Global Learning Management System Market Based on Component(Solution, Services, Consulting, Implementation, Support Services), Based on Deployment Type(Cloud, On-Premises), Based on the Delivery Mode(Distance Learning, Instructor-Led Training, Blended Learning), Based On User Type(Academic, K-12, Higher Education, Corporate, Software & Technology, Healthcare, Retail, Others), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

22738

-

April 2024

-

300

-

-

This report was compiled by Vishwa Gaul Vishwa is an experienced market research and consulting professional with over 8 years of expertise in the ICT industry, contributing to over 700 reports across telecommunications, software, hardware, and digital solutions. Correspondence Team Lead- ICT Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

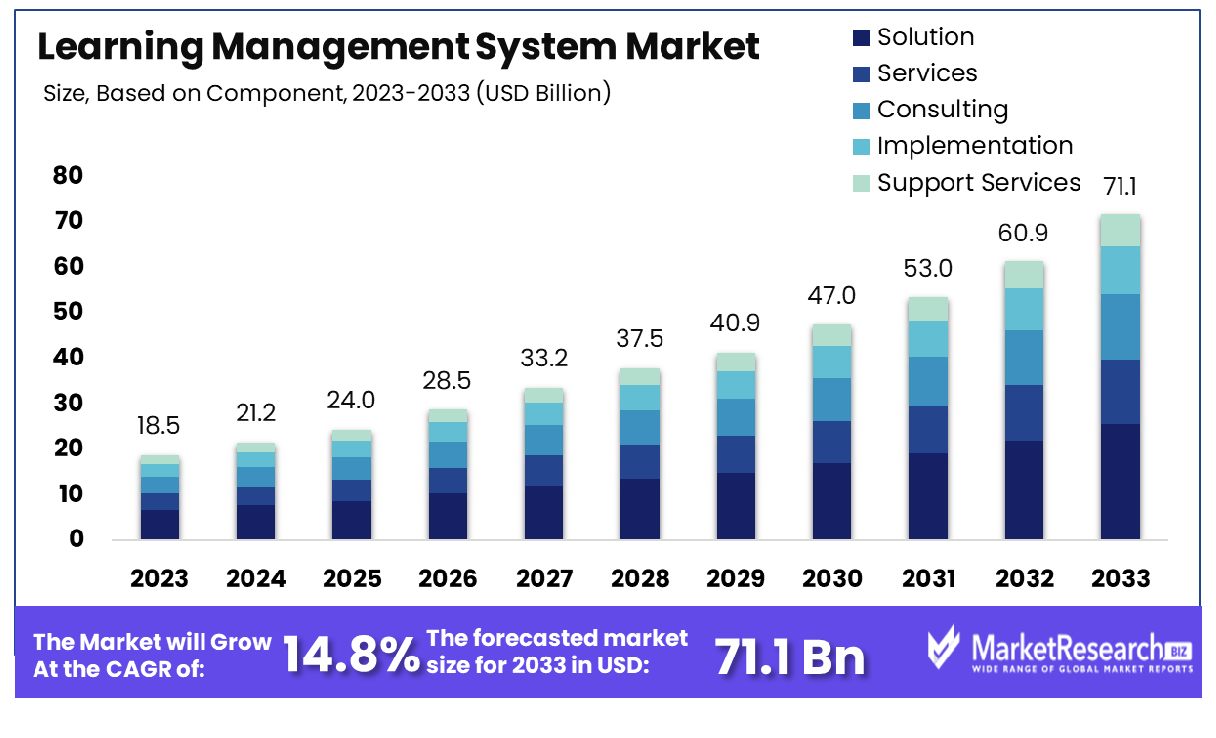

The Global Learning Management System Market was valued at USD 18.5 billion in 2023. It is expected to reach USD 71.1 billion by 2033, with a CAGR of 14.8% during the forecast period from 2024 to 2033.

The Learning Management System (LMS) market encompasses a range of software solutions designed to facilitate the administration, documentation, tracking, reporting, and delivery of educational courses, training programs, and learning and development initiatives. These systems are integral to corporate, academic, and government sectors, enhancing organizational efficiency by providing a structured platform for content delivery and skills assessment.

Key stakeholders, including product managers, leverage LMS to support strategic training outcomes, improve employee performance, and measure the effectiveness of educational initiatives through data-driven insights, thereby driving organizational learning process and growth.

