Hard Candy Market By Flavor (Fruit Flavors, Strawberry, Lemon,and Others), By Packaging (Pouches, Jars, Boxes, Wrappers, Others), By Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores, And Others), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2023-2032

-

37447

-

June 2023

-

137

-

-

This report was compiled by Shreyas Rokade Shreyas Rokade is a seasoned Research Analyst with CMFE, bringing extensive expertise in market research and consulting, with a strong background in Chemical Engineering. Correspondence Team Lead-CMFE Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

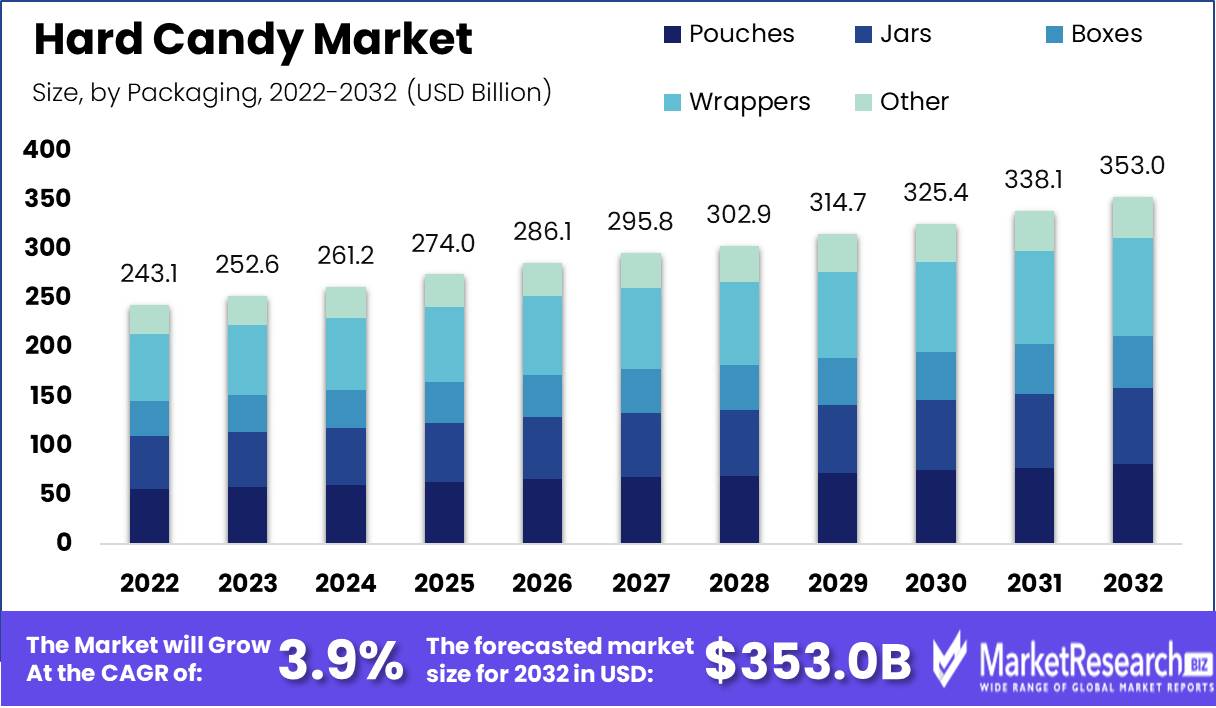

Hard Candy Market size is expected to be worth around USD 353.0 Bn by 2032 from USD 243.1 Bn in 2022, growing at a CAGR of 3.9% during the forecast period from 2023 to 2032.

