Gluten-Free Products Market Type Analysis(Snacks And RTE Products, Bakery Products, Dairy/ Dairy Alternatives and Other), Distribution Analysis, Conventional Stores, Grocery Stores and Other), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2023-2032

-

3291

-

Jul 2023

-

181

-

-

This report was compiled by Shreyas Rokade Shreyas Rokade is a seasoned Research Analyst with CMFE, bringing extensive expertise in market research and consulting, with a strong background in Chemical Engineering. Correspondence Team Lead-CMFE Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

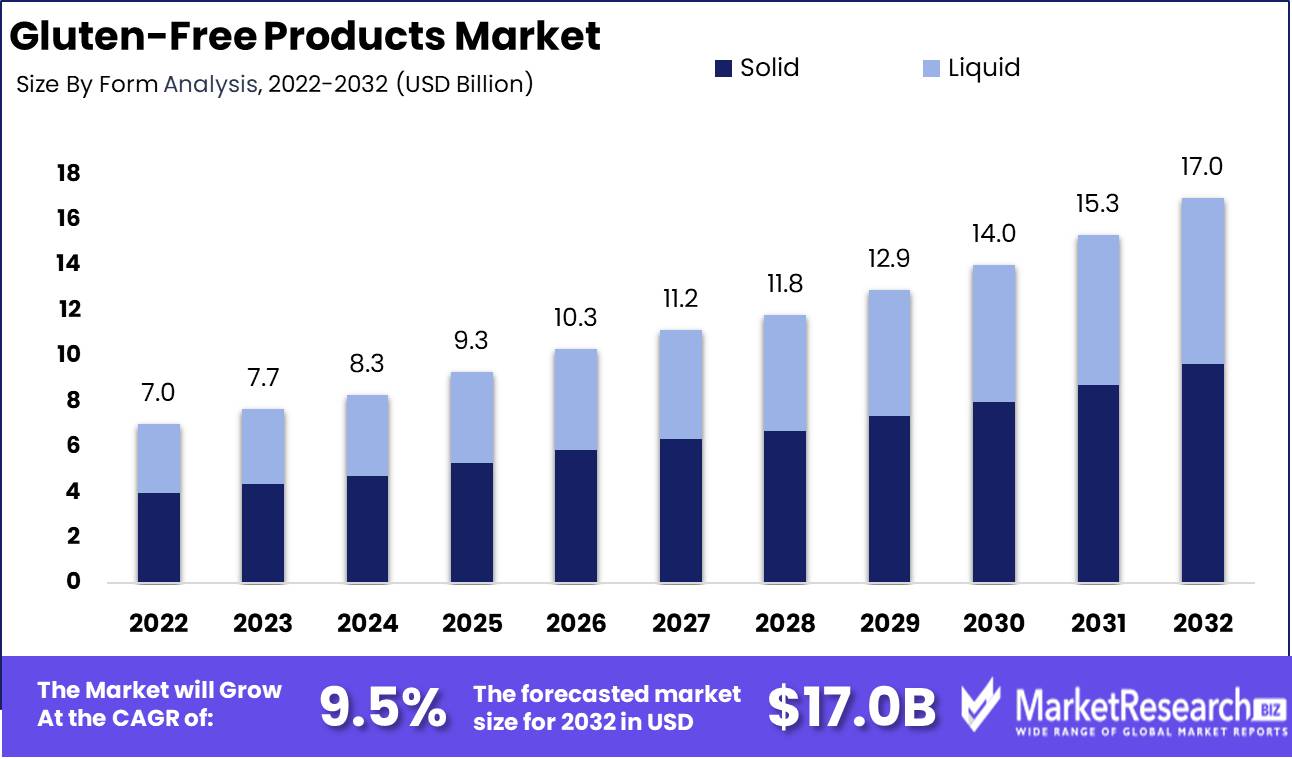

Gluten-Free Products Market size is expected to be worth around USD 17.0 Bn by 2032 from USD 7.0 Bn in 2022, growing at a CAGR of 9.5% during the forecast period from 2023 to 2032.

