Higher Education Solutions Market By Solution Type (Student Information Systems (SIS), Learning Management Systems (LMS), Learning Analytics, Campus Management Solutions, Others), By Deployment Mode (Cloud-Based, On-Premise), By End-User (Public Universities, Private Universities, Community Colleges, Vocational Schools, By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

51170

-

September 2024

-

300

-

-

This report was compiled by Vishwa Gaul Vishwa is an experienced market research and consulting professional with over 8 years of expertise in the ICT industry, contributing to over 700 reports across telecommunications, software, hardware, and digital solutions. Correspondence Team Lead- ICT Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

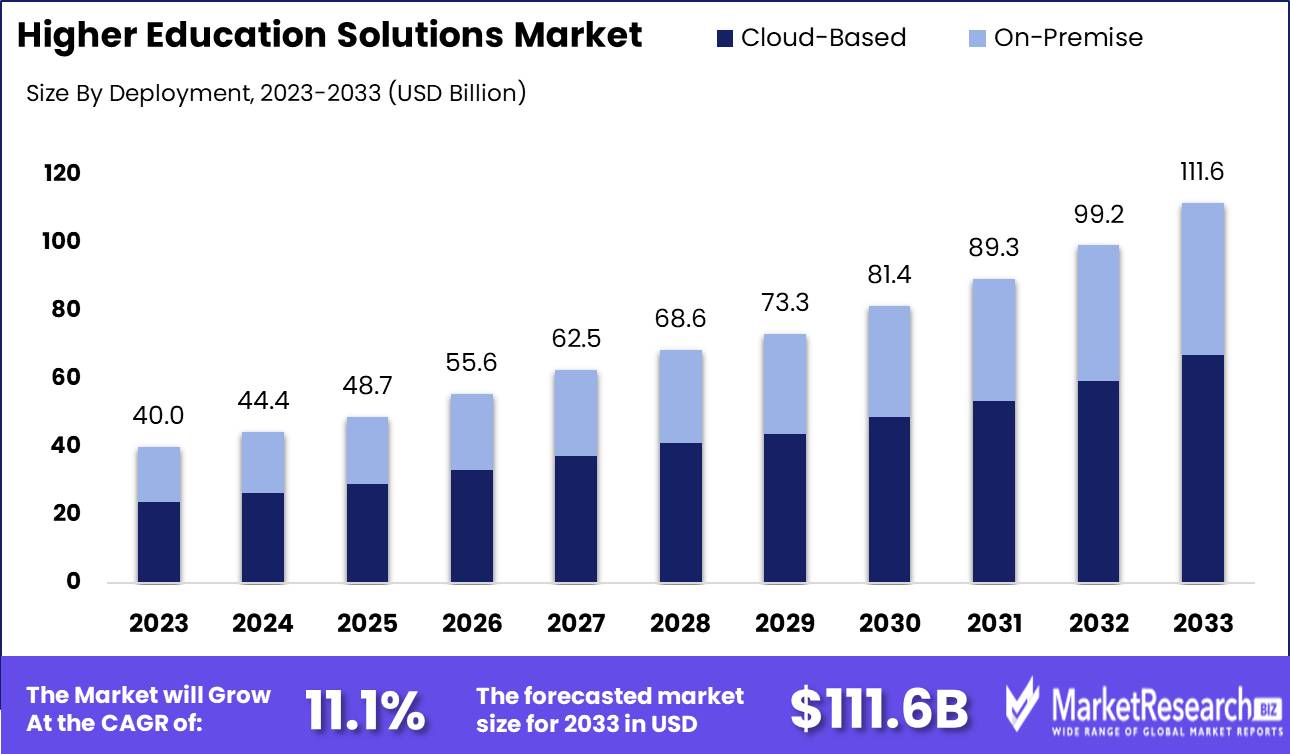

The Higher Education Solutions Market was valued at USD 40.0 billion in 2023. It is expected to reach USD 111.6 billion by 2033, with a CAGR of 11.1% during the forecast period from 2024 to 2033.

