High Speed Motor Market Report By Motor Type (AC Motors [Synchronous Motors, Asynchronous Motors], DC Motors [Brushless DC Motors, Brushed DC Motors], Step Motors, Others), By Application (Industrial [Pumps, Compressors, Fans, Conveyors], Automotive [Electric Vehicles, Powertrain Components], Aerospace [Aircraft Systems, Avionics], Energy [Wind Turbines, Power Generation Systems], Others), By End-User Industry (Manufacturing, Transportation, Aerospace & Defense, Energy & Utilities, Automotive, Consumer Electronics, Others), By Region and Companies -

-

49380

-

July 2024

-

280

-

-

This report was compiled by Kalyani Khudsange Kalyani Khudsange is a Research Analyst at Prudour Pvt. Ltd. with 2.5 years of experience in market research and a strong technical background in Chemical Engineering and manufacturing. Correspondence Sr. Research Analyst Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

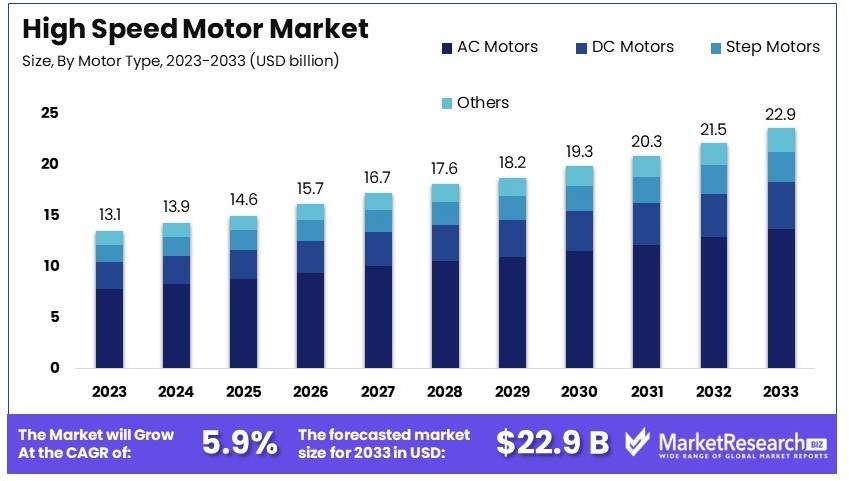

The Global High Speed Motor Market size is expected to be worth around USD 22.9 Billion by 2033, from USD 13.1 Billion in 2023, growing at a CAGR of 5.9% during the forecast period from 2024 to 2033.

The High Speed Motor Market focuses on motors designed to operate at high speeds, typically above 10,000 RPM. These motors are crucial in various industries, including automotive, aerospace, manufacturing, and electronics. High speed motors provide increased efficiency, reduced size, and higher power output.

They are used in applications such as electric vehicles, industrial machinery, and HVAC systems. The market is driven by the need for improved performance, energy efficiency, and technological advancements. Companies in this market invest in research and development to innovate and meet the specific needs of high-performance applications, ensuring competitive advantages and compliance with industry standards.

The high-speed motor market is gaining traction due to its critical role in various applications, including electric vehicles (EVs) and industrial machinery. High-speed motors, particularly in EVs, are essential for delivering high torque and efficiency, crucial for vehicle performance and range. These motors can reach speeds exceeding 20,000 RPM. Companies like Nidec are leading the market with designs that optimize power density and minimize space, meeting the stringent requirements of automotive applications.

In the industrial sector, high-speed motors are indispensable for applications demanding precise control and high efficiency. They are extensively used in CNC machines and robotic systems. For instance, KEB’s high-speed spindle motors, capable of reaching frequencies up to 1600 Hz, are pivotal in CNC applications, ensuring precision and reliability. These motors can enhance productivity by up to 15%, underscoring their importance in industrial settings.

The market dynamics indicate strong growth prospects for high-speed motors, driven by advancements in technology and the increasing adoption of automation and electric vehicles. The emphasis on energy efficiency and performance in both automotive and industrial sectors is propelling demand. Additionally, regulatory support for reducing emissions and enhancing energy efficiency is expected to further boost market growth.