Global Hard Candy Market has seen an astounding increase in growth and development, capturing the attention of candy lovers everywhere. Hard candy, distinguished by its rigid texture, brittleness, and propensity to fracture upon biting, is a testament to confectionery craftsmanship. With a kaleidoscope of vibrant colors and a symphony of tantalizing flavors, the overwhelming variety of hard candy is awe-inspiring. Sugar, maize syrup, and a symphony of fruits, nuts, and seasonings create these delectable confections. This phenomenal trajectory has been significantly influenced by the exponential growth of the confectionery industry. Hard Candy Market is evolving to accommodate to the discerning preferences of health-conscious consumers around the globe.

Prepare to navigate the labyrinthine alleys of the Hard Candy Market Research Report, where insights into the industry's current trends, emerging opportunities, as well as its challenges and threats, are awaiting your perusal. A panoramic view of the market landscape and its bountiful growth prospects will unfold before your eyes, revealing its hidden secrets. The history of Hard Candy can be traced back to ancient civilizations, who, equipped with the knowledge of the gods, created their own variants of this sweet treat. By combining honey with a variety of exotic seasonings and herbs, they laid the groundwork for a legacy that continues to flourish to this day. In the modern era, the Hard Candy industry has developed into a flourishing colossus, dominating the confectionery market with its vast assortment of flavors and hues.

At the core of the Hard Candy industry is an unwavering mission: to titillate consumers' taste receptors with a wide variety of succulent confections. Hard Candy is appealing not only because of its rigidity, fragility, and tendency to disintegrate, but also because of its kaleidoscope of flavors, hues, and textures. Hard Candy, a nexus of sugar, sugar substitutes, sweeteners, pigments, essences, and a plethora of other ingredients, serves as the canvas upon which confectioners create their delectable tapestries.

Age- and culture-independent, the Hard Candy industry plays a crucial role in satisfying the universal desire for flavor. This industry provides employment opportunities, generates considerable revenue for both manufacturers and distributors, and contributes significantly to economic growth. Hard candy, which is not only a delicious source of energy but also a mood-altering substance when consumed in moderation, emerges as a guilt-free indulgence for those seeking the pleasures of a sweet respite without the burden of excessive caloric.

Driving factors

Consumer Preference for Sugary Delights

In the coming years, it is anticipated that the Global Hard Candy Market will expand significantly. The predilection of consumers for delectable indulgences is contributing to this expansion. People have always had a sweet appetite, but in recent years, the variety of flavors and textures offered by manufacturers has increased the demand for hard candies. The hard candy industry has been accommodating consumers' desires for a variety of flavors, from bitter to sweet. This has increased the popularity of firm confectionery among both children and adults.

Product Development in Packaging and Components

Product innovation in packaging and ingredients is another factor fueling the expansion of the Global Hard Candy Market. Manufacturers have developed consumer-appealing packaging that is novel and innovative. They are experimenting with eco-friendly packaging or packaging adhesives that can be reused. This appeals to eco-conscious consumers who readily adopt brands that share their values. In addition, manufacturers are experimenting with exotic ingredients in their chocolates to attract and retain consumers' interest.

Potential Effects of Regulatory Alterations

However, there are possible regulatory changes that could affect the Global Hard Candy Market. In recent years, efforts have been made to regulate the sugar content of foods. The industry of hard candies may need to devise novel approaches to reduce sugar content without sacrificing product quality or flavor.

Emerging Technologies and 3D Printing

Emerging technologies may also have an effect on the Global Hard Candy Market. One such technology is 3D printing, which has the potential to revolutionize the production of rigid confectionery. The technology would enable manufacturers to construct intricate patterns and designs on candies, thereby increasing their visual allure.

Alternate Sweeteners

Alternate sweeteners, such as stevia, could be potential disruptors that influence the competitive landscape of the Global Hard Candy Market. Due to the rising rates of diabetes and obesity, these alternative sweeteners are gaining in popularity. Manufacturers who integrate these sweeteners into their chocolates will likely enjoy a competitive advantage.