The Learning Management System (LMS) market is currently positioned at a pivotal juncture, marked by rapid technological advancements and a growing recognition of its strategic importance across various sectors. Organizations are increasingly adopting LMS solutions to enhance educational outcomes and workplace efficiency, acknowledging that robust LMS platforms can significantly influence both academic segments and professional landscapes.

Empirical evidence underscores the considerable benefits of LMS and e-Learning platforms. Research indicates that LMS can boost employee engagement performance by 15 to 25% when learners are permitted to progress at their own pace. Furthermore, these systems can reduce learning time by 40 to 60%, while also enhancing retention rates by 25 to 60%. A notable 72% of organizations assert that e-learning capabilities are critical in maintaining competitiveness and adapting to continual changes in the market landscape.

From an educational perspective, the impact of LMS and e-Learning has been transformative. Since the year 2000, digital learning has surged by 900%, with the LMS market projected to reach approximately $41 billion by 2029. Moodle emerges as a leader in this arena, boasting 124 million users globally. This reflects significant market trends toward online education, with nearly four million post-secondary students engaged in at least one distance education program.

The frequency of updates to learning technologies varies significantly among organizations. While 7% update or replace their primary learning technologies annually, 49% lack a defined schedule for such updates. This variation highlights the diverse approaches to leveraging LMS technologies in response to evolving educational needs and technological advancements.

This growth trajectory and strategic focus on LMS underscore its potential to reshape learning modalities and significantly contribute to organizational success. The integration of LMS across sectors is not merely a trend but a fundamental component of future educational and workplace strategies.

Key Takeaways

- Market Growth: The Global Learning Management System Market was valued at USD 18.5 billion in 2023. It is expected to reach USD 71.1 billion by 2033, with a CAGR of 14.8% during the forecast period from 2024 to 2033.

- Based on Component: Solution-based components lead with a 61% market share.

- Based on Deployment Type: Cloud deployment dominates, accounting for 65% of the market.

- Based on the Delivery Mode: Distance learning holds 38% in the delivery mode category.

- Based On User Type: Academic users form the majority, comprising 54% of users.

- Regional Dominance: North America holds a 39% share of the global Learning Management System market.

- Growth Opportunity: In 2023, the Learning Management System (LMS) market growth is driven by increasing e-learning adoption and a shift towards cost-effective, scalable cloud-based LMS solutions.

Driving factors

Cost Efficiency and Convenience Drive Adoption in Online and Classroom Instruction

The Learning Management System (LMS) market is experiencing significant growth, primarily driven by the increasing adoption of these platforms to streamline educational processes and enhance the convenience of both online and traditional classroom instruction. Educational entities and corporate training departments are leveraging LMSs to reduce operational costs associated with physical infrastructures and manual administrative tasks.

This shift is underscored by the potential for LMS to provide scalable and accessible educational environments that accommodate diverse learning preferences and schedules. The integration of multimedia tools and interactive content, facilitated by LMS, further enriches the learning experience, thereby boosting user engagement and retention rates.

Expansion in Educational Institutions Catalyzes Market Growth

LMS platforms have become integral to the operational framework of educational institutions worldwide. This widespread implementation can be attributed to the versatility of LMSs in managing coursework, assessments, and communication between educators and students. The scalability of these systems allows institutions—from K-12 to higher education—to customize and expand their offerings, reaching more students while maintaining educational quality.

The data-driven capabilities of LMSs enable institutions to track student progress and adapt teaching methods accordingly, thus enhancing educational outcomes. This systemic integration supports continuous growth in the LMS market as institutions seek to optimize educational delivery and outcomes.

Technological Accessibility Accelerates LMS Adoption

The proliferation of smartphones and the enhancement of internet connectivity are crucial factors propelling the adoption of LMS. The ubiquity of these technologies has made learning accessible on a global scale, allowing users to access educational content from anywhere at any time. This accessibility is particularly transformative in regions with growing digital infrastructures, where mobile learning is often the first and most common means of online education.

As internet speeds increase and the cost of smart devices decreases, the barrier to entry for using LMS is significantly reduced, enabling a broader, more diverse user base to participate in digital learning. This trend not only expands the market for LMS providers but also fosters an inclusive educational environment that transcends geographical and socioeconomic barriers.