The Higher Education Solutions Market encompasses a broad range of technology-driven products and services aimed at enhancing the learning experience, operational efficiency, and institutional management within universities and colleges. These solutions include learning management systems (LMS), student information systems (SIS), and advanced analytics platforms, enabling institutions to streamline administrative tasks, improve student engagement, and make data-driven decisions. The growing demand for personalized learning, online education, and digital transformation across campuses is driving the adoption of these solutions.

The higher education solutions market is poised for significant growth, driven by the increasing demand for digital learning platforms and the rapid advancements in technology. Institutions globally are transitioning to more sophisticated learning management systems (LMS) and digital tools, fueled by the need for remote and hybrid education models. The global shift toward digitization in education has been further accelerated by the COVID-19 pandemic, which underscored the necessity for scalable, accessible learning environments. Technological advancements, such as AI-powered educational tools and adaptive learning systems, are reshaping how institutions deliver content, enabling more personalized and data-driven approaches to student engagement and outcomes.

However, the market faces critical challenges, primarily centered around the high cost of implementation and rising cybersecurity concerns. The adoption of advanced digital solutions often requires substantial investment in infrastructure, training, and ongoing maintenance, which can be a deterrent for smaller institutions or those operating on tight budgets.

Furthermore, the increased reliance on digital platforms elevates the risk of cyberattacks, raising concerns over data privacy and the security of sensitive student information. As institutions continue to integrate more technology into their operations, robust cybersecurity frameworks will be essential to mitigate these risks. Despite these challenges, the higher education solutions market is expected to witness sustained growth, as the benefits of digital transformation outweigh the associated risks.

Key Takeaways

- Market Growth: The Higher Education Solutions Market was valued at USD 40.0 billion in 2023. It is expected to reach USD 111.6 billion by 2033, with a CAGR of 11.1% during the forecast period from 2024 to 2033.

- By Solution Type: Learning Management Systems (LMS) dominated Higher Education Solutions, driving digital transformation.

- By Deployment Mode: Cloud-based solutions dominated the Higher Education Solutions Market.