Altering Consumer Conduct and Emerging Tendencies

The Global Hard Candy Market may be impacted by new trends and shifts in consumer behavior. Increasing demand for sugar-free or low-calorie confectionery is one such trend. Manufacturers who meet this demand will likely enjoy a competitive advantage over their rivals. Similarly, as more individuals adopt a vegan or vegetarian lifestyle, producers of vegan or vegetarian hard candies are likely to capture this expanding market segment.

Restraining Factors

Concerns Relating to the Consumption of Sugar

The market for firm candies has always been criticized for the product's excessive sugar content. As consumers become more aware of the negative effects of sugar on health, they become more health-conscious and seek out healthier alternatives. The excessive sugar content of hard confectionery has been linked to obesity, tooth decay, and other health problems. To combat this issue, manufacturers must develop low- or sugar-free products. By doing so, they will be able to appeal to the health-conscious population and increase the size of the potential market.

Competition from competing confectioneries

Hard Candy Market faces competition not only from other candies, but also from healthful refreshment options such as fruits and nuts. Healthy nibbling is a rapidly growing trend, and consumers are increasingly likely to choose options with less sugar content. Manufacturers must surmount this obstacle by developing distinctive products that offer consumers a distinct experience. By developing a product with a distinct identity, manufacturers can attract consumers who are seeking something novel and not just healthful.

Potential Problems with Product Shelf Life and Freshness

The expiration life of hard confectionery is similar to that of all other candies. It becomes more difficult to chew as the product ages on the shelf. This can make the product unattractive to consumers and have a negative effect on sales. Manufacturers must resolve this issue by employing preservatives that extend the product's storage life without diminishing its flavor or quality. Alternately, they could modify the candy's formulation to increase its shelf life without sacrificing flavor. By doing so, they can ensure that the product remains fresh and alluring to consumers, thereby expanding its market potential.

Low-Calorie and Sugar-Free Alternatives

Sugar-free and low-calorie alternatives are in greater demand as a result of rising awareness of the negative effects of sugar consumption. Consumers are currently seeking sugar-free products with the same flavor and experience as traditional candies. This demand requires manufacturers to create sugar-free and low-calorie alternatives. In addition, they can use natural sweeteners like stevia and monk fruit to create healthier and more alluring products for health-conscious consumers.

Flavor Analysis

The fruit flavors segment of the hard candy business is growing fast. According to industry data, the fruit flavors segment dominates the worldwide hard candy market. Consumers like fruit tastes because they fulfill their sweet craving and are healthier than other confectionary flavors. Hard candy consumers now favor fruit flavors. Consumers are seeking better refreshment alternatives due to the health-consciousness trend. Fruit tastes are considered healthier than sugary confectionery flavors. Fruit-flavored sweets' natural flavour, considered healthier than artificial flavors, also draws customers.

Fruit flavors are gaining popularity among vegans because they are a plant-based flavoring alternative that does not contain animal-derived additives. Another factor fueling the growth of the fruit flavors segment is the increasing popularity of convenience foods. Consumers seek snacks that are portable and simple to ingest on the go. Different packages and quantities are available for fruit-flavored chocolates, making them a convenient option for snacking.

Packaging Analysis

The wrappers segment dominates the worldwide hard candy industry. User-friendly wrapper packaging enhances product shelf life. Hard chocolates in wrappers are a favorite refreshment since they're easy to carry and eat. Consumers are drawn to the wrappers market segment by convenience. Wrapper-packaged sweets are popular snacks because they are easy to carry and eat. This market segment has grown since wrapper packing extends shelf life. Candy in wrappers is popular among snackers.

Wrapper packaging's ease should keep the wrappers segment growing. On-the-go food alternatives are expected to change consumer snacking behavior, with customers selecting snacks that are easy to travel and enjoy quietly. The segment of wrapper-packaged sweets is expected to rise, with producers developing new items to fulfill demand.

