Sugar Substitutes Market By Source (Natural, Artificial), By Type (High Intensity Sweetners, Low Intensity Sweetners), By Application (Food and Beverages, Pharmaceutical, Cosmetics & Personal Care), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2023-2032

-

4048

-

Oct 2023

-

159

-

-

This report was compiled by Correspondence Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Report Overview

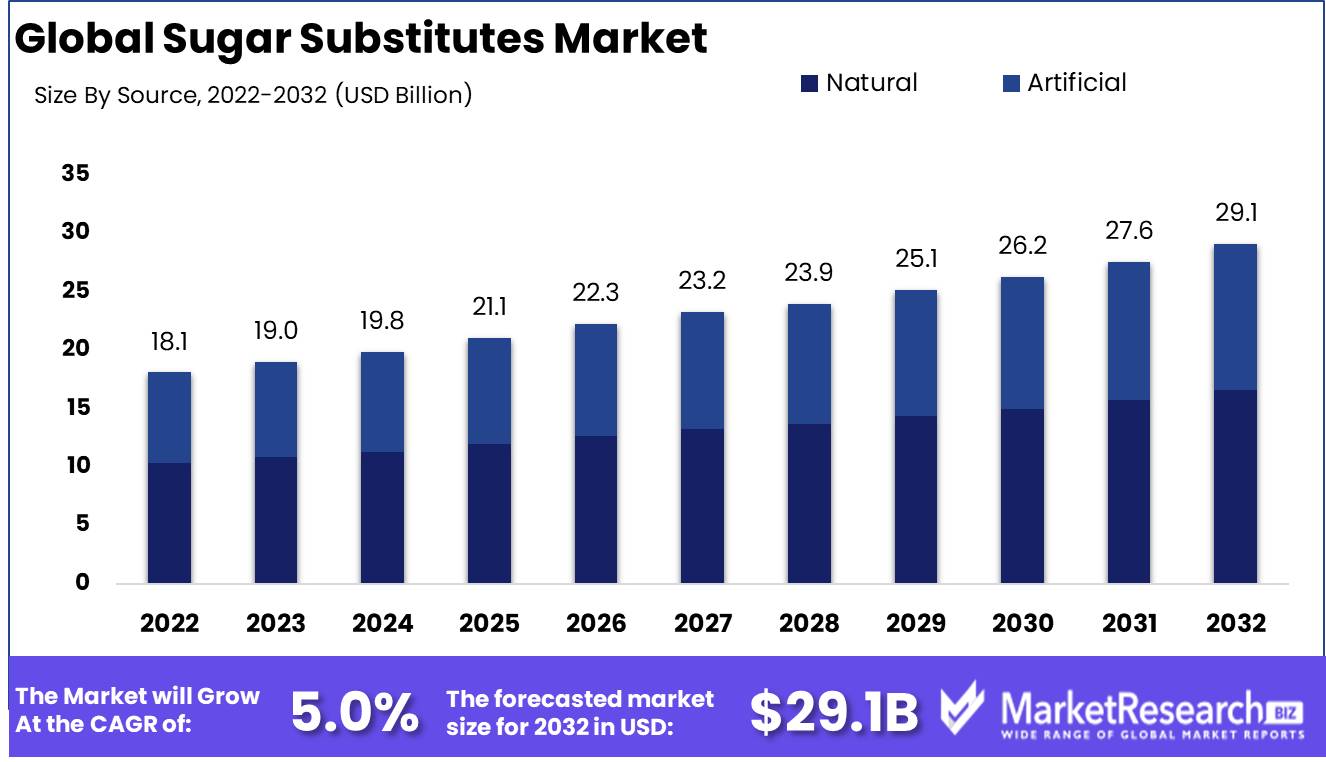

Sugar Substitutes Market size is expected to be worth around USD 29.1 Bn by 2032 from USD 18.1 Bn in 2022, growing at a compound annual growth rate (CAGR) of 5.0% during the forecast period from 2023 to 2032.

Sugar substitutes consist of alternative substances used to supplant sugar in a variety of food and beverage products. This market's primary objective is to offer consumers a healthier and more balanced option for gratifying their sugar tooth. Sugar substitutes, such as aspartame, saccharin, and stevia, are typically artificial or synthesized, as opposed to natural carbohydrates derived from sugarcane or fruit. These substitutes seek to replicate the flavor of sugar while substantially reducing or eliminating the caloric content.