Restraining Factors

Connectivity Challenges Limit Market Expansion

Erratic internet connectivity in rural and remote areas significantly hampers the adoption and effective use of Learning Management Systems (LMS). Such connectivity issues prevent consistent access to online educational resources, undermining the reliability and effectiveness of LMS platforms in these regions. This limitation not only restricts the geographic expansion of the LMS market but also affects the equity of educational opportunities, as students and institutions in less connected areas cannot fully leverage the benefits of digital learning tools.

Awareness and Training Gaps Impede User Adoption

A major restraint on the growth of the LMS market is the lack of awareness and adequate training regarding the potential and operation of these systems. Many potential users—both educators and students—may not be fully aware of how LMS features can be utilized to enhance learning outcomes and streamline educational processes. Furthermore, the absence of sufficient training for users contributes to underutilization and inefficiency, discouraging adoption and potentially leading to dissatisfaction with the system. Addressing these knowledge gaps is crucial for maximizing the effectiveness of LMS platforms and expanding their use across diverse educational settings.

Based on Component

Based on Components, the Solution segment commands a significant 61% share of the market.

In 2023, Solution held a dominant market position in the Based on Component segment of the Learning Management System (LMS) Market, capturing more than a 61% share. This segment encompasses Services, Consulting, Implementation, and Support Services. Each component has contributed significantly to the market's dynamics, reflecting diverse applications across educational institutions and corporate training programs.

Services within the LMS market have been pivotal, ensuring that educational and corporate entities can customize and optimize the platform to meet specific learning objectives. Consulting, as a subset of services, has seen robust demand, with organizations seeking expert advice to integrate LMS solutions seamlessly into their existing technological infrastructure. This demand is driven by the need to address specific learning outcomes and operational efficiencies.

Implementation services have played a critical role in the deployment phase of LMS solutions. The expertise provided during implementation ensures that the systems are configured to maximize functionality and user engagement. The success of this segment is attributed to the meticulous planning and execution of tailored solutions that align with client objectives.

Support Services have been essential in maintaining the continuity and effectiveness of LMS platforms. Continuous support and maintenance ensure high uptime and prompt resolution of any issues, thereby enhancing the overall user experience and sustaining long-term user satisfaction.

The dominance of the Solution segment in the LMS market can be attributed to its comprehensive approach, which addresses all aspects of the system lifecycle from consultation and implementation to ongoing support. This holistic approach not only ensures the optimal performance of the systems but also contributes to the enduring success of LMS deployments across various sectors.

Based on Deployment Type

In terms of Deployment Type, Cloud-based systems dominate with 65% of the market.

In 2023, Cloud held a dominant market position in the Based on Deployment Type segment of the Learning Management System (LMS) Market, capturing more than a 65% share. This segment includes Cloud and On-Premises deployment options, with Cloud solutions leading the market due to their scalability, cost-effectiveness, and ease of access.

Cloud-based LMS solutions have been increasingly favored by educational institutions and businesses alike, as they allow users to access learning materials from any location and at any time, provided there is internet connectivity. This flexibility has proven particularly valuable in supporting remote learning and hybrid working models, trends that have been accentuated by recent global shifts towards more flexible work and study environments.

The significant market share of cloud deployment can also be attributed to the lower upfront costs compared to on-premises solutions. Organizations are not required to invest heavily in physical infrastructure or dedicated IT staff, as cloud providers handle the maintenance, updates, and security. This shift has enabled small to medium-sized enterprises to adopt advanced LMS solutions, which were previously accessible only to larger organizations with the resources to support extensive on-premises setups.

On-premises deployment, while more controlled and secure, has seen a relative decline in preference due to its higher cost of ownership and complexity in scalability. However, it remains a critical option for organizations that demand stringent data control, security, and customization.