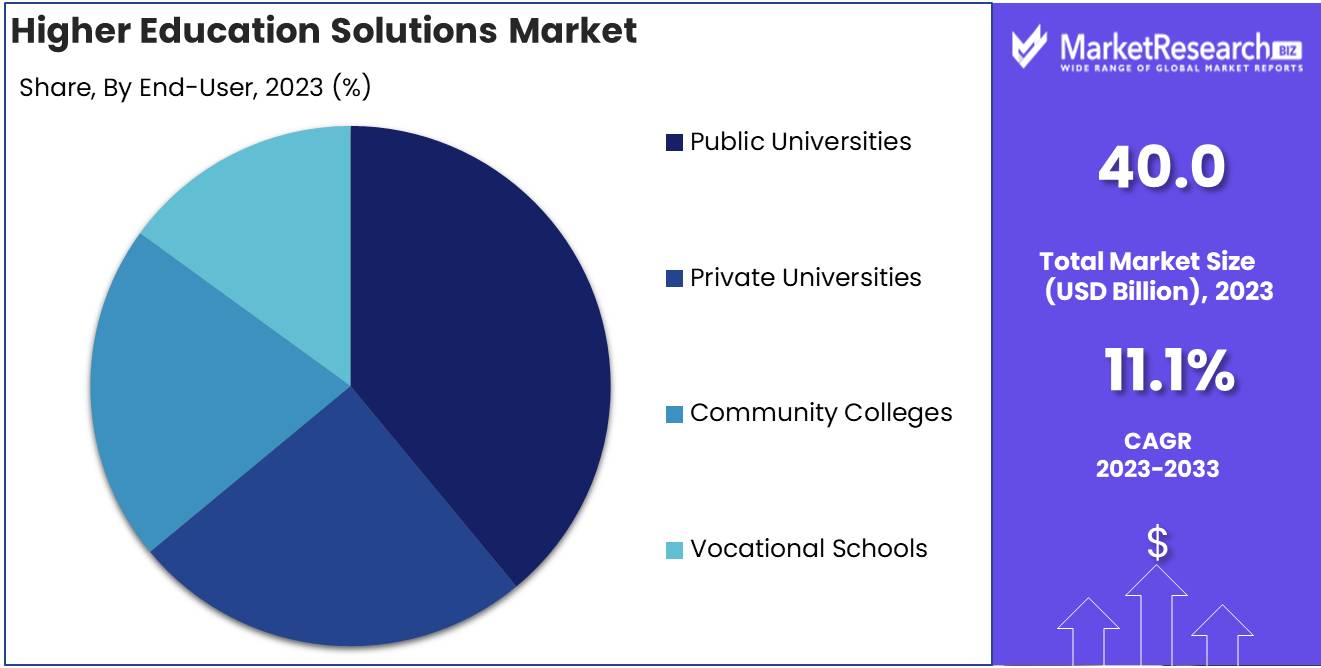

- By End-User: Public Universities dominated the Higher Education Solutions Market.

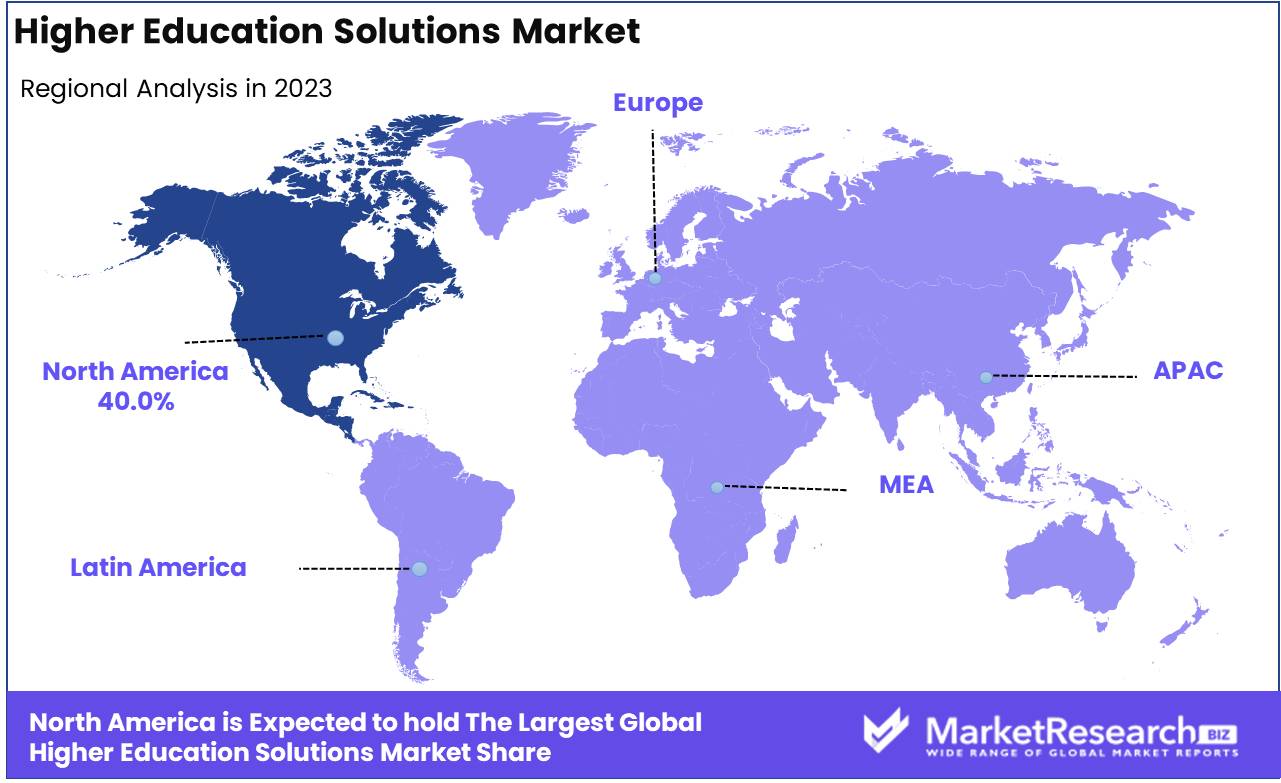

- Regional Dominance: North America leads the higher education solutions market with a 40% largest share.