The sugar substitute market holds immense significance, and it's not just about making your desserts guilt-free. Excessive sugar consumption has been linked to various health issues like obesity, diabetes, and heart disease. This market plays a vital role in promoting healthier lifestyles by offering alternatives that allow people to satisfy their sweet tooth without worrying about their health. Moreover, sugar substitutes often have lower glycemic indexes, making them suitable for diabetics and those managing their blood sugar levels.

In recent years, we've seen a noteworthy shift towards natural alternatives in the sugar substitute market. While artificial sweeteners have dominated the scene for decades, natural options are gaining traction. Take Stevia, for example. It's derived from the leaves of the Stevia rebaudiana plant and has gained popularity as a natural sugar substitute due to its plant-based origins and zero-calorie content. Other natural alternatives like monk fruit extract are also on the rise. As consumers become more conscious of what they consume, the demand for natural sugar substitutes is expected to surge.

Investments in the sugar substitute market have been pouring in from both established food and beverage giants and newcomers. This surge in demand for sugar-free and reduced-sugar products has led companies to incorporate sugar substitutes into their offerings. Whether it's soft drinks, snacks, baked goods, or dairy products, the sugar substitutes market has left its mark on nearly every corner of the food and beverage industry. This integration allows businesses to cater to health-conscious consumers without compromising on taste or appeal.

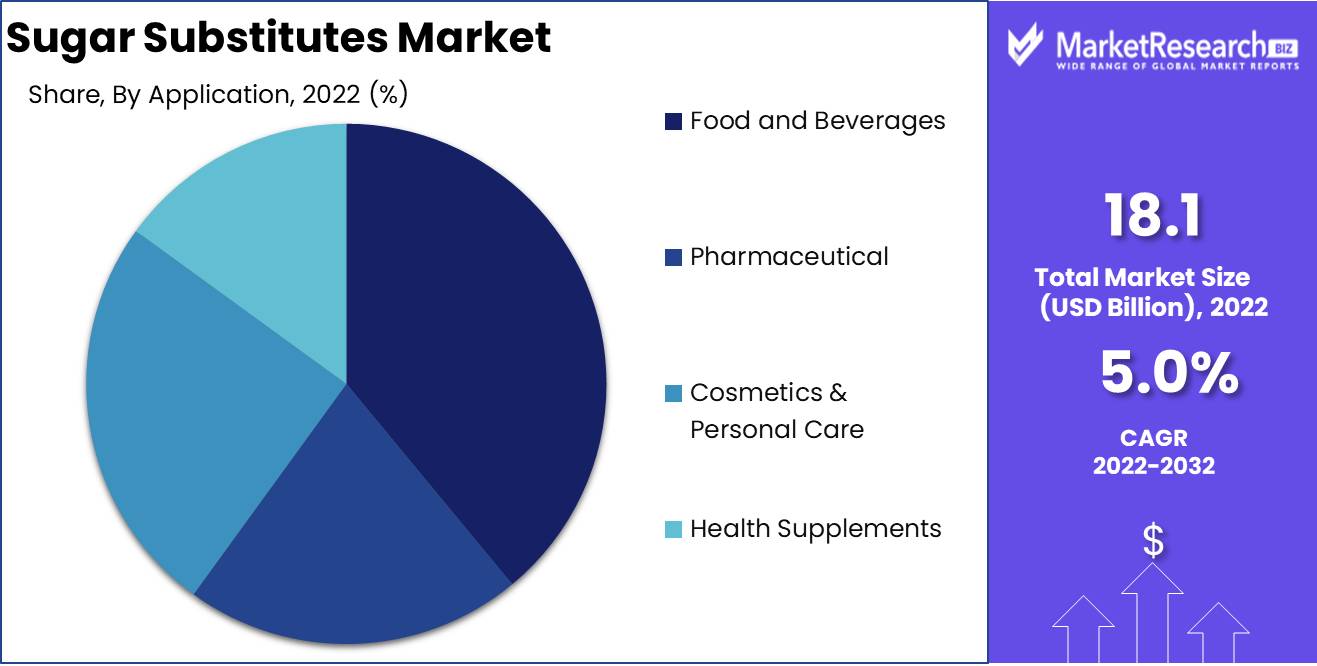

As the market continues to grow, so does the range of applications for sugar substitutes. Beyond food and beverages, they are finding their way into pharmaceutical products, oral hygiene items, and even personal care products. The versatility of sugar substitutes opens up exciting opportunities for businesses to create innovative products and services that cater to a wide array of consumers.