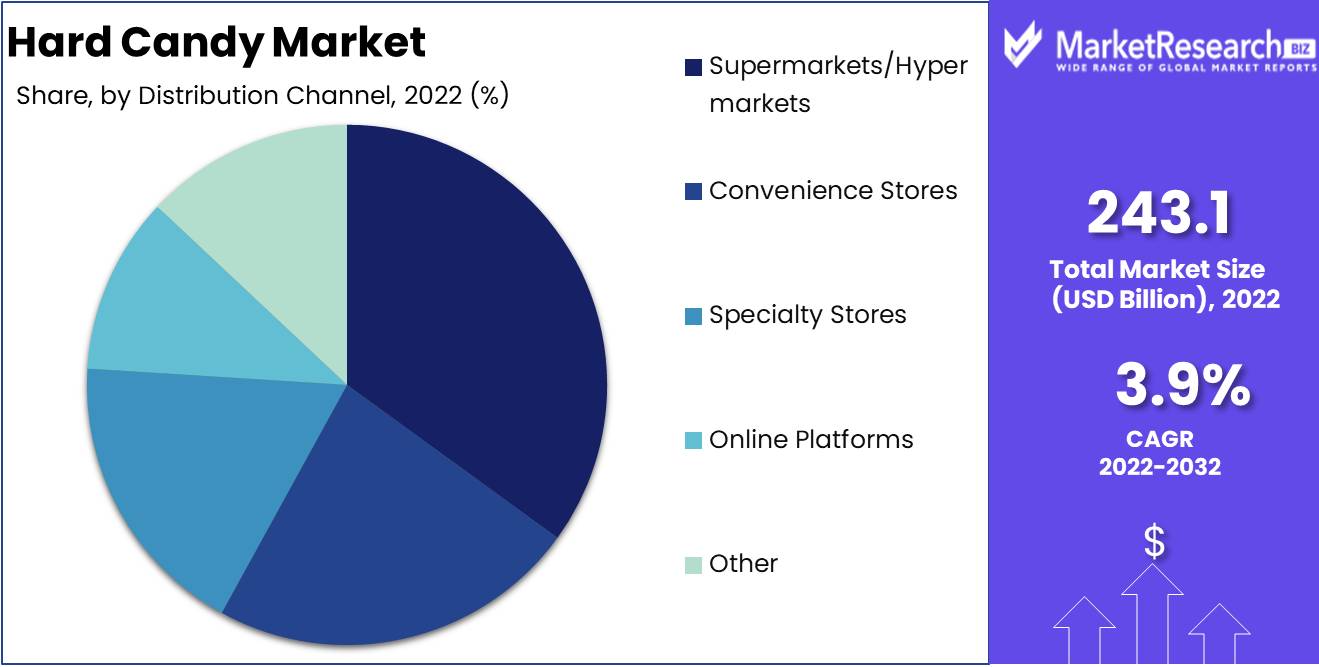

Distribution Channel Analysis

The supermarkets/hypermarkets segment dominates the global hard confectionery market, holding the largest market share. These retail locations provide consumers with convenience and accessibility, making them the preferred option for purchasing hard chocolates. Consumers are attracted to supermarkets and hypermarkets because they offer one-stop shopping for all their requirements. Attractive offers and promotions, combined with the convenience of having multiple options under one roof, have made supermarkets/hypermarkets a popular option. Consumers are drawn to these retail establishments for the purchase of hard candies due to their extensive selection and competitive pricing.

The ease of supermarkets and hypermarkets is likely to keep this segment growing. Retail chains and new market entrants will enhance competition, prompting manufacturers to provide competitive prices and promotions. This segment is predicted to develop because to its convenience, accessibility, and cheap cost.