- Growth Opportunity: The global higher education solutions market is expected to witness significant growth, driven by the adoption of cloud-based solutions and personalized, adaptive learning technologies enhancing educational delivery and engagement.

Driving factors

Increasing Enrollment Rates: Expanding Student Populations Fueling Market Demand

The growth of enrollment rates in higher education institutions is one of the most significant driving factors contributing to the Higher Education Solutions Market. According to report, global enrollment in tertiary education has been increasing steadily, reaching approximately 220 million students in 2020. This surge is driven by demographic growth, the expansion of educational opportunities, and the increasing recognition of the value of higher education in achieving better employment outcomes. Higher enrollment rates result in greater demand for administrative solutions, student management systems, and learning platforms, as institutions seek to accommodate and manage larger student populations efficiently.

Additionally, this increased enrollment is not limited to traditional students. The rising interest in lifelong learning and continuous professional development has broadened the scope of higher education solutions to include adult learners and non-traditional students. As more people seek flexible learning options, there is a corresponding demand for online learning platforms, digital credentialing, and other technology-driven solutions that cater to these diverse learner needs.

Technological Advancements: Digital Transformation Driving Innovation and Efficiency

Technological advancements are transforming the higher education landscape, enabling institutions to innovate and scale their operations. The adoption of cloud-based solutions, artificial intelligence (AI), and data analytics in higher education is significantly enhancing learning outcomes, streamlining administrative processes, and improving decision-making. According to a study, over 90% of higher education institutions are expected to continue investing in digital learning environments and online learning technologies post-2021. These technologies have expanded the capabilities of higher education institutions, facilitating the management of both academic and non-academic operations.

The integration of AI-powered solutions has also led to the development of personalized learning experiences, predictive analytics for student retention, and intelligent campus management systems. In addition, institutions are increasingly investing in cybersecurity solutions to protect sensitive student and institutional data, further driving the demand for comprehensive, integrated solutions in the market.

Moreover, the growth of Massive Open Online Courses (MOOCs), Learning Management Systems (LMS), and virtual classrooms has accelerated the need for scalable, interoperable platforms that enhance the accessibility of education globally. This shift to digital infrastructure is pivotal in expanding the Higher Education Solutions Market, as institutions of all sizes increasingly rely on cutting-edge technology to deliver education effectively, particularly in the context of remote and hybrid learning environments that have been catalyzed by the COVID-19 pandemic.

Changing Workforce Requirements: Aligning Education with Market-Driven Skills

The evolving nature of the global workforce is another critical factor driving the growth of the Higher Education Solutions Market. As industries across sectors adopt new technologies and shift towards automation, there is a growing demand for specialized skills, particularly in fields such as data science, information technology, engineering, and healthcare. According to the report, In 2025, 50% of all employees will need reskilling, and more than 85 million jobs may be displaced by a shift in the division of labor between humans and machines.

In response to these changes, higher education institutions are under increasing pressure to offer programs that align with the evolving needs of the labor market. This has led to the development of modular, flexible curricula and micro-credentialing programs that allow students to gain specific, industry-relevant skills. Higher education institutions are increasingly adopting platforms that support competency-based education (CBE) and upskilling initiatives, which are tailored to meet the expectations of both students and employers.

This alignment between education and employment opportunities has fueled investments in career services platforms, internship management solutions, and job placement systems, all of which contribute to the overall growth of the Higher Education Solutions Market. Institutions are partnering with corporations to ensure their graduates are equipped with the skills necessary to thrive in the rapidly changing job market, further amplifying the need for dynamic, integrated education solutions.

