes involve substantial capital investment, which can be a deterrent for small and medium-sized enterprises (SMEs). These costs include not only the purchase of the homogenizers themselves but also the expenses related to installation, maintenance, and operator training.

High-pressure homogenizers, known for their efficiency and effectiveness, are particularly costly. This financial burden can limit the market penetration and adoption rate of homogenizers, especially in emerging markets where budget constraints are more pronounced. Consequently, despite the numerous benefits offered by homogenization, the high initial investment can slow down the overall market growth, particularly among smaller players in the industry.

Regulatory Requirements

Regulatory requirements significantly influence the homogenizers market by ensuring product safety, quality, and environmental compliance. Various industries, including food and beverage, pharmaceuticals, and cosmetics, are subject to stringent regulations that mandate the use of specific homogenization processes to meet health and safety standards. In the food and beverage industry, regulations enforced by authorities like the FDA and EFSA require homogenization to ensure the microbiological safety and stability of products.

The pharmaceutical industry must adhere to GMP (Good Manufacturing Practice) guidelines, which often necessitate the use of homogenizers to achieve the required product consistency and purity. These regulatory requirements, while ensuring high standards, also impose additional costs and operational challenges on manufacturers. Companies must invest in compliance processes, certification, and regular audits, which can be both time-consuming and costly.

By Type Analysis

Pressure homogenizers account for 50% of the market.

In 2023, Pressure held a dominant market position in the "By Type" segment of the Homogenizers Market, capturing more than a 50% share. Pressure homogenizers are essential in various industries, including food and beverage, pharmaceuticals, and biotechnology, due to their efficiency in creating uniform and stable mixtures at high pressures. These devices, operating at pressures ranging from 8,000 psi to 40,000 psi (550 to 2,750 bars), ensure consistent product quality and enhance shelf life, making them indispensable in processes requiring precise emulsification and particle size reduction.

Ultrasonic homogenizers follow, leveraging high-frequency sound waves to create cavitation and shear forces, effectively disrupting cells and particles. These homogenizers are particularly valuable in applications requiring gentle yet effective homogenization, such as in the production of pharmaceuticals, cosmetics, and nanomaterials. Their ability to maintain temperature control and prevent thermal degradation makes them suitable for sensitive materials and applications.

Mechanical homogenizers, while capturing a smaller market share, are widely used in industrial applications where robustness and simplicity are paramount. These devices employ physical forces such as shear, impact, and agitation to achieve homogenization, making them ideal for processing viscous materials and large volumes. Their versatility and cost-effectiveness make them a staple in various manufacturing processes.

By Technology Analysis

Single-Valve Assembly technology leads with a 60% market share.

In 2023, Single-Valve Assembly held a dominant market position in the "By Technology" segment of the Homogenizers Market, capturing more than a 60% share. Single-valve assembly homogenizers are widely favored across various industries due to their simpler design, lower maintenance requirements, and cost-effectiveness. These homogenizers are particularly effective in applications that demand high-pressure homogenization, such as in the food and beverage, dairy, and pharmaceutical industries. Their efficiency in processing large volumes with consistent results makes them a preferred choice for many manufacturers seeking reliability and operational efficiency.

Two-Valve Assembly homogenizers, while representing a smaller portion of the market, play a crucial role in applications requiring higher precision and control over homogenization processes. These devices offer enhanced flexibility in adjusting pressure and flow rates, making them suitable for complex emulsification tasks and high-end applications in biotechnology and advanced pharmaceuticals. The ability to fine-tune the homogenization parameters ensures optimal performance in creating highly stable and uniform mixtures, which is critical for products with stringent quality requirements.

By Application Analysis

The food and beverages sector represents 35% of the market.

In 2023, Food & Beverages held a dominant market position in the "By Application" segment of the Homogenizers Market, capturing more than a 35% share. The high demand for homogenizers in this sector is driven by the need for consistent product quality, extended shelf life, and enhanced texture in various food and beverage products. From dairy and sauces to juices and beverages, homogenizers play a crucial role in ensuring uniformity and stability, making them indispensable in modern food processing.

Pharmaceuticals follow closely, leveraging homogenization technology to achieve precise and stable emulsions, suspensions, and nanoparticle formulations. The critical need for high-quality, reproducible results in drug manufacturing and formulation underpins the substantial use of homogenizers in this sector. Their ability to ensure uniform particle size and distribution is vital for the efficacy and safety of pharmaceutical products.