Overall, the high-speed motor market is set for significant expansion, driven by technological innovations and the growing need for efficient and reliable performance in critical applications. The focus on optimizing power density, enhancing productivity, and supporting regulatory compliance will continue to drive the market forward.

Key Takeaways

- Market Value: The High Speed Motor market was valued at USD 13.1 billion in 2023, and is expected to reach USD 22.9 billion by 2033, with a CAGR of 5.9%.

- By Motor Type Analysis: AC Motors dominated with 60%; Preferred for their efficiency and versatility in various applications.

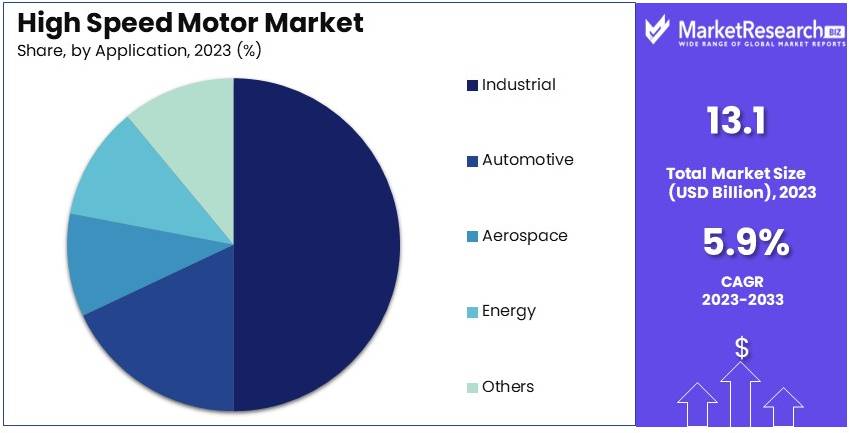

- By Application Analysis: Industrial dominated with 50%; Essential for driving machinery and equipment in manufacturing processes.

- By End-User Industry Analysis: Manufacturing dominated with 45%; Critical for operational efficiency and productivity.

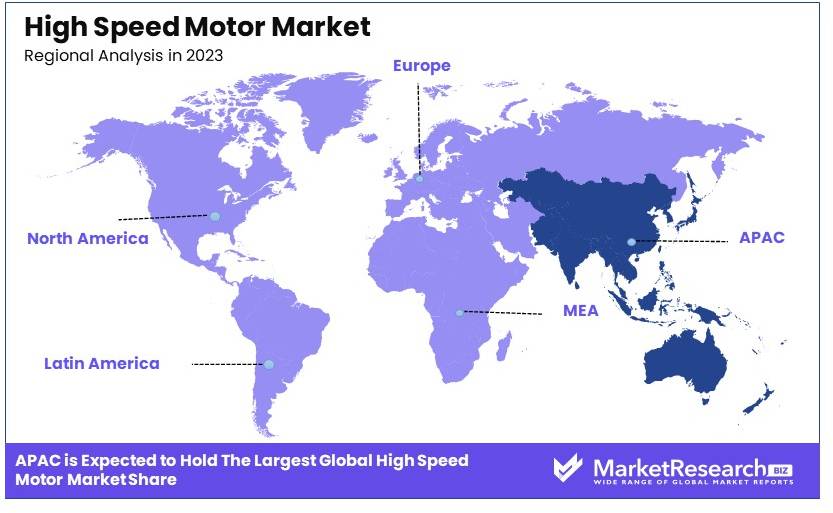

- Dominant Region: APAC dominated with 37.2%; Growth driven by industrial expansion and infrastructure development.

- High Growth Region: Europe; Increasing adoption of high-speed motors in automotive and energy sectors.

- Analyst Viewpoint: The market is moderately saturated with high competition, but innovations in motor efficiency and energy savings present growth potential.

- Growth Opportunities: Focus on developing energy-efficient motors and expanding in emerging markets can provide significant opportunities for growth.

Driving Factors

Increasing Industrial Automation Drives Market Growth

The rise in industrial automation across various sectors significantly boosts the high-speed motor market. Industries are increasingly seeking ways to improve efficiency, reduce labor costs, and enhance productivity. High-speed motors are essential in automated systems due to their capability to perform rapid and precise movements. In the automotive industry, these motors play a critical role in robotic assembly lines, facilitating the swift and accurate manufacturing of vehicles.