Key Market Segments

By Flavor

- Fruit Flavors

- Strawberry

- Lemon

- Orange

- Others

- Mint Flavors

- Peppermint and Spearmint

- Chocolate

- Caramel

- Butterscotch

- Others

By Packaging

- Pouches

- Jars

- Boxes

- Wrappers

- Other Packaging

By Distribution Channel

- Supermarkets/Hypermarkets

- Convenience Stores

- Specialty Stores

- Online Platforms

- Other Distribution Channels

Growth Opportunity

Sugar-free and Healthier Options for Hard Candies

The expansion of the global market for firm candies has been fueled by consumers' increasing interest in health. The demand for sugar-free and healthful confectionery options has increased significantly as more people attempt to reduce their sugar intake. Manufacturers of sweets are responding to this trend by creating novel formulations with natural sweeteners such as stevia and erythritol. These sugar substitutes enable consumers to experience the sweet flavor of hard confectionery without the adverse health effects of added sugar. In addition, these products are frequently low in calories and cholesterol, making them an attractive option for health-conscious consumers.

Market expansion abroad

While hard candies have traditionally been popular in American and European markets, there is potential for development in international markets. Emerging economies such as China and India are experiencing a rise in disposable income, resulting in an increase in demand for novel and thrilling refreshment options. To take advantage of this opportunity, confectionery companies are entering these markets and offering flavors and packaging that appeal to local preferences. By comprehending and adapting to regional preferences, businesses are able to plug into new consumer bases and fuel further expansion.

Natural and organic ingredients are incorporated.

Rising demand for natural and organic ingredients has significantly contributed to the expansion of Hard Candy Market. Health-conscious consumers seek out products made with natural ingredients and devoid of artificial flavors and colors. As a result, confectionery manufacturers are incorporating fruit extracts, vegetable juice, and other natural ingredients into their recipes. In addition, they are removing artificial colors and flavors to meet the demand for greater transparency and clean labelsing. By embracing natural and organic ingredients, confectioners can attract health-conscious consumers and obtain a competitive advantage in the market.

Marketing strategies and innovative packaging

The success of hard confectionery brands requires innovative packaging and marketing strategies in a snack market that is becoming increasingly congested. To differentiate products on store displays and attract consumers' attention, attractive packaging designs are increasingly used. Unique and visually attractive packaging can elicit emotions and encourage consumer purchases. Additionally, creative marketing campaigns are assisting with brand awareness and sales. Utilizing the influence of influencer marketing, candy companies are partnering with social media influencers to promote their products on social media platforms.

Latest Trends

Sour and Fruit-Flavored Hard Candies

The rising demand for fruit-flavored and acidic hard candies is one of the leading trends in the global Hard Candy Market. Candies with a fruity flavor are a favorite among both children and adults. Young adults, on the other hand, frequently favor sour chocolates.

Formulations with Natural and Plant-Based Ingredients

The trend toward natural and clean-label products is also influencing the global Hard Candy Market. Increasingly, consumers desire products manufactured with natural and plant-based components. This trend is prompted by a concern for health and the environment. In response, manufacturers are incorporating fruit extracts, natural sweeteners, and herbal extracts into hard candies. Typically, these products are marketed as healthier alternatives to conventional hard chocolates.

Hard Candies Enhanced with Vitamins or Herbal Extracts

The demand for functional foods and beverages transcends nibble foods and beverages. Additionally, consumers are looking for chocolates with added health benefits. Health-conscious consumers are increasingly interested in hard candies with added vitamins, minerals, or herbal extracts. These items are frequently marketed as energy-enhancing or immune-enhancing chocolates.

Retro and nostalgic candy designs

Candies manufacturers are utilizing nostalgia as a potent marketing tool. Retro confectionery packaging is making a reappearance, appealing to older consumers who wish to relive their youth. These goods are frequently marketed as collector's items or limited editions.