Driving Factors

Demand for sugar-free products is growing

More than ever, today's health-conscious consumers desire improved sugar substitutes. Individuals are actively pursuing alternatives to satisfy their sweet tooth as they become more aware of the health hazards of excessive sugar intake. Diabetic patients and those concerned about their blood pressure are particularly interested in these alternatives. Diabetes and obesity are worldwide epidemics. Several chronic health issues are caused by excessive sugar consumption, prompting people to seek out sugar substitutes. Awareness of the health risks of excessive sugar consumption has led to a healthier lifestyle, creating an opening for the sugar substitute industry.

Increased awareness of the health risks of sugar

The pervasive dissemination of health risks associated with excessive sugar intake has altered consumer preference for sugar substitutes. According to scientific research, a high sugar consumption is associated with diabetes, obesity, cardiovascular disease, and several malignancies. Consumers, especially diabetic patients, are becoming increasingly cognizant of these issues and adopting healthier sugar alternatives. People are therefore searching for alternatives to sugar that provide the same level of sweetness without the health dangers. Here, you can also include a client testimonial from someone who has benefited from using sugar substitutes to manage their health.

Increasing Food and Drink Applications

Due to applications in food and beverages, the sugar substitutes market share has expanded significantly. Manufacturers are constantly inventing new sugar substitutes to satisfy shifting consumer dietary preferences. Sugar substitutes are now present in diet beverages and sugar-free confectionery. These options are lower in sugar and calories. The market for sugar replacements is expanding swiftly to meet the food and beverage industry's demand for healthier alternatives.

Sugar Substitutes Induce Dietary Alterations

The sugar substitutes market share is affected by dietary changes among consumers. Currently, natural, organic, and plant-based products are preferable due to their health benefits and sustainability. Many natural and plant-based sweeteners have been introduced to the sugar substitutes market in response to dietary shifts. These healthful options are also environmentally sustainable.

Health Implications of Sugar Substitutes Market

The sugar substitutes market has benefited public health. Reducing sugar helps control chronic diseases such as diabetes and obesity, thereby enhancing health. Sugar substitutes allow for healthy dining without forsaking flavor. They can now enjoy their favored treats mindfully. You can include a client testimonial here to emphasize how sugar substitutes have positively impacted someone's health and lifestyle.

Restraining Factors

Comparing Taste and Texture to Sugar

One of the primary concerns regarding the use of sugar substitutes is their ability to match the flavor and consistency of sugar. Although technological advancements have made it possible to produce sugar substitutes with a sweetness that closely resembles that of sugar, there are still subtle differences in flavor and texture. Individuals habituated to the taste and texture of sugar may find it difficult to adapt to new alternatives if they differ in flavor and consistency. To eliminate this disparity and provide consumers with a seamless experience, manufacturers of sugar substitutes must continuously improve their products.

Requirements for Labeling and Regulation

Regulatory and labeling requirements are an additional factor restraining the sugar substitutes market. As with any other food product, sugar substitutes must comply with specific rules and guidelines established by regulatory authorities. This regulation violation may result in fines and legal complications. In addition, consumers must be made aware of the constituents and potential side effects of sugar substitutes through clear and accurate labeling. Companies operating in the sugar substitutes market must navigate these regulatory requirements with care to ensure compliance and build consumer trust.

Limited Consumer Acceptance and Familiarity

Despite the growing demand for sugar substitutes, a substantial portion of the population remains skeptical or ignorant of their advantages. Some consumers may find the idea of substituting sugar with artificial or natural alternatives foreign and resistant. It is essential for businesses selling sugar substitutes to educate consumers on the benefits and safety of their products. It is possible to increase consumer acceptance of sugar substitutes and encourage their wider adoption by implementing effective marketing campaigns and educational initiatives.

Competition between Natural and Synthetic Sweeteners

Both natural and synthetic sweeteners present intense competition in Sugar Substitutes Market. Because of the perception that natural sweeteners, such as stevia and monk fruit extract, are healthier alternatives to sugar, their popularity has increased. On the other hand, artificial sweeteners have been available for decades, and consumers have developed brand loyalty. Businesses must differentiate their products on the sugar substitutes market by emphasizing flavor, texture, and health advantages, amongst others, in order to achieve success.