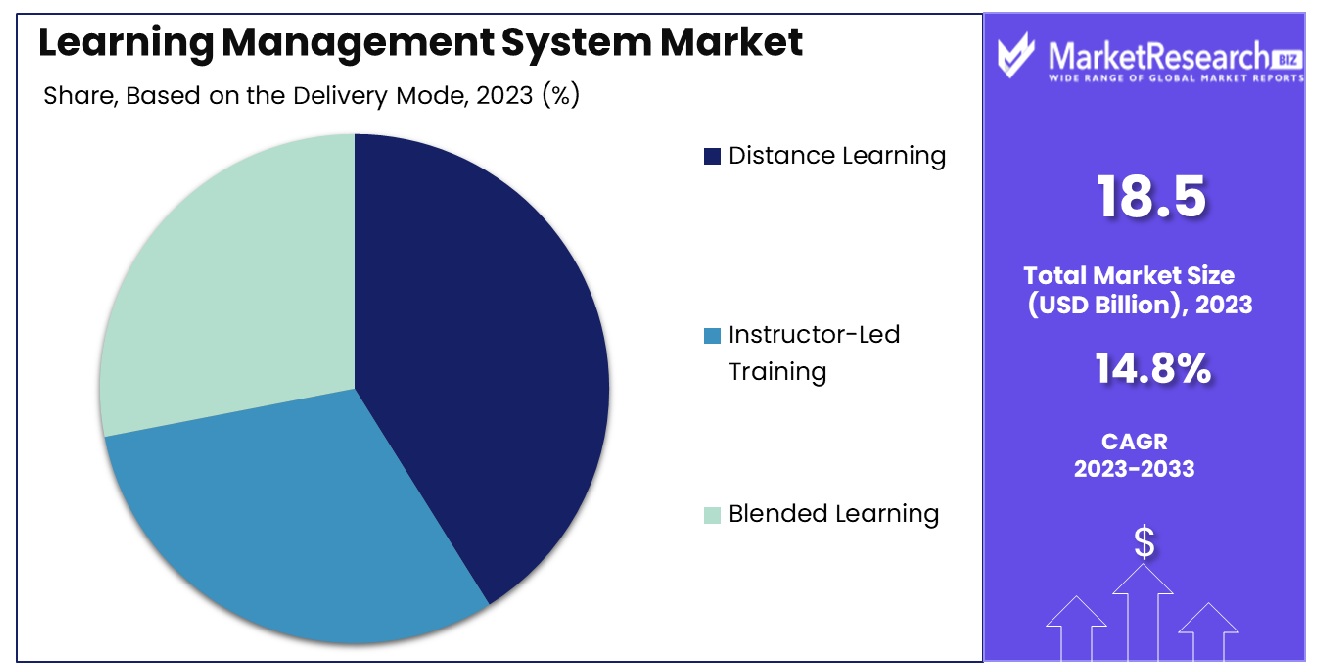

Based on the Delivery Mode

Regarding Delivery Mode, Distance Learning leads, hold 38% of the market share.

In 2023, Distance Learning held a dominant market position in the Based on Delivery Mode segment of the Learning Management System (LMS) Market, capturing more than a 38% share. This segment is categorized into Distance Learning, Instructor-Led Training, and Blended Learning. The substantial share held by Distance Learning underscores its increasing adoption in global education and corporate training sectors.

Distance Learning, facilitated by LMS platforms, allows learners to access educational content and resources remotely, eliminating the need for physical presence in a traditional classroom setting. This mode of delivery has become particularly prevalent due to its flexibility, cost-effectiveness, and wide reach, enabling institutions to offer educational opportunities to a more extensive and diverse audience.

Instructor-led training (ILT) continues to play a vital role within the LMS market, providing a structured learning environment where instructors interact directly with learners. However, the integration of LMS tools enhances ILT by allowing for the digital distribution of materials and online assessments, thus enriching the learning experience.

Blended Learning, which combines online educational materials with traditional place-based classroom methods, has also seen growth. This method leverages the strengths of both Distance Learning and ILT, offering flexibility while maintaining the benefits of face-to-face interaction and collaboration.

Based On User Type

Based on User Type, the Academic sector predominates, capturing 54% of the market.

In 2023, Academic held a dominant market position in the Based On User Type segment of the Learning Management System (LMS) Market, capturing more than a 54% share. This segment includes diverse sectors such as Higher Education, Corporate, Software & Technology, Healthcare, Retail, and Others. The Academic sector's substantial market share highlights its pivotal role in driving the adoption and innovation within the LMS landscape.

The preference for LMS in academic settings, particularly in higher education, stems from the need to manage vast amounts of educational content and facilitate effective learning processes for a diverse and extensive student body. LMS platforms in these environments support a range of functionalities from course planning and assignment distribution to tracking student progress and facilitating communication between educators and learners.