The exorbitant and ever-expanding gluten-free products market is a colossal industry with an abundance of bread, pasta, snacks, and other packaged goods worth billions of dollars and showing no signs of diminishing. Despite being predominantly marketed to those with celiac disease or gluten sensitivity, gluten-free products have gradually acquired popularity among health-conscious consumers, which has contributed to the expansion of the industry. Numerous companies are vying for market share in a highly competitive environment, leading to a market that is fiercely competitive.

Gluten-free products, as their name implies, do not contain gluten, a protein primarily found in cereals such as wheat, rye, and barley. It has been demonstrated that this protein causes inflammation in the small intestines of individuals with celiac disease, leading to a variety of health complications. Therefore, the gluten-free products market seeks to provide tasty, nutritious, and secure alternatives to conventional foods.

The gluten-free products market is a lifesaver for those with celiac disease, gluten sensitivity, or gluten intolerance. These products offer a variety of gluten-free alternatives to foods that are typically off-limits. In addition, gluten-free products have increased in prominence among health-conscious consumers who wish to limit their gluten consumption and embrace whole foods.

The gluten-free products market has undergone significant changes and innovative adaptations over the years. One such development is the use of alternative flours such as coconut, almond, and quinoa flour, which are healthier alternatives to conventional wheat flour and offer a wide range of gluten-free health products. In terms of flavour and texture, the industry has made significant advancements, producing products that are nearly indistinguishable from their wheat-based counterparts.

Diverse industries, including the food and beverage, pharmaceutical, and cosmetic sectors, have made substantial investments in the gluten-free products market. Large corporations in the food and beverage industry, such as General Mills, Kellogg's, and Nestle, have significantly invested in research and development to create innovative and delicious gluten-free products. In addition, restaurants and cafes have begun to offer gluten-free options in response to the growing demand for gluten-free products.

Driving factors

Customers Concerned With Their Health

The recognition and diagnosis of celiac disease and gluten sensitivity have led to an increase in the demand for products that are gluten-free. As more people become aware that they are gluten sensitive, they look for gluten-free alternatives that are natural and organic. This has prompted food producers to design creative gluten-free products that cater to the demands of the expanding number of customers who are health concerned.

Stringent Labelling Regulations

The regulatory climate that encompasses the gluten-free products market has not seen significant shifts in recent years. In spite of this, producers have a responsibility to ensure that severe labeling standards are followed in order to protect those who are gluten-sensitive.

Large Food Manufacturers and Consumer Behaviour

The entry of significant food manufacturers into the gluten-free market or alterations in consumer behavior, such as the recent trend towards more plant-based diets as a result of the COVID-19 epidemic, both have the potential to cause a disruption in the existing competitive environment.

Restraining Factors

Availability of gluten-free products is limited in some regions

The limited availability of gluten-free products in certain regions is one of the greatest factors restraining the gluten-free products market. Many regions of the globe still lack access to gluten-free products, making it difficult for individuals with gluten intolerance or sensitivity to control their diet. Some countries have even outlawed the sale of gluten-free products, making it nearly impossible for those with gluten intolerance or sensitivity to locate the necessary products. This dearth of gluten-free product availability is a significant concern for both consumers and manufacturers in the gluten-free products market.

Products that are gluten-free come at a high price

The high price of gluten-free products is another key factor restraining the market for these products. Gluten-free products are typically considerably more expensive than their gluten-containing counterparts. This is in part because gluten-free products require more expensive basic materials. In addition, because gluten-free products have a limited consumer base, manufacturers cannot attain the same economies of scale as those producing non-gluten-free products. This may cause gluten-free products to be prohibitively expensive for some consumers.

Type Analysis

The Snacks and RTE Products Segment has been driving this expansion over the past few years. This segment includes gluten-free munchies and ready-to-eat dishes, making them suitable for individuals with gluten intolerance or celiac disease.