As industries continue to adopt Industry 4.0 and Industry 5.0 technologies, which integrate automation, data exchange, and smart manufacturing processes, the demand for high-speed motors is expected to surge. This integration allows for real-time monitoring and control of manufacturing processes, further driving the need for reliable and efficient high-speed motors. The continued evolution of industrial automation thus presents significant growth opportunities for the high-speed motor market.

Growing Demand in Electric Vehicles Drives Market Growth

The rapid growth of the electric vehicle (EV) market is a major driver for high-speed motors. High-speed motors are vital components in EV powertrains, providing the necessary performance and efficiency. Governments worldwide are implementing stricter emissions regulations and offering incentives for EV adoption, encouraging major automakers to invest heavily in electric vehicle production.

Tesla's Model 3, which uses high-speed motors, exemplifies this trend. It has become one of the best-selling EVs globally, highlighting the increasing demand for these motors in the automotive sector. As more consumers and businesses shift towards electric vehicles, the high-speed motor market is poised for substantial growth. This demand not only propels the automotive sector but also spurs technological advancements in motor efficiency and performance.

Advancements in Motor Technology Drive Market Growth

Technological innovations in high-speed motor design and materials are key drivers of market growth. Manufacturers are continually developing more efficient, compact, and powerful motors to meet the evolving needs of various industries. The introduction of permanent magnet synchronous motors (PMSMs), for example, has significantly enhanced the performance and efficiency of high-speed motors.

These advancements open up new applications and markets for high-speed motors, particularly in aerospace and medical equipment industries. The continuous improvement in motor technology not only broadens the scope of high-speed motor applications but also fosters greater adoption across different sectors. As industries demand more advanced and reliable motors, the high-speed motor market is expected to expand further, driven by these ongoing technological innovations.

Restraining Factors

High Initial Costs Restrain Market Growth

The high initial costs of high-speed motors pose a significant barrier to market growth. These motors, which incorporate advanced technologies and materials, have higher production costs than conventional motors. For example, a high-speed motor for a CNC machine tool can cost several thousand dollars.

This cost can be prohibitive for small and medium-sized enterprises (SMEs) with limited budgets, slowing down adoption rates. In price-sensitive markets or industries with tight profit margins, the high upfront investment needed for high-speed motors can deter potential buyers, limiting market expansion.

Technical Challenges in Design and Manufacturing Restrain Market Growth

Producing high-speed motors involves several technical challenges that can restrict market growth. Issues like bearing design, rotor dynamics, and thermal management become more complex at higher speeds, requiring specialized expertise and advanced manufacturing capabilities. For instance, achieving proper balancing in ultra-high-speed motors operating at 100,000 RPM or more is extremely challenging and demands precision engineering.

These technical difficulties limit the number of manufacturers capable of producing high-quality high-speed motors. Consequently, the supply of such motors is restricted, slowing down market expansion.

Motor Type Analysis

AC Motors dominate with 60% due to high efficiency and wide applications

The high-speed motor market is segmented by motor type into AC Motors, DC Motors, Step Motors, and others. AC Motors dominate this segment with a significant 60% market share. This dominance is due to the high efficiency, reliability, and wide range of applications of AC motors. Synchronous motors and asynchronous motors fall under the AC motors category, both playing crucial roles in various industrial applications.

Synchronous motors are highly efficient and provide constant speed, making them ideal for applications requiring precise speed control such as conveyors and compressors in industrial settings. Asynchronous motors, also known as induction motors, are widely used due to their simple construction, durability, and cost-effectiveness. They are commonly found in pumps, fans, and other industrial machinery.

DC motors, including brushless and brushed types, also hold a significant share in the market. Brushless DC motors are known for their high efficiency, low maintenance, and long operational life, making them suitable for applications like electric vehicles and power tools. Brushed DC motors, while less efficient and requiring more maintenance, are still used in many low-cost applications due to their simplicity and ease of control.

Step motors, though a smaller segment, are essential for applications requiring precise positioning and speed control, such as robotics and CNC machinery. The 'others' category includes emerging motor technologies that cater to specialized applications, providing unique benefits such as high torque or specific environmental resistance. These sub-segments, while not as dominant as AC motors, contribute to the overall growth and diversification of the high-speed motor market.