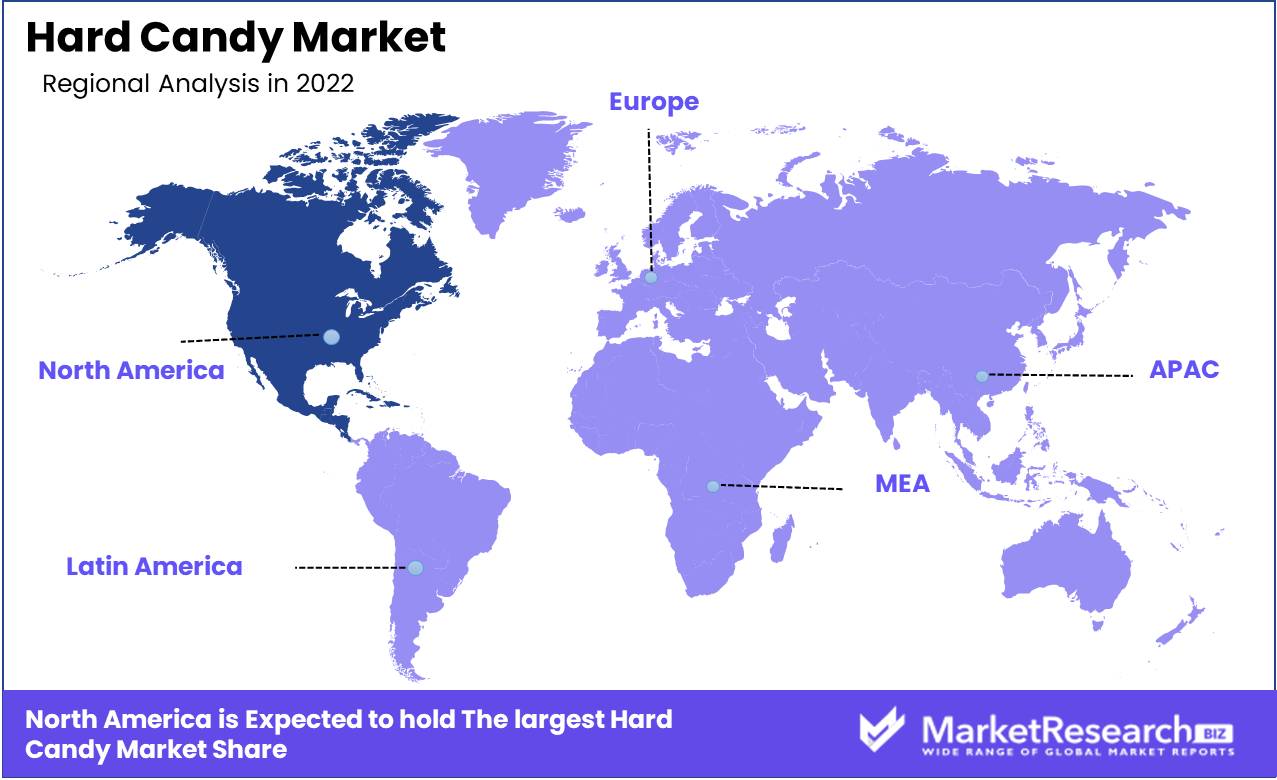

Regional Analysis

The Hard Candy Market is Predominated by North America. Regardless of the type of hard candy, one thing is certain: North America dominates the hard candy market. Recent statistics indicate that North America accounts for more than fifty percent of the global hard confectionery market. Let's investigate why North America has prevailed in this category. Taste preferences are one of the primary factors for North America's success in the hard confectionery market. Consumers in North America prefer sweet, robust flavors that persist in the palate. This is reflected in the vast variety of flavors available on the hard candy market in North America, which range from floral to piquant and everything in between.

Additionally, North American consumers have a high demand for both sweet and bitter candies. Particularly sour hard candy has become increasingly popular in recent years and dominates a substantial portion of the market for hard candy. Consumer demographics are another factor contributing to North America's dominance in the hard confectionery market. The population of North America is relatively youthful, and hard candies appeal powerfully to younger consumers. Hard candies are typically viewed as an enjoyable and playful delicacy, relished by both children and adults.