The growth of the Snacks and RTE Products Segment is driven by economic development in emerging economies. As the population of these countries becomes more affluent, they adopt Western eating patterns, which frequently involve grazing and convenience foods. Even if they have not been diagnosed with gluten sensitivity, many people are seeking gluten-free options as the health and wellness movement gains popularity. This trend has been especially prominent in nations such as China, India, and Brazil.

Snacks and RTE Products Segment is experiencing a swift shift in consumer behavior. Today's consumers want gluten-free products that are also healthful, convenient, and delicious. Companies invest significantly in product innovation to ensure that their gluten-free munchies and RTE meals meet these requirements.

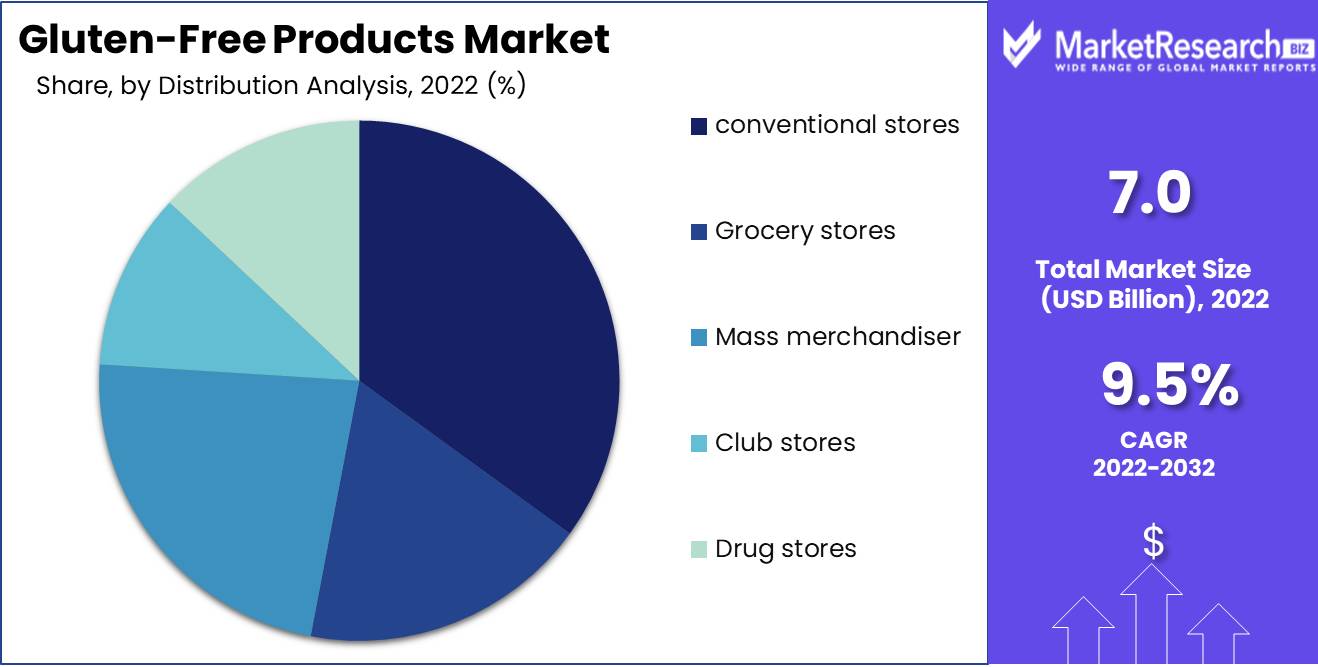

Distribution Analysis

When it comes to the distribution of gluten-free products, conventional stores continue to be the dominant channel. These include supermarkets, hypermarkets, and grocery stores. The dominance of conventional stores is due to the fact that they offer a variety of gluten-free products in one location, making it convenient for consumers to purchase. In addition, conventional stores offer a greater degree of product visibility, which is essential for companies seeking to market their gluten-free products to a larger audience.