Application Analysis

Industrial application dominates with 50% due to high demand for automation

The high-speed motor market is segmented by application into Industrial, Automotive, Aerospace, Energy, and others. The industrial application segment dominates with a commanding 50% market share. This dominance is driven by the high demand for automation and efficiency in industrial processes. High-speed motors are critical in various industrial applications such as pumps, compressors, fans, and conveyors.

In industrial settings, high-speed motors improve process efficiency, reduce energy consumption, and enhance overall productivity. The use of high-speed motors in pumps and compressors helps in maintaining consistent pressure and flow rates, essential for many manufacturing processes. Fans equipped with high-speed motors ensure proper ventilation and cooling, which is crucial for maintaining optimal working conditions and equipment longevity.

Automotive applications also contribute significantly to the market. Electric vehicles (EVs) rely heavily on high-speed motors for their powertrains, providing the necessary torque and speed for efficient vehicle performance. The growing adoption of EVs due to environmental concerns and regulatory support is boosting the demand for high-speed motors in the automotive sector. Additionally, high-speed motors are used in various powertrain components, enhancing vehicle efficiency and performance.

Aerospace applications, including aircraft systems and avionics, require high-speed motors for various functions such as actuation, control systems, and auxiliary power units. The energy sector uses high-speed motors in wind turbines and power generation systems, where efficiency and reliability are paramount. The 'others' category includes niche applications where high-speed motors provide specific advantages, contributing to the overall market growth.

End-User Industry Analysis

Manufacturing industry dominates with 45% due to extensive use of automation and machinery

The high-speed motor market is segmented by end-user industry into Manufacturing, Transportation, Aerospace & Defense, Energy & Utilities, Automotive, Consumer Electronics, and others. The manufacturing industry dominates this segment with a substantial 45% market share. This dominance is attributed to the extensive use of automation and machinery in manufacturing processes, where high-speed motors play a crucial role.

In the manufacturing industry, high-speed motors are essential for operating various types of machinery and equipment, including CNC machines, robotic arms, and automated production lines. These motors help in enhancing the efficiency, precision, and speed of manufacturing processes, thereby improving overall productivity and reducing operational costs. The growing trend towards Industry 4.0 and smart manufacturing further drives the demand for high-speed motors in this sector.

The transportation industry, including automotive and rail transport, also significantly contributes to the market. High-speed motors are used in electric and hybrid vehicles to improve efficiency and performance. In rail transport, these motors are crucial for propulsion systems and auxiliary functions, enhancing the reliability and speed of trains.

The aerospace and defense sector relies on high-speed motors for various applications such as flight control systems, actuators, and unmanned aerial vehicles (UAVs). These motors provide the necessary precision and reliability required for critical aerospace operations. The energy and utilities sector uses high-speed motors in power generation systems, including wind turbines and hydroelectric plants, where efficiency and durability are key considerations.

Consumer electronics, including household appliances and power tools, also use high-speed motors for their compact size and high performance. The 'others' category encompasses diverse applications where high-speed motors provide specific benefits, contributing to the overall market expansion.

Key Market Segments

By Motor Type

- AC Motors

- Synchronous Motors

- Asynchronous Motors

- DC Motors

- Brushless DC Motors

- Brushed DC Motors

- Step Motors

- Others

By Application

- Industrial

- Pumps

- Compressors

- Fans

- Conveyors

- Automotive

- Electric Vehicles

- Powertrain Components

- Aerospace

- Aircraft Systems

- Avionics

- Energy

- Wind Turbines

- Power Generation Systems

- Others

By End-User Industry

- Manufacturing

- Transportation

- Aerospace & Defense

- Energy & Utilities

- Automotive

- Consumer Electronics

- Others

Growth Opportunities

Integration with IoT and Predictive Maintenance Offers Growth Opportunity

The integration of high-speed motors with Internet of Things (IoT) technology presents a major growth opportunity. By incorporating sensors and connectivity features, manufacturers can offer predictive maintenance capabilities, reducing downtime and improving motor lifespan. For example, companies like ABB and Siemens are developing smart motor systems that can predict failures before they occur, allowing for scheduled maintenance and improved operational efficiency.