Considerations of Cost and Affordability

In the sugar substitutes market, affordability and pricing play a substantial role in consumer decisions. Manufacturers must strike a balance between quality and price when creating sugar substitutes. It is essential to offer products at competitive prices in order to attract price-conscious consumers. Strategic pricing strategies can help position sugar substitutes as accessible alternatives for a larger audience, thereby fostering market growth.

Source Analysis

The sugar substitutes market is experiencing rapid market growth, with the natural segment taking the lead. As consumers become more health-conscious and aware of the negative effects of excessive sugar consumption, they are turning to natural alternatives. This shift in consumer behavior, combined with economic development in emerging economies, is driving the adoption of natural sugar substitutes.

Consumers are increasingly seeking out natural, plant-based alternatives to traditional sugar. They are concerned about the negative health effects of high sugar consumption, such as obesity, diabetes, and heart disease. As a result, there is a growing demand for natural sweeteners that offer similar taste and sweetness without the negative effects of sugar. This trend is driving the growth of the natural segment in the sugar substitutes market.

Type Analysis

The high-fructose syrup segment currently dominates the sugar substitutes market. High-fructose corn syrup is widely used in various food and beverage products, including soft drinks, baked goods, and processed foods. This segment is driven by economic development in emerging economies.

Consumers are increasingly concerned about the negative health effects of regular sugar, such as high-fructose corn syrup. There is a growing awareness of the link between excessive consumption of sugar content and health issues such as obesity and metabolic disorders. As a result, some consumers are actively seeking out alternatives to products that contain high-fructose syrup, opting for natural or low-calorie sweeteners like sugar alcohol instead.

Application Analysis

The food and beverages segment is the largest and most dominant in the sugar substitutes market. This segment includes various applications such as bakery, confectionery, beverages, and dairy products. Economic development in emerging economies is a key factor driving the adoption of sugar substitutes in the food and beverages segment.

Consumers are becoming more health-conscious and are seeking out healthier food and beverage options. They are concerned about the negative effects of excessive conventional sugar consumption and are actively looking for alternatives. This trend is driving the adoption of sugar substitutes in various food and beverage applications, as consumers seek products that offer the same taste and sweetness without the negative health effects of animal-derived products.

Key Market Segments

By Source

- Natural

- Artificial

By Type

- High-Intensity Sweeteners

- Low-Intensity Sweeteners

- High-Fructose Syrup

By Application

- Food and Beverages

- Pharmaceutical

- Cosmetics & Personal Care

- Health Supplements

Growth Opportunity

Innovative Ingredients for Sugar Substitutes

As the industry growth for sugar substitutes expands, companies have numerous opportunities to discover and develop novel plant-based sugar alternatives. Consumers desire tasty, nutritious alternatives to refined sugar. By investing in R&D, companies can use uncommon constituents such as stevia, monk fruit, and coconut sugar. Natural and plant-based sweeteners are superior to artificial sweeteners from a health perspective. These chemicals help business growth satisfy the evolving preferences of health-conscious consumers. Novel sugar replacement ingredients present a tremendous opportunity for the segments in the industry to expand and meet consumer demand for healthier alternatives. By incorporating these substances into their products, businesses can increase their sugar replacement market share.

Altering Diets and Lifestyles in Emerging Markets

Expanding into developing regions with altering lifestyles and diets is a further possibility. As their economies grow and their populations become more health-conscious, these regions seek sugar alternatives. As awareness of sugar's health hazards grows, the demand for sugar substitutes is anticipated to increase. To capitalize on this opportunity, businesses must target emerging markets with their marketing. It is essential to comprehend the cultures, preferences, and diets of these regions. Localizing products and branding, educating consumers, and collaborating with local distributors and retailers can increase market penetration and expansion.

Reformulating with Food and Drink Businesses

Alternatives to sugar can expand substantially among food and beverage manufacturers. As awareness of sugar's health hazards increases, many food and beverage companies are attempting to reduce the amount of sugar in their products and provide consumers with healthier options. These manufacturers can collaborate with sugar replacement companies to develop healthier versions of popular foods and beverages. This partnership permits the addition of sugar substitutes to soft drinks, baked goods, candies, and dairy products. The distribution channels and customers of manufacturers can help sugar substitute companies reach more customers. Co-marketing, co-branding, and strategic partnerships can increase the exposure and adoption of sugar substitutes.