Restraining Factors

Data Security Risks: Inhibiting Market Expansion Through Growing Concerns

Data security risks represent a significant restraining factor for the growth of the Higher Education Solutions Market. Institutions are increasingly adopting digital platforms to manage learning, administration, and student information, which heightens the risk of cyber threats. The potential exposure of sensitive student and faculty data, such as personal identification and academic records, makes higher education institutions a prime target for cyberattacks. According to a recent report, the education sector experienced over 1,300 cyberattacks in 2023 alone, with data breaches leading to significant financial and reputational damage.

These risks compel institutions to invest heavily in security measures, which can detract from budget allocations for other digital transformation initiatives. Moreover, potential data breaches may reduce the trust in digital education solutions, discouraging widespread adoption among conservative institutions. While some educational institutions are embracing cloud-based solutions and SaaS models, concerns about data privacy and compliance with regulations like GDPR and FERPA further slow down the pace of market growth.

High Operational Costs: Impeding Broad Adoption of Advanced Solutions

High operational costs present another critical challenge to the growth of the Higher Education Solutions Market. The implementation and maintenance of cutting-edge digital infrastructure, such as learning management systems (LMS), student information systems (SIS), and analytics tools, require substantial financial investments. This includes initial setup costs, ongoing software licensing fees, staff training, and IT infrastructure upgrades.

Smaller institutions and those in developing regions are particularly affected by these financial barriers. Many universities face budgetary constraints, and prioritizing investments in new technology solutions may be difficult amidst competing financial obligations. A study indicates that over 40% of higher education institutions in emerging economies are constrained by financial limitations, leading to slower adoption of comprehensive digital solutions.

By Solution Type Analysis

In 2023, Learning Management Systems (LMS) dominated Higher Education Solutions, driving digital transformation.

In 2023, The Learning Management Systems (LMS) segment held a dominant market position in the "By Solution Type" segment of the Higher Education Solutions Market. This growth can be attributed to the increasing adoption of e-learning platforms, driven by the need for flexible learning environments and the proliferation of digital content. LMS solutions enable institutions to deliver and manage course content, track student progress, and facilitate communication between students and educators, making them indispensable in the modern education ecosystem.

The Student Information Systems (SIS) segment followed closely, as institutions increasingly sought comprehensive platforms to manage student data, enrollment, and academic records. Learning Analytics, another growing segment, gained traction due to the rising demand for data-driven insights to enhance student performance and retention rates.

Campus Management Solutions also witnessed steady growth, with universities prioritizing integrated solutions for managing administrative tasks, facilities, and operations efficiently. Lastly, the "Others" category encompasses niche solutions, including digital libraries and virtual labs, catering to specialized needs within the sector. Together, these solutions reflect the ongoing digital transformation of higher education, aimed at enhancing operational efficiency and improving learning outcomes.

By Deployment Mode Analysis

In 2023, Cloud-based solutions dominated the Higher Education Solutions Market.

In 2023, The Cloud-based deployment mode held a dominant market position in the Higher Education Solutions Market. This dominance can be attributed to the growing preference for scalable, flexible, and cost-efficient solutions among educational institutions. Cloud-based solutions allow universities and colleges to streamline administrative processes, facilitate remote learning, and provide easier access to resources for students and faculty. Additionally, the reduced need for extensive IT infrastructure and maintenance drives the adoption of cloud models, particularly as institutions continue to seek operational efficiencies in a post-pandemic landscape.

On-premises solutions, while still relevant, are increasingly being overshadowed due to their higher upfront costs and maintenance requirements. These solutions are often favored by institutions with strict data security concerns or those that prefer maintaining control over their IT infrastructure. However, the shift towards digital transformation in education, coupled with enhanced cybersecurity measures in cloud platforms, has prompted a gradual migration from on-premises to cloud-based systems. This trend is expected to continue, further solidifying the cloud-based model's leadership in the deployment mode segment of the Higher Education Solutions Market.

By End-User Analysis

In 2023, Public universities dominated the Higher Education Solutions Market.