This proactive approach not only minimizes unexpected breakdowns but also extends the operational life of high-speed motors. Additionally, the data collected through IoT integration can help in optimizing performance and energy consumption, leading to cost savings for businesses. As more industries adopt IoT technologies, the demand for high-speed motors with these advanced features is expected to grow significantly.

Customization for Niche Applications Offers Growth Opportunity

There is a growing demand for customized high-speed motors in specialized applications such as aerospace, medical devices, and renewable energy infrastructure solutions. Manufacturers who can provide tailored solutions for these niche markets can capture significant value. For instance, in the medical field, high-speed motors are being used in advanced surgical tools like dental drills and orthopedic saws, requiring specific designs to meet strict medical standards.

Similarly, the aerospace industry demands motors that can withstand extreme conditions while maintaining high performance. By focusing on the unique requirements of these sectors, manufacturers can differentiate themselves and secure a competitive edge. The ability to deliver specialized, high-performance motors will be crucial in tapping into these lucrative niche markets.

Trending Factors

Shift Towards More Compact and Lightweight Designs Are Trending Factors

There is a growing trend towards miniaturization in various industries, driving demand for smaller, lighter high-speed motors. This trend is particularly evident in sectors like aerospace and portable electronics. For example, in the drone industry, manufacturers are constantly seeking more compact and efficient motors to improve flight time and payload capacity.

Smaller, lighter motors also contribute to overall energy efficiency and cost savings, making them attractive across multiple applications. The push for miniaturization is likely to continue as technology advances, offering significant opportunities for high-speed motor manufacturers to innovate and meet the evolving needs of their customers.

Increasing Focus on Sustainability Are Trending Factors

The trend towards sustainable and environmentally friendly technologies is influencing the high-speed motor market. Manufacturers are developing more energy-efficient motors and exploring the use of sustainable materials in motor construction.

For instance, some companies are researching the use of recycled rare earth magnets in motor production to reduce environmental impact and address concerns about the supply of these critical materials. This focus on sustainability is driven by both regulatory pressures and consumer demand for greener products. By prioritizing eco-friendly practices, high-speed motor manufacturers can not only comply with regulations but also appeal to environmentally conscious customers, enhancing their market position and long-term viability.

Regional Analysis

APAC Dominates with 37.2% Market Share in the High Speed Motor Market

APAC’s 37.2% market share in the high speed motor market can be attributed to rapid industrialization and the expansion of manufacturing sectors. The region’s robust growth in automotive, aerospace, and industrial machinery, where high speed motors are crucial, supports this significant market share. Additionally, investments in innovation and the adaptation of advanced manufacturing technologies play a vital role.

The regional dynamics of APAC are greatly influenced by its large manufacturing base and growing economic activities. The demand for high speed motors is also driven by the increasing automation in manufacturing processes and the need for energy efficiency, which are priorities in countries like China, Japan, and South Korea.

Looking ahead, APAC’s influence in the high speed motor market is expected to continue growing. The region’s commitment to technological advancement and its strategic investments in sectors reliant on high speed motors are likely to keep driving demand. Moreover, the shift towards more sustainable and efficient technologies will bolster market growth.

Regional Market Shares and Dynamics:

- North America: With about 29% of the market, North America’s performance is strengthened by its advanced industrial sector and high adoption rates of automation technologies. The region’s focus on energy-efficient technologies and strong regulatory frameworks will likely sustain its market growth.

- Europe: Holding around 26% of the market share, Europe's market is driven by its stringent energy efficiency regulations and the high adoption of advanced technologies across its industrial sectors. Europe's emphasis on innovation and sustainability in manufacturing processes also supports the demand for high speed motors.

- Middle East & Africa: This region accounts for approximately 4% of the market. The smaller share is due to less industrialization compared to other regions. However, ongoing industrial development and investments in infrastructure are expected to increase the demand for high speed motors.