The emergence of convenience stores as a distribution channel for gluten-free products is being driven by economic growth in emergent economies. As these nations become more prosperous, there is a growing demand for supermarkets and hypermarkets resembling those in the West that carry a wide variety of products, including gluten-free options. As more consumers turn to online platforms to purchase groceries, the trend towards online purchasing is also bolstering the expansion of conventional stores.

Form Analysis

The form of gluten-free products is also a significant factor in the expansion of the gluten-free market. The Solid Form Segment, which includes pasta, bread, and cereal, is the dominant form of gluten-free products.

The dominance of solid-form products is due to their adaptability. These products can be used to create a vast array of dishes, from simple sandwiches to intricate pasta dishes. This adaptability has made them a popular option among consumers, especially those with gluten intolerance or celiac disease.

Additionally, economic growth in emerging economies is propelling the expansion of the Solid Form Segment. As the population of these nations becomes more affluent, they adopt Western eating habits, which frequently include bread, macaroni, and cereal. With the rise of the health and wellness movement, an increasing number of individuals are searching for gluten-free alternatives in these product categories.

Key Market Segments

Type Analysis

- Snacks and RTE Products

- Bakery products

- Dairy/ dairy alternatives

- Meats/ meats alternatives

- Condiments, seasonings, spreads

- Desserts & ice-creams

- Prepared foods

- Pasta and rice

Distribution Analysis

- conventional stores

- Grocery stores

- Mass merchandiser

- Club stores

- Drug stores

Form Analysis

- Solid

- Liquid

Growth Opportunity

Developing New Geographical Markets

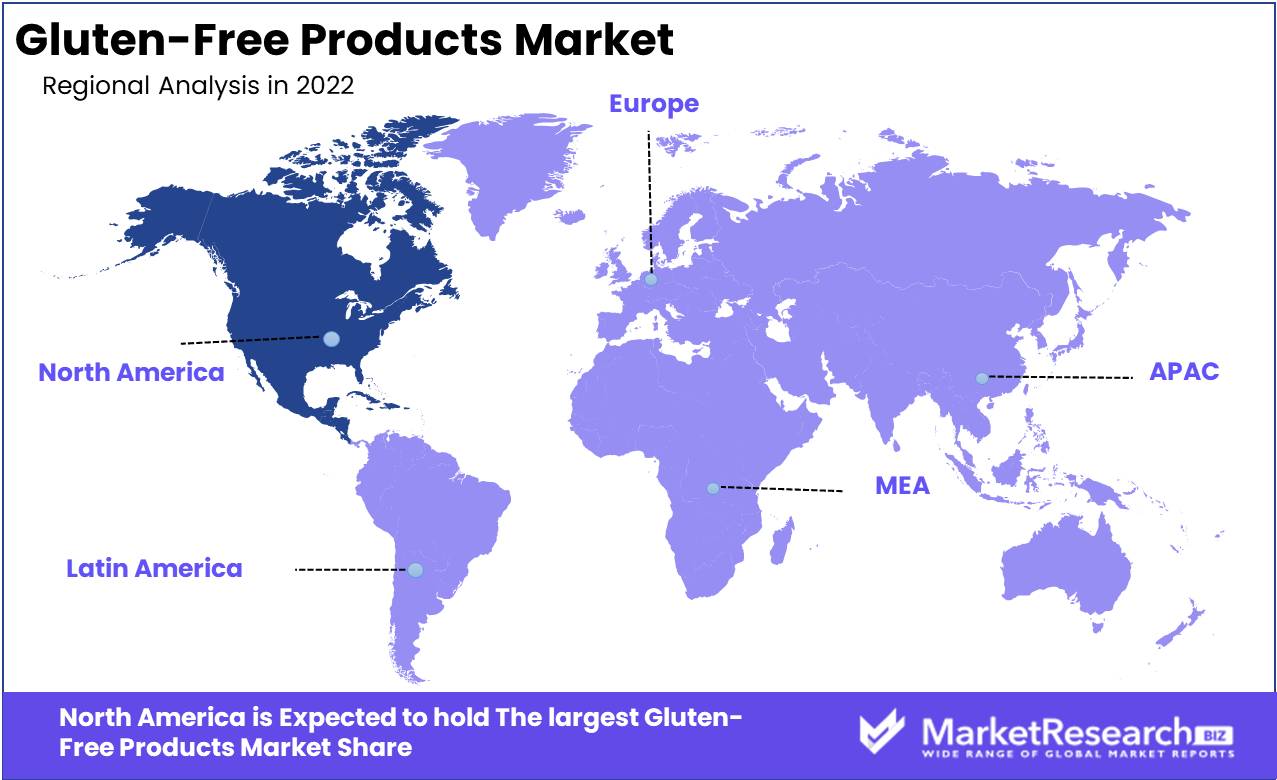

The expansion into new geographic markets represents one of the greatest growth opportunities for gluten-free food manufacturers. Europe and North America have been the primary markets for gluten-free products to date. However, the demand for gluten-free products is developing significantly in Asia-Pacific, Latin America, and the Middle East, where gluten intolerance and celiac disease are becoming more prevalent. Adapting the product offering to local preferences and cultures, with an emphasis on high-quality ingredients, convenience, and affordability, will be the key to success in these new markets.

Gluten-Free Food Product Development and Marketing for Millennials and Generation Z

Millennials and Generation Z are fueling the demand for gluten-free food products, and manufacturers who comprehend their distinctive preferences and tastes will be well-positioned for growth. These consumers seek food items that are not only gluten-free, but also organic, non-GMO, and sourced sustainably. In addition, they seek convenience, authenticity, and transparency in the products they ingest. These influential consumers will be won over by gluten-free food producers who are able to meet these requirements while also developing novel and delectable products.