Personal Care applications also contribute significantly to the market, utilizing homogenizers to produce smooth and stable creams, lotions, and other cosmetic products. The demand for innovative and high-performance personal care products drives the adoption of advanced homogenization techniques to achieve the desired consistency and stability.

Chemical applications benefit from homogenizers in the production of emulsions, dispersions, and fine suspensions, essential for various industrial processes. The ability to maintain uniform particle size and distribution enhances the quality and performance of chemical products, making homogenizers a key technology in this industry.

Others category includes emerging applications in biotechnology, nanotechnology, and other specialized fields where precise and uniform mixing is critical. The versatility of homogenization technology allows it to be adapted for a wide range of innovative and high-precision applications.

Key Market Segments

By Type

- Ultrasonic

- Mechanical

- Pressure

By Technology

- Single-Valve Assembly

- Two-Valve Assembly

By Application

- Pharmaceuticals

- Personal Care

- Food & Beverages

- Chemical

- Others

Growth Opportunity

Innovation in Product Formulations

Innovation in product formulations offers another promising avenue for market expansion. The ongoing development of new and improved formulations in the food and beverage, pharmaceutical, and cosmetics industries necessitates advanced homogenization techniques. The rise in functional foods, plant-based beverages, and personalized medicine requires precise particle size reduction and stable emulsions, which homogenizers are well-equipped to deliver.

Companies are increasingly investing in R&D to develop innovative products that cater to evolving consumer preferences. This trend not only drives the demand for advanced homogenizers but also fosters continuous technological advancements within the market.

Technological Advancements and Compliance

Technological advancements continue to play a pivotal role in market growth. The introduction of high-pressure and ultrasonic homogenizers, coupled with automation and digitalization, enhances process efficiency, product quality, and energy savings. Compliance with stringent regulatory standards across various industries ensures that homogenized products meet the highest safety and quality benchmarks, further driving market demand.

Latest Trends

Energy-Efficient Homogenizers

In 2024, the global homogenizers market is expected to see a significant trend towards energy-efficient solutions. With rising energy costs and increasing awareness of environmental sustainability, manufacturers are prioritizing the development and adoption of homogenizers that minimize energy consumption.

These energy-efficient homogenizers not only reduce operational costs but also align with global efforts to reduce carbon footprints. The push for greener technologies is prompting companies to innovate and improve the energy efficiency of their equipment, which is likely to enhance the market's appeal to environmentally conscious industries and consumers.

Automation and IoT Integration

The integration of automation and the Internet of Things (IoT) is revolutionizing the homogenizers market. Automated homogenizers equipped with IoT capabilities offer enhanced precision, control, and monitoring of the homogenization process. These advanced systems allow for real-time data collection and analysis, enabling manufacturers to optimize operations, improve product quality, and reduce downtime.

The trend towards smart manufacturing is driving the adoption of these cutting-edge technologies, which not only increase efficiency but also provide valuable insights into the production process. As industries increasingly embrace Industry 4.0, the demand for automated and IoT-integrated homogenizers is set to rise.

Regional Analysis

In 2023, the Asia Pacific region held a dominant market position in the Homogenizers Market, capturing more than 38% share. This dominance is attributed to the significant presence of food and beverage, pharmaceutical, and dairy industries in countries like China, India, and Japan. The region benefits from a growing population, rising disposable incomes, and increasing urbanization, which drive demand for processed food and beverages.

North America follows closely, characterized by advanced technological adoption and significant investments in research and development. The U.S. and Canada are major contributors, with robust food processing, pharmaceutical, and biotechnology industries. The region's focus on innovation and high-quality standards drives demand for advanced homogenization technologies.

Europe is another significant market for homogenizers, driven by stringent regulatory standards and a strong focus on food safety and pharmaceutical quality. Countries such as Germany, France, and Italy are key players, with well-established food and pharmaceutical industries.

Middle East & Africa is experiencing steady growth, driven by increasing investments in the food and beverage and pharmaceutical sectors. The region's market is also supported by efforts to diversify economies and reduce dependence on oil revenues, leading to the development of manufacturing industries.