The Corporate sector also leverages LMS extensively, particularly for training and development purposes within industries such as Software & Technology, Healthcare, and Retail. These sectors utilize LMS platforms to deliver continuous education and regulatory compliance training, essential for maintaining competitive edges and adhering to industry standards.

Software & Technology companies use LMS to keep pace with rapid technological advancements, ensuring that their workforce is proficient in the latest tools and technologies. Similarly, the Healthcare sector relies on LMS for ongoing medical education and training critical for patient care and regulatory compliance.

Key Market Segments

Based on Component

- Solution

- Services

- Consulting

- Implementation

- Support Services

Based on Deployment Type

- Cloud

- On-Premises

Based on the Delivery Mode

- Distance Learning

- Instructor-Led Training

- Blended Learning

Based On User Type

- Academic

- K-12

- Higher Education

- Corporate

- Software & Technology

- Healthcare

- Retail

- Others

Growth Opportunity

Increasing Adoption of E-learning Solutions

In 2023, the global market for Learning Management Systems (LMS) has observed a significant uptrend, primarily fueled by the escalating adoption of e-learning solutions across educational institutions and organizations. This shift is driven by a growing recognition of the versatility and efficiency that LMS platforms introduce to educational and professional development frameworks.

The penetration of LMS in various sectors is transforming traditional learning paradigms, offering tailored educational experiences that are accessible remotely. Consequently, the integration of advanced technological features like AI and machine learning in LMS platforms enhances the personalization of content, fostering an interactive and engaging learning environment. This trend is anticipated to burgeon, as institutions continue to prioritize digital infrastructure in education, thereby amplifying the growth trajectory of the LMS market.

Growing Demand for Cloud-Based LMS Solutions

Parallel to the increasing adoption of e-learning systems, there is a marked shift towards cloud-based Learning Management Systems over traditional on-premises solutions. The inclination towards cloud-based systems is predominantly due to their scalability, superior accessibility, and cost-effectiveness, which significantly outweigh the capabilities of on-premises installations.

Cloud-based LMS solutions facilitate seamless updates and integration of new features, which ensures that educational and training programs are up-to-date with the latest content and pedagogical methodologies. Moreover, the operational flexibility offered by cloud-based systems allows organizations and educational institutions to manage and expand their learning programs without substantial investments in physical infrastructure. This shift not only supports the dynamic needs of global learners but also positions cloud-based LMS solutions as a focal growth area in the LMS market for 2023 and beyond.

Latest Trends

Adoption of AI-Powered Learning Management Systems

In 2023, a pivotal trend within the global Learning Management System (LMS) market is the accelerated adoption of AI-powered systems. Organizations are leveraging artificial intelligence to refine and personalize the learning experience, making educational content not only more engaging but also more relevant to individual learner needs.

AI enhances LMS capabilities by providing adaptive learning paths, automated content recommendations, and predictive analytics to assess learner performance and predict future learning outcomes. This trend indicates a significant evolution from traditional LMS platforms, as AI integration offers a more dynamic, responsive, and efficient learning environment, thereby increasing the effectiveness of training programs and educational courses.

LMS Adoption in the Retail Industry

The retail sector is increasingly emerging as a significant user of Learning Management Systems. Retailers are recognizing that modern customers seek more than just transactional interactions; they desire a richer, more informative shopping experience. By integrating LMS platforms, retailers can provide staff with extensive training on product knowledge, customer service skills, and operational procedures, thereby enhancing the overall customer experience.

Furthermore, LMS tools are being used to educate customers about products, enabling informed purchasing decisions and fostering brand loyalty. This trend not only broadens the scope of LMS applications but also underscores the versatility of LMS tools in adapting to diverse industry needs, making it a key growth area in the LMS market.