Collaborations with dining establishments to provide gluten-free menu options

Gluten-free diners have historically had a difficult time in restaurants, as gluten is prevalent in many dishes and cross-contamination is a major concern. However, collaborations between restaurants and gluten-free food manufacturers can assist in addressing this problem by creating gluten-free menu options. This partnership can be beneficial for both parties, as it enables restaurants to attract and retain gluten-free consumers while also generating additional revenue streams for gluten-free food manufacturers. This strategy can also assist in bridging the divide between online and offline sales by fostering brand awareness and consumer loyalty.

Latest Trends

Increasing predilection for diets based on plants

There has been a remarkable transition toward plant-based diets as the number of individuals adopting a healthier lifestyle increased. Concerns about the environmental impact of livestock production, animal welfare, and personal health have fuelled this trend. Diets based on plants have gained popularity among those seeking gluten-free diets as well. Gluten-free plant-based alternatives such as quinoa, legumes, lentils, nuts, and seeds have acquired popularity, and food manufacturers are rapidly expanding their product offerings to serve this market segment.

Athletes and fitness enthusiasts are adopting gluten-free diets

A gluten-free diet is one method athletes and fitness enthusiasts can enhance their performance. Gluten-free diets have been shown to enhance athletic performance and recuperation by decreasing inflammation, which results in faster muscle recovery and less muscle soreness. In turn, this has increased the demand for gluten-free products in the sports nutrition market, which is expected to grow exponentially over the next few years.

Food industry growth and online retail channel expansion

With the emergence of e-commerce sites and online grocery stores, gluten-free products are more accessible to consumers. The food industry has undergone a rapid transformation, with a multitude of new entrants introducing innovative gluten-free products to meet rising demand. This has increased competition, which has ultimately resulted in price reductions, making gluten-free products more accessible and affordable to consumers.

Regional Analysis

North America Leads in Revenue Share for the Year 2022

North America continued to dominate the market in 2022, accounting for 36.9% of the total revenue. North America has been the epicenter of economic development for decades, so this accomplishment is not surprising. The region has achieved technological and innovative leadership. This article will investigate the reasons for North America's continuous success and why it has maintained its market dominance.