Utilizing Innovative Low-Calorie Sweeteners

Alternatives to sugar can expand substantially among food and beverage manufacturers, driving Industry Growth. As awareness of sugar's health hazards increases, many food and beverage companies are attempting to reduce the amount of sugar in their products and provide consumers with healthier options, contributing to Segment Growth. These manufacturers can collaborate with sugar replacement companies to develop healthier versions of popular foods and beverages. This partnership permits the addition of sugar substitutes to soft drinks, baked goods, candies, and dairy products. The distribution channels and customers of manufacturers can help sugar substitute companies reach more customers. Co-marketing, co-branding, and strategic partnerships can increase the exposure and adoption of sugar substitutes.

Latest Trends

Stevia and Monk Fruit-Based Sugar Substitutes

The popularity of Stevia and monk fruit-based sugar substitutes has increased due to their natural origins and consumer demand for healthful ingredients. Stevia and monk fruit sugar are sweeteners devoid of the calories and health hazards of sugar. These natural substitutes are therefore popular among individuals attempting to reduce their sugar intake and live a healthy lifestyle. In addition, the popularity of stevia and monk fruit-based sugar substitutes in food and beverages has increased.

Increased demand for low-calorie and calorie-free sweeteners

With an emphasis on health and fitness, consumers seek sugar substitutes that taste pleasant without containing calories. This has increased demand for industry-growth sugar substitutes with fewer or no calories. In response to this trend, manufacturers have developed business growth sugar substitutes that taste similar to sugar but contain fewer or no calories. Sucralose, aspartame, and saccharin are sweeteners utilized in diet beverages, sugar-free treats, and low-calorie desserts. This market segment's growth is being driven by health-conscious consumers who desire reduced sugar without sacrificing flavor.

Diabetic and low-sugar foods use sugar substitutes.

As diabetes prevalence increases worldwide, the demand for foods suitable for diabetics has skyrocketed. Diabetic and low-sugar dishes utilize sugar substitutes to add sweetness without elevating blood sugar levels. These products are for diabetics and sugar-aware individuals on low-carb or ketogenic diets. These specialized foods with sugar substitutes have spawned a profitable industry for those with dietary restrictions or health problems.

Rise of natural and clean-label sugar substitutes

As a result of the clean dining trend, consumers pursue natural and label-free food products. This transition in consumer preferences has contributed to the emergence of natural and clean-label sweeteners in the industry of sugar substitutes. Natural sweeteners like honey, maple syrup, and agave nectar are considered healthier than artificial sweeteners due to their minimal processing and natural origins. As health-conscious consumers demand clear labels and transparency, manufacturers are incorporating these natural sweeteners into their formulations.

Blends and Combinations of Sugar Substitutes

Manufacturers are combining sugar substitutes in order to satisfy consumers' varied preferences. Mixing sweeteners such as stevia, monk fruit, erythritol, and xylitol enables businesses to produce products with the desired sweetness and flavor. Blends and mixtures improve flavor while diminishing the residue of individual sweeteners. This method appeals to consumers who desire a comprehensive sweetening solution tailored to their preferences.