Regional Analysis

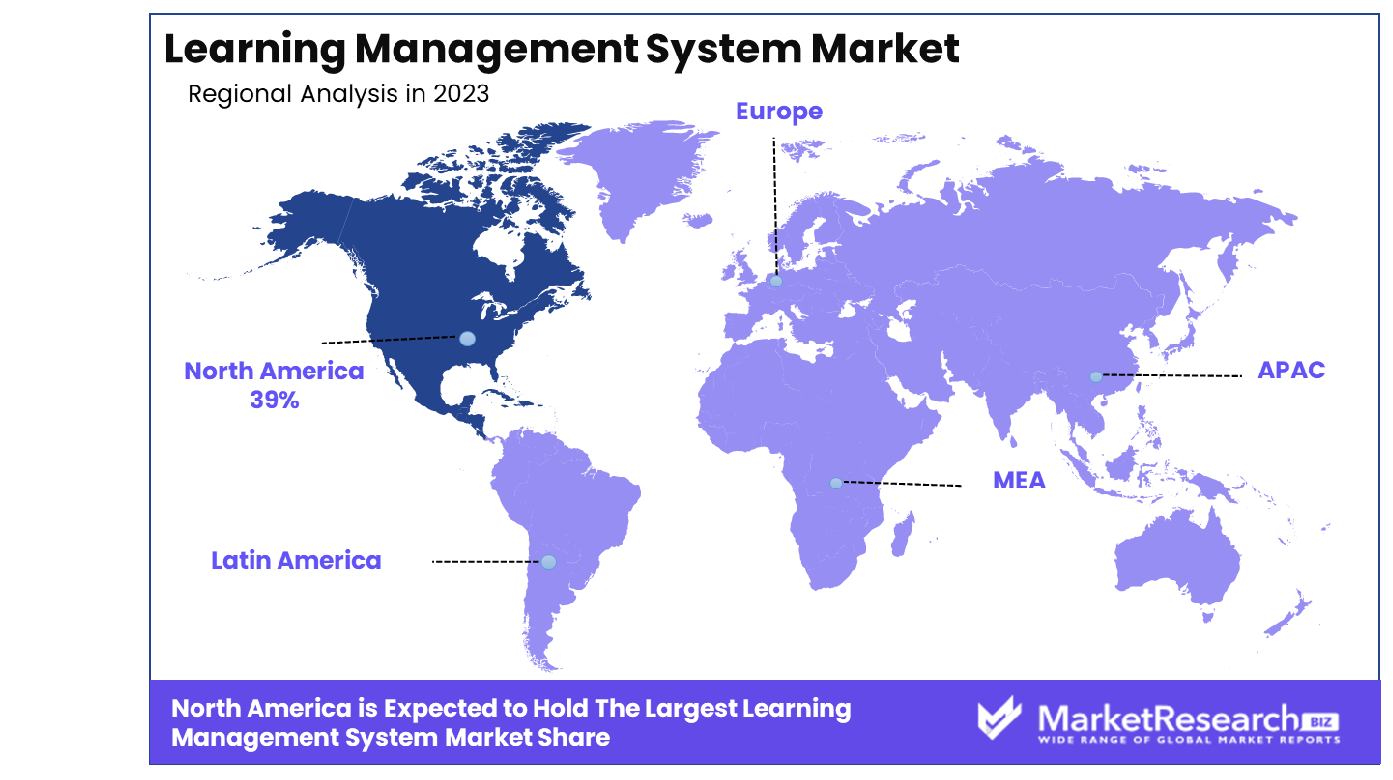

North America holds a 39% share of the global Learning Management System (LMS) market.

The global Learning Management System (LMS) market is segmented into several key regions: North America, Europe, Asia Pacific, Middle East & Africa, and Latin America. Each region presents distinct characteristics and dynamics in the adoption and implementation of LMS solutions.

North America dominates the LMS market with a 39% share, driven by advanced technological infrastructure and a strong presence of leading LMS providers. The widespread adoption in both educational institutions and corporate settings fuels this region's substantial market share. In Europe, the market is characterized by increasing regulatory compliance regarding digital education and a high emphasis on continuous professional development, contributing to robust market growth.

Asia Pacific is witnessing the fastest growth in the LMS market, attributed to rapid digitalization, growing educational sectors, and significant investments in technology across countries like China, India, and Japan. The demand in this region is further propelled by the increasing need for scalable and cost-effective e-learning solutions.