- Latin America: Representing 4% of the market, Latin America's growth is fueled by industrial upgrading and increasing automation in manufacturing. Economic stabilization and investments in sectors like mining and manufacturing will likely enhance the adoption of high speed motors.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The High Speed Motor Market is expanding rapidly, driven by increasing demand in industrial applications. Siemens AG and GE Power Conversion are at the forefront of this market, known for their advanced technologies and strong brand presence. These companies lead the market by continuously innovating and setting new benchmarks for performance and efficiency.

Nidec Corporation and ABB Ltd. focus on energy-efficient solutions, which are becoming increasingly important as industries seek to reduce their carbon footprints. This focus on sustainability not only drives market growth but also aligns with global environmental trends. Toshiba Corporation and WEG Electric Corp. cater to a broad range of sectors with their diverse product offerings, enhancing their market reach and influence.

Emerson Electric Co. and Mitsubishi Electric Corporation maintain competitive advantages through extensive research and development efforts. Their commitment to innovation ensures that they remain at the cutting edge of technology. Hitachi Ltd. and Regal Beloit Corporation have expanded their market presence through strategic acquisitions, enabling them to offer comprehensive solutions to their customers.

Companies like Synchrony (Dresser-Rand Group Inc.) and Meidensha Corporation focus on niche markets, where they can exert significant influence through specialized products. Danfoss and Continental AG emphasize innovation and sustainability, setting industry standards and driving market trends. Fuji Electric Co., Ltd. combines technological expertise with excellent customer service, securing a strong position in the market.

These companies employ strategies such as mergers and acquisitions, product diversification, and geographic expansion to strengthen their market positions. Their focus on energy efficiency and sustainability aligns with market trends, enhancing their competitive advantages. Leading firms like Siemens and GE Power Conversion drive market trends through innovation and strategic collaborations, shaping industry standards and fostering market growth.

Market Key Players

- Siemens AG

- GE Power Conversion

- Nidec Corporation

- ABB Ltd.

- Toshiba Corporation

- WEG Electric Corp.

- Emerson Electric Co.

- Mitsubishi Electric Corporation

- Hitachi Ltd.

- Regal Beloit Corporation

- Synchrony (Dresser-Rand Group Inc.)

- Meidensha Corporation

- Danfoss

- Continental AG

- Fuji Electric Co., Ltd.

Recent Developments

October 2023: Ford reported its third-quarter 2023 financial results, indicating strong demand for its products. The company earned USD 9.4 billion in adjusted EBIT through the third quarter, and although full-year guidance was withdrawn due to the UAW strike, Ford reaffirmed its commitment to the Ford+ strategy. This strategy emphasizes growth through software-enabled services and advanced driver-assistance systems like Ford BlueCruise. The company is also focusing on improving quality and reducing costs to enhance profitability.

January 2023: Caterpillar announced an investment in Lithos Energy, a U.S.-based battery technology company specializing in high-performance lithium-ion battery packs. This investment aims to accelerate the development of Caterpillar's electrified product portfolio, enhancing the performance of equipment used in demanding environments. Caterpillar's collaboration with Lithos supports its commitment to providing lower-carbon advanced power technologies for hybrid and full-electric machines.

Report Scope

Report Features Description Market Value (2023) USD 13.1 Billion Forecast Revenue (2033) USD 22.9 Billion CAGR (2024-2033) 5.9% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Motor Type (AC Motors [Synchronous Motors, Asynchronous Motors], DC Motors [Brushless DC Motors, Brushed DC Motors], Step Motors, Others), By Application (Industrial [Pumps, Compressors, Fans, Conveyors], Automotive [Electric Vehicles, Powertrain Components], Aerospace [Aircraft Systems, Avionics], Energy [Wind Turbines, Power Generation Systems], Others), By End-User Industry (Manufacturing, Transportation, Aerospace & Defense, Energy & Utilities, Automotive, Consumer Electronics, Others) Regional Analysis North America - The US, Canada, & Mexico; Western Europe - Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe - Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC - China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America - Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa - Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Siemens AG, GE Power Conversion, Nidec Corporation, ABB Ltd., Toshiba Corporation, WEG Electric Corp., Emerson Electric Co., Mitsubishi Electric Corporation, Hitachi Ltd., Regal Beloit Corporation, Synchrony (Dresser-Rand Group Inc.), Meidensha Corporation, Danfoss, Continental AG, Fuji Electric Co., Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-