Latin America is emerging as a promising market for homogenizers, with Brazil and Mexico leading the growth. The region's market is driven by an expanding food and beverage industry, increasing healthcare expenditure, and the rising demand for processed dairy products.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

In 2024, the global Homogenizers Market is anticipated to experience robust growth, driven by the increasing demand across industries such as food and beverage, pharmaceuticals, biotechnology, and cosmetics. Key players are leveraging technological advancements and expanding their geographical presence to capture larger market shares.

NETZSCH Group and Sonic Corporation are expected to maintain their leadership positions through continuous innovation and product development. NETZSCH's strong focus on R&D and Sonic's expertise in ultrasonic homogenization will enable them to meet the evolving needs of high-precision applications in pharmaceuticals and biotechnology.

BOS Homogenisers and PHD Technology are anticipated to expand their market presence by focusing on custom solutions and high-efficiency systems. Their ability to tailor homogenizers to specific industrial needs makes them attractive partners for specialized applications.

GEA Group continues to be a formidable player with its comprehensive product portfolio and strong global distribution network. The company's emphasis on energy-efficient and sustainable solutions aligns well with the industry's growing focus on green technologies.

Shanghai Donghua High Pressure Homogenizer and FBF ITALIA are poised to capitalize on their competitive pricing and strong manufacturing capabilities. These companies are particularly well-positioned in the Asia-Pacific region, where industrial growth and demand for processed food and beverages are driving the market.

Krones AG and Microfluidics International Corporation will likely benefit from their advanced technological offerings and strong presence in the beverage and pharmaceutical sectors. Krones' integration capabilities and Microfluidics' precision engineering are key strengths in these markets.

Alitec and Bertoli are expected to grow by focusing on quality and reliability, which are critical in the dairy and food processing industries. Their robust product designs and strong customer support systems enhance their market appeal.

Goma and Milkotek-Hommak will continue to serve niche markets with specialized homogenizers for dairy and food applications, leveraging their deep industry knowledge and strong customer relationships.

Ekato Holding and Avestin Inc. are poised to expand their footprint in the biotechnology and pharmaceutical sectors with their high-performance homogenizers designed for demanding applications, ensuring product consistency and quality.

SPX Corporation and Simes SA are expected to strengthen their positions through strategic partnerships and acquisitions, expanding their product offerings and market reach.

Market Key Players

- NETZSCH Group

- Sonic Corporation

- BOS Homogenisers

- PHD Technology

- GEA Group

- Shanghai Donghua High Pressure Homogenizer

- FBF ITALIA

- Krones AG

- Microfluidics International Corporation

- Alitec

- Bertoli

- Goma

- Milkotek-Hommak

- Ekato Holding

- Avestin Inc.

- SPX Corporation

- Simes SA

Recent Development

- In April 2024, GEA Group introduced an innovative high-pressure homogenizer designed for enhanced efficiency in dairy and food processing applications.

- In March 2024, SPX Flow expanded its homogenizer product line to include models with advanced automation features for improved performance in pharmaceutical manufacturing.

Report Scope

Report Features Description Market Value (2023) USD 1.8 Bn Forecast Revenue (2033) USD 3.0 Bn CAGR (2024-2033) 5.4% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Ultrasonic, Mechanical, Pressure), By Technology (Single-Valve Assembly, Two-Valve Assembly), By Application (Pharmaceuticals, Personal Care, Food & Beverages, Chemical, Others) Regional Analysis North America - The US, Canada, & Mexico; Western Europe - Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe - Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC - China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America - Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa - Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape NETZSCH Group, Sonic Corporation, BOS Homogenisers, PHD Technology, GEA Group, Shanghai Donghua High Pressure Homogenizer, FBF ITALIA, Krones AG, Microfluidics International Corporation, Alitec, Bertoli, Goma, Milkotek-Hommak, Ekato Holding, Avestin Inc., SPX Corporation, Simes SA Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- NETZSCH Group

- Sonic Corporation

- BOS Homogenisers

- PHD Technology

- GEA Group

- Shanghai Donghua High Pressure Homogenizer

- FBF ITALIA

- Krones AG

- Microfluidics International Corporation

- Alitec

- Bertoli

- Goma

- Milkotek-Hommak

- Ekato Holding

- Avestin Inc.

- SPX Corporation

- Simes SA