The Middle East & Africa (MEA) region, although smaller in comparison to other regions, is experiencing noticeable growth due to governmental initiatives to promote digital education and improve the overall education system infrastructure. Latin America, on the other hand, shows promising growth potential driven by the rising adoption of technology in education and corporate training needs, particularly in countries such as Brazil and Mexico.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of Middle East & Africa

Key Players Analysis

In 2023, the global Learning Management System (LMS) market is highly competitive, with several key players driving innovation and market growth. Among these, Blackboard Inc. continues to be a leader, primarily serving educational institutions with comprehensive solutions that enhance both teaching and learning experiences. IBM Corporation leverages its robust technological prowess to integrate advanced analytics and cognitive solutions into its LMS offerings, appealing to a wide range of industries beyond education.

Instructure Inc., known for its Canvas LMS, maintains strong market visibility through its user-friendly interface and robust functionality that supports both academic institutions and businesses. Absorb LMS Software Inc. distinguishes itself with a flexible LMS platform that is particularly appealing to the corporate sector for its scalability and mobile compatibility.

Cornerstone OnDemand Inc. and SAP SE are noteworthy for their extensive enterprise-focused features that facilitate talent management and employee training, resonating well with large organizations seeking comprehensive workforce development solutions. Oracle Corporation integrates its LMS into a larger suite of services, offering a seamless blend of learning with other enterprise processes, enhancing user engagement and operational efficiency.

Emerging major players like Edcast Inc. and D2L Corporation are making significant inroads with their innovative approaches to personalized learning and data-driven insights, which are critical in tailoring learning paths and improving outcomes. Companies like Epignosis LLC and Paradiso Solutions offer cost-effective, versatile LMS solutions that enable smaller businesses and educational institutions to adopt e-learning strategies effectively.

Market Key Players

- Blackboard Inc.

- IBM Corporation

- Instructure Inc.

- Absorb LMS Software Inc.

- Xerox Corporation

- Cornerstone OnDemand Inc.

- Edcast Inc.

- D2L Corporation

- Callidus Software Inc.

- Epignosis LLC

- John Wiley & Sons, Inc.

- Oracle Corporation

- Jzero Solutions Ltd.

- Paradiso Solutions

- SABA Software, Inc

- SAP SE

- Other Key Player

Recent Development

- In April 2024, Valamis, a leader in learning systems, unveils a new brand identity, emphasizing data-driven insights and impactful L&D. The refreshed approach reflects an innovative vision, connecting learning to business success.

- In April 2024, Tech firm InnovateSafe revolutionizes workplace safety training, addressing challenges like scheduling and authenticity verification. Their innovations ensure accessible and effective training, improving workplace safety across North America.

- In March 2024, American Residential Services emphasizes L&D's strategic role, leveraging technology like Microsoft Teams for remote collaboration and training. Their initiatives drive employee development and foster a forward-thinking learning culture.

Report Scope

Report Features Description Market Value (2023) USD 18.5 Billion Forecast Revenue (2033) USD 71.1 Billion CAGR (2024-2032) 14.8% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered Based on Component(Solution, Services, Consulting, Implementation, Support Services), Based on Deployment Type(Cloud, On-Premises), Based on the Delivery Mode(Distance Learning, Instructor-Led Training, Blended Learning), Based On User Type(Academic, K-12, Higher Education, Corporate, Software & Technology, Healthcare, Retail, Others) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Blackboard Inc., IBM Corporation, Instructure Inc., Absorb LMS Software Inc., Xerox Corporation, Cornerstone OnDemand Inc., Edcast Inc., D2L Corporation, Callidus Software Inc., Epignosis LLC, John Wiley & Sons, Inc., Oracle Corporation, Jzero Solutions Ltd., Paradiso Solutions, SABA Software, Inc, SAP SE, Other Key Player Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) - Market Growth: The Global Learning Management System Market was valued at USD 18.5 billion in 2023. It is expected to reach USD 71.1 billion by 2033, with a CAGR of 14.8% during the forecast period from 2024 to 2033.

-

-

- Blackboard Inc.

- IBM Corporation

- Instructure Inc.

- Absorb LMS Software Inc.

- Xerox Corporation

- Cornerstone OnDemand Inc.

- Edcast Inc.

- D2L Corporation

- Callidus Software Inc.

- Epignosis LLC

- John Wiley & Sons, Inc.

- Oracle Corporation

- Jzero Solutions Ltd.

- Paradiso Solutions

- SABA Software, Inc

- SAP SE

- Other Key Player