Infrastructure is crucial to the economic progress and development of any region. North America's infrastructure is by far the most developed in the world. The region's roads, bridges, airports, and railroads are modern and well-maintained. This infrastructure has enabled quick and effective conveyance, which is advantageous for conducting business. Airports and seaports in North America have also facilitated international trade, which has significantly increased its revenue share.

Most developed nations are now propelled by innovation and technology. From Silicon Valley to innovative manufacturing processes, North America has always been at the vanguard of technological advancements. Innovation plays a crucial role in the creation of new industries, products, and services, which has contributed to the overall development of North America. The region's innovation and technology have made it an attractive market for foreign investment, creating employment opportunities for the local populace and fostering business expansion.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

Over the years, the gluten-free products market has grown at a consistent rate, and its main players are continuously expanding their product lines to meet the rising demand. These participants include both major food and beverage corporations and smaller, specialized businesses.

General Mills, which owns renowned gluten-free brands such as Cheerios, Chex, and Betty Crocker, is one of the most prominent participants in the gluten-free market. The company has made a concerted effort to develop gluten-free versions of many of its most popular products, which has contributed to increased sales and market share.

Nestle is another significant market participant, with a portfolio of gluten-free products that includes KitKat, Smarties, and Nesquik. The company has invested in R&D to create new, innovative gluten-free products and to expand its offerings internationally.

In recent years, many specialized gluten-free companies have acquired popularity alongside these large corporations. These brands include Udi's Gluten-Free, which provides a variety of gluten-free bread and baked products, and Glutino, which specializes in nibbles and sweets.

Top Key Players in Gluten Free Products Market

- Boulder Brands, Inc.

- Hain Celestial Group

- General Mills, Inc.

- The Kellogg Company

- Kraft Foods Inc.

- Hero Group AG

- Schaer Spa

- Freedom Foods Group Limited

- General Mills, Inc.

Recent Development

- In 2022, Nestlé launched a gluten-free version of its popular KitKat chocolate bar in the UK. This was a major development, as KitKat is one of the most popular chocolate bars in the world. The gluten-free version of KitKat is made with rice flour and tapioca starch.

- In 2022, the company announced that it would make nearly 90% of its Cheerios breakfast cereals gluten-free. This was a major development, as Cheerios is one of the most popular breakfast cereals in the world. The gluten-free versions of Cheerios are made with oats that have been certified gluten-free.

- In 2022, the company launched a gluten-free version of its popular Beyond Burger. This was a major development, as the Beyond Burger is one of the most popular plant-based burgers in the world. The gluten-free version of the Beyond Burger is made with pea protein, rice protein, and coconut oil.

- In 2023, the company introduced a gluten-free menu that includes items such as the Crunchwrap Supreme, the Quesadilla, and the Taco Salad. This was a major development, as Taco Bell is one of the most popular fast-food chains in the world. The gluten-free menu items at Taco Bell are made with certified gluten-free ingredients.

Report Scope

Report Features Description Market Value (2022) USD 7.0 Bn Forecast Revenue (2032) USD 17.0 Bn CAGR (2023-2032) 9.5% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered Type Analysis(Snacks and RTE Products, Bakery products, Dairy/ dairy alternatives, Meats/ meats alternatives, Condiments, seasonings, spreads, Desserts & ice-creams, Prepared foods, Pasta and rice), Distribution Analysis, conventional stores, Grocery stores, Mass merchandiser, Club stores, Drug stores, Form Analysis(Solid, Liquid) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Boulder Brands, Inc., Hain Celestial Group, General Mills, Inc., The Kellogg Company, Kraft Foods Inc., Hero Group AG, Schaer Spa, Freedom Foods Group Limited, General Mills, Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Boulder Brands, Inc.

- Hain Celestial Group

- General Mills, Inc.

- The Kellogg Company

- Kraft Foods Inc.

- Hero Group AG

- Schaer Spa

- Freedom Foods Group Limited

- General Mills, Inc.