In 2023, Public Universities held a dominant market position in the by End-User segment of the Higher Education Solutions Market driven by their extensive student enrollment and substantial government funding. Public universities, often characterized by a broad range of programs and research capabilities, invest significantly in advanced education technology solutions to enhance learning experiences and streamline administrative functions. This market dominance is further supported by their capacity to integrate large-scale digital infrastructure across multiple campuses, making them a critical user base for education technology providers.

Private Universities, while smaller in enrollment, demonstrate a strong demand for customized solutions to enhance their competitive edge in attracting students. Community Colleges, with a focus on affordable, accessible education, have been increasingly adopting cost-effective learning management systems (LMS) and virtual learning environments. Meanwhile, Vocational Schools focused on skill-based training, have shown growing interest in solutions that integrate practical learning with digital tools, particularly in response to the rising demand for remote and hybrid education models. Each of these segments represents a vital part of the evolving Higher Education Solutions Market, with unique needs driving technological innovation and adoption.

Key Market Segments

By Solution Type

- Student Information Systems (SIS)

- Learning Management Systems (LMS)

- Learning Analytics

- Campus Management Solutions

- Others

By Deployment Mode

- Cloud-Based

- On-Premise

By End-User

- Public Universities

- Private Universities

- Community Colleges

- Vocational Schools

Growth Opportunity

Increasing Adoption of Cloud-Based Solutions

The integration of cloud-based solutions within higher education is expected to be a major growth driver. Cloud-based platforms provide scalable, cost-effective solutions for managing academic and administrative functions. With the ability to access data remotely, institutions can streamline processes like admissions, learning management, and student information systems. The global shift towards hybrid and online learning models has accelerated the demand for such platforms, enabling institutions to provide flexible and accessible education. By 2024, it is projected that a significant portion of higher education institutions will transition from on-premises systems to cloud-based models, further fueling market expansion.

Personalized Learning and Adaptive Technologies

Another crucial growth opportunity lies in personalized learning and adaptive technologies. These innovations allow institutions to tailor the educational experience to individual student needs, improving learning outcomes and engagement. Adaptive learning platforms analyze student data and deliver customized content, enhancing retention and comprehension rates. As student-centered learning gains prominence, the demand for adaptive technologies is expected to grow, fostering innovation in the higher education solutions market. The adoption of personalized learning systems is forecasted to rise significantly, contributing to the sector’s overall growth.

Latest Trends

Online and Distance Education

The growth of online and distance education continues to be a dominant force in reshaping higher education. Driven by increased accessibility and cost-effectiveness, students are increasingly opting for flexible learning models. The market is projected to see a rise in hybrid learning platforms that blend on-campus and online experiences, ensuring quality and scalability. Cloud-based learning management systems, AI-driven personalized learning, and collaborative virtual environments are expected to play critical roles in enhancing student engagement and outcomes. Furthermore, global access to education will widen, with providers capitalizing on untapped markets.

Lifelong Learning and Upskilling

As the nature of work evolves, so too does the demand for lifelong learning and upskilling. The higher education solutions will increasingly focus on modular and stackable credentials, allowing individuals to continuously update their skills in response to industry needs. Universities and solution providers are expected to partner with corporations to offer tailored learning programs that bridge the gap between academia and industry. Technologies like micro-credentialing and learning analytics will become integral in personalizing learning pathways, ensuring that education remains relevant and accessible throughout an individual’s career.

Regional Analysis

North America leads the higher education solutions market with a 40% largest share.

The higher education solutions market exhibits varied growth patterns across different regions, with North America leading the segment. Dominating the global market, North America accounted for approximately 40% of the total revenue share, driven by the high adoption rate of advanced technologies such as Learning Management Systems (LMS), cloud-based solutions, and artificial intelligence (AI) in educational institutions. The U.S. and Canada are key contributors, supported by substantial government funding and a strong demand for online education platforms.

In Europe, the market is growing steadily, with a focus on integrating digital solutions to modernize traditional education systems. Countries like the UK, Germany, and France are at the forefront, bolstered by governmental initiatives aimed at promoting e-learning and digital transformation.