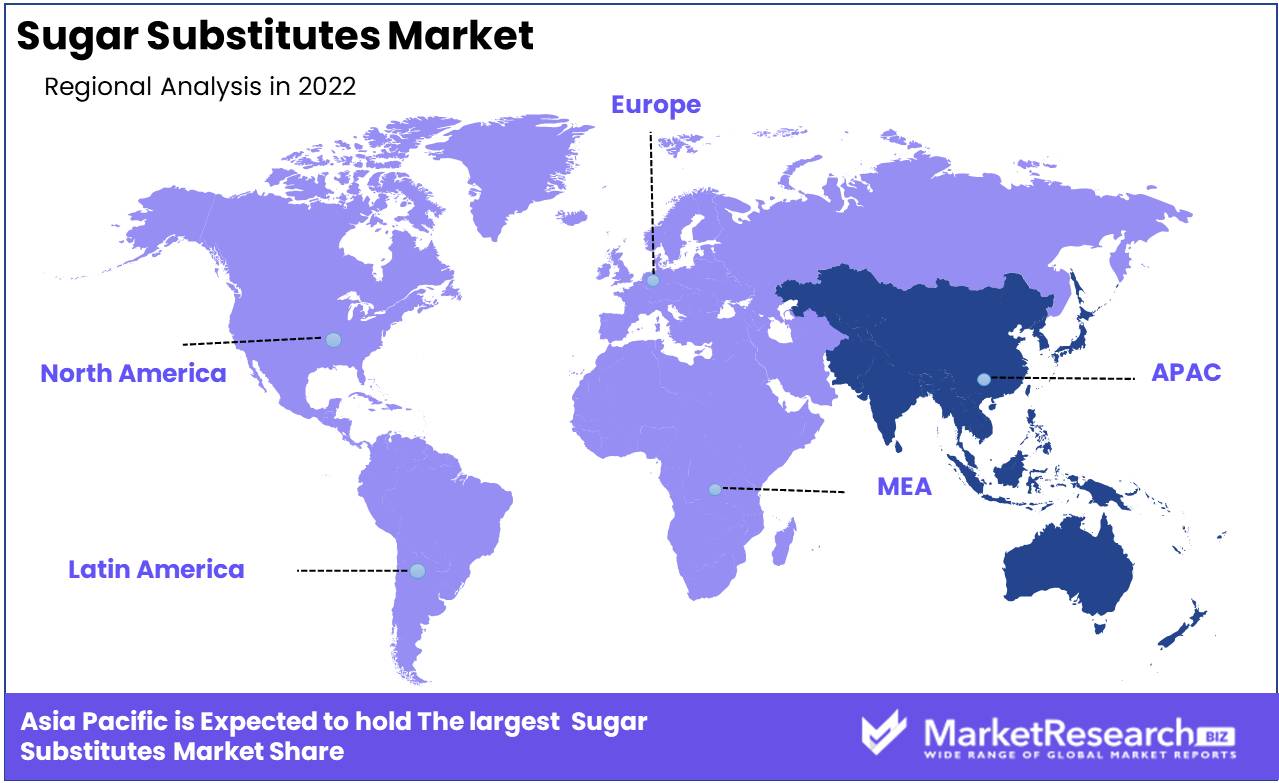

Regional Analysis

The Asia-Pacific region is home to the world's largest collection of sugarcane. In today's health-conscious society, the potential negative effects of excessive sugar consumption are becoming increasingly apparent. As a consequence, the demand for sugar substitutes has been on the rise, and the Asia-Pacific region has genuinely taken the lead in this market. It comes as no surprise that this region has emerged as the dominant force in the sugar substitutes industry, given its extensive population and expanding awareness of healthy lifestyles.

Several variables account for the Asia-Pacific region's dominance in the sugar substitutes market. First and foremost, the region has experienced substantial economic development, which has led to an increase in disposable incomes and a shift toward healthier dietary choices. Due to a greater emphasis on personal health, consumers are actively pursuing alternatives to traditional sugar, which has increased the demand for sugar substitutes.

The Asia-Pacific region has a long history of using natural sweeteners in its cuisine. Monk fruit, stevia, and coconut sugar have been staples in the region's traditional cuisines for centuries. The low glycemic index and minimal effect on blood sugar levels of these natural sweeteners make them desirable alternatives to refined sugar. Therefore, manufacturers in the region have incorporated these natural sweeteners into their products to leverage on this opportunity.

Governments and health organizations in the Asia-Pacific region have actively advocated for a reduction in sugar consumption as a means to combat rising obesity rates and related health problems. The demand for sugar substitutes has been bolstered by public health campaigns encouraging individuals to choose healthier options. This supportive regulatory environment and increased consumer awareness have combined to create a prospering market for sugar substitutes in the region.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

zuChem Inc. develops and manufactures high-quality sugar alternatives. The firm excels at tailored sugar solutions that meet consumer and commercial needs by focusing on fermentation-based production techniques. zuChem Inc. holds the largest market share in the industry and has developed low-calorie, natural sugar replacements using biocatalysis. Their unique products have made them a major sugar alternatives player with a wide range of offerings.

Ingredion Incorporated is a leading sugar replacement supplier. The firm has a wide selection of sweeteners to meet customer demands. Ingredients natural and artificial sweeteners offer producers and consumers alternatives to sugar. Research and innovation have made them a trusted global producer of high-quality sugar alternatives, and they also maintain a significant market share.

BENEO, a Südzucker Group company, is a leading functional ingredient and sugar replacement provider. BENEO develops organically based sweeteners from chicory roots, beet sugar, and rice. These additives let producers make sugar-free or low-sugar goods without sacrificing taste or texture. BENEO's sustainable and nutritious sugar substitute products are respected by industry colleagues and consumers, and they hold a substantial market share as well.