The viability of the North American hard confectionery market is largely dependent on market strategies. Specifically, branding has been a highly effective strategy. Numerous confectionery manufacturers in North America devote substantial resources to establishing a distinct brand identity for their products. This includes attention-grabbing slogans, packaging, and innovative marketing campaigns. These marketing strategies not only serve to distinguish one brand from another, but also foster consumer brand loyalty.

Hard Candy Market in North America is extremely competitive, with numerous companies competing for consumer attention. In response to this competition, confectionery manufacturers continuously innovate and provide a vast selection of products to meet consumer demand. Hard confectionery manufacturers frequently experiment with new flavors, forms, and sizes. The introduction of sugar-free hard candies, which have expanded the market to include health-conscious consumers, is a noteworthy innovation.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

Ferrara Candy Company, The Hershey Company, Arcor U.S.A., Perfetti Van Melle, Arcor Group, and Mars, Inc. are the dominant market participants. Due to their diverse product portfolio, extensive distribution channels, and strategic acquisitions, these competitors have a substantial presence on the market.

Nestle S.A. is one of the primary participants in the global hard candy market, offering an extensive selection of products under the Nestle Crunch, Butterfinger, Raisinets, and Laffy Taffy brands. Recently acquired by Ferrero, Ferrara Candy Company is renowned for its iconic labels such as Lemonheads, Red Hots, and Atomic Fireballs.

The Hershey Company, renowned for its signature Hershey's Kisses and Jolly Rancher labels, is another market leader. Arcor U.S.A., a subsidiary of Arcor Group, is a prominent manufacturer of premium candies and chocolates, offering products under the Bon o Bon and Mogul trademarks. Perfetti Van Melle, a global confectionery company, is well-known for its Mentos and Airheads trademarks, whereas Mars, Inc. offers a variety of products under well-known brands such as M&Ms and Snickers.

Top Key Players in Hard Candy Market

- Ferrero SpA

- Ferrara Candy Company

- Mars, Incorporated

- Nestlé S.A.

- The Hershey Company

- Perfetti Van Melle

- Wm. Wrigley Jr. Company

- Haribo GmbH & Co. KG

- Lotte Confectionery Co., Ltd.

- August Storck KG

- Arcor Group

- Other Key Players

Recent Development

In 2021, Hershey's announced a $50 million investment in a new hard confectionery manufacturing facility in Mexico. The facility will be located in Guadalajara and will produce various varieties of hard candy to meet the region's increasing demand.

In 2022, Mars Wrigley will declare plans to construct a $100 million manufacturing facility for hard candies in China. The facility is anticipated to produce a variety of hard confectionery products for the Chinese market and for export to other regions.

In 2023, Tootsie Roll Industries intends to construct a new $200 million manufacturing facility in the United States, representing a significant investment in the hard confectionery market. The new facility is anticipated to increase the company's hard confectionery production capacity and create new employment in the surrounding area.

Report Scope:

Report Features Description Market Value (2022) USD 243.1 Bn Forecast Revenue (2032) USD 353.0 Bn CAGR (2023-2032) 3.9% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Flavor (Fruit Flavors, Strawberry, Lemon, Orange, Others, Mint Flavors, Peppermint and Spearmint, Chocolate, Caramel, Butterscotch, Others)

By Packaging (Pouches, Jars, Boxes, Wrappers, Other Packaging)

By Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores, Specialty Stores, Online Platforms, Other Distribution Channels)Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Ferrero SpA, Mars, Incorporated, Nestlé S.A., The Hershey Company, Perfetti Van Melle, Wm. Wrigley Jr. Company, Haribo GmbH & Co. KG, Lotte Confectionery Co., Ltd., August Storck KG, Arcor Group, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Ferrero SpA

- Ferrara Candy Company

- Mars, Incorporated

- Nestlé S.A.

- The Hershey Company

- Perfetti Van Melle

- Wm. Wrigley Jr. Company

- Haribo GmbH & Co. KG

- Lotte Confectionery Co., Ltd.

- August Storck KG

- Arcor Group

- Other Key Players