The Asia Pacific region is witnessing rapid growth, with increasing investments in education technology by countries like China, India, and Japan. This growth is driven by the expanding student population and rising internet penetration, leading to the widespread adoption of online learning platforms.

The Middle East & Africa and Latin America regions are also experiencing growth, though at a slower pace. Government efforts to enhance educational infrastructure, coupled with increasing awareness about the benefits of digital education, are expected to drive the market in these regions over the forecast period.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of the Middle East & Africa

Key Players Analysis

The global Higher Education Solutions Market is expected to witness significant advancements driven by digital transformation, remote learning demands, and institutional modernization. Key players like Blackboard Inc. and Ellucian Company L.P. remain dominant due to their strong portfolios in learning management systems (LMS) and student information systems (SIS). Blackboard continues to evolve with innovative LMS features, while Ellucian’s cloud-based offerings position it as a leader in the administrative solutions space.

Oracle Corporation and SAP SE are poised to benefit from the increasing adoption of cloud-based enterprise resource planning (ERP) systems. Their robust platforms, tailored for higher education, provide solutions that integrate back-end operations with student services, enhancing operational efficiency.

Anthology Inc. and Instructure Inc. (Canvas) are expected to expand their market presence through product diversification and integrations with third-party tools, catering to the growing need for personalized learning experiences. Meanwhile, Microsoft Corporation and IBM Corporation, leveraging their expertise in AI and cloud computing, are expected to drive innovation in digital learning environments.

Adobe Systems Inc. plays a crucial role in digital content creation, providing educators with tools to enhance interactive learning. Coursera Inc. and 2U, Inc. remain influential in the online learning and micro-credentialing space, capitalizing on the surge in demand for flexible learning models.

Workday, Inc. continues to gain traction with its student and financial management solutions, addressing the evolving needs of higher education institutions. Overall, these key players are well-positioned to lead market growth by offering integrated, scalable, and flexible solutions.

Market Key Players

- Blackboard Inc.

- Ellucian Company L.P.

- Oracle Corporation

- SAP SE

- Anthology Inc.

- Instructure Inc. (Canvas)

- Microsoft Corporation

- IBM Corporation

- Adobe Systems Inc.

- Coursera Inc.

- 2U, Inc.

- Workday, Inc.

Recent Development

- In February 2024, Huawei introduced the Smart Classroom 3.0 Solution at Ningxia University in China. This AI-powered solution is designed to enhance the quality of education by offering intelligent tools that cater to both in-person and online learning environments. This marks a continued shift towards smart, technologically advanced classrooms.

- In January 2024, Penn State University launched "Lionchat," an AI-enabled chatbot designed to assist students with various administrative queries such as enrollment, scholarships, and transcripts. This development underscores the growing trend of using AI to enhance administrative efficiency in higher education institutions and improve student experiences.

- In November 2023, Imperial College London launched a new scholarship program for Indian students, covering full tuition and accommodation costs for master's degree programs in fields such as engineering, medical research, and business. This initiative is part of a broader trend where institutions leverage public-private partnerships to provide more inclusive and global opportunities for students.

Report Scope

Report Features Description Market Value (2023) USD 40.0 Billion Forecast Revenue (2033) USD 111.6 Billion CAGR (2024-2032) 11.1% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Solution Type (Student Information Systems (SIS), Learning Management Systems (LMS), Learning Analytics, Campus Management Solutions, Others), By Deployment Mode (Cloud-Based, On-Premise), By End-User (Public Universities, Private Universities, Community Colleges, Vocational Schools Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Blackboard Inc., Ellucian Company L.P., Oracle Corporation, SAP SE, Anthology Inc., Instructure Inc. (Canvas), Microsoft Corporation, IBM Corporation, Adobe Systems Inc., Coursera Inc., 2U, Inc., Workday, Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Blackboard Inc.

- Ellucian Company L.P.

- Oracle Corporation

- SAP SE

- Anthology Inc.

- Instructure Inc. (Canvas)

- Microsoft Corporation

- IBM Corporation

- Adobe Systems Inc.

- Coursera Inc.

- 2U, Inc.

- Workday, Inc.