Through intensive research and development, multinational food business Cargill Incorporated has become a major sugar alternatives player. Cargill has developed novel stevia-based sweeteners by leveraging nature. Their expertise in stevia extraction and formulation allows them to make natural, zero-calorie sweeteners that are popular globally. Cargill leads the industry with its dedication to sustainability and consumer health, and they command a significant portion of the market.

DuPont, a worldwide business, has advanced the sugar alternatives industry with its cutting-edge technology and products. DuPont developed plant-based sugar substitutes using biotechnology. These new techniques allow manufacturers to reduce sugar levels without sacrificing taste or functionality. DuPont's scientific competence and environmental responsibility have made it a leading sugar alternatives company, and they also enjoy a substantial market share.

Foodchem International Corporation is a major provider of food additives and ingredients, notably sugar alternatives. The firm provides many natural and artificial sweeteners to meet the desire for healthier options. Foodchem's products help food and beverage businesses make sugar-free or low-sugar products. Foodchem dominates the sugar alternatives industry with their quality and customer service, and they are a significant player in the market as well.

Top Key Players in Sugar Substitutes Market

- zuChem Inc.

- Ingredion Incorporated

- BENEO

- Cargill Incorporated

- DuPont

- Foodchem International Corporation

- JK Sucralose Inc.

- HYET Sweet

- Roquette Frères

- Mitsui Sugar Co.Ltd.

- ADM

- Tate & Lyle

- Pyure Brands LLC

- PureCircle

- Ajinomoto Health & Nutrition North America Inc.

- Alsiano

- StartingLine S.p.A.

- NutraSweet Co.

- MAFCO Worldwide LLC

- Matsutani Chemical Industry Co. Ltd.

Recent Development

- In 2023, Zydus Wellness's Truvia® SweetLeaf Stevia In The Raw® is a leading sugar alternative. Truvia uses Stevia, a plant-based sweetener, to give a guilt-free choice without sacrificing taste. Zydus Wellness believes Truvia will change sugar replacements.

- In 2022, Coca-Cola announced a major health initiative. The beverage giant announced intentions to add stevia to US beverages. Coca-Cola's use of stevia shows its dedication to provide healthier options without losing taste.

- In 2021, PepsiCo announced its intention to sweeten European drinks using sucralose, following industry competitors. Zero-calorie sucralose delivers sweet flavor without calories. PepsiCo hopes to attract health-conscious Europeans who want to drink their favorite drinks without sugar.

- In 2020, Nestle entered the Asian market with monk fruit extract sweeteners to meet demand for natural sugar substitutes. Monk fruit, a little green melon, extract tastes delicious. Nestle's daring use of monk fruit extract shows its commitment to meeting consumer demand for natural and healthier products.

Report Scope:

Report Features Description Market Value (2022) USD 18.1 Bn Forecast Revenue (2032) USD 30.1 Bn CAGR (2023-2032) 5.0% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Source (Natural, Artificial)

By Type (High Intensity Sweetners, Low Intensity Sweetners, High-Fructose Syrup)

By Application (Food and Beverages, Pharmaceutical, Cosmetics & Personal Care, Health SupplementsRegional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape zuChem Inc., Ingredion Incorporated, BENEO, Cargill Incorporated, DuPont, Foodchem International Corporation, JK Sucralose Inc., HYET Sweet, Roquette Frères, Mitsui Sugar Co.Ltd., ADM, Tate & Lyle, Pyure Brands LLC, PureCircle, Ajinomoto Health & Nutrition North America Inc., Alsiano, StartingLine S.p.A., NutraSweet Co., MAFCO Worldwide LLC, and Matsutani Chemical Industry Co. Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- zuChem Inc.

- Ingredion Incorporated

- BENEO

- Cargill Incorporated

- DuPont

- Foodchem International Corporation

- JK Sucralose Inc.

- HYET Sweet

- Roquette Frères

- Mitsui Sugar Co.Ltd.

- ADM

- Tate & Lyle

- Pyure Brands LLC

- PureCircle

- Ajinomoto Health & Nutrition North America Inc.

- Alsiano

- StartingLine S.p.A.

- NutraSweet Co.

- MAFCO Worldwide LLC

- Matsutani Chemical Industry Co